Difference between revisions of "Inventory ledger/nb"

(Created page with "=Anleggsregister i Marathon=") |

(Updating to match new version of source page) |

||

| (23 intermediate revisions by one other user not shown) | |||

| Line 1: | Line 1: | ||

| + | <htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

||

| − | =Anleggsregister i Marathon= |

||

| − | The inventory ledger is a separate module in Marathon for handling of the company’s assets. It is integrated with the accounting system; the assets are entered as suppliers’ invoices or manual vouchers and depreciations and disposals are posted on the accounts that are set on the different asset types. |

||

| − | |||

| − | == Settings and base registers == |

||

| − | There are some settings that concern the functions in the inventory ledger. |

||

| + | =Inventory ledger= |

||

| − | === Assignment on accounts=== |

||

| + | The inventory ledger is a separate module in Marathon to manage the company's fixed assets. The inventory ledger is integrated with the accounting system – inventory is recorded via supplier invoices or manual vouchers, and depreciation and disposals are automatically posted to the accounts set up for the inventory types. |

||

| − | The acquisition accounts must be assigned to the inventory ledger, so that assets from the bookkeeping and suppliers’ invoices can be registered. |

||

| + | ==Settings and base registers== |

||

| − | The setting for that is on the account in {{pth|Base registers|GL/Accounts}}. Select INV in the Assignment field. |

||

| + | There are a few settings concerning the functions in the inventory ledger. |

||

| + | ===Assignments on accounts=== |

||

| + | To register inventory items from accounting and supplier invoices, the accounts for acquisitions must be set up with assignment to the Inventory Ledger. |

||

| + | The setting is in the account in Accounting | Backoffice | Base registers, Accounting tab. Open the Account and select INV in the '''Assignment''' field. |

||

| + | ===Asset types=== |

||

| + | All assets in Marathon must belong to an asset type. The asset type controls accounting for depreciation and provides suggestions for the number of depreciation months. It is also a way of categorising assets. |

||

| + | Asset types are registered in Accounting | Backoffice | Base registers, the Inventory Ledger tab |

||

| + | |||

| + | {{ExpandImage|ACC-INV-EN-Bild1.png}} |

||

| + | The '''code''' can be a maximum of four characters and is usually a short name of the type, for example, COMP for Computers. |

||

| − | {{ExpandImage|ACC-INV-SV-Bild1.png}} |

||

| + | The '''handling code'''' controls the depreciation rules for the asset type: |

||

| + | Asset is the standard handling code; an asset with this handling code can be depreciated and disposed of with automatic posting. |

||

| + | ''Leasing'' does not generate any depreciation and does not expense any part of the acquisition but treats the asset as a lease. |

||

| + | ''Expensed'' can be used to register asset that is expensed directly upon acquisition. |

||

| + | ''Cost estimate'' allows you to budget for assets. |

||

| + | In inventory reports, you can select by handling code. |

||

| + | |||

| + | '''Depreciation - months''' The Depreciation period in months field is used to enter the proposed number of months for which equipment of this type should be depreciated. The number of months can be changed for individual assets when they are registered. |

||

| + | |||

| + | The '''next asset number''' determines the number of future assets that are registered. The asset number has the format XXXX-NNNNNN-NN, where XXXX is the code for the asset type, NNNNNN is a serial number for the main asset, and NN at the end is a sub-serial number for a main asset. An example of an asset number is COMP-000001-01. |

||

| + | |||

| + | '''Next asset number'''. It is possible to have separate series for each asset type or to use a central number series for several or all asset types. If the series is to be globall, 0 is specified as the next asset. |

||

| + | |||

| + | The '''acquisition account''' is used when recording new assets and when disposing of it. Upon acquisition, the entire cost of the asset is debited. Upon disposal, crediting of the entire cost of the asset is suggested, but this can be changed. |

||

| + | |||

| + | The '''account for depreciations''' is used for depreciation and disposal. When depreciating, the amount being depreciated is credited. When disposing, the entire amount previously depreciated is debited. |

||

| + | |||

| + | The '''account for depreciation costs''' is used for depreciation. When depreciating, the amount that is depreciated is debited. |

||

| + | |||

| + | The '''account for sales costs''' is used for disposals of the Sales type. When disposing, it is suggested that the amount remaining after the sale be debited. |

||

| + | |||

| + | The '''account for disposal costs''' is used for disposals of the disposal type. |

||

| + | |||

| + | The '''account for theft''' costs is used for disposals of the theft type. |

||

| + | |||

| + | Separate accounts should be used for each type of inventory and type of posting. |

||

| + | ===Placement codes=== |

||

| + | Placement codes can be used to link assets to different departments, such as different offices or floors. The codes are set up in Accounting | Backoffice | Base registers, on the Inventory Ledger tab, and require a Code and a Name. |

||

| + | |||

| + | {{ExpandImage|ACC-INV-EN-Bild2.png}} |

||

| + | |||

| + | ===Parameters=== |

||

| + | The parameters for the inventory ledger are in Accounting | Backoffice | Base registers, Inventory ledger tab |

||

| + | |||

| + | {{ExpandImage|ACC-INV-EN-Bild3.png}} |

||

| + | '''General asset type''' Specifies whether one or more asset numbers should use the same number series. All asset types with 0 as the Next asset number use the central number series. In this case, the number series for the asset type registered here is used. |

||

| − | === Asset types === |

||

| − | All assets in Marathon must belong to an asset type. The asset type controls postings when depreciating and suggests number of depreciation months. It is also a way to categorise the assets. |

||

| − | The asset types are registered in {{pth|Base registers|INV/Asset types}}. |

||

| + | '''Posting of depreciations in G/L''' and '''Posting of disposals in G/L''' determine whether depreciation and disposals are to be posted automatically in the accounts. If this option is not selected, depreciation and disposals must be posted manually to ensure that the inventory ledger and the accounts match. |

||

| − | {|class= mandeflist |

||

| − | !The code |

||

| − | |can be maximum four digits and is normally a short name of the type, e.g. COMP for Computers. |

||

| − | |- |

||

| − | !The Handling code |

||

| − | |controls the depreciation rules for the asset type: |

||

| − | '''Asset''' is the most used handling code; assets with this type can be depreciated and sold with automatic posting. |

||

| − | '''Leasing''' does not generate any depreciations and does not carry any part of the acquisition as expense but handles the asset as leasing. |

