Difference between revisions of "Enter vouchers"

(Marked this version for translation) |

(Marked this version for translation) |

||

| (2 intermediate revisions by the same user not shown) | |||

| Line 3: | Line 3: | ||

A program for registration of supporting vouchers, either without integration to other subsystems och with assignations to other ledgers. |

A program for registration of supporting vouchers, either without integration to other subsystems och with assignations to other ledgers. |

||

| − | =Enter vouchers= |

+ | =Enter vouchers= <!--T:60--> |

==General== |

==General== |

||

Vouchers are registered in Accounting | Vouchers. The standard series has the prefix BO, but more voucher series can be registered in Accounting | Backoffice | Base registers, The General ledger tab. The series code must contain two characters and start with a B. |

Vouchers are registered in Accounting | Vouchers. The standard series has the prefix BO, but more voucher series can be registered in Accounting | Backoffice | Base registers, The General ledger tab. The series code must contain two characters and start with a B. |

||

| Line 90: | Line 90: | ||

''Foreign currency'' |

''Foreign currency'' |

||

| + | |||

| + | <!--T:85--> |

||

'''Automatic posting of spreads''' If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Sales ledger tab, exchange rate differences are posted automatically. |

'''Automatic posting of spreads''' If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Sales ledger tab, exchange rate differences are posted automatically. |

||

| Line 114: | Line 116: | ||

''Foreign currency'' |

''Foreign currency'' |

||

| + | |||

| + | <!--T:86--> |

||

'''Automatic posting of spreads''' If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Purchase ledger tab, exchange rate differences are posted automatically. |

'''Automatic posting of spreads''' If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Purchase ledger tab, exchange rate differences are posted automatically. |

||

| Line 155: | Line 159: | ||

* If the acquisition account is only linked to one type of asset, the asset type will be filled in automatically. Otherwise, the asset type must be filled in. |

* If the acquisition account is only linked to one type of asset, the asset type will be filled in automatically. Otherwise, the asset type must be filled in. |

||

* Enter amount and optional description. |

* Enter amount and optional description. |

||

| + | |||

| + | <!--T:87--> |

||

| + | {{ExpandImage|BOK-VER-EN-Bild8.png}} |

||

| − | == Correct a voucher== |

+ | == Correct a voucher== <!--T:80--> |

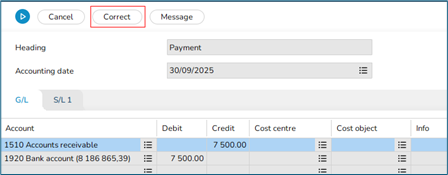

It is parameter-controlled to be able to click the Correct button on an AT, ER or LF voucher, as the original voucher and not the correction is reversed if the invoice is reversed after a manual correction has been made. |

It is parameter-controlled to be able to click the Correct button on an AT, ER or LF voucher, as the original voucher and not the correction is reversed if the invoice is reversed after a manual correction has been made. |

||

* Select the voucher you wish to correct, press Open. |

* Select the voucher you wish to correct, press Open. |

||

| Line 164: | Line 171: | ||

<!--T:81--> |

<!--T:81--> |

||

| − | {{ExpandImage|BOK-VER-EN- |

+ | {{ExpandImage|BOK-VER-EN-Bild9.png}} |

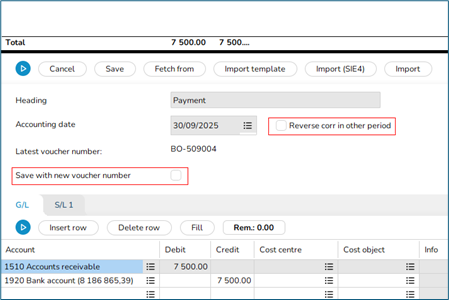

* If the correction is to be saved with its own voucher number, tick the box ‘Save with new voucher number’ and enter the accounting date. The accounting date does not need to be in the same period as the original voucher. |

* If the correction is to be saved with its own voucher number, tick the box ‘Save with new voucher number’ and enter the accounting date. The accounting date does not need to be in the same period as the original voucher. |

||

<!--T:82--> |

<!--T:82--> |

||

| − | {{ExpandImage|BOK-VER-EN- |

+ | {{ExpandImage|BOK-VER-EN-Bild10.png}} |

* If the correction is to be reversed in another period, select ‘Reverse correction in another period’ and an accounting date at the top. Both the correction and the reversal of the correction will be posted on this date and receive a number from the voucher series in this period. In total, two new vouchers are created – the correction and the reversal of the correction. |

* If the correction is to be reversed in another period, select ‘Reverse correction in another period’ and an accounting date at the top. Both the correction and the reversal of the correction will be posted on this date and receive a number from the voucher series in this period. In total, two new vouchers are created – the correction and the reversal of the correction. |

||

Latest revision as of 11:10, 27 January 2026

A program for registration of supporting vouchers, either without integration to other subsystems och with assignations to other ledgers.

