Difference between revisions of "Enter vouchers/nb"

(Created page with "Dersom kontoen du anvender har integrasjon med ett annet delsystem, vil en gulefarget flik vises, med delsystemets navnforkortelse. I fliken registreres opplysninger som høre...") |

(Created page with "=== Kundeinnbetalinger ===") |

||

| Line 73: | Line 73: | ||

Dersom kontoen du anvender har integrasjon med ett annet delsystem, vil en gulefarget flik vises, med delsystemets navnforkortelse. I fliken registreres opplysninger som hører til delsystemet. Neden beskrives de vanligste integrasjonene. |

Dersom kontoen du anvender har integrasjon med ett annet delsystem, vil en gulefarget flik vises, med delsystemets navnforkortelse. I fliken registreres opplysninger som hører til delsystemet. Neden beskrives de vanligste integrasjonene. |

||

| − | === |

+ | === Kundeinnbetalinger === |

The account receivable is assigned to the sales ledger, which means that when you enter the account, the system creates a tab called SL followed by the tab number. Register the payments in the tab. Enter invoice number or search invoices with the function Import Invoices. |

The account receivable is assigned to the sales ledger, which means that when you enter the account, the system creates a tab called SL followed by the tab number. Register the payments in the tab. Enter invoice number or search invoices with the function Import Invoices. |

||

Revision as of 15:06, 28 January 2016

Contents

Registrering av bilag uten integrasjon til annet delsystem

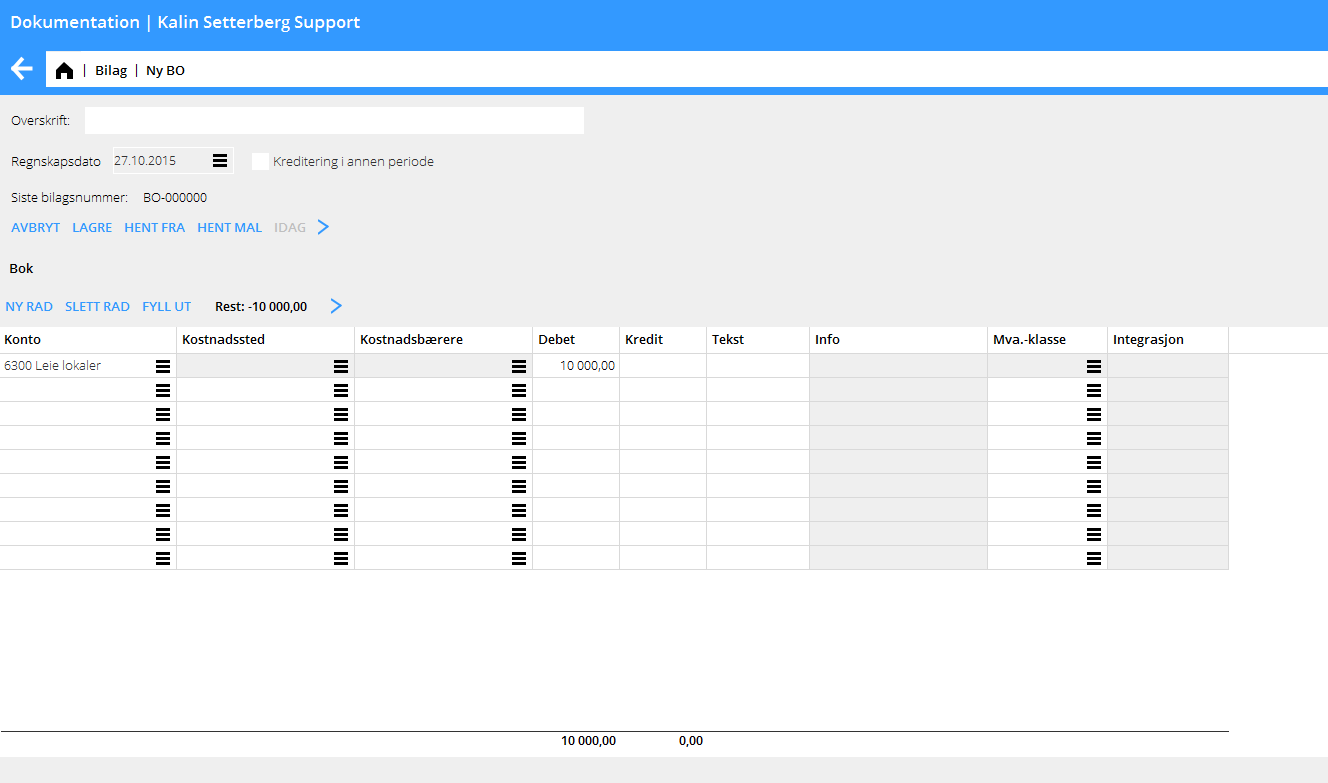

Bilag registreres i Økonomi: Bilag. Standardserien har prefikset BO, men fler bilagsserier kan opprettes i System: Grunnregister/Bok/Bilagsserier. Felles for alle er at de må bestå av to tegn, hvorav den første er B.

