Difference between revisions of "Enter and approval of supplier invoices/sv"

(Created page with "= Registrering och attest av leverantörsfakturor = Denna manual beskriver hantering av inkommande leverantörsfakturor i Marathon") |

|||

| Line 1: | Line 1: | ||

| + | <htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

||

| − | __FORCETOC__ |

||

| + | = Registrering och attest av leverantörsfakturor = |

||

| − | == Allmänt == |

||

| + | Denna manual beskriver hantering av inkommande leverantörsfakturor i Marathon |

||

| + | == General == |

||

| − | I {{pth|Ekonomi|Leverantörsfakturor}}, flik Ankomstregistrering registreras leverantörsfakturor då Marathons attestfunktion används. |

||

| + | Suppliers’ invoices shall be registered in {{pth|Accounting|Suppliers’ invoices}}, tab preliminary entering, when you use the approval function in Marathon. |

||

| + | The program consists of the tabs: Quotation queries, Purchase orders, Preliminary entering, Watch list, Booked invoices, errors/reminders and Queries. |

||

| + | == Preliminary entering - scanning == |

||

| − | Programmet består av flikarna: Förfrågningar, rekvisitioner, Ankomstregistrering, Attestbevakning samt Fel/Påminnelser |

||

| + | Start with scanning or importing the invoice documents in {{pth|Accounting|Suppliers’ invoices}}, tab Preliminary entering. Press {{btn|Scanning}}. |

||

| + | It you are using Kalin Setterberg’s invoice interpretation service, the invoices are automatically entered with supplier, invoice number, invoice- and due dates and amount. |

||

| + | If you are scanning the invoices, put them in the scanner and press {{btn|Scan}}. |

||

| + | If the scanner is not connected to Marathon you can use another unit for scanning them to your computer or- if they already exist digitally, press {{btn|Import}}. A dialogue box opens, from which you can fetch a pdf file with one or several invoices. |

||

| + | You can also use drag and drop to get a pdf into Marathon. |

||

| + | {{ExpandImage|LEV-ATT-EN-Bild1.png}} |

||

| − | == Ankomstregistrering – skanning == |

||

| + | |||

| + | After the import, the pages are shown as miniatures to the left part of the screen. Check the quality of the scanned invoice by clicking on the miniature. Check the box and click Save. If the invoice has several pages, check one page at the time and then {{btn|Save}}. If the invoice consists of several pages, check each page and save them together. Use {{btn|Save separate}} if there are many invoices on only one page. |

||

| + | Write AT number on the original invoice, from the field Next AT number. |

||

| + | If you want to delete a scanned invoice, select it and click {{btn|Delete}}. {{btn|Select all}} Select all checks all scanned documents. {{btn|Undo}} puts back scanned and saved – but not registered invoices. |

||

| + | == Preliminary entering == |

||

| − | Registreringen av fakturor börjar med att fakturadokumenten skannas in i {{pth|Ekonomi|Leverantörsfakturor}} fliken Ankomstregistrering. Tryck på {{btn|Skanning}}. Lägg en bunt med fakturor i skannern och välj {{btn|Skanna}}. Om skanner inte är kopplad till Marathon kan en annan enhet användas för att skanna in dokumenten till datorn, och sedan använda knappen {{btn|Importera}} för att få in dokumenten i Marathon. |

||

| + | Select {{btn|New}} in the preliminary entering. The system automatically suggests next arrival number, but you can overwrite it. The arrival number is the number that the invoice got at the scanning and is connected to the scanned document. Compare original invoice with the scanned one in the tab Scanned document. Fill in information about supplier, invoice number, date and invoice amount including VAT. (The VAT amount can be calculated with or without decimals with a parameter setting in {{pth|Base registers/Lev/Parameters}}, tab Invoices – Show decimals) Select one or several approvers and save, or proceed to Posting. |

||

| − | {{ExpandImage| |

+ | {{ExpandImage|LEV-ATT-EN-Bild2.png}} |

| + | |||

| + | == Posting== |

||

| + | The invoice can already now be posted in the Posting tab. |

||

| + | {{ExpandImage|LEV-ATT-EN-Bild3.png}} |

||

| − | Kontrollera kvaliteten på den skannade fakturan genom att klicka på miniatyren som kommer upp till vänster i bild. Markera fakturan genom att bocka i rutan vid miniatyren och {{btn|Spara }}. Om fakturan innehåller flera sidor så bockas sidorna för i tur och ordning och sparas tillsammans. Märk originalfakturan med AT-numret som visas vid Nästa AT-nr. |

||

| + | Use the upper table for posting of project purchases. The account for project purchases is already set in the parameters. If you have been using purchase orders, enter PO number and the remaining contents will be automatically updated (client, project, purchase code, purchase price). Otherwise, fill in these fields, the purchase price will be fetched from the invoice registration. The mark-up for the purchase price comes from the purchase code in {{pth|Base registers/Pro/Cost codes Purchases}} (and in some cases from the project). The sales price is automatically calculated. The system can be set such that the suggested mark-up cannot be changed. |

||

| − | En inskannad faktura kan även raderas genom att markera den och trycka på {{btn|Radera}}. Med knappen {{btn|Välj alla}} markeras alla inskannade dokument. Knappen {{btn|Ångra}} lägger tillbaka inskannade och sparade, men ej registrerade fakturor. |

||

| + | The setting is in {{pth|Base registers/PRO/Parameters}}, tab Purchases and Other, field Change purchase mark-up. In the Adjustments tab there is more alternative in handling mark-ups and sales prices. It is called Special gross purchase as adjustment. When activated, it turns the difference between the suggested and the new sales price into an adjustment. |