Contents

Enter vouchers

General

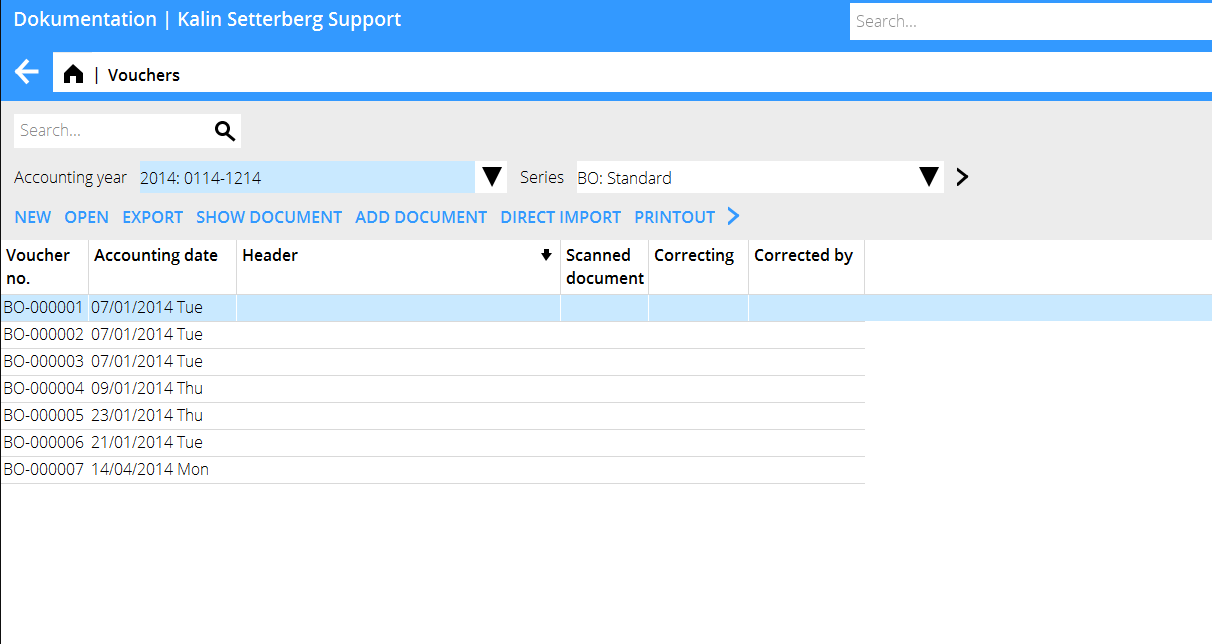

Vouchers are registered in Accounting | Vouchers. The standard series has the prefix BO, but more voucher series can be registered in Accounting | Backoffice | Base registers, The General ledger tab. The series code must contain two characters and start with a B.

Enter voucher without assignment to another subsystem

- Select series and press NEW

- Write heading

- Enter accounting date, the Today button gives today’s date.

- Enter thereafter account and debit/credit

| Fetch from | Function for copying previous voucher |

|---|---|

| Import template | Backoffice | Base register, under the General ledger tab. See the description under Create Voucher template. |

| Import (SIE 4) | Import of Sie 4- file to Swedish tax agency. |

| Import | Import from e.g. Excel |

| Reversing in another period | Creates a reversed voucher with a different posting date |

| Accounting date + Today | The Accounting date field must be filled in before the remaining information can be registered. The specified date will be suggested in the next voucher. |

| Heading | The heading is shown in the voucher list and is searchable |

| Voucher number | Backoffice | Base registers, General ledger tab |

| Account | Enter account |

| Cost centre/-object | Enter cost centre and cost object if the account requires/allows that. |

| Debit/Credit | Enter amount |

| Dimensions | Backoffice | Base registers, General ledger tab. Open the year and go to the Dimensions tab. Manual dimensions are edited in Accounting | Backoffice | Base registers, General ledger tab |