Velg serie og klikk på Ny. Begynn registreringen med å angi regnskapsdato.

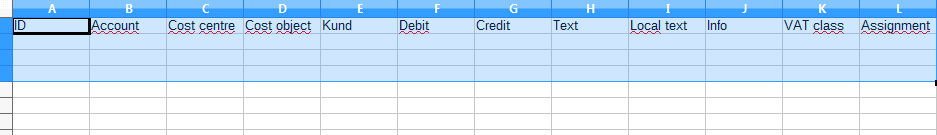

Et enkelt bilag registreres med to eller flere kontoer, og beløper i debet og i kredit. Andre funksjoner er:

| Hent fra | Funksjon for å kopiere tidligere bilag. Bilaget velges fra en liste. |

|---|---|

| Hent mal | En bilagsmal kan skapes i Grunnregister/Bok/Bilagsmaler. Se beskrivelse under Skap bilagsmal. |

| Importer | Importerer sie-filer (Sverige) |

| Kreditering i annen periode | Skaper ett kreditert innrykk med en annen regnskapsdato. |

| Regnskapsdato + I dag | Feltet med regnskapsdato skal alltid utfylles før andre opplysninger kan registreres. Klikk på I dag for å velge dagens dato eller skriv inn andre datoer manuelt. Den dato som du oppgir kommer som forslag i neste bilag. |

| Overskrift | Overskriften vises på startsiden til bilagsregistreringen og er mulig å søke på. |

| Bilagsnummer | Hentes automatisk fra Grunnregister/BOK/Bilagsserier. |

| Konto | Angi konto |

| Kostnadssted/-bærer | Dersom kontoen krever/tillater kostnadssted og kostnadsbærer skal du oppgi det her. |

| Debet/Kredit | Angi beløp. |

| Dimensjoner | Dersom firmaet deres bruker dimensjoner, vises de som separate kolonner. Dimensjoner opprettes i Grunnregister/Bok/Parametrer i fliken Dimensjoner. Manuelle dimensjoner kan redigeres i Grunnregister/Bok/Dimensjoner. |

| Tekst | Skriv inn eventuell tekst (maksimalt 25 tegn). Vises inne i hovedboken og i kontospesifikasjonen. |

| Summering | Lengst nede summeres debet- og kreditkolonnene. De må overensstemme, ellers kan ikke bilaget lagres. |

| Skap mva. – kontering | Dersom dere bruker den inngående mva.-håndteringen i Marathon kan en automatisk mva.-kontering skapes. Konteringa bestemmes av mva.-klassene i Grunnregister/Bok/Mva.-klasser. Systemet beregner den inngående mva etter hvor mye som er oppmerket med de ulike mva.-klassene og henter mva.- kontoen derifra. |

| Fyll ut | Fyller automatisk ut resterende beløp slik at bilaget balanserer, forutsatt at en konto er blitt angitt. |

