Akontofakturering i mediesystemet

Contents

Fakturering med Akonto

- Løpende akonto avregnes i den alminnelige faktureringen, fliken Fakturering.

- Ikke løpende akontofakturering avregnes i fliken Akontoavregning.

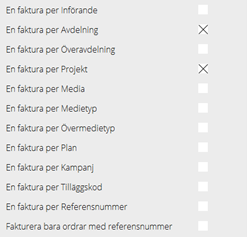

- Vilkårene for akontofakturering gjelder kun pr. faktura, dvs. hvis en av ordrene i fakturaen matcher vilkårene, vil hele beløpet bli avregnet, ikke ordrebeløpet. For å unngå dette kan fakturaen splittes i fakturainnstillingene på kunden i Grunnregister/MED/Kunder/Fakturering.

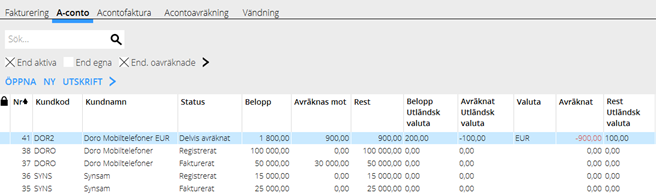

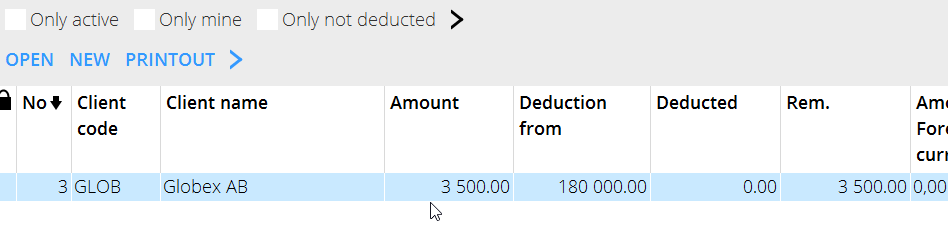

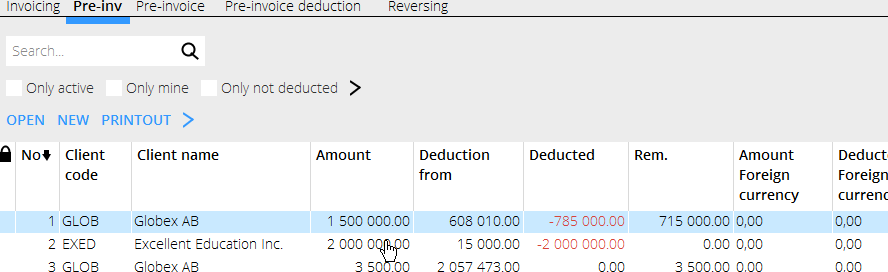

Kun aktive betyr at listen bare viser akontoer. Da en akonto er blitt avregnet og tømt/avsluttet, får den status Avregnet og vises i listen kun da Kun aktive ikke er valgt. Kolonnen Avregning fra viser det beløp som er mulig å regne av. Beløpet vises i den valutaen som er angitt i Grunnregistret (eller hvis ordren har en spesifikk valuta). Beløpet vises hvis:

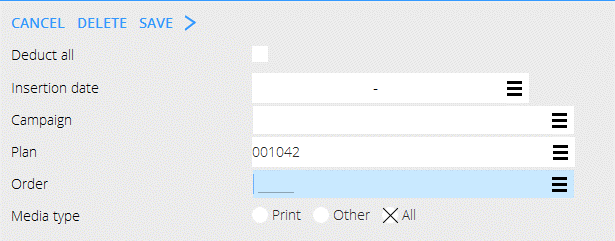

- "Avregn alt" er avkrysset

- Spesifikke budsjetter/ordrer/perioder eller andre kriterier er angitt.

- Dersom ingen spesifikk budsjett/ordre er angitt eller "Avregn alt" er avkrysset, vises ingen beløp i listen under Avregning fra. Det betyr, at alle planlagte innrykk på kunden kan avregnes. Denne løpende avregning gjøres i den alminnelige faktureringen.

Avregningen gjøres trinnvis på akontonummer og fortsetter så lenge der finnes beløp å avregne

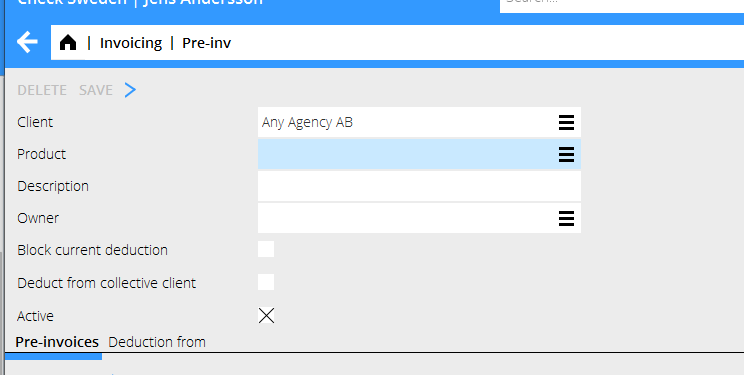

Agreements with current pre-invoice deduction:

