Difference between revisions of "Translations:Pre-invoicing in the Media system/10/en"

From Marathon Documentation

| Line 1: | Line 1: | ||

When printing out under the tab Invoicing, there will be no deduction. If plans/orders are listed under ”Deduction from”, they will be blocked from being invoiced in the usual manner. |

When printing out under the tab Invoicing, there will be no deduction. If plans/orders are listed under ”Deduction from”, they will be blocked from being invoiced in the usual manner. |

||

| + | |||

| − | Handling of pre-invoices in foreign currency |

+ | === Handling of pre-invoices in foreign currency === |

| + | |||

When setting up a pre-invoice in another currency, you must state the currency rate on the invoice. The deductions are not following the stated rate on the pre-invoice; they follow the client agreement with either day rate according to the base register or order rate stated on the order. |

When setting up a pre-invoice in another currency, you must state the currency rate on the invoice. The deductions are not following the stated rate on the pre-invoice; they follow the client agreement with either day rate according to the base register or order rate stated on the order. |

||

The pre-invoice: |

The pre-invoice: |

||

Revision as of 16:33, 1 November 2021

When printing out under the tab Invoicing, there will be no deduction. If plans/orders are listed under ”Deduction from”, they will be blocked from being invoiced in the usual manner.

Handling of pre-invoices in foreign currency

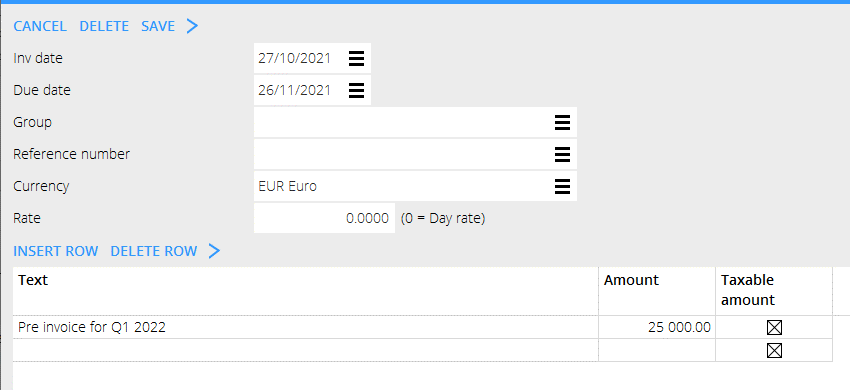

When setting up a pre-invoice in another currency, you must state the currency rate on the invoice. The deductions are not following the stated rate on the pre-invoice; they follow the client agreement with either day rate according to the base register or order rate stated on the order. The pre-invoice: