Difference between revisions of "Clearing of accounts/en"

(Updating to match new version of source page) |

|||

| Line 1: | Line 1: | ||

<htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

<htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

||

| + | Clearing of accounts is used to clear transactions in the bookeeping, in order to see only the transactions that is active and make the account balance. |

||

| − | = Clearing of accounts= |

||

| − | The function Clearing of accounts is located under Accounting. |

||

==General== |

==General== |

||

| Line 69: | Line 68: | ||

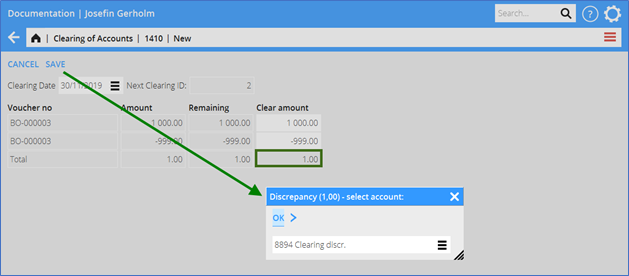

It could be manually fixed by booking 1 in debit on the account and 1 in credit on some discrepancy account and thereafter clear the three transactions with total amount zero. The function for clearing with remaining amount is actually doing the same, but you don’t need to do the booking manually. |

It could be manually fixed by booking 1 in debit on the account and 1 in credit on some discrepancy account and thereafter clear the three transactions with total amount zero. The function for clearing with remaining amount is actually doing the same, but you don’t need to do the booking manually. |

||

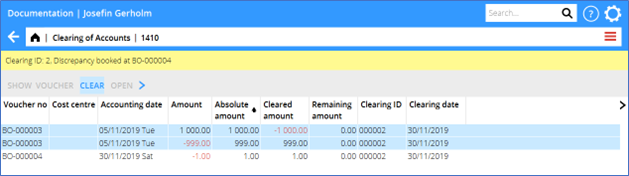

Since the total cleared amount per account has to be zero as at a certain date (otherwise the closing balance could be different for All transactions and Only not cleared), Marathon needs to create a new voucher with the discrepancy in debit/credit on the original account with a counter posting on a special account for discrepancies. |

Since the total cleared amount per account has to be zero as at a certain date (otherwise the closing balance could be different for All transactions and Only not cleared), Marathon needs to create a new voucher with the discrepancy in debit/credit on the original account with a counter posting on a special account for discrepancies. |

||

| − | The new transaction on the original account is cleared automatically whilst the new transaction on the discrepancy account remains uncleared. This |

+ | The new transaction on the original account is cleared automatically whilst the new transaction on the discrepancy account remains uncleared. This methos ensures that the total cleared amount always is zero. |

The new voucher is registered in voucher series BO, if no other series for clearing has been selected in {{|pth|Base registers|GL/Parameters}} tab Registration. |

The new voucher is registered in voucher series BO, if no other series for clearing has been selected in {{|pth|Base registers|GL/Parameters}} tab Registration. |

||

Latest revision as of 15:53, 29 August 2023

Clearing of accounts is used to clear transactions in the bookeeping, in order to see only the transactions that is active and make the account balance.

Contents

General

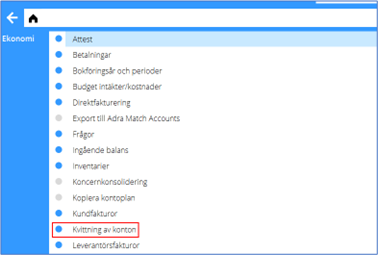

The purpose of the function is to see which transactions on an account make the account balance. It is done in two parts. First you match the transactions that can be cleared against each other. The clearing is done as at a certain date. Thereafter the function can be used as an account specification where you can choose to see only uncleared transactions per a certain date. The CB/balance per account will be the same regardless of if you wish to see all transactions or only uncleared ones. The only difference is that with the uncleared you don’t need to see cleared transactions and thus no longer are “open” on the account. As an example, you might want to clear transactions on account Receivable, Personnel, where you have a transaction of a payment to an employee and then their registered expense report. When the whole advance has been used and you have cleared expenses with the transaction so that the remaining amount is zero, you will no longer see the transaction in the account specification at as the date of last matching. You will also be able to see how much of the advance that is open as at a certain date since you continuously clear the expenses that the employee is registering. The function can be used for any kind of accounts. The clearing does not affect the bookkeeping, except when clearing amounts that don’t cancel out and clearing of transactions between different subaccounts (XXXX1 – XXXX09). The function is located in Accounting: Clearing of accounts

As the function goes back to previous years, it is possible to select first accounting year for the transactions to be clearable. Set the year in Base registers/General/Company specific parameters.

