Difference between revisions of "Revaluation of foreign trade debtors/creditors"

(→Print revaluation) |

|||

| (4 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| + | <htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

||

| + | |||

<translate> |

<translate> |

||

| − | =Revaluation of foreign trade debtors and -creditors= |

+ | ==Revaluation of foreign trade debtors and -creditors== <!--T:1--> |

| + | <!--T:2--> |

||

The functionality offers possibility for revaluation of remaining amounts on trade debtors and – creditors in another currency than the base currency with an automatic booking of the spread. |

The functionality offers possibility for revaluation of remaining amounts on trade debtors and – creditors in another currency than the base currency with an automatic booking of the spread. |

||

The function is located in Accounting: Revaluation of foreign trade debtors/creditors. |

The function is located in Accounting: Revaluation of foreign trade debtors/creditors. |

||

| + | <!--T:3--> |

||

{{ExpandImage|acc-rev-en-Bild1.png}} |

{{ExpandImage|acc-rev-en-Bild1.png}} |

||

| + | <!--T:4--> |

||

{|<class=mandeflist |

{|<class=mandeflist |

||

!Per date |

!Per date |

||

| Line 31: | Line 36: | ||

|} |

|} |

||

| + | <!--T:5--> |

||

Print the revaluation with Export. A sharp printout creates two vouchers and you can see voucher numbers on them respectively. |

Print the revaluation with Export. A sharp printout creates two vouchers and you can see voucher numbers on them respectively. |

||

| + | <!--T:6--> |

||

The invoices that are revaluated are going to be set as paid per the revaluation date in order the ledger and bookkeeping to agree. The payment is automatically reversed per the first day of the next month. |

The invoices that are revaluated are going to be set as paid per the revaluation date in order the ledger and bookkeeping to agree. The payment is automatically reversed per the first day of the next month. |

||

| − | ===Example=== |

+ | ===Example=== <!--T:7--> |

| + | <!--T:8--> |

||

Below an example of how the list looks like, how the booking goes and how it looks in the sales ledger. |

Below an example of how the list looks like, how the booking goes and how it looks in the sales ledger. |

||

The invoice 1250 DKK equals 1750 SEK with invoicing rate 1,4. |

The invoice 1250 DKK equals 1750 SEK with invoicing rate 1,4. |

||

| + | <!--T:9--> |

||

| − | {{ExpandImage|acc-rev-en- |

+ | {{ExpandImage|acc-rev-en-Bild2.png}} |

| + | <!--T:10--> |

||

In the revaluation, currency set with rate 1,45 is used. |

In the revaluation, currency set with rate 1,45 is used. |

||

| − | ==Print revaluation== |

+ | ==Print revaluation== <!--T:11--> |

| + | <!--T:12--> |

||

| − | {{ExpandImage|acc-rev-en- |

+ | {{ExpandImage|acc-rev-en-Bild3.png}} |

| + | <!--T:13--> |

||

The spread is set as paid in BU-911002 |

The spread is set as paid in BU-911002 |

||

| + | <!--T:14--> |

||

| − | {{ExpandImage|acc-rev-en- |

+ | {{ExpandImage|acc-rev-en-Bild4.png}} |

| + | <!--T:15--> |

||

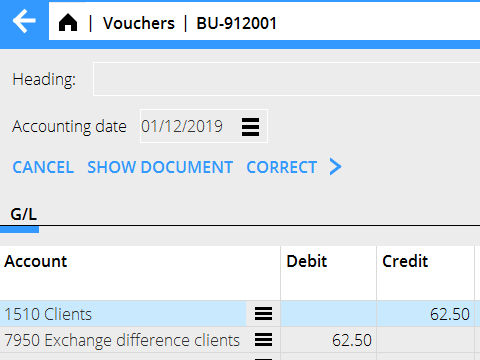

… and is reversed in BU-912001 |

… and is reversed in BU-912001 |

||

| + | <!--T:16--> |

||

| − | {{ExpandImage|acc-rev-en- |

+ | {{ExpandImage|acc-rev-en-Bild5.png}} |

| + | <!--T:17--> |

||

The revaluated invoice will look like this in the sales ledger: |

The revaluated invoice will look like this in the sales ledger: |

||

| + | <!--T:18--> |

||

| − | {{ExpandImage|acc-rev-en- |

+ | {{ExpandImage|acc-rev-en-Bild6.png}} |

| + | <!--T:19--> |

||

The invoice in sales ledger per 301119 |

The invoice in sales ledger per 301119 |

||

Here you can see only the “payment” in BU-911002, which makes the remaining amount to be shown regarding the revaluation per 301119. |

