Difference between revisions of "New year in Marathon/sv"

(Created page with "Man kan också välja att få notiser skickade via e-post. Det ställs in under kugghjulet → Inställningar i fliken Notiser.") |

(Created page with "Åtgärda felet och bekräfta notisen, så försvinner den från listan.") |

||

| Line 33: | Line 33: | ||

Man kan också välja att få notiser skickade via e-post. Det ställs in under kugghjulet → Inställningar i fliken Notiser. |

Man kan också välja att få notiser skickade via e-post. Det ställs in under kugghjulet → Inställningar i fliken Notiser. |

||

| + | Åtgärda felet och bekräfta notisen, så försvinner den från listan. |

||

| − | Correct the error and confirm the notification, it will then disappear. |

||

= Bank free days = |

= Bank free days = |

||

Revision as of 14:55, 23 November 2016

Contents

- 1 Nytt bokföringsår i Marathon

- 2 Notiser

- 3 Bank free days

- 4 Calendary

- 5 Frequent questions

- 5.1 » What does the alternative ”Update OB at new transactions in previous years” mean?

- 5.2 » I activated the parameter ""Update OB at new transactions in previous years”",but when I register accounts in the previous year I cannot see them in the new year?

- 5.3 » I didn't activate ""Update OB at transactions in previous year”" when I created new accounting year. Can I undo that?

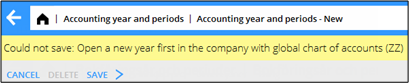

- 5.4 » I receive a message ”Could not save: Open a new year first in the company with global chart of accounts” when I try to save my new accounting year?

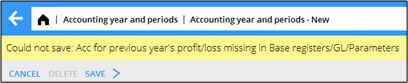

- 5.5 » I receive a message ”Could not save: Account for previous year's profit/loss missing in System: Base registers/GL/Parameters”?

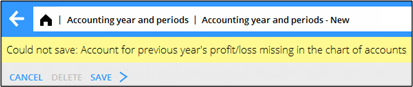

- 5.6 » I receive a message ”Could not save: Account for previous year's profit/loss missing in the chart of accounts”?

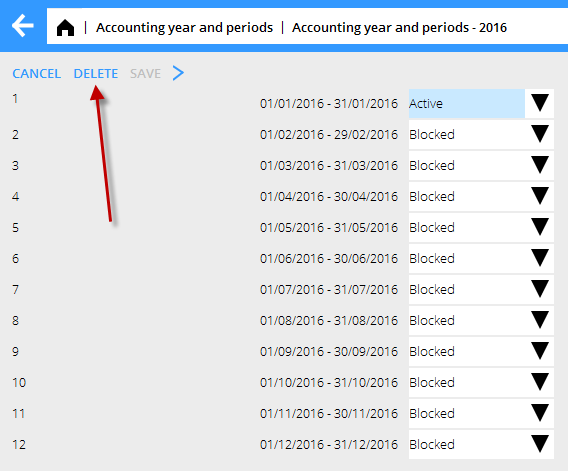

- 5.7 » I created a new accounting year that I now want to delete. How do I do that?

- 5.8 » How do I change year in Classic?

Nytt bokföringsår i Marathon

Nedan följer en beskrivning på hur du skapar ett nytt år i Marathon. De två första sidorna ska ses som själva beskrivningen, därefter följer svar på vanliga frågor som kan uppstå vid upplägget.

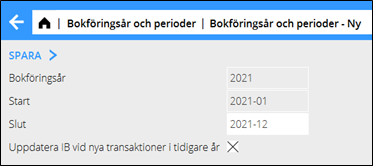

Nytt år läggs upp i Ekonomi: Bokföringsår och perioder. Klicka på knappen Ny och kontrollera så att de föreslagna start- och slutperioderna stämmer. Om slutperioden ska vara en annan, exempelvis vid förlängning av ett bokföringsår, så kan den skrivas över. Välj om IB från föregående år ska uppdateras automatiskt genom att kryssa i eller kryssa ur rutan ”Uppdatera IB vid nya transaktioner i tidigare år”. Klicka på Spara.

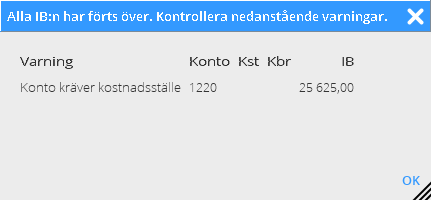

När det nya året sparas görs samtidigt en överföring av IB, periodiseringar, kontoplan, kostnadsställen, kostnadsbärare, dimensioner, automatkonteringar, automatfördelningar, budgetmallar, rapportmallar, verifikationsmallar, konteringsmallar, momsklasser och verifikationsserier från föregående år till det nya året. Eventuella fel visas på en felrapport, men endast som varningar. Konto, kostnadsställe, kostnadsbärare som saknas läggs upp i det nya året.

