Difference between revisions of "Inventory ledger/nb"

(Created page with "== Bytt inventarnummer == Dersom du har ett inventar som har havnet på feil inventarsort eller fått feil nummer, kan du korrigere det i {{pth|Økonomi|Inventarer}}, flik Inv...") |

(Updating to match new version of source page) |

||

| (6 intermediate revisions by one other user not shown) | |||

| Line 1: | Line 1: | ||

| + | <htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

||

| − | =Anleggsregister i Marathon= |

||

| − | Anleggsregistret er en separat modul i Marathon for håndtering av selskapet sine inventarer. Den er integrert med bokføringen; inventarerna registreres enten som leverandørsfakturaer eller som manuelle bilag og avskrivninger og avhendinger konteres på de kontoer som er oppgitte på forskjellige inventarsorter. |

||

| − | |||

| − | == Innstillinger og grunnregister == |

||

| − | Det finnes visse innstillinger som rører funksjonene i anleggsregistret. |

||

| + | =Inventory ledger= |

||

| − | === Integrasjon på konto=== |

||

| + | The inventory ledger is a separate module in Marathon to manage the company's fixed assets. The inventory ledger is integrated with the accounting system – inventory is recorded via supplier invoices or manual vouchers, and depreciation and disposals are automatically posted to the accounts set up for the inventory types. |

||

| − | Anskaffelseskontoerne måtte ha integrasjon til anleggsregistret for at inventarer fra bokføring og leverandørsfakturaer skulle registreres. |

||

| + | ==Settings and base registers== |

||

| − | Innstillingen ligger på kontoen i {{pth|Grunnregister|BOK/Kontoer}}. Velg INV i integrasjonsfeltet. |

||

| + | There are a few settings concerning the functions in the inventory ledger. |

||

| − | |||

| + | ===Assignments on accounts=== |

||

| + | To register inventory items from accounting and supplier invoices, the accounts for acquisitions must be set up with assignment to the Inventory Ledger. |

||

| + | The setting is in the account in Accounting | Backoffice | Base registers, Accounting tab. Open the Account and select INV in the '''Assignment''' field. |

||

| + | ===Asset types=== |

||

| + | All assets in Marathon must belong to an asset type. The asset type controls accounting for depreciation and provides suggestions for the number of depreciation months. It is also a way of categorising assets. |

||

| + | Asset types are registered in Accounting | Backoffice | Base registers, the Inventory Ledger tab |

||

| + | |||

{{ExpandImage|ACC-INV-EN-Bild1.png}} |

{{ExpandImage|ACC-INV-EN-Bild1.png}} |

||

| + | The '''code''' can be a maximum of four characters and is usually a short name of the type, for example, COMP for Computers. |

||

| − | === Inventarsorter === |

||

| + | The '''handling code'''' controls the depreciation rules for the asset type: |

||

| − | Alle inventarer i Marathon må tilhøre en inventarsort. Inventarsorten styr konteringene ved avskrivning og foreslår antall avskrivningsmåneder. det er også en måte for p kategorisere inventarer. |

||

| + | Asset is the standard handling code; an asset with this handling code can be depreciated and disposed of with automatic posting. |

||

| − | Inventarsortene registreres i {{pth|Grunnregister|INV/Inventarsorter}}. |

||

| + | ''Leasing'' does not generate any depreciation and does not expense any part of the acquisition but treats the asset as a lease. |

||

| + | ''Expensed'' can be used to register asset that is expensed directly upon acquisition. |

||

| + | ''Cost estimate'' allows you to budget for assets. |

||

| + | In inventory reports, you can select by handling code. |

||

| + | '''Depreciation - months''' The Depreciation period in months field is used to enter the proposed number of months for which equipment of this type should be depreciated. The number of months can be changed for individual assets when they are registered. |

||

| − | {|class= mandeflist |

||

| − | !Koden |

||

| − | |må være maksimalt fire tegn og er oftest en forkortelse av navnet til sorten, f eks, DATA for Datamaskiner. |

||

| − | |- |

||

| − | !Håndteringskoden |

||

| − | |styrer avskrivningsreglene til inventarsorten: |

||

| − | '''Inventar''' er den mest brukte koden; inventarer med denne sort kan bli avskrevne og avhendte med automatisk kontering. |

||

| − | '''Leasing''' genererer ikke avskrivninger og kostnadsfører heller ikke noen del av anskaffelsen, uten håndterer inventaren som leasing. |

||

| − | '''Kostnadsført''' kan brukes for registreing av inventarer som kostnadsf8res direkte ved anskaffelse. '''Budsjett''' muliggør budsjettering av inventarer. |

||

| − | I rapporter som rører anleggsregistret kan man lage selekteringer med håndteringskoder. |

||

| − | |- |

||

| − | !Feltet Avskrivninger- måneder |

||

| − | |Viser ett forslag på antall avskrivningsmå for denne inventarsort. Nummeret kan endres for enkelte inventarer. |

||

| − | |- |

||

| − | !Neste inventarnummer |

||

| − | |viser nummeret på neste inventar som blir registrert. Nummeret er i formatet XXXX-NNNNNN-NN hvor XXXX er koden til inventarsorten, NNNNNN et serienummer for hovedinventaret og det siste NN ett underserienummer til hovedinventaret. Ett eksempel på inventarnummer: DATA-000001-01 |

||

| − | |- |

||

| − | !Nummerseriene |

||

| − | |kan holdes separate pr. inventarsort. Det er også mulig å bruke en sentral nummerserie for flere eller alle inventarsorter. Dersom du bruker sentrale nummerserier, må Neste inventarnummer være 0. |

||

| − | |- |

||

| − | !Konto for anskaffelser |

||

| − | |brukes ved booking av nye inventarer og avhendinger. Ved tiden for anskaffelse |

||

| − | debiteres hele kostnaden til inventaret. Ved tiden for avhending foreslås kreditering av hele beløpet, men den kan endres. |

||

| − | |- |

||

| − | !Konto for verdiminskning |

||

| − | |brukes ved avskrivninger og avhendinger. Ved avskrivning krediteres beløpet. Ved avhendingforeslås debitering av hele det tidligere avskrevne beløpet. |

||

| − | |- |

||

| − | !Konto for kostnad ved avskrivning |

||

| − | |brukes vid avskrivning. Ved avskrivning debiteres hele beløbet. Ved avhending foreslås debitering av den totale tidligere avskrevne summen. |

