Difference between revisions of "SAF-T Finance in Marathon"

| (2 intermediate revisions by the same user not shown) | |||

| Line 3: | Line 3: | ||

Prerequisites, setup and general information about the SAF-T Financial report in Marathon. |

Prerequisites, setup and general information about the SAF-T Financial report in Marathon. |

||

=== General info and configuration/setup needed === |

=== General info and configuration/setup needed === |

||

| − | + | There is a report in Accounting/Reports, tab: General ledger, report: SAF-T. |

|

To be able to run the report you need to do some preparations in Marathon. There are also some additional information and possible changes in processes that you may or may not be of concern for You, depending on what functionality you are using in Marathon. These topics are described last under Function specific information. |

To be able to run the report you need to do some preparations in Marathon. There are also some additional information and possible changes in processes that you may or may not be of concern for You, depending on what functionality you are using in Marathon. These topics are described last under Function specific information. |

||

You are recommended to read the general information regarding the SAF-T reporting on skatteetaten. There you’ll find information about how to map the chart of accounts, VAT codes etc. The following documentation simply states where in Marathon the SAF-T required information is to be entered; not how this information should be filled. |

You are recommended to read the general information regarding the SAF-T reporting on skatteetaten. There you’ll find information about how to map the chart of accounts, VAT codes etc. The following documentation simply states where in Marathon the SAF-T required information is to be entered; not how this information should be filled. |

||

We recommend that you do the required mapping as soon as possible in January and test the report continuously during January. This way Kalin Setterberg can help you sort out unforeseen errors before deadline for the definitive VAT reporting. |

We recommend that you do the required mapping as soon as possible in January and test the report continuously during January. This way Kalin Setterberg can help you sort out unforeseen errors before deadline for the definitive VAT reporting. |

||

| − | The report can only handle data registered in the graphical interface in Marathon. We recommend you to close Classic completely before entering any data in 2020. Contact Kärt on km@kase.se if you want assistance to close Classic. |

||

| − | If you don’t close Classic completely, following functions are not allowed to use for any data in 2020. |

||

| − | === Update Marathon to W1946 === <!--T:2--> |

||

| − | The Norwegian SAF-T financial exists in Marathon as of Marathon version W1946. If You do not see the report in Accounting/Reports, tab: General ledger, report: SAF-T you need to get your installation updated to W1946. Contact support@kase.se for help in this. If you do see the SAF-T report, you have W1946 and can continue reading this instruction. |

||

== Basic setup and mapping == <!--T:3--> |

== Basic setup and mapping == <!--T:3--> |

||

| Line 27: | Line 23: | ||

{{ExpandImage|ACC-REN-Bild2.png}} |

{{ExpandImage|ACC-REN-Bild2.png}} |

||

| − | Information about how to map Your VAT classes is found on skatteetaten. |

+ | Information about how to map Your VAT classes is found on skatteetaten.no |

=== Mapping of VAT-classes to the Norwegian SAF-T financial standard === <!--T:7--> |

=== Mapping of VAT-classes to the Norwegian SAF-T financial standard === <!--T:7--> |

||

| Line 36: | Line 32: | ||

Information about how to map Your VAT classes is found on skatteetaten. |

Information about how to map Your VAT classes is found on skatteetaten. |

||

| − | === VAT number on all clients and suppliers subject to VAT === <!--T:8--> |

+ | === VAT number and post address on all clients and suppliers subject to VAT === <!--T:8--> |

| − | All clients and suppliers |

+ | All clients and suppliers , taxable or not must be registered with VAT number and postal address in Marathon. This is registered on the client in MED or PRO and S/L. Only clients/Suppliers for which you have sent or received an invoice needs to be registered with VAT number. |

Recommendation: There is a parameter which makes VAT number mandatory on suppliers in Base register / P/L / Parameters, tab: General, field: VAT number mandatory. |

Recommendation: There is a parameter which makes VAT number mandatory on suppliers in Base register / P/L / Parameters, tab: General, field: VAT number mandatory. |

||

VAT no shall be registered in the following format: 999999999MVA or NO999999999MVA |

VAT no shall be registered in the following format: 999999999MVA or NO999999999MVA |

||

| + | |||

| + | <!--T:12--> |

||

| + | Post address must be entered in its entirety on the supplier, with both postal code and city, e.g. 0101 Oslo |

||

=== Mapping of chart of accounts to Norwegian SAF-T financial standard === <!--T:9--> |

=== Mapping of chart of accounts to Norwegian SAF-T financial standard === <!--T:9--> |

||

Latest revision as of 10:37, 25 March 2022

Contents

- 1 Norwegian SAF-T financial in Marathon

- 1.1 General info and configuration/setup needed

- 1.2 Basic setup and mapping

- 1.2.1 Contact person and other company specific information

- 1.2.2 Mapping of outgoing VAT to the Norwegian SAF-T financial standard

- 1.2.3 Mapping of VAT-classes to the Norwegian SAF-T financial standard

- 1.2.4 VAT number and post address on all clients and suppliers subject to VAT

- 1.2.5 Mapping of chart of accounts to Norwegian SAF-T financial standard

- 1.3 Running the report

Norwegian SAF-T financial in Marathon

Prerequisites, setup and general information about the SAF-T Financial report in Marathon.

