Difference between revisions of "Media accounting"

| Line 2: | Line 2: | ||

<translate> |

<translate> |

||

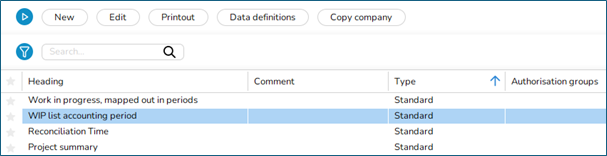

| + | {{ExpandImage|PRO-REP-EN-Bild1.png}} |

||

| − | = Invoicing = <!--T:1--> |

||

| + | Media economy |

||

| + | Invoicing |

||

| − | <!--T:2--> |

||

| − | All invoicing is |

+ | All invoicing is done in Media | Invoicing, including pre-invoicing, deductions and reversals of invoices. |

| + | |||

| + | Various selections can be made based on, for example, insertion date, plan number, client and client category. Invoicing per campaign can also be selected, if used. |

||

| + | If a specific media type or client is invoiced continuously, the selection can be saved so that a new selection does not have to be made each time. The options are located behind the blue arrow. |

||

| + | Different selections and description |

||

| + | |||

| + | Current invoicing Both = includes everything, regardless of whether the agreement has ‘Current invoicing’ or not. Yes = plans/orders that have ‘Current invoicing’ according to the agreement are invoiced. No = only includes agreements that do not have ‘Current invoicing’ checked. |

||

| − | <!--T:3--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild1.png}} |

||

| + | Also not checked If ticked, insertions are included even if they haven’t been ad checked |

||

| − | <!--T:4--> |

||

| + | - if plan- or order number is entered. |

||

| − | You can make different selections such as insertion date, plan number, client, client category etc. If you use invoicing per campaign, it is also possible to select. |

||

| + | No reference no. If Yes, all plans and orders without reference number but the client setting states that it is mandatory, will be invoiced. If Both is selected, everything is printed out but only in a test print. |

||

| + | Debit/credit Blank = everything is printed out. |

||

| + | Debit = Only debit invoices are printed out. |

||

| + | Credit = Only Credit invoices are printed out. |

||

| + | Separately = debit – and credit records are printed on separate invoices. |

||

| + | Corrections Insertions that are marked with Correction (x) can be invoiced peparately or be excluded: |

||

| + | Not corrected + external corrections |

||

| + | External corrections |

||

| + | Not corrected |

||

| + | Not corrected + external corrections separately |

||

| + | Internal corrections |

||

| + | Force one invoice… If selected, the minimum amount for invoice in the client setting will be overruled and an invoice will be printed anyway |

||

| − | <!--T:119--> |

||

| + | Invoice text Possibility to write an invoice text at every invoicing. |

||

| − | {{ExpandImage|MED-EK-EN-Bild2.png}} |

||

| + | |||

| − | <!--T:120--> |

||

| + | Credit invoice |

||

| − | If you invoice a certain media type or client continuously, you can save the selection for the next time. The options for saving are behind the blue arrow. |

||

| + | If the entire invoice is incorrect, it can be credited under the Reversing tab. There, you can also reverse part of the invoice by entering the order number/entry. |

||

| + | |||

| − | <!--T:121--> |

||

| + | Inv.no.series It is possible to set a deviating number series for credit invoices. |

||

| − | {{ExpandImage|MED-EK-EN-Bild3.png}} |

||

| + | Block ins. after rev… Means that after reversal of the invoice, all its insertions are blocked for invoicing. |

||

| − | |||

| − | <!--T:5--> |

||

| − | {| class=mandeflist |

||

| − | !Current invoicing |

||

| − | |If this is left blank, everything is printed out regardless if the agreement has “current invoicing” or not. If you only want to invoice plans/orders with “current invoicing” in their agreements, select Yes. |

||

| − | |- |

||

| − | !Also not checked |

||

| − | |If Yes, insertions will be printed out even if they haven’t been ad checked, provided that plan-/order number has been stated. |

||

| − | |- |

||

| − | !No reference number |

||

| − | |If No here, all orders with reference number are invoiced, provided that the client has “invoice only orders with ref no” activated. |

||

| − | |} |

||

| + | |||

| − | <!--T:6--> |

||

| + | Credit insertion |

||

| − | If Yes, all plans/orders without reference number will be invoiced, provided that the client has stated that it is mandatory. |

||

| + | Orders and single insertions are credited in Media | Plans. Also, corrections are made here. |

||

| + | Open order and insertion. |

||

| + | Select one or several insertions that shall be credited and use the Credit button. |