||

| − | |- |

||

| − | !Konto for kostnad ved salg |

||

| − | |brukes ved salg. Vid salg foreslås at resterende beløp debiteres. |

||

| − | |- |

||

| − | !Konto for kostnad ved skrotning |

||

| − | |Brukes da invventarer skrotes |

||

| − | |- |

||

| − | !Konto for kostnad ved svinn |

||

| − | |Brukes ved svinn av inventarer |

||

| − | |- |

||

| − | |} |

||

| − | Vi foreslår at dere bruker flere separate kontoer for hver inventarsort og konteringssort. |

||

| + | The '''next asset number''' determines the number of future assets that are registered. The asset number has the format XXXX-NNNNNN-NN, where XXXX is the code for the asset type, NNNNNN is a serial number for the main asset, and NN at the end is a sub-serial number for a main asset. An example of an asset number is COMP-000001-01. |

||

| − | {{ExpandImage|ACC-INV-EN-Bild2.png}} |

||

| + | |||

| + | '''Next asset number'''. It is possible to have separate series for each asset type or to use a central number series for several or all asset types. If the series is to be globall, 0 is specified as the next asset. |

||

| + | |||

| + | The '''acquisition account''' is used when recording new assets and when disposing of it. Upon acquisition, the entire cost of the asset is debited. Upon disposal, crediting of the entire cost of the asset is suggested, but this can be changed. |

||

| + | |||

| + | The '''account for depreciations''' is used for depreciation and disposal. When depreciating, the amount being depreciated is credited. When disposing, the entire amount previously depreciated is debited. |

||

| + | |||

| + | The '''account for depreciation costs''' is used for depreciation. When depreciating, the amount that is depreciated is debited. |

||

| + | |||

| + | The '''account for sales costs''' is used for disposals of the Sales type. When disposing, it is suggested that the amount remaining after the sale be debited. |

||

| + | |||

| + | The '''account for disposal costs''' is used for disposals of the disposal type. |

||

| + | |||

| + | The '''account for theft''' costs is used for disposals of the theft type. |

||

| + | |||

| + | Separate accounts should be used for each type of inventory and type of posting. |

||

| + | ===Placement codes=== |

||

| + | Placement codes can be used to link assets to different departments, such as different offices or floors. The codes are set up in Accounting | Backoffice | Base registers, on the Inventory Ledger tab, and require a Code and a Name. |

||

| + | |||

| + | {{ExpandImage|ACC-INV-EN-Bild2.png}} |

||

| + | |||

| + | ===Parameters=== |

||

| + | The parameters for the inventory ledger are in Accounting | Backoffice | Base registers, Inventory ledger tab |

||

| + | |||

| + | {{ExpandImage|ACC-INV-EN-Bild3.png}} |

||

| + | '''General asset type''' Specifies whether one or more asset numbers should use the same number series. All asset types with 0 as the Next asset number use the central number series. In this case, the number series for the asset type registered here is used. |

||

| − | === Plasseringskoder === |

||

| + | |||

| − | Plaseringskoder kan brukes for å kople inventarer til forkjellige avdelinger, f eks kontor eller etasjer. Plasseringskoder registreres i {{pth|System|Grunnregister/INV/ Plasseringskoder}} och krever kun en kode og ett navn. |

||

| + | '''Posting of depreciations in G/L''' and '''Posting of disposals in G/L''' determine whether depreciation and disposals are to be posted automatically in the accounts. If this option is not selected, depreciation and disposals must be posted manually to ensure that the inventory ledger and the accounts match. |

||

| − | {{ExpandImage|ACC-INV-EN-Bild3.png}} |

||

| + | |||

| + | ==Register assets== |

||

| + | You can register assets in three ways: in the purchase ledger, with a journal voucher or directly in the inventory ledger. |

||

| + | ===Via supplier’s invoice=== |

||

| + | If the asset comes from a supplier’s invoice, it can be registered when posting the invoice. |

||

| + | |||

| + | Enter the acquisition account for the asset. If only one asset type has this account set as the acquisition account, it is suggested for the Asset type field. If several asset types have this account set as the acquisition account, no asset type is suggested and must be selected manually. |

||

| + | |||

| + | {{ExpandImage|ACC-INV-EN-Bild4.png}} |

||

| − | == |

+ | ===Via journal voucher=== |

| + | Enter the acquisition account for the asset. In the INV tab that has been created, enter the Asset type, Amount and Description. Return to the GL tab and complete the posting before saving the voucher. |

||

| − | Parametre som påvirker anleggsregistret finnes i {{pth|System|Grunnregister/INV/ Parametrer}}. |

||

| − | Generell inventartype må angis dersom en eller flere inventarnummer vil bruke en sentral nummerserie. Alle inventartyper med 0 i Neste inventarnummer bruker den sentrale nummerserien. Det er den nummerserie på inventarsort som brukes som er registrert her. |

||

| + | {{ExpandImage|ACC-INV-EN-Bild5.png}} |

||

| − | Parametrene Kontering av avskrivninger i BOK og Kontering av avhendinger i BOK styr hvis avskrivninger og avhendinger vil konteres automatisk i bokføringen. Dersom det ikke er avkrysset, må man booke manuelt for at anleggsregister og bokføring skulle stemme. |

||

| + | |||

| + | ===Manual registration=== |

||

| + | It is possible to register assets directly in the inventory ledger. Manual registration must be booked manually for the subsystems to match. Manual assets are registered in Accounting | Backoffice | Base registers, Inventory Ledger tab using the New button. |

||

| + | |||

| + | ==Complete assets== |

||

| + | Asset registered via a supplier’s invoice, or a journal voucher needs to be completed in Accounting | Backoffice | Asset, the Asset tab. |

||

| + | |||

| + | '''Only not completed''' is ticked to see only assets that need to be completed. |

||

| + | |||

| + | {{ExpandImage|ACC-INV-EN-Bild6.png}} |

||

| + | |||

| + | Open the asset and enter at least the '''First depreciation period'''. Also enter other supplementary information such as '''Serial number''', '''Placement''' and '''Comment'''. |

||

| + | |||

| + | ==Depreciation of assets== |

||

| + | Depreciations are made in Accounting | Backoffice | Assets, Depreciation tab. |

||

| − | {{ExpandImage|ACC-INV-EN- |

+ | {{ExpandImage|ACC-INV-EN-Bild7.png}} |

| + | Enter the end period, '''Until period''', for depreciation and the '''Accounting date''' for depreciation. |

||

| − | == Registrer inventarer == |

||

| − | Inventarer kan registreres i tre ulike program. |

||

| + | It is possible to depreciate only a specific '''type of asset'''. If the field is left blank, all types of assets will be included. |

||

| − | === Via leverandørsreskontroen === |

||

| − | Dersom inventaret kommer fra en leverandørsfaktura kan du registrera den da du registrear leverandørsfakturaen. |

