Difference between revisions of "Media accounting/da"

(Updating to match new version of source page) |

|||

| (3 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

<htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

<htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

||

| − | __FORCETOC__ |

||

| − | = Fakturering = |

||

| + | = Media Accounting = |

||

| − | All fakturering gøres i MEDIA/FAKTURERING, ogsp acontofakturering og afregninger. |

||

| + | ==Invoicing== |

||

| − | {{ExpandImage|MED-EK-DA-Bild1.png}} |

||

| + | All invoicing is done in Media | Invoicing, including pre-invoicing, deductions and reversals of invoices. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild1.png}} |

||

| − | Du kan selektere på indrykningsdato, budgetnummer, kunde, kundekategori, etc. Dersom I fakturerer pr. kampagne, kan det også vælges. |

||

| + | |||

| + | Various selections can be made based on, for example, insertion date, plan number, client and client category. Invoicing per campaign can also be selected, if used. |

||

| + | If a specific media type or client is invoiced continuously, the selection can be saved so that a new selection does not have to be made each time. The options are located behind the blue arrow. |

||

| − | {{ExpandImage|MED-EK-DA-Bild2.png}} |

||

| + | ===Different selections and description=== |

||

| − | Hvis du fakturerer en særskilt mediegruppe eller kunde kontinuerlig, kan gu gemme selekteringen til neste gang. Klik på den blå pil for mere oplysninger. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild2.png}} |

| − | {| |

+ | {|class=mandeflist |

| + | !Current invoicing |

||

| − | !Løbende fakturering |

||

| + | |Both = includes everything, regardless of whether the agreement has ‘Current invoicing’ or not. Yes = plans/orders that have ‘Current invoicing’ according to the agreement are invoiced. No = only includes agreements that do not have ‘Current invoicing’ checked. |

||

| − | |Hvis dette felt er blankt, skrives alt ud, uanset "Løbende fakturering" på aftalen eller ikke. Hvis du bare ønsker at fakturere budgetter/ordrer med "løbende fakturering", vælg JA. |

||

|- |

|- |

||

| + | !Also not checked |

||

| − | !Også ikke kontrollerede |

||

| + | |If ticked, insertions are included even if they haven’t been ad checked - if plan- or order number is entered. |

||

| − | |Ved JA skrives indrykningerne ud selv om de ikke er blevet annoncekontrollerede, forudsat at budget-/ordrenummer er angivet. |

||

|- |

|- |

||

| + | !No reference no. |

||

| − | !Referencenummer mangler |

||

| + | |If Yes, all plans and orders without reference number but the client setting states that it is mandatory, will be invoiced. If Both is selected, everything is printed out but only in a test print. |

||

| − | |Hvis NEJ her, bliver alle ordrer med referencenummer fakturerede, forudsat at kunden har " Fakturér kun ordrer med referencenummer" aktiveret. Hvis JA, vil alle budgetter/ordrer uden referencenummer blive fakturerede forudsat at kunden angivet det som obligatorisk |

||

| + | |- |

||

| − | Hvis Blank, skrives alt ut, men kun i testudskrift. |

||

| + | !Debit/credit |

||

| − | |} |

||

| + | |Blank = everything is printed out. |

||

| + | Debit = Only debit invoices are printed out. |

||

| − | I basisregistres kunderegister findes en parameter" Fakturér kun ordrer med referencenummer". |

||

| + | Credit = Only Credit invoices are printed out. |

||

| − | Hvornår den vælges må parameteren være på JA. Hvis du vælger en forkert kombination, får du en fejlmeddelelse og kan ikke fortsætte faktureringen |

||

| + | Separately = debit – and credit records are printed on separate invoices. |

||

| − | {| class=mandeflist |

||

| − | !Debit/kredit |

||

| − | |Blank = alt faktureres. |

||

| − | Debet = Kun debetfakturaer udskrives. |

||

| − | Kredit = Kun kreditnotaer udskrives. |

||

| − | Separate = debet- og kreditfakturaer faktureres separat. |

||

|- |

|- |

||

| + | !Corrections |

||

| − | !Korrektioner |

||

| + | |Insertions that are marked with Correction (x) can be invoiced peparately or be excluded: |

||

| − | |Indrykninger market med korrektion (x) kan faktureres separat. |

||

| + | Not corrected + external corrections |

||

| − | Ja = inkludér korrigeringer |

||

| − | No = inkludér ikke korrigeringer |

||

| − | Separate = fakturér generelle fakturaer og korrigeringer på separate fakturaer |

||

| − | Int = kun interne korrigeringer |

||

| − | |- |

||

| − | !Fremtving én faktura pr. kunde |

||

| − | |Hvis afkrydset overstyres kundens minimumbeløb. |

||

| − | |} |

||

| + | External corrections |

||

| − | Generel fakturatekst kan skrives for hver fakturering. |

||

| + | Not corrected |

||

| − | == Kreditér/vend faktura == |

||

| + | Not corrected + external corrections separately |

||

| − | Dersom hele fakturaen er fejl kan du kreditere den i fanebladet Kreditering. |

||

| + | Internal corrections |

||

| − | {{ExpandImage|MED-EK-DA-Bild4.png}} |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !Spær indrykninger |

||

| − | |Betyder at hvornår en faktura krediteres, bliver alle indrykninger spærrede så, at de ikke kan blive fakturerede. Hvis feltet ikke er afkrydset, bliver indrykningerne bookede og kan senere genfaktureres. |

||

|- |

|- |

||

| + | !Force one invoice… |

||

| − | !Send e-mail … |

||

| + | |If selected, the minimum amount for invoice in the client setting will be overruled and an invoice will be printed anyway |

||

| − | |Ikke længere i brug. Brug fakturadistribution i Økonomi: Fakturadistribution. |

||

| + | |- |

||

| + | !Invoice text |

||

| + | |Possibility to write an invoice text at every invoicing. |

||

|} |

|} |

||

| + | |||

| − | == Kreditér/Vend indrykninger == |

||

| + | == Credit an invoice == |

||

| + | If the entire invoice is incorrect, it can be credited under the Reversing tab. There, you can also reverse part of the invoice by entering the order number/entry. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild3.png}} |

||

| − | Åbn ordren og indrykningen. Vælg indrykning og tryk på KREDITER |

||

| + | {|class=mandeflist |

||

| − | {{ExpandImage|MED-EK-DA-Bild5.png}} |

||

| + | !Inv.no.series |

||

| − | {{ExpandImage|MED-EK-DA-Bild6.png}} |

||

| + | |It is possible to set a deviating number series for credit invoices. |

||

| − | |||

| + | |- |

||

| − | |||

| + | !Block ins. after rev… |

||

| − | Indrykningen bliver krediteret, dvs. den bliver en kreditindrykning og mærkes med en korrektion. Det indebærer at du kan vælge at fakturere kreditten separat i den løbende fakturering. Vælg hvis du vil at det tidligere fakturanummer bliver lagt til som kommentar. |

