Difference between revisions of "Media accounting/sv"

(Updating to match new version of source page) |

|||

| Line 1: | Line 1: | ||

<htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

<htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

||

| − | __FORCETOC__ |

||

| − | =Fakturering= |

||

| + | = Media Accounting = |

||

| − | All fakturering sker under MEDIA/FAKTURERING, även a-conto-fakturering och avräkningar. |

||

| + | ==Invoicing== |

||

| − | {{ExpandImage|MED-EK-SV-Bild1.png}} |

||

| + | All invoicing is done in Media | Invoicing, including pre-invoicing, deductions and reversals of invoices. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild1.png}} |

||

| − | Olika selekteringar kan göras på införingsdatum, plannummer, kund, kundkategori osv. Även fakturering per kampanj om detta används. |

||

| + | |||

| + | Various selections can be made based on, for example, insertion date, plan number, client and client category. Invoicing per campaign can also be selected, if used. |

||

| + | If a specific media type or client is invoiced continuously, the selection can be saved so that a new selection does not have to be made each time. The options are located behind the blue arrow. |

||

| − | {{ExpandImage|MED-EK-SV-Bild2.png}} |

||

| + | ===Different selections and description=== |

||

| − | Fakturerar man en specifik medietyp eller kund kontinuerligt kan man spara urvalet och då inte behöva ange ny selektering varje gång. Valen finns bakom den blå pilen. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild2.png}} |

| − | {| |

+ | {|class=mandeflist |

| + | !Current invoicing |

||

| − | !Löpande fakturering |

||

| + | |Both = includes everything, regardless of whether the agreement has ‘Current invoicing’ or not. Yes = plans/orders that have ‘Current invoicing’ according to the agreement are invoiced. No = only includes agreements that do not have ‘Current invoicing’ checked. |

||

| − | |Om man sätter blankt kommer allt ut oavsett om avtalet har "Löpande fakturering"eller ej. Vill man bara fakturera ut de planer/ordrar som enligt avtal har "löpandefakturering skall valet vara Ja. |

||

|- |

|- |

||

| + | !Also not checked |

||

| − | !Även ej kontrollerade |

||

| + | |If ticked, insertions are included even if they haven’t been ad checked - if plan- or order number is entered. |

||

| − | |Sätter man Ja kommer införande med även om de inte är annonskontrollerade under förutsättning att man anger plan eller ordernummer. |

||

|- |

|- |

||

| + | !No reference no. |

||

| − | !Ref-nr saknas |

||

| + | |If Yes, all plans and orders without reference number but the client setting states that it is mandatory, will be invoiced. If Both is selected, everything is printed out but only in a test print. |

||

| − | |Om Nej så faktureras ordrar där ett referensnummer ligger inlagt - då parametern på kunden "Fakturera bara ordrar med ref. nr" är ikryssad. |

||

| − | | |

+ | |- |

| + | !Debit/credit |

||

| + | |Blank = everything is printed out. |

||

| + | Debit = Only debit invoices are printed out. |

||

| − | Om Ja, faktureras alla planer/ordrar där referensnummer är blankt och där man dessutom på kunden har sagt att det måste anges. |

||

| − | Om Referensnummer saknas = blankt kommer allt ut men endast vid provutskrift. |

||

| + | Credit = Only Credit invoices are printed out. |

||

| − | I Basregister på kunden finns en parameter "Fakturera bara ordrar med ref. nr". När denna är vald måste parametern vara J. Vid felaktig kombination av val kommer ett felmeddelande upp och fakturering tillåts inte. |

||

| + | Separately = debit – and credit records are printed on separate invoices. |

||

| − | {| class=mandeflist |

||

| − | !Debet/kredit |

||

| − | |Blank= allt faktureras ut. Debet = bara debetfakturor skrivs ut. Kredit = endast kreditfakturor skrivs ut.Separat = debet-och kreditposter faktureras ut på separata fakturor. |

||

|- |

|- |

||

| + | !Corrections |

||

| − | !Korrigeringar |

||

| + | |Insertions that are marked with Correction (x) can be invoiced peparately or be excluded: |

||

| − | |Införanden som markerats med korrigering (x) kan faktureras ut separat. Ja = tag med korrigeringar.|Nej = tag inte med korrigeringar. Separat = fakturera ordinarie fakturering och korrigeringar på separata fakturor. |

||

| + | Not corrected + external corrections |

||

| − | |- |

||

| − | !Tvinga fram en faktura/kund |

||

| − | |Genom att markera överstyr man kundens minibelopp för faktura. |

||

| − | |} |

||

| + | External corrections |

||

| − | Allmän fakturatext kan man skriva in inför varje fakturering. |

||

| + | Not corrected |

||

| − | == Kreditera faktura == |

||

| + | Not corrected + external corrections separately |

||

| − | Om hela fakturan blivit fel kan den krediteras under fliken Vändning. |

||

| + | Internal corrections |

||

| − | {{ExpandImage|MED-EK-SV-Bild4.png}} |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !Stoppa inf. för fakt. |

||

| − | |innebär att vid vändning av fakturan så stoppas alla införande för fakturering. Om okryssad blir införandena definitiva och kan korrigeras samt faktureras igen. |

||

|- |

|- |

||

| + | !Force one invoice… |

||

| − | !Maila kunder med mailadress för fakturor |

||

| + | |If selected, the minimum amount for invoice in the client setting will be overruled and an invoice will be printed anyway |

||

| − | |Fungerar ej. För att mejla fakturor gå till {{pth|Ekonomi|Fakturadistribution}} (se separat manual). |

||

| + | |- |

||

| + | !Invoice text |

||

| + | |Possibility to write an invoice text at every invoicing. |

||

|} |

|} |

||

| + | |||

| − | == Kreditera införande == |

||

| + | == Credit an invoice == |

||

| + | If the entire invoice is incorrect, it can be credited under the Reversing tab. There, you can also reverse part of the invoice by entering the order number/entry. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild3.png}} |

||

| − | Öppna order och införande. Markera det införande som skall krediteras och använd knappen Kreditera. |

||

| + | {|class=mandeflist |

||

| − | {{ExpandImage|MED-EK-SV-Bild5.png}} |

||

| + | !Inv.no.series |

||

| − | {{ExpandImage|MED-EK-SV-Bild6.png}} |

||

| + | |It is possible to set a deviating number series for credit invoices. |

||

| + | |- |

||

| + | !Block ins. after rev… |

||

| + | |Means that after reversal of the invoice, all its insertions are blocked for invoicing. |

||

| + | |} |

||

| + | |||

| + | == Credit an insertion == |

||

| + | Orders and single insertions are credited in Media | Plans. Also, corrections are made here. |

