Difference between revisions of "Media accounting/sv"

(Created page with "{{ExpandImage|MED-ACC-SV-Bild11.png}} * Markera införandet som ska debiteras (ursprungliga införandet, ej krediteringen). * Använd Debitera fördelning och markera den ku...") |

(Created page with "{{ExpandImage|MED-ACC-SV-Bild12.png}} * Markera det nya debetinförandet och öppna. * Under fliken korrigering kan en fakturakommentar läggas till") |

||

| Line 117: | Line 117: | ||

* Använd Debitera fördelning och markera den kund som ska debiteras. |

* Använd Debitera fördelning och markera den kund som ska debiteras. |

||

| − | {{ExpandImage|MED-ACC- |

+ | {{ExpandImage|MED-ACC-SV-Bild12.png}} |

| + | * Markera det nya debetinförandet och öppna. |

||

| − | * Select the new debit insertion and open. |

||

| + | * Under fliken korrigering kan en fakturakommentar läggas till |

||

| − | * An invoice comment can be added in the correction tab. |

||

{{ExpandImage|MED-ACC-EN-Bild13.png}} |

{{ExpandImage|MED-ACC-EN-Bild13.png}} |

||

Revision as of 11:31, 26 January 2026

Contents

- 1 Media Ekonomi

- 1.1 Fakturering

- 1.2 Kreditera faktura

- 1.3 Kreditera införande

- 1.4 Kreditera del av fördelning

- 1.5 Pre-invoicing

- 1.6 Invoice project together with a media invoice

- 1.7 Reconcile media discrepancies/Discrepancy handling

- 1.8 Book away discrepancies

- 1.9 Move media invoice to another order or insertion date

- 1.10 Agency settlement

Media Ekonomi

Fakturering

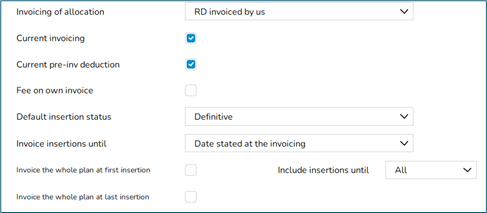

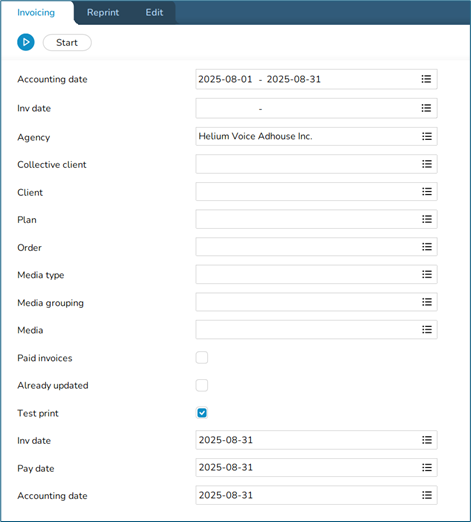

All fakturering sker under Media | Fakturering, även a-conto-fakturering, avräkningar och vändning av faktura.

Olika selekteringar kan göras på bland annat införingsdatum, plannummer, kund och kundkategori. Även fakturering per kampanj om det används.

Om en specifik medietyp eller kund faktureras kontinuerligt så kan urvalet sparas så att en ny selektering inte måste göras varje gång. Valen finns bakom den blå pilen.

Olika selekteringar och beskrivning

| Löpande fakturering | Både och = tar med allt om avtalet har ”Löpande fakturering” eller ej.

Ja = planer/order som enligt avtal har "Löpande fakturering faktureras. Nej = tar endast med avtal som inte har ”Löpande fakturering” ikryssat. |

|---|---|

| Även ej kontrollerade | Vid kryss kommer införande med även om de inte är annonskontrollerade under förutsättning att plan eller ordernummer anges. |

| Referensnummer saknas | Om ja faktureras alla planer och ordrar där referensnummer är

blankt och kundinställning är satt att referensnummer måste anges. Om referensnummer är satt till Både och kommer allt ut men enbart vid provutskrift. |

| Debet/kredit | Blank = allt faktureras ut.

