Difference between revisions of "Translations:News:Posting of fictitious VAT in the function for Reverse charge/9/en"

From Marathon Documentation

(Importing a new version from external source) |

|||

| Line 1: | Line 1: | ||

| − | ''' |

+ | '''Booked posting:''' |

| + | When the invoice is booked, the fictitious VAT is booked on debit and credit on the account chosen for the VAT class. |

||

| − | När fakturan bokförs så bokförs den fiktiva momsen i debet och kredit på de konton som angivits på momsklassen. |

||

{{ExpandImage|Reverse charge.booked.png}} |

{{ExpandImage|Reverse charge.booked.png}} |

||

Latest revision as of 09:47, 7 June 2018

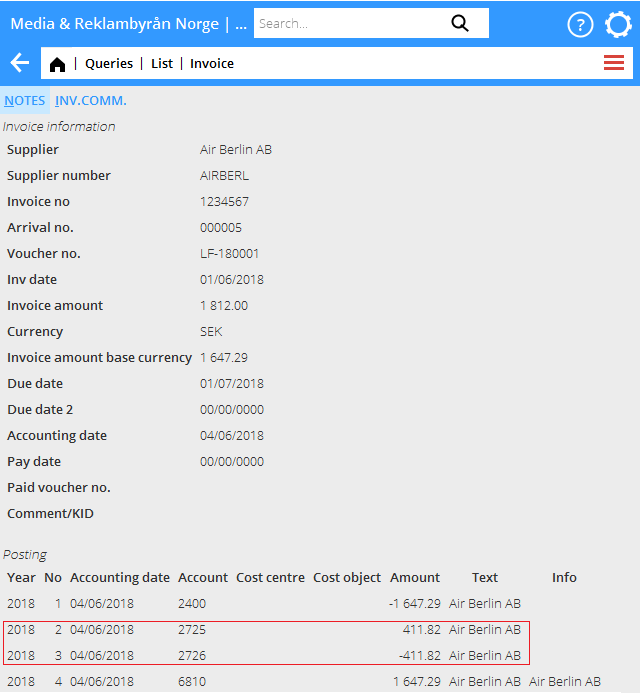

Booked posting:

When the invoice is booked, the fictitious VAT is booked on debit and credit on the account chosen for the VAT class.