||

| + | * Open order and insertion. |

||

| + | * Select one or several insertions that shall be credited and use the Credit button. |

||

| + | * Select type of crediting and press OK. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild4.png}} |

||

| − | Införandet vänds, det vill säga läggs som ett kreditförande och får en korrigeringsmärkning. Den innebär att man kan välja att fakturera ut denna kredit separat i den löpande faktureringen. |

||

| + | |||

| − | Välj om referens till tidigare fakturanummer skall läggas till som kommentar. |

||

| + | The insertion will be reversed as a credit insertion and gets a correction mark. Now the credit can be separately invoiced in the current invoicing. |

||

| + | * Select if you want to use the previous invoice number as a comment on the credit invoice. |

||

| − | {{ExpandImage|MED-EK-SV-Bild7.png}} |

||

| + | {{ExpandImage|MED-ACC-EN-Bild5.png}} |

||

| − | Denna kreditering innebär att hela införandet inkl. ev. Införingsavgift och kapitalkostnad krediteras. |

||

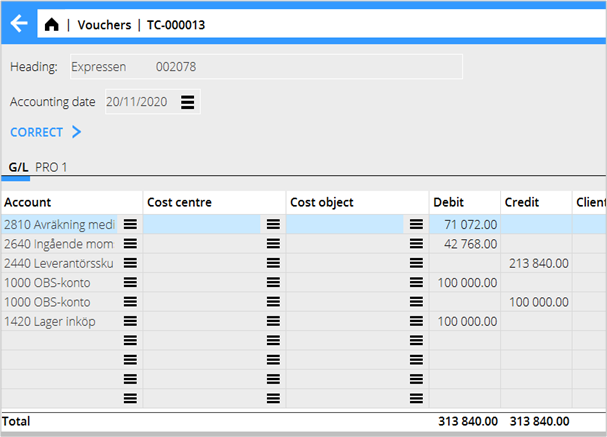

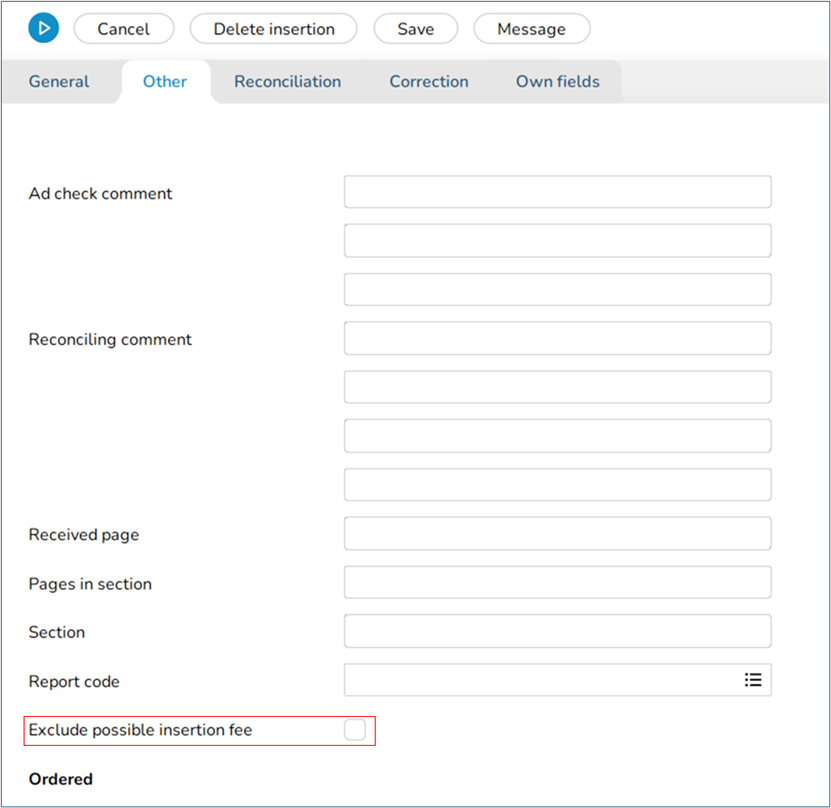

| + | This credit means that the complete insertion including possible insertion fee and capital cost will be credited. To credit an insertion without including insertion fee and capital cost, they can be excluded. Exclude insertion fee in the Other tab on the insertion. |

||

| − | För att kreditera ett införande utan att ta med införingsavgift och kapitalkostnad kan man ''undertrycka'' dessa avgifter. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild6.png}} |

||

| + | |||

| + | Exclude capital cost on the insertion. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild7.png}} |

||

| − | Undertryck (välj bort) införingsavgift och /eller kapitalkostnad under fliken Övrigt inne på införandet. |

||

| + | |||

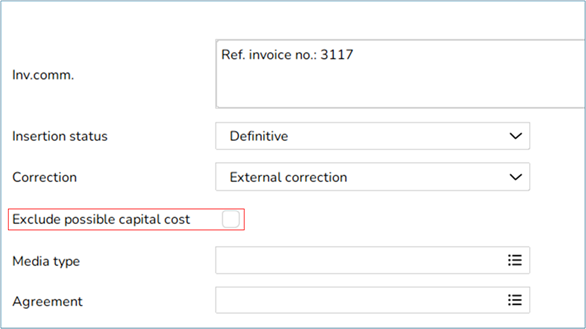

| + | == Credit part of allocation == |

||

| + | If an allocation exists and only one of the clients shall be credited, the cost must be “moved” to another client. |

||

| + | '''Example''' The client Toyota Norway shall be credited, and Toyota Sweden shall be debited instead, meaning that Toyota Sweden shall pay the entire cost. |

||

| − | {{ExpandImage|MED-EK-SV-Bild8.png}} |

||

| + | {{ExpandImage|MED-ACC-EN-Bild8.png}} |

||

| − | == Kreditera del av fördelning == |

||

| + | |||

| + | * Open the order and select the insertion that shall be corrected, press the Credit allocation button. |

||

| + | |||

| + | {{ExpandImage|MED-ACC-EN-Bild9.png}} |

||

| + | {{ExpandImage|MED-ACC-EN-Bild10.png}} |

||

| − | Om man har en fördelning och bara skall kreditera en av kunderna innebär att man ”flyttar” kostnaden till annan kund. |

||

| + | |||

| + | * Select the insertion to be credited, press OK. |

||

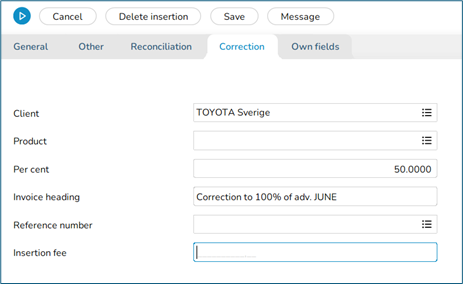

| + | * Open the credit row and write an invoice comment under the Correction tab. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild11.png}} |

