Difference between revisions of "Enter vouchers/da"

(Updating to match new version of source page) |

|||

| (34 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| + | <htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

||

| − | __FORCETOC__ |

||

| + | A program for registration of supporting vouchers, either without integration to other subsystems och with assignations to other ledgers. |

||

| + | |||

| + | =Enter vouchers= |

||

| + | ==General== |

||

| + | Vouchers are registered in Accounting | Vouchers. The standard series has the prefix BO, but more voucher series can be registered in Accounting | Backoffice | Base registers, The General ledger tab. The series code must contain two characters and start with a B. |

||

| + | ==Enter voucher without assignment to another subsystem == |

||

| + | * Select series and press NEW |

||

| + | * Write heading |

||

| + | * Enter accounting date, the Today button gives today’s date. |

||

| + | * Enter thereafter account and debit/credit |

||

| + | {{ExpandImage|BOK-VER-EN-Bild1.png}} |

||

| − | == Registrering af bilag uden integration til andet delsystem == |

||

| + | {|class=mandeflist |

||

| − | Bilag registreres i {{pth|Økonomi| Verifikationer/Registrering af bilag.}} |

||

| + | !Fetch from |

||

| − | Standardserien har præfikset BO, men flere bilagsserier kan skabes i {{pth|System|Basisregister/Bog/Verifikationsserier}}. Fælles for alle er, at de består af to tegn, hvoraf den ene er B. |

||

| + | |Function for copying previous voucher |

||

| − | |||

| − | Vælg serie og tast {{btn|Ny}}. Registreringen begyndes altid ved at opgive regnskabsdato. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-da-grafik1.png}} |

||

| − | |||

| − | Et enkelt bilag registreres med to eller flere konti samt beløber i debet og kredit. Andre funktioner er: |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !Hent fra |

||

| − | |Funktion for at kopiere tidligere bilag. Bilagene vælges ud fra en liste. |

||

|- |

|- |

||

| + | !Import template |

||

| − | !Hent skabelon |

||

| + | |A voucher template can be registered in Accounting | Backoffice | Base register, under the General ledger tab. See the description under Create Voucher template. |

||

| − | |En bilagsskabelon kan skabes i Basisregister/Bog/Bilagsskabeloner. Se beskrivelse under Skab bilagsskabelon |

||

|- |

|- |

||

| + | !Import (SIE 4) |

||

| − | !Importer |

||

| + | |Import of Sie 4- file to Swedish tax agency. |

||

| − | |Importerer sie-filer (Sverige) |

||

|- |

|- |

||

| + | !Import |

||

| − | !Kreditér i anden periode |

||

| + | |Import from e.g. Excel |

||

| − | |Skaber et krediteret bilag med anden regnskabsdato. |

||

|- |

|- |

||

| + | !Reversing in another period |

||

| − | !Regnskabsdato + I dag |

||

| + | |Creates a reversed voucher with a different posting date |

||

| − | |Feltet skal altid være udfyldt før andre oplysninger kan registreres. Klik på I dag for at vælge dagens dato. Den angivne dato vil blive foreslået også i næste bilag. |

||

|- |

|- |

||

| + | !Accounting date + Today |

||

| − | !Overskrift |

||

| + | |The Accounting date field must be filled in before the remaining information can be registered. The specified date will be suggested in the next voucher. |

||

| − | |Denne overskrift vises på startsiden til bilagsregistreringen og er søgbar. |

||

|- |

|- |

||

| + | !Heading |

||

| − | !Bilagsnummer |

||

| + | |The heading is shown in the voucher list and is searchable |

||

| − | |Bilagsnummer hentes automatisk fra {{pth|System|Basisregister/BOG/Bilagsserier}}. |

||

|- |

|- |

||

| + | !Voucher number |

||

| − | !Konto |

||

| + | |The voucher number is automatically fetched from Accounting | Backoffice | Base registers, General ledger tab |

||

| − | |Opgiv konto |

||

|- |

|- |

||

| + | !Account |

||

| − | !Omkostningssted/-bærer |

||

| + | |Enter account |

||

| − | |Udfyld omkostningssted og – bærer dersom kontoen kræver/tillader dette. |

||

|- |

|- |

||

| + | !Cost centre/-object |

||

| − | !Debet/Kredit |

||

| + | |Enter cost centre and cost object if the account requires/allows that. |

||

| − | |Angiv beløb |

||

|- |

|- |

||

| + | !Debit/Credit |

||

| − | !Dimensioner |

||

| + | |Enter amount |

||

| − | |Hvis I bruger dimensioner, vises de som separate kolonner. Oprettes i {{pth|System|Basisregister/BOG/Parametre}}, fanebladet {{flik|Dimensioner}}. Manuelle dimensioner redigeres i {{pth|System|Basisregister/BOG/Dimensioner}}. |

||

|- |

|- |

||

| + | !Dimensions |

||

| − | !Tekst |

||

| + | |If dimensions are used, they are displayed as separate columns. Dimensions are set up in Accounting | Backoffice | Base registers, General ledger tab. Open the year and go to the Dimensions tab. Manual dimensions are edited in Accounting | Backoffice | Base registers, General ledger tab |