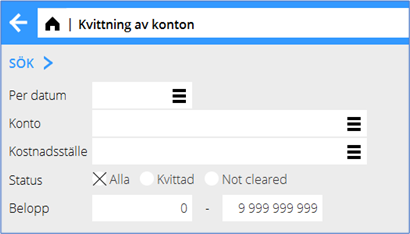

Selection

Per date is a mandatory field. If your next step is to make a clearing, this date will be suggested as clearing date. You can select a specific account. If you leave the field blank, all accounts will be in the selection. If you select accounts with subaccounts, they will also be within the selection (e.g., selection on 2420 includes also 242001–242009). You can also select on Cost centre. By making selection on matching status, you can choose to see all transaction that date, only cleared or only uncleared. If you are in the function for clearing transactions or for looking at the cleared account statement for an account, select only Not cleared. If you have transactions that has been erroneously matched, print the list with only Cleared. You can also make a selection based on Amounts. The amounts are absolute values. That means that a selection 1 000 – 1 000 will include transactions with 1 000 in both debit and credit.

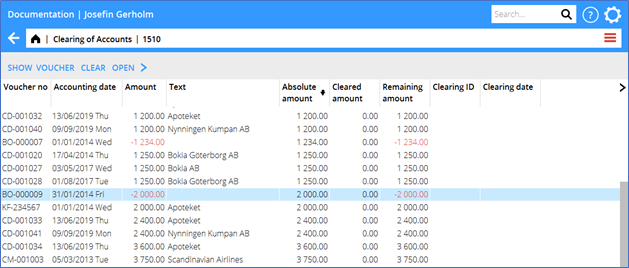

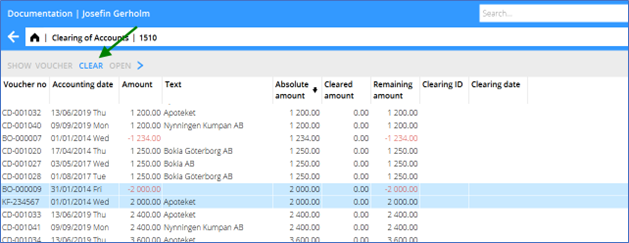

List of transactions

The list shows all transactions according to your selection. It consists of more or less the same information as in Nominal ledger/Account specification but has a few more columns that have to do with the clearing. Absolute amount shows the absolute value of the transaction, to enable sorting of transactions with the same amount but with reverse signs. Cleared amount shows how much has been cleared per the date you have chosen. Remaining amount shows the original value of the transaction minus cleared amount, i.e., the remaining amount to be cleared. Clearing ID and Clearing date shows ID and date for previous clearings.

Clear transactions

To make a clearing, select two or more rows in the list and press CLEAR. Only transactions on the same main account, cost centre and - object can be cleared.

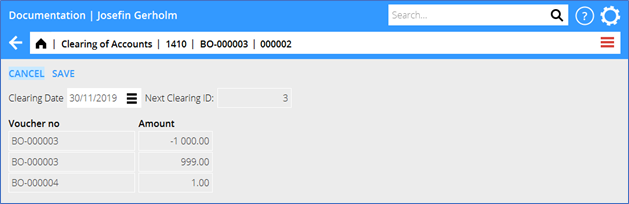

All transactions you wish to clear are shown in a table with three columns.

Amount is the original amount of the transaction; Remaining is not cleared per the selected date and Clear amount is for entering amount to clear from each transaction. It is suggested to clear the remaining amount, but you can change it and do a partial clearing.

Clearing date is suggested to be same as Per date in the selection but can be changed. Clearing ID is automatically generated and cannot be changed. There are four clearing situations with different handling.

- Single clearing

- Partial clearing

- Clearing with remaining amounts

- Clearing between subaccounts

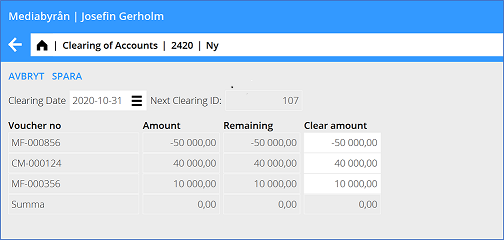

Single clearing

Single clearing is when the whole remaining account for two or more transactions to be cleared to zero, for example a debit- and a credit transaction cleared between each other.

In this case all you need to do is to press SAVE.