||

| − | '''Carry as expensed''' can be used for registering assets that are carried as expenses directly at the time of acquisition. '''Estimate''' enables budgeting assets. |

||

| − | In inventory related reports it is possible to make selections based on handling code. |

||

| − | |- |

||

| − | !The field Depreciation - months |

||

| − | |shows a suggestion of number of depreciation months for this kind of asset. The number can be changed for single assets. |

||

| − | |- |

||

| − | !Next asset no |

||

| − | |shows the number of the next asset to be registered. The asset number is in the format XXXX-NNNNNN-NN where XXXX is the asset |type code, NNNNNN a serial number for the main asset and the last NN a sub serial number to a main asset. An asset number can |look like this: COMP-000001-01 |

||

| − | |- |

||

| − | !The number ranges |

||

| − | |can be kept separately per asset type. It is also possible to use one global number range number for several or all asset types. If you use a global numbering ranges, Next asset no must be 0. |

||

| − | |- |

||

| − | !Account for acquisitions |

||

| − | |is used when booking new assets and disposals. By the time of acquisition, the total cost of the asset is charged. By time of selling an asset, a reversal of the total amount is suggested, but can be changed. |

||

| − | |- |

||

| − | !Account for decrease of value |

||

| − | |is used in depreciations and disposals. When depreciating, the amount is credited. When selling, charging of the total previously depreciated amount is suggested. |

||

| − | |- |

||

| − | !Account for depreciation expenses |

||

| − | |is used when depreciating. When depreciating the total amount to depreciate is charged. When selling, charging of the total previously depreciated amount is suggested |

||

| − | |- |

||

| − | !Account for sales expenses |

||

| − | |is used in sales. When selling, the remaining amount is suggested to be charged. |

||

| − | |- |

||

| − | !Account for rejection expenses |

||

| − | |Used when rejecting assets |

||

| − | |- |

||

| − | !Account for larceny expenses |

||

| − | |Used when assets have been stolen |

||

| − | |- |

||

| − | |} |

||

| − | We recommend you use separate accounts for each asset type and type of posting. |

||

| + | ==Register assets== |

||

| − | {{ExpandImage|ACC-INV-SV-Bild2.png}} |

||

| + | You can register assets in three ways: in the purchase ledger, with a journal voucher or directly in the inventory ledger. |

||

| + | ===Via supplier’s invoice=== |

||

| + | If the asset comes from a supplier’s invoice, it can be registered when posting the invoice. |

||

| + | |||

| + | Enter the acquisition account for the asset. If only one asset type has this account set as the acquisition account, it is suggested for the Asset type field. If several asset types have this account set as the acquisition account, no asset type is suggested and must be selected manually. |

||

| + | |||

| + | {{ExpandImage|ACC-INV-EN-Bild4.png}} |

||

| − | === |

+ | ===Via journal voucher=== |

| + | Enter the acquisition account for the asset. In the INV tab that has been created, enter the Asset type, Amount and Description. Return to the GL tab and complete the posting before saving the voucher. |

||

| − | Placement codes can be used for connecting assets to different departments, e.g. offices or floor levels. Placement codes are registered in {{pth|System|Base registers/INV/ Placement codes}} and requires only a code and a name. |

||

| + | |||

| − | {{ExpandImage|ACC-INV-SV-Bild3.png}} |

||

| + | {{ExpandImage|ACC-INV-EN-Bild5.png}} |

||

| + | ===Manual registration=== |

||

| − | == Parameters == |

||

| + | It is possible to register assets directly in the inventory ledger. Manual registration must be booked manually for the subsystems to match. Manual assets are registered in Accounting | Backoffice | Base registers, Inventory Ledger tab using the New button. |

||

| − | The parameters concerning the inventory ledger are in {{pth|System|Base registers/INV/ Parameters}}. |

||

| − | General asset type shall be stated if one or several asset numbers shall use a global numbering range. All asset types with 0 as Next asset number use the global number range. It is the number range on asset type that is registered here that is used. |

||

| − | The parameters Posting of depreciations in GL and Posting of disposals in GL control whether depreciation and disposals shall be posted automatically in the bookkeeping or not. If left unticked, they will have to be manually booked in order for the inventory ledger to agree with the bookkeeping. |

||

| + | ==Complete assets== |

||

| − | {{ExpandImage|ACC-INV-SV-Bild4.png}} |

||

| + | Asset registered via a supplier’s invoice, or a journal voucher needs to be completed in Accounting | Backoffice | Asset, the Asset tab. |

||

| + | |||

| + | '''Only not completed''' is ticked to see only assets that need to be completed. |

||

| + | |||

| + | {{ExpandImage|ACC-INV-EN-Bild6.png}} |

||

| + | |||

| + | Open the asset and enter at least the '''First depreciation period'''. Also enter other supplementary information such as '''Serial number''', '''Placement''' and '''Comment'''. |

||

| + | |||

| + | ==Depreciation of assets== |

||

| + | Depreciations are made in Accounting | Backoffice | Assets, Depreciation tab. |

||

| + | |||

| + | {{ExpandImage|ACC-INV-EN-Bild7.png}} |

||

| + | Enter the end period, '''Until period''', for depreciation and the '''Accounting date''' for depreciation. |

||

| − | == Register assets == |

||

| − | Assets can be registered through three different programs. |

||

| + | It is possible to depreciate only a specific '''type of asset'''. If the field is left blank, all types of assets will be included. |

||

| − | === Through the purchase ledger === |

||

| − | If the inventory comes from a suppliers’ invoice you can register it whilst posting the invoice. |

||

| − | Enter acquisition account for the asset. Om only one asset type is assigned to this account, the asset type will be suggested in the field Asset type. If several asset types are assigned to the account, the field must be completed manually. |

||

| + | Start by making a '''test print''' to get a list showing what will be included in the depreciation and how the accounting will be done. If it looks correct, make a final printout by removing the check mark next to Test printout. |

||

| − | {{ExpandImage|ACC-INV-SV-Bild5.png}} |

||

| + | |||

| + | ==Disposal of assets== |

||

| + | Disposal of assets is done in Accounting | Backoffice | Assets, under the Assets tab. Select the asset and click on the Dispose button. |

||

| + | |||

| + | Enter the '''Disposal code''' that corresponds to the reason for disposal and the '''Accounting date'''. If it is being disposed of due to a sale, the '''Sales price''' must be entered. |