| Rest | Viser resterende beløp igjen å balansere. |

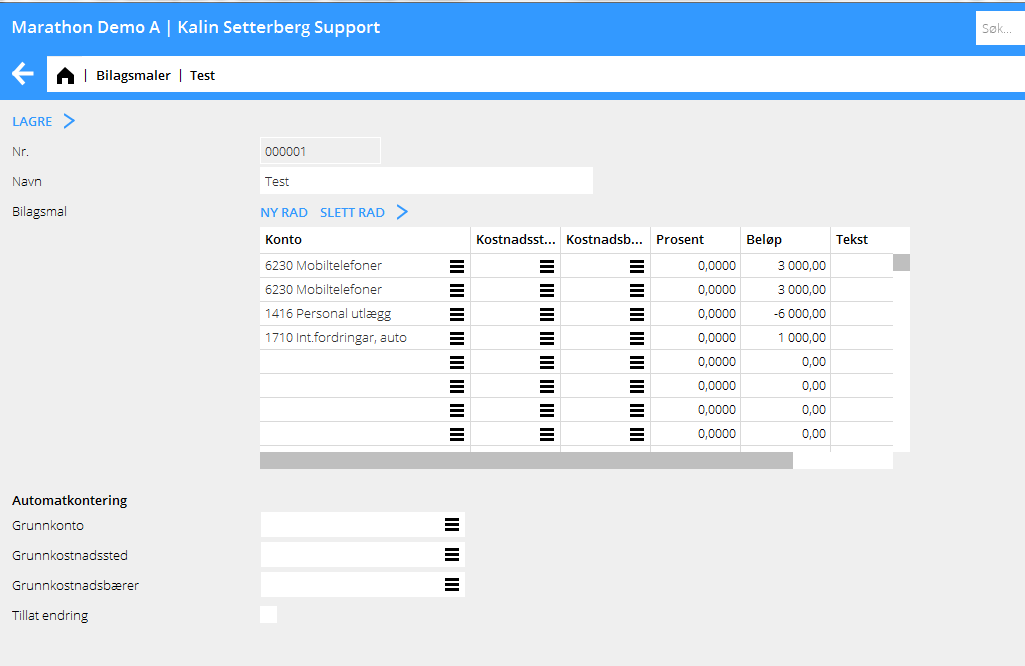

Skap bilagsmal

Skap din egen bilagsmal i System: Grunnregister/Bok/Bilagsmaler. Velg Ny og gi malen et navn. Oppgi konto og eventuelle kostnadssteder/-bærere. Skriv inn enten en prosentuell del av et beløp eller et beløp i NOK. Hvis du oppgir en prosentuell del, spør systemet etter totalbeløpet da malen anvendes og beregner ut andelen med hjelp av prosentsatsen.

Registrering av bilag som er integrert med annet delsystem

Dersom kontoen du anvender har integrasjon med ett annet delsystem, vil en gulefarget flik vises, med delsystemets navnforkortelse. I fliken registreres opplysninger som hører til delsystemet. Neden beskrives de vanligste integrasjonene.