||

| − | Exempel: |

||

| + | |||

| + | * Select the insertion to be debited (the original, not the credit). |

||

| + | * Use Debit allocation and select the client to be debited. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild12.png}} |

||

| − | Kunden Sas Norge skall krediteras och istället debiteras kunden SAS Sverige, SAS Sverige skall alltså betala hela kostnaden. |

||

| + | |||

| + | * Select the new debit insertion and open. |

||

| + | * An invoice comment can be added in the correction tab. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild13.png}} |

| + | |||

| + | * Save. Two new invoices are printed at the next invoicing. A credit to Toyota Norway and a new debit to Toyota Sweden. |

||

| + | == Pre-invoicing == |

||

| − | 1. Öppna ordern och markera det införande som skall korrigeras. Använd Kreditera fördelning. |

||

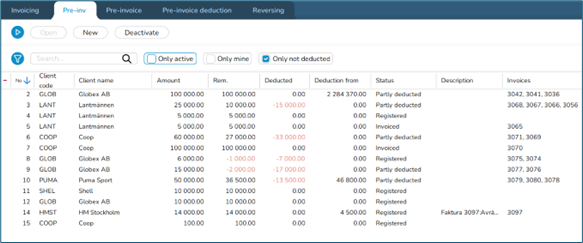

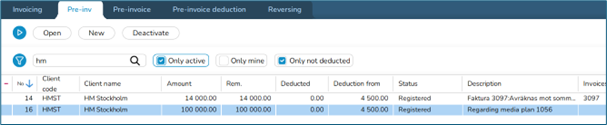

| + | The list under the Pre-invoice tab shows pre-invoice status. Here you can see the invoice amount, how much has been deducted and from which amounts, and the remaining amount. |

||

| + | The Deduction from column shows definitive orders that can be deducted from. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild14.png}} |

| + | |||

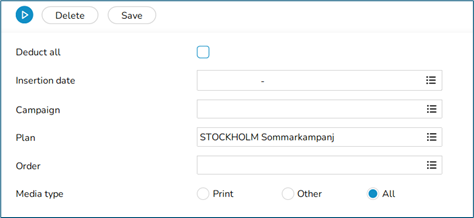

| + | There are two ways to pre-invoice that are managed from the client agreement. |

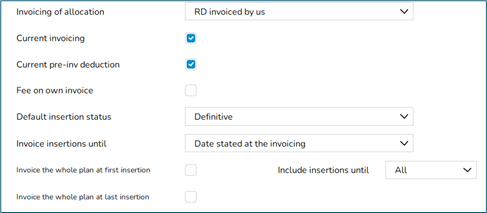

||

| + | '''No current pre-invoice deduction''' The client is pre-invoiced, and a controlled deduction takes place. |

||

| + | '''Current pre-invoice deduction''' The client is pre-invoiced, and all definitive insertions are currently deducted. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild15.png}} |

||

| − | 2. Markera den faktura som skall krediteras och tryck OK. |

||

| + | |||

| + | The parameter setting ”Current pre-invoice deduction per row” should be set to make sure that what is in ”Deduction from” only shall be used. This parameter is in Media | Backoffice | Base registers | Parameters | Invoicing tab. |

||

| + | |||

| + | ===New pre-invoice=== |

||

| + | * Go to the Pre invoice tab. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild16.png}} |

||

| + | |||

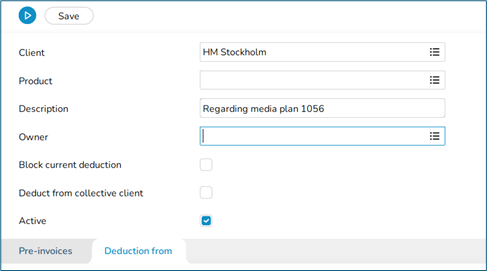

| + | * Enter client and possible owner. Owner is only used for sorting and filtering in the pre-invoice list. |

||

| + | * Write a description. It will be shown in the pre-invoice list. |

||

| + | * Block current deduction means that the pre-invoice will not be deducted in the current pre-invoice deduction. |

||

| + | * It is possible to deduct from another client, if it belongs to the same collective client. |

||

| + | * Select NEW in the Pre-invoices tab. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild17.png}} |

| + | |||

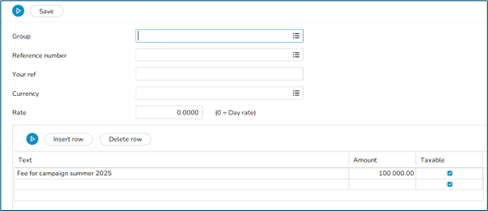

| + | * Fill in text and amount. Select if the pre-invoice shall be subject to VAT or not. The invoice cannot have mixed rows with VAT and VAT-free. |

||

| + | * If you know from which plan/order the pre-invoice shall be deducted, you can fill in that in the Deduction from tab. |

||

| + | * Deduct all is selected as default but you can remove it an enter plan, order or other to be deducted from. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild18.png}} |

| + | |||

| + | * Save and print the invoice in the Pre-invoice tab. |

||

| + | |||

| + | === Pre-invoice deduction === |

||

| + | '''Current pre-invoicing''' is deducted in the Invoicing tab. |

||

| + | '''No current pre-invoicing''', i.e. a controlled deduction is done in the Pre-invoice deduction tab. Enter the pre-invoice number to be deducted here. Any surplus/deficit will be invoiced in the form of a debit or credit invoice, and the pre-invoiced will be cleared. |

||

| − | 3. Markera införandet som skall debiteras. (ursprungliga införandet, ej krediteringen) |

||

| + | '''Keep in mind''' When invoicing clients with agreements that states ”Current pre-invoice deduction”, the system takes the oldest pre-invoice and begins with it. If nothing meets the condition set for the pre-invoice, deduction continues with the next pre-invoice and continues until as much as possible can be deducted. |

||

| − | 4. Använd Debitera fördelning. |

||

| + | You should therefore link a pre-invoice to a plan/order if you want to be sure that only that plan/those orders are included in the deduction. |

||

| − | 5. Markera den post som skall debiteras på nytt och OK. (SAS Sverige-delen) |

||

| + | |||

| + | == Invoice project together with a media invoice == |

||

| − | 6. Markera det nya debetinförandet och öppna. Under fliken korrigering skall kund ändras till SAS Sverige och en ev. fakturakommentar kan läggas till. |