||

| − | |Angiv eventuel tekst (25 tegn). Vises inde i hovedbogen og i kontospecifikationen |

||

|- |

|- |

||

| + | !Text |

||

| − | !Summering |

||

| + | |Enter any text with a maximum of 25 characters. Displayed in the Nominal ledger and account specification. |

||

| − | |Længst nede summeres debet- respektive kreditkolonnerne. Et bilag der ikke balancerer, kan ikke gemmes. |

||

|- |

|- |

||

| + | !Subtotal |

||

| − | !Skab momskontering |

||

| + | |The debit and credit columns are totalled at the bottom. The voucher cannot be saved if it does not balance. |

||

| − | |Hvis I bruger Marathons indgående momshåndtering, kan I skabe en automatik kontering af moms. Systemet beregner konteringen efter hvor meget der er opmærket med de forskellige momsklasser. Systemet henter den momskonto, som er angivet på momsklassen |

||

|- |

|- |

||

| + | !Create VAT posting |

||

| − | !Udfyld |

||

| + | |If Marathon's input VAT handling is used, automatic VAT posting can be created using the Input tax button, and the calculation of amounts is retrieved from the settings in the VAT classes. |

||

| − | |Hvis et konto er blevet angivet, fylder denne funktion automatisk resterende beløb ud, så at bilaget skulle balancere. |

||

|- |

|- |

||

| + | !Fill |

||

| − | !Rest |

||

| + | |Automatically fills in the remaining amount to balance the voucher, provided that an account has been specified. |

||

| − | |Viser hvor stort beløb der er tilbage før bilaget balancerer. |

||

| + | |- |

||

| + | !Rem. |

||

| + | |Shows remaining amount to balance. |

||

|} |

|} |

||

| + | == Voucher template or automatic posting == |

||

| + | Voucher templates are created in Accounting | Backoffice | Base registers, General ledger tab. |

||

| + | * Press New and give the template a name. |

||

| + | * Enter account and possible cost centre and cost object if the account requires/allows that. |

||

| + | * Enter either a percentage of an amount or an amount. If a percentage is entered, the system will ask for the total amount when the template is used and calculate the share using the percentage. |

||

| + | * Press Import template button to import the template into a voucher. |

||

| + | * An automatic posting, without clicking the Import template button in a voucher, is performed when the Base account, Base cost centre and Base cost object fields in Automatic posting at the bottom of the voucher template are filled in. See image below. Automatic posting is triggered when the base account is specified in a voucher and is displayed in the registration screen. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild2.png}} |

||

| − | == Skab bilagsskabelon == |

||

| + | |||

| − | |||

| + | == Enter voucher with assignment to another subsystem == |

||

| − | Bilagsskabeloner skabes i {{pth|System|Basisregister/Bog/Bilagsskabeloner}}. Tast på {{btn|Ny}} og navngiv skabelonen. Angiv konto og eventuel omkostningsbærer og/eller omkostningssted hvis kontoen tillader det. Angiv enten en procentuel del af et beløb, eller et beløb. Hvis du angiver en procentuel del, |

||

| + | Accounts can be set up with assignment to a subsystem. When registering for an account that is integrated with another subsystem, a red tab with the name of the subsystem will appear. Information belonging to the subsystem is registered in this tab. The most common assignments are described below. |

||

| − | spørger systemet efter beløbet i alt hvornår du bruger skabelonen, og regner andelen ud med hjælp af procentsatsen |

||

| − | |||

| − | En automatkontering (uden Importér skabelon-knappen) udføres hvornår basiskonto, omkostningssted og omkostningsbærer er blevet indtastet i Automatkonteringsfeltet i bunden på skabelonen. Automatkonteringen trigges da basiskontoen angives i bilaget og vises i registreringsbilledet. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-da-grafik14.png}} |

||

| − | |||

| − | == Registrering af bilag med integration til andet delsystem == |

||

| − | |||

| − | Hvis kontoen, du angav, er integreret til andet delsystem, åbnes et gulfarvet faneblad med navnet til delsystemet. I fanen registreres oplysninger, der hører til delsystemet. Neden vises de vanligste integrationer. |

||

| − | |||

| − | === Kundeindbetalinger === |

||

| − | |||

| − | Kontoen for kundefordringer er integreret med Debitorer, hvilket indebærer, at kontering på denne konto skaber et faneblad der hedder DEB X. X står for fanenummeret. I fanen registreres kundeindbetalingerne. Angiv fakturanummer for den faktura, der er blevet betalt, eller søg fakturaer med funktionen Hent fakturaer. Du kan selektere på kunde, dato, fakturanummer, mm. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-da-grafik2.png}} |

||

| − | |||

| − | Systemet henter fakturabeløbet i alt. Ved delbetaling af faktura, skriv beløbet øver det beløb som står i feltet Erh. bet (valuta). En udenlandsk betaling vises ikke i dette felt uden du er nødt til at skrive det beløb ind, som er kommet til banken. Kursdifferencen konteres automatisk på den konto, der er angivet i {{pth|System|Basisregister/Deb/Parametre}}, fanen {{flik|betalinger}} (Konto for valutakursfortjenester og konto for valutakurstab). |