Debet = bara debetfakturor skrivs ut. Kredit = endast kreditfakturor skrivs ut. Separat = debet-och kreditposter faktureras ut på separata fakturor. |

| Korrigeringar | Införanden som markerats med korrigering (x) kan faktureras ut separat eller undantas:

Ej korrigerade + externa korrigeringar Externa korrigeringar Ej korrigerade Ej korrigerade + externa korrigeringar separat Interna korrigeringar |

| Tvinga fram en faktura per kund | Genom att markera överstyrs kundens minibelopp för faktura enligt inställning på kunden |

| Invoice text | Possibility to write an invoice text at every invoicing. |

Kreditera faktura

Om hela fakturan blivit fel kan den krediteras under fliken Vändning. Där går det också att vända en del av fakturan genom att ange ordernummer/införande.

| Fakt.nr. serie | Det går att ställa in en avvikande nummerserie för kreditfakturor |

|---|---|

| Stoppa inf. efter vändning | Innebär att vid vändning av fakturan stoppas alla införande för fakturering. |

Kreditera införande

I Media | Planer krediteras order och enskilda införanden. Där görs också korrigeringar.

- Öppna order och införande.

- Markera ett eller flera införanden som ska krediteras och använd knappen Kreditera.

- Välj vilken sorts kreditering det ska vara och markera med OK.

Införandet vänds, det vill säga läggs som ett kreditinförande och får en korrigeringsmärkning. Nu kan krediten faktureras separat i den löpande faktureringen.

- Välj om referens till tidigare fakturanummer skall läggas till som kommentar.

Denna kreditering innebär att hela införandet inkl. ev. Införingsavgift och kapitalkostnad krediteras.

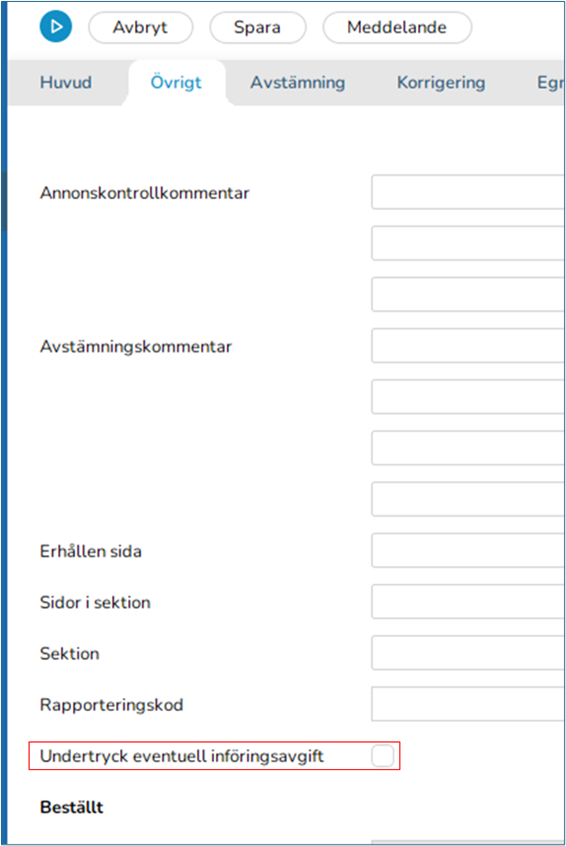

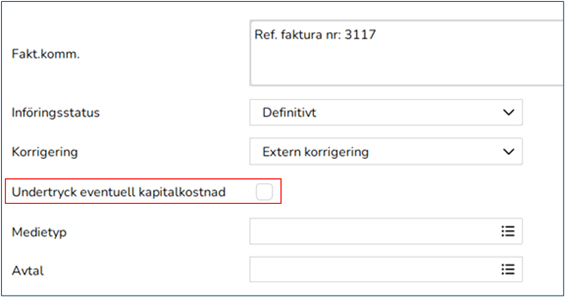

För att kreditera ett införande utan att ta med införingsavgift och kapitalkostnad kan dessa avgifter undantryckas.