||

| + | |Means that after reversal of the invoice, all its insertions are blocked for invoicing. |

||

| − | |||

| − | {{ExpandImage|MED-EK-DA-Bild7.png}} |

||

| − | |||

| − | {| class=mandeflist |

||

| − | Krediteringen indebærer at hele indrykningen, inklusive mulige indrykningsgebyrer og fee bliver krediteret. |

||

| − | | |

||

|} |

|} |

||

| + | |||

| + | == Credit an insertion == |

||

| + | Orders and single insertions are credited in Media | Plans. Also, corrections are made here. |

||

| + | * Open order and insertion. |

||

| − | Hvis du vil kreditere en indrykning uden at inkludere indrykningsgebyr eller fee, kan du ekskludere dem. |

||

| + | * Select one or several insertions that shall be credited and use the Credit button. |

||

| + | * Select type of crediting and press OK. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild4.png}} |

||

| + | |||

| + | The insertion will be reversed as a credit insertion and gets a correction mark. Now the credit can be separately invoiced in the current invoicing. |

||

| + | * Select if you want to use the previous invoice number as a comment on the credit invoice. |

||

| − | Det gøres i fanebladet Øvrigt inde i indrykningen. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild5.png}} |

| + | This credit means that the complete insertion including possible insertion fee and capital cost will be credited. To credit an insertion without including insertion fee and capital cost, they can be excluded. Exclude insertion fee in the Other tab on the insertion. |

||

| − | == Krediter dele af fordeling == |

||

| + | {{ExpandImage|MED-ACC-EN-Bild6.png}} |

||

| − | Hvis du har en fordeling og du kun vil kreditere én af kunderne , flytter du i praktikken omkostningen til en anden kunde |

||

| + | |||

| + | Exclude capital cost on the insertion. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild7.png}} |

||

| − | {| class=mandeflist |

||

| + | |||

| − | !Eksempel: |

||

| + | == Credit part of allocation == |

||

| − | | |

||

| + | If an allocation exists and only one of the clients shall be credited, the cost must be “moved” to another client. |

||

| − | |} |

||

| + | '''Example''' The client Toyota Norway shall be credited, and Toyota Sweden shall be debited instead, meaning that Toyota Sweden shall pay the entire cost. |

||

| − | Kunden SAS Norge skal krediteres og kunden SAS Sverige skal i stedet debiteres, dvs. den seneste skal betale hele beløbet. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild8.png}} |

| + | |||

| + | * Open the order and select the insertion that shall be corrected, press the Credit allocation button. |

||

| + | |||

| + | {{ExpandImage|MED-ACC-EN-Bild9.png}} |

||

| + | {{ExpandImage|MED-ACC-EN-Bild10.png}} |

||

| − | Gør : |

||

| + | |||

| − | 1. Åbn ordren og vælg indrykningen som ska korrigeres, brug KREDITÈR FORDELING. |

||

| + | * Select the insertion to be credited, press OK. |

||

| + | * Open the credit row and write an invoice comment under the Correction tab. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild11.png}} |

| + | |||

| + | * Select the insertion to be debited (the original, not the credit). |

||

| + | * Use Debit allocation and select the client to be debited. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild12.png}} |

||

| − | 2. Vælg faktura som skal krediteres, tryk OK. |

||

| + | |||

| + | * Select the new debit insertion and open. |

||

| + | * An invoice comment can be added in the correction tab. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild13.png}} |

||

| + | |||

| + | * Save. Two new invoices are printed at the next invoicing. A credit to Toyota Norway and a new debit to Toyota Sweden. |

||

| + | == Pre-invoicing == |

||

| − | {{ExpandImage|MED-EK-DA-Bild11.png}} |

||

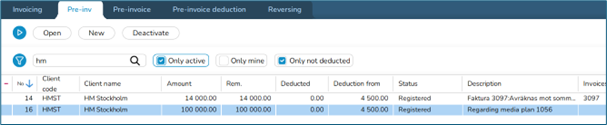

| + | The list under the Pre-invoice tab shows pre-invoice status. Here you can see the invoice amount, how much has been deducted and from which amounts, and the remaining amount. |

||

| + | The Deduction from column shows definitive orders that can be deducted from. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild14.png}} |

| + | |||

| + | There are two ways to pre-invoice that are managed from the client agreement. |

||

| + | '''No current pre-invoice deduction''' The client is pre-invoiced, and a controlled deduction takes place. |

||

| + | '''Current pre-invoice deduction''' The client is pre-invoiced, and all definitive insertions are currently deducted. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild15.png}} |

||

| − | 3. Vælg indrykning som skal debiteres (originalindrykningen, ikke krediteringen). |

||

| + | |||

| + | The parameter setting ”Current pre-invoice deduction per row” should be set to make sure that what is in ”Deduction from” only shall be used. This parameter is in Media | Backoffice | Base registers | Parameters | Invoicing tab. |

||

| + | |||

| + | ===New pre-invoice=== |

||

| + | * Go to the Pre invoice tab. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild16.png}} |

||

| − | 4. Brug DEBITER FORDELING. |

||

| + | |||

| + | * Enter client and possible owner. Owner is only used for sorting and filtering in the pre-invoice list. |

||

| + | * Write a description. It will be shown in the pre-invoice list. |

||

| + | * Block current deduction means that the pre-invoice will not be deducted in the current pre-invoice deduction. |

||

| + | * It is possible to deduct from another client, if it belongs to the same collective client. |

||

| + | * Select NEW in the Pre-invoices tab. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild17.png}} |

||

| − | 5. Vælg post som skal debiters på nyt (SAS Sverige) og tryk OK. |

||

| + | |||

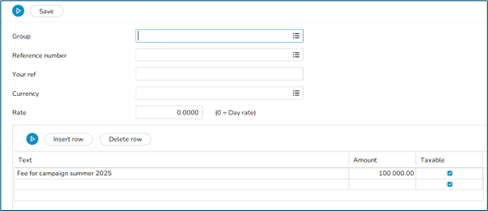

| + | * Fill in text and amount. Select if the pre-invoice shall be subject to VAT or not. The invoice cannot have mixed rows with VAT and VAT-free. |