||

| − | |||

| + | Use the lower table for posting costs. Write the account number and possible cost centre and -object if the account allows/requires it in the chart of accounts. If the cost shall be allocated over a period (accrued), state cost account only and fill in the fields for periods. The balance sheet account for periodical allocations is fetched from the parameters. |

||

| − | == Ankomstregistrering == |

||

| + | The posting for both project purchases and costs can also be made in the invoice currency. Use the field Amount invoice currency. This enables the sorting of foreign invoices on different projects or accounts. |

||

| − | |||

| + | Use {{btn|Import template}} if you want to import a posting template from {{pth|Base registers/PL/Posting templates}}. Read more in Create posting template. |

||

| − | Välj {{btn|Ny}} i ankomstregistreringen. Systemet föreslår automatiskt nästa ankomstnummer, men det går att fylla i ett annat nummer. Ankomstnummer är det nummer fakturan blev tilldelad vid skanningen och är kopplat till det inskannade dokumentet. Titta på den inskannade fakturan i fliken Inskannat dokument och jämför med originalet så att allt överensstämmer. |

||

| + | When all scanned invoices are preliminary entered, they shall be sent to the approvers. Use the {{btn|Send mail}} function in {{pth|Accounting| Suppliers’ invoices}} tab Watch list. |

||

| − | Fyll i uppgifter om leverantör, fakturanummer, datum och fakturabelopp inklusive moms. (Momsbeloppet kan räknas ut automatiskt med eller utan decimaler genom en parameterinställning i {{pth|System|Basregister/Lev/Parametrar}} fliken Fakturor vid fältet Uträkning av momsbelopp.) Välj en eller flera attestörer och spara, eller gå vidare till Kontering. |

||

| + | The email will be sent to all approvers on unapproved invoices. The invoice is marked with the approver in {{pth|Accounting:|Approval |

||

| − | |||

| − | {{ExpandImage|lev-att-sv-grafik72.png}} |

||

| − | |||

| − | == Kontering == |

||

| − | |||

| − | Fakturan kan redan nu konteras i fliken Kontering. |

||

| − | |||

| − | {{ExpandImage|lev-att-sv--grafik73.png}} |

||

| − | |||

| − | Kontering av projektinköp görs i den övre tabellen. Vid kontering av projektinköp fylls inget konto i eftersom det redan är förinställt i parametrarna. Ange eventuellt rekvisition om detta används, varpå resterande uppgifter om kund, projekt, inköpskod och inpris automatiskt fylls på. |

||

| − | I annat fall fyll i dessa uppgifter, inpriset hämtas då från registreringen av fakturan. Pålägget på inpriset hämtas från inköpskoden i {{pth|System|Basregister/Pro/Kostnadskoder Inköp}} (och i vissa fall från projektet), och utpriset räknas automatiskt ut. Systemet kan ställas in så att det föreslagna pålägget inte kan ändras. Inställningen görs i {{pth|Sytem|Basregister/Pro/Parametrar}} fliken Inköp och Övrigt vid kryssrutan Ändra inköpspålägg. I fliken Justering finns ytterligare en parameter som påverkar hur ändringar av påslag och utpris ska hanteras. Den heter {{kryss|Avvikande inköpsbrutto som justering}}, och med den aktiverad blir mellanskillnaden mellan det föreslagna utpriset och det nya utpriset en justering. |

||

| − | |||

| − | Vid kontering av omkostnader ska kontot anges i den nedre tabellen. |

||

| − | Kostnadsställe och kostnadsbärare kan anges men endast om kontot i kontoplanen tillåter det. Om kostnaden ska periodiseras anges endast kostnadskontot och period från och period till. Balanskontot för periodiseringar hämtas från parametrarna. |

||

| − | |||

| − | Konteringen för projektinköp eller omkostnader kan även göras i fakturavalutan i fältet Belopp fakturavaluta. Detta underlättar uppdelningen av utländska fakturor på flera olika projekt eller konton. |

||

| − | |||

| − | Med {{btn|Hämta mall}} kan Konteringsmallar skapade i {{pth|Basregister/Lev/Konteringsmallar}} användas, se beskrivning under Skapa konteringsmall. |

||

| − | |||

| − | Då alla skannade fakturor är ankomstregistrerade skickas de till attestörerna genom knappen {{btn|Maila}} i {{pth|Ekonomi|Leverantörfakturor}} fliken Attesbevakning. |

||

| − | |||

| − | Mailet skickas till alla attestörer på oattesterade fakturor som inte redan fått mejl om respektive faktura. Även om attestören inte mailas finns fakturorna i {{pth|Ekonomi|Attest}} hos respektive person. |

||

== Skapa konteringsmall == |

== Skapa konteringsmall == |

||

| + | You can create Posting templates in {{pth|Base registers/PL/Posting templates}}. Click on {{btn|New}} and write a name for the template. Enter account and possible cost centre/cost objects if the account allows it. The amount can be stated either as percentage or as a monetary amount in your currency. If you choose percentage, you will get a question about the total amount at the time you use the template and calculates the share with help of the percentage. |

||

| + | {{ExpandImage|LEV-ATT-EN-Bild4.png}} |

||

| − | Konteringsmallar skapas i {{pth|System|Basregister/Lev/Konteringsmallar}}. Tryck på Ny, och namnge mallen. Fyll i konto och eventuellt kostnad. Ange antingen en procentuell del av ett belopp, eller ett belopp i SEK. Om en procentuell del anges frågar systemet efter totalbeloppet när mallen används, och räknar ut andelen med hjälp av procentsatsen. |