||

| + | Select type of crediting and press OK. |

||

| + | |||

| + | The insertion will be reversed as a credit insertion and gets a correction mark. Now the credit can be separately invoiced in the current invoicing. |

||

| + | Select if you want to use the previous invoice number as a comment on the credit invoice. |

||

| − | If left blank, everything will be printed out, but only in the test print. |

||

| + | This credit means that the complete insertion including possible insertion fee and capital cost will be credited. To credit an insertion without including insertion fee and capital cost, they can be excluded. Exclude insertion fee in the Other tab on the insertion. |

||

| − | <!--T:8--> |

||

| − | In the base registers’ client record there is a parameter “Invoice only invoices with reference number". When selected, the parameter must be set on Yes. If you select an erroneous combination, you will receive an error message and invoicing will not be allowed. |

||

| + | |||

| − | <!--T:9--> |

||

| + | Exclude capital cost on the insertion. |

||

| − | {| class=mandeflist |

||

| + | |||

| − | !Debit/credit |

||

| + | Credit part of allocation |

||

| − | |Blank = everything is invoiced. |

||

| + | If an allocation exists and only one of the clients shall be credited, the cost must be “moved” to another client. |

||

| − | Debit = Only debit invoices are printed out. |

||

| + | Example The client Toyota Norway shall be credited, and Toyota Sweden shall be debited instead, meaning that Toyota Sweden shall pay the entire cost. |

||

| − | Credit = Only credit invoices are printed out. |

||

| + | |||

| − | Separate = debit- and credit records are invoiced in separate invoices. |

||

| + | Open the order and select the insertion that shall be corrected, press the Credit allocation button. |

||

| − | |- |

||

| + | |||

| − | !Corrections |

||

| + | |||

| − | |Insertions marked with correction (x) can be invoiced separately. |

||

| + | Select the insertion to be credited, press OK. |

||

| − | Yes = include corrections |

||

| + | Open the credit row and write an invoice comment under the Correction tab. |

||

| − | No = don’t include corrections |

||

| + | |||

| − | Separate = invoice ordinary invoicing and corrections on separate invoices |

||

| + | Select the insertion to be debited (the original, not the credit). |

||

| − | Int = only internal corrections |

||

| + | Use Debit allocation and select the client to be debited. |

||

| − | |- |

||

| + | |||

| − | !Force one inv/client |

||

| + | Select the new debit insertion and open. |

||

| − | |If checked, the client’s minimum amount for invoicing is overruled. |

||

| + | An invoice comment can be added in the correction tab. |

||

| − | |} |

||

| + | |||

| + | Save. Two new invoices are printed at the next invoicing. A credit to Toyota Norway and a new debit to Toyota Sweden. |

||

| + | Pre-invoicing |

||

| + | The list under the Pre-invoice tab shows pre-invoice status. Here you can see the invoice amount, how much has been deducted and from which amounts, and the remaining amount. |

||

| + | The Deduction from column shows definitive orders that can be deducted from. |

||

| + | |||

| + | There are two ways to pre-invoice that are managed from the client agreement. |

||

| + | No current pre-invoice deduction The client is pre-invoiced, and a controlled deduction takes place. |

||

| + | Current pre-invoice deduction The client is pre-invoiced, and all definitive insertions are currently deducted. |

||

| + | |||

| + | The parameter setting ”Current pre-invoice deduction per row” should be set to make sure that what is in ”Deduction from” only shall be used. This parameter is in Media | Backoffice | Base registers | Parameters | Invoicing tab. |

||

| + | |||

| + | New pre-invoice |

||

| + | Go to the Pre invoice tab. |

||

| + | |||

| + | Enter client and possible owner. Owner is only used for sorting and filtering in the pre-invoice list. |

||

| + | Write a description. It will be shown in the pre-invoice list. |

||

| + | Block current deduction means that the pre-invoice will not be deducted in the current pre-invoice deduction. |

||

| + | It is possible to deduct from another client, if it belongs to the same collective client. |

||

| + | Select NEW in the Pre-invoices tab. |

||

| + | |||

| + | Fill in text and amount. Select if the pre-invoice shall be subject to VAT or not. The invoice cannot have mixed rows with VAT and VAT-free. |

||

| + | If you know from which plan/order the pre-invoice shall be deducted, you can fill in that in the Deduction from tab. |

||

| + | Deduct all is selected as default but you can remove it an enter plan, order or other to be deducted from. |

