Difference between revisions of "Enter vouchers"

(Marked this version for translation) |

|||

| Line 94: | Line 94: | ||

The whole invoice amount is fetched into the table. If only a part of the invoice has been paid, write the received amount over the amount in the Rec. amt (your currency) – field. |

The whole invoice amount is fetched into the table. If only a part of the invoice has been paid, write the received amount over the amount in the Rec. amt (your currency) – field. |

||

| − | === Foreign currency=== |

+ | === Foreign currency=== <!--T:54--> |

'''Automatic posting of currency rate discrepancy''' |

'''Automatic posting of currency rate discrepancy''' |

||

If accounts s for currency rate losses and profits are set in {{pth|Base registers/SL/Parameters}}, tab Payments, the discrepancies will be automatically booked. |

If accounts s for currency rate losses and profits are set in {{pth|Base registers/SL/Parameters}}, tab Payments, the discrepancies will be automatically booked. |

||

| + | <!--T:55--> |

||

If the payment is in a foreign currency this field is empty and you must write in the amount that the bank has received. |

If the payment is in a foreign currency this field is empty and you must write in the amount that the bank has received. |

||

| Line 104: | Line 105: | ||

If a foreign invoice is partly paid, write the received amount both in Rec. amt (your currency) and Rec. amt invoice currency. The remaining difference will be a residue and a possible rate discrepancy (if received amount in your currency divided with the rate doesn't correspond with the amount in the field Rec. amt Invoice, the difference will be a rate discrepancy). |

If a foreign invoice is partly paid, write the received amount both in Rec. amt (your currency) and Rec. amt invoice currency. The remaining difference will be a residue and a possible rate discrepancy (if received amount in your currency divided with the rate doesn't correspond with the amount in the field Rec. amt Invoice, the difference will be a rate discrepancy). |

||

| + | <!--T:56--> |

||

'''Manual posting of currecy rate discrepancies''' |

'''Manual posting of currecy rate discrepancies''' |

||

| + | <!--T:57--> |

||

If there is no accounts stated for currency rate profits and losses, the amounts are fetched into the fields Rec amt in base currency and Rec amt invoice currency. The amounts can be changed by partial payment and possible rate dicrepancy has to be booked manually. |

If there is no accounts stated for currency rate profits and losses, the amounts are fetched into the fields Rec amt in base currency and Rec amt invoice currency. The amounts can be changed by partial payment and possible rate dicrepancy has to be booked manually. |

||

| Line 119: | Line 122: | ||

{{ExpandImage|Registrering-verifikationer-en-grafik8.png}} |

{{ExpandImage|Registrering-verifikationer-en-grafik8.png}} |

||

| − | <!--T:21--> |

+ | === Foreign currency=== <!--T:21--> |

| − | === Foreign currency=== |

||

'''Automatic posting of currency rate discrepancy''' |

'''Automatic posting of currency rate discrepancy''' |

||

If accounts s for currency rate losses and profits are set in {{pth|Base registers/SL/Parameters}}, tab Payments, the discrepancies will be automatically booked. |

If accounts s for currency rate losses and profits are set in {{pth|Base registers/SL/Parameters}}, tab Payments, the discrepancies will be automatically booked. |

||

| Line 127: | Line 129: | ||

If the payment is in a foreign currency this field is empty and you must write in the amount that the bank has received. |

If the payment is in a foreign currency this field is empty and you must write in the amount that the bank has received. |

||

| + | <!--T:58--> |

||

If a foreign invoice is partly paid, write the received amount both in Rec. amt (your currency) and Rec. amt invoice currency. The remaining difference will be a residue and a possible rate discrepancy (if received amount in your currency divided with the rate doesn't correspond with the amount in the field Rec. amt Invoice, the difference will be a rate discrepancy). |

If a foreign invoice is partly paid, write the received amount both in Rec. amt (your currency) and Rec. amt invoice currency. The remaining difference will be a residue and a possible rate discrepancy (if received amount in your currency divided with the rate doesn't correspond with the amount in the field Rec. amt Invoice, the difference will be a rate discrepancy). |

||

| + | <!--T:52--> |

||

| − | '''Manual posting of currecy rate discrepancies''' |

+ | '''Manual posting of currecy rate discrepancies''' |

<!--T:23--> |

<!--T:23--> |

||

If there is no accounts stated for currency rate profits and losses, the amounts are fetched into the fields Rec amt in base currency and Rec amt invoice currency. The amounts can be changed by partial payment and possible rate dicrepancy has to be booked manually. |

If there is no accounts stated for currency rate profits and losses, the amounts are fetched into the fields Rec amt in base currency and Rec amt invoice currency. The amounts can be changed by partial payment and possible rate dicrepancy has to be booked manually. |

||

| + | <!--T:59--> |

||

After registration of the invoices, go back to the GL tab and enter an account for the payment (e.g. bank account). If you press the function Fill here, the remaining will be posted on the account. |