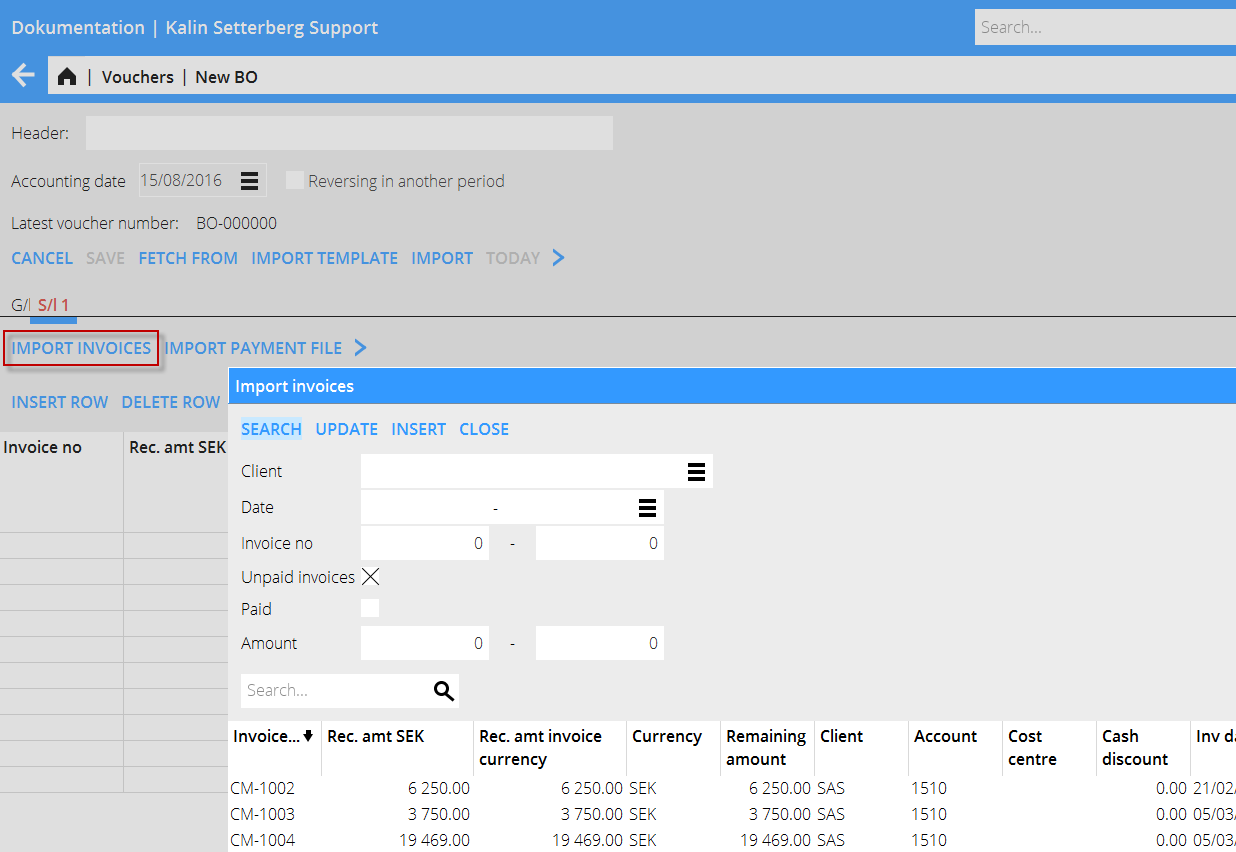

Kundeinnbetalinger

The account receivable is assigned to the sales ledger, which means that when you enter the account, the system creates a tab called SL followed by the tab number. Register the payments in the tab. Enter invoice number or search invoices with the function Import Invoices. You can search with client, date, invoice number, etc.

The whole invoice amount is fetched into the table. If only a part of the invoice has been paid, write the received amount over the amount in the Rec. amt (your currency) – field. If the payment is in a foreign currency this field is empty and you must write in the amount that the bank has received. The currency discrepancy that might occur is automatically posted on an account defined for that (Base registers/SL/Parameters: Acc for currency rate profits and Acc for currency rate losses).

If a foreign invoice is partly paid, write the received amount both in Rec. amt (your currency) and Rec. amt invoice currency. The remaining difference will be a residue and a possible rate discrepancy (if received amount in your currency divided with the rate doesn't correspond with the amount in the field Rec. amt Invoice, the difference will be a rate discrepancy).

After registration of the invoices, go back to the GL tab and enter an account for the payment (e.g. bank account). If you press the function Fill here, the remaining will be posted on the account.

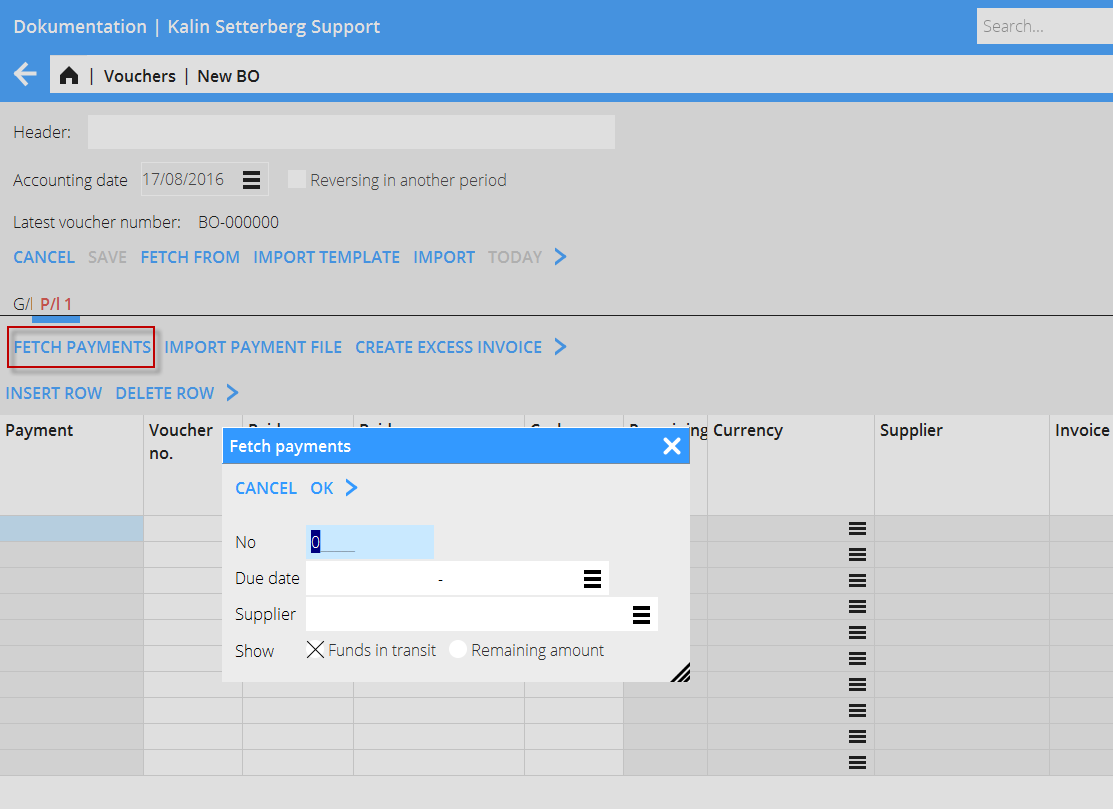

Supplier payments

The account payable is assigned to the purchase ledger, which means that when you enter the account, the system creates a tab called PL followed by the tab number. Register the payments in the tab. Enter invoice number of the paid invoice or search a created payment with the function Fetch payments. Here you can search on payment number, date or supplier. You can also find invoices with residues. Ther e is also a function for importing a payment file.