||

| − | Angi anskaffelseskonto for inventaret. Hvis kun en inventarsort er integrert med kontoen, vil den bli foreslått i feltet Inventarsort. Hvis det er flere sorter som er integrerte med kontoen, må du skrive in kontoen manuelt. |

||

| + | Start by making a '''test print''' to get a list showing what will be included in the depreciation and how the accounting will be done. If it looks correct, make a final printout by removing the check mark next to Test printout. |

||

| − | {{ExpandImage|ACC-INV-EN-Bild5.png}} |

||

| + | |||

| + | ==Disposal of assets== |

||

| + | Disposal of assets is done in Accounting | Backoffice | Assets, under the Assets tab. Select the asset and click on the Dispose button. |

||

| + | |||

| + | Enter the '''Disposal code''' that corresponds to the reason for disposal and the '''Accounting date'''. If it is being disposed of due to a sale, the '''Sales price''' must be entered. |

||

| + | |||

| + | The posting for the disposal is suggested based on the remaining value of the asset, any sales price and the accounts you have set up for the asset type. The posting can be corrected manually. When the posting is complete, select Start. |

||

| + | |||

| + | {{ExpandImage|ACC-INV-EN-Bild8.png}} |

||

| + | ==Split asset== |

||

| − | === Via bokføringsbilag === |

||

| + | An asset can be split into several in Accounting | Backoffice | Assets, tab Assets. Press the '''Split''' button. Then enter the name, placement, and acquisition price for each asset per row in the table. |

||

| − | Angi anskaffelseskonto for inventaret. Fliken INV skapes. I fliken, angi Inventarsort, Beløp og Navn. Gå tilbake til fliken BOK og gjør ferdig konteringen før du lagrer bilaget. |

||

| − | {{ExpandImage|ACC-INV-EN- |

+ | {{ExpandImage|ACC-INV-EN-Bild9.png}} |

| + | All assets created because of splitting are given the same main number but separate sub-numbers. An asset COMP-1-1 that is split into two is therefore given the numbers COMP-1-1 and COMP-1-2 respectively. |

||

| − | === Via manuell registrering === |

||

| − | Det er mulig å registrere inventarer direkte i anleggsregistret. En manuell registrering måtte også bokføres manuelt for at delsystemen skulle overensstemme. |

||

| − | Den manuelle registerringen gjøres i {{pth|Økonomi|Inventarer}}, ved å klikke på {{btn|NY}}. |

||

| + | ==Change asset number== |

||

| − | == Kompletter inventarer== |

||

| + | If an asset has been assigned to the wrong asset type or given the wrong number, this can be corrected in Accounting | Backoffice | Assets, under the Assets tab. Select the asset and press '''Change Number''', then enter the number to which the asset should be moved. Please note that the accounting needs to be corrected manually when changing the asset type for the subsystem to be correct. |

||

| − | Inventarer som er blitt registrerte i systemet via leverandørsfaktura eller bilag må kompleteres i {{pth|Økonomi|Inventarer}},flik Avskrivning |

||

| − | Avkryss feltet Kun ikke kompletterte for å se listen på inventarer som trenger komplettering |

||

| − | {{ExpandImage|ACC-INV-EN- |

+ | {{ExpandImage|ACC-INV-EN-Bild10.png}} |

| + | |||

| + | ==Edit depreciation plan== |

||

| + | Assets are depreciated using a straight-line depreciation plan, Acquisition price / Number of months to depreciate. An asset of SEK 60,000 to be depreciated over 60 months is therefore depreciated at SEK 1,000 per month. |

||

| + | If the depreciation plan needs to be changed, there are two different options. |

||

| − | Åpn inventaret og angi minst Første avskrivningsperiode.Du kan også skrive inn annnen kompletterernde informasjon, som Serienummer, Plassering og Kommentar. |

||

| + | 1. Edit depreciation plan (only correction of future depreciation) |

||

| − | {{ExpandImage|ACC-INV-EN-Bild8.png}} |

||

| + | To correct the depreciation rate on the remaining amount of the asset, the depreciation plan can be changed under Accounting | Backoffice | Asset, the Asset tab. Open the asset, the Depreciation Plan tab. Enter the month from which the number of depreciation months is to be changed in the '''From Period''' column. The '''To period column''' is usually left blank, in which case the new plan applies to all future depreciation. The '''Quantity''' column specifies the number of months for which the asset is to be depreciated. |

||

| − | == Avskrivning av inventarer == |

||

| − | Avskrivninar gjøres i {{pth|Økonomi|Inventarer}}, flik Avskrivning. |

||

| − | Angi Periode Til for avskrivningen og regnskapsdato. |

||

| − | Du kan velge å kun avskrive en sorts inventar. DErsom feltet er blank, avskrives alle inventarsorter. |

||

| − | Du kan begynne ved å skrive ut en prøveutskrift for få en liste på hva avskrivningen omfatter og hvordan konteringene vil bli. Hvis det ser OK ut, fjern krysset fra feltet {{btn|Prøveutskrift}} og skriv ut. |

||

| + | The '''From period''' is filled in where the new depreciation plan is to apply. Depreciation already made is not affected. |

||

| − | {{ExpandImage|ACC-INV-EN-Bild9.png}} |

||

| − | == Avhending == |

||

| − | For å avhende et inventar, gå til {{pth|Økonomi|Inventarer}}, flik Inventarer. Velg inventaret of klikk på {{btn|Avhend}}. |

||

| − | Velg kode som sammenhenger med avhendingsmåte og regnskapsdato. Dersom afhendingen er salg, oppgi også salgsprisen. |

||

| − | KOnteruingen av ahemdingen foreslås basert på restbeløpet til inventaret, mulig salgspris og hvilke kontoer som er innstilte på inventarsorten. KOnteringen kan korrigeres manuelt. Da konteringen er ferdig, klikk {{btn|Start}}. |

||

| + | '''Example:''' |

||

| − | {{ExpandImage|ACC-INV-EN-Bild10.png}} |

||

| + | Acquisition price SEK 60,000. First depreciation period 2024–01. Number of months to depreciate = 60. Depreciation made up to and including 2024–12. New depreciation plan from period 2025–01 onwards with number of months to depreciate = 12. |

||

| + | |||

| + | In 2024, there are 12 depreciation amounts of SEK 1,000 per month. The remaining amount after 2024 = SEK 48,000. |

||

| + | |||

| + | For depreciation in 2025–01 and onwards, SEK 5,000 is depreciated (SEK 60,000 / 12). |