||

| + | |||

| + | The posting for the disposal is suggested based on the remaining value of the asset, any sales price and the accounts you have set up for the asset type. The posting can be corrected manually. When the posting is complete, select Start. |

||

| + | |||

| + | {{ExpandImage|ACC-INV-EN-Bild8.png}} |

||

| + | ==Split asset== |

||

| − | === Through bookkeeping voucher === |

||

| + | An asset can be split into several in Accounting | Backoffice | Assets, tab Assets. Press the '''Split''' button. Then enter the name, placement, and acquisition price for each asset per row in the table. |

||

| − | Enter acquisition account for the asset. The tab INV will be created. There, state Asset type, Amount and Name. Return to the tab GL and complete the posting before you save the voucher. |

||

| − | {{ExpandImage|ACC-INV- |

+ | {{ExpandImage|ACC-INV-EN-Bild9.png}} |

| + | All assets created because of splitting are given the same main number but separate sub-numbers. An asset COMP-1-1 that is split into two is therefore given the numbers COMP-1-1 and COMP-1-2 respectively. |

||

| − | === Through manual registration === |

||

| − | It is possible to register assets directly in the inventory ledger. A manual registration has also to be manually booked so that the subsystems will agree. |

||

| − | Manual asset registration is done in {{pth|Accounting|Assets}}, by pressing {{btn|New}}. |

||

| − | == |

+ | ==Change asset number== |

| + | If an asset has been assigned to the wrong asset type or given the wrong number, this can be corrected in Accounting | Backoffice | Assets, under the Assets tab. Select the asset and press '''Change Number''', then enter the number to which the asset should be moved. Please note that the accounting needs to be corrected manually when changing the asset type for the subsystem to be correct. |

||

| − | Assets that have been entered to the system with a supplier’s invoice or a voucher must be completed in {{pth|Accounting|Assets}}, tab Depreciation |

||

| − | Check the box Only not completed to see a list of assets not yet completed. |

||

| − | {{ExpandImage|ACC-INV- |

+ | {{ExpandImage|ACC-INV-EN-Bild10.png}} |

| + | |||

| + | ==Edit depreciation plan== |

||

| + | Assets are depreciated using a straight-line depreciation plan, Acquisition price / Number of months to depreciate. An asset of SEK 60,000 to be depreciated over 60 months is therefore depreciated at SEK 1,000 per month. |

||

| + | If the depreciation plan needs to be changed, there are two different options. |

||

| − | Open the asset and state at least First depreciation period. You can also write in other completing information such as Serial number, Placement and Comment. |

||

| + | 1. Edit depreciation plan (only correction of future depreciation) |

||

| − | {{ExpandImage|ACC-INV-SV-Bild8.png}} |

||

| + | To correct the depreciation rate on the remaining amount of the asset, the depreciation plan can be changed under Accounting | Backoffice | Asset, the Asset tab. Open the asset, the Depreciation Plan tab. Enter the month from which the number of depreciation months is to be changed in the '''From Period''' column. The '''To period column''' is usually left blank, in which case the new plan applies to all future depreciation. The '''Quantity''' column specifies the number of months for which the asset is to be depreciated. |

||

| − | == Depreciation of assets == |

||

| − | Depreciations are done in {{pth|Accounting|Assets}}, tab Depreciation. |

||

| − | Write To period for the depreciation and accounting date. |

||

| − | You can choose to only depreciate a certain type of asset. If you leave the field empty, all asset types will be included. |

||

| − | You can start with making a test print to get a list of what the depreciation includes and how the postings will be. When you have checked that it looks correct, remove the tick from {{btn|Test print}} and then print. |

||

| + | The '''From period''' is filled in where the new depreciation plan is to apply. Depreciation already made is not affected. |

||

| − | {{ExpandImage|ACC-INV-SV-Bild9.png}} |

||

| − | == Disposal == |

||

| − | To dispose an asset, go to {{pth|Accounting|Assets}}, tab Assets. Select the asset and press {{btn|Sell}}. |

||

| − | Choose the code that correlates to type of disposal and accounting date. If the disposal is due to sales, enter also Sales price. |

||

| − | The posting for the disposal is suggested based on the remaining amount on the asset, possible sales price and the accounts you have set on the asset type. The posting can be corrected manually. When the posting is ready, press {{btn|Start}}. |

||

| + | '''Example:''' |

||

| − | {{ExpandImage|ACC-INV-SV-Bild10.png}} |

||

| + | Acquisition price SEK 60,000. First depreciation period 2024–01. Number of months to depreciate = 60. Depreciation made up to and including 2024–12. New depreciation plan from period 2025–01 onwards with number of months to depreciate = 12. |

||

| + | In 2024, there are 12 depreciation amounts of SEK 1,000 per month. The remaining amount after 2024 = SEK 48,000. |

||

| − | == Split asset == |

||

| − | If you want to split one asset into many assets; select it in {{pth|Accounting|Assets}}, and press {{btn|Split}}. In the table, register name, placement and acquisition price, one row per asset. |

||

| − | All assets that are created by a split get the same main number but separate subnumbers. For example, asset COMP-1-1 that gets split to two gets numbers COMP-1-1 and COMP-1-2. |

||

| − | {{ExpandImage|ACC-INV-SV-Bild11.png}} |

||

| + | For depreciation in 2025–01 and onwards, SEK 5,000 is depreciated (SEK 60,000 / 12). |

||

| − | == Change asset number == |

||

| + | |||

| − | If you have an asset that for some reason has ended up in wrong asset type or gotten a wrong number, you can correct it in {{pth|Accounting|Assets}}, tab Assets. Select the asset and press {{btn|Change number}} and write the number the asset shall be moved to. Note that the bookkeeping must be manually corrected in order for the subsystems to agree. |

||

| + | {{ExpandImage|ACC-INV-EN-Bild11.png}} |

||

| + | |||

| + | 2. Edit number of months (retroactive correction) |

||

| + | |||

| + | If the depreciation plan for the asset is incorrect and depreciation already made needs to be corrected, this is done directly on the asset in Accounting| Backoffice | Assets, under the Assets tab. |

||

| + | |||

| + | The next depreciation will correct previous depreciation according to the new number of months. |