The whole invoice amount is fetched into the table. If only a part of the invoice has been paid, write the paid amount over the amount in the Rec. amt (your currency) – field. If the payment is in a foreign currency this field is empty and you must write in the amount that the bank has sent. The currency discrepancy that might occur is automatically posted on an account defined for that (Base registers/SL/Parameters: Acc for currency rate profits and Acc for currency rate losses).

If a foreign invoice is partly paid, write the paid amount both in Rec. amt (your currency) and Rec. amt invoice currency. The remaining difference will be a residue and a possible rate discrepancy (if received amount in your currency divided with the rate doesn't correspond with the amount in the field Rec. amt Invoice, the difference will be a rate discrepancy).

After registration of the invoices, go back to the GL tab and enter an account for the payment (e.g. bank account). If you press the function Fill here, the remaining will be posted on the account.

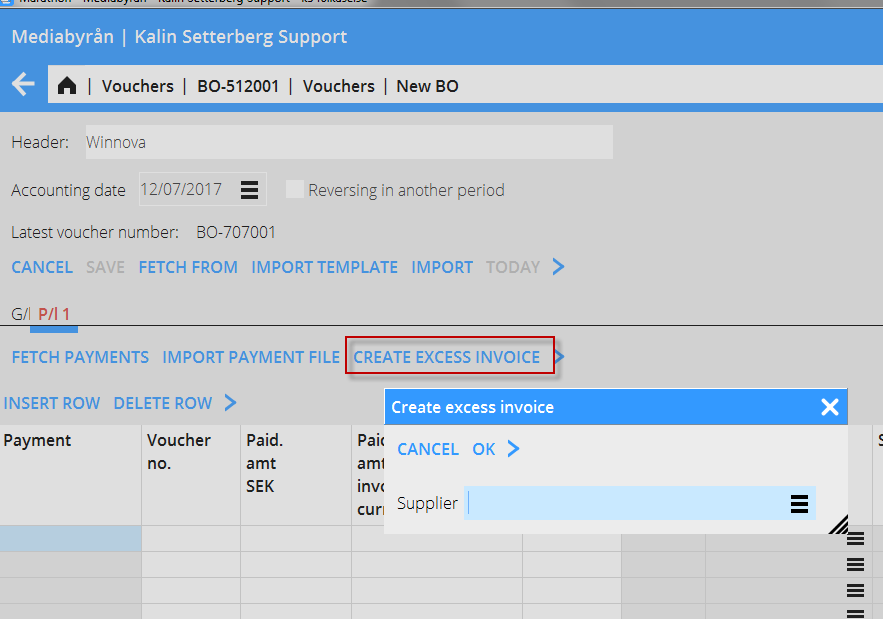

Create excess invoice

With this function, you can register a pre-paid amount in the purchase ledger directly, even when the supplier's invoice hasn't arrived yet. The payment gets an LA -number.

Enter supplier and an amount.