||

| − | == Splitt inventar == |

||

| − | Dersom du vil dele opp ett inventar i flere, velg inventaret i {{pth|Økonomi| Inventarer}}, og klikk {{btn|Splitt}}. I tabellen registrerer du navn, plassering og anskaffelespris, en rad pr. inventar. |

||

| − | Alle inventarer som skapes vid oppdeling får samme hovednummer men forskjellige undernummer. For eksempel, inventaret DATA-1-1 som splittes får numrene DATA-1-1 og DATA-1-2. |

||

{{ExpandImage|ACC-INV-EN-Bild11.png}} |

{{ExpandImage|ACC-INV-EN-Bild11.png}} |

||

| + | |||

| + | 2. Edit number of months (retroactive correction) |

||

| + | If the depreciation plan for the asset is incorrect and depreciation already made needs to be corrected, this is done directly on the asset in Accounting| Backoffice | Assets, under the Assets tab. |

||

| − | == Bytt inventarnummer == |

||

| + | |||

| − | Dersom du har ett inventar som har havnet på feil inventarsort eller fått feil nummer, kan du korrigere det i {{pth|Økonomi|Inventarer}}, flik Inventarer. Velg inventar og klikk {{btn|Bytt nummer}} og skriv hvilket nummer inventaret må byttes til. Husk at bokføringen må bli manuelt korrigert for at delsystemene skulle overensstemme. |

||

| + | The next depreciation will correct previous depreciation according to the new number of months. |

||

| − | {{ExpandImage|ACC-INV-SV-Bild12.png}} |

||

| − | |||

| − | == Edit depreciation plan == |

||

| − | The assets are depreciated with a flat depreciation plan, Acquisition price/Number of depreciation months. An asset for 60 000 SEK that shall be depreciated in 60 months is thus depreciated with 1000 SEK per month. |

||

| − | There are two ways of changing the depreciation plan. |

||

| − | === 1.Edit depreciation plan (only correcting future depreciations)=== |

||

| − | If you want to change the depreciation pace of an asset’s remaining amount, open the asset in {{pth|Accounting|Assets}}, tab Assets, tab Depreciation plan. State correction month in the field From period. The column To period is normally left blank; the new plan concerns hence all future depreciations. |

||

| − | The new depreciation plan is valid from and including the month stated in the From period field. Already performed depreciations are not affected. |

||

'''Example:''' |

'''Example:''' |

||

| − | Acquisition price 60 |

+ | Acquisition price SEK 60,000. First depreciation period 2024–01. Number of months to depreciate = 60. Depreciation made up to and including 2024–12. |

| − | During 2019 12 depreciations have been made with 1 000 SEK /month. Remaining amount after 2019 = 48 000 SEK. |

||

| − | Depreciations 01-2020 and forward will be 5 000 SEK (60 000 SEK / 12). |

||

| + | Change to the asset to Number of months to depreciate = 24, which means that SEK 2,500 per month should be depreciated. |

||

| − | {{ExpandImage|ACC-INV-SV-Bild13.png}} |

||

| + | |||

| − | |||

| + | In 2024, there are 12 depreciations of SEK 1,000 per month = SEK 12,000. |

||

| − | === 2.Edit months (correction retrospectively)=== |

||

| + | |||

| − | If the asset’s depreciation plan is erroneous and you want to correct also already performed depreciations, you can change months directly on the asset {{pth|Accounting|Assets}}t, tab Assets, tab Asset. |

||

| + | In 2025–01, SEK 20,500 is depreciated. SEK 2,500 for 2025–01 and SEK 18,000 to correct the previous depreciation for 2024 (60,000 / 24 * 12 - 12,000). |

||

| − | The next depreciation will correct previous depreciations based on the new number of months. |

||

| + | |||

| − | '''Example:''' |

||

| + | ==Reports== |

||

| − | Acquisition price 60 000 SEK. First depreciation period 01-2019. Months to depreciate = 60. Performed depreciations to 12–2019. |

||

| + | Reports for the fixed asset ledger are located under Accounting | Reports, the Inventory Ledger tab. |

||

| − | Change in field Months to depreciate on the asset = 24, which means monthly depreciation of 2 500 SEK. |

||

| − | During 2019 there has been 12 depreciations of 1 000 SEK/month = 12 000 SEK. |

||

| − | In 01–2020, 20 500 SEK is depreciated. 2 500 SEK for 01-2020 and 18 000 SEK that corrects the previous depreciations for 2019 (60 000 / 24 * 12 - 12 000). |

||

| + | The '''Depreciation List''' report is a standard report that lists assets according to selection by depreciation period, accounting date and asset type. |

||

| − | == Reports == |

||

| + | The '''Reports''' report is used to print reports with custom column templates. |

||

| − | Inventory ledger reports is found in {{pth|Accounting|Reports}}, tab Inventory ledger. |

||

| − | The report List depreciations is a standard report that lists assets selected on depreciation period, accounting date and asset type. |

||

| − | The report Reports is used for printing reports with tailor-made column templates. |

||

| − | {{ExpandImage|ACC-INV-SV-Bild14.png}} |

||

| − | [Category: |

+ | [[Category: ACC-INV-EN]] |

| − | [Category: |

+ | [[Category: Accounting]] |

| − | [Category: Manuals] |

+ | [[Category: Manuals]] |

Latest revision as of 15:04, 28 January 2026

Contents

Inventory ledger

The inventory ledger is a separate module in Marathon to manage the company's fixed assets. The inventory ledger is integrated with the accounting system – inventory is recorded via supplier invoices or manual vouchers, and depreciation and disposals are automatically posted to the accounts set up for the inventory types.

Settings and base registers

There are a few settings concerning the functions in the inventory ledger.