Undertryck (välj bort) kapitalkostnad inne på införandet

Kreditera del av fördelning

Om det finns en fördelning och enbart en av kunderna ska krediteras så innebär det att kostnaden ”flyttas” till annan kund.

Exempel Kunden Toyota Norge ska krediteras och i stället debiteras kunden Toyota Sverige, Toyota Sverige ska alltså betala hela kostnaden.

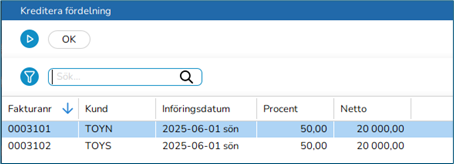

- Öppna ordern och markera det införande som ska korrigeras, klicka på knappen Kreditera fördelning.

- Markera den faktura som ska krediteras och tryck OK.

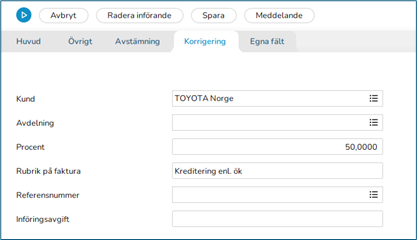

- Öppna Krediteringsraden och lägg på en fakturakommentar under fliken Korrigering.

- Markera införandet som ska debiteras (ursprungliga införandet, ej krediteringen).

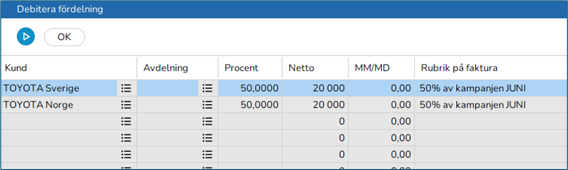

- Använd Debitera fördelning och markera den kund som ska debiteras.

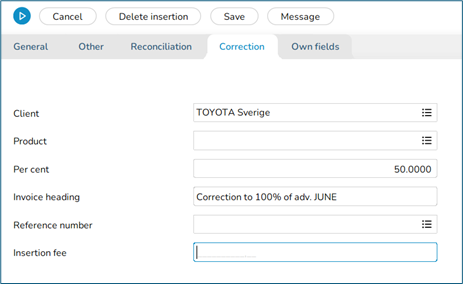

- Markera det nya debetinförandet och öppna.

- Under fliken korrigering kan en fakturakommentar läggas till

- Save. Two new invoices are printed at the next invoicing. A credit to Toyota Norway and a new debit to Toyota Sweden.

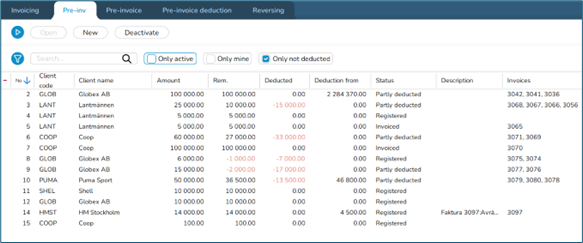

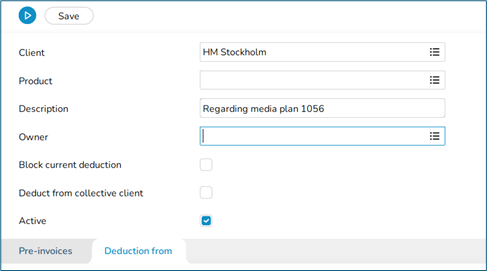

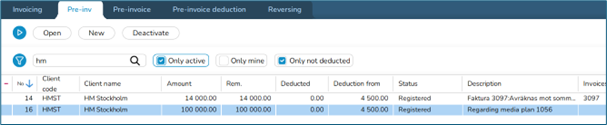

Pre-invoicing

The list under the Pre-invoice tab shows pre-invoice status. Here you can see the invoice amount, how much has been deducted and from which amounts, and the remaining amount. The Deduction from column shows definitive orders that can be deducted from.