||

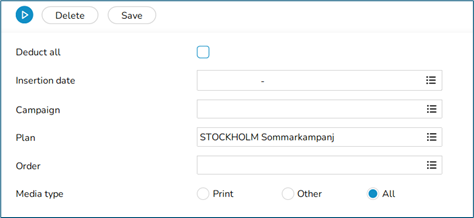

| + | * If you know from which plan/order the pre-invoice shall be deducted, you can fill in that in the Deduction from tab. |

||

| + | * Deduct all is selected as default but you can remove it an enter plan, order or other to be deducted from. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild18.png}} |

||

| − | 6. Vælg den nye debetindrykning og åbn den. Under fanen Korrektion, ændr kunde till SAS Sverige og skriv eventuelt en fakturakommentar. |

||

| + | |||

| + | * Save and print the invoice in the Pre-invoice tab. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild19.png}} |

| + | |||

| + | === Pre-invoice deduction === |

||

| + | '''Current pre-invoicing''' is deducted in the Invoicing tab. |

||

| + | '''No current pre-invoicing''', i.e. a controlled deduction is done in the Pre-invoice deduction tab. Enter the pre-invoice number to be deducted here. Any surplus/deficit will be invoiced in the form of a debit or credit invoice, and the pre-invoiced will be cleared. |

||

| − | 7. Gem. To nye fakturaer vil skrives ud ved næste fakturering. En kreditnota til SAS Norge og en ny debetfaktura til SAS Sverige. |

||

| + | '''Keep in mind''' When invoicing clients with agreements that states ”Current pre-invoice deduction”, the system takes the oldest pre-invoice and begins with it. If nothing meets the condition set for the pre-invoice, deduction continues with the next pre-invoice and continues until as much as possible can be deducted. |

||

| − | == Acontofakturering == |

||

| + | You should therefore link a pre-invoice to a plan/order if you want to be sure that only that plan/those orders are included in the deduction. |

||

| + | |||

| + | == Invoice project together with a media invoice == |

||

| − | Listen i aconto-fanen viser status på acontofakturaer; fakturabeløb, afregningsbeløb og resterende beløb. Afregning fra viser bookede ordrer der er tilgængelige for afregning. |

||

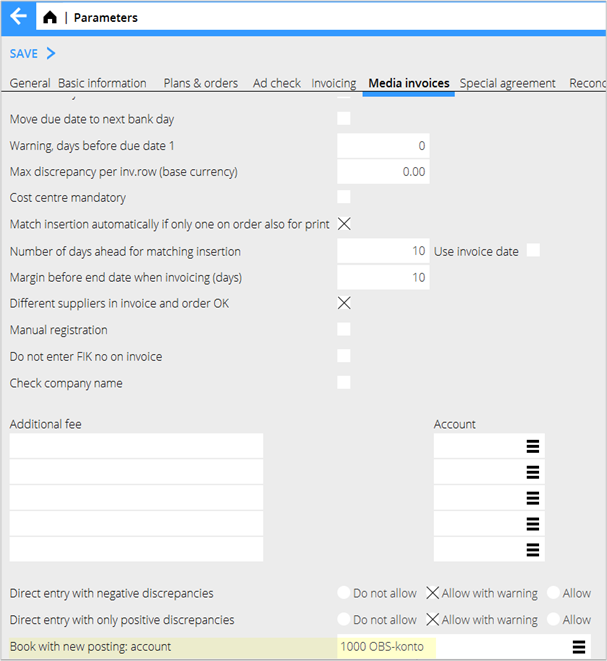

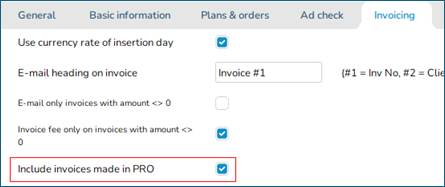

| + | To be able to print a project invoice together with a media invoice, parameter settings must be made in Media | Backoffice | Base registers | Parameters | Invoicing. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild20.png}} |

| + | |||

| + | * Create an invoice in Project | Invoicing and connect the invoice to the media plan in the Parameters tab. |

||

| + | * The invoicing is done in media invoicing. |

||

| + | '''NB!''' The media invoice print template must be updated so that it fetches information from the project accounting. |

||

| + | |||

| − | Der er to måder for acontofakturering baseret på kundeaftalen: |

||

| + | == Reconcile media discrepancies/Discrepancy handling== |

||

| + | Reconciliation and booking away discrepancies are made in Media | Reconciliation. |

||

| + | You can select on reconciliation codes, owner, client, date among other things. Your choices can be saved as default or as a selection, so that you don’t need to change each time you want to print the list. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild21.png}} |

||

| − | * Kunden acontofaktureres og en kontrolleret afregning foretages. Ingen løbende acontofakturering. |

||

| + | |||

| + | '''Discr. net/Discr. Net-Net''' |

||

| + | This specifies how large the discrepancies should be to be displayed in the list. |

||

| − | * Kunden acontofaktureres og alle bookede indrykninger afregnes løbende. Løbende acontoafregning. |

||

| + | 1–999 999 999 in Discr.Net-Net is specified to avoid seeing all entries without a discrepancy or that are already booked away. |

||

| + | 0–999 999 999 in Diff Net-Net is specified to see all booked away discrepancies. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild22.png}} |

| + | When reconciling with the media settlement account, only the accounting date is entered, nothing else. The Net-Net amount is reconciled with the media settlement account in, for example, Accounting | Queries, Accounts tab or the Account specification in Accounting | Reports, General Ledger tab. |

||

| − | Ny acontofaktura: |

||

| + | {{ExpandImage|MED-ACC-EN-Bild23.png}} |

||

| − | Lav en ny acontofaktura i fanebladet Aconto. Notér, at det ikke er mulig at afregne aconto fra en anden kunde. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild24.png}} |

||

| − | Angiv kunde og evt. ejer (dersom du vil sortere og søge på egne i listen). |

||

| − | Spær løbende afregning = acontofaktureret afregnes ikke ved løbende acontoafregning. |

||

| − | |||

| − | |||

| − | I acontofakturering, tryk NY. |

||

| + | Set up the columns so that the relevant information is visible. The columns are selected using the list button on the far right of the header row. |

||

| − | {{ExpandImage|MED-EK-DA-Bild16.png}} |

||

| + | {|class=mandeflist |

||

| − | |||

| + | !Open |

||

| − | Angiv fakturadato, forfaldsdato og tekst med beløber. Vælg hvis acontoen skal have moms eller ikke. Gem og udskriv i fanebladet Acontofaktura. Hvis du allerede ved, hvilken budget/ordre fakturaen skal afregnes fra, kan du angive det før du skriver fakturaen ud. |