||

| − | {{ExpandImage|ACC-INV-SV-Bild12.png}} |

||

| − | |||

| − | == Edit depreciation plan == |

||

| − | The assets are depreciated with a flat depreciation plan, Acquisition price/Number of depreciation months. An asset for 60 000 SEK that shall be depreciated in 60 months is thus depreciated with 1000 SEK per month. |

||

| − | There are two ways of changing the depreciation plan. |

||

| − | === 1.Edit depreciation plan (only correcting future depreciations)=== |

||

| − | If you want to change the depreciation pace of an asset’s remaining amount, open the asset in {{pth|Accounting|Assets}}, tab Assets, tab Depreciation plan. State correction month in the field From period. The column To period is normally left blank; the new plan concerns hence all future depreciations. |

||

| − | The new depreciation plan is valid from and including the month stated in the From period field. Already performed depreciations are not affected. |

||

'''Example:''' |

'''Example:''' |

||

| − | Acquisition price 60 |

+ | Acquisition price SEK 60,000. First depreciation period 2024–01. Number of months to depreciate = 60. Depreciation made up to and including 2024–12. |

| − | During 2019 12 depreciations have been made with 1 000 SEK /month. Remaining amount after 2019 = 48 000 SEK. |

||

| − | Depreciations 01-2020 and forward will be 5 000 SEK (60 000 SEK / 12). |

||

| + | Change to the asset to Number of months to depreciate = 24, which means that SEK 2,500 per month should be depreciated. |

||

| − | {{ExpandImage|ACC-INV-SV-Bild13.png}} |

||

| + | |||

| − | |||

| + | In 2024, there are 12 depreciations of SEK 1,000 per month = SEK 12,000. |

||

| − | === 2.Edit months (correction retrospectively)=== |

||

| + | |||

| − | If the asset’s depreciation plan is erroneous and you want to correct also already performed depreciations, you can change months directly on the asset {{pth|Accounting|Assets}}t, tab Assets, tab Asset. |

||

| + | In 2025–01, SEK 20,500 is depreciated. SEK 2,500 for 2025–01 and SEK 18,000 to correct the previous depreciation for 2024 (60,000 / 24 * 12 - 12,000). |

||

| − | The next depreciation will correct previous depreciations based on the new number of months. |

||

| + | |||

| − | '''Example:''' |

||

| + | ==Reports== |

||

| − | Acquisition price 60 000 SEK. First depreciation period 01-2019. Months to depreciate = 60. Performed depreciations to 12–2019. |

||

| + | Reports for the fixed asset ledger are located under Accounting | Reports, the Inventory Ledger tab. |

||

| − | Change in field Months to depreciate on the asset = 24, which means monthly depreciation of 2 500 SEK. |

||

| − | During 2019 there has been 12 depreciations of 1 000 SEK/month = 12 000 SEK. |

||

| − | In 01–2020, 20 500 SEK is depreciated. 2 500 SEK for 01-2020 and 18 000 SEK that corrects the previous depreciations for 2019 (60 000 / 24 * 12 - 12 000). |

||

| + | The '''Depreciation List''' report is a standard report that lists assets according to selection by depreciation period, accounting date and asset type. |

||

| − | == Reports == |

||

| + | The '''Reports''' report is used to print reports with custom column templates. |

||

| − | Inventory ledger reports is found in {{pth|Accounting|Reports}}, tab Inventory ledger. |

||

| − | The report List depreciations is a standard report that lists assets selected on depreciation period, accounting date and asset type. |

||

| − | The report Reports is used for printing reports with tailor-made column templates. |

||

| − | {{ExpandImage|ACC-INV-SV-Bild14.png}} |

||

| − | [Category: |

+ | [[Category: ACC-INV-EN]] |

| − | [Category: |

+ | [[Category: Accounting]] |

| − | [Category: Manuals] |

+ | [[Category: Manuals]] |

Latest revision as of 15:04, 28 January 2026

Contents

Inventory ledger

The inventory ledger is a separate module in Marathon to manage the company's fixed assets. The inventory ledger is integrated with the accounting system – inventory is recorded via supplier invoices or manual vouchers, and depreciation and disposals are automatically posted to the accounts set up for the inventory types.

Settings and base registers

There are a few settings concerning the functions in the inventory ledger.

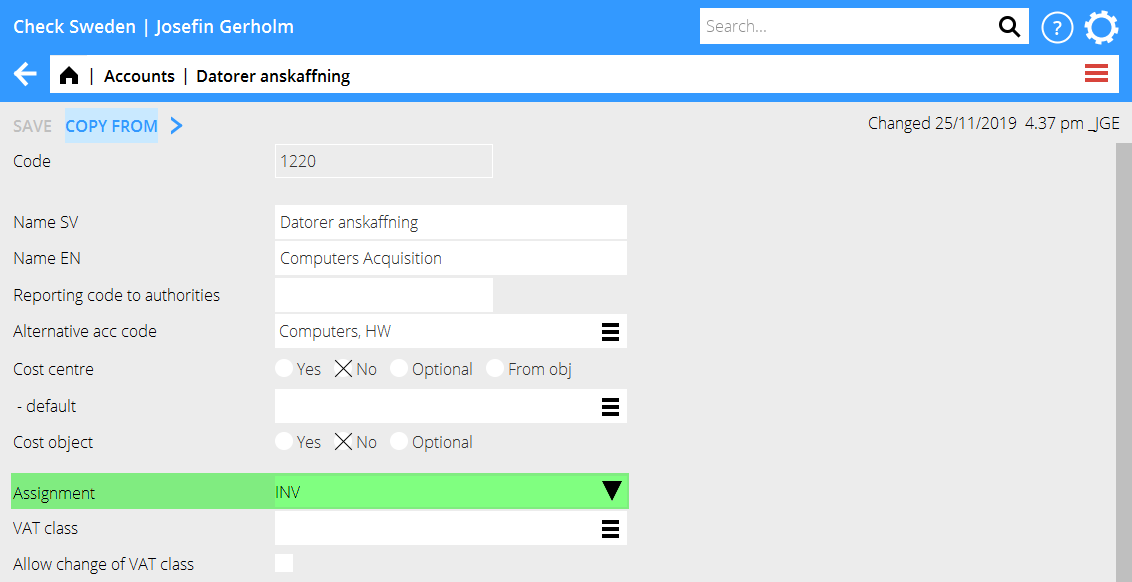

Assignments on accounts

To register inventory items from accounting and supplier invoices, the accounts for acquisitions must be set up with assignment to the Inventory Ledger. The setting is in the account in Accounting | Backoffice | Base registers, Accounting tab. Open the Account and select INV in the Assignment field.