General info and configuration/setup needed

There is a report in Accounting/Reports, tab: General ledger, report: SAF-T. To be able to run the report you need to do some preparations in Marathon. There are also some additional information and possible changes in processes that you may or may not be of concern for You, depending on what functionality you are using in Marathon. These topics are described last under Function specific information. You are recommended to read the general information regarding the SAF-T reporting on skatteetaten. There you’ll find information about how to map the chart of accounts, VAT codes etc. The following documentation simply states where in Marathon the SAF-T required information is to be entered; not how this information should be filled. We recommend that you do the required mapping as soon as possible in January and test the report continuously during January. This way Kalin Setterberg can help you sort out unforeseen errors before deadline for the definitive VAT reporting.

Basic setup and mapping

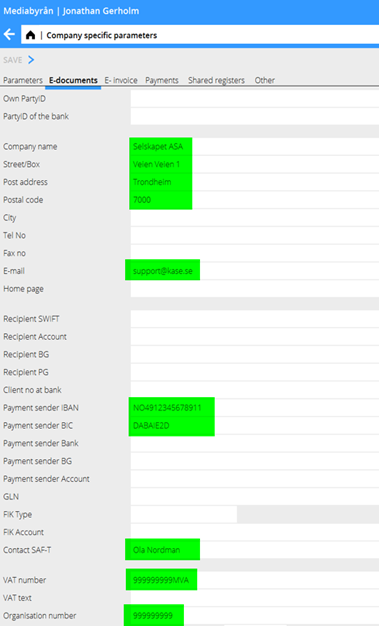

Contact person and other company specific information

Below listed fields in Base registers / General / Company Specific parameters, tab: E-documents needs to be filled for each company on your installation that are to run the SAF-T report.

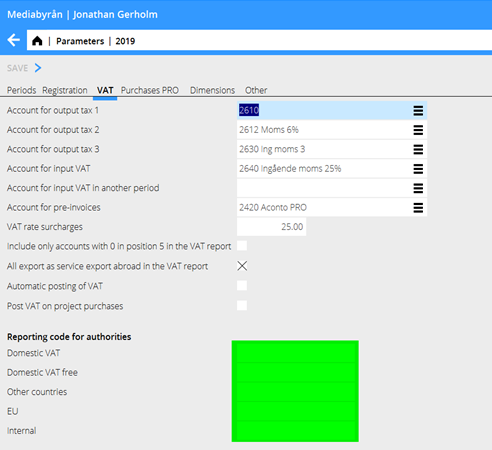

Mapping of outgoing VAT to the Norwegian SAF-T financial standard

Outgoing VAT codes (position 5-6 on revenue accounts) needs to be mapped according to the Norwegian SAF-T financial standard. This is done by filling the field Reporting code to authorities in Base registers / G/L / Parameters, tab: VAT

Information about how to map Your VAT classes is found on skatteetaten.no

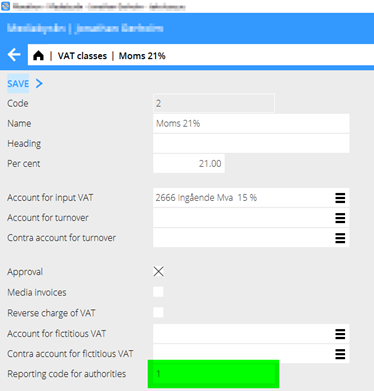

Mapping of VAT-classes to the Norwegian SAF-T financial standard

All VAT classes in the current bookkeeping year must be mapped according to the Norwegian SAF-T financial standard. This is done by filling the field Reporting code to authorities in Base registers / G/L, VAT classes.

Information about how to map Your VAT classes is found on skatteetaten.

VAT number and post address on all clients and suppliers subject to VAT

All clients and suppliers , taxable or not must be registered with VAT number and postal address in Marathon. This is registered on the client in MED or PRO and S/L. Only clients/Suppliers for which you have sent or received an invoice needs to be registered with VAT number. Recommendation: There is a parameter which makes VAT number mandatory on suppliers in Base register / P/L / Parameters, tab: General, field: VAT number mandatory. VAT no shall be registered in the following format: 999999999MVA or NO999999999MVA

Post address must be entered in its entirety on the supplier, with both postal code and city, e.g. 0101 Oslo

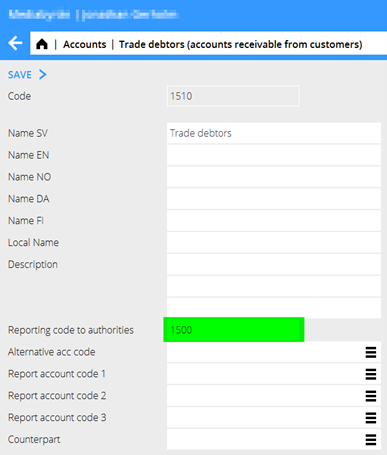

Mapping of chart of accounts to Norwegian SAF-T financial standard

All accounts in the current bookkeeping year must be mapped according to the Norwegian SAF-T financial accounts. This is done by filling the field Reporting code to authorities in Base registers / G/L, Account.

Information about how to map Your chart of accounts is found on skatteetaten.

Running the report

The SAF-T report is found in Accounting/Reports, tab: General ledger, report: SAF-T. Select the reporting period and press EXPORT. Save the file on desired location. If the report cannot be exported, you will receive an error message. Please note that only the first error will be displayed. So, we urge you to follow the instructions thoroughly and map everything accordingly before running the report.