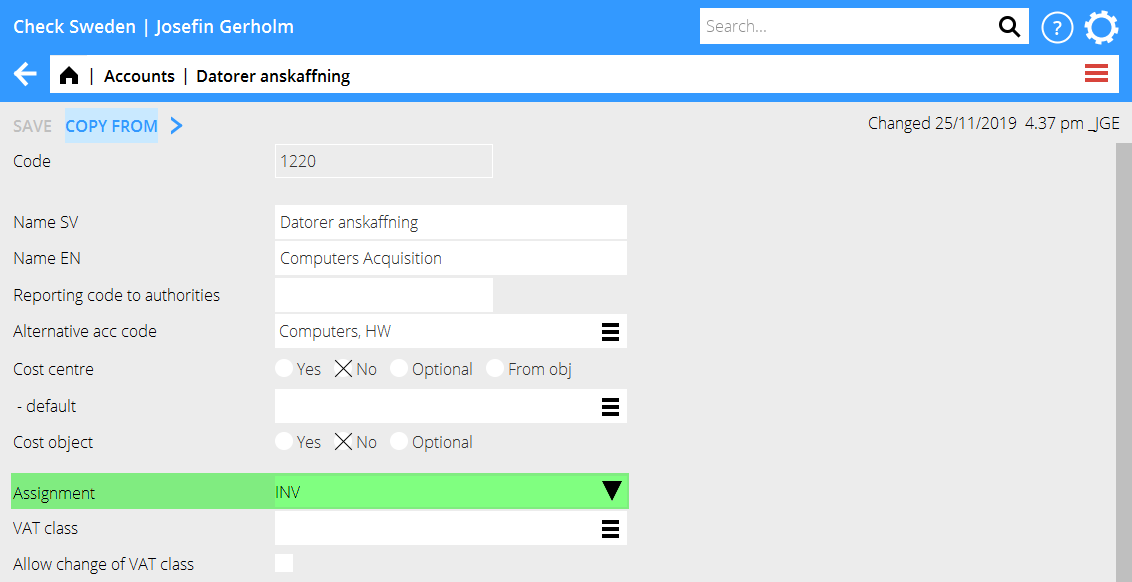

Assignments on accounts

To register inventory items from accounting and supplier invoices, the accounts for acquisitions must be set up with assignment to the Inventory Ledger. The setting is in the account in Accounting | Backoffice | Base registers, Accounting tab. Open the Account and select INV in the Assignment field.

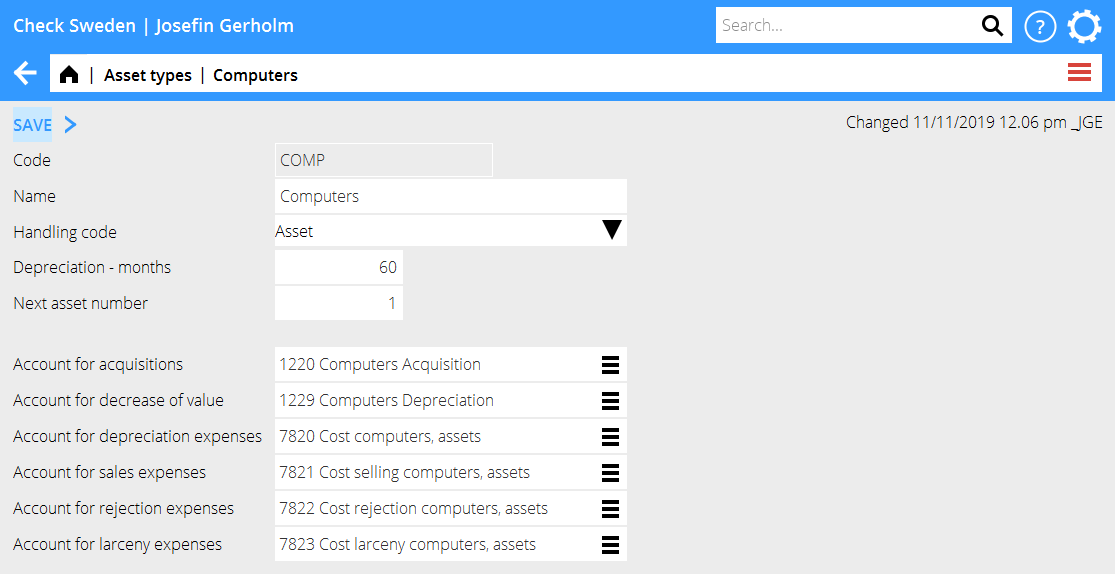

Asset types

All assets in Marathon must belong to an asset type. The asset type controls accounting for depreciation and provides suggestions for the number of depreciation months. It is also a way of categorising assets. Asset types are registered in Accounting | Backoffice | Base registers, the Inventory Ledger tab

The code can be a maximum of four characters and is usually a short name of the type, for example, COMP for Computers. The handling code' controls the depreciation rules for the asset type: Asset is the standard handling code; an asset with this handling code can be depreciated and disposed of with automatic posting. Leasing does not generate any depreciation and does not expense any part of the acquisition but treats the asset as a lease. Expensed can be used to register asset that is expensed directly upon acquisition. Cost estimate allows you to budget for assets. In inventory reports, you can select by handling code.

Depreciation - months The Depreciation period in months field is used to enter the proposed number of months for which equipment of this type should be depreciated. The number of months can be changed for individual assets when they are registered.

The next asset number determines the number of future assets that are registered. The asset number has the format XXXX-NNNNNN-NN, where XXXX is the code for the asset type, NNNNNN is a serial number for the main asset, and NN at the end is a sub-serial number for a main asset. An example of an asset number is COMP-000001-01.

Next asset number. It is possible to have separate series for each asset type or to use a central number series for several or all asset types. If the series is to be globall, 0 is specified as the next asset.

The acquisition account is used when recording new assets and when disposing of it. Upon acquisition, the entire cost of the asset is debited. Upon disposal, crediting of the entire cost of the asset is suggested, but this can be changed.

The account for depreciations is used for depreciation and disposal. When depreciating, the amount being depreciated is credited. When disposing, the entire amount previously depreciated is debited.

The account for depreciation costs is used for depreciation. When depreciating, the amount that is depreciated is debited.

The account for sales costs is used for disposals of the Sales type. When disposing, it is suggested that the amount remaining after the sale be debited.

The account for disposal costs is used for disposals of the disposal type.

The account for theft costs is used for disposals of the theft type.

Separate accounts should be used for each type of inventory and type of posting.

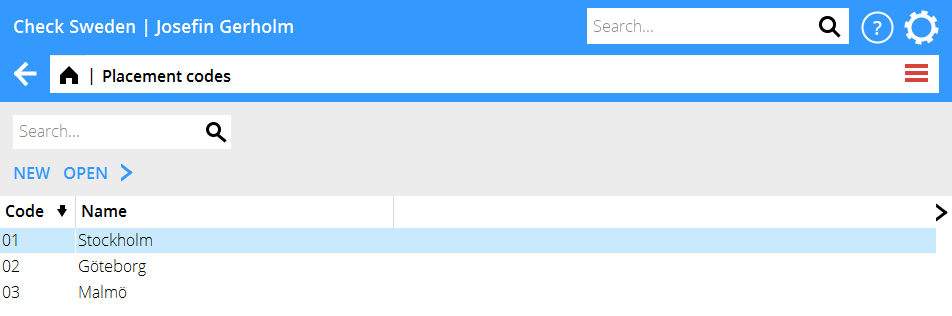

Placement codes

Placement codes can be used to link assets to different departments, such as different offices or floors. The codes are set up in Accounting | Backoffice | Base registers, on the Inventory Ledger tab, and require a Code and a Name.