||

| + | |Open the order for deepening. |

||

| − | |||

| − | |||

| − | {{ExpandImage|MED-EK-DA-Bild17.png}} |

||

| − | |||

| − | Afregning fra |

||

| − | |||

| − | {{ExpandImage|MED-EK-DA-Bild18.png}} |

||

| − | |||

| − | {{ExpandImage|MED-EK-DA-Bild19.png}} |

||

| − | |||

| − | Angiv budget, ordre eller kampagne. Hvis du vælger "Afregn alt" kan du ikke lægge til noget i felten, de er udfyldte med defaultindstillinger. |

||

| − | |||

| − | {{ExpandImage|MED-EK-DA-Bild20.png}} |

||

| − | |||

| − | Beskrivelsesfeltet kan være til god nytte. |

||

| − | |||

| − | Hvornår det er tid for afregning, gøres det enten i Fakturering (ved løbende afregning) eller i fanebladet Acontoafregning (ved kontrolleret afregning). Angiv her acontofakturanummer, der skal afregnes. Eventuel over-/underskud faktureres som debet- eller kreditfakturaer og acontoen bliver udlignet. |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !Husk på: |

||

| − | | |

||

| − | |} |

||

| − | |||

| − | Ved fakturering af kunder med aftaler som siger ”Løbende acontoafregning”, vil Marathon begynde med den ældste acontoen. Hvis der ikke er noget, der opfylder betingelserne for den acontoen, fortsætter den med næste. |

||

| − | |||

| − | |||

| − | = Afstemning af mediedifferencer/Differencehåndtering = |

||

| − | |||

| − | Postere differencer i Media: Afstemning. |

||

| − | |||

| − | {{ExpandImage|MED-EK-DA-Bild21.png}} |

||

| − | |||

| − | Du kan lave en selektering på afstemningskoder, ejer, kunde, dato og mange flere felt. Du kan gemme din selektering hvis du vil bruge den på nyt. |

||

| − | |||

| − | {{ExpandImage|MED-EK-DA-Bild22.png}} |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !Diff Net /Diff Net-net |

||

| − | |Vælg hvor store differencer, liste skal vise. Hvis du ikke vil se alle indrykninger, skriv 1-999 999 999 ii Diff. Net-net. Indstillingen for at se bortposterede differencer er 0-999 999 999 i begge felten. |

||

| − | |} |

||

| − | {{ExpandImage|MED-EK-DA-Bild23.png}} |

||

| − | |||

| − | Beløbet i listen som viser Diff Net-net afstemmes mod kontoen for medieafregning. |

||

| − | Vælg bare “til regnskabsdato” dersom du vil stemme af med afregningskontoer, intet andet. |

||

| − | {{ExpandImage|MED-EK-DA-Bild24.png}} |

||

| − | {{ExpandImage|MED-EK-DA-Bild25.png}} |

||

| − | |||

| − | Placer kolonnerne så, at du kan se al relevant information. Brug pilen til højre i overskriftsraden for at skulle se alternativer. |

||

| − | |||

| − | |||

| − | {| class=mandeflist |

||

| − | !Åbn |

||

| − | |Åbn ordren for fordybning |

||

| − | |- |

||

| − | !Skab korrigeringer |

||

| − | |Skaber en ny indrykning på den valgte indrykningens net-net-difference, enten positiv eller negativ. Den nye indrykning kan senere faktureres til kunde. |

||

| − | |- |

||

| − | !Postér differencer |

||

| − | |Se neden. |

||

|- |

|- |

||

| + | !Create correction |

||

| − | !Afstemningskode |

||

| + | |Creates a new insertion of the selected insertion’s Net-Net discrepancy – negative or positive depending on the discrepancy. The new insertion can then be sent as an invoice to the client. |

||

| − | |Kan skiftes. |

||

|- |

|- |

||

| + | !Book away |

||

| − | !Afstemningskommentar |

||

| + | |See chapter below |

||

| − | |Mulighed for at lægge til eller ændre kommentarer. |

||

|- |

|- |

||

| + | !Reconciliation code/Comment |

||

| − | !Skift ordrenummer/indr.dato |

||

| + | |Possibility to change reconciliation code or add a comment on the insertion. |

||

| − | |Her kan du flytte mediefaktura mellem indrykninger. Se beskrivelse neden. |

||

|- |

|- |

||

| + | !Change order no/insertion date |

||

| − | !Skift ejer/kunde |

||

| + | |A registered media invoice can be moved to a new insertion. Read more in the chapter below |

||

| − | |Ændring af ejer eller kunde kræver en parameterindstilling som tillader skift. |

||

|- |

|- |

||

| + | !Change owner/client |

||

| − | !Vis faktura |

||

| + | |For changing plan owner or client. A parameter setting is required for change of client on an invoiced insertion. |

||

| − | |Viser en fakturakopi i PDF-format, hvis fakturaen er indscannet. |

||

| + | |- |

||

| + | !Show media invoices |

||

| + | |Shows invoice copy as PDF, if the invoice has been scanned. |

||

|- |

|- |

||

| + | !Claim |

||

| − | !Udskrift |

||

| + | |If the invoice is erroneous, it can here be sent as a reclamation to the supplier. |

||

| − | |Skriver afstemningslisten ud. For udskrift trænger I en udskriftsskabelon fra Kalin Setterberg. |

||

|} |

|} |

||

| + | |||

| − | == |

+ | == Book away discrepancies == |

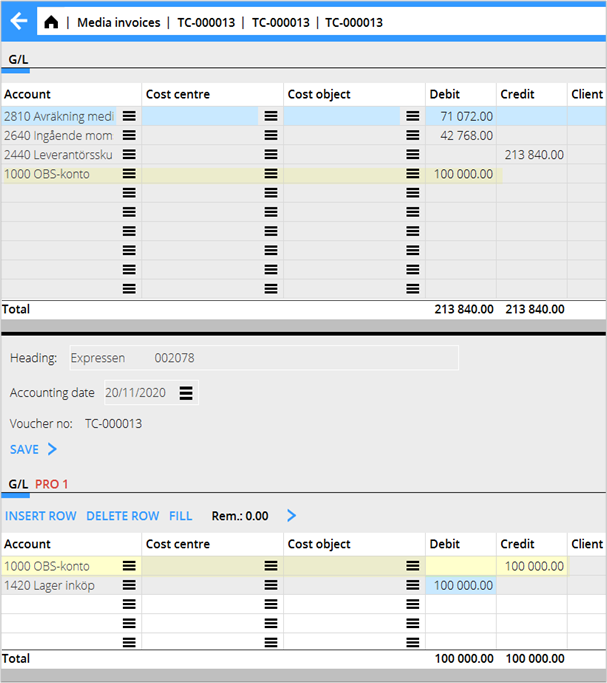

| + | * Select one or several rows and press Book away. |

||

| + | * Enter accounting date. It is also possible to book away a part by changing the amount and also change to optional account. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild25.png}} |