||

| + | |||

| + | Save and print the invoice in the Pre-invoice tab. |

||

| + | |||

| + | Pre-invoice deduction |

||

| + | Current pre-invoicing is deducted in the Invoicing tab. |

||

| + | No current pre-invoicing, i.e. a controlled deduction is done in the Pre-invoice deduction tab. Enter the pre-invoice number to be deducted here. Any surplus/deficit will be invoiced in the form of a debit or credit invoice, and the pre-invoiced will be cleared. |

||

| + | Keep in mind When invoicing clients with agreements that states ”Current pre-invoice deduction”, the system takes the oldest pre-invoice and begins with it. If nothing meets the condition set for the pre-invoice, deduction continues with the next pre-invoice and continues until as much as possible can be deducted. |

||

| + | You should therefore link a pre-invoice to a plan/order if you want to be sure that only that plan/those orders are included in the deduction. |

||

| + | Invoice project together with a media invoice |

||

| + | To be able to print a project invoice together with a media invoice, parameter settings must be made in Media | Backoffice | Base registers | Parameters | Invoicing. |

||

| + | |||

| + | Create an invoice in Project | Invoicing and connect the invoice to the media plan in the Parameters tab. |

||

| + | The invoicing is done in media invoicing. |

||

| + | NB! The media invoice print template must be updated so that it fetches information from the project accounting. |

||

| + | |||

| − | <!--T:10--> |

||

| + | Reconcile media discrepancies/Discrepancy handling |

||

| − | General invoice text can be written for each invoicing. |

||

| + | Reconciliation and booking away discrepancies are made in Media | Reconciliation. |

||

| + | You can select on reconciliation codes, owner, client, date among other things. Your choices can be saved as default or as a selection, so that you don’t need to change each time you want to print the list. |

||

| + | |||

| + | Discr. net/Discr. Net-Net |

||

| + | This specifies how large the discrepancies should be to be displayed in the list. |

||

| + | 1–999 999 999 in Discr.Net-Net is specified to avoid seeing all entries without a discrepancy or that are already booked away. |

||

| + | 0–999 999 999 in Diff Net-Net is specified to see all booked away discrepancies. |

||

| + | |||

| + | When reconciling with the media settlement account, only the accounting date is entered, nothing else. The Net-Net amount is reconciled with the media settlement account in, for example, Accounting | Queries, Accounts tab or the Account specification in Accounting | Reports, General Ledger tab. |

||

| + | |||

| + | |||

| − | == Credit/Reverse an invoice == <!--T:11--> |

||

| + | Set up the columns so that the relevant information is visible. The columns are selected using the list button on the far right of the header row. |

||

| + | Open Open the order for deepening. |

||

| + | Create correction Creates a new insertion of the selected insertion’s Net-Net discrepancy – negative or positive depending on the discrepancy. The new insertion can then be sent as an invoice to the client. |

||

| + | Book away See chapter below |

||

| + | Reconciliation code/ Possibility to change reconciliation code or add a comment on the Comment insertion. |

||

| + | Change order no/ A registered media invoice can be moved to a new insertion. Read insertion date more in the chapter below |

||

| + | Change owner/client For changing plan owner or client. A parameter setting is required for change of client on an invoiced insertion. |

||

| + | Show media invoices Shows invoice copy as PDF, if the invoice has been scanned. |

||

| + | Claims If the invoice is erroneous, it can here be sent as a reclamation to the supplier. |

||

| + | |||

| + | Book away discrepancies |

||

| + | Select one or several rows and press Book away. |

||

| + | Enter accounting date. It is also possible to book away a part by changing the amount and also change to optional account. |

||

| + | |||

| + | Move media invoice to another order or insertion date |

||

| + | Use the function Change order number/insertion date for moving an erroneously registered media invoice. Select the order and press the button. |

||

| + | Select the media invoice and enter order number the insertion date into which the invoice shall be moved. It is possible to move it to an existing order number/insertion date. |

||

| + | If only a part of the invoice shall be moved, enter amount. |

||

| + | |||

| − | <!--T:12--> |

||

| + | Agency settlement |

||

| − | If the complete invoice is wrong, you can credit it in the tab Reversing. |

||

| + | For clients whose agreements stipulate that the advertising agency is to receive a share of commissions, fees and charges, Agency is added to the client in order to create an agency settlement. When the agency settlement is printed, a supplier invoice is created and added to the corresponding supplier in the Purchase ledger, which is then paid.. |

||

| − | |||

| + | Set up agency in Media | Backoffice | Base registers | Agencies |

||

| − | <!--T:13--> |

||

| + | Enter the agency on the client in Media | Backoffice | Base registers | Client, Parameters 1 tab. |