There are two ways to pre-invoice that are managed from the client agreement. No current pre-invoice deduction The client is pre-invoiced, and a controlled deduction takes place. Current pre-invoice deduction The client is pre-invoiced, and all definitive insertions are currently deducted.

The parameter setting ”Current pre-invoice deduction per row” should be set to make sure that what is in ”Deduction from” only shall be used. This parameter is in Media | Backoffice | Base registers | Parameters | Invoicing tab.

New pre-invoice

- Go to the Pre invoice tab.

- Enter client and possible owner. Owner is only used for sorting and filtering in the pre-invoice list.

- Write a description. It will be shown in the pre-invoice list.

- Block current deduction means that the pre-invoice will not be deducted in the current pre-invoice deduction.

- It is possible to deduct from another client, if it belongs to the same collective client.

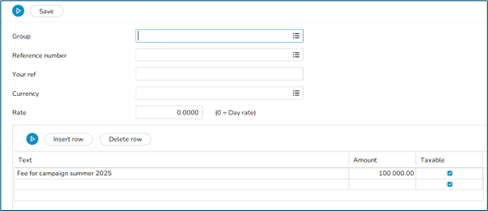

- Select NEW in the Pre-invoices tab.

- Fill in text and amount. Select if the pre-invoice shall be subject to VAT or not. The invoice cannot have mixed rows with VAT and VAT-free.

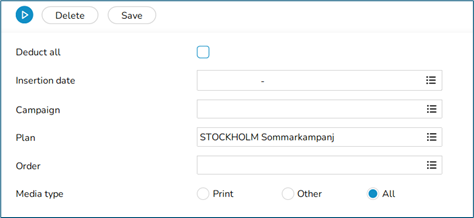

- If you know from which plan/order the pre-invoice shall be deducted, you can fill in that in the Deduction from tab.

- Deduct all is selected as default but you can remove it an enter plan, order or other to be deducted from.

- Save and print the invoice in the Pre-invoice tab.

Pre-invoice deduction

Current pre-invoicing is deducted in the Invoicing tab.

No current pre-invoicing, i.e. a controlled deduction is done in the Pre-invoice deduction tab. Enter the pre-invoice number to be deducted here. Any surplus/deficit will be invoiced in the form of a debit or credit invoice, and the pre-invoiced will be cleared.

Keep in mind When invoicing clients with agreements that states ”Current pre-invoice deduction”, the system takes the oldest pre-invoice and begins with it. If nothing meets the condition set for the pre-invoice, deduction continues with the next pre-invoice and continues until as much as possible can be deducted.

You should therefore link a pre-invoice to a plan/order if you want to be sure that only that plan/those orders are included in the deduction.

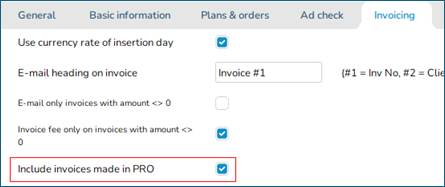

Invoice project together with a media invoice

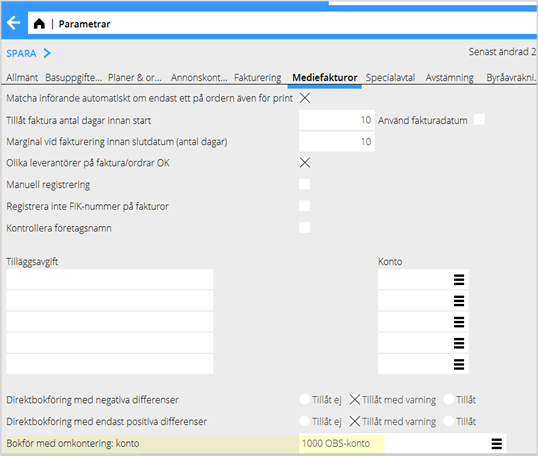

To be able to print a project invoice together with a media invoice, parameter settings must be made in Media | Backoffice | Base registers | Parameters | Invoicing.