Here you can see only the “payment” in BU-911002, which makes the remaining amount to be shown regarding the revaluation per 301119. |

||

| + | <!--T:20--> |

||

| − | {{ExpandImage|acc-rev-en- |

+ | {{ExpandImage|acc-rev-en-Bild7.png}} |

| + | <!--T:21--> |

||

The invoice in the sales ledger per 011219 |

The invoice in the sales ledger per 011219 |

||

Here both “payments” are shown from BU-911002 and BU-912001, which makes the remaining amount to be shown as the original. The remaining amount will change if a new revaluation is made per 311219. |

Here both “payments” are shown from BU-911002 and BU-912001, which makes the remaining amount to be shown as the original. The remaining amount will change if a new revaluation is made per 311219. |

||

| + | <!--T:22--> |

||

| − | {{ExpandImage|acc-rev-en- |

+ | {{ExpandImage|acc-rev-en-Bild8.png}} |

| + | [[Category: Manuals]] |

||

| + | [[Category: ACC-REV-EN]] |

||

| + | [[Category: Accounting]] |

||

| + | |||

</translate> |

</translate> |

||

Latest revision as of 12:48, 22 December 2020

Revaluation of foreign trade debtors and -creditors

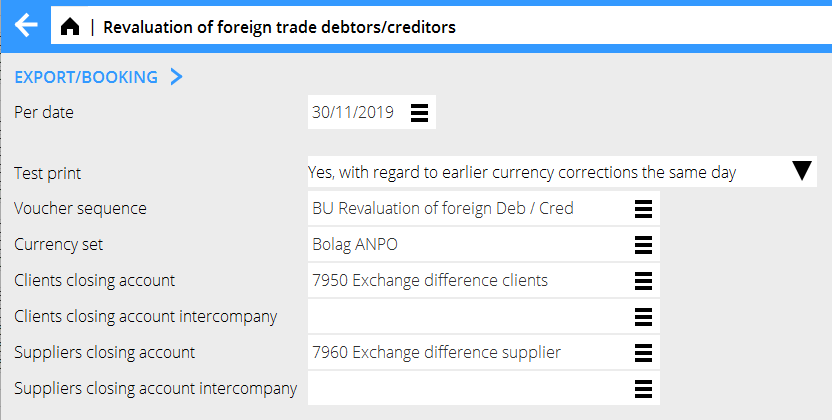

The functionality offers possibility for revaluation of remaining amounts on trade debtors and – creditors in another currency than the base currency with an automatic booking of the spread. The function is located in Accounting: Revaluation of foreign trade debtors/creditors.

| Per date | Enter per which date the revaluation shall be done |

|---|---|

| Test print: | If Yes, there are two options:

Yes, with regard to earlier currency corrections the same day. Yes, without regard to earlier currency corrections the same day If No, the system makes a sharp revaluation. An accounting order is created, with a reversal in the next period. If you select period as above, it will be a voucher with date 301119 and a reversal 011219. |

| Voucher sequence: | It is possible to have an own voucher sequence for revaluations. Create new in System: Base registers /GL/Voucher sequences. |

| Currency set: | Shows the currency rate for the valuation. Create currency set in System: Base registers/General/Currency sets. |

| Closing account: | Select account for booking the spread. |

| Closing acc intercompany: | Select account for spreads for intercompany clients and suppliers. |

Print the revaluation with Export. A sharp printout creates two vouchers and you can see voucher numbers on them respectively.

The invoices that are revaluated are going to be set as paid per the revaluation date in order the ledger and bookkeeping to agree. The payment is automatically reversed per the first day of the next month.