||

| − | {{ExpandImage|MED-EK-EN-Bild4.png}} |

||

| + | On the client agreement in Media | Backoffice | Base registers | Agreements, you state how big part/percentage of insertion fee, agency commission and capital cost that shall be forwarded to the agency. |

||

| − | |||

| + | Media | Backoffice | Agency settlement for printing out invoice and agency settlement specification. |

||

| − | <!--T:14--> |

||

| + | Select agency and accounting date or another selection. You can have different selections for different purposes, e.g. if only a certain media shall be settled on a plan. |

||

| − | {| class=mandeflist |

||

| + | |||

| − | !Block insertions |

||

| + | Paid invoices Creates settlement only for paid client invoices. |

||

| − | |Means that when an invoice is reversed, all insertions will be blocked so that they cannot be invoiced. If unchecked, the insertions become definitive and open for corrections and can then be reinvoiced. |

||

| + | Already updated Possibility to reprint the specification. |

||

| − | |- |

||

| + | Reprint All agency settlements can be reprinted. |

||

| − | !Mail clients with … |

||

| − | |Obsolete function. Use Invoice distribution in Accounting: Invoice distribution. |

||

| − | |} |

||

| − | |||

| − | == Credit/Reverse insertions== <!--T:15--> |

||

| − | |||

| − | <!--T:16--> |

||

| − | Open the order and the insertion. Select the insertion you wish to credit and press the option CREDIT. |

||

| − | |||

| − | <!--T:122--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild5.png}} |

||

| − | {{ExpandImage|MED-EK-EN-Bild6.png}} |

||

| − | |||

| − | |||

| − | <!--T:18--> |

||

| − | The insertion is credited, meaning it is classified as a credit insertion and marked with a correction. That means that you can choose to invoice the credit separately in the current invoicing. Choose if the earlier invoice number should be added as a comment. |

||

| − | |||

| − | <!--T:19--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild7.png}} |

||

| − | |||

| − | <!--T:20--> |

||

| − | {| class=mandeflist |

||

| − | This reversal means that the whole insertion, including possible insertion fees and capital cost will be credited. |

||

| − | | |

||

| − | |} |

||

| − | |||

| − | <!--T:21--> |

||

| − | If you want to reverse an insertion without including insertion fee and capital cost, you can exclude these fees. |

||

| − | |||

| − | |||

| − | <!--T:23--> |

||

| − | Exclude insertion fee and/or capital cost in the tab Other within the insertion. |

||

| − | |||

| − | <!--T:123--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild8.png}} |

||

| − | |||

| − | == Credit/Reverse part of allocation == <!--T:24--> |

||

| − | |||

| − | <!--T:25--> |

||

| − | If you have an allocation and you only wish to credit one of the clients, you are practically “moving” the cost to another client. |

||

| − | {| class=mandeflist |

||

| − | !Example: |

||

| − | | |

||

| − | |} |

||

| − | |||

| − | <!--T:26--> |

||

| − | The client SAS Norge shall be credited, and the client SAS Sverige shall be debited instead, meaning the latter shall pay the whole amount. |

||

| − | |||

| − | <!--T:124--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild9.png}} |

||

| − | |||

| − | <!--T:27--> |

||

| − | Proceed like this: |

||

| − | 1. Open the order and select the insertion that shall be corrected. Use CREDIT ALLOCATION. |

||

| − | |||

| − | <!--T:125--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild10.png}} |

||

| − | |||

| − | <!--T:28--> |

||

| − | 2. Select the invoice to be credited, press OK. |

||

| − | |||

| − | |||

| − | <!--T:126--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild11.png}} |

||

| − | |||

| − | <!--T:127--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild12.png}} |

||

| − | |||

| − | <!--T:29--> |

||

| − | 3. Select the insertion to be debited (the original insertion, not the credit). |

||

| − | |||

| − | <!--T:30--> |

||

| − | 4. Use DEBIT ALLOCATION. |

||

| − | |||

| − | <!--T:31--> |

||

| − | 5. Select the post that shall be debited again /SAS Sverige) and press OK. |

||

| − | |||

| − | <!--T:32--> |

||

| − | 6. Select the new debit insertion and open it. Under the tab Correction, change the client to SAS Sweden and write a possible invoice comment. |

||

| − | |||

| − | <!--T:128--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild13.png}} |

||

| − | |||

| − | <!--T:33--> |

||

| − | 7. Save. Two new invoices will be printed out at next invoicing. One credit invoice to SAS Norway and a new debit invoice to SAS Sweden. |