- Create an invoice in Project | Invoicing and connect the invoice to the media plan in the Parameters tab.

- The invoicing is done in media invoicing.

NB! The media invoice print template must be updated so that it fetches information from the project accounting.

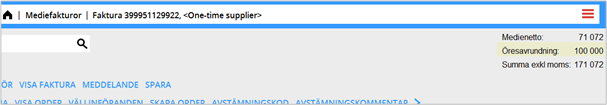

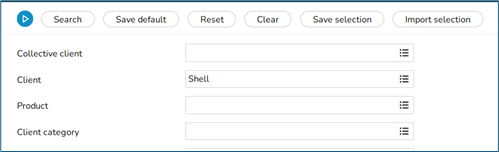

Reconcile media discrepancies/Discrepancy handling

Reconciliation and booking away discrepancies are made in Media | Reconciliation. You can select on reconciliation codes, owner, client, date among other things. Your choices can be saved as default or as a selection, so that you don’t need to change each time you want to print the list.

Discr. net/Discr. Net-Net

This specifies how large the discrepancies should be to be displayed in the list. 1–999 999 999 in Discr.Net-Net is specified to avoid seeing all entries without a discrepancy or that are already booked away. 0–999 999 999 in Diff Net-Net is specified to see all booked away discrepancies.

When reconciling with the media settlement account, only the accounting date is entered, nothing else. The Net-Net amount is reconciled with the media settlement account in, for example, Accounting | Queries, Accounts tab or the Account specification in Accounting | Reports, General Ledger tab.

Set up the columns so that the relevant information is visible. The columns are selected using the list button on the far right of the header row.

| Open | Open the order for deepening. |

|---|---|

| Create correction | Creates a new insertion of the selected insertion’s Net-Net discrepancy – negative or positive depending on the discrepancy. The new insertion can then be sent as an invoice to the client. |

| Book away | See chapter below |

| Reconciliation code/Comment | Possibility to change reconciliation code or add a comment on the insertion. |

| Change order no/insertion date | A registered media invoice can be moved to a new insertion. Read more in the chapter below |

| Change owner/client | For changing plan owner or client. A parameter setting is required for change of client on an invoiced insertion. |

| Show media invoices | Shows invoice copy as PDF, if the invoice has been scanned. |

| Claim | If the invoice is erroneous, it can here be sent as a reclamation to the supplier. |