||

| − | |||

| − | En udenlandsk betaling som delbetales må derimod skrives ind i begge felterne Erh bel (valuta) og Erh bel. Fakturavaluta. |

||

| − | Differencen bliver då en restpost og eventuelt en kursdifference (Dersom det erholdte beløb i den egne valutaen delt med valutakursen ikke er den samme som beløbet i feltet Erholdt beløb fakturavaluta, bliver mellemforskellen en kursdifference). |

||

| − | |||

| − | Efter at fakturaerne registreres angiver du en konto for betalingen i fanen {{flik|Bog}} (fx bankkontoen). Her kan du godt nyde funktionen {{btn|Udfyld}} for at kontere resterende på kontoen. |

||

| − | |||

| − | === Leverandørbetalinger === |

||

| − | |||

| − | <div class="mw-translate-fuzzy"> |

||

| − | Kontoen for leverandørgæld er integreret med Kreditorer, hvilket indebærer, at kontering på denne konto skaber et faneblad der hedder KRE X. X står for fanenummeret. I fanen registreres leverandørbetalingerne. Angiv fakturanummer for den faktura, der er blevet betalt, eller søg fakturaer med funktionen Hent betalinger. Her kan du selektere på betalingsnummer, dato eller leverandør. Fakturaer med et restbeløb kan også hentes. Med funktionen Hent betalingsfil kan du hente en fil med betalinger. |

||

| − | </div> |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-da-grafik8.png}} |

||

| − | |||

| − | Systemet henter fakturabeløbet i alt. Ved delbetaling af faktura, skriv beløbet øver det beløb som står i feltet Erh. bet (valuta). En udenlandsk betaling vises ikke i dette felt uden du er nødt til at skrive det beløb ind, som er trækket fra bankkontoen. Kursdifferencen konteres automatisk på den konto, der er angivet i {{pth|System|Basisregister/Lev/Parametre}}, fanen {{flik|Betalinger}} (Konto for valutakursfortjenester og konto for valutakurstab). |

||

| − | |||

| − | En udenlandsk betaling som delbetales må derimod skrives ind i begge felterne Erh bel (valuta) og Erh bel. |

||

| − | Fakturavaluta. Differencen bliver då en restpost og eventuelt en kursdifference (Dersom det erholdte beløb i den egne valutaen delt med valutakursen ikke er den samme som beløbet i feltet Erholdt beløb fakturavaluta, bliver mellemforskellen en kursdifference). |

||

| − | |||

| − | Efter at fakturaerne registreres angiver du en konto for betalingen i fanen {{flik|Bog}} (fx bankkontoen). Her kan du godt nyde funktionen {{btn|Udfyld}} for at kontere resterende på kontoen. |

||

| − | |||

| − | === Skab forskudsfaktura === |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-da-grafik10.png}} |

||

| + | === Client payments === |

||

| − | Med funktionen {{btn|Skab forskudsfaktura}} kan et forskudsbeløb placeres direkte i Kreditorer på en leverandør, hvis faktura ikke endnu er indkommet. Denne betaling får et LA-nummer. |

||

| + | The trade debtors’ account is assigned to the sales ledger. |

||

| + | * Fill in trade debtors’ account. A new tab opens, S/L. |

||

| + | * In the S/L tab, enter the invoice number that has been paid or search invoices with the Import invoices button. A payment file can be imported (requires settings). |

||

| + | * The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency). |

||

| + | {{ExpandImage|BOK-VER-EN-Bild3.png}} |

||

| − | Angiv leverandør og siden et beløb ved registreringen. |

||

| + | |||

| + | ''Foreign currency'' |

||

| + | '''Automatic posting of spreads''' If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Sales ledger tab, exchange rate differences are posted automatically. |

||

| − | === Registrering af jobindkøb === |

||

| + | For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount paid into the bank must be entered. |

||

| + | If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference. |

||

| − | Kontoen for jobindkøb er integreret med jobmodulen, hvilket indebærer, at kontering på denne konto skaber et faneblad der hedder JOB X. X står for fanenummeret. I fanen registreres indkøb, der skal belaste et job. Opgiv job, indkøbskode og en kostpris. Salgsprisen regnes automatisk ifølge det avance, der er registreret på indkøbskoden. Det er dog mulig at ændre den (parameterstyrt) og skrive over den. Skriv valgfri indkøbstekst. Hvis I bruger rekvisitioner, kan PO -nummeret angives ved registrering af jobindkøb - alle oplysninger hentes da ind fra rekvisitionen. Modkonteringen foretages siden i fanen BOG. |

||

| + | '''Manual posting of spreads''' If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually. |

||

| − | {{ExpandImage|Registrering-verifikationer-da-grafik4.png}} |

||

| + | Contrary posting is made in the G/L tab. Here you can use the Fill button, for posting the rest on the account. |