After registration of the invoices, go back to the GL tab and enter an account for the payment (e.g. bank account). If you press the function Fill here, the remaining will be posted on the account. |

||

Revision as of 13:27, 10 August 2020

Contents

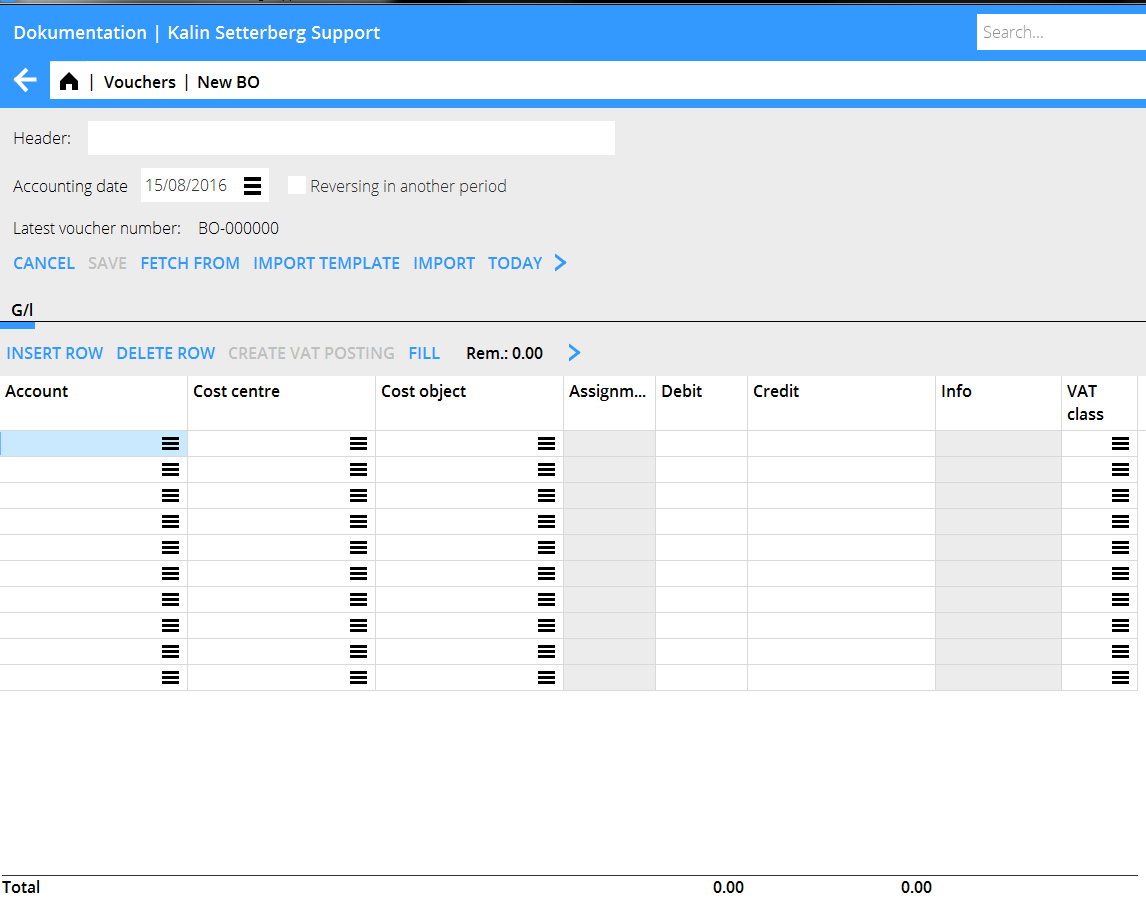

Enter vouchers without assignation to other subsystem

Enter vouchers into Marathon in Accounting: Vouchers. The standard series has the prefix BO but you can add new voucher series in System: Base registers/GL/Voucher series. All series consist of two characters, of which the first must be B.

Select series and click New. Always start the entering process with stating the accounting date.

A simple voucher is entered with two or more accounts and amounts in debit and credit. Other functions:

| Fetch from | Copy earlier voucher. Select from a list. |

| Import template | You can create a voucher template in System: Base registers/GL/Voucher templates. Read more in create voucher template. |

| Import | Imports sie-files (Sweden). |

| Reverse in another period | Credits a voucher with another accounting date. |

| Accounting date+ today | Accounting day must always be stated before other contents can be entered. Click on Today to fetch today's date, other dates are stated manually. The given date will be suggested in the next voucher. |

| Header | The header is shown on the start page of the entering program and is searchable. |

| Voucher number | Voucher number comes automatically from Base registers: GL/Voucher series. |

| Account | State account. |

| Cost centre/-object | Enter cost centre and cost object if the account demands/allows it. |

| Debit/Credit | Enter amounts. |

| Dimensions | If your company uses dimensions, they are shown as separate columns. Dimensions are determined in Base registers/GL/Parameters, tab Dimensions. Edit manual dimensions in Base registers/GL/Dimensions. |

| Text | Optional text field (25 characters). The text is shown in the General ledger and Account specification. |

| Sums | At the bottom of the table the debit- and credit columns are summarized. A voucher must balance before it can be saved. |

| Create VAT posting | If you use Marathon's input VAT handling, you can create an automatic VAT posting (based on the VAT classes defined in Base registers/GL/VAT classes). Marathon calculates input VAT after how much there has been marked with VAT class and fetches the correct account from its definition. |

| Fill | Fills automatically remaining amount so that the voucher shall balance, provided that account has been stated. |