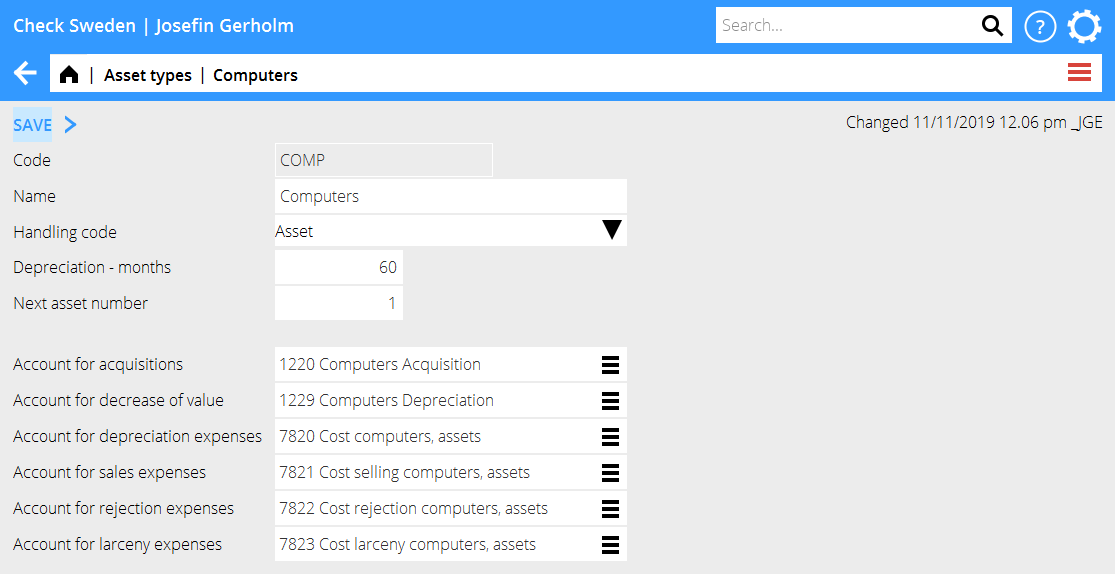

Asset types

All assets in Marathon must belong to an asset type. The asset type controls accounting for depreciation and provides suggestions for the number of depreciation months. It is also a way of categorising assets. Asset types are registered in Accounting | Backoffice | Base registers, the Inventory Ledger tab

The code can be a maximum of four characters and is usually a short name of the type, for example, COMP for Computers. The handling code' controls the depreciation rules for the asset type: Asset is the standard handling code; an asset with this handling code can be depreciated and disposed of with automatic posting. Leasing does not generate any depreciation and does not expense any part of the acquisition but treats the asset as a lease. Expensed can be used to register asset that is expensed directly upon acquisition. Cost estimate allows you to budget for assets. In inventory reports, you can select by handling code.

Depreciation - months The Depreciation period in months field is used to enter the proposed number of months for which equipment of this type should be depreciated. The number of months can be changed for individual assets when they are registered.

The next asset number determines the number of future assets that are registered. The asset number has the format XXXX-NNNNNN-NN, where XXXX is the code for the asset type, NNNNNN is a serial number for the main asset, and NN at the end is a sub-serial number for a main asset. An example of an asset number is COMP-000001-01.

Next asset number. It is possible to have separate series for each asset type or to use a central number series for several or all asset types. If the series is to be globall, 0 is specified as the next asset.

The acquisition account is used when recording new assets and when disposing of it. Upon acquisition, the entire cost of the asset is debited. Upon disposal, crediting of the entire cost of the asset is suggested, but this can be changed.

The account for depreciations is used for depreciation and disposal. When depreciating, the amount being depreciated is credited. When disposing, the entire amount previously depreciated is debited.

The account for depreciation costs is used for depreciation. When depreciating, the amount that is depreciated is debited.

The account for sales costs is used for disposals of the Sales type. When disposing, it is suggested that the amount remaining after the sale be debited.

The account for disposal costs is used for disposals of the disposal type.

The account for theft costs is used for disposals of the theft type.

Separate accounts should be used for each type of inventory and type of posting.

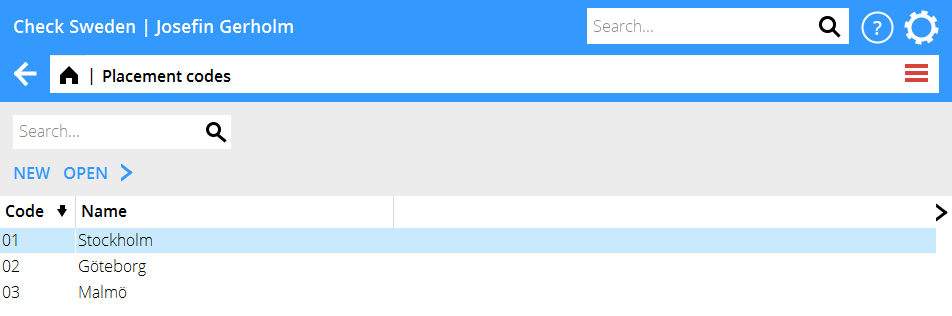

Placement codes

Placement codes can be used to link assets to different departments, such as different offices or floors. The codes are set up in Accounting | Backoffice | Base registers, on the Inventory Ledger tab, and require a Code and a Name.