||

| − | Vælg én eller flere linier og tryk på POSTER DIFF |

||

| + | == Move media invoice to another order or insertion date== |

||

| − | {{ExpandImage|MED-EK-DA-Bild26.png}} |

||

| + | * Use the function Change order number/insertion date for moving an erroneously registered media invoice. Select the order and press the button. |

||

| + | * Select the media invoice and enter order number the insertion date into which the invoice shall be moved. It is possible to move it to an existing order number/insertion date. |

||

| + | * If only a part of the invoice shall be moved, enter amount. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild26.png}} |

||

| − | Angiv regnskabsdato. Du kan også postere en del af beløbet ved at ændre beløbet, lige så kontoen. |

||

| + | == Agency settlement== |

||

| − | {{ExpandImage|MED-EK-DA-Bild27.png}} |

||

| + | For clients whose agreements stipulate that the advertising agency is to receive a share of commissions, fees and charges, Agency is added to the client in order to create an agency settlement. When the agency settlement is printed, a supplier invoice is created and added to the corresponding supplier in the Purchase ledger, which is then paid. |

||

| + | Set up agency in Media | Backoffice | Base registers | Agencies |

||

| − | = Flyt mediefaktura til anden ordre eller indrykningsdato = |

||

| + | Enter the agency on the client in Media | Backoffice | Base registers | Client, Parameters 1 tab. |

||

| − | Funktionen Skift ordrenummer/indrykningsdato bruges for at flytte en fejlagtigt registreret faktura. Vælg ordre og klik på funktionen. Angiv mediefakturaen (søgbar i listen) og ordrenumret og den indrykningsdato, fakturaen skal flyttes til. Det er kun muligt at flytte til en eksisterende ordre og indrykningsdato. Hvis kun en del af fakturaen skal flyttes, angiv beløb. |

||

| − | {{ExpandImage|MED-EK-DA-Bild28.png}} |

||

| − | {{ExpandImage|MED-EK-DA-Bild29.png}} |

||

| + | On the client agreement in Media | Backoffice | Base registers | Agreements, you state how big part/percentage of insertion fee, agency commission and capital cost that shall be forwarded to the agency. |

||

| + | * Media | Backoffice | Agency settlement for printing out invoice and agency settlement specification. |

||

| − | = Bureauafregning = |

||

| + | * Select agency and accounting date or another selection. You can have different selections for different purposes, e.g. if only a certain media shall be settled on a plan. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild27.png}} |

||

| − | For kunder med aftaler, der tillader deler af provisioner, fee og andet til reklamebureauet, bruges kundens bureau for en bureauafreging. Ved udskrift af afregningen skabes en leverandørfktura på modsvarende leverandør i Kreditorer. Den betales senere som en almindelig leverandørsfaktura. |

||

| − | Skab bureau i Basisregister/MED/Bureauer. |

||

| − | {{ExpandImage|MED-EK-EN-Bild30.png}} |

||

| + | {|class=mandeflist |

||

| − | I kunderegistret i Basisregister/MED/Kunder, angiv bureauet i fanen Parametre 1. |

||

| + | !Paid invoices |

||

| − | |||

| + | |Creates settlement only for paid client invoices. |

||

| − | På kundeaftalen i Basisregister/MED/Aftaler angiver du hvor stor del/hvor mange procentenheder af indrykningsgebyr, bureauprovision og fees som skal gå videre til reklamebureauet. |

||

| − | Fakturaen og bureauafregningsdokumentet udskrives under Bureauafregning. |

||

| − | |||

| − | {{ExpandImage|MED-EK-EN-Bild31.png}} |

||

| − | |||

| − | {{ExpandImage|MED-EK-EN-Bild32.png}} |

||

| − | |||

| − | |||

| − | Vælg bureau og regnskabsdato eller anden selektering. Du kan fx lave selektering for at afregne et særskilt medie mod et vist budget. |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !Betalte fakturaer |

||

| − | |Viser kun betalte fakturaer i bureauafregningen |

||

|- |

|- |

||

| + | !Already updated |

||

| − | !Allerede opdateret |

||

| + | |Possibility to reprint the specification. |

||

| − | |Afkryds for mulighed at genudskrive specifikationen |

||

|- |

|- |

||

| + | !Reprint |

||

| − | !Genudskrift |

||

| + | |All agency settlements can be reprinted. |

||

| − | |Alle bureauafregninger udskrives på nyt. |

||

|} |

|} |

||

| + | [[Category:MED-ACC-EN]] |

||

| − | = Fakturér jobs sammen med mediefaktura = |

||

| + | [[Category:Media]] |

||

| − | |||

| + | [[Category:Manuals]] |

||

| − | Hvis du vil fakturere jobfakturaer sammen med mediefakturaer, må du aktivere en parameter i Media/Parametre/Fakturering. Faktureringen gøres i mediedelen og i jobstyringen angiver du på fakturaen, hvilket budget, fakturaen vedrør. Skab en faktura som normalt i Fakturering/Justering og kobl den med et budget i fanebladet Parametre. |

||

| − | |||

| − | Skabelonen for mediefaktura måtte opdateres så, at den henter information fra Jobstyringen. |

||

| − | |||

| − | [[Category:MED-EK-EN]] [[Category:Manuals]] [[Category:Media]] |

||

Latest revision as of 15:46, 26 January 2026

Contents

- 1 Media Accounting

- 1.1 Invoicing

- 1.2 Credit an invoice

- 1.3 Credit an insertion

- 1.4 Credit part of allocation

- 1.5 Pre-invoicing

- 1.6 Invoice project together with a media invoice

- 1.7 Reconcile media discrepancies/Discrepancy handling

- 1.8 Book away discrepancies

- 1.9 Move media invoice to another order or insertion date

- 1.10 Agency settlement

Media Accounting

Invoicing

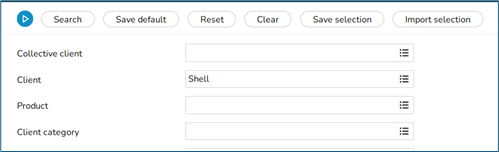

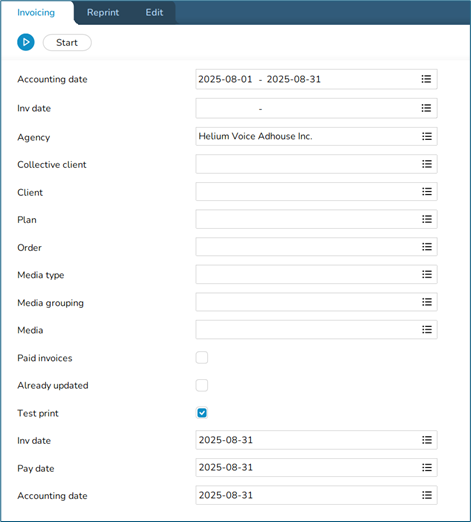

All invoicing is done in Media | Invoicing, including pre-invoicing, deductions and reversals of invoices.