||

| − | {{ExpandImage|lev-att-sv--grafik74.png}} |

||

| − | == |

+ | == Automatic posting == |

| + | You can register a template for automatic posting in a voucher template in {{pth|Base registers/GL/Voucher templates}}. A template makes an automatic posting when you book on a base account, e.g. 7410. However, the posting is not shown on the screen while entering the invoice, but you can see it in the bookkeeping. |

||

| + | == Approval == |

||

| − | I {{pth|Ekonomi|Attest}} kan attestören öppna fakturorna för att attestera och kontera dem. Attestfunktionen kan även nås via snabblänken längst ned i fönstret som syns markerad i bild. |

||

| + | The approver can open the invoices in {{pth|Accounting|Approval}} for approving and posting. |

||

| − | |||

| − | {{ExpandImage|lev-att-sv-grafik75.png}} |

||

| − | |||

| − | Med {{btn|Visa faktura}} kan fakturadokumentet visas. Med {{btn|Direktattest}} kan fakturan attesteras utan att den öppnas, detta är dock behörighetsstyrt. Välj att visa |

||

| + | {{ExpandImage|LEV-ATT-EN-Bild5.png}} |

||

| + | |||

| + | You can see the invoice document with the function {{btn|Show invoice}}. If you are authorised, you can also approve an invoice without opening it with {{btn|Direct approval. Select: |

||

{| class=mandeflist |

{| class=mandeflist |

||

| − | |''' |

+ | |'''All''' |

| + | |Shows all invoices, also those without approvers |

||

| − | |Visar alla fakturor, även de utan attestörer |

||

|- |

|- |

||

| − | |''' |

+ | |'''Only not handled''' |

| + | |Shows all unapproved invoices |

||

| − | |Visar alla oattesterade fakturor |

||

|- |

|- |

||

| − | |''' |

+ | |'''Only own app. left''' |

| + | |Shows only the invoices where you are the only remaining approver |

||

| − | |Visar endast de fakturor där du står ensam kvar som attestör |

||

|- |

|- |

||

| − | |''' |

+ | |'''Booked''' |

| + | |Shows all booked invoices |

||

| − | |Visar alla bokförda fakturor |

||

| − | |} |

+ | |} |

| + | Select an invoice and click {{btn|Open}}. |

||

| − | |||

| − | Markera en faktura och tryck på {{btn|Öppna}}. |

||

| − | |||

| − | {{ExpandImage|lev-att-sv-grafik76.png}} |

||

| − | |||

| − | Om fakturan redan är konterad i förväg visas det med en eller flera rader i rutan längst ned till vänster. Typ Pro är projektinköp och typ Omk är omkostnader. I rutan Fakturabelopp visas en sammanfattning av fakturan med fakturabelopp, vad som är konterat och hur mycket som är kvar att kontera. |

||

| − | Information om övriga fakturauppgifter finns under knappen Fakturauppgifter, samt i det inskannade fakturadokumentet som syns i bild. Hela dokumentet kan tas fram med hjälp av knappen {{btn|Visa faktura}}. I {{btn|Anteckningar}} visas alla anteckningar gjorda kring fakturan, och här kan fler anteckningar läggas till. |

||

| − | |||

| − | För att kontera ett projektinköp väljs {{btn|Ny rad Projekt}}. Ange eventuellt rekvisition om detta används, varpå resterande uppgifter om kund, projekt, inköpskod och inpris automatiskt fylls på. I annat fall fyll i dessa uppgifter, inpriset hämtas då från registreringen av fakturan. Pålägget på inpriset hämtas från inköpskoden i {{pth|Basregister/Pro/Kostnadskoder Inköp}} (och i vissa fall från projektet), och utpriset räknas automatiskt ut. Beloppet kan även anges i fakturavalutan, vilket underlättar om en utländsk faktura ska fördelas på flera projekt. |

||

| − | Systemet kan ställas in så att det föreslagna pålägget inte kan ändras. Inställningen görs i {{pth|Basregister/Pro/Parametrar}} fliken Inköp och Övrigt vid kryssrutan Ändra inköpspålägg. I fliken Justering finns ytterligare en parameter som påverkar hur ändringar av påslag och utpris ska hanteras. Den heter Avvikande inköpsbrutto som justering, och med den aktiverad blir mellanskillnaden mellan det föreslagna utpriset och det nya utpriset en justering. |

||

| − | |||

| − | För att kontera en omkostnadsfaktura väljs {{btn|Ny rad Omk}}. Ange konto och eventuellt kostnadsställe och kostnadsbärare om kontot tillåter det. Om kostnaden ska periodiseras anges endast kostnadskontot och period från och period till. Balanskontot för periodiseringar hämtas från parametrarna. |

||

| − | |||

| − | För att attestera väljs {{btn|Attest}} och därefter kan man välja förattest, slutattest, betala ej eller endast del av beloppet. Komplettera evetuellt med en kommentat och tryck på Spara attest. Men knappen {{btn|Ny attestör}} läggs en till attestör till fakturan. Spara hela faktura med knappen {{btn|Spara}}. |

||

| − | |||

| − | == Attestbevakning == |

||

| − | |||

| − | Modulen används endast av ekonomipersonal. Här visas alla fakturor som är ankomstregistrerade men inte bokförda. |