| Rest | Shows remaining amount |

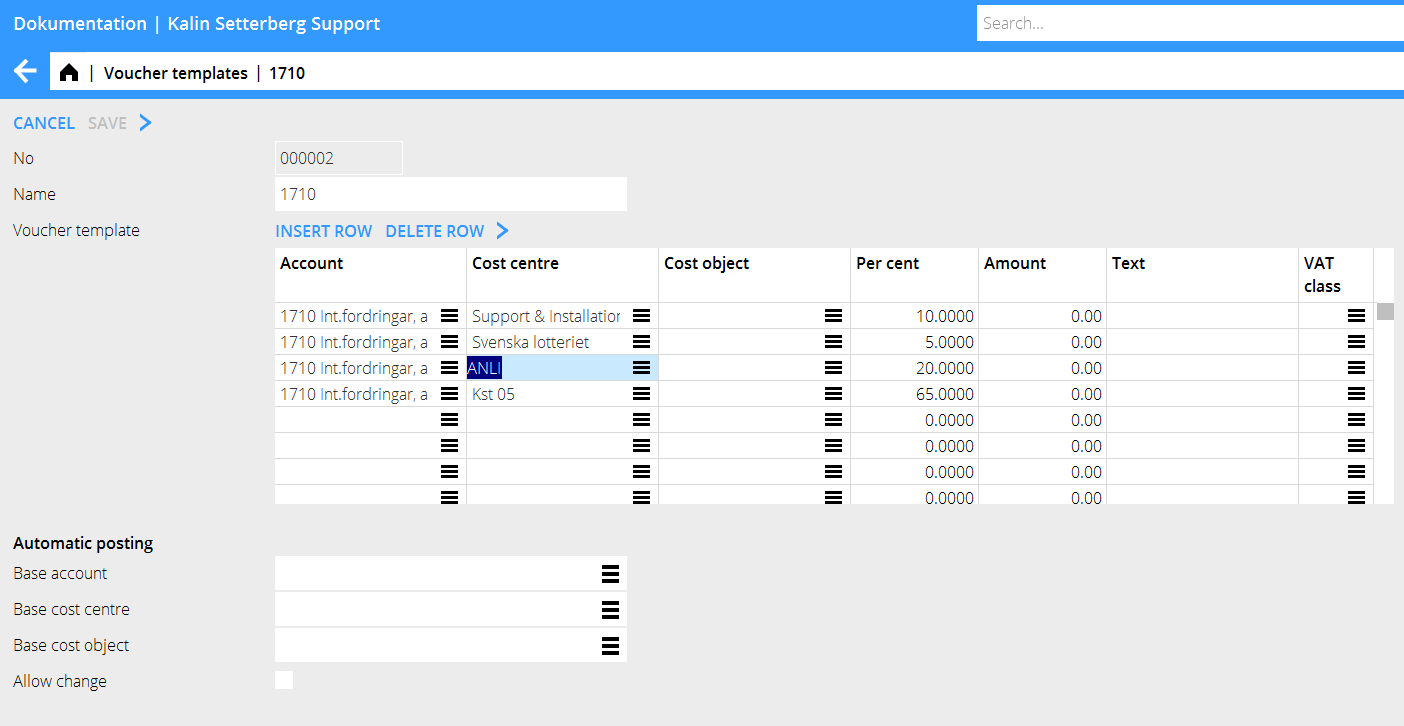

Create voucher template or Automatic posting

Create voucher templates in Base registers/GL/Voucher templates. Press New and give the template a name. Enter amount and possible cost centre or/and cost object, if the account allows it. Enter either a part of the amount in per cent or the monetary amount in your currency. If you use per cents the system asks for the total amount and calculates the part with the percentage you have entered. Click Import template to import the template into the voucher. An automatic posting (without the Import template button) is done when basic account, -cost object and -cost centre has been entered at Automatic posting on the bottom of the template. The automatic posting is trigged when the base account is entered into a voucher and shown in the registration image.

Enter voucher with assignment to another subsystem

If the entered account is assigned to another subsystem, a yellow tab will appear, with an abbreviation of the subsystem name. In the tab you shall enter contents that concerns the subsystem. Below a description of the most common integrations.