||

| − | === Registrering af periodiseringar === |

||

| + | ===Suppliers’ payments=== |

||

| − | Kontoen for automatiske interimsfordringer er integreret med periodiseringer, hvilket indebærer, at kontering på denne konto skaber et faneblad der hedder PERIODISERING X. X står for fanenummeret. I fanen registreres omkostninger, der skal periodiseres over en vis periode. Angiv omkostningskonto og beløb samt den periode, beløbet skal fordeles over. Der findes to måder for at angive periode, MMÅÅ-MMÅÅ eller DDMMÅÅ-DDMMÅÅ. I det første fald periodiseres beløbene jævnt over alle måneder, i det andre fald periodiseres beløbene efter hvor mange dage der er i en måned. Modkonteringen foretages siden i fanen BOG. |

||

| + | The trade creditors’ account is assigned to the Purchase ledger. |

||

| + | * Enter trade creditors’ account. A new tab appears, P/L. |

||

| + | * Write invoice number in the P/L tab or search invoice with the Import invoices function. A payment file can be imported (requires settings). |

||

| + | * The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency). |

||

| − | {{ExpandImage| |

+ | {{ExpandImage|BOK-VER-EN-Bild4.png}} |

| + | |||

| + | ''Foreign currency'' |

||

| + | '''Automatic posting of spreads''' If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Purchase ledger tab, exchange rate differences are posted automatically. |

||

| − | === Registrering af inventarer === |

||

| + | For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount withdrawn from the bank must be entered. |

||

| − | Kontoen for anskaffelse af inventarer er integreret til anlægskartoteket, hvilket indebærer, at kontering på denne konto skaber et faneblad der hedder INV X. X står for fanenummeret. Hvis kontoen kun er koblet til én anlægstype udfyldes det automatisk. I andet fald skal anlægstype angives. Angiv siden beløb og eventuelt en beskrivelse. Modkonteringen foretages siden i fanen BOG. |

||

| + | If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference. |

||

| − | {{ExpandImage|Registrering-verifikationer-da-grafik5.png}} |

||

| + | '''Manual posting of spreads''' If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually. |

||

| − | == Korrigering af bilag == |

||

| + | After registration, enter an account in the G/L tab. Here you can use the Fill button, for posting the rest on the account. |

||

| − | Marker det bilag, der skal rettes og klik på Åbn. Vælg derefter Korrigér. |

||

| + | ====Create excess invoice==== |

||

| − | {{ExpandImage|Registrering-verifikationer-da-grafik17.png}} |

||

| + | By using the Create excess invoice function, an excess payment can be placed directly in the purchase ledger for a supplier whose invoice has not yet arrived. This payment is assigned an LA number. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild5.png}} |

||

| − | Systemet spørger hvis du vil kreditere bilaget |

||

| + | |||

| + | * Select supplier and enter amount when registering. |

||

| + | === Project purchases === |

||

| + | The account for project purchases is assigned to the project accounting. |

||

| + | * Fill in the project purchase account for purchases to be charged to the project, and a new tab called PRO will appear. |

||

| + | * Fill in project, purchase code and a purchase price. The sales price is automatically calculated according to the mark-up that has been registered on the purchase code. |

||

| + | * Write optional purchase text. |

||

| + | * If you use purchase orders, enter PO number when registering project purchases. All information will then be fetched from it. |

||

| − | {{ExpandImage| |

+ | {{ExpandImage|BOK-VER-EN-Bild6.png}} |

| + | |||

| + | ===Periodical allocations=== |

||

| + | The account for automatic accruals is assigned to Periodical allocations. |

||

| + | * Fill in account for periodical allocations for costs that shall be accrued over a period. A new tab appears, Allocation. |

||

| + | * Enter the cost account and amount, as well as the period over which the amount is to be distributed. There are two ways to enter the period: YYYYMM – YYYYMM or YYYYMMDD – YYYYMMDD. In the first case, the amount is distributed evenly over the months; in the second case, the amounts are distributed differently depending on how many days there are in the month. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild7.png}} |

||

| − | Klik {{btn|Ja}} hvis bilaget skal krediteres helt. Ellers vælger du {{btn|Nej}} og konterer korrigeringen i den nedre tabel. Hvis du vil gemme bilaget med eget bilagsnummer, afkryds {{kryss|Gem med nyt bilagsnummer}} og angiv regnskabsdato. Den er ikke nødt til at være i den samme periode som det oprindelige bilag. |

||

| + | |||

| + | ===Assets/Inventory=== |

||

| + | The account for the acquisition of assets is assigned to the Inventory ledger. |

||

| + | * Fill in acquisition account for the asset. A new tab appears, INV. |

||

| + | * If the acquisition account is only linked to one type of asset, the asset type will be filled in automatically. Otherwise, the asset type must be filled in. |

||

| + | * Enter amount and optional description. |

||

| − | {{ExpandImage| |

+ | {{ExpandImage|BOK-VER-EN-Bild8.png}} |

| − | Hvis du ønsker at kreditere korrigeringen i en anden periode, afkryds da {{kryss|Kreditér korr i anden periode}} og angiv regnskabsdato øverst i billedet. |