Konton som inte ska ha kostnadsställe/-bärare, men där det finns en utgående balans i föregående år på sådan kombination, rättas till genom att kostnadsställe/-bärare tas bort. Utgående balans på konton som kräver kostnadsställe/-bärare där detta saknas förs över utan.

En varning vid upplägg av nytt år kan se ut såhär:

I exemplet ovan förs saldot på konto 1220 över till det nya året, men utan koppling till kostnadsställe.

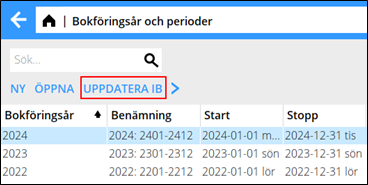

Vill man så kan man åtgärda de fel som rapporteras på listan och göra en ny överföring. En ny överföring görs i Bokföringsår och perioder genom att man markerar året och klickar på knappen Uppdatera IB.

Notiser

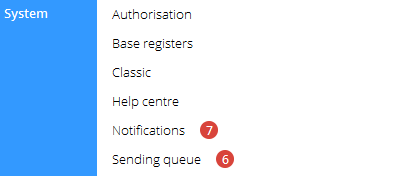

Om man valt att IB i föregående år ska uppdateras automatiskt (se föregående sida) skapas en notis om någon transaktion inte kan uppdateras till bokföringen. Notisen visas under System/Notiser.

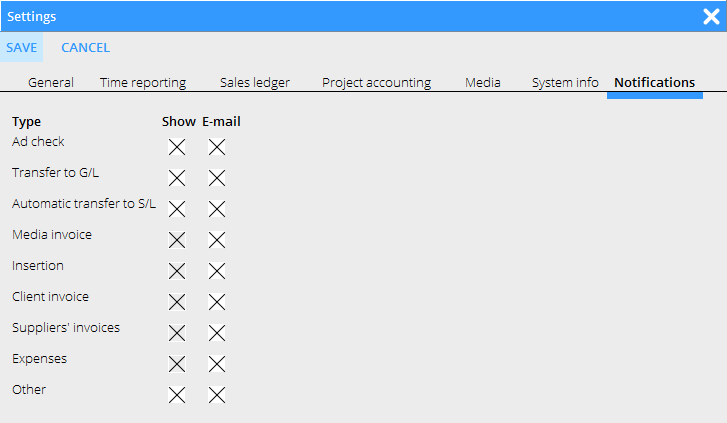

Man kan också välja att få notiser skickade via e-post. Det ställs in under kugghjulet → Inställningar i fliken Notiser.

Åtgärda felet och bekräfta notisen, så försvinner den från listan.

Bank free days

Update bank holidays for the new year and the following year in System: Base registers/PL/Bank holidays. This enables the automatic payments to function.

Calendary

Create calendars for different working time measures in System: Base registers/PRO/Calendar. Click New and write in the year, same calendar number as before and name (if not, you have to do the change in the employees' records in System: Base registers/Pro/Employees. Write in amount of expected working hours per day in the field Time/day.

In the tab Working Days, you can click Import standard to import a standard calendar. Fill in which days that are working days and which are not. A working day is expressed as a digit with two decimals. A complete working day is 1,00, half day is 0,50 and a free day is 0,00. This enables different calendars for different working time measures.

You can copy working days from a calendar to another, as long as it is in the same year. Remember to change hours per day and the name after copying.

Frequent questions

» What does the alternative ”Update OB at new transactions in previous years” mean?

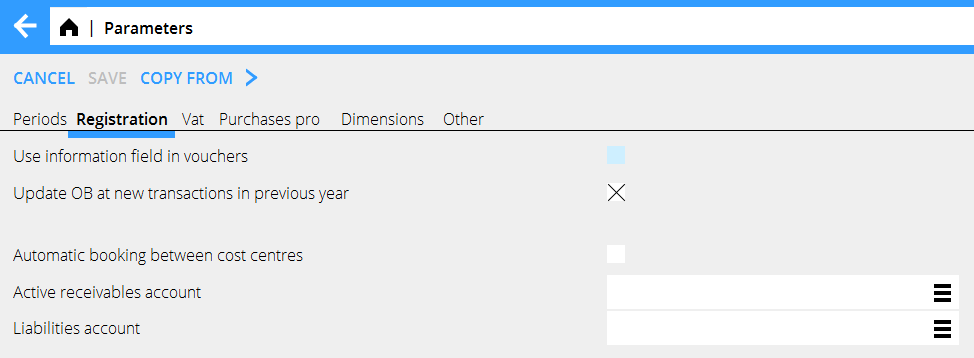

If the box is checked, the same parameter will be checked in System: Base registers/GL/Parameters, tab Registration.