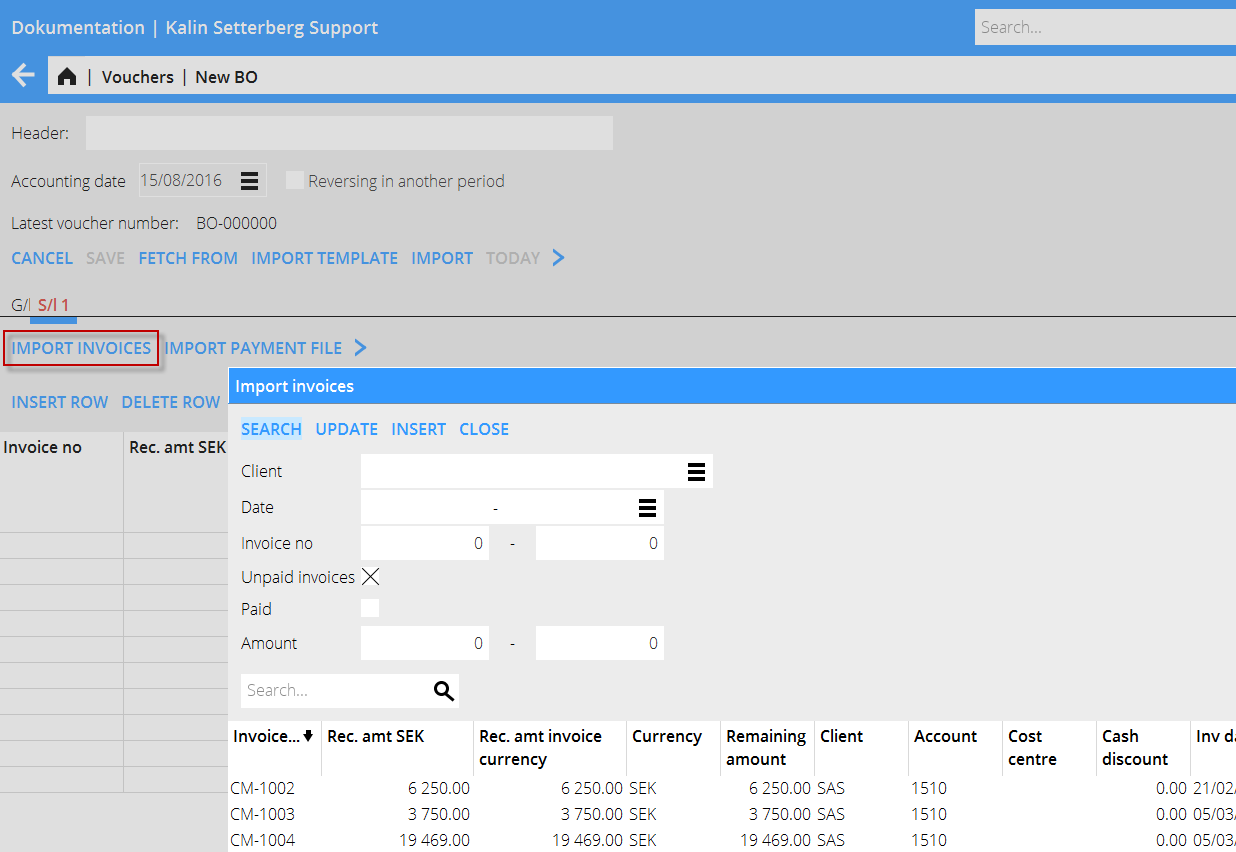

Client payments

The account receivable is assigned to the sales ledger, which means that when you enter the account, the system creates a tab called SL followed by the tab number. Register the payments in the tab. Enter invoice number or search invoices with the function Import Invoices. You can search with client, date, invoice number, etc.

The whole invoice amount is fetched into the table. If only a part of the invoice has been paid, write the received amount over the amount in the Rec. amt (your currency) – field.

Foreign currency

Automatic posting of currency rate discrepancy If accounts s for currency rate losses and profits are set in Base registers/SL/Parameters, tab Payments, the discrepancies will be automatically booked.

If the payment is in a foreign currency this field is empty and you must write in the amount that the bank has received.

If a foreign invoice is partly paid, write the received amount both in Rec. amt (your currency) and Rec. amt invoice currency. The remaining difference will be a residue and a possible rate discrepancy (if received amount in your currency divided with the rate doesn't correspond with the amount in the field Rec. amt Invoice, the difference will be a rate discrepancy).

Manual posting of currecy rate discrepancies

If there is no accounts stated for currency rate profits and losses, the amounts are fetched into the fields Rec amt in base currency and Rec amt invoice currency. The amounts can be changed by partial payment and possible rate dicrepancy has to be booked manually.

After registration of the invoices, go back to the GL tab and enter an account for the payment (e.g. bank account). If you press the function Fill here, the remaining will be posted on the account.