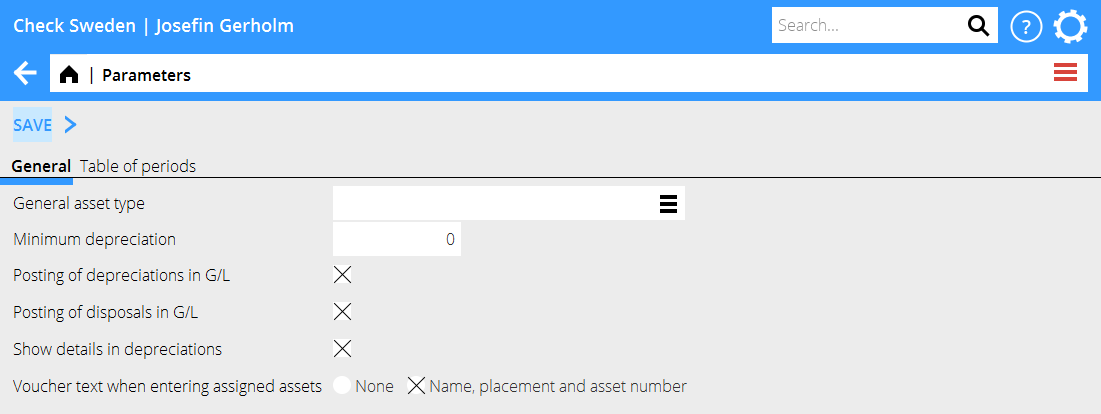

Parameters

The parameters for the inventory ledger are in Accounting | Backoffice | Base registers, Inventory ledger tab

General asset type Specifies whether one or more asset numbers should use the same number series. All asset types with 0 as the Next asset number use the central number series. In this case, the number series for the asset type registered here is used.

Posting of depreciations in G/L and Posting of disposals in G/L determine whether depreciation and disposals are to be posted automatically in the accounts. If this option is not selected, depreciation and disposals must be posted manually to ensure that the inventory ledger and the accounts match.

Register assets

You can register assets in three ways: in the purchase ledger, with a journal voucher or directly in the inventory ledger.

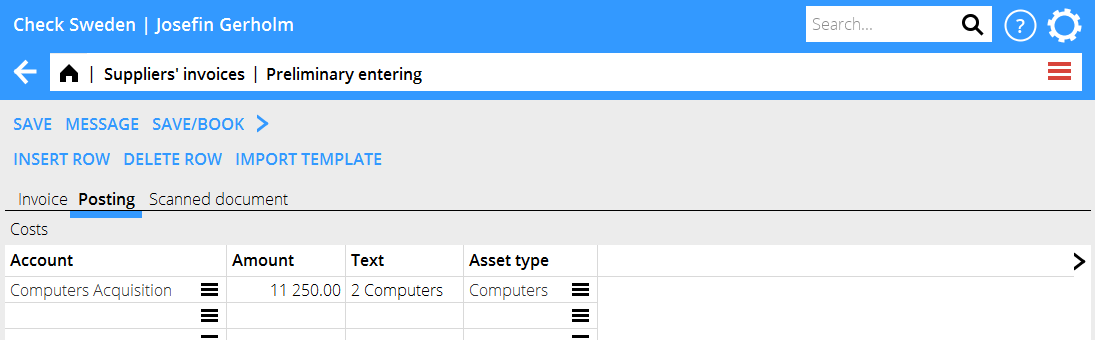

Via supplier’s invoice

If the asset comes from a supplier’s invoice, it can be registered when posting the invoice.

Enter the acquisition account for the asset. If only one asset type has this account set as the acquisition account, it is suggested for the Asset type field. If several asset types have this account set as the acquisition account, no asset type is suggested and must be selected manually.

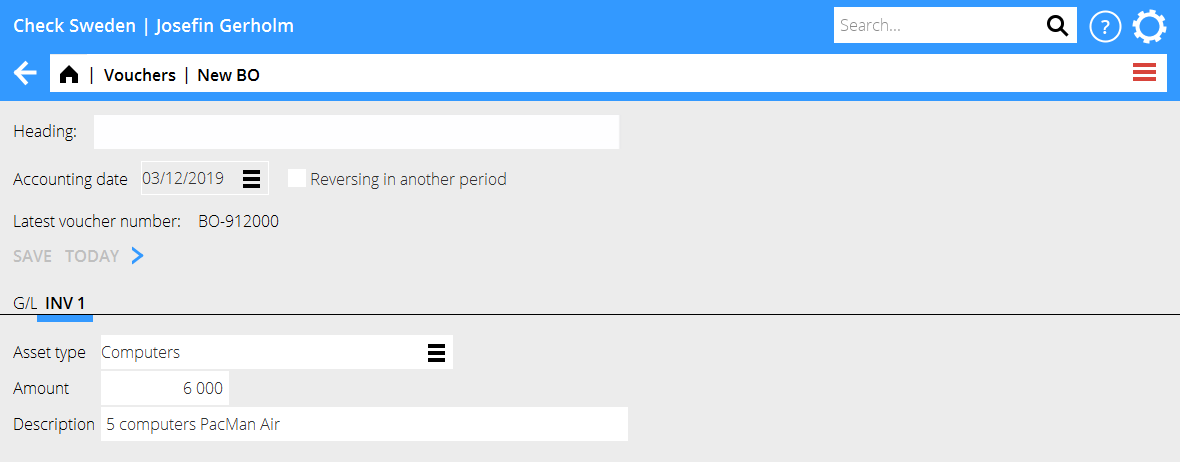

Via journal voucher

Enter the acquisition account for the asset. In the INV tab that has been created, enter the Asset type, Amount and Description. Return to the GL tab and complete the posting before saving the voucher.

Manual registration

It is possible to register assets directly in the inventory ledger. Manual registration must be booked manually for the subsystems to match. Manual assets are registered in Accounting | Backoffice | Base registers, Inventory Ledger tab using the New button.