||

| − | Välj: |

||

| + | {{ExpandImage|LEV-ATT-EN-Bild6.png}} |

||

| + | |||

| + | If the invoice already is posted it is shown as one or several posting rows in the field at the bottom left side of the page. Type Pro means project purchase and Type Cost a cost invoice. The field in the middle shows a summary of the invoice with invoice amount, how much that has been posted and how much posting remains. Click on Invoice information to see other invoice details. You can also scroll in the scanned invoice in the upper part of the screen. Click on Show invoice. The function Notes shows all notes that has been made concerning the invoice. You can also make new notes there. |

||

| + | If the invoice already is posted it is shown as one or several posting rows in the field at the bottom left side of the page. Type Pro means project purchase and Type Cost a cost invoice. The field in the middle shows a summary of the invoice with invoice amount, how much that has been posted and how much posting remains. Click on {{btn|Invoice information}} to see other invoice details. You can also scroll in the scanned invoice in the upper part of the screen. Click on {{btn|Show invoice}}. The function Notes shows all notes that has been made concerning the invoice. You can also make new notes there. |

||

| + | To post a project purchase, select {{btn|Insert row Project}}. If you have been using purchase orders and state the PO-number, the remaining contents will be filled in automatically (client, project, purchase code and purchase price). Otherwise, fill in these fields, the purchase price will be fetched from the invoice registration. The mark-up for the purchase price comes from the purchase code in {{pth|Base registers|Pro/Cost codes}} Purchases (and in some cases from the project). The sales price is automatically calculated. You can also use the invoice currency, which makes dividing a foreign invoice in several projects easier. The system can be set such that the suggested mark-up cannot be changed. The setting is in {{pth|Base registers/PA/Parameters}}, tab Purchases and Other, field Change purchase mark-up. In the Adjustments tab there is more alternative in handling mark-ups and sales prices. It is called Special gross purchase as adjustment. When activated, it turns the difference between the suggested and the new sales price into an adjustment. |

||

| + | Use the lower table for posting costs. Write the account number and possible cost centre and -object if the account allows/requires it in the chart of accounts. If the cost shall be allocated over a period (accrued), state cost account only and fill in the fields for periods. The balance sheet account for periodical allocations is fetched from the parameters. |

||

| + | For pre-approval, final approval, partial approval or to state that the invoice shall not be paid, press {{btn|Approval}} and select type of approval. You can also write comments regarding the approval. Click on {{btn|Save approval}}. You can add approvers to the invoice with the function {{btn|New approver}}. Save the whole invoice with {{btn|Save}}. |

||

| + | == Watch list == |

||

| + | The watch list module is only used by the accounting department. The list shows all preliminary entered, but not booked invoices. List selections: |

||

{| class=mandeflist |

{| class=mandeflist |

||

| − | |''' |

+ | |'''All (1)''' |

| + | |Shows all invoices regardless of approval status |

||

| − | |Visar alla fakturor oavsett om de är attesterade eller ej |

||

|- |

|- |

||

| − | |''' |

+ | |'''Finished''' |

| + | |Shows fully approved invoices |

||

| − | |Visar färdigattesterade fakturor |

||

|- |

|- |

||

| − | |''' |

+ | |'''Not finished''' |

| + | |Shows invoices with at least one remaining approver |

||

| − | |Visar fakturor där det finns mins en kvarvarande attestör |

||

|- |

|- |

||

| − | |''' |

+ | |'''All (2)''' |

| + | |Shows all project- and cost invoices |

||

| − | |Visar alla projekt- och omkostnadsfakturor |

||

|- |

|- |

||

|'''Pro''' |

|'''Pro''' |

||

| + | |Shows all project invoices |

||

| − | |Visar alla projektfakturor |

||

|- |

|- |

||

| − | |''' |

+ | |'''Cost''' |

| + | |Shows all cost invoices |

||

| − | |Visar alla omkostnadsfakturor |

||

|- |

|- |

||

| − | |''' |

+ | |'''Rem. appr''' |

| + | |You can select a specific approver's unapproved invoices |

||

| − | |Möjlighet att visa en specifik attestörs oattesterade fakturor |

||

|} |

|} |

||

| − | {{ExpandImage| |

+ | {{ExpandImage|LEV-ATT-EN-Bild7.png}} |

{| class=mandeflist |

{| class=mandeflist |

||

| + | |'''Reminder mail''' |

||

| − | !Maila påminnelse |

||

| + | |Selected invoices will be sent as reminders to the approver |

||

| − | |Markerade fakturor skickas för påminnelse till attestören |

||

|- |

|- |

||

| + | |'''Book''' |

||

| − | !Bokför |

||

| + | |Book one or several selected invoices that are fully posted and approved. Today's date is suggested as accounting date. |

||

| − | |Bokför en eller flera markerade faktura som är färdigkonterade och attesterade. Föreslår dagens datum som bokföringsdatum |

