Difference between revisions of "New year in Marathon/nb"

(Created page with "For at automatiske betalinger ska fungere må du angi hvilke dager som er bankfrie (helligdager) i Grunnregister/Lev/Bankfrie dager for året du oppretter och året deretter.") |

(Created page with "= Kalendarium =") |

||

| Line 39: | Line 39: | ||

For at automatiske betalinger ska fungere må du angi hvilke dager som er bankfrie (helligdager) i Grunnregister/Lev/Bankfrie dager for året du oppretter och året deretter. |

For at automatiske betalinger ska fungere må du angi hvilke dager som er bankfrie (helligdager) i Grunnregister/Lev/Bankfrie dager for året du oppretter och året deretter. |

||

| − | = |

+ | = Kalendarium = |

Create calendars for different working time measures in {{pth|System|Base registers/PRO/Calendar}}. Click {{btn|New}} and write in the year, same calendar number as before and name (if not, you have to do the change in the employees' records in {{pth|System|Base registers/Pro/Employees}}. Write in amount of expected working hours per day in the field {{fld|Time/day}}. |

Create calendars for different working time measures in {{pth|System|Base registers/PRO/Calendar}}. Click {{btn|New}} and write in the year, same calendar number as before and name (if not, you have to do the change in the employees' records in {{pth|System|Base registers/Pro/Employees}}. Write in amount of expected working hours per day in the field {{fld|Time/day}}. |

||

Revision as of 14:30, 29 November 2016

Contents

- 1 Nytt år i Marathon

- 2 Varslinger

- 3 Bankfrie dager

- 4 Kalendarium

- 5 Frequent questions

- 5.1 » What does the alternative ”Update OB at new transactions in previous years” mean?

- 5.2 » I activated the parameter ""Update OB at new transactions in previous years”",but when I register accounts in the previous year I cannot see them in the new year?

- 5.3 » I didn't activate ""Update OB at transactions in previous year”" when I created new accounting year. Can I undo that?

- 5.4 » I receive a message ”Could not save: Open a new year first in the company with global chart of accounts” when I try to save my new accounting year?

- 5.5 » I receive a message ”Could not save: Account for previous year's profit/loss missing in System: Base registers/GL/Parameters”?

- 5.6 » I receive a message ”Could not save: Account for previous year's profit/loss missing in the chart of accounts”?

- 5.7 » I created a new accounting year that I now want to delete. How do I do that?

- 5.8 » How do I change year in Classic?

Nytt år i Marathon

Neden følger en beskrivelse om å bytte regnskapsår i Marathon. De to første sidene er selve beskrivelsen, deretter følger svar på vanlige spørsmål som kan oppstå ved opprettelsen.

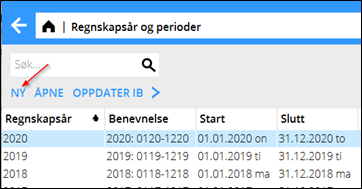

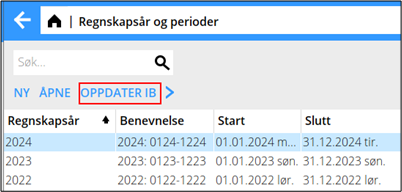

Nytt år opprettes i Økonomi: Bokføring/Regnskapsår og perioder. Klikk på funksjonen Ny og kontroller at de foreslagne start – og sluttdatoene er korrekte. Dersom sluttperioden skal være en annen, kan du skrive over den, f eks ved forlangning av et regnskapsår. Velg hvis IB fra foregående år skal oppdateres automatisk med alternativet ”Oppdater IB ved nye transaksjoner i tidligere år”. Klikk på Lagre.

Da det nye året lagres gjøres samtidig en overføring av IB, periodiseringer, kontoplan, kostnadssteder, kostnadsbærere, dimensjoner, automatkonteringer, budsjettmaler, rapportmaler, bilagsmaler, konteringsmaler, mva-klasser og bilagsserier fra foregående år til det nye. Eventuelle feil vises på en feilrapport, men kun som advarsler. Konto, kostnadssted eller kostnadsbærer som mangler opprettes i det nye året.

Kontoer, som ikke skal ha kostnadssted/-bærer, men der det finnes en utgående balanse i foregående år på en slik kombinasjon, rettes ved at fjerne kostnadsstedet/-bæreren. Utgående balanse på kontoer som krever kostnadssted, der det ikke eksisterer, overfores uten dem.

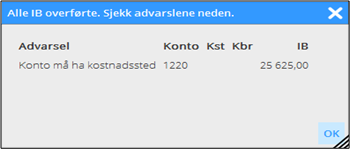

En advarsel ved opprettelse av nytt år kan se ut så her:

I eksempelet oven overføres saldoen på konto 1220 til det nye året, men uten kopling til kostnadssted.

Vil man så kan man korrigere de feil som listen rapporterte og siden gjøre en ny overføring. En ny overføring gjøres i Regnskapsår og periode ved å markere året og klikke på Oppdater IB.