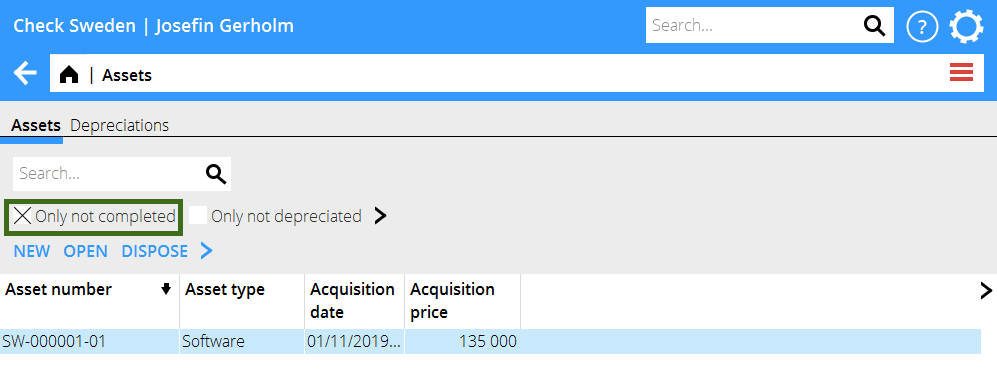

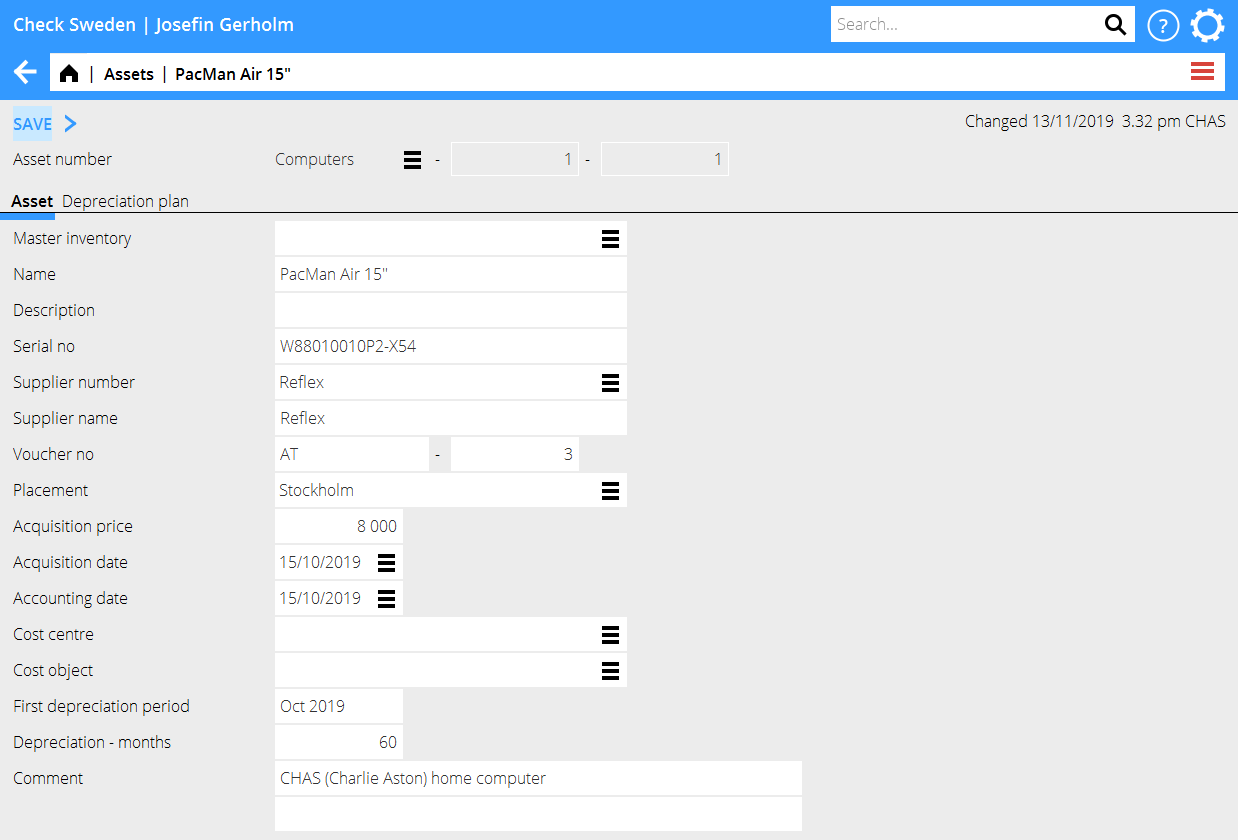

Complete assets

Asset registered via a supplier’s invoice, or a journal voucher needs to be completed in Accounting | Backoffice | Asset, the Asset tab.

Only not completed is ticked to see only assets that need to be completed.

Open the asset and enter at least the First depreciation period. Also enter other supplementary information such as Serial number, Placement and Comment.

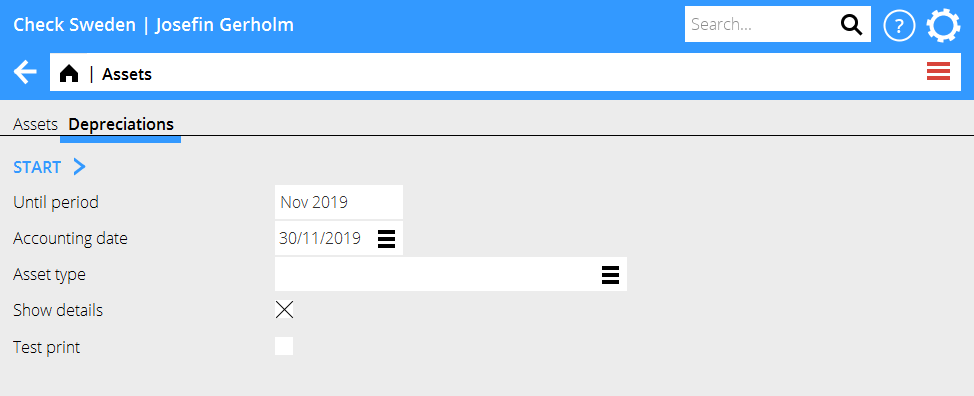

Depreciation of assets

Depreciations are made in Accounting | Backoffice | Assets, Depreciation tab.

Enter the end period, Until period, for depreciation and the Accounting date for depreciation.

It is possible to depreciate only a specific type of asset. If the field is left blank, all types of assets will be included.

Start by making a test print to get a list showing what will be included in the depreciation and how the accounting will be done. If it looks correct, make a final printout by removing the check mark next to Test printout.