||

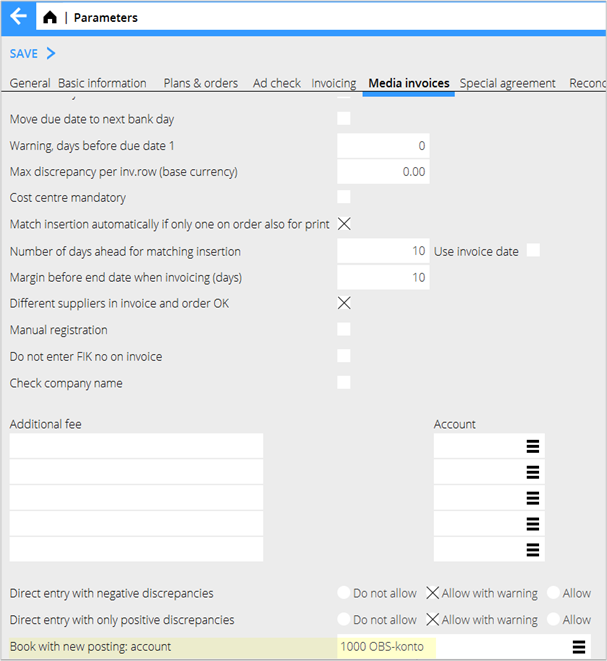

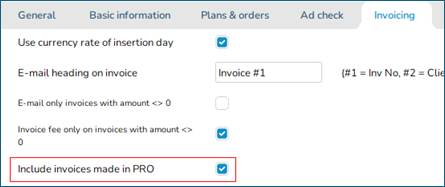

| + | To be able to print a project invoice together with a media invoice, parameter settings must be made in Media | Backoffice | Base registers | Parameters | Invoicing. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild19.png}} |

| + | |||

| + | * Create an invoice in Project | Invoicing and connect the invoice to the media plan in the Parameters tab. |

||

| + | * The invoicing is done in media invoicing. |

||

| + | '''NB!''' The media invoice print template must be updated so that it fetches information from the project accounting. |

||

| + | |||

| − | Spara. Två nya fakturor skrivs ut vid nästa fakturering. En kredit till SAS Norge och en ny debitering till SAS Sverige. |

||

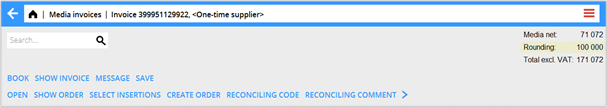

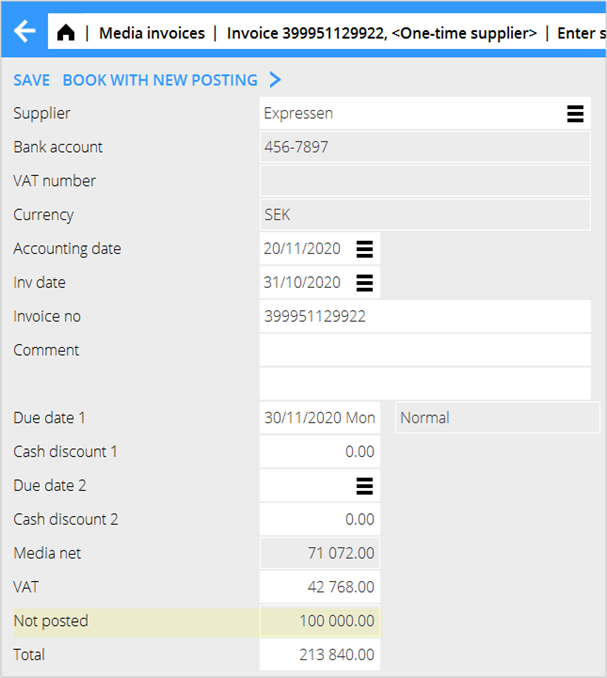

| + | == Reconcile media discrepancies/Discrepancy handling== |

||

| + | Reconciliation and booking away discrepancies are made in Media | Reconciliation. |

||

| + | You can select on reconciliation codes, owner, client, date among other things. Your choices can be saved as default or as a selection, so that you don’t need to change each time you want to print the list. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild20.png}} |

||

| − | == Acontofakturering == |

||

| + | |||

| + | '''Discr. net/Discr. Net-Net''' |

||

| + | This specifies how large the discrepancies should be to be displayed in the list. |

||

| + | 1–999 999 999 in Discr.Net-Net is specified to avoid seeing all entries without a discrepancy or that are already booked away. |

||

| + | 0–999 999 999 in Diff Net-Net is specified to see all booked away discrepancies. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild21.png}} |

||

| − | Listan under A-conto fliken visar status på a-contot. Hur mycket fakturan är utställd på, vad som har blivit avräknat och mot vilka fakturor. Och restbelopp. Avräknas mot visar definitiva order som kan räknas av. |

||

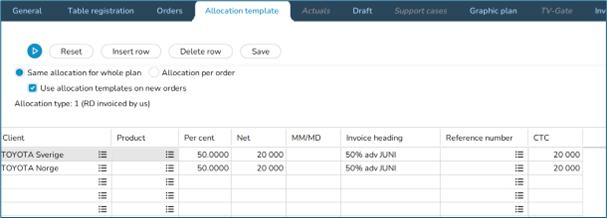

| + | When reconciling with the media settlement account, only the accounting date is entered, nothing else. The Net-Net amount is reconciled with the media settlement account in, for example, Accounting | Queries, Accounts tab or the Account specification in Accounting | Reports, General Ledger tab. |

||

| − | {{ExpandImage|MED-EK-SV-Bild14.png}} |

||

| + | {{ExpandImage|MED-ACC-EN-Bild22.png}} |

||

| − | Det finns två sätt att fakturera a-conto som styrs från kundavtalet: |

||

| + | {{ExpandImage|MED-ACC-EN-Bild23.png}} |

||

| − | * Kunden förskottsfaktureras och en kontrollerad avräkning sker.'''Ej löpande a-conto-avräkning.''' |

||

| + | |||

| − | |||

| + | Set up the columns so that the relevant information is visible. The columns are selected using the list button on the far right of the header row. |

||

| − | * Kunden förskottsfaktureras och alla definitiva införanden räknas av löpande. '''Löpande a-conto-avräkning.''' |

||

| + | {|class=mandeflist |

||

| − | |||

| + | !Open |

||

| − | {{ExpandImage|MED-EK-SV-Bild15.png}} |

||

| + | |Open the order for deepening. |

||

| − | |||

| − | Lägg upp ett nytt a-conto: |

||

| − | |||

| − | Lägg upp ett a-conto under fliken A-conto Observera att man inte kan räkna av ett a-conto mot en annan kund. |