||

| − | |||

| − | == Pre-invoicing == <!--T:129--> |

||

| − | |||

| − | |||

| − | <!--T:35--> |

||

| − | The list in the Pre-invoice tab shows the status of the pre-invoices; the invoice amount, deduction amount and deducted invoices, and remining amount. Deduction from shows definitive orders that are available for deduction |

||

| − | |||

| − | <!--T:36--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild14.png}} |

||

| − | |||

| − | <!--T:39--> |

||

| − | There are two ways to pre-invoice based on the client agreement: |

||

| − | |||

| − | <!--T:40--> |

||

| − | • The client is pre-invoiced and a controlled deduction is made. Not current pre-invoicing. |

||

| − | |||

| − | <!--T:41--> |

||

| − | The client is pre-invoiced, and all definitive insertions are deducted currently. Current pre-invoice deduction. |

||

| − | |||

| − | <!--T:130--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild15.png}} |

||

| − | |||

| − | <!--T:42--> |

||

| − | New pre-invoice: |

||

| − | |||

| − | <!--T:43--> |

||

| − | Make a new pre-invoice in the tab Pre-invoice Note, that it is not possible to deduct pre-invoiced from another client. |

||

| − | |||

| − | <!--T:44--> |

||

| − | Enter client and possible owner (if you want to sort and search within your own in the list) |

||

| − | Block current deduction = the pre-invoiced is not deducted at the current pre-invoice deduction. |

||

| − | |||

| − | |||

| − | <!--T:45--> |

||

| − | In pre-invoices, press NEW. |

||

| − | {{ExpandImage|MED-EK-EN-Bild16.png}} |

||

| − | |||

| − | <!--T:46--> |

||

| − | 3. Enter invoice date, due date and text with amounts. Choose if the pre-invoice is taxable or not. Save and printout in the tab Pre-invoice. |

||

| − | If you already know what plan/order the pre-invoice shall be deducted from, you can fill in that before printing out the invoice. |

||

| − | |||

| − | <!--T:131--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild17.png}} |

||

| − | |||

| − | <!--T:47--> |

||

| − | Deduction from |

||

| − | {{ExpandImage|MED-EK-EN-Bild18.png}} |

||

| − | |||

| − | <!--T:132--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild19.png}} |

||

| − | |||

| − | <!--T:48--> |

||

| − | Enter plan, order or campaign. If you select “Deduct all”, you cannot enter anything in the fields, these are default settings. |

||

| − | {{ExpandImage|MED-EK-EN-Bild20.png}} |

||

| − | |||

| − | <!--T:133--> |

||

| − | The description field can be very useful. |

||

| − | |||

| − | <!--T:50--> |

||

| − | When the time for deduction comes, it is done either in Invoicing (if current deduction) or in the tab Pre-invoice deduction (if controlled deduction). Enter here the pre-invoice number that shall be deducted. Possible surpluses/deficits are invoiced as debit- or credit invoices and the pre-invoice is settled. |

||

| − | |||

| − | <!--T:51--> |

||

| − | {| class=mandeflist |

||

| − | !To keep in mind: |

||

| − | | |

||

| − | |} |

||

| − | |||

| − | <!--T:52--> |

||

| − | When invoicing clients with agreements based on Current pre-invoice deduction, the system starts with the oldest pre-invoice. If there is nothing that matches the conditions for the pre-invoice, it goes to the next one. |

||

| − | |||

| − | |||

| − | = Reconciliation of media discrepancies/ Discrepancy handling = <!--T:55--> |

||

| − | |||

| − | <!--T:56--> |

||

| − | Book away discrepancies in Media: Reconciliation. |

||

| − | {{ExpandImage|MED-EK-EN-Bild21.png}} |

||

| − | |||

| − | <!--T:57--> |

||

| − | You can make a selection based on reconciliation codes, owner, client, date and many other fields. You can save your selection if you use it often. |

||

| − | {{ExpandImage|MED-EK-EN-Bild22.png}} |

||

| − | |||

| − | <!--T:59--> |

||

| − | {| class=mandeflist |

||

| − | !Discr Net /Discr Net-net |

||

| − | |Describes how big discrepancies that shall be shown in the list.If you don’t want to see all the insertions, write 1-999 999 999 in Discr. Net-net. The setting to see booked away discrepancies is 0-999 999 999 in both fields. |

||

| − | |} |

||

| − | {{ExpandImage|MED-EK-EN-Bild23.png}} |

||

| − | |||

| − | <!--T:60--> |

||

| − | The amount in the list showing Discr Net-net is reconciled with the media deduction account. |

||

| − | Select only “to accounting date” if you want to reconcile with the deduction account, nothing else. |