||

| + | == Correct a voucher== |

||

| − | Både korrigeringen og krediteringen af korrigeringen vil bogføres på denne dato og få et nummer fra bilagsserien i denne periode. I alt vil altså to nye bilag skabes: korrigeringen og krediteringen af korrigeringen. |

||

| + | It is parameter-controlled to be able to click the Correct button on an AT, ER or LF voucher, as the original voucher and not the correction is reversed if the invoice is reversed after a manual correction has been made. |

||

| + | * Select the voucher you wish to correct, press Open. |

||

| + | * Press Correct. |

||

| + | * Answer the question about reversing the voucher. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild9.png}} |

||

| − | == Paste data into a voucher == |

||

| + | |||

| + | * If the correction is to be saved with its own voucher number, tick the box ‘Save with new voucher number’ and enter the accounting date. The accounting date does not need to be in the same period as the original voucher. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild10.png}} |

||

| − | Start with right clicking on the posting table (without marking anything) and select COPY. Then paste it in Excel. |

||

| + | |||

| − | Your Excel has to have exactly the same structure in order to fit in a voucher. Paste in the voucher by marking all cells including the headings and all columns. Put the cursor over the posting table and select PASTE. |

||

| + | * If the correction is to be reversed in another period, select ‘Reverse correction in another period’ and an accounting date at the top. Both the correction and the reversal of the correction will be posted on this date and receive a number from the voucher series in this period. In total, two new vouchers are created – the correction and the reversal of the correction. |

||

| + | == Paste data into a voucher== |

||

| − | {{ExpandImage|Registrering-verifikationer-en-grafik42.png}} |

||

| + | * Start by right-clicking on the accounting table without selecting anything and choose Copy. Then paste into Excel. This is exactly how Excel should be structured in order to be copied into a voucher. |

||

| + | * To paste into the voucher, select the cells including headings and all columns. |

||

| + | * Right-click in the account table and select Paste. |

||

| + | |||

| − | [[Category:BOK-VER-DA]] [[Category:Manuals]] [[Category:Accounting]] |

||

| + | [[Category:BOK-VER-EN]] [[Category:Manuals]] [[Category:Accounting]] |

||

Latest revision as of 11:10, 27 January 2026

A program for registration of supporting vouchers, either without integration to other subsystems och with assignations to other ledgers.

Contents

Enter vouchers

General

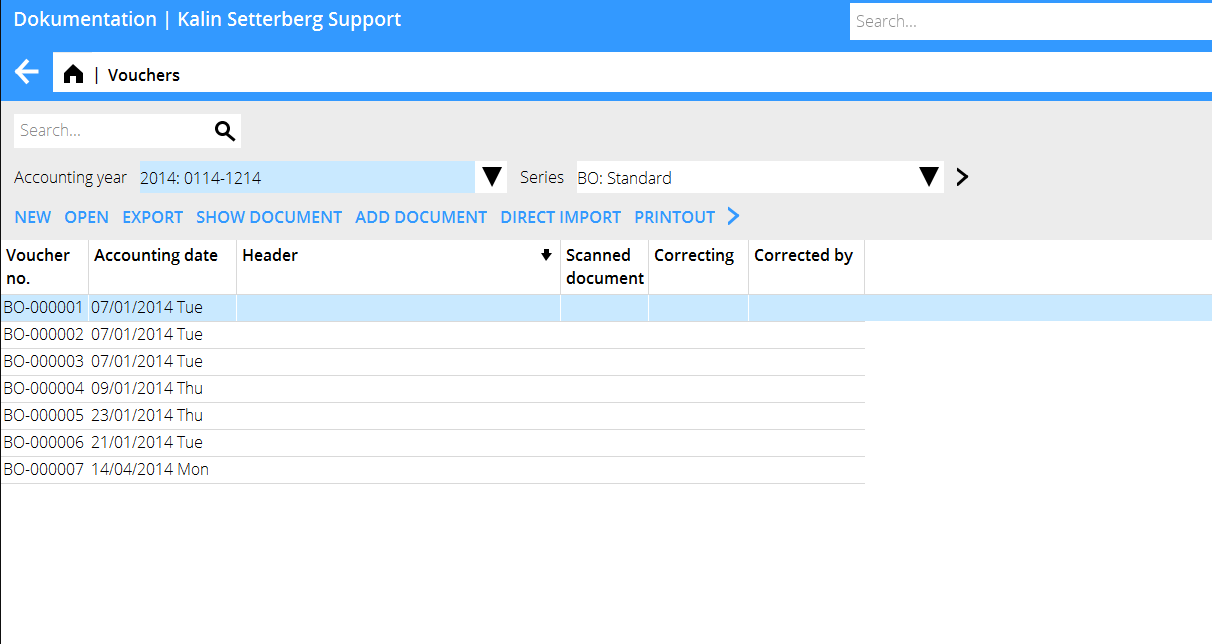

Vouchers are registered in Accounting | Vouchers. The standard series has the prefix BO, but more voucher series can be registered in Accounting | Backoffice | Base registers, The General ledger tab. The series code must contain two characters and start with a B.