||

|- |

|- |

||

| + | |'''Show invoice''' |

||

| − | !Visa Faktura |

||

| + | |Shows the scanned invoice document |

||

| − | |Visar det inskannade fakturadokumentet |

||

|- |

|- |

||

| + | |'''Scan''' |

||

| − | !Skanna |

||

| + | |Possibility to add documents to the invoice |

||

| − | |Ger möjlighet att komplettera fakturan med fler dokument |

||

|- |

|- |

||

| + | |'''Invoice''' |

||

| − | !Faktura |

||

| + | |Shows invoice information. You can also edit the information here |

||

| − | |Visar och ger möjlighet att ändra fakturauppgifter |

||

|- |

|- |

||

| + | |'''Posting''' |

||

| − | !Kontering |

||

| + | |Shows posting. You can change posting here |

||

| − | |Visar och ger möjlighet att ändra kontering |

||

|- |

|- |

||

| + | |'''Notes''' |

||

| − | !Anteckningar |

||

| + | |Shows notes, possibility to add notes |

||

| − | |Visar och ger möjlighet att lägga till anteckningar |

||

|} |

|} |

||

| + | Move the mouse pointer over the Posting pro/cost field to see more detailed information. Move the pointer over the employee code to see how much that has been approved and possible comments. If a final approval or a posting is red and in parenthesis it indicates that the whole amount is not approved or that the approver has written a comment. |

||

| + | After booking project related purchases they need to be updates ti the project accounting in Project: Registration, corrections and updates, tab Purchases. That can also be done automatically; the parameter is in System: Base registers/Pro/Parameters, tab Purchase and Other. |

||

| + | Note that possible existing purchases must be updated manually at the time you check the parameter box. |

||

| + | == Booked invoices == |

||

| + | The tab shows the booked invoices. It shows also time and approver and what type of approval it was in the columns Final approval and Pre-approval. Select an invoice and click {{pth|Open}}. The same invoice picture and invoice information as in the approval will be shown. |

||

| + | It is also possible to read notes here. |

||

| + | == Reverse erroneous invoice == |

||

| + | You can reverse an erroneous invoice. Select invoice and press {{btn|Reverse}}. There are two options: |

||

| + | #1 Change approver. The suggestion is that the approvers are the same as on the selected invoice, but you can change them. |

||

| + | #2 Also create a new debit invoice. |

||

| + | If you choose to create a new debit invoice, the reversal will result in two new invoices; one credit invoice of the selected invoice and a new debit invoice that is identical with the reversed invoice. |

||

| − | För att se detaljer kring kontering kan muspekaren föras över fältet Kontering Omk/Pro. För att se hur stort belopp attestören har attesterat eller om en kommentar lämnats, kan muspekaren placeras över medarbetarkoden. Om en slutattest eller en kontering är i parentes och skriven i röd text är det en indikering om att hela beloppet inte är konterat eller att attestören har lämnat en kommentar. |

||

| − | |||

| − | Efter att projektrelaterade fakturor bokförst måste dessa uppdateras till projektredovisningen i {{pth|Projekt|Registrering, korrigering och uppdatering}} fliken inköp. |

||

| − | Automatisk uppdatering av inköp kan också slås på i {{pth|System|Basregister/Pro/Parametrar}} fliken Inköp och övrigt. |

||

| − | Observera att inköp som redan ligger ouppdaterade när parametern slås på måste uppdateras manuellt. |

||

| − | |||

| − | == Bokföringslogg == |

||

| − | |||

| − | I bokföringsloggen visas de bokförda fakturorna. Här visas även när attesteringen är gjord och av vem, samt vilken typ av attest i kolumnerna Slutattest och Förattest. |

||

| − | Markera fakturan och tryck på {{btn|Öppna}}, så visas samma bild av fakturan och dess uppgifter som i attesteringen. Här kan även anteckningarna läsas i efterhand. |

||

| + | The invoices created by the reversal will be seen in the Watch list. All invoice details and postings are copied from the original invoice (but with opposite signs on the reversed invoice). The invoices are now ready for booking or correction or approval before booking. |

||

| − | {{ExpandImage|lev-att-sv-grafik78.png}} |

||

| − | [[Category:LEV-ATT-EN |

+ | [[Category: LEV-ATT-EN]] |

| + | [[Category: Accounting]] |

||

| + | [[Category: Manuals]] |

||

Revision as of 13:36, 7 July 2020

Contents

Registrering och attest av leverantörsfakturor

Denna manual beskriver hantering av inkommande leverantörsfakturor i Marathon

General

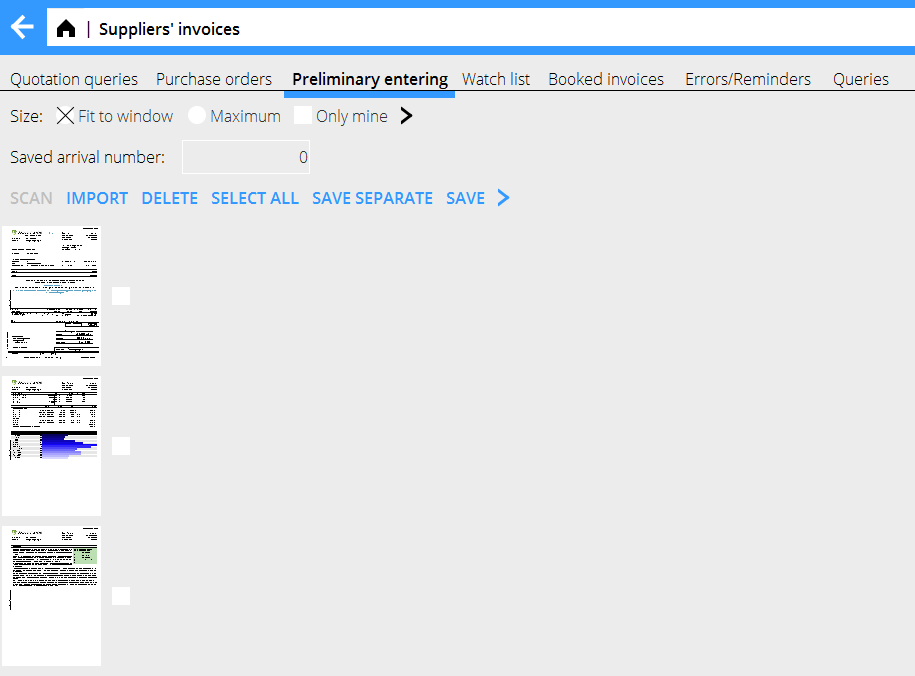

Suppliers’ invoices shall be registered in Accounting: Suppliers’ invoices, tab preliminary entering, when you use the approval function in Marathon. The program consists of the tabs: Quotation queries, Purchase orders, Preliminary entering, Watch list, Booked invoices, errors/reminders and Queries.