||

| − | |||

| − | Ange kund och ev. ägare. Ägare endast för att kunna sortera och filtrera på egna i listan. |

||

| − | Spärra löpande avräkning = a-contot räknas inte av vid den löpande a-contoavräkningen. |

||

| − | |||

| − | |||

| − | Ange NY under a-contofakturor. |

||

| − | {{ExpandImage|MED-EK-SV-Bild16.png}} |

||

| − | |||

| − | Ange fakturadatum, förfallodatum och text med belopp. Markera om detta a-conto skall vara momspliktigt eller ej. Spara och skriv ut fakturan under fliken A-contofaktura. |

||

| − | Vet man redan mot vilken plan/order detta a-conto skall avräknas mot kan man fylla i det direkt innan man skriver ut fakturan |

||

| − | |||

| − | {{ExpandImage|MED-EK-SV-Bild17.png}} |

||

| − | |||

| − | Avräknas mot |

||

| − | |||

| − | {{ExpandImage|MED-EK-SV-Bild18.png}} |

||

| − | |||

| − | {{ExpandImage|MED-EK-SV-Bild19.png}} |

||

| − | |||

| − | Ange Plan, order eller kampanj. ''Om man markerar Avräkna allt är det inte möjligt att ange något i fälten.'' |

||

| − | {{ExpandImage|MED-EK-SV-Bild20.png}} |

||

| − | |||

| − | Använd med fördel beskrivningsfältet. |

||

| − | |||

| − | När det sedan är dags för avräkning görs det under Fakturering (vid löpande a-contoavräkning) eller under fliken A-contoavräkning om det gäller en kontrollerad avräkning. Här anges a-contonumret som ska räknas av. Eventuell över-/underskott faktureras ut i form av en debet eller kreditfaktura och a-contot töms |

||

| − | |||

| − | === Att tänka på: === |

||

| − | |||

| − | Vid fakturering på kunder med avtal som säger ”Löpande a-contoavräkning” tar systemet det äldsta a-contot och börjar med den. Om inget uppfyller villkoret som är satt för det a-contot så fortsätter den med nästa a-conto. |

||

| − | |||

| − | Ett problem som kan uppstå är om man dels har allmänna a-conton (dvs a-conton som inte är riktade mot specifika planer/order), dels a-conton som är bundna till specifika planer. Systemet tar på de allmänna a-contona inte hänsyn till de som är låsta mot en specifik plan utan avräknar mot allt den kan. |

||

| − | |||

| − | |||

| − | = Avstämning mediadifferenser / Differenshantering = |

||

| − | |||

| − | Bortbokningar av differenser görs i {{pth|Media|Avstämning}}. |

||

| − | |||

| − | {{ExpandImage|MED-EK-SV-Bild21.png}} |

||

| − | |||

| − | Selektering kan göras på avstämningskoder, ägare, kund, datum eller andra fält. Val som gjorts kan sparas default eller som ett urval som kan sparas för att slippa ändra varje gång man vill ta ut listan. |

||

| − | {{ExpandImage|MED-EK-SV-Bild22.png}} |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !Diff netto/Diff Net-net |

||

| − | |Har anges hur stora diffar som ska visas i listan. För att slippa se alla införanden ange 1-999 999 999 i Diff Net-net. Inställning för att se bortbokade differenser är 0-999 999 999 på båda fälten. |

||

| − | |} |

||

| − | {{ExpandImage|MED-EK-SV-Bild23.png}} |

||

| − | |||

| − | Beloppet i listan som visar Diff. Net-Net stäms av mot medieavräkningskontot. Skall man stämma av avräkningskontot mot differenslistan skall man välja till och med bokföringsdatum, inget annat. |

||

| − | {{ExpandImage|MED-EK-SV-Bild24.png}} |

||

| − | {{ExpandImage|MED-EK-SV-Bild25.png}} |

||

| − | |||

| − | Ställ in kolumnerna så att relevant information syns. Valet av kolumner görs med pilen längst till höger i rubrikraden. |

||

| − | |||

| − | |||

| − | {| class=mandeflist |

||

| − | !Öppna |

||

| − | |Öppna ordern för att fördjupa dig. |

||

|- |

|- |

||

| + | !Create correction |

||

| − | !Skapa korrigeringar |

||

| + | |Creates a new insertion of the selected insertion’s Net-Net discrepancy – negative or positive depending on the discrepancy. The new insertion can then be sent as an invoice to the client. |

||

| − | |Skapar ett nytt införande av det markerade införandets net-net-differens, i minus eller plus beroende på om differensen är positiv eller negativ. Det nya införandet kan sedan faktureras kunden. |

||

|- |

|- |

||

| + | !Book away |

||

| − | !Boka bort |

||

| + | |See chapter below |

||

| − | |Se nedan. |

||

|- |

|- |

||

| + | !Reconciliation code/Comment |

||

| − | !Avstämningskod/kommentar |

||

| + | |Possibility to change reconciliation code or add a comment on the insertion. |

||

| − | |Möjlighet att ändra införandets avstämningskodoch/eller lägga in en kommentar. |

||

|- |

|- |

||

| + | !Change order no/insertion date |

||

| − | !Byt ordernr/inf.datum |

||

| + | |A registered media invoice can be moved to a new insertion. Read more in the chapter below |

||

| − | |Ger möjlighet att flytta mediafakturan som ligger registrerad på införandet till ett nytt införande. Se nedan för utförligare beskrivning. |

||

|- |

|- |

||

| + | !Change owner/client |

||

| − | !Byt ägare/kund |

||

| + | |For changing plan owner or client. A parameter setting is required for change of client on an invoiced insertion. |

||

| − | |För att byta planens ägare eller kund. Byte av kund på fakturerad plan kräver en parameterinställning som tillåter det. |

||

| + | |- |

||

| + | !Show media invoices |

||

| + | |Shows invoice copy as PDF, if the invoice has been scanned. |

||

|- |

|- |

||

| + | !Claim |

||

| − | !Visa mediefakturor |

||

| + | |If the invoice is erroneous, it can here be sent as a reclamation to the supplier. |

||

| − | |Visar en fakturakopia i PDF-format om fakturan skannats in. |

||

| − | |- |

||

| − | !Utskrift |

||

| − | |Skriver ut avstämningslistan. Kräver utskriftsmall som måste beställas separat från Kalin Setterberg om det inte finns. |