Activating the parameter means that the OB will be updated automatically when a new transaction is registered in the previous year. Thus you don't need to update OB manually when working in two accounting years concurrently. If an OB record for some reason not can be updated, a notification about it is creates. The notifications are shown in System: Notifications.

You can also choose to receive the notifications by e-mail. Settings for that are available under the cog wheel → Settings, tab Notifications.

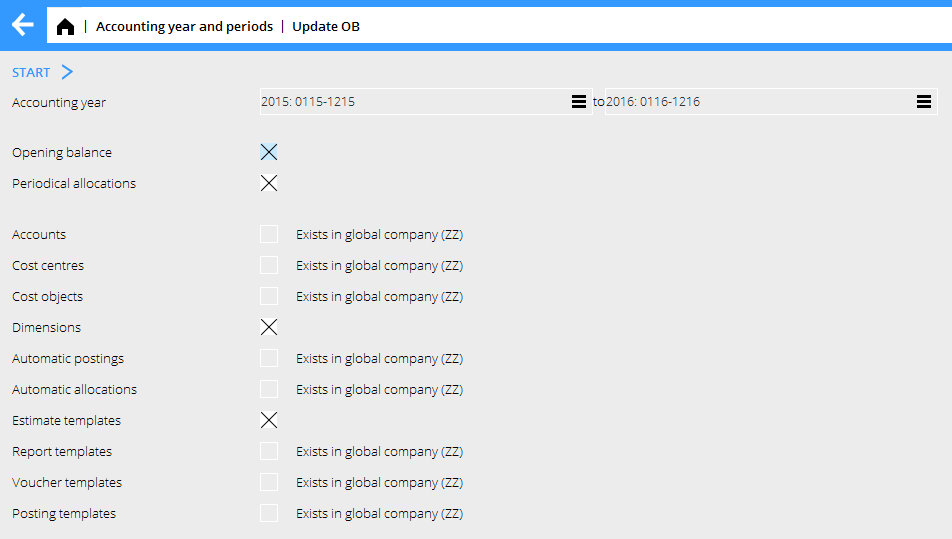

Please note that the automatic update only concerns OB and periodical allocations (accruals). Other changes in the previous years such as accounts, cost centres and -objects, etc. shall be updated manually with the function Update OB, which is located in Accounting: Accounting year and periods.If you activate automatic update after you've already registered transaction in the previous year, these records must be updated manually with the Update OB -function.

If you choose not to check the box "Update OB at new transactions in previous year" and thus not the parameter either, you will have to update opening balances manually when working concurrently in two accounting years. The function is found in Accounting: Accounting year and period. Select year and click on Update OB. Check the records you wish to update and click on Start. If there is a global company, where these records exist, it is mentioned in parenthesis. Change company under the cog wheel and make the update there instead.

» I activated the parameter ""Update OB at new transactions in previous years”",but when I register accounts in the previous year I cannot see them in the new year?

The automatic update only concerns OB and periodical allocations (accruals). Other changes in the previous years such as accounts, cost centres and -objects, etc. shall be updated manually with the function Update OB, which is located in Accounting: Accounting year and periods.

» I didn't activate ""Update OB at transactions in previous year”" when I created new accounting year. Can I undo that?

Yes, you can check the parameter in System: Base registers/GL/Parameters, tab Registration. Note, that if you activate automatic update after you've already registered transaction in the previous year, these records must be updated manually with the Update OB-function.

» I receive a message ”Could not save: Open a new year first in the company with global chart of accounts” when I try to save my new accounting year?

A company can be connected with another company's chart of accounts and report generator. If that is the case, you will have to open the new accounting year in that company first, and Marathon will show a warning if you are trying to save other companies before it. Change company under the cog wheel and create a new year in the global company for chart of accounts and report generator (in this case company ZZ).

» I receive a message ”Could not save: Account for previous year's profit/loss missing in System: Base registers/GL/Parameters”?

Earlier the account for previous year's profit/loss was not mandatory in Marathon, it was shown on account 2999. Now the account has to be there. Register the account in System: Base registers/GL/Accounts and write it in the field for Account for previous year's profit/loss in System: Base registers/GL/Parameters, tab Other. The account does not have to have number 2999.

» I receive a message ”Could not save: Account for previous year's profit/loss missing in the chart of accounts”?

There is an account in the field “Account for previous year's profit/loss” in System: Base registers/GL/Parameters, tab Other, that is not in the chart of accounts. Register the account in System: Base registers/GL//Accounts or select another one from the chart of accounts.

» I created a new accounting year that I now want to delete. How do I do that?

Open the latest year and click on Delete.

» How do I change year in Classic?

By pressing the F8 key and the letter B.