Example

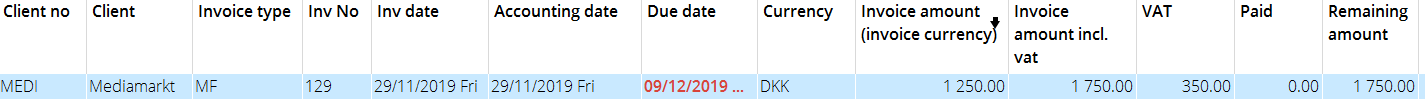

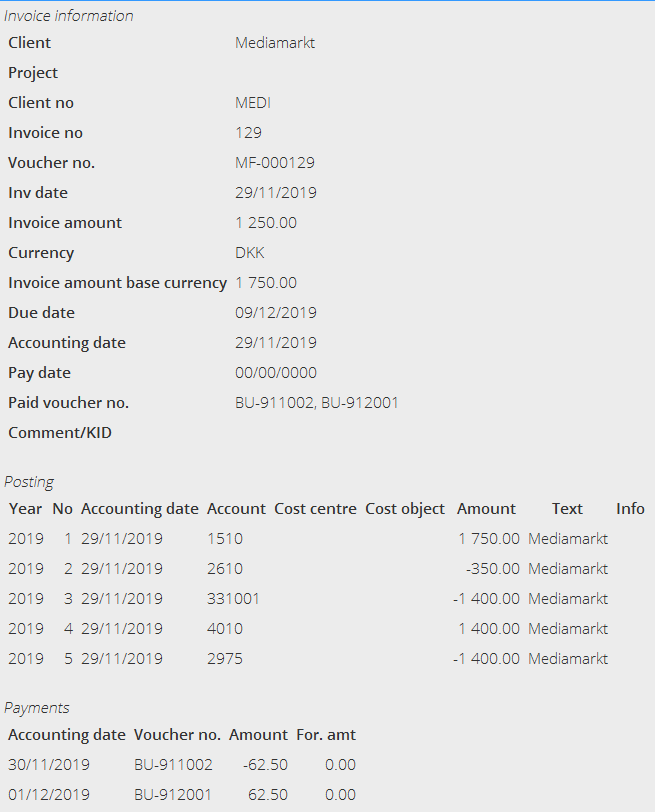

Below an example of how the list looks like, how the booking goes and how it looks in the sales ledger. The invoice 1250 DKK equals 1750 SEK with invoicing rate 1,4.

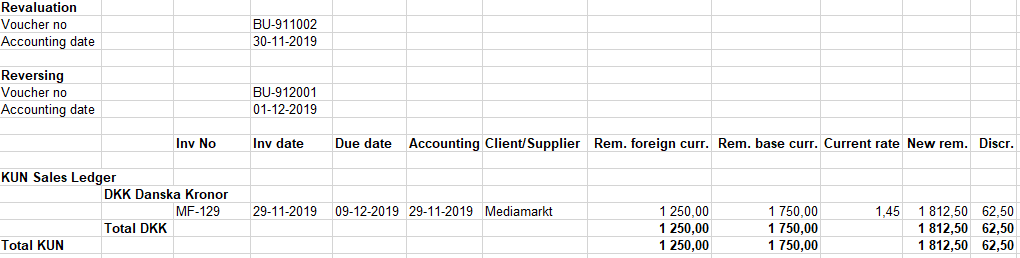

In the revaluation, currency set with rate 1,45 is used.

Print revaluation

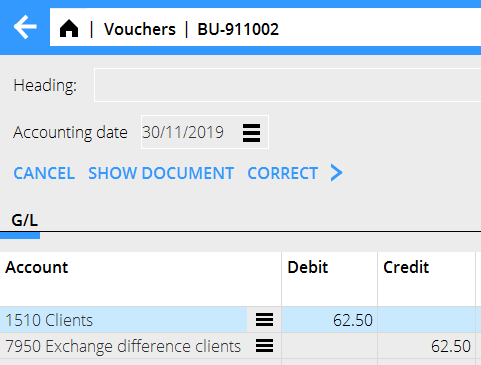

The spread is set as paid in BU-911002

… and is reversed in BU-912001

The revaluated invoice will look like this in the sales ledger:

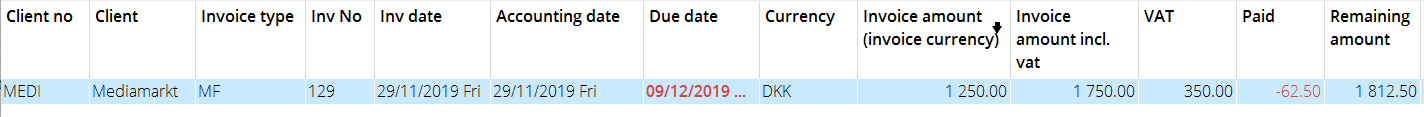

The invoice in sales ledger per 301119

Here you can see only the “payment” in BU-911002, which makes the remaining amount to be shown regarding the revaluation per 301119.

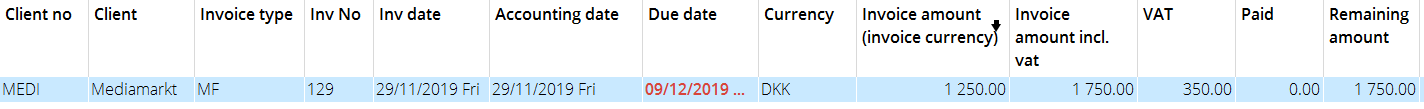

The invoice in the sales ledger per 011219 Here both “payments” are shown from BU-911002 and BU-912001, which makes the remaining amount to be shown as the original. The remaining amount will change if a new revaluation is made per 311219.