||

| − | |- |

||

| − | !Reklamationer |

||

| − | |Om fakturan är felaktig kan man direkt reklamera till leverantören. |

||

|} |

|} |

||

| + | |||

| − | == |

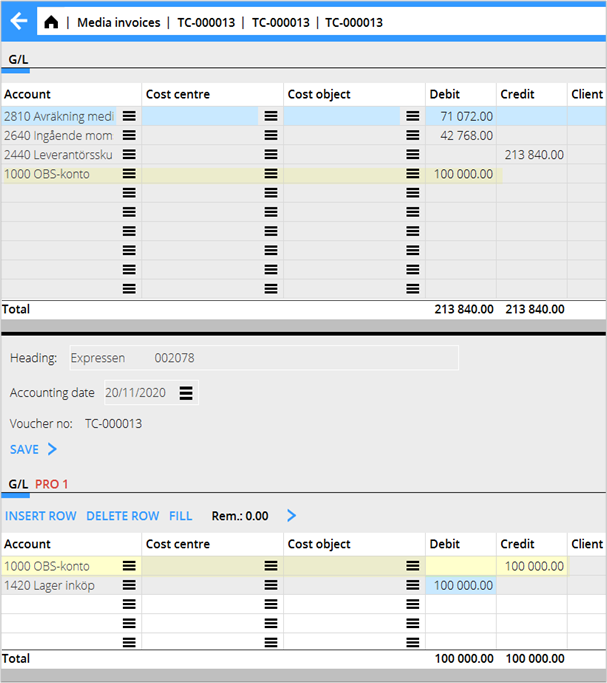

+ | == Book away discrepancies == |

| + | * Select one or several rows and press Book away. |

||

| + | * Enter accounting date. It is also possible to book away a part by changing the amount and also change to optional account. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild25.png}} |

||

| − | Markera en eller flera rader och tryck på Boka bort. |

||

| + | == Move media invoice to another order or insertion date== |

||

| − | {{ExpandImage|MED-EK-SV-Bild26.png}} |

||

| + | * Use the function Change order number/insertion date for moving an erroneously registered media invoice. Select the order and press the button. |

||

| + | * Select the media invoice and enter order number the insertion date into which the invoice shall be moved. It is possible to move it to an existing order number/insertion date. |

||

| + | * If only a part of the invoice shall be moved, enter amount. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild26.png}} |

||

| − | Ange bokföringsdatum. Det går också att endast boka bort en del av beloppet genom att ändra och också ändra till valfritt konto. |

||

| − | {{ExpandImage|MED-EK-SV-Bild27.png}} |

||

| + | == Agency settlement== |

||

| − | = Flytta mediefaktura till annan order eller inf. datum. = |

||

| + | For clients whose agreements stipulate that the advertising agency is to receive a share of commissions, fees and charges, Agency is added to the client in order to create an agency settlement. When the agency settlement is printed, a supplier invoice is created and added to the corresponding supplier in the Purchase ledger, which is then paid. |

||

| + | Set up agency in Media | Backoffice | Base registers | Agencies |

||

| − | Med funktionen Byt ordernummer /införingsdatum kan man flytta en felregistrerad mediefaktura. Markera ordern och klicka på knappen. Ange mediefakturan (finns att välja i sökboxen) och ange ordernummer + införandedatum dit fakturan skall flyttas. Man kan bara flytta till en existerande order och införingsdatum. Ange belopp om endast del av fakturan skall flyttas. |

||

| − | {{ExpandImage|MED-EK-SV-Bild28.png}} |

||

| − | {{ExpandImage|MED-EK-SV-Bild29.png}} |

||

| + | Enter the agency on the client in Media | Backoffice | Base registers | Client, Parameters 1 tab. |

||

| + | On the client agreement in Media | Backoffice | Base registers | Agreements, you state how big part/percentage of insertion fee, agency commission and capital cost that shall be forwarded to the agency. |

||

| − | = Byråavräkning = |

||

| + | * Media | Backoffice | Agency settlement for printing out invoice and agency settlement specification. |

||

| − | För de kunder vars avtal säger att reklambyrån ska få del av provision, arvode och avgifter används byrån på kunden för att kunna skapa en byråavräkning. När man skriver ut byråavräkningen skapas en leverantörsfaktura som lägger sig på motsvarande leverantör i leverantörsreskontran och som sedan blir utbetald precis som vilken annan leverantörsfaktura som helst. |

||

| + | * Select agency and accounting date or another selection. You can have different selections for different purposes, e.g. if only a certain media shall be settled on a plan. |

||

| − | Upplägg av byrå sker i {{pth|Basregister/MED/Byråer}}. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild27.png}} |

| + | {|class=mandeflist |

||

| − | På kunden i {{pth|Basregister/MED/Kunder}}anges därefter byrån under fliken Parametrar 1. |

||

| + | !Paid invoices |

||

| − | |||

| + | |Creates settlement only for paid client invoices. |

||

| − | På kundavtalet i {{pth|Basregister/MED/Avtal}} ställs in hur stor del/hur många procentandelar av införingsavgift, förmedlingsersättning och kapitalkostnad som ska ges vidare till byrån. |

||

| − | |||

| − | Fakturan och byråavräkningsunderlaget skrivs ut under Byråavräkning |

||

| − | |||

| − | {{ExpandImage|MED-EK-SV-Bild31.png}} |

||

| − | |||

| − | {{ExpandImage|MED-EK-SV-Bild32.png}} |

||

| − | |||

| − | |||

| − | Välj byrå och bokföringsdatum eller annan selektering. Olika selekteringar kan även göras om det är så att ex. endast ett visst media skall avräknas på en viss plan. |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !Betalda fakturor |

||

| − | |Ja = Skapar bara avräkning för de kundfakturor som betalats. |

||

|- |

|- |

||

| + | !Already updated |

||

| − | !Redan uppdaterade |

||

| + | |Possibility to reprint the specification. |

||

| − | |Ja = Möjlighet till omutskrift av specifikationen. |

||

| + | |- |

||

| − | !Omutskrif |

||

| + | !Reprint |

||

| − | |Alla byråavräkningar kan omutskrivas. |

||

| + | |All agency settlements can be reprinted. |

||

|} |

|} |

||

| + | [[Category:MED-ACC-EN]] |

||

| − | = Fakturera projekt tillsammans med mediefakturan = |

||

| + | [[Category:Media]] |

||

| − | |||

| + | [[Category:Manuals]] |

||

| − | För att kunna skriva ut projektfakturering tillsammans med mediefaktura skall parameterinställningar göras inne i Media/Parametrar/Fakturering. Faktureringen sker från mediafaktureringen och inne i projektfaktureringen lägger man in på fakturan vilken plan som gäller. Skapa en faktura som vanligt inne i Justering/Fakturering och koppla den till mediaplanen. Det görs under fliken Parametrar. |

