From Marathon Documentation

|

|

| Line 2: |

Line 2: |

| |

{{ExpandImage|MED-PRE-EN-Bild11.png}} |

|

{{ExpandImage|MED-PRE-EN-Bild11.png}} |

| |

|

|

|

| − |

* Plan 1092 ”Februari kampanj” is on 700 000 which you can see in the list under Deducted from. |

+ |

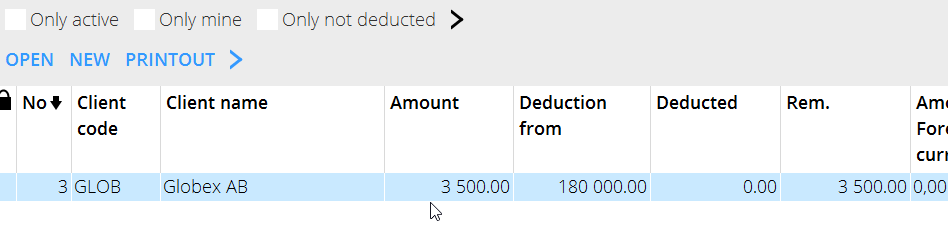

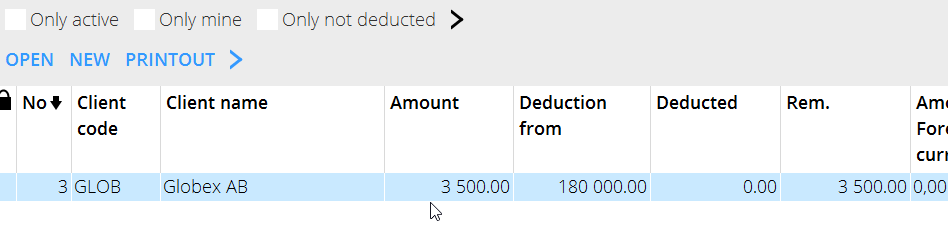

* Plan 3 , Globex AB is on 180 000 which you can see in the list under Deducted from. |

| |

{{ExpandImage|MED-PRE-EN-Bild12.png}} |

|

{{ExpandImage|MED-PRE-EN-Bild12.png}} |

| |

|

|

|

Latest revision as of 07:29, 4 November 2021

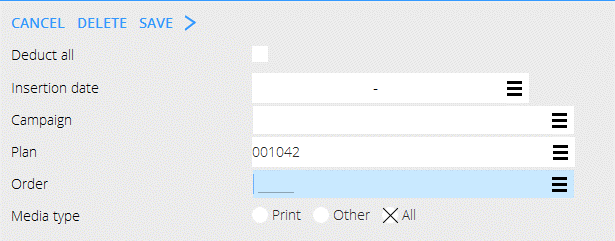

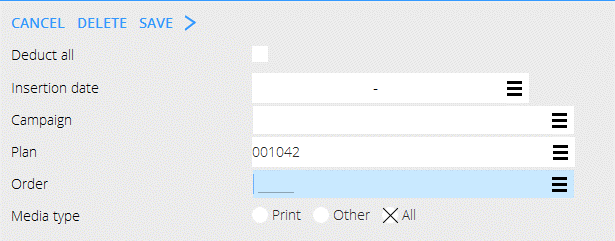

- State where the pre-invoice shall be deducted from. You can add more rows under “Deducted from”.

- Plan 3 , Globex AB is on 180 000 which you can see in the list under Deducted from.

- The deduction is done in Pre-invoice deduction