Varslinger

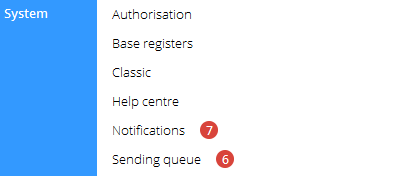

Om man har valgt at IB foregående år skal oppdateres automatisk (se foregående side) skapes en varsling, dersom noen transaksjon ikke kan oppdateres til bokføringen. Varslingen vises under System: Varslinger.

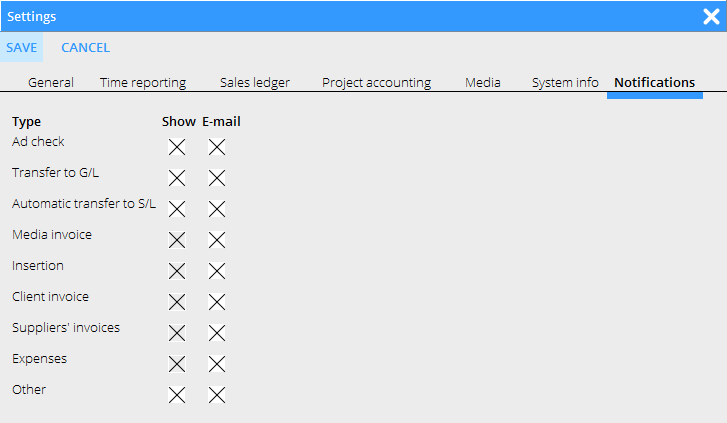

Man kan også velge å få varslingene sendte per e-post. Innstillinger for dette ligger unde rtannhjulet → Innstillinger, fliken Varslinger

Rett feilen og bekreft varslingen, så forsvinner den fra listen.

Bankfrie dager

For at automatiske betalinger ska fungere må du angi hvilke dager som er bankfrie (helligdager) i Grunnregister/Lev/Bankfrie dager for året du oppretter och året deretter.

Kalendarium

Create calendars for different working time measures in System: Base registers/PRO/Calendar. Click New and write in the year, same calendar number as before and name (if not, you have to do the change in the employees' records in System: Base registers/Pro/Employees. Write in amount of expected working hours per day in the field Time/day.

In the tab Working Days, you can click Import standard to import a standard calendar. Fill in which days that are working days and which are not. A working day is expressed as a digit with two decimals. A complete working day is 1,00, half day is 0,50 and a free day is 0,00. This enables different calendars for different working time measures.

You can copy working days from a calendar to another, as long as it is in the same year. Remember to change hours per day and the name after copying.

Frequent questions

» What does the alternative ”Update OB at new transactions in previous years” mean?

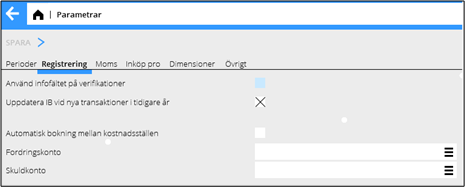

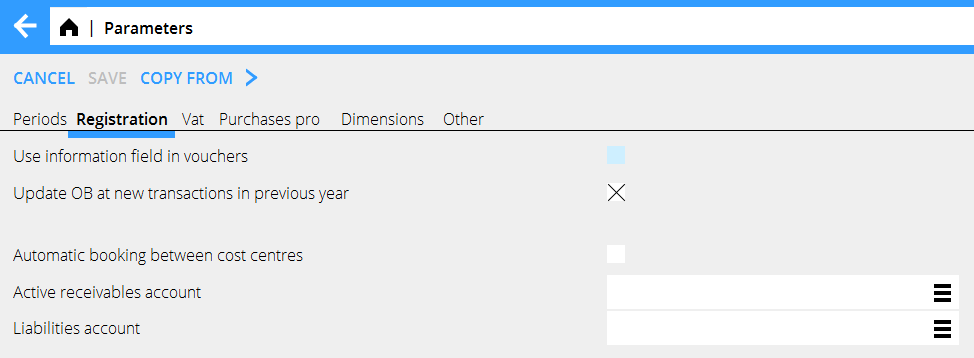

If the box is checked, the same parameter will be checked in System: Base registers/GL/Parameters, tab Registration.

Activating the parameter means that the OB will be updated automatically when a new transaction is registered in the previous year. Thus you don't need to update OB manually when working in two accounting years concurrently. If an OB record for some reason not can be updated, a notification about it is creates. The notifications are shown in System: Notifications.

You can also choose to receive the notifications by e-mail. Settings for that are available under the cog wheel → Settings, tab Notifications.

Please note that the automatic update only concerns OB and periodical allocations (accruals). Other changes in the previous years such as accounts, cost centres and -objects, etc. shall be updated manually with the function Update OB, which is located in Accounting: Accounting year and periods.If you activate automatic update after you've already registered transaction in the previous year, these records must be updated manually with the Update OB -function.