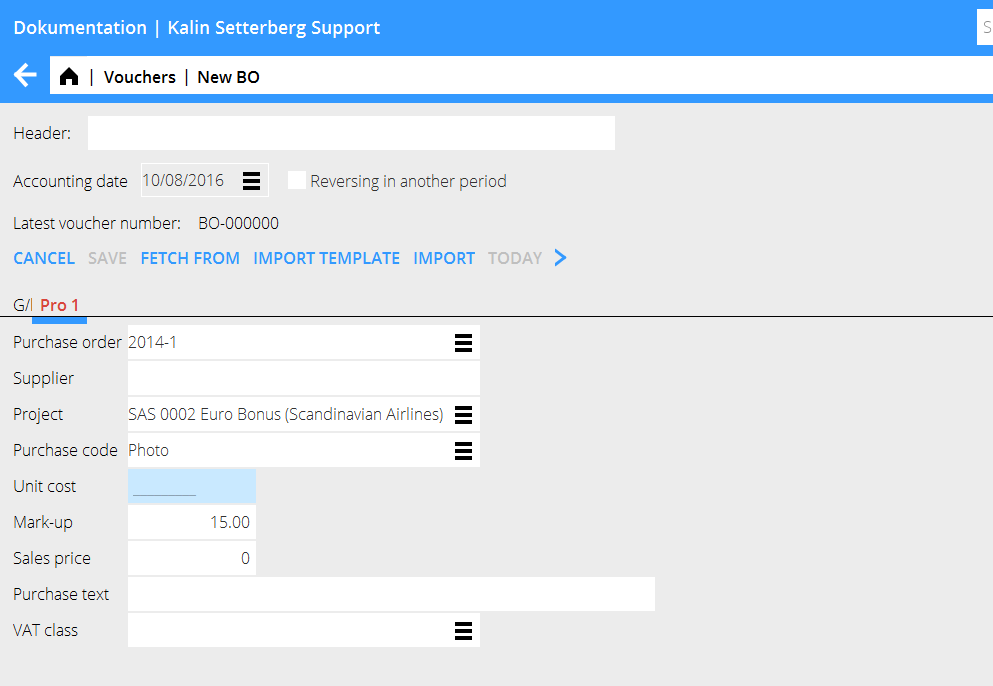

Enter project purchase

The account for project purchases is assigned to the project management, which means that when you enter the account, the system creates a tab called PRO followed by the tab number. Register purchases that shall be charged a project in the tab. Enter project, purchase code and a purchase price. The sales price is automatically calculated with the mark-up percentage that has been defined on the purchase code. In many cases the mark -up can be changed (there is a parameter setting for that option) if you want to change it. Write optional purchase text. If you have been using purchase orders at the project purchase, you can enter it here and the system will fetch all contents from it. Make the contrary posting in the tab GL.

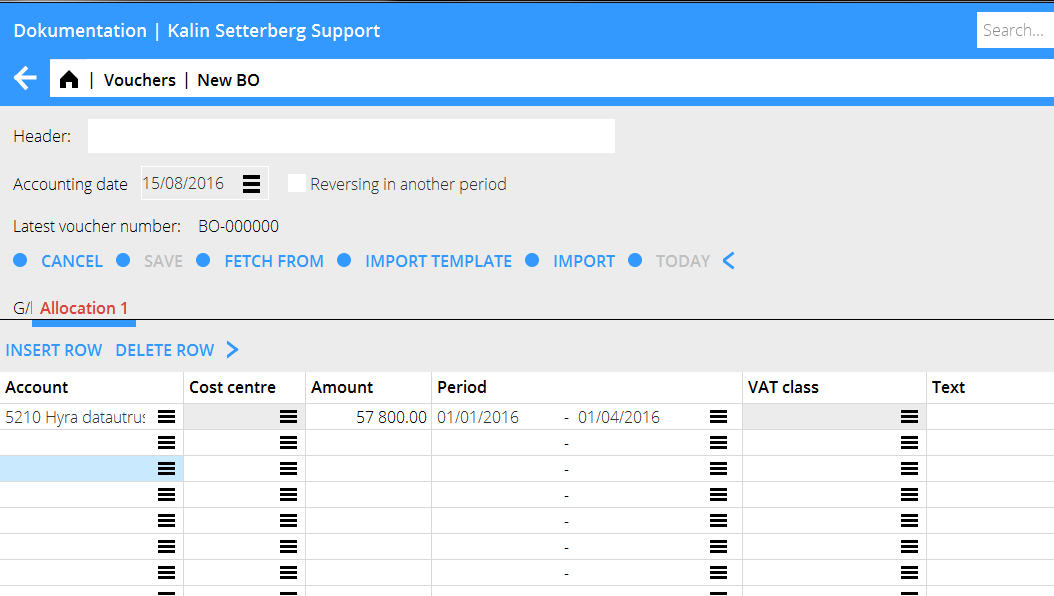

Enter periodical allocations

The account for accruals (periodical allocations) is assigned to periodical allocations, which means that when you enter the account, the system creates a tab called Allocations followed by the tab number. Enter the costs that shall be allocated over a certain period. Enter cost account, amount and the period for the allocation. You can enter the date in two different ways: MMYY– MMYY or DDMMYY. In the first case the amount is allocated evenly on all months, in the latter depending on how many days each month has. Make the contrary posting in the GL tab

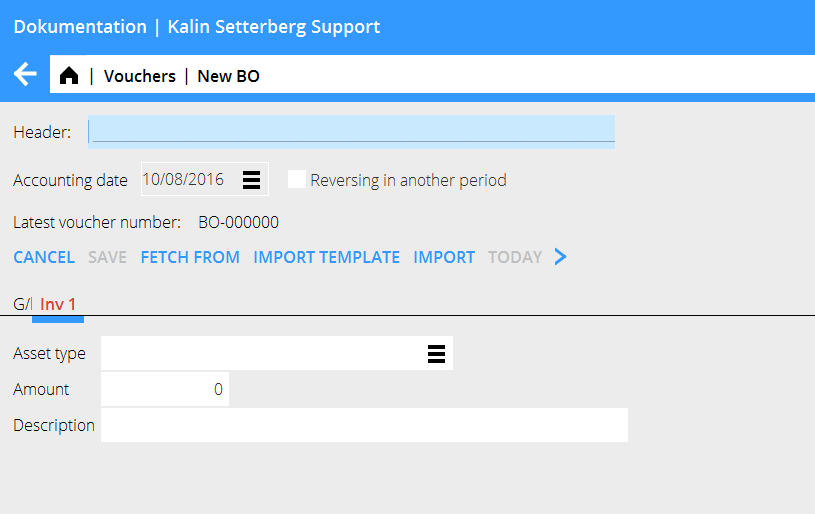

Enter assets (inventories)