Preliminary entering - scanning

Start with scanning or importing the invoice documents in Accounting: Suppliers’ invoices, tab Preliminary entering. Press Scanning. It you are using Kalin Setterberg’s invoice interpretation service, the invoices are automatically entered with supplier, invoice number, invoice- and due dates and amount. If you are scanning the invoices, put them in the scanner and press Scan. If the scanner is not connected to Marathon you can use another unit for scanning them to your computer or- if they already exist digitally, press Import. A dialogue box opens, from which you can fetch a pdf file with one or several invoices. You can also use drag and drop to get a pdf into Marathon.

After the import, the pages are shown as miniatures to the left part of the screen. Check the quality of the scanned invoice by clicking on the miniature. Check the box and click Save. If the invoice has several pages, check one page at the time and then Save. If the invoice consists of several pages, check each page and save them together. Use Save separate if there are many invoices on only one page. Write AT number on the original invoice, from the field Next AT number. If you want to delete a scanned invoice, select it and click Delete. Select all Select all checks all scanned documents. Undo puts back scanned and saved – but not registered invoices.

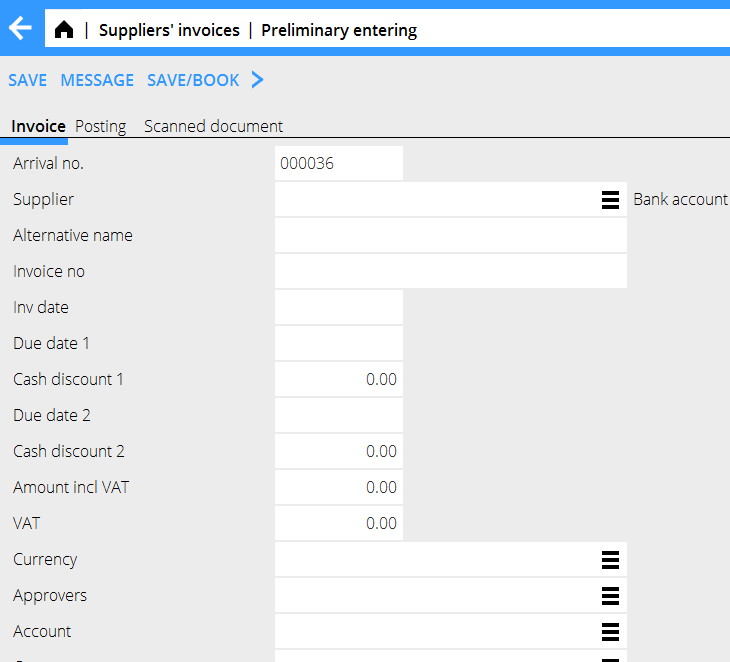

Preliminary entering

Select New in the preliminary entering. The system automatically suggests next arrival number, but you can overwrite it. The arrival number is the number that the invoice got at the scanning and is connected to the scanned document. Compare original invoice with the scanned one in the tab Scanned document. Fill in information about supplier, invoice number, date and invoice amount including VAT. (The VAT amount can be calculated with or without decimals with a parameter setting in Base registers/Lev/Parameters, tab Invoices – Show decimals) Select one or several approvers and save, or proceed to Posting.

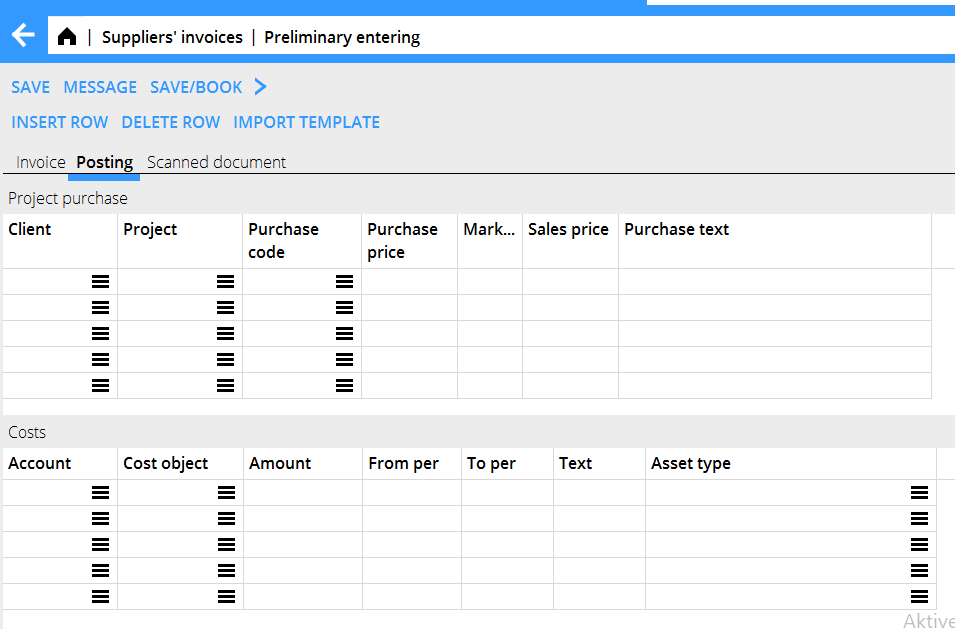

Posting

The invoice can already now be posted in the Posting tab.