Enter voucher without assignment to another subsystem

- Select series and press NEW

- Write heading

- Enter accounting date, the Today button gives today’s date.

- Enter thereafter account and debit/credit

| Fetch from | Function for copying previous voucher |

|---|---|

| Import template | Backoffice | Base register, under the General ledger tab. See the description under Create Voucher template. |

| Import (SIE 4) | Import of Sie 4- file to Swedish tax agency. |

| Import | Import from e.g. Excel |

| Reversing in another period | Creates a reversed voucher with a different posting date |

| Accounting date + Today | The Accounting date field must be filled in before the remaining information can be registered. The specified date will be suggested in the next voucher. |

| Heading | The heading is shown in the voucher list and is searchable |

| Voucher number | Backoffice | Base registers, General ledger tab |

| Account | Enter account |

| Cost centre/-object | Enter cost centre and cost object if the account requires/allows that. |

| Debit/Credit | Enter amount |

| Dimensions | Backoffice | Base registers, General ledger tab. Open the year and go to the Dimensions tab. Manual dimensions are edited in Accounting | Backoffice | Base registers, General ledger tab |

| Text | Enter any text with a maximum of 25 characters. Displayed in the Nominal ledger and account specification. |

| Subtotal | The debit and credit columns are totalled at the bottom. The voucher cannot be saved if it does not balance. |

| Create VAT posting | If Marathon's input VAT handling is used, automatic VAT posting can be created using the Input tax button, and the calculation of amounts is retrieved from the settings in the VAT classes. |

| Fill | Automatically fills in the remaining amount to balance the voucher, provided that an account has been specified. |

| Rem. | Shows remaining amount to balance. |

Voucher template or automatic posting

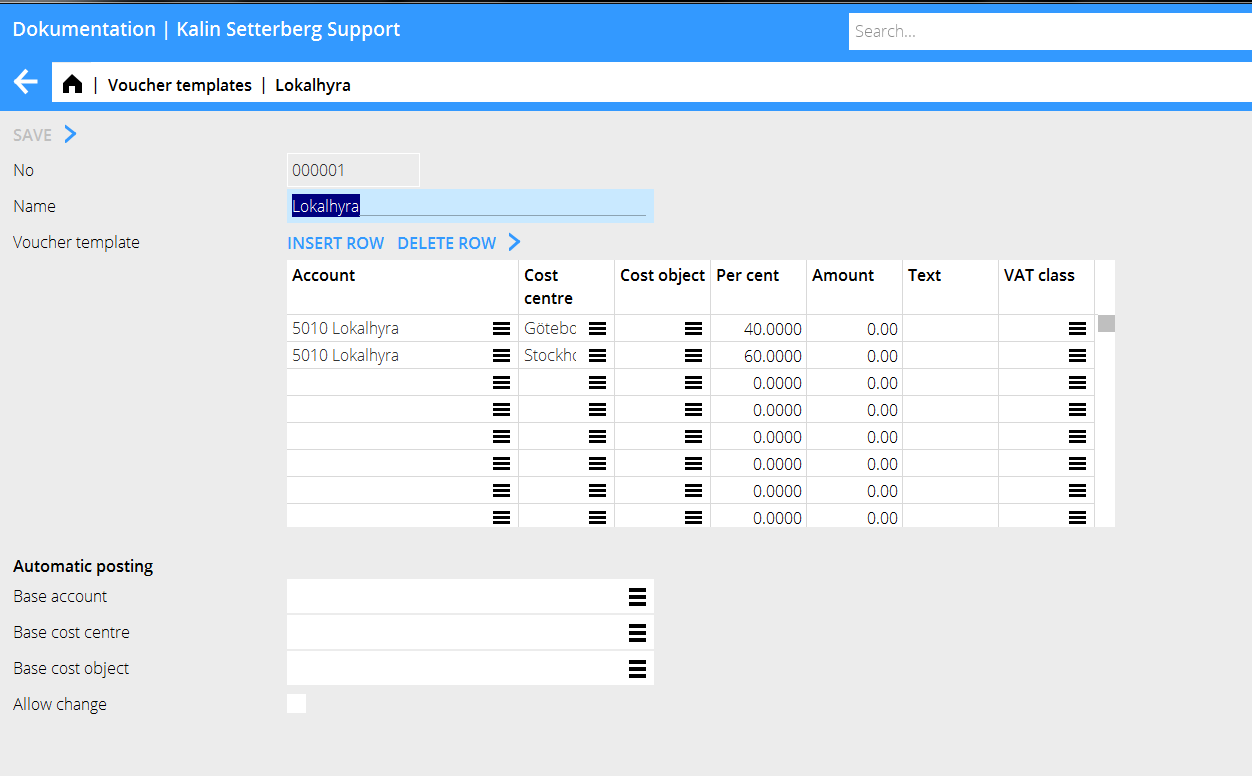

Voucher templates are created in Accounting | Backoffice | Base registers, General ledger tab.