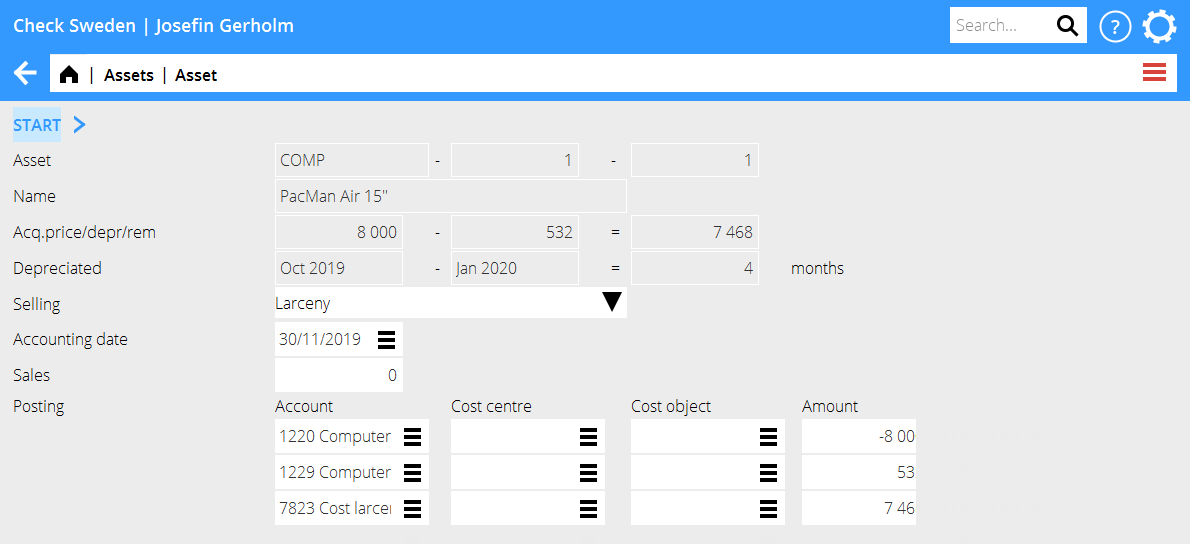

Disposal of assets

Disposal of assets is done in Accounting | Backoffice | Assets, under the Assets tab. Select the asset and click on the Dispose button.

Enter the Disposal code that corresponds to the reason for disposal and the Accounting date. If it is being disposed of due to a sale, the Sales price must be entered.

The posting for the disposal is suggested based on the remaining value of the asset, any sales price and the accounts you have set up for the asset type. The posting can be corrected manually. When the posting is complete, select Start.

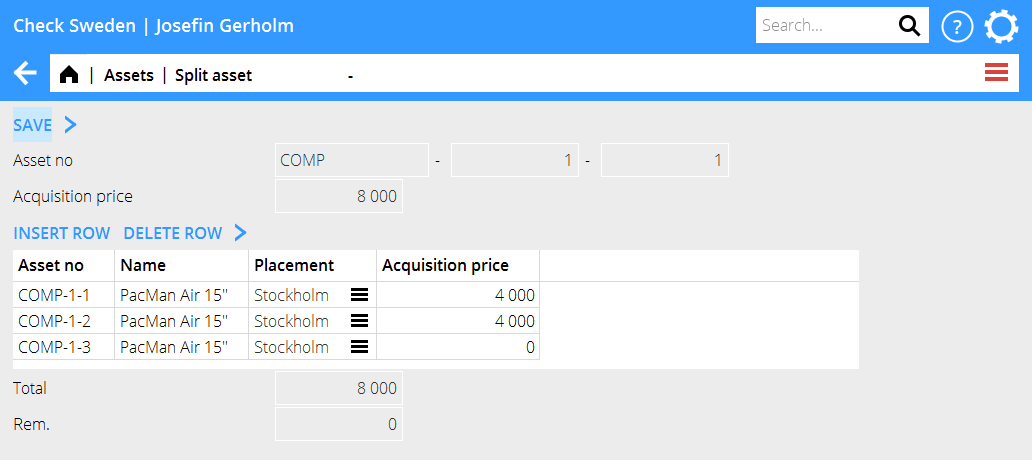

Split asset

An asset can be split into several in Accounting | Backoffice | Assets, tab Assets. Press the Split button. Then enter the name, placement, and acquisition price for each asset per row in the table.

All assets created because of splitting are given the same main number but separate sub-numbers. An asset COMP-1-1 that is split into two is therefore given the numbers COMP-1-1 and COMP-1-2 respectively.

Change asset number

If an asset has been assigned to the wrong asset type or given the wrong number, this can be corrected in Accounting | Backoffice | Assets, under the Assets tab. Select the asset and press Change Number, then enter the number to which the asset should be moved. Please note that the accounting needs to be corrected manually when changing the asset type for the subsystem to be correct.

Edit depreciation plan

Assets are depreciated using a straight-line depreciation plan, Acquisition price / Number of months to depreciate. An asset of SEK 60,000 to be depreciated over 60 months is therefore depreciated at SEK 1,000 per month.

If the depreciation plan needs to be changed, there are two different options.

1. Edit depreciation plan (only correction of future depreciation)

To correct the depreciation rate on the remaining amount of the asset, the depreciation plan can be changed under Accounting | Backoffice | Asset, the Asset tab. Open the asset, the Depreciation Plan tab. Enter the month from which the number of depreciation months is to be changed in the From Period column. The To period column is usually left blank, in which case the new plan applies to all future depreciation. The Quantity column specifies the number of months for which the asset is to be depreciated.

The From period is filled in where the new depreciation plan is to apply. Depreciation already made is not affected.

Example: Acquisition price SEK 60,000. First depreciation period 2024–01. Number of months to depreciate = 60. Depreciation made up to and including 2024–12. New depreciation plan from period 2025–01 onwards with number of months to depreciate = 12.

In 2024, there are 12 depreciation amounts of SEK 1,000 per month. The remaining amount after 2024 = SEK 48,000.

For depreciation in 2025–01 and onwards, SEK 5,000 is depreciated (SEK 60,000 / 12).

2. Edit number of months (retroactive correction)

If the depreciation plan for the asset is incorrect and depreciation already made needs to be corrected, this is done directly on the asset in Accounting| Backoffice | Assets, under the Assets tab.

The next depreciation will correct previous depreciation according to the new number of months.

Example: Acquisition price SEK 60,000. First depreciation period 2024–01. Number of months to depreciate = 60. Depreciation made up to and including 2024–12.

Change to the asset to Number of months to depreciate = 24, which means that SEK 2,500 per month should be depreciated.

In 2024, there are 12 depreciations of SEK 1,000 per month = SEK 12,000.

In 2025–01, SEK 20,500 is depreciated. SEK 2,500 for 2025–01 and SEK 18,000 to correct the previous depreciation for 2024 (60,000 / 24 * 12 - 12,000).

Reports

Reports for the fixed asset ledger are located under Accounting | Reports, the Inventory Ledger tab.

The Depreciation List report is a standard report that lists assets according to selection by depreciation period, accounting date and asset type. The Reports report is used to print reports with custom column templates.