The account for inventories is assigned to the inventory ledger, which means that when you enter the account, the system creates a tab called INV. If the acquisition account only is connected to one asset type, it will show automatically. If not, select asset type. Write amount and a possible description. Make the contrary posting in the GL tab.

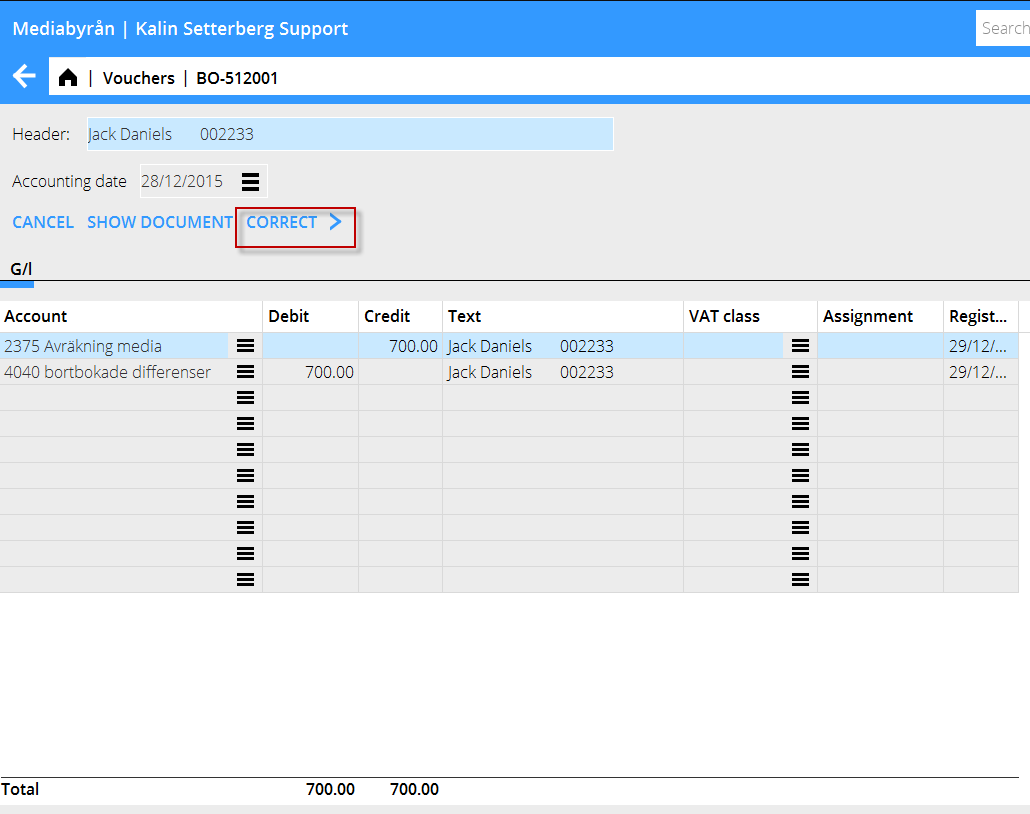

Correct a voucher

Select the voucher that you want to correct and press Open. Then press Correct.

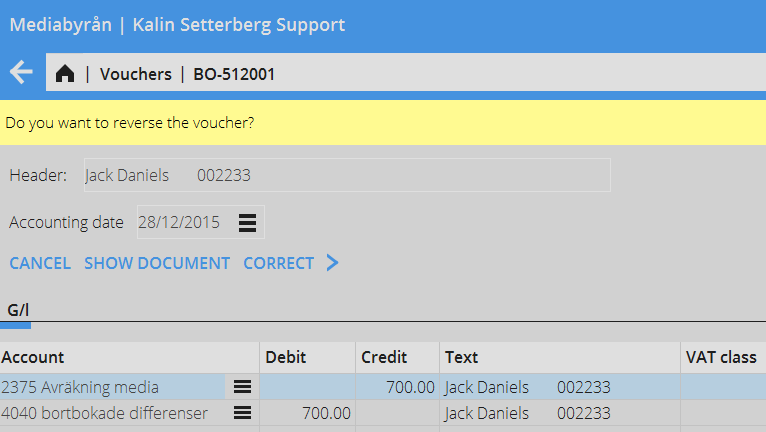

Marathon asks you if you want to reverse the voucher.