||

| − | |||

| − | Mediefakturamallen (utskriftsmall) skall uppdateras så att den hämtar information från projektredovisningen. |

||

| − | |||

| − | [[Category:MED-EK-SV]] [[Category:Manuals]] [[Category:Media]] |

||

Revision as of 10:34, 26 January 2026

Contents

- 1 Media Accounting

- 1.1 Invoicing

- 1.2 Credit an invoice

- 1.3 Credit an insertion

- 1.4 Credit part of allocation

- 1.5 Pre-invoicing

- 1.6 Invoice project together with a media invoice

- 1.7 Reconcile media discrepancies/Discrepancy handling

- 1.8 Book away discrepancies

- 1.9 Move media invoice to another order or insertion date

- 1.10 Agency settlement

Media Accounting

Invoicing

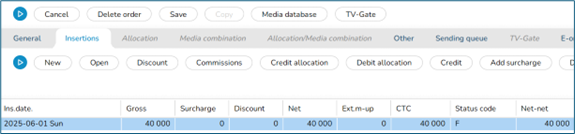

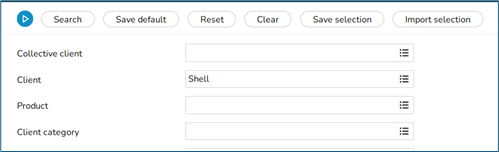

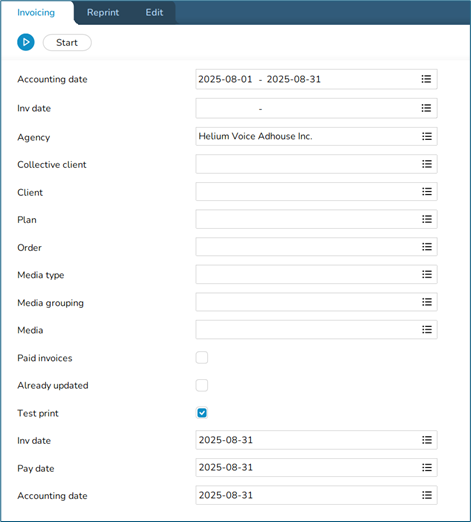

All invoicing is done in Media | Invoicing, including pre-invoicing, deductions and reversals of invoices.

Various selections can be made based on, for example, insertion date, plan number, client and client category. Invoicing per campaign can also be selected, if used.

If a specific media type or client is invoiced continuously, the selection can be saved so that a new selection does not have to be made each time. The options are located behind the blue arrow.

Different selections and description

| Current invoicing | Both = includes everything, regardless of whether the agreement has ‘Current invoicing’ or not. Yes = plans/orders that have ‘Current invoicing’ according to the agreement are invoiced. No = only includes agreements that do not have ‘Current invoicing’ checked. |

|---|---|

| Also not checked | If ticked, insertions are included even if they haven’t been ad checked - if plan- or order number is entered. |

| No reference no. | If Yes, all plans and orders without reference number but the client setting states that it is mandatory, will be invoiced. If Both is selected, everything is printed out but only in a test print. |

| Debit/credit | Blank = everything is printed out.

Debit = Only debit invoices are printed out. Credit = Only Credit invoices are printed out. Separately = debit – and credit records are printed on separate invoices. |

| Corrections | Insertions that are marked with Correction (x) can be invoiced peparately or be excluded:

Not corrected + external corrections External corrections Not corrected Not corrected + external corrections separately Internal corrections |

| Force one invoice… | If selected, the minimum amount for invoice in the client setting will be overruled and an invoice will be printed anyway |

| Invoice text | Possibility to write an invoice text at every invoicing. |

Credit an invoice

If the entire invoice is incorrect, it can be credited under the Reversing tab. There, you can also reverse part of the invoice by entering the order number/entry.

| Inv.no.series | It is possible to set a deviating number series for credit invoices. |

|---|---|

| Block ins. after rev… | Means that after reversal of the invoice, all its insertions are blocked for invoicing. |

Credit an insertion

Orders and single insertions are credited in Media | Plans. Also, corrections are made here.

- Open order and insertion.

- Select one or several insertions that shall be credited and use the Credit button.

- Select type of crediting and press OK.

The insertion will be reversed as a credit insertion and gets a correction mark. Now the credit can be separately invoiced in the current invoicing.

- Select if you want to use the previous invoice number as a comment on the credit invoice.

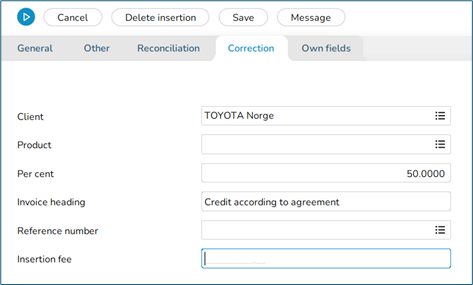

This credit means that the complete insertion including possible insertion fee and capital cost will be credited. To credit an insertion without including insertion fee and capital cost, they can be excluded. Exclude insertion fee in the Other tab on the insertion.

Exclude capital cost on the insertion.

Credit part of allocation

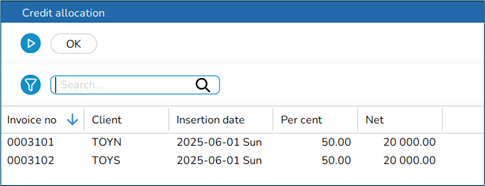

If an allocation exists and only one of the clients shall be credited, the cost must be “moved” to another client.

Example The client Toyota Norway shall be credited, and Toyota Sweden shall be debited instead, meaning that Toyota Sweden shall pay the entire cost.

- Open the order and select the insertion that shall be corrected, press the Credit allocation button.

- Select the insertion to be credited, press OK.

- Open the credit row and write an invoice comment under the Correction tab.

- Select the insertion to be debited (the original, not the credit).

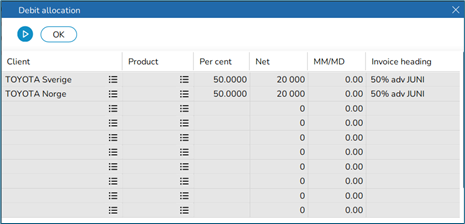

- Use Debit allocation and select the client to be debited.

- Select the new debit insertion and open.

- An invoice comment can be added in the correction tab.

- Save. Two new invoices are printed at the next invoicing. A credit to Toyota Norway and a new debit to Toyota Sweden.

Pre-invoicing

The list under the Pre-invoice tab shows pre-invoice status. Here you can see the invoice amount, how much has been deducted and from which amounts, and the remaining amount. The Deduction from column shows definitive orders that can be deducted from.