- Press New and give the template a name.

- Enter account and possible cost centre and cost object if the account requires/allows that.

- Enter either a percentage of an amount or an amount. If a percentage is entered, the system will ask for the total amount when the template is used and calculate the share using the percentage.

- Press Import template button to import the template into a voucher.

- An automatic posting, without clicking the Import template button in a voucher, is performed when the Base account, Base cost centre and Base cost object fields in Automatic posting at the bottom of the voucher template are filled in. See image below. Automatic posting is triggered when the base account is specified in a voucher and is displayed in the registration screen.

Enter voucher with assignment to another subsystem

Accounts can be set up with assignment to a subsystem. When registering for an account that is integrated with another subsystem, a red tab with the name of the subsystem will appear. Information belonging to the subsystem is registered in this tab. The most common assignments are described below.

Client payments

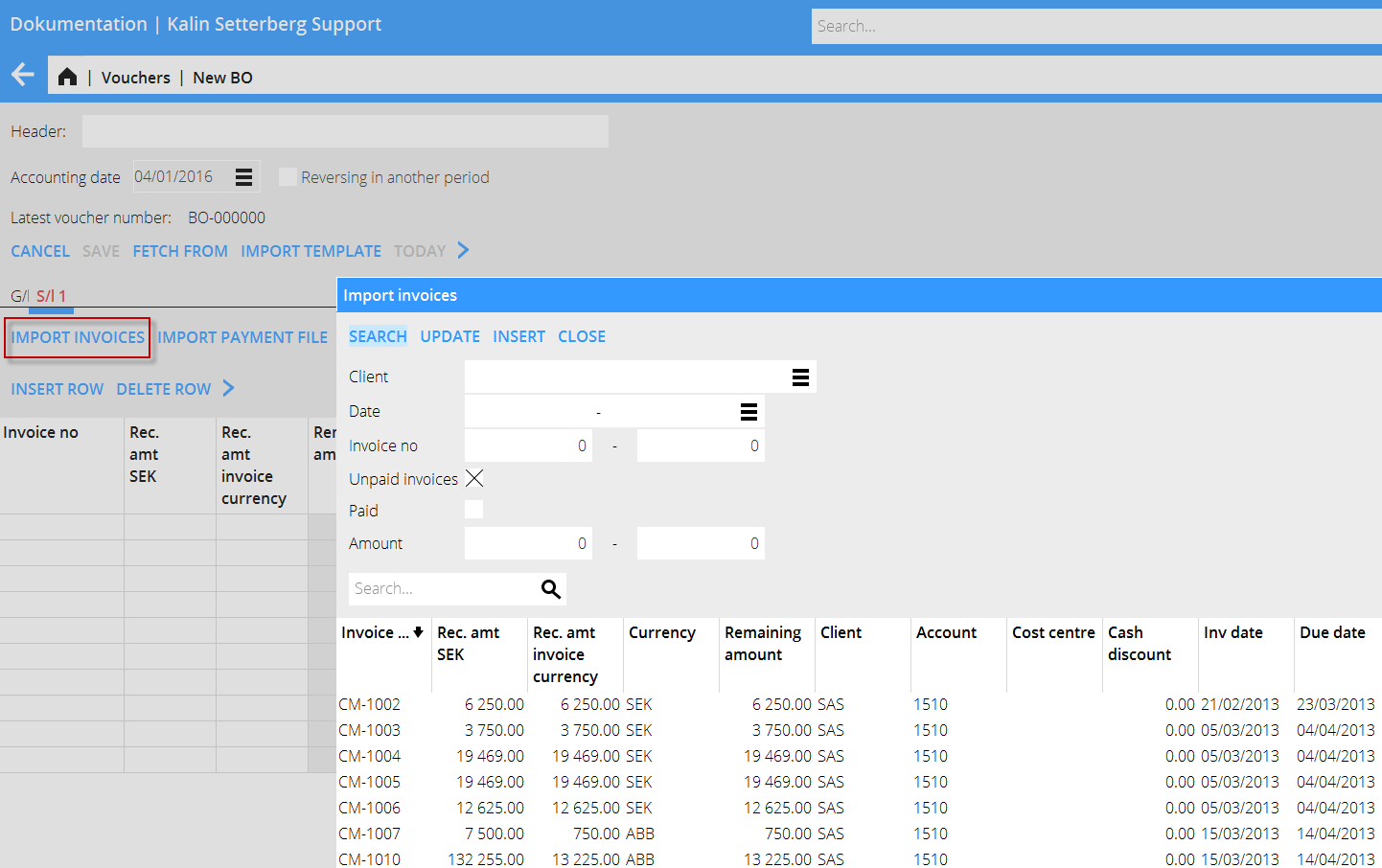

The trade debtors’ account is assigned to the sales ledger.

- Fill in trade debtors’ account. A new tab opens, S/L.

- In the S/L tab, enter the invoice number that has been paid or search invoices with the Import invoices button. A payment file can be imported (requires settings).

- The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency).

Foreign currency

Automatic posting of spreads If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Sales ledger tab, exchange rate differences are posted automatically.