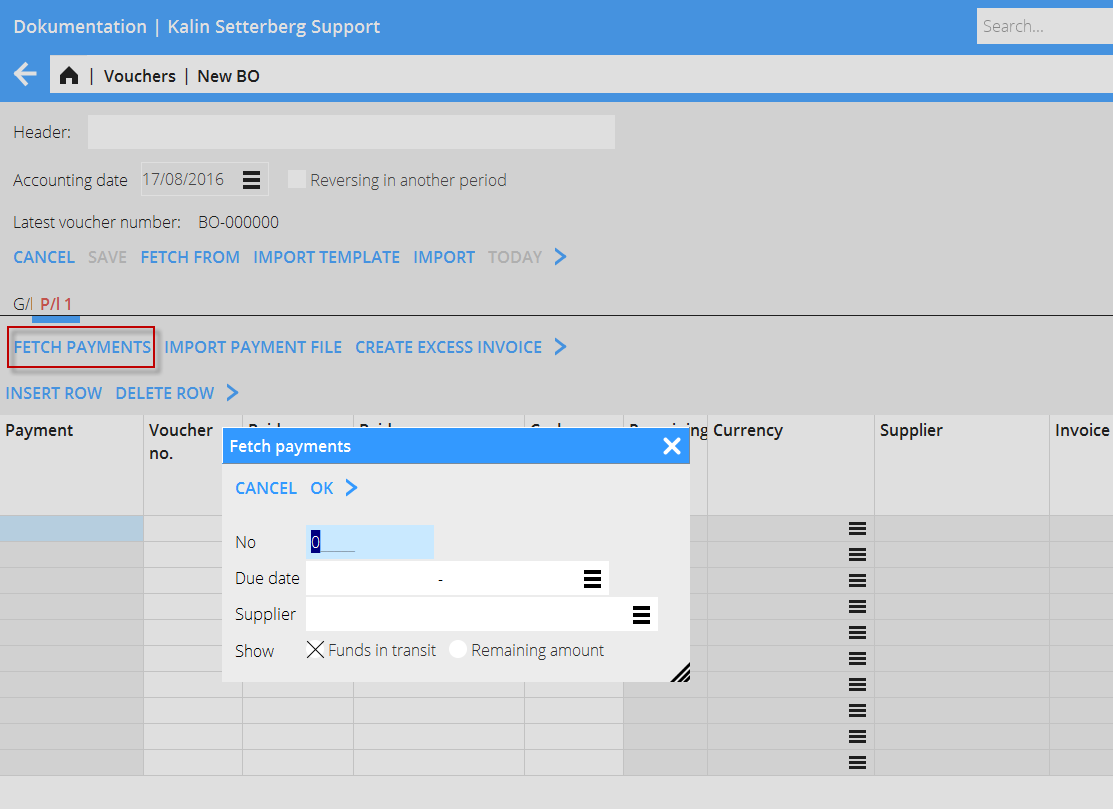

Supplier payments

The account payable is assigned to the purchase ledger, which means that when you enter the account, the system creates a tab called PL followed by the tab number. Register the payments in the tab. Enter invoice number of the paid invoice or search a created payment with the function Fetch payments. Here you can search on payment number, date or supplier. You can also find invoices with residues. There is also a function for importing a payment file.

Foreign currency

Automatic posting of currency rate discrepancy If accounts s for currency rate losses and profits are set in Base registers/SL/Parameters, tab Payments, the discrepancies will be automatically booked.

If the payment is in a foreign currency this field is empty and you must write in the amount that the bank has received.

If a foreign invoice is partly paid, write the received amount both in Rec. amt (your currency) and Rec. amt invoice currency. The remaining difference will be a residue and a possible rate discrepancy (if received amount in your currency divided with the rate doesn't correspond with the amount in the field Rec. amt Invoice, the difference will be a rate discrepancy).

Manual posting of currecy rate discrepancies

If there is no accounts stated for currency rate profits and losses, the amounts are fetched into the fields Rec amt in base currency and Rec amt invoice currency. The amounts can be changed by partial payment and possible rate dicrepancy has to be booked manually.

After registration of the invoices, go back to the GL tab and enter an account for the payment (e.g. bank account). If you press the function Fill here, the remaining will be posted on the account.

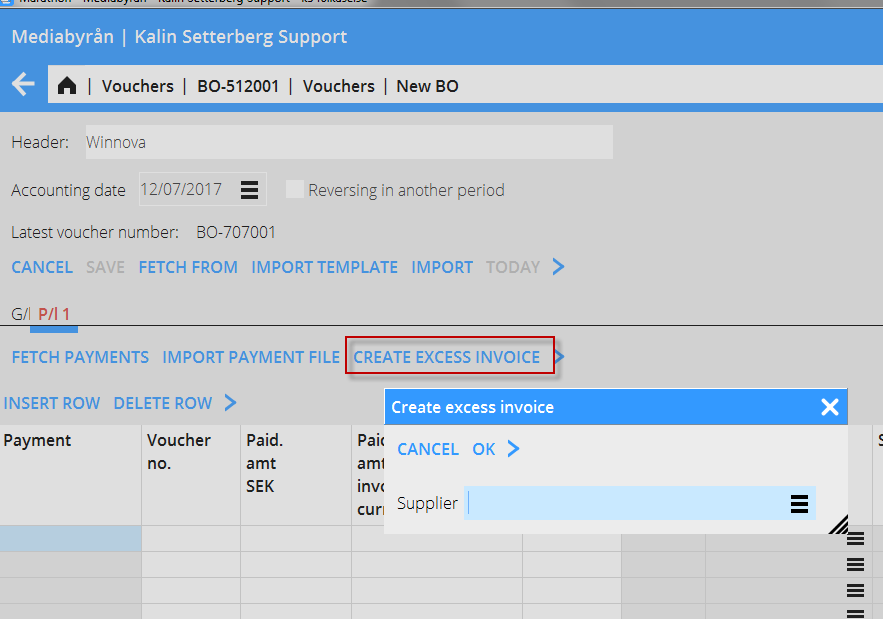

Create excess invoice

With this function, you can register a pre-paid amount in the purchase ledger directly, even when the supplier's invoice hasn't arrived yet. The payment gets an LA -number.

Enter supplier and an amount.