There are two ways to pre-invoice that are managed from the client agreement. No current pre-invoice deduction The client is pre-invoiced, and a controlled deduction takes place. Current pre-invoice deduction The client is pre-invoiced, and all definitive insertions are currently deducted.

The parameter setting ”Current pre-invoice deduction per row” should be set to make sure that what is in ”Deduction from” only shall be used. This parameter is in Media | Backoffice | Base registers | Parameters | Invoicing tab.

New pre-invoice

- Go to the Pre invoice tab.

- Enter client and possible owner. Owner is only used for sorting and filtering in the pre-invoice list.

- Write a description. It will be shown in the pre-invoice list.

- Block current deduction means that the pre-invoice will not be deducted in the current pre-invoice deduction.

- It is possible to deduct from another client, if it belongs to the same collective client.

- Select NEW in the Pre-invoices tab.

- Fill in text and amount. Select if the pre-invoice shall be subject to VAT or not. The invoice cannot have mixed rows with VAT and VAT-free.

- If you know from which plan/order the pre-invoice shall be deducted, you can fill in that in the Deduction from tab.

- Deduct all is selected as default but you can remove it an enter plan, order or other to be deducted from.

- Save and print the invoice in the Pre-invoice tab.

Pre-invoice deduction

Current pre-invoicing is deducted in the Invoicing tab.

No current pre-invoicing, i.e. a controlled deduction is done in the Pre-invoice deduction tab. Enter the pre-invoice number to be deducted here. Any surplus/deficit will be invoiced in the form of a debit or credit invoice, and the pre-invoiced will be cleared.

Keep in mind When invoicing clients with agreements that states ”Current pre-invoice deduction”, the system takes the oldest pre-invoice and begins with it. If nothing meets the condition set for the pre-invoice, deduction continues with the next pre-invoice and continues until as much as possible can be deducted.

You should therefore link a pre-invoice to a plan/order if you want to be sure that only that plan/those orders are included in the deduction.

Invoice project together with a media invoice

To be able to print a project invoice together with a media invoice, parameter settings must be made in Media | Backoffice | Base registers | Parameters | Invoicing.

- Create an invoice in Project | Invoicing and connect the invoice to the media plan in the Parameters tab.

- The invoicing is done in media invoicing.

NB! The media invoice print template must be updated so that it fetches information from the project accounting.

Reconcile media discrepancies/Discrepancy handling

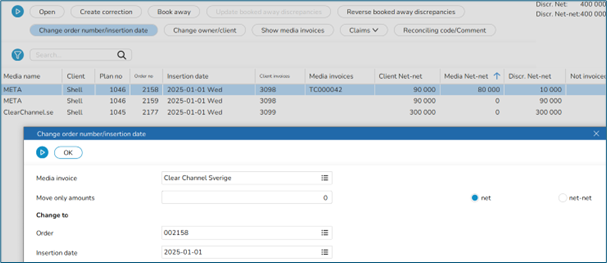

Reconciliation and booking away discrepancies are made in Media | Reconciliation. You can select on reconciliation codes, owner, client, date among other things. Your choices can be saved as default or as a selection, so that you don’t need to change each time you want to print the list.

Discr. net/Discr. Net-Net

This specifies how large the discrepancies should be to be displayed in the list. 1–999 999 999 in Discr.Net-Net is specified to avoid seeing all entries without a discrepancy or that are already booked away. 0–999 999 999 in Diff Net-Net is specified to see all booked away discrepancies.

When reconciling with the media settlement account, only the accounting date is entered, nothing else. The Net-Net amount is reconciled with the media settlement account in, for example, Accounting | Queries, Accounts tab or the Account specification in Accounting | Reports, General Ledger tab.

Set up the columns so that the relevant information is visible. The columns are selected using the list button on the far right of the header row.

| Open | Open the order for deepening. |

|---|---|

| Create correction | Creates a new insertion of the selected insertion’s Net-Net discrepancy – negative or positive depending on the discrepancy. The new insertion can then be sent as an invoice to the client. |

| Book away | See chapter below |

| Reconciliation code/Comment | Possibility to change reconciliation code or add a comment on the insertion. |

| Change order no/insertion date | A registered media invoice can be moved to a new insertion. Read more in the chapter below |

| Change owner/client | For changing plan owner or client. A parameter setting is required for change of client on an invoiced insertion. |

| Show media invoices | Shows invoice copy as PDF, if the invoice has been scanned. |

| Claim | If the invoice is erroneous, it can here be sent as a reclamation to the supplier. |

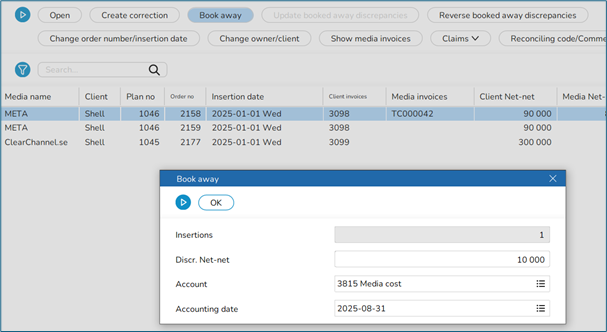

Book away discrepancies

- Select one or several rows and press Book away.

- Enter accounting date. It is also possible to book away a part by changing the amount and also change to optional account.

Move media invoice to another order or insertion date

- Use the function Change order number/insertion date for moving an erroneously registered media invoice. Select the order and press the button.

- Select the media invoice and enter order number the insertion date into which the invoice shall be moved. It is possible to move it to an existing order number/insertion date.

- If only a part of the invoice shall be moved, enter amount.

Agency settlement

For clients whose agreements stipulate that the advertising agency is to receive a share of commissions, fees and charges, Agency is added to the client in order to create an agency settlement. When the agency settlement is printed, a supplier invoice is created and added to the corresponding supplier in the Purchase ledger, which is then paid.

Set up agency in Media | Backoffice | Base registers | Agencies

Enter the agency on the client in Media | Backoffice | Base registers | Client, Parameters 1 tab.

On the client agreement in Media | Backoffice | Base registers | Agreements, you state how big part/percentage of insertion fee, agency commission and capital cost that shall be forwarded to the agency.

- Media | Backoffice | Agency settlement for printing out invoice and agency settlement specification.

- Select agency and accounting date or another selection. You can have different selections for different purposes, e.g. if only a certain media shall be settled on a plan.

| Paid invoices | Creates settlement only for paid client invoices. |

|---|---|

| Already updated | Possibility to reprint the specification. |

| Reprint | All agency settlements can be reprinted. |