Various selections can be made based on, for example, insertion date, plan number, client and client category. Invoicing per campaign can also be selected, if used.

If a specific media type or client is invoiced continuously, the selection can be saved so that a new selection does not have to be made each time. The options are located behind the blue arrow.

Different selections and description

| Current invoicing | Both = includes everything, regardless of whether the agreement has ‘Current invoicing’ or not. Yes = plans/orders that have ‘Current invoicing’ according to the agreement are invoiced. No = only includes agreements that do not have ‘Current invoicing’ checked. |

|---|---|

| Also not checked | If ticked, insertions are included even if they haven’t been ad checked - if plan- or order number is entered. |

| No reference no. | If Yes, all plans and orders without reference number but the client setting states that it is mandatory, will be invoiced. If Both is selected, everything is printed out but only in a test print. |

| Debit/credit | Blank = everything is printed out.

Debit = Only debit invoices are printed out. Credit = Only Credit invoices are printed out. Separately = debit – and credit records are printed on separate invoices. |

| Corrections | Insertions that are marked with Correction (x) can be invoiced peparately or be excluded:

Not corrected + external corrections External corrections Not corrected Not corrected + external corrections separately Internal corrections |

| Force one invoice… | If selected, the minimum amount for invoice in the client setting will be overruled and an invoice will be printed anyway |

| Invoice text | Possibility to write an invoice text at every invoicing. |

Credit an invoice

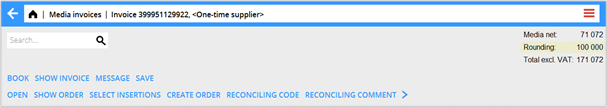

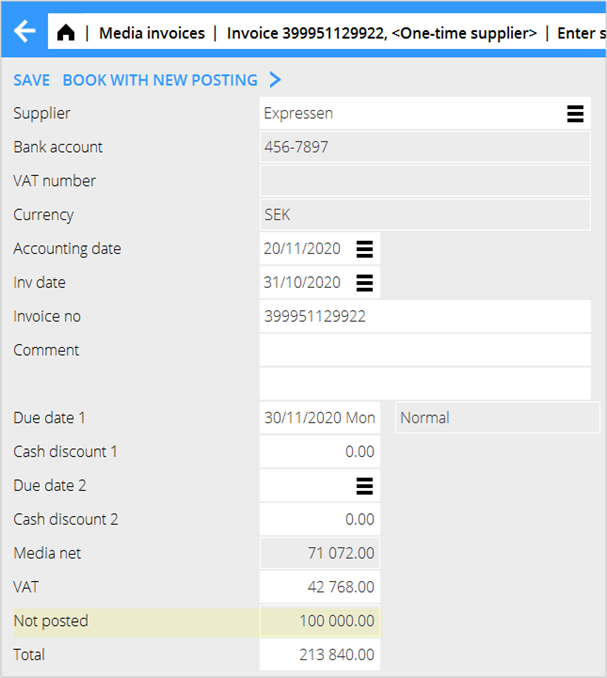

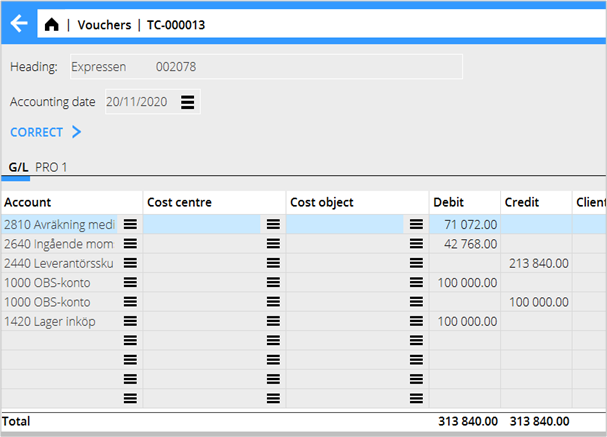

If the entire invoice is incorrect, it can be credited under the Reversing tab. There, you can also reverse part of the invoice by entering the order number/entry.

| Inv.no.series | It is possible to set a deviating number series for credit invoices. |

|---|---|

| Block ins. after rev… | Means that after reversal of the invoice, all its insertions are blocked for invoicing. |

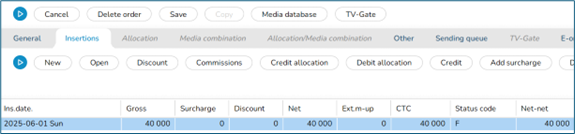

Credit an insertion

Orders and single insertions are credited in Media | Plans. Also, corrections are made here.

- Open order and insertion.

- Select one or several insertions that shall be credited and use the Credit button.

- Select type of crediting and press OK.

The insertion will be reversed as a credit insertion and gets a correction mark. Now the credit can be separately invoiced in the current invoicing.

- Select if you want to use the previous invoice number as a comment on the credit invoice.

