Difference between revisions of "News:SAFT reporting new version/nb"

From Marathon Documentation

(Created page with "{{News |SAF-T 1.3 |module=Økonomi |group=Grunnregister |version=546W2410 |revision=0 |case=CORE-6114 |published=2024-11-20 }}") |

(Created page with "Fra versjon 546W2410 er det mulig å lage SAF-T-rapporter i versjon SAF-T 1.3.") |

||

| Line 11: | Line 11: | ||

<b>SAF-T 1.3</b> |

<b>SAF-T 1.3</b> |

||

| − | + | Fra versjon 546W2410 er det mulig å lage SAF-T-rapporter i versjon SAF-T 1.3. |

|

SAF-T 1.3 is mandatory from January 2025. |

SAF-T 1.3 is mandatory from January 2025. |

||

Revision as of 13:42, 20 November 2024

SAF-T 1.3

| Published | 2024-11-20 |

|---|---|

| Module | Økonomi |

| Version | 546W2410 |

| Revision | 0 |

| Case number | CORE-6114 |

SAF-T 1.3

Fra versjon 546W2410 er det mulig å lage SAF-T-rapporter i versjon SAF-T 1.3.

SAF-T 1.3 is mandatory from January 2025.

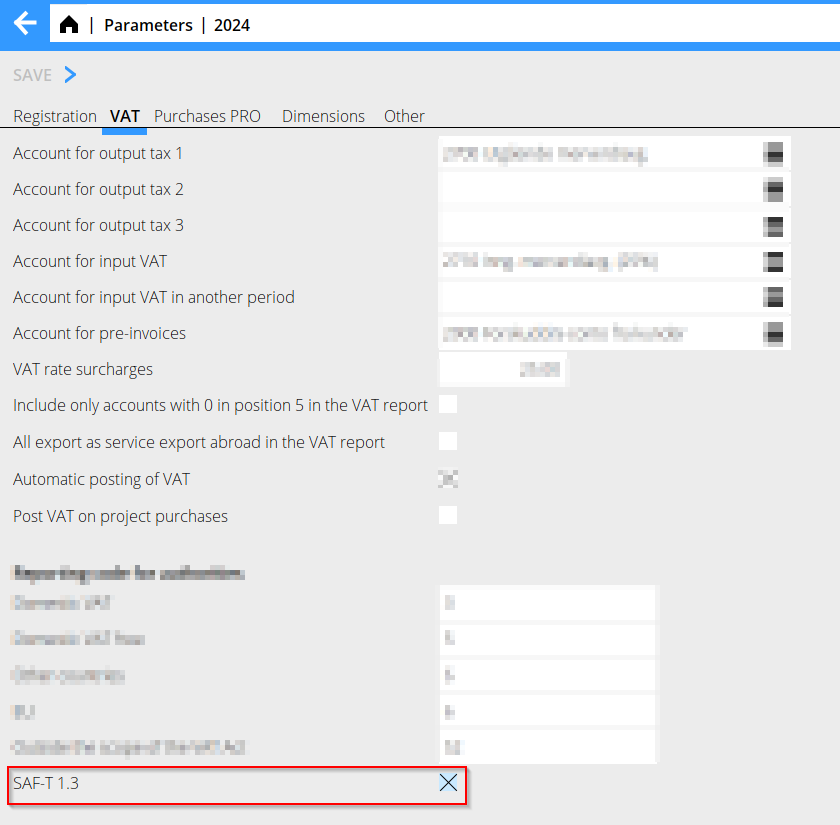

To create SAF-T 1.3 files you need to activate the parameter SAF-T 1.3 in Base registers/G/L/Parameters, tab VAT.

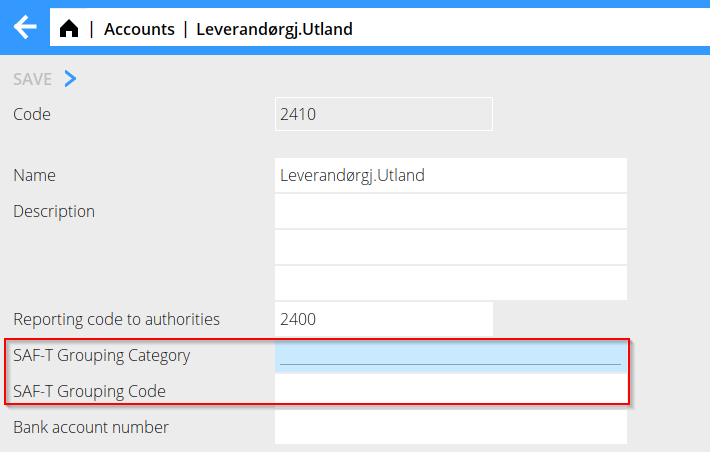

SAF-T 1.3 requires additional information, Grouping Category and Grouping Code.

The Grouping Category and Grouping Code is registered on the Account in Base registers/G/L/Accounts.

For which reporting codes and categories to use, please refer to Skattetaten.no