Difference between revisions of "News:New warning for VAT on foreign suppliers/sv"

From Marathon Documentation

(Created page with "Ny varning för moms på utländska leverantörer") |

(Created page with "{{News |Ny varning för moms på utländska leverantörer |group=Leverantörsfakturor |version=546W2409 |revision=0 |case=CORE-6216 |published=2024-11-15 }}") |

||

| Line 1: | Line 1: | ||

{{News |

{{News |

||

| + | |Ny varning för moms på utländska leverantörer |

||

| − | |New warning for VAT on foreign suppliers |

||

| + | |group=Leverantörsfakturor |

||

| − | |module=Accounting |

||

| − | |group=Suppliers' invoices |

||

|version=546W2409 |

|version=546W2409 |

||

|revision=0 |

|revision=0 |

||

Revision as of 08:35, 20 November 2024

Ny varning för moms på utländska leverantörer

| Published | 2024-11-15 |

|---|---|

| Module | Leverantörsfakturor |

| Version | 546W2409 |

| Revision | 0 |

| Case number | CORE-6216 |

New warning for VAT on foreign suppliers

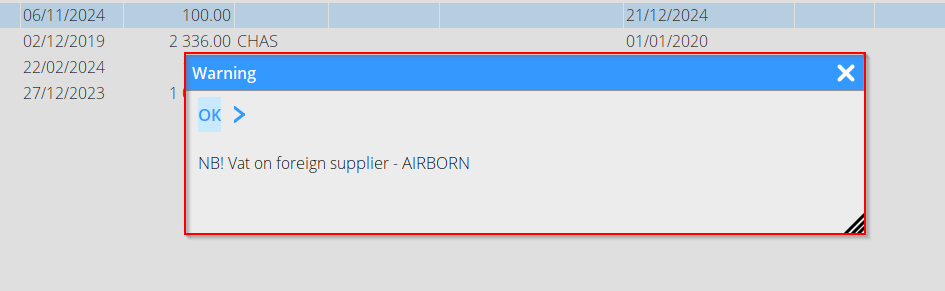

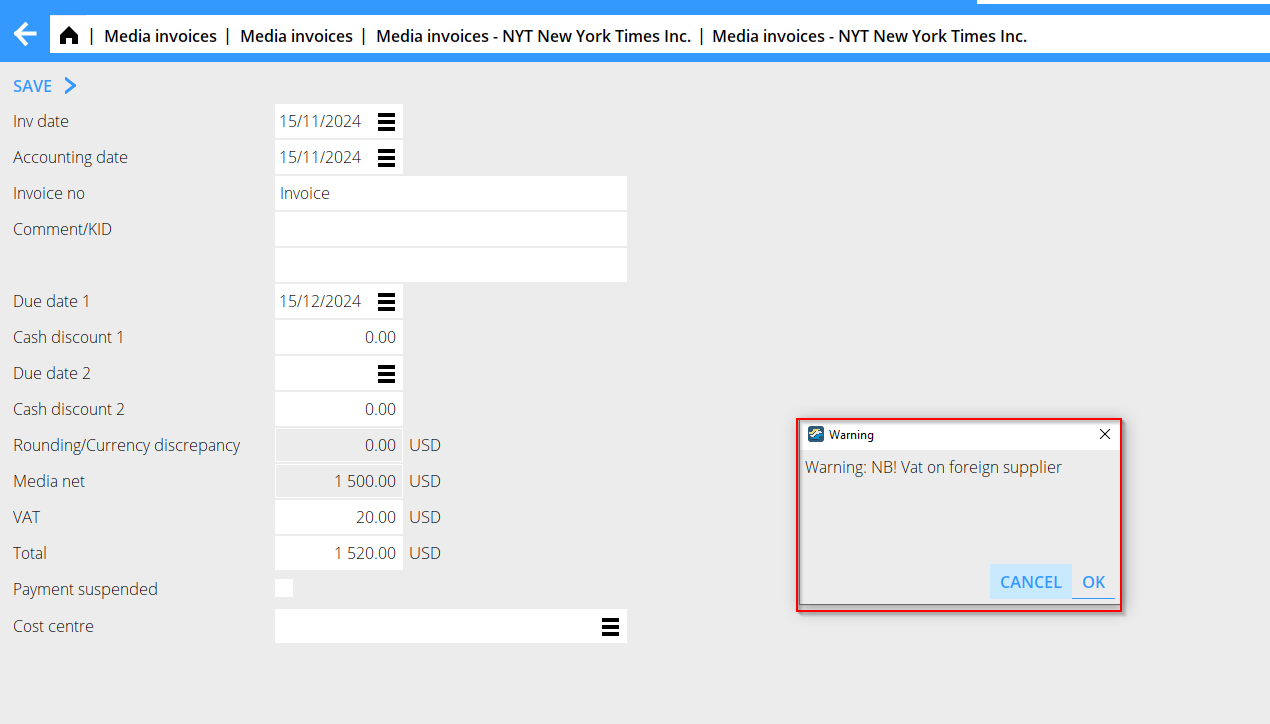

A new warning has been developed, which warns if an invoice from a foreign Supplier is about to be booked with VAT-amount.

The warning is conditioned on the field VAT-code on the Supplier in Base register/Suppliers.

If a Supplier has VAT-code Purchase of services from other EU country, Purchase of goods from EU country Purchase of services outside EU Purchase of goods outside EU, the warning will be displayed when booking invoices in Accounting/Suppliers' invoices, Preliminary entering and Media/Media invoices.

The warning is a soft block, and can be ignored by pressing OK.