||

| − | {{ExpandImage|MED-EK-EN-Bild24.png}} |

||

| − | {{ExpandImage|MED-EK-EN-Bild25.png}} |

||

| − | |||

| − | <!--T:61--> |

||

| − | Order the column so that you can see all relevant information. Use the arrow on the right in heading row to see all column options. |

||

| − | |||

| − | |||

| − | <!--T:64--> |

||

| − | {| class=mandeflist |

||

| − | !Open |

||

| − | |Open the order to deepen into it |

||

| − | |- |

||

| − | !Create corrections |

||

| − | |Creates a new insertion of the selected insertion's net-net discrepancy, depending on the discrepancy either a negative or a positive one. The new insertion can later be invoiced to client. |

||

| − | |- |

||

| − | !Book away |

||

| − | |See below. |

||

| − | |- |

||

| − | !Reconciling code |

||

| − | |Changeable. |

||

| − | |- |

||

| − | !Reconciling comment |

||

| − | |Possibility to add or edit comments. |

||

| − | |- |

||

| − | !Change order number/ins. date |

||

| − | |Here you can move the media invoice of the insertion to another insertion. See further description below. |

||

| − | |- |

||

| − | !Change owner/client |

||

| − | |Change owner or client. This requires a parameter setting that allows change. |

||

| − | |- |

||

| − | !Show invoice |

||

| − | |Shows an invoice copy in PDF format, if the invoice has been scanned. |

||

| − | |- |

||

| − | !Printout |

||

| − | |Prints the reconciling list. Requires a special print template from Kalin Setterberg. |

||

| − | |} |

||

| − | |||

| − | == Book away discrepancies == <!--T:65--> |

||

| − | |||

| − | <!--T:66--> |

||

| − | Select one or several rows and click on BOOK AWAY. |

||

| − | |||

| − | <!--T:67--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild26.png}} |

||

| − | |||

| − | <!--T:68--> |

||

| − | Enter accounting date. You can also book away only a part of the amount by changing the amount, as well as the account. |

||

| − | {{ExpandImage|MED-EK-EN-Bild27.png}} |

||

| − | |||

| − | = Move media invoice to another order or insertion date. = <!--T:71--> |

||

| − | |||

| − | <!--T:72--> |

||

| − | The function Change order number/insertion date is used for moving an invoice that has been erroneously registered. Select the order and click on the function. Enter the media invoice (searchable in the list) and the order number and insertion date, where the invoice shall be moved. It is only possible to move to an existing order and insertion date. If only a part of the invoice shall be moved, enter amount. |

||

| − | {{ExpandImage|MED-EK-EN-Bild28.png}} |

||

| − | {{ExpandImage|MED-EK-EN-Bild29.png}} |

||

| − | |||

| − | |||

| − | = Agency settlement = <!--T:76--> |

||

| − | |||

| − | <!--T:77--> |

||

| − | For clients, whose agreements allow a part of the commission, working fee and other fees to the advertising agency, the agency on the client is used for an agency settlement. When printing the settlement, a supplier invoice is created on the corresponding supplier in the purchase ledger. It will later be paid as a normal supplier’s invoice. |

||

| − | Create agency in Base registers/MED/Agencies. |

||

| − | {{ExpandImage|MED-EK-EN-Bild30.png}} |

||

| − | |||

| − | <!--T:79--> |

||

| − | In the client record in Base registers/MED/Clients, enter the agency in the tab Parameters 1. |

||

| − | |||

| − | <!--T:80--> |

||

| − | On the client agreement in Base registers/MED/Agreements, state how big part/how many percent units of insertion fee, agency commission and capital cost you want to pass on to the advertising agency. |

||

| − | The invoice and the agency settlement document are printed out under Agency settlement |

||

| − | |||

| − | <!--T:82--> |

||

| − | {{ExpandImage|MED-EK-EN-Bild31.png}} |

||

| − | {{ExpandImage|MED-EK-EN-Bild32.png}} |

||

| − | |||

| − | |||

| − | <!--T:83--> |

||

| − | Select agency and accounting date or other selection. You can make different selections if for example a certain media only shall be settled against a certain plan. |

||

| − | |||

| − | <!--T:84--> |

||

| − | {| class=mandeflist |

||

| − | !Paid invoices |

||

| − | |If selected, only paid client invoices are taken into the settlement |

||

| − | |- |

||

| − | !Already updated |

||

| − | |If selected, it is possible to reprint the specification |

||

| − | |- |

||

| − | !Reprint |

||

| − | |All agency settlements can be reprinted. |

||

| − | |} |

||

| − | |||

| − | = Invoice projects together with the media invoice = <!--T:87--> |

||

| − | |||

| − | <!--T:88--> |

||

| − | If you want to invoice project invoices together with media invoices, you have to activate a parameter in Media/Parameters/invoicing. The invoicing is made in the media invoicing part and in the project invoicing part you state on the invoice, which plan the invoice concerns. Create an invoice as normally in Adjusting/Invoicing and connect it to a plan in the tab Parameters. |