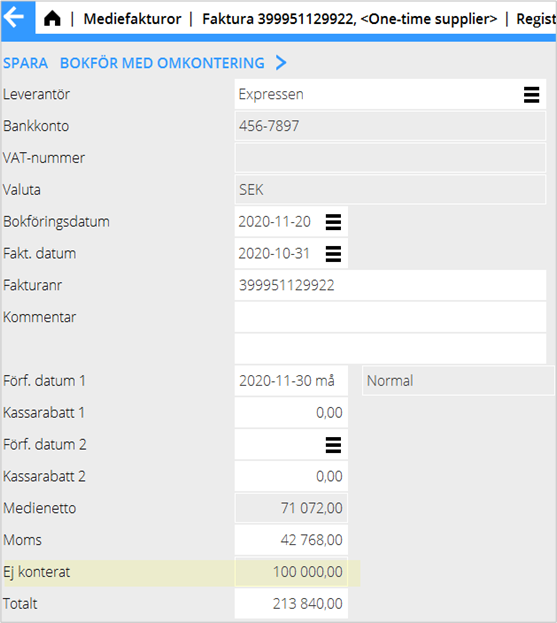

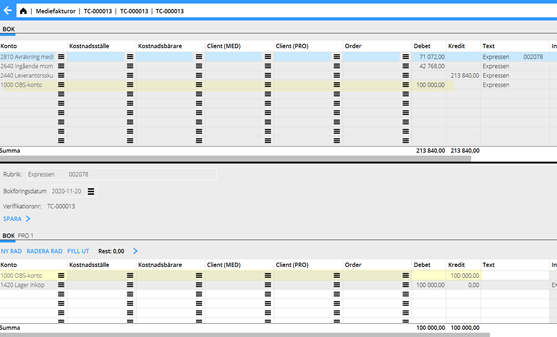

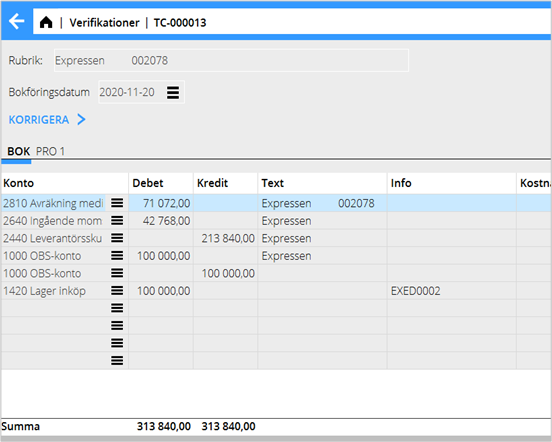

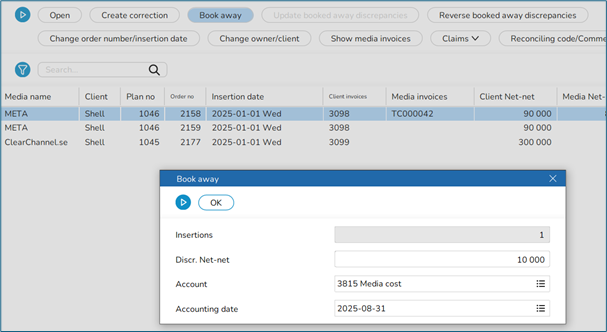

Book away discrepancies

- Select one or several rows and press Book away.

- Enter accounting date. It is also possible to book away a part by changing the amount and also change to optional account.

Move media invoice to another order or insertion date

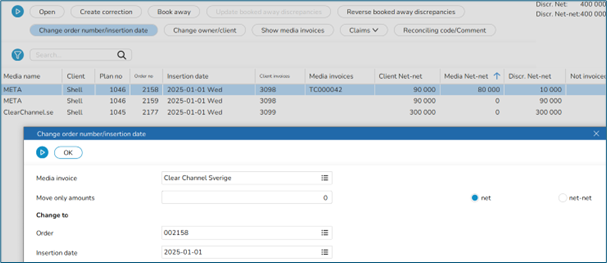

- Use the function Change order number/insertion date for moving an erroneously registered media invoice. Select the order and press the button.

- Select the media invoice and enter order number the insertion date into which the invoice shall be moved. It is possible to move it to an existing order number/insertion date.

- If only a part of the invoice shall be moved, enter amount.

Agency settlement

For clients whose agreements stipulate that the advertising agency is to receive a share of commissions, fees and charges, Agency is added to the client in order to create an agency settlement. When the agency settlement is printed, a supplier invoice is created and added to the corresponding supplier in the Purchase ledger, which is then paid.

Set up agency in Media | Backoffice | Base registers | Agencies

Enter the agency on the client in Media | Backoffice | Base registers | Client, Parameters 1 tab.

On the client agreement in Media | Backoffice | Base registers | Agreements, you state how big part/percentage of insertion fee, agency commission and capital cost that shall be forwarded to the agency.

- Media | Backoffice | Agency settlement for printing out invoice and agency settlement specification.

- Select agency and accounting date or another selection. You can have different selections for different purposes, e.g. if only a certain media shall be settled on a plan.

| Paid invoices | Creates settlement only for paid client invoices. |

|---|---|

| Already updated | Possibility to reprint the specification. |

| Reprint | All agency settlements can be reprinted. |