| Text | Enter any text with a maximum of 25 characters. Displayed in the Nominal ledger and account specification. |

| Subtotal | The debit and credit columns are totalled at the bottom. The voucher cannot be saved if it does not balance. |

| Create VAT posting | If Marathon's input VAT handling is used, automatic VAT posting can be created using the Input tax button, and the calculation of amounts is retrieved from the settings in the VAT classes. |

| Fill | Automatically fills in the remaining amount to balance the voucher, provided that an account has been specified. |

| Rem. | Shows remaining amount to balance. |

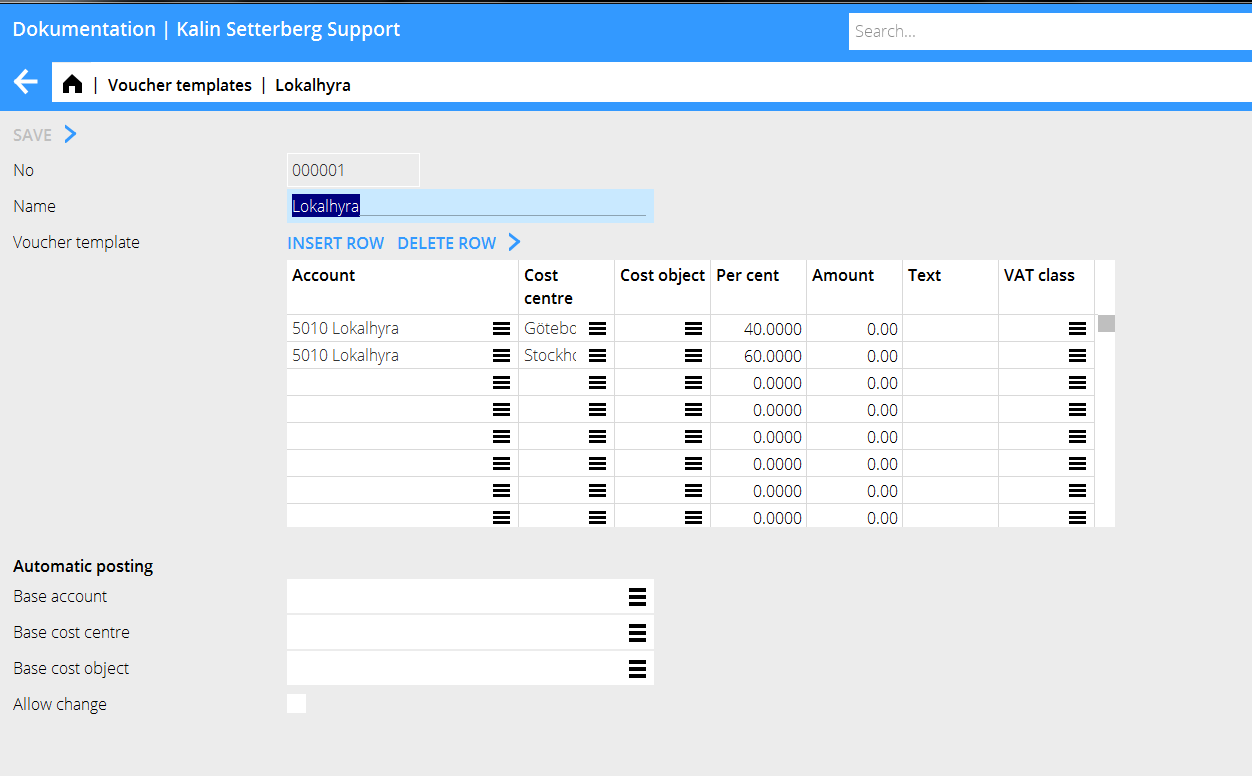

Voucher template or automatic posting

Voucher templates are created in Accounting | Backoffice | Base registers, General ledger tab.

- Press New and give the template a name.

- Enter account and possible cost centre and cost object if the account requires/allows that.

- Enter either a percentage of an amount or an amount. If a percentage is entered, the system will ask for the total amount when the template is used and calculate the share using the percentage.

- Press Import template button to import the template into a voucher.

- An automatic posting, without clicking the Import template button in a voucher, is performed when the Base account, Base cost centre and Base cost object fields in Automatic posting at the bottom of the voucher template are filled in. See image below. Automatic posting is triggered when the base account is specified in a voucher and is displayed in the registration screen.