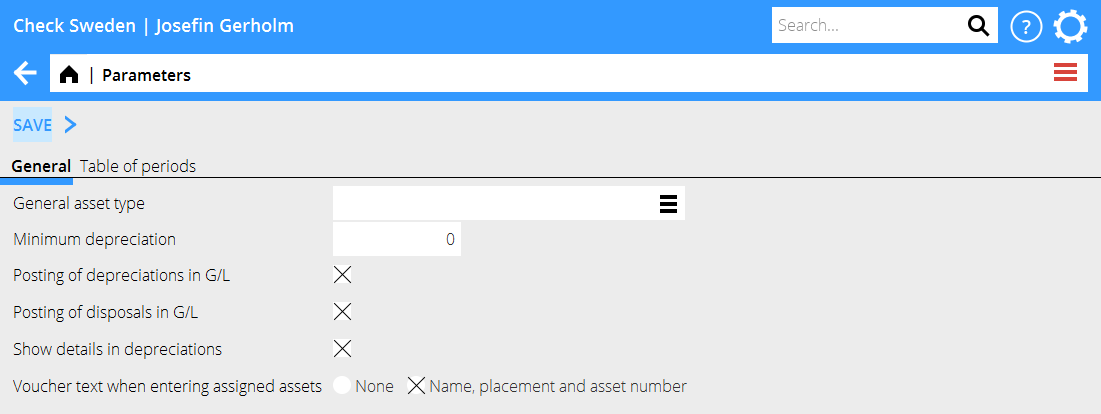

Parameters

The parameters for the inventory ledger are in Accounting | Backoffice | Base registers, Inventory ledger tab

General asset type Specifies whether one or more asset numbers should use the same number series. All asset types with 0 as the Next asset number use the central number series. In this case, the number series for the asset type registered here is used.

Posting of depreciations in G/L and Posting of disposals in G/L determine whether depreciation and disposals are to be posted automatically in the accounts. If this option is not selected, depreciation and disposals must be posted manually to ensure that the inventory ledger and the accounts match.

Register assets

You can register assets in three ways: in the purchase ledger, with a journal voucher or directly in the inventory ledger.

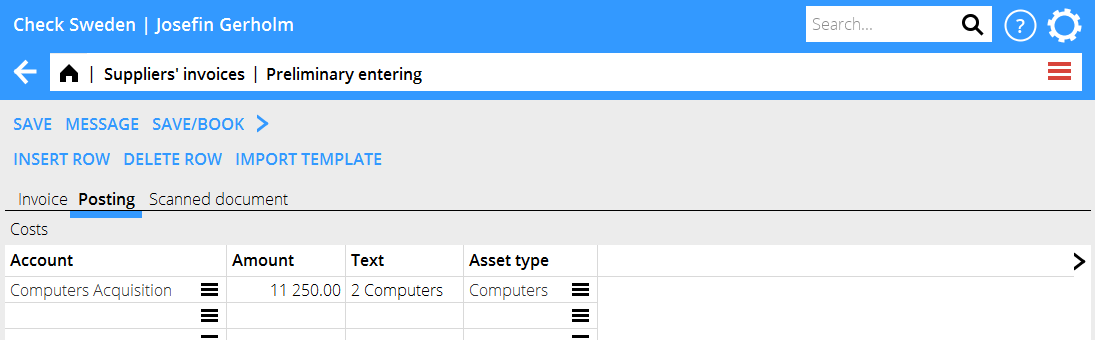

Via supplier’s invoice

If the asset comes from a supplier’s invoice, it can be registered when posting the invoice.

Enter the acquisition account for the asset. If only one asset type has this account set as the acquisition account, it is suggested for the Asset type field. If several asset types have this account set as the acquisition account, no asset type is suggested and must be selected manually.

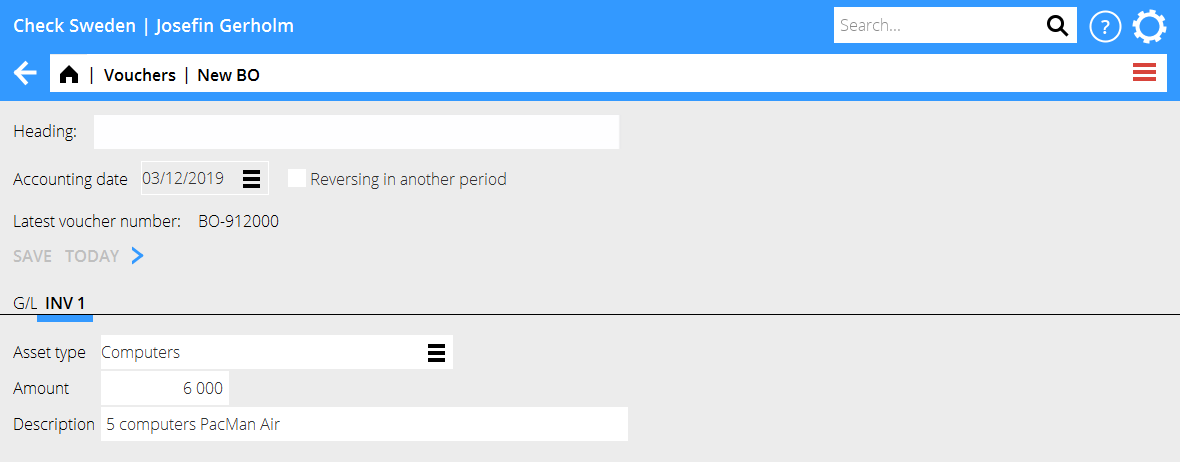

Via journal voucher

Enter the acquisition account for the asset. In the INV tab that has been created, enter the Asset type, Amount and Description. Return to the GL tab and complete the posting before saving the voucher.

Manual registration

It is possible to register assets directly in the inventory ledger. Manual registration must be booked manually for the subsystems to match. Manual assets are registered in Accounting | Backoffice | Base registers, Inventory Ledger tab using the New button.