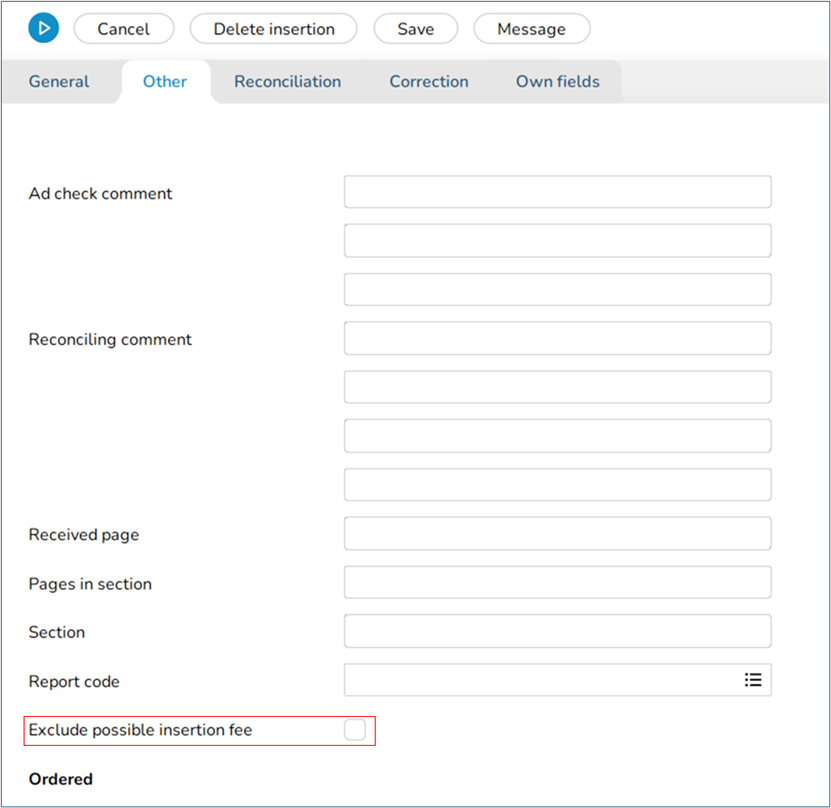

This credit means that the complete insertion including possible insertion fee and capital cost will be credited. To credit an insertion without including insertion fee and capital cost, they can be excluded. Exclude insertion fee in the Other tab on the insertion.

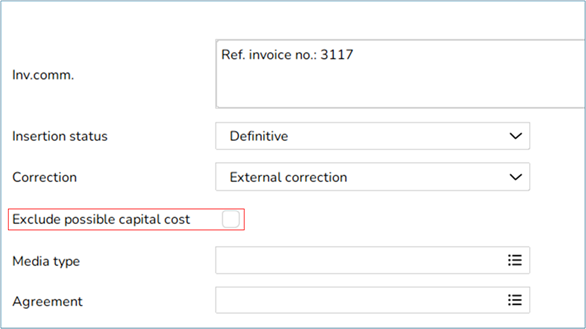

Exclude capital cost on the insertion.

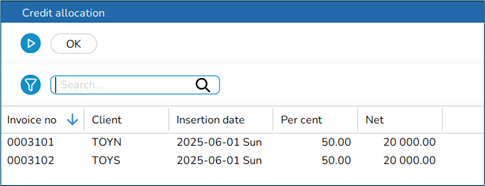

Credit part of allocation

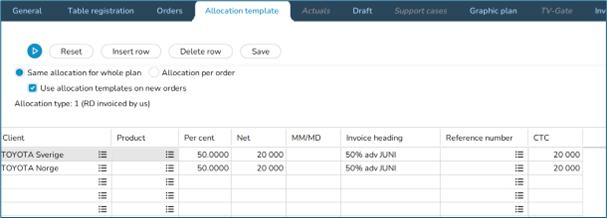

If an allocation exists and only one of the clients shall be credited, the cost must be “moved” to another client.

Example The client Toyota Norway shall be credited, and Toyota Sweden shall be debited instead, meaning that Toyota Sweden shall pay the entire cost.

- Open the order and select the insertion that shall be corrected, press the Credit allocation button.

- Select the insertion to be credited, press OK.

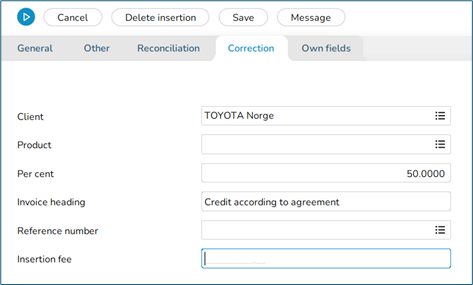

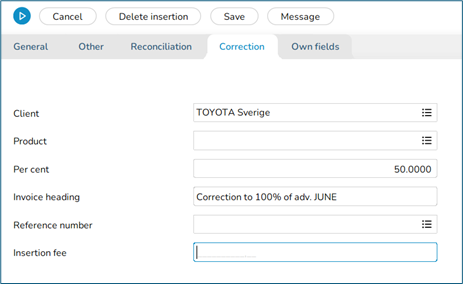

- Open the credit row and write an invoice comment under the Correction tab.

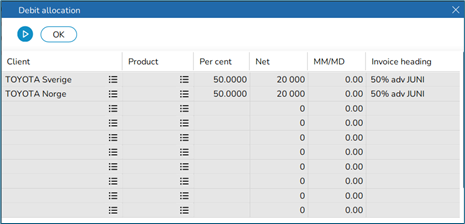

- Select the insertion to be debited (the original, not the credit).

- Use Debit allocation and select the client to be debited.

- Select the new debit insertion and open.

- An invoice comment can be added in the correction tab.

- Save. Two new invoices are printed at the next invoicing. A credit to Toyota Norway and a new debit to Toyota Sweden.

Pre-invoicing

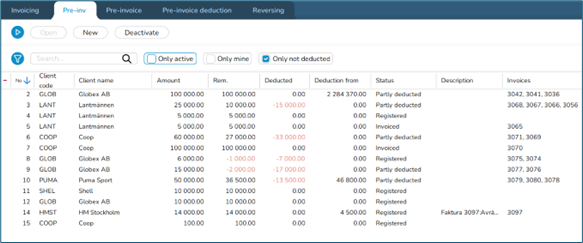

The list under the Pre-invoice tab shows pre-invoice status. Here you can see the invoice amount, how much has been deducted and from which amounts, and the remaining amount. The Deduction from column shows definitive orders that can be deducted from.

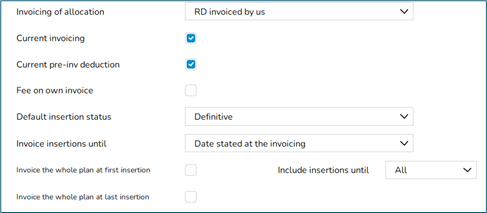

There are two ways to pre-invoice that are managed from the client agreement. No current pre-invoice deduction The client is pre-invoiced, and a controlled deduction takes place. Current pre-invoice deduction The client is pre-invoiced, and all definitive insertions are currently deducted.

The parameter setting ”Current pre-invoice deduction per row” should be set to make sure that what is in ”Deduction from” only shall be used. This parameter is in Media | Backoffice | Base registers | Parameters | Invoicing tab.

New pre-invoice

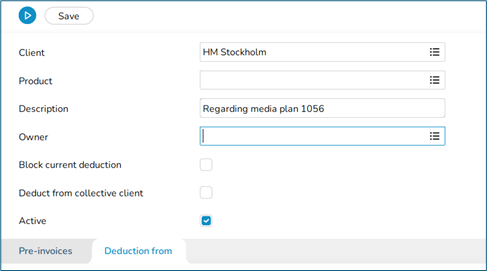

- Go to the Pre invoice tab.