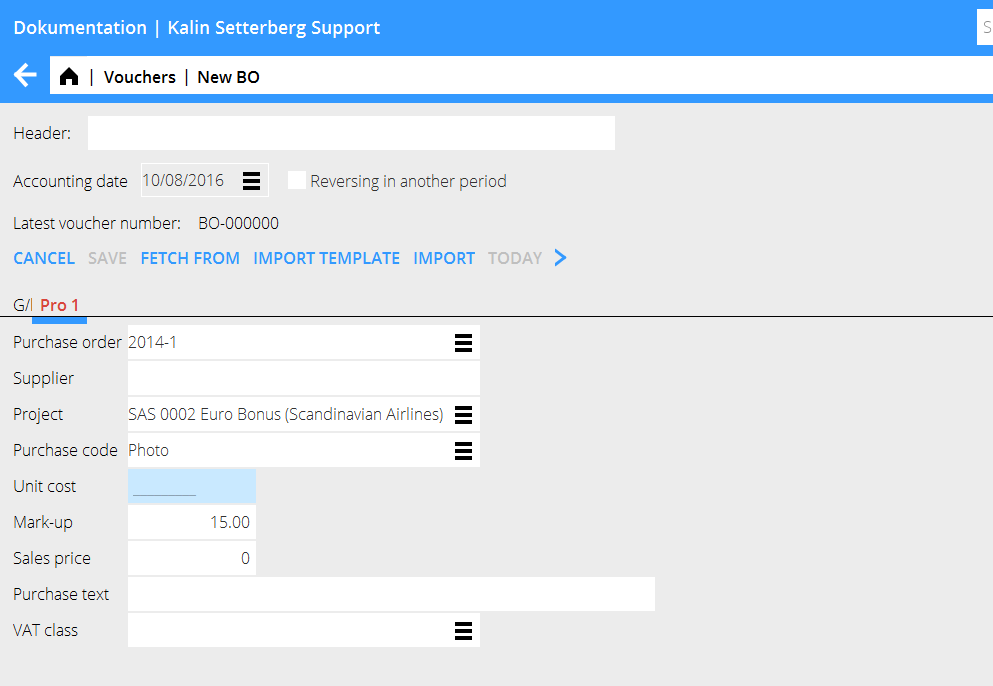

Enter project purchase

The account for project purchases is assigned to the project management, which means that when you enter the account, the system creates a tab called PRO followed by the tab number. Register purchases that shall be charged a project in the tab. Enter project, purchase code and a purchase price. The sales price is automatically calculated with the mark-up percentage that has been defined on the purchase code. In many cases the mark -up can be changed (there is a parameter setting for that option) if you want to change it. Write optional purchase text. If you have been using purchase orders at the project purchase, you can enter it here and the system will fetch all contents from it. Make the contrary posting in the tab GL.

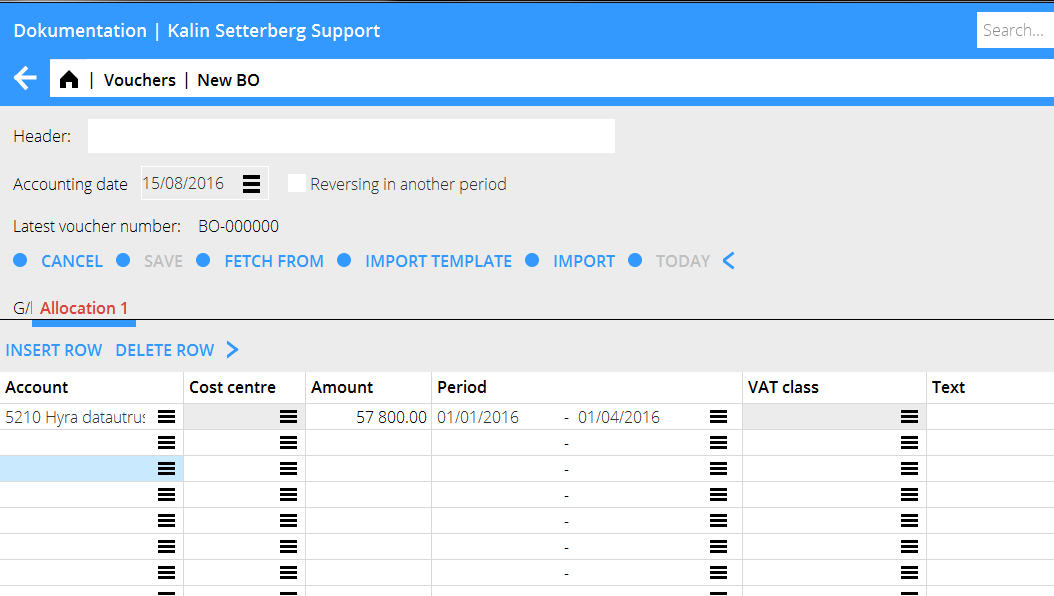

Enter periodical allocations

The account for accruals (periodical allocations) is assigned to periodical allocations, which means that when you enter the account, the system creates a tab called Allocations followed by the tab number. Enter the costs that shall be allocated over a certain period. Enter cost account, amount and the period for the allocation. You can enter the date in two different ways: MMYY– MMYY or DDMMYY. In the first case the amount is allocated evenly on all months, in the latter depending on how many days each month has. Make the contrary posting in the GL tab