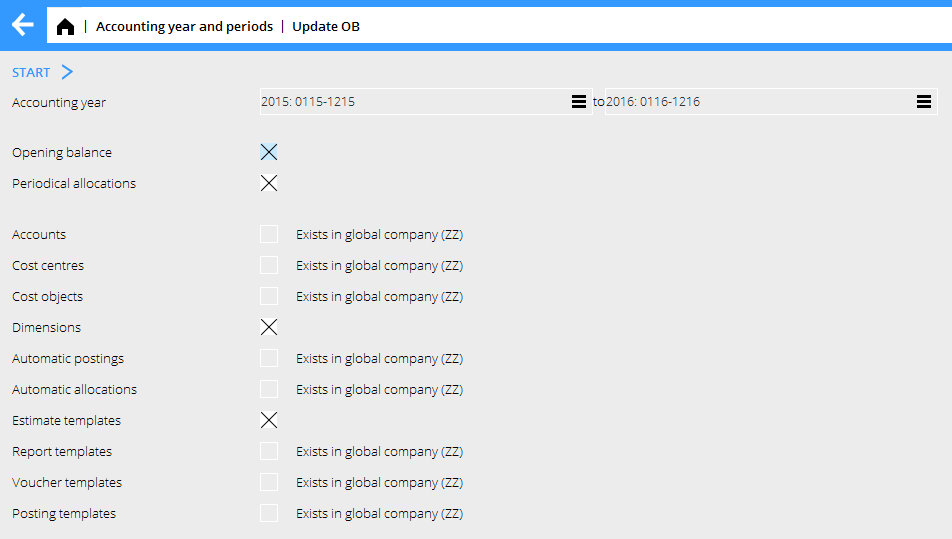

If you choose not to check the box "Update OB at new transactions in previous year" and thus not the parameter either, you will have to update opening balances manually when working concurrently in two accounting years. The function is found in Accounting: Accounting year and period. Select year and click on Update OB. Check the records you wish to update and click on Start. If there is a global company, where these records exist, it is mentioned in parenthesis. Change company under the cog wheel and make the update there instead.

» I activated the parameter ""Update OB at new transactions in previous years”",but when I register accounts in the previous year I cannot see them in the new year?

The automatic update only concerns OB and periodical allocations (accruals). Other changes in the previous years such as accounts, cost centres and -objects, etc. shall be updated manually with the function Update OB, which is located in Accounting: Accounting year and periods.

» I didn't activate ""Update OB at transactions in previous year”" when I created new accounting year. Can I undo that?

Yes, you can check the parameter in System: Base registers/GL/Parameters, tab Registration. Note, that if you activate automatic update after you've already registered transaction in the previous year, these records must be updated manually with the Update OB-function.

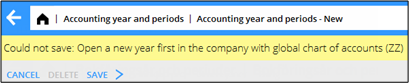

» I receive a message ”Could not save: Open a new year first in the company with global chart of accounts” when I try to save my new accounting year?

A company can be connected with another company's chart of accounts and report generator. If that is the case, you will have to open the new accounting year in that company first, and Marathon will show a warning if you are trying to save other companies before it. Change company under the cog wheel and create a new year in the global company for chart of accounts and report generator (in this case company ZZ).

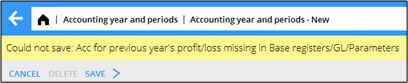

» I receive a message ”Could not save: Account for previous year's profit/loss missing in System: Base registers/GL/Parameters”?

Earlier the account for previous year's profit/loss was not mandatory in Marathon, it was shown on account 2999. Now the account has to be there. Register the account in System: Base registers/GL/Accounts and write it in the field for Account for previous year's profit/loss in System: Base registers/GL/Parameters, tab Other. The account does not have to have number 2999.

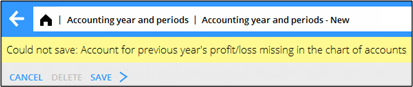

» I receive a message ”Could not save: Account for previous year's profit/loss missing in the chart of accounts”?

There is an account in the field “Account for previous year's profit/loss” in System: Base registers/GL/Parameters, tab Other, that is not in the chart of accounts. Register the account in System: Base registers/GL//Accounts or select another one from the chart of accounts.

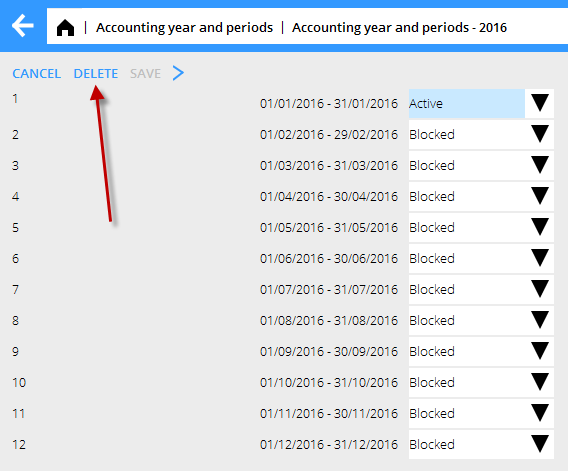

» I created a new accounting year that I now want to delete. How do I do that?

Open the latest year and click on Delete.

» How do I change year in Classic?

By pressing the F8 key and the letter B.