Enter voucher with assignment to another subsystem

Accounts can be set up with assignment to a subsystem. When registering for an account that is integrated with another subsystem, a red tab with the name of the subsystem will appear. Information belonging to the subsystem is registered in this tab. The most common assignments are described below.

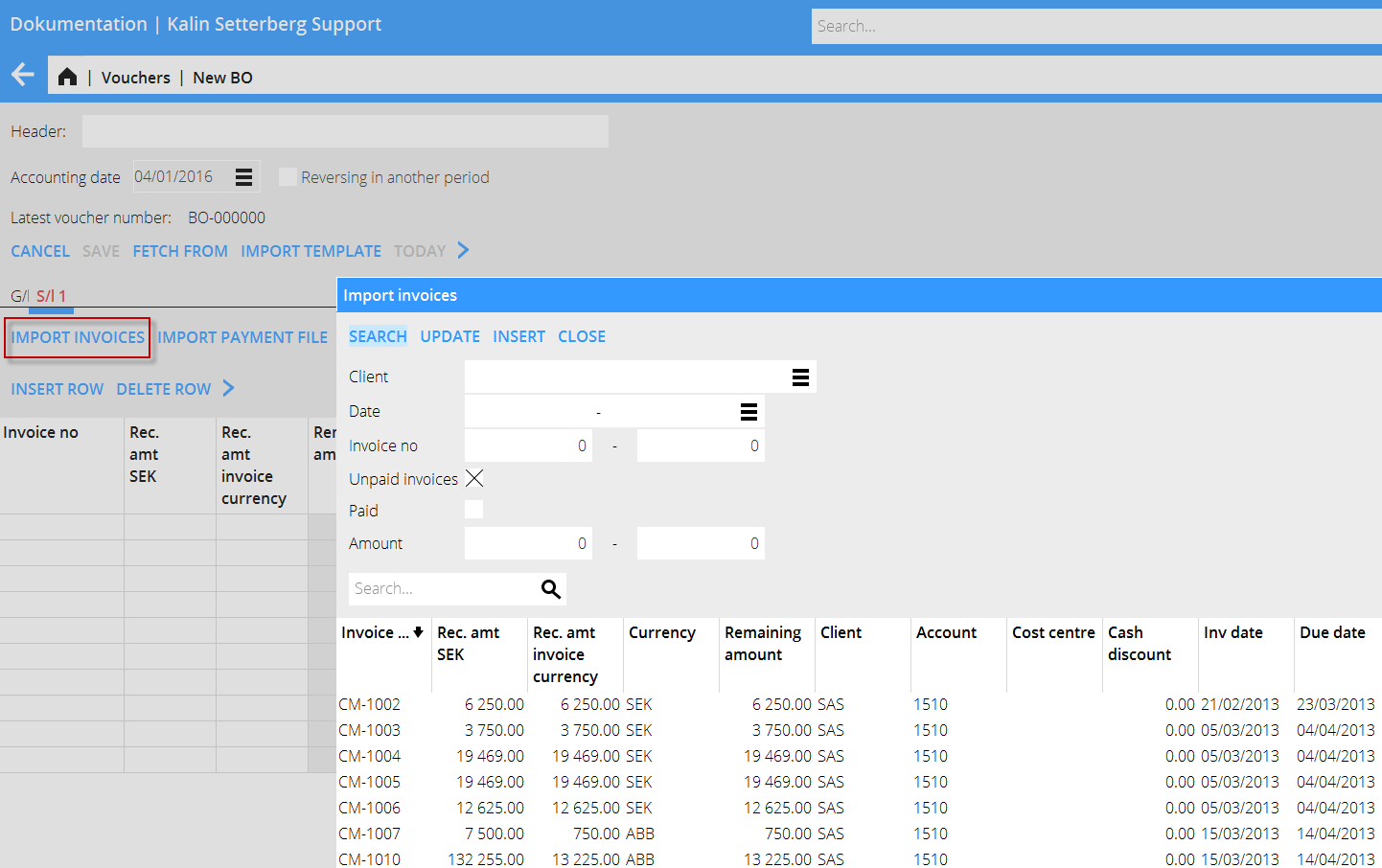

Client payments

The trade debtors’ account is assigned to the sales ledger.

- Fill in trade debtors’ account. A new tab opens, S/L.

- In the S/L tab, enter the invoice number that has been paid or search invoices with the Import invoices button. A payment file can be imported (requires settings).