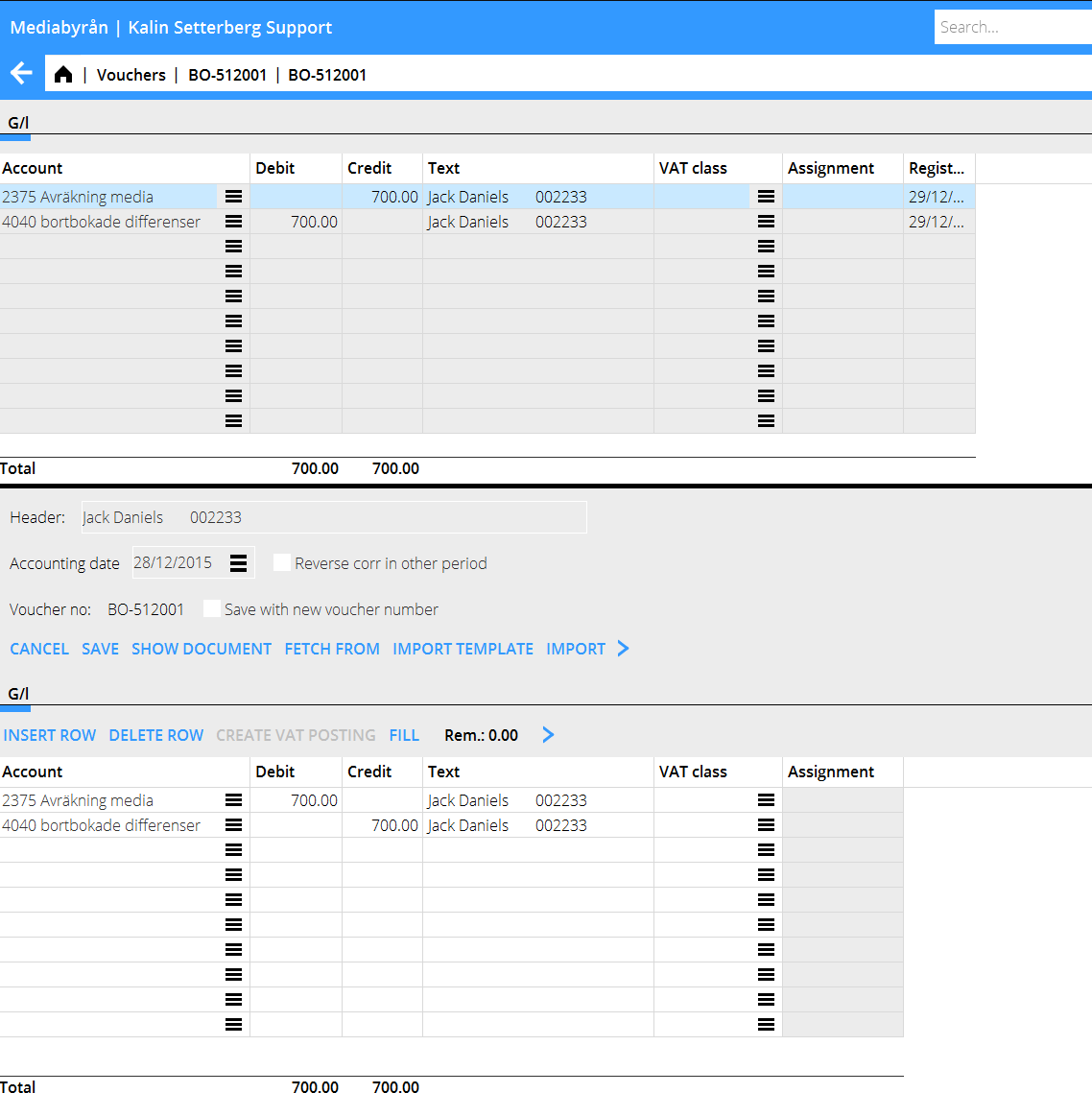

Click on Yes if you want to reverse the whole voucher. If you want to reverse the correction in another period, check the box Reverse corr in another period and select Reversing date at the top of the screeen.

The reversing can also be saved with the same date, but with a new voucher number. Use “Save withnew voucher number”.

Select No if the voucher shall be corrected and not reversed. Make the correction in the lower table. Also here you can reverse the correction in another period and/or save with the same date but a new voucher number.