||

| − | |||

| − | <!--T:90--> |

||

| − | The media invoice template must be updated such that it fetches information from the Project accounting. |

||

| − | <!--T:118--> |

||

| − | [[Category:MED-EK-EN]] [[Category:Manuals]] [[Category:Media]] |

||

</translate> |

</translate> |

||

Revision as of 15:53, 22 January 2026

Invoicing All invoicing is done in Media | Invoicing, including pre-invoicing, deductions and reversals of invoices.

Various selections can be made based on, for example, insertion date, plan number, client and client category. Invoicing per campaign can also be selected, if used. If a specific media type or client is invoiced continuously, the selection can be saved so that a new selection does not have to be made each time. The options are located behind the blue arrow. Different selections and description

Current invoicing Both = includes everything, regardless of whether the agreement has ‘Current invoicing’ or not. Yes = plans/orders that have ‘Current invoicing’ according to the agreement are invoiced. No = only includes agreements that do not have ‘Current invoicing’ checked.

Also not checked If ticked, insertions are included even if they haven’t been ad checked

- if plan- or order number is entered.

No reference no. If Yes, all plans and orders without reference number but the client setting states that it is mandatory, will be invoiced. If Both is selected, everything is printed out but only in a test print. Debit/credit Blank = everything is printed out. Debit = Only debit invoices are printed out. Credit = Only Credit invoices are printed out. Separately = debit – and credit records are printed on separate invoices. Corrections Insertions that are marked with Correction (x) can be invoiced peparately or be excluded: Not corrected + external corrections External corrections Not corrected Not corrected + external corrections separately Internal corrections

Force one invoice… If selected, the minimum amount for invoice in the client setting will be overruled and an invoice will be printed anyway Invoice text Possibility to write an invoice text at every invoicing.

Credit invoice If the entire invoice is incorrect, it can be credited under the Reversing tab. There, you can also reverse part of the invoice by entering the order number/entry.

Inv.no.series It is possible to set a deviating number series for credit invoices.

Block ins. after rev… Means that after reversal of the invoice, all its insertions are blocked for invoicing.

Credit insertion Orders and single insertions are credited in Media | Plans. Also, corrections are made here. Open order and insertion. Select one or several insertions that shall be credited and use the Credit button. Select type of crediting and press OK.

The insertion will be reversed as a credit insertion and gets a correction mark. Now the credit can be separately invoiced in the current invoicing. Select if you want to use the previous invoice number as a comment on the credit invoice.

This credit means that the complete insertion including possible insertion fee and capital cost will be credited. To credit an insertion without including insertion fee and capital cost, they can be excluded. Exclude insertion fee in the Other tab on the insertion.

Exclude capital cost on the insertion.

Credit part of allocation If an allocation exists and only one of the clients shall be credited, the cost must be “moved” to another client. Example The client Toyota Norway shall be credited, and Toyota Sweden shall be debited instead, meaning that Toyota Sweden shall pay the entire cost.

Open the order and select the insertion that shall be corrected, press the Credit allocation button.

Select the insertion to be credited, press OK.

Open the credit row and write an invoice comment under the Correction tab.

Select the insertion to be debited (the original, not the credit). Use Debit allocation and select the client to be debited.

Select the new debit insertion and open. An invoice comment can be added in the correction tab.

Save. Two new invoices are printed at the next invoicing. A credit to Toyota Norway and a new debit to Toyota Sweden. Pre-invoicing The list under the Pre-invoice tab shows pre-invoice status. Here you can see the invoice amount, how much has been deducted and from which amounts, and the remaining amount. The Deduction from column shows definitive orders that can be deducted from.

There are two ways to pre-invoice that are managed from the client agreement. No current pre-invoice deduction The client is pre-invoiced, and a controlled deduction takes place. Current pre-invoice deduction The client is pre-invoiced, and all definitive insertions are currently deducted.

The parameter setting ”Current pre-invoice deduction per row” should be set to make sure that what is in ”Deduction from” only shall be used. This parameter is in Media | Backoffice | Base registers | Parameters | Invoicing tab. New pre-invoice Go to the Pre invoice tab.