- The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency).

Foreign currency

Automatic posting of spreads If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Sales ledger tab, exchange rate differences are posted automatically.

For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount paid into the bank must be entered.

If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference.

Manual posting of spreads If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually.

Contrary posting is made in the G/L tab. Here you can use the Fill button, for posting the rest on the account.

Suppliers’ payments

The trade creditors’ account is assigned to the Purchase ledger.

- Enter trade creditors’ account. A new tab appears, P/L.

- Write invoice number in the P/L tab or search invoice with the Import invoices function. A payment file can be imported (requires settings).

- The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency).

Foreign currency

Automatic posting of spreads If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Purchase ledger tab, exchange rate differences are posted automatically.

For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount withdrawn from the bank must be entered.

If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference.

Manual posting of spreads If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually.

After registration, enter an account in the G/L tab. Here you can use the Fill button, for posting the rest on the account.

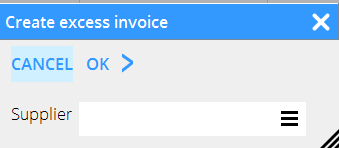

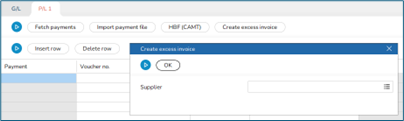

Create excess invoice

By using the Create excess invoice function, an excess payment can be placed directly in the purchase ledger for a supplier whose invoice has not yet arrived. This payment is assigned an LA number.

- Select supplier and enter amount when registering.

Project purchases

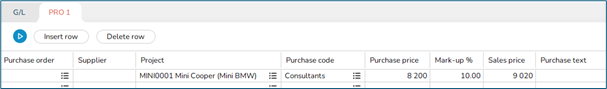

The account for project purchases is assigned to the project accounting.

- Fill in the project purchase account for purchases to be charged to the project, and a new tab called PRO will appear.

- Fill in project, purchase code and a purchase price. The sales price is automatically calculated according to the mark-up that has been registered on the purchase code.

- Write optional purchase text.

- If you use purchase orders, enter PO number when registering project purchases. All information will then be fetched from it.

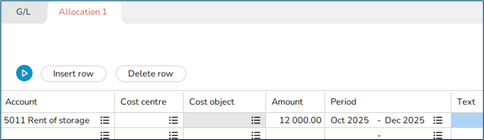

Periodical allocations

The account for automatic accruals is assigned to Periodical allocations.

- Fill in account for periodical allocations for costs that shall be accrued over a period. A new tab appears, Allocation.

- Enter the cost account and amount, as well as the period over which the amount is to be distributed. There are two ways to enter the period: YYYYMM – YYYYMM or YYYYMMDD – YYYYMMDD. In the first case, the amount is distributed evenly over the months; in the second case, the amounts are distributed differently depending on how many days there are in the month.

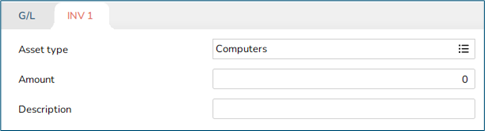

Assets/Inventory

The account for the acquisition of assets is assigned to the Inventory ledger.

- Fill in acquisition account for the asset. A new tab appears, INV.

- If the acquisition account is only linked to one type of asset, the asset type will be filled in automatically. Otherwise, the asset type must be filled in.

- Enter amount and optional description.

Correct a voucher

It is parameter-controlled to be able to click the Correct button on an AT, ER or LF voucher, as the original voucher and not the correction is reversed if the invoice is reversed after a manual correction has been made.

- Select the voucher you wish to correct, press Open.

- Press Correct.

- Answer the question about reversing the voucher.

- If the correction is to be saved with its own voucher number, tick the box ‘Save with new voucher number’ and enter the accounting date. The accounting date does not need to be in the same period as the original voucher.

- If the correction is to be reversed in another period, select ‘Reverse correction in another period’ and an accounting date at the top. Both the correction and the reversal of the correction will be posted on this date and receive a number from the voucher series in this period. In total, two new vouchers are created – the correction and the reversal of the correction.

Paste data into a voucher

- Start by right-clicking on the accounting table without selecting anything and choose Copy. Then paste into Excel. This is exactly how Excel should be structured in order to be copied into a voucher.

- To paste into the voucher, select the cells including headings and all columns.

- Right-click in the account table and select Paste.