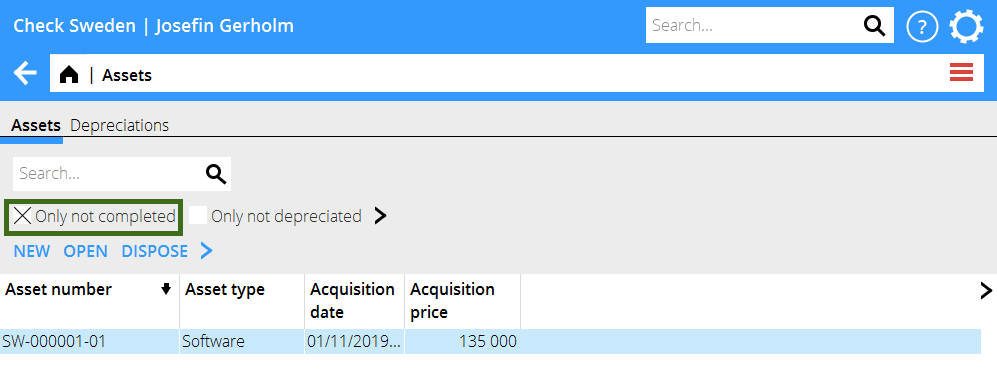

Complete assets

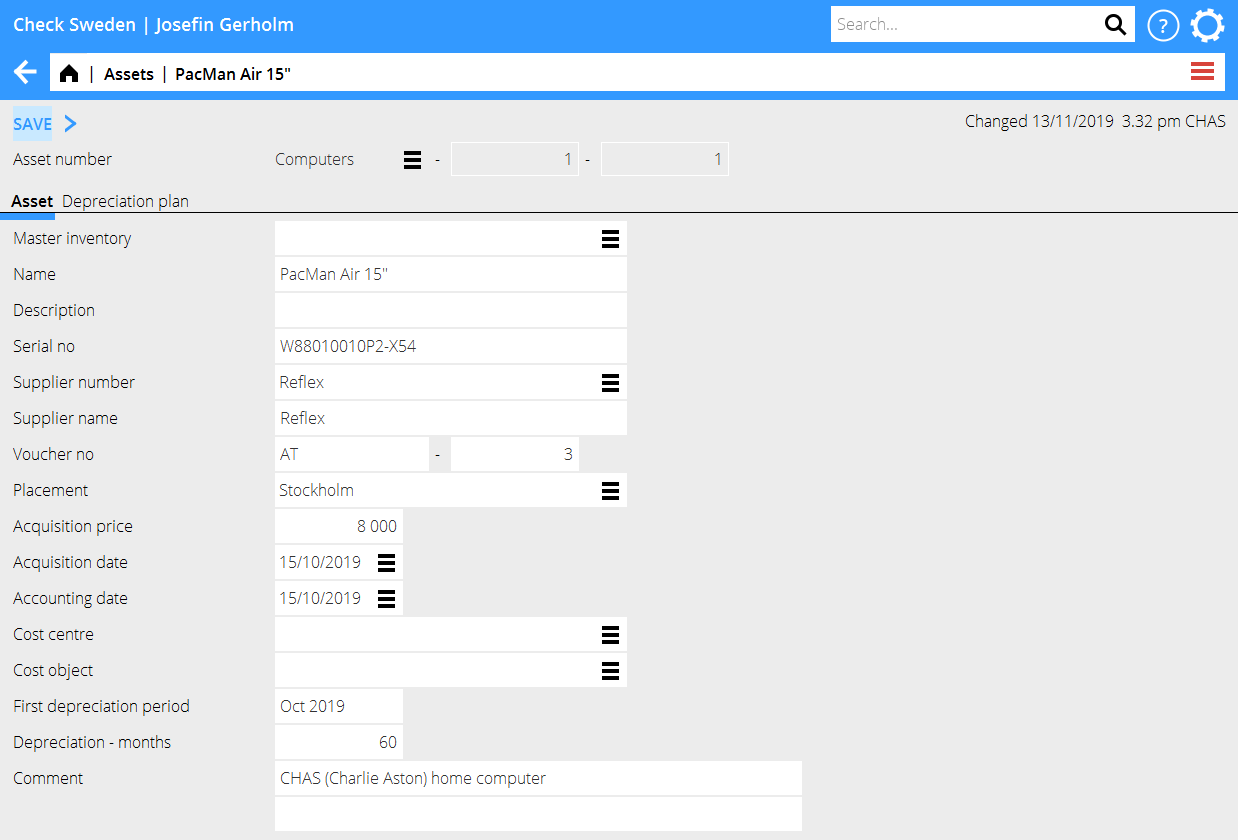

Asset registered via a supplier’s invoice, or a journal voucher needs to be completed in Accounting | Backoffice | Asset, the Asset tab.

Only not completed is ticked to see only assets that need to be completed.

Open the asset and enter at least the First depreciation period. Also enter other supplementary information such as Serial number, Placement and Comment.

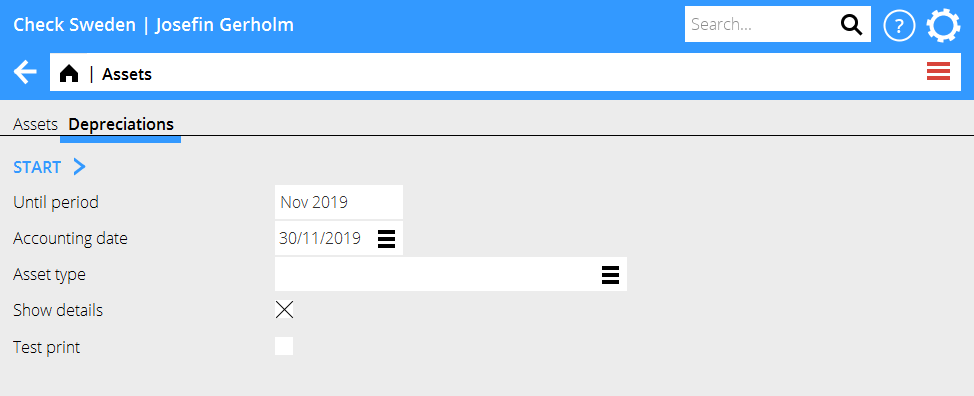

Depreciation of assets

Depreciations are made in Accounting | Backoffice | Assets, Depreciation tab.

Enter the end period, Until period, for depreciation and the Accounting date for depreciation.

It is possible to depreciate only a specific type of asset. If the field is left blank, all types of assets will be included.

Start by making a test print to get a list showing what will be included in the depreciation and how the accounting will be done. If it looks correct, make a final printout by removing the check mark next to Test printout.