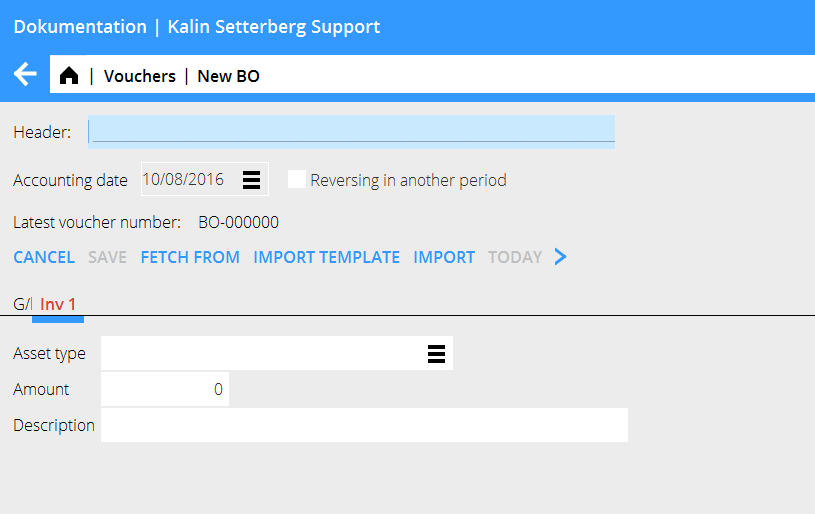

Enter assets (inventories)

The account for inventories is assigned to the inventory ledger, which means that when you enter the account, the system creates a tab called INV. If the acquisition account only is connected to one asset type, it will show automatically. If not, select asset type. Write amount and a possible description. Make the contrary posting in the GL tab.

Correct a voucher

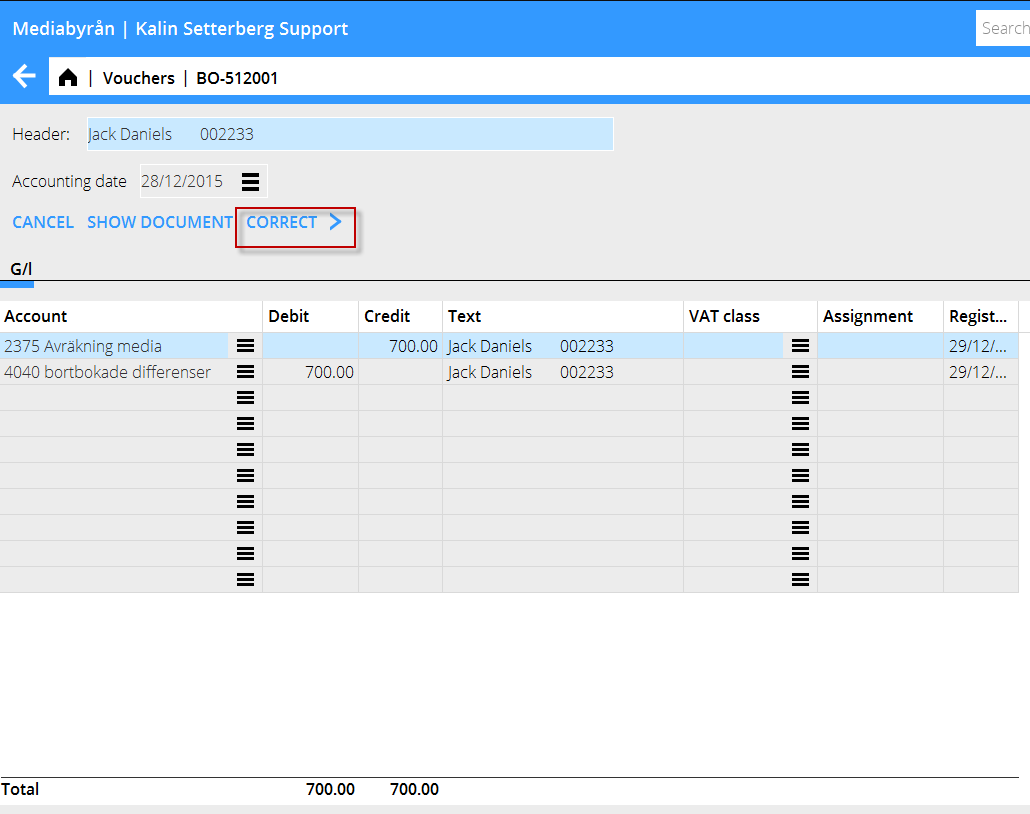

Select the voucher that you want to correct and press Open. Then press Correct.

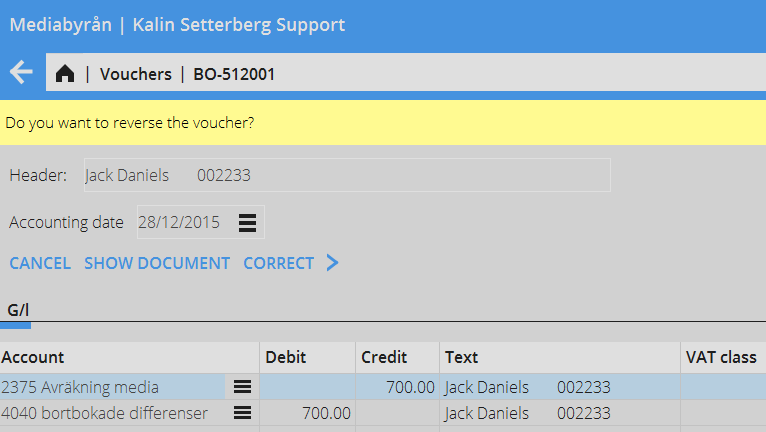

Marathon asks you if you want to reverse the voucher.