Enter client and possible owner. Owner is only used for sorting and filtering in the pre-invoice list. Write a description. It will be shown in the pre-invoice list. Block current deduction means that the pre-invoice will not be deducted in the current pre-invoice deduction. It is possible to deduct from another client, if it belongs to the same collective client. Select NEW in the Pre-invoices tab.

Fill in text and amount. Select if the pre-invoice shall be subject to VAT or not. The invoice cannot have mixed rows with VAT and VAT-free. If you know from which plan/order the pre-invoice shall be deducted, you can fill in that in the Deduction from tab. Deduct all is selected as default but you can remove it an enter plan, order or other to be deducted from.

Save and print the invoice in the Pre-invoice tab.

Pre-invoice deduction Current pre-invoicing is deducted in the Invoicing tab. No current pre-invoicing, i.e. a controlled deduction is done in the Pre-invoice deduction tab. Enter the pre-invoice number to be deducted here. Any surplus/deficit will be invoiced in the form of a debit or credit invoice, and the pre-invoiced will be cleared. Keep in mind When invoicing clients with agreements that states ”Current pre-invoice deduction”, the system takes the oldest pre-invoice and begins with it. If nothing meets the condition set for the pre-invoice, deduction continues with the next pre-invoice and continues until as much as possible can be deducted. You should therefore link a pre-invoice to a plan/order if you want to be sure that only that plan/those orders are included in the deduction. Invoice project together with a media invoice To be able to print a project invoice together with a media invoice, parameter settings must be made in Media | Backoffice | Base registers | Parameters | Invoicing.

Create an invoice in Project | Invoicing and connect the invoice to the media plan in the Parameters tab. The invoicing is done in media invoicing. NB! The media invoice print template must be updated so that it fetches information from the project accounting.

Reconcile media discrepancies/Discrepancy handling Reconciliation and booking away discrepancies are made in Media | Reconciliation. You can select on reconciliation codes, owner, client, date among other things. Your choices can be saved as default or as a selection, so that you don’t need to change each time you want to print the list.

Discr. net/Discr. Net-Net This specifies how large the discrepancies should be to be displayed in the list. 1–999 999 999 in Discr.Net-Net is specified to avoid seeing all entries without a discrepancy or that are already booked away. 0–999 999 999 in Diff Net-Net is specified to see all booked away discrepancies.

When reconciling with the media settlement account, only the accounting date is entered, nothing else. The Net-Net amount is reconciled with the media settlement account in, for example, Accounting | Queries, Accounts tab or the Account specification in Accounting | Reports, General Ledger tab.

Set up the columns so that the relevant information is visible. The columns are selected using the list button on the far right of the header row. Open Open the order for deepening. Create correction Creates a new insertion of the selected insertion’s Net-Net discrepancy – negative or positive depending on the discrepancy. The new insertion can then be sent as an invoice to the client. Book away See chapter below Reconciliation code/ Possibility to change reconciliation code or add a comment on the Comment insertion. Change order no/ A registered media invoice can be moved to a new insertion. Read insertion date more in the chapter below Change owner/client For changing plan owner or client. A parameter setting is required for change of client on an invoiced insertion. Show media invoices Shows invoice copy as PDF, if the invoice has been scanned. Claims If the invoice is erroneous, it can here be sent as a reclamation to the supplier. Book away discrepancies Select one or several rows and press Book away. Enter accounting date. It is also possible to book away a part by changing the amount and also change to optional account.

Move media invoice to another order or insertion date Use the function Change order number/insertion date for moving an erroneously registered media invoice. Select the order and press the button. Select the media invoice and enter order number the insertion date into which the invoice shall be moved. It is possible to move it to an existing order number/insertion date. If only a part of the invoice shall be moved, enter amount.

Agency settlement

For clients whose agreements stipulate that the advertising agency is to receive a share of commissions, fees and charges, Agency is added to the client in order to create an agency settlement. When the agency settlement is printed, a supplier invoice is created and added to the corresponding supplier in the Purchase ledger, which is then paid..

Set up agency in Media | Backoffice | Base registers | Agencies

Enter the agency on the client in Media | Backoffice | Base registers | Client, Parameters 1 tab.

On the client agreement in Media | Backoffice | Base registers | Agreements, you state how big part/percentage of insertion fee, agency commission and capital cost that shall be forwarded to the agency.

Media | Backoffice | Agency settlement for printing out invoice and agency settlement specification.

Select agency and accounting date or another selection. You can have different selections for different purposes, e.g. if only a certain media shall be settled on a plan.

Paid invoices Creates settlement only for paid client invoices. Already updated Possibility to reprint the specification. Reprint All agency settlements can be reprinted.