- Enter client and possible owner. Owner is only used for sorting and filtering in the pre-invoice list.

- Write a description. It will be shown in the pre-invoice list.

- Block current deduction means that the pre-invoice will not be deducted in the current pre-invoice deduction.

- It is possible to deduct from another client, if it belongs to the same collective client.

- Select NEW in the Pre-invoices tab.

- Fill in text and amount. Select if the pre-invoice shall be subject to VAT or not. The invoice cannot have mixed rows with VAT and VAT-free.

- If you know from which plan/order the pre-invoice shall be deducted, you can fill in that in the Deduction from tab.

- Deduct all is selected as default but you can remove it an enter plan, order or other to be deducted from.

- Save and print the invoice in the Pre-invoice tab.

Pre-invoice deduction

Current pre-invoicing is deducted in the Invoicing tab.

No current pre-invoicing, i.e. a controlled deduction is done in the Pre-invoice deduction tab. Enter the pre-invoice number to be deducted here. Any surplus/deficit will be invoiced in the form of a debit or credit invoice, and the pre-invoiced will be cleared.

Keep in mind When invoicing clients with agreements that states ”Current pre-invoice deduction”, the system takes the oldest pre-invoice and begins with it. If nothing meets the condition set for the pre-invoice, deduction continues with the next pre-invoice and continues until as much as possible can be deducted.

You should therefore link a pre-invoice to a plan/order if you want to be sure that only that plan/those orders are included in the deduction.

Invoice project together with a media invoice

To be able to print a project invoice together with a media invoice, parameter settings must be made in Media | Backoffice | Base registers | Parameters | Invoicing.

- Create an invoice in Project | Invoicing and connect the invoice to the media plan in the Parameters tab.

- The invoicing is done in media invoicing.

NB! The media invoice print template must be updated so that it fetches information from the project accounting.

Reconcile media discrepancies/Discrepancy handling

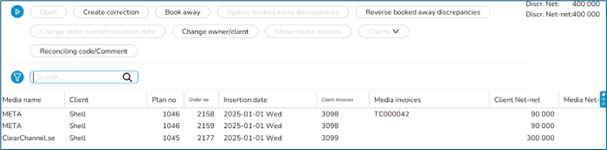

Reconciliation and booking away discrepancies are made in Media | Reconciliation. You can select on reconciliation codes, owner, client, date among other things. Your choices can be saved as default or as a selection, so that you don’t need to change each time you want to print the list.

Discr. net/Discr. Net-Net

This specifies how large the discrepancies should be to be displayed in the list. 1–999 999 999 in Discr.Net-Net is specified to avoid seeing all entries without a discrepancy or that are already booked away. 0–999 999 999 in Diff Net-Net is specified to see all booked away discrepancies.

When reconciling with the media settlement account, only the accounting date is entered, nothing else. The Net-Net amount is reconciled with the media settlement account in, for example, Accounting | Queries, Accounts tab or the Account specification in Accounting | Reports, General Ledger tab.

Set up the columns so that the relevant information is visible. The columns are selected using the list button on the far right of the header row.

| Open | Open the order for deepening. |

|---|---|

| Create correction | Creates a new insertion of the selected insertion’s Net-Net discrepancy – negative or positive depending on the discrepancy. The new insertion can then be sent as an invoice to the client. |

| Book away | See chapter below |

| Reconciliation code/Comment | Possibility to change reconciliation code or add a comment on the insertion. |

| Change order no/insertion date | A registered media invoice can be moved to a new insertion. Read more in the chapter below |

| Change owner/client | For changing plan owner or client. A parameter setting is required for change of client on an invoiced insertion. |

| Show media invoices | Shows invoice copy as PDF, if the invoice has been scanned. |

| Claim | If the invoice is erroneous, it can here be sent as a reclamation to the supplier. |

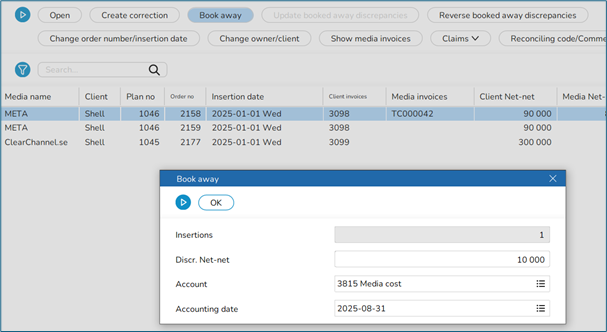

Book away discrepancies

- Select one or several rows and press Book away.

- Enter accounting date. It is also possible to book away a part by changing the amount and also change to optional account.

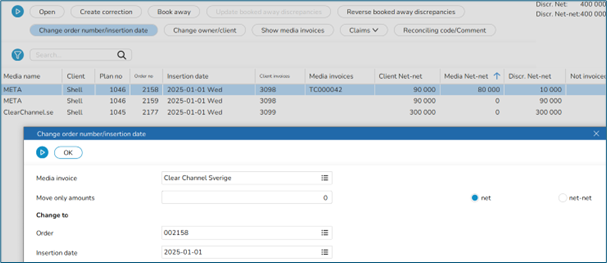

Move media invoice to another order or insertion date

- Use the function Change order number/insertion date for moving an erroneously registered media invoice. Select the order and press the button.

- Select the media invoice and enter order number the insertion date into which the invoice shall be moved. It is possible to move it to an existing order number/insertion date.

- If only a part of the invoice shall be moved, enter amount.

Agency settlement

For clients whose agreements stipulate that the advertising agency is to receive a share of commissions, fees and charges, Agency is added to the client in order to create an agency settlement. When the agency settlement is printed, a supplier invoice is created and added to the corresponding supplier in the Purchase ledger, which is then paid.

Set up agency in Media | Backoffice | Base registers | Agencies

Enter the agency on the client in Media | Backoffice | Base registers | Client, Parameters 1 tab.

On the client agreement in Media | Backoffice | Base registers | Agreements, you state how big part/percentage of insertion fee, agency commission and capital cost that shall be forwarded to the agency.

- Media | Backoffice | Agency settlement for printing out invoice and agency settlement specification.

- Select agency and accounting date or another selection. You can have different selections for different purposes, e.g. if only a certain media shall be settled on a plan.

| Paid invoices | Creates settlement only for paid client invoices. |

|---|---|

| Already updated | Possibility to reprint the specification. |

| Reprint | All agency settlements can be reprinted. |