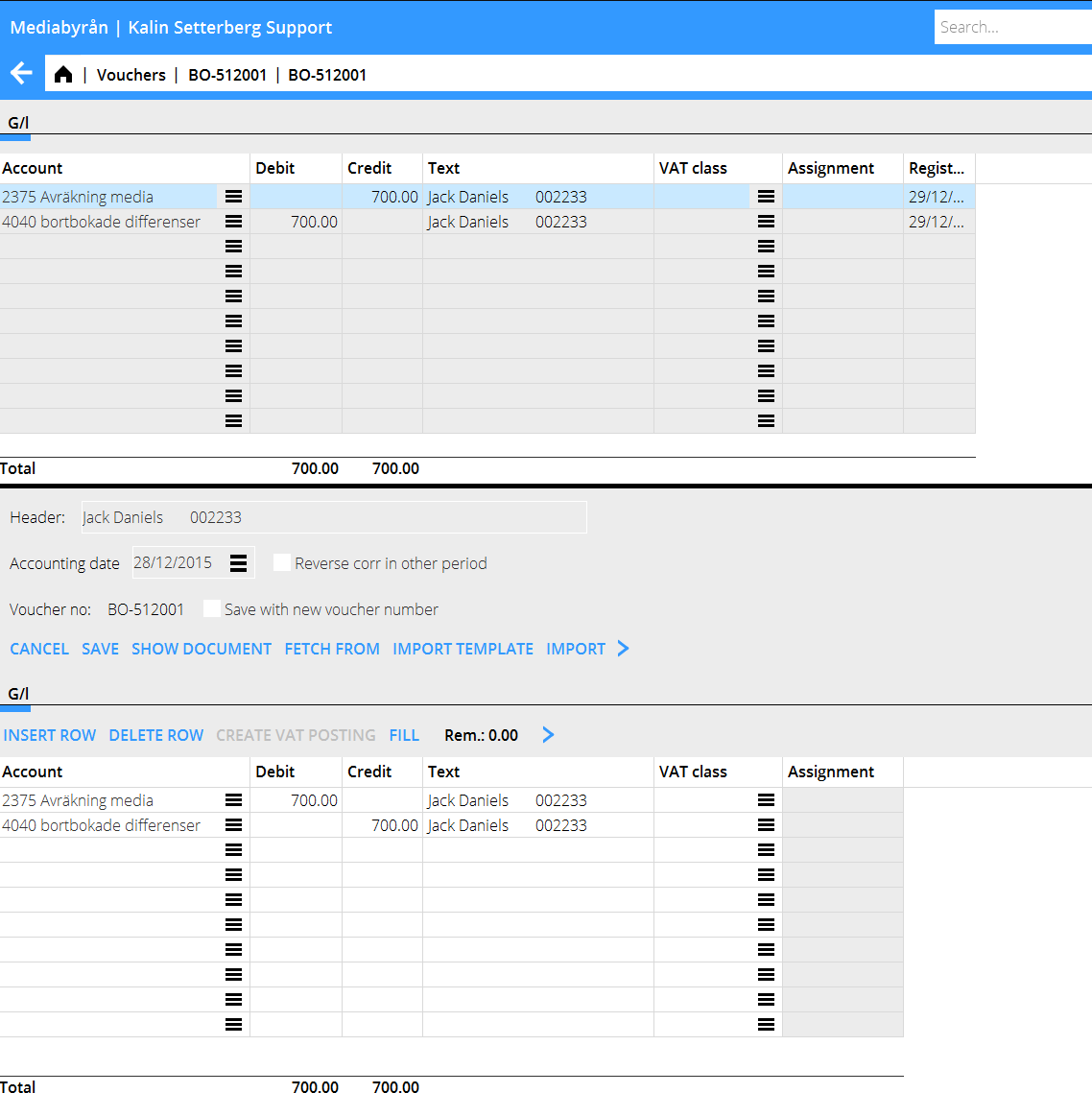

Click on Yes if you want to reverse the whole voucher. Otherwise, click on No and make the posting in the lower table. If you want to save the correction with a separate voucher number, check the box ((kryss|Save with new voucher number}} and enter an accounting date. The accounting date does not have to be in the same period than the original voucher.

If you want to reverse in another period, check the box "Reverse corr in another period" and enter an accounting date in the upper part of the screen.

Both the correction and the reversing of it will be booked on that date and receive voucher numbers in this period. There will be two new vouchers, the correction and the reverse of the correction.

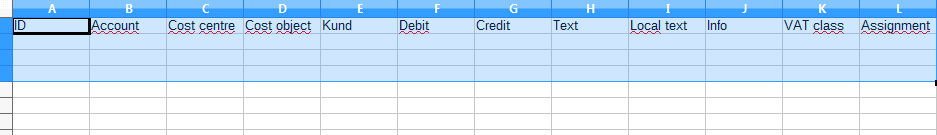

Paste data into a voucher

Start with right clicking on the posting table (without marking anything) and select COPY. Then paste it in Excel. Your Excel has to have exactly the same structure in order to fit in a voucher. Paste in the voucher by marking all cells including the headings and all columns. Put the cursor over the posting table and select PASTE.