For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount paid into the bank must be entered.

If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference.

Manual posting of spreads If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually.

Contrary posting is made in the G/L tab. Here you can use the Fill button, for posting the rest on the account.

Suppliers’ payments

The trade creditors’ account is assigned to the Purchase ledger.

- Enter trade creditors’ account. A new tab appears, P/L.

- Write invoice number in the P/L tab or search invoice with the Import invoices function. A payment file can be imported (requires settings).

- The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency).

Foreign currency

Automatic posting of spreads If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Purchase ledger tab, exchange rate differences are posted automatically.

For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount withdrawn from the bank must be entered.

If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference.

Manual posting of spreads If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually.

After registration, enter an account in the G/L tab. Here you can use the Fill button, for posting the rest on the account.

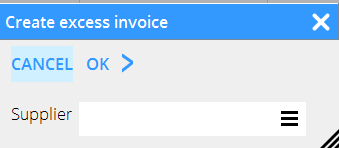

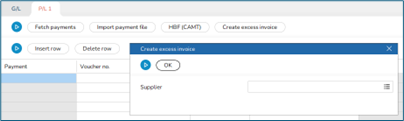

Create excess invoice

By using the Create excess invoice function, an excess payment can be placed directly in the purchase ledger for a supplier whose invoice has not yet arrived. This payment is assigned an LA number.

- Select supplier and enter amount when registering.

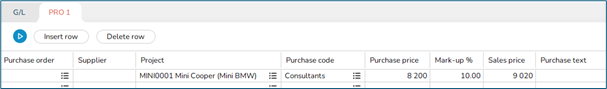

Project purchases

The account for project purchases is assigned to the project accounting.

- Fill in the project purchase account for purchases to be charged to the project, and a new tab called PRO will appear.

- Fill in project, purchase code and a purchase price. The sales price is automatically calculated according to the mark-up that has been registered on the purchase code.

- Write optional purchase text.

- If you use purchase orders, enter PO number when registering project purchases. All information will then be fetched from it.

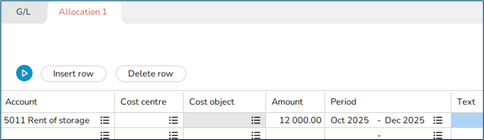

Periodical allocations

The account for automatic accruals is assigned to Periodical allocations.

- Fill in account for periodical allocations for costs that shall be accrued over a period. A new tab appears, Allocation.

- Enter the cost account and amount, as well as the period over which the amount is to be distributed. There are two ways to enter the period: YYYYMM – YYYYMM or YYYYMMDD – YYYYMMDD. In the first case, the amount is distributed evenly over the months; in the second case, the amounts are distributed differently depending on how many days there are in the month.

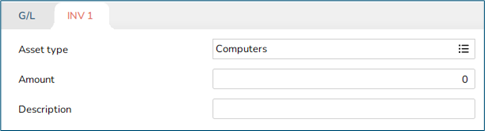

Assets/Inventory

The account for the acquisition of assets is assigned to the Inventory ledger.

- Fill in acquisition account for the asset. A new tab appears, INV.

- If the acquisition account is only linked to one type of asset, the asset type will be filled in automatically. Otherwise, the asset type must be filled in.

- Enter amount and optional description.

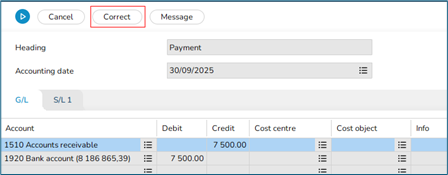

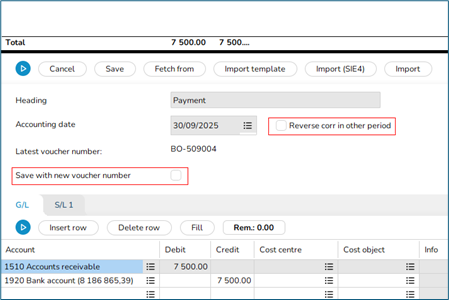

Correct a voucher

It is parameter-controlled to be able to click the Correct button on an AT, ER or LF voucher, as the original voucher and not the correction is reversed if the invoice is reversed after a manual correction has been made.

- Select the voucher you wish to correct, press Open.

- Press Correct.

- Answer the question about reversing the voucher.

- If the correction is to be saved with its own voucher number, tick the box ‘Save with new voucher number’ and enter the accounting date. The accounting date does not need to be in the same period as the original voucher.

- If the correction is to be reversed in another period, select ‘Reverse correction in another period’ and an accounting date at the top. Both the correction and the reversal of the correction will be posted on this date and receive a number from the voucher series in this period. In total, two new vouchers are created – the correction and the reversal of the correction.

Paste data into a voucher

- Start by right-clicking on the accounting table without selecting anything and choose Copy. Then paste into Excel. This is exactly how Excel should be structured in order to be copied into a voucher.

- To paste into the voucher, select the cells including headings and all columns.

- Right-click in the account table and select Paste.