Use the upper table for posting of project purchases. The account for project purchases is already set in the parameters. If you have been using purchase orders, enter PO number and the remaining contents will be automatically updated (client, project, purchase code, purchase price). Otherwise, fill in these fields, the purchase price will be fetched from the invoice registration. The mark-up for the purchase price comes from the purchase code in Base registers/Pro/Cost codes Purchases (and in some cases from the project). The sales price is automatically calculated. The system can be set such that the suggested mark-up cannot be changed. The setting is in Base registers/PRO/Parameters, tab Purchases and Other, field Change purchase mark-up. In the Adjustments tab there is more alternative in handling mark-ups and sales prices. It is called Special gross purchase as adjustment. When activated, it turns the difference between the suggested and the new sales price into an adjustment. Use the lower table for posting costs. Write the account number and possible cost centre and -object if the account allows/requires it in the chart of accounts. If the cost shall be allocated over a period (accrued), state cost account only and fill in the fields for periods. The balance sheet account for periodical allocations is fetched from the parameters. The posting for both project purchases and costs can also be made in the invoice currency. Use the field Amount invoice currency. This enables the sorting of foreign invoices on different projects or accounts. Use Import template if you want to import a posting template from Base registers/PL/Posting templates. Read more in Create posting template. When all scanned invoices are preliminary entered, they shall be sent to the approvers. Use the Send mail function in Accounting: Suppliers’ invoices tab Watch list. The email will be sent to all approvers on unapproved invoices. The invoice is marked with the approver in {{pth|Accounting:|Approval

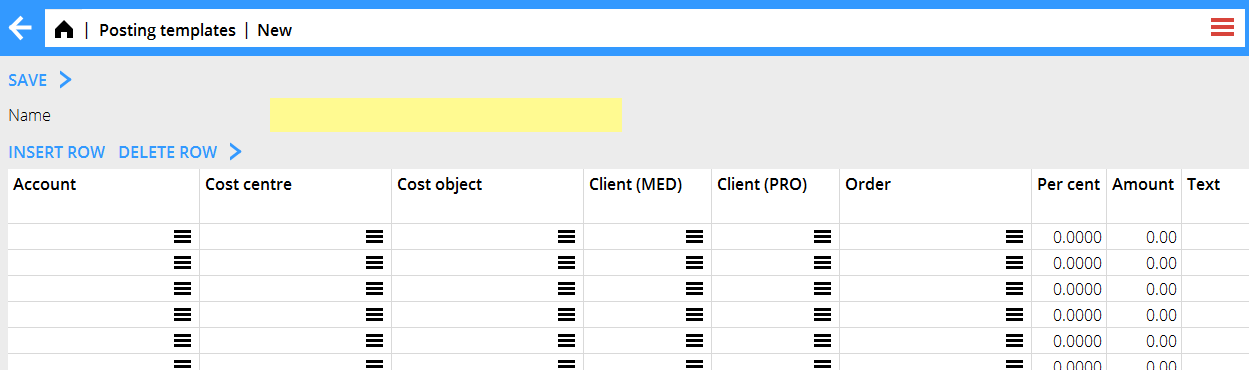

Skapa konteringsmall

You can create Posting templates in Base registers/PL/Posting templates. Click on New and write a name for the template. Enter account and possible cost centre/cost objects if the account allows it. The amount can be stated either as percentage or as a monetary amount in your currency. If you choose percentage, you will get a question about the total amount at the time you use the template and calculates the share with help of the percentage.

Automatic posting

You can register a template for automatic posting in a voucher template in Base registers/GL/Voucher templates. A template makes an automatic posting when you book on a base account, e.g. 7410. However, the posting is not shown on the screen while entering the invoice, but you can see it in the bookkeeping.

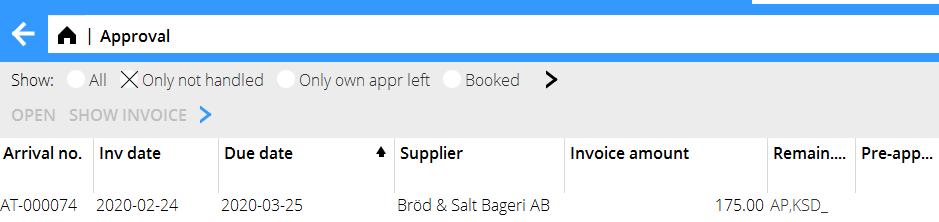

Approval

The approver can open the invoices in Accounting: Approval for approving and posting.

You can see the invoice document with the function Show invoice. If you are authorised, you can also approve an invoice without opening it with {{btn|Direct approval. Select:

| All | Shows all invoices, also those without approvers |

| Only not handled | Shows all unapproved invoices |

| Only own app. left | Shows only the invoices where you are the only remaining approver |

| Booked | Shows all booked invoices |

Select an invoice and click Open.