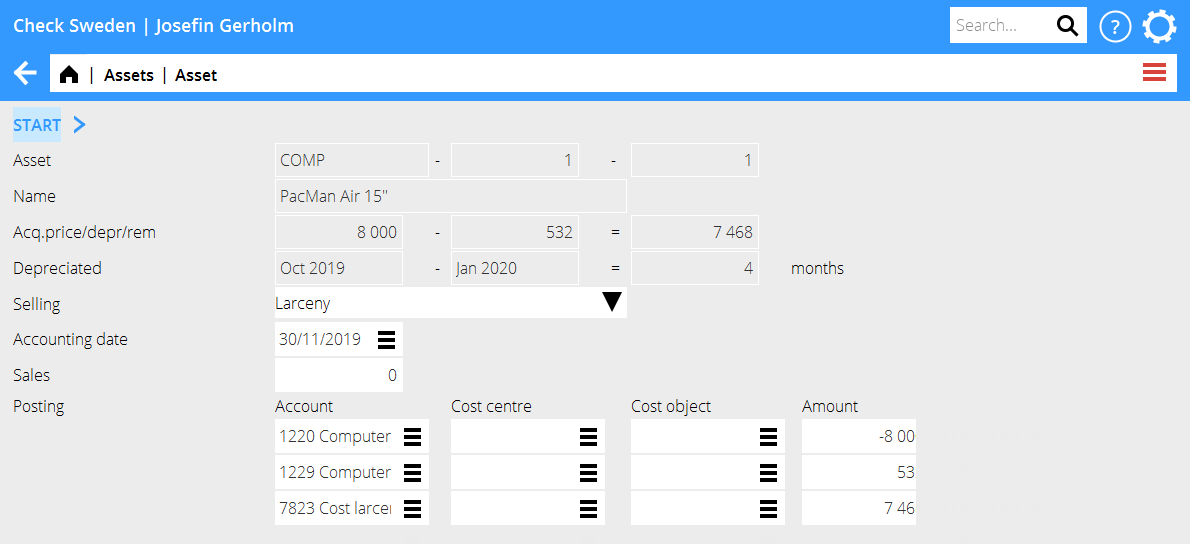

Disposal of assets

Disposal of assets is done in Accounting | Backoffice | Assets, under the Assets tab. Select the asset and click on the Dispose button.

Enter the Disposal code that corresponds to the reason for disposal and the Accounting date. If it is being disposed of due to a sale, the Sales price must be entered.

The posting for the disposal is suggested based on the remaining value of the asset, any sales price and the accounts you have set up for the asset type. The posting can be corrected manually. When the posting is complete, select Start.

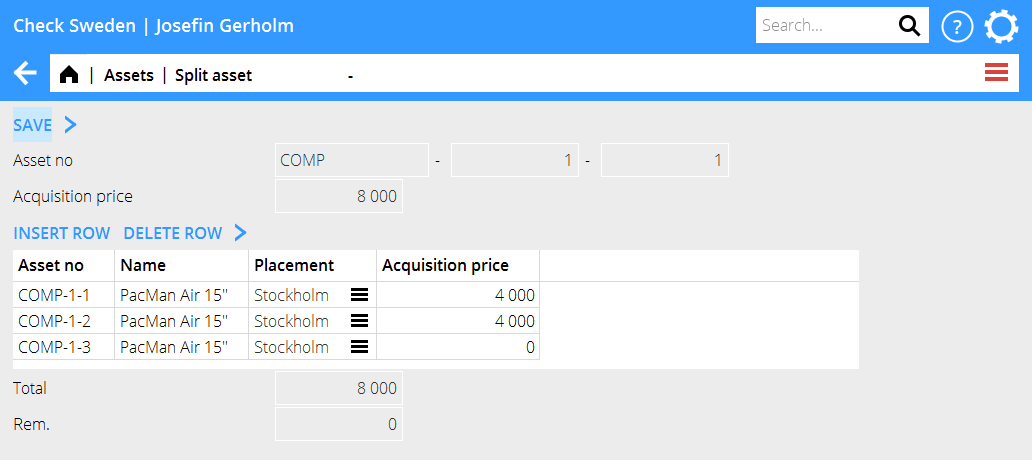

Split asset

An asset can be split into several in Accounting | Backoffice | Assets, tab Assets. Press the Split button. Then enter the name, placement, and acquisition price for each asset per row in the table.

All assets created because of splitting are given the same main number but separate sub-numbers. An asset COMP-1-1 that is split into two is therefore given the numbers COMP-1-1 and COMP-1-2 respectively.

Change asset number

If an asset has been assigned to the wrong asset type or given the wrong number, this can be corrected in Accounting | Backoffice | Assets, under the Assets tab. Select the asset and press Change Number, then enter the number to which the asset should be moved. Please note that the accounting needs to be corrected manually when changing the asset type for the subsystem to be correct.

Edit depreciation plan

Assets are depreciated using a straight-line depreciation plan, Acquisition price / Number of months to depreciate. An asset of SEK 60,000 to be depreciated over 60 months is therefore depreciated at SEK 1,000 per month.

If the depreciation plan needs to be changed, there are two different options.

1. Edit depreciation plan (only correction of future depreciation)

To correct the depreciation rate on the remaining amount of the asset, the depreciation plan can be changed under Accounting | Backoffice | Asset, the Asset tab. Open the asset, the Depreciation Plan tab. Enter the month from which the number of depreciation months is to be changed in the From Period column. The To period column is usually left blank, in which case the new plan applies to all future depreciation. The Quantity column specifies the number of months for which the asset is to be depreciated.

The From period is filled in where the new depreciation plan is to apply. Depreciation already made is not affected.

Example: Acquisition price SEK 60,000. First depreciation period 2024–01. Number of months to depreciate = 60. Depreciation made up to and including 2024–12. New depreciation plan from period 2025–01 onwards with number of months to depreciate = 12.

In 2024, there are 12 depreciation amounts of SEK 1,000 per month. The remaining amount after 2024 = SEK 48,000.

For depreciation in 2025–01 and onwards, SEK 5,000 is depreciated (SEK 60,000 / 12).

2. Edit number of months (retroactive correction)

If the depreciation plan for the asset is incorrect and depreciation already made needs to be corrected, this is done directly on the asset in Accounting| Backoffice | Assets, under the Assets tab.

The next depreciation will correct previous depreciation according to the new number of months.

Example: Acquisition price SEK 60,000. First depreciation period 2024–01. Number of months to depreciate = 60. Depreciation made up to and including 2024–12.

Change to the asset to Number of months to depreciate = 24, which means that SEK 2,500 per month should be depreciated.

In 2024, there are 12 depreciations of SEK 1,000 per month = SEK 12,000.

In 2025–01, SEK 20,500 is depreciated. SEK 2,500 for 2025–01 and SEK 18,000 to correct the previous depreciation for 2024 (60,000 / 24 * 12 - 12,000).

Reports

Reports for the fixed asset ledger are located under Accounting | Reports, the Inventory Ledger tab.

The Depreciation List report is a standard report that lists assets according to selection by depreciation period, accounting date and asset type. The Reports report is used to print reports with custom column templates.