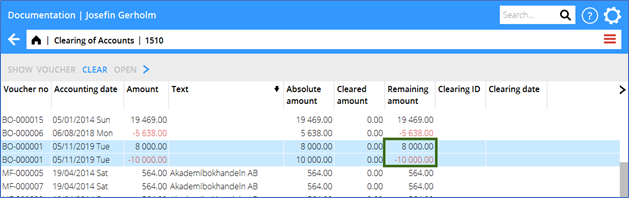

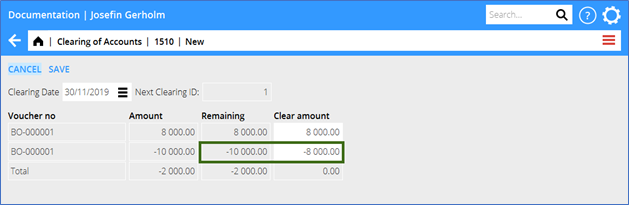

Partial clearing

Partial clearing is used when you want to clear another amount than the remaining one on one or more transactions where the total clearing still is zero. Example: You have a debit transaction 8 000 SEK and a credit transaction 10 000 SEK and want to clear the whole debit transaction with 8 000 SEK of the credit transaction’s 10 000SEK. In this case you must manually change amount for the credit transaction in the column Clear accounts to -8 000, since the suggested amount to clear is the whole remaining amount.

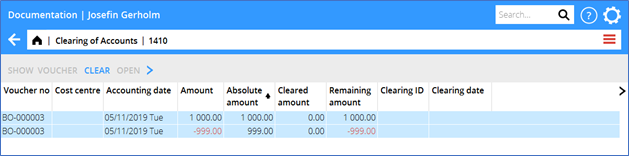

Clearing with remaining amounts

For clearing of transactions where the total amount is not zero you can make a clearing with remaining amount. It is mainly designed for clearing records that almost cancel out each other and you don’t ned to handle the remaining small discrepancy, for example that you like to clean a debit transaction 1000 SEK with a credit transaction 999 SEK. It could be manually fixed by booking 1 in debit on the account and 1 in credit on some discrepancy account and thereafter clear the three transactions with total amount zero. The function for clearing with remaining amount is actually doing the same, but you don’t need to do the booking manually. Since the total cleared amount per account has to be zero as at a certain date (otherwise the closing balance could be different for All transactions and Only not cleared), Marathon needs to create a new voucher with the discrepancy in debit/credit on the original account with a counter posting on a special account for discrepancies. The new transaction on the original account is cleared automatically whilst the new transaction on the discrepancy account remains uncleared. This methos ensures that the total cleared amount always is zero. The new voucher is registered in voucher series BO, if no other series for clearing has been selected in {{|pth|Base registers|GL/Parameters}} tab Registration.

Clearing between subaccounts

Clearing between subaccounts is generally not allowed. There is an exception, and that is if the two subaccounts have the same main account, e.g., between 24901 and 24903. If you clear transactions between subaccounts, Marathon will first create a new voucher that reverses the amounts on all transactions to be cleared. All transactions, both the original and the reversed ones are thereafter cleared automatically. Note, that clearing 6-digit accounts ending 1-9 affects taxable amounts. Such clearings should thus not be performed. The new voucher will be registered on the voucher series that is selected in the parameters (if nothing has been selected, it will be BO) and gets same accounting date as clearing date.

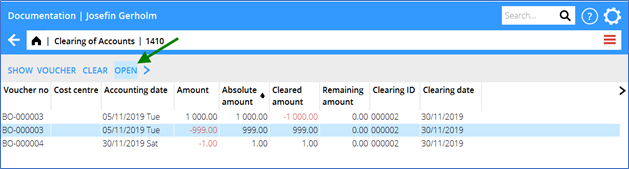

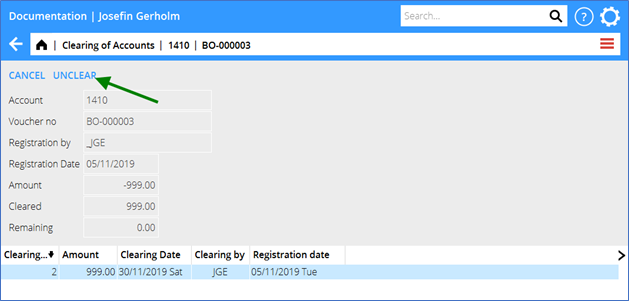

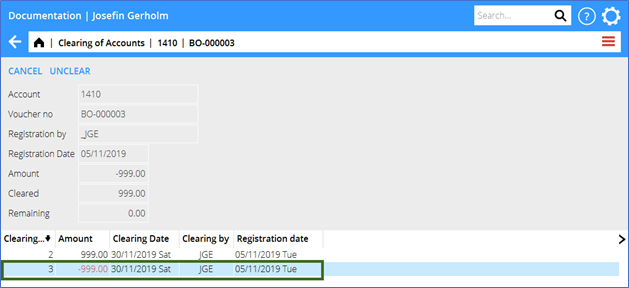

To reverse a clearing

You can undo an erroneous clearing. A new clearing is made, with reversed signs. To undo a clearing, select a transaction in the list and press OPEN. All performed clearings on it are shown in a table. Select a clearing record row and click on REVERSE CLEARING. The table now shows all transactions included in the clearing that will be reversed and affected by it. Select clearing date and press SAVE.