If the invoice already is posted it is shown as one or several posting rows in the field at the bottom left side of the page. Type Pro means project purchase and Type Cost a cost invoice. The field in the middle shows a summary of the invoice with invoice amount, how much that has been posted and how much posting remains. Click on Invoice information to see other invoice details. You can also scroll in the scanned invoice in the upper part of the screen. Click on Show invoice. The function Notes shows all notes that has been made concerning the invoice. You can also make new notes there. If the invoice already is posted it is shown as one or several posting rows in the field at the bottom left side of the page. Type Pro means project purchase and Type Cost a cost invoice. The field in the middle shows a summary of the invoice with invoice amount, how much that has been posted and how much posting remains. Click on Invoice information to see other invoice details. You can also scroll in the scanned invoice in the upper part of the screen. Click on Show invoice. The function Notes shows all notes that has been made concerning the invoice. You can also make new notes there. To post a project purchase, select Insert row Project. If you have been using purchase orders and state the PO-number, the remaining contents will be filled in automatically (client, project, purchase code and purchase price). Otherwise, fill in these fields, the purchase price will be fetched from the invoice registration. The mark-up for the purchase price comes from the purchase code in Base registers: Pro/Cost codes Purchases (and in some cases from the project). The sales price is automatically calculated. You can also use the invoice currency, which makes dividing a foreign invoice in several projects easier. The system can be set such that the suggested mark-up cannot be changed. The setting is in Base registers/PA/Parameters, tab Purchases and Other, field Change purchase mark-up. In the Adjustments tab there is more alternative in handling mark-ups and sales prices. It is called Special gross purchase as adjustment. When activated, it turns the difference between the suggested and the new sales price into an adjustment. Use the lower table for posting costs. Write the account number and possible cost centre and -object if the account allows/requires it in the chart of accounts. If the cost shall be allocated over a period (accrued), state cost account only and fill in the fields for periods. The balance sheet account for periodical allocations is fetched from the parameters. For pre-approval, final approval, partial approval or to state that the invoice shall not be paid, press Approval and select type of approval. You can also write comments regarding the approval. Click on Save approval. You can add approvers to the invoice with the function New approver. Save the whole invoice with Save.

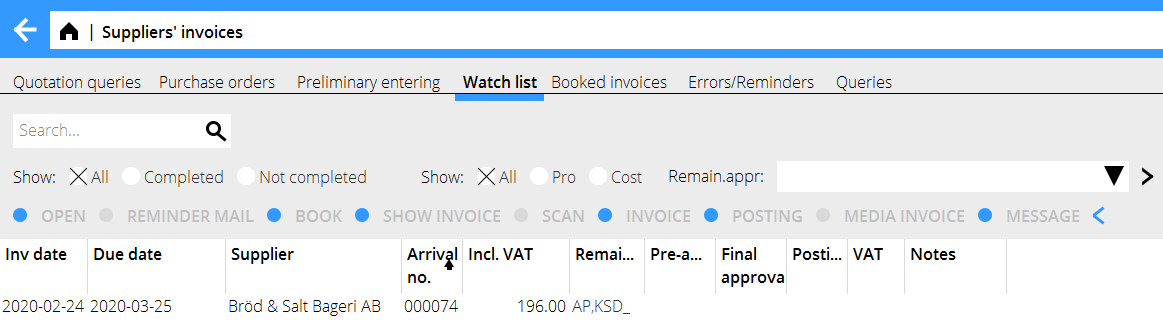

Watch list

The watch list module is only used by the accounting department. The list shows all preliminary entered, but not booked invoices. List selections:

| All (1) | Shows all invoices regardless of approval status |

| Finished | Shows fully approved invoices |

| Not finished | Shows invoices with at least one remaining approver |

| All (2) | Shows all project- and cost invoices |

| Pro | Shows all project invoices |

| Cost | Shows all cost invoices |

| Rem. appr | You can select a specific approver's unapproved invoices |

| Reminder mail | Selected invoices will be sent as reminders to the approver |

| Book | Book one or several selected invoices that are fully posted and approved. Today's date is suggested as accounting date. |

| Show invoice | Shows the scanned invoice document |

| Scan | Possibility to add documents to the invoice |

| Invoice | Shows invoice information. You can also edit the information here |

| Posting | Shows posting. You can change posting here |

| Notes | Shows notes, possibility to add notes |

Move the mouse pointer over the Posting pro/cost field to see more detailed information. Move the pointer over the employee code to see how much that has been approved and possible comments. If a final approval or a posting is red and in parenthesis it indicates that the whole amount is not approved or that the approver has written a comment. After booking project related purchases they need to be updates ti the project accounting in Project: Registration, corrections and updates, tab Purchases. That can also be done automatically; the parameter is in System: Base registers/Pro/Parameters, tab Purchase and Other. Note that possible existing purchases must be updated manually at the time you check the parameter box.

Booked invoices

The tab shows the booked invoices. It shows also time and approver and what type of approval it was in the columns Final approval and Pre-approval. Select an invoice and click Open. The same invoice picture and invoice information as in the approval will be shown. It is also possible to read notes here.

Reverse erroneous invoice

You can reverse an erroneous invoice. Select invoice and press Reverse. There are two options:

- 1 Change approver. The suggestion is that the approvers are the same as on the selected invoice, but you can change them.

- 2 Also create a new debit invoice.

If you choose to create a new debit invoice, the reversal will result in two new invoices; one credit invoice of the selected invoice and a new debit invoice that is identical with the reversed invoice.

The invoices created by the reversal will be seen in the Watch list. All invoice details and postings are copied from the original invoice (but with opposite signs on the reversed invoice). The invoices are now ready for booking or correction or approval before booking.