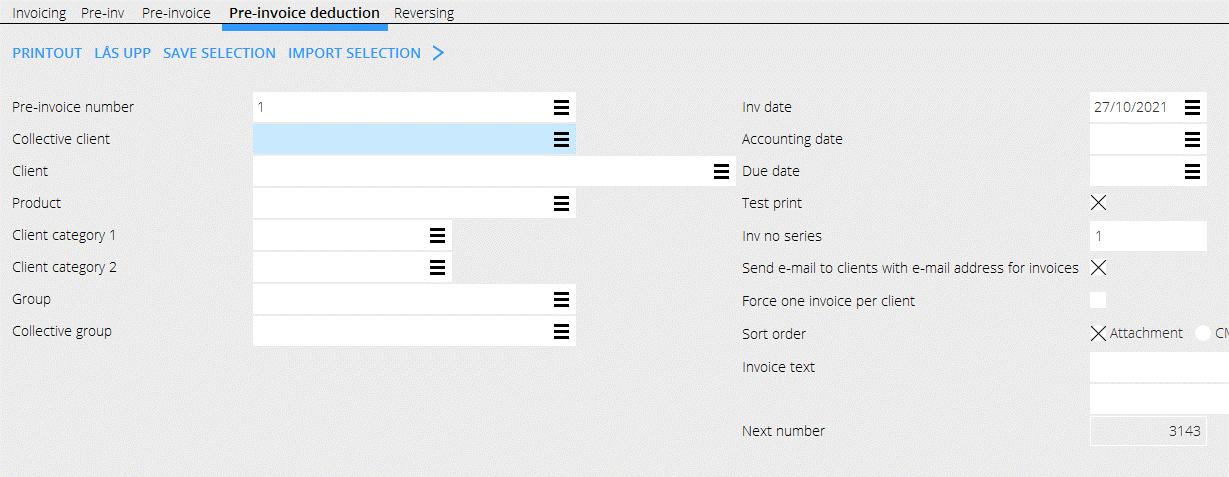

When printing out under the tab Pre-invoice deduction, all the plans/orders listed under” Deduction from” - or all, if you have checked “Deduct all” - will be included. If there is nothing under ”Deduction from” the pre-invoice will be printed out without deduction.

When printing in the tab Invoicing all plans/orders that are definitive are included, regardless of what is listed (or if empty) under ”Deduction from”.

If you want to avoid deduction from a certain pre-invoice, you can Block current deduction. That is only possible if nothing is listed under ”Deduction from”.

If you want to remove “Deducted from”, open the row/rows and delete.

Agreement with No current pre-invoice deduction:

When printing out under the tab Pre-invoice deduction, all the plans/orders listed under” Deduction from” - or all, if you have checked “Deduct all” - will be included. If there is nothing under ”Deduction from” the pre-invoice will be printed out without deduction.

When printing out under the tab Invoicing, there will be no deduction. If plans/orders are listed under ”Deduction from”, they will be blocked from being invoiced in the usual manner.

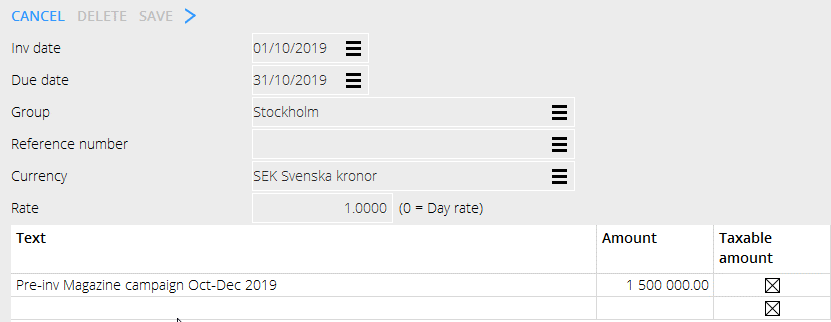

Handling of pre-invoices in foreign currency

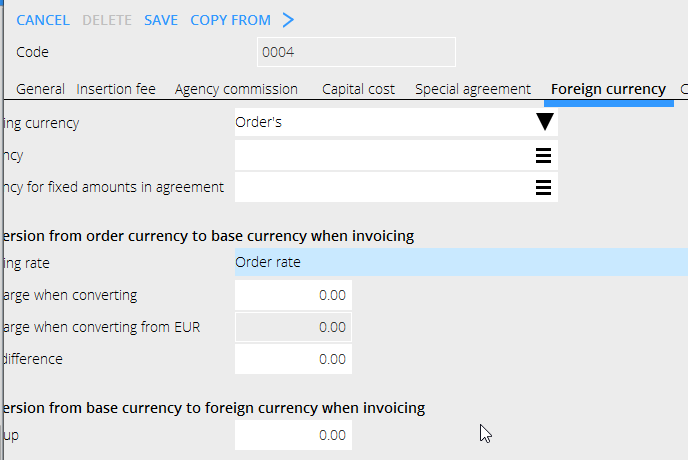

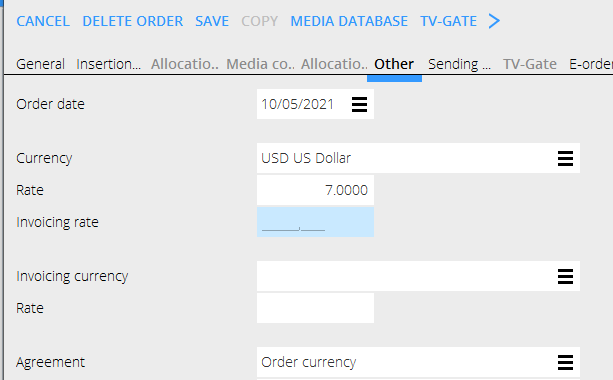

When setting up a pre-invoice in another currency, you must state the currency rate on the invoice. The deductions are not following the stated rate on the pre-invoice; they follow the client agreement with either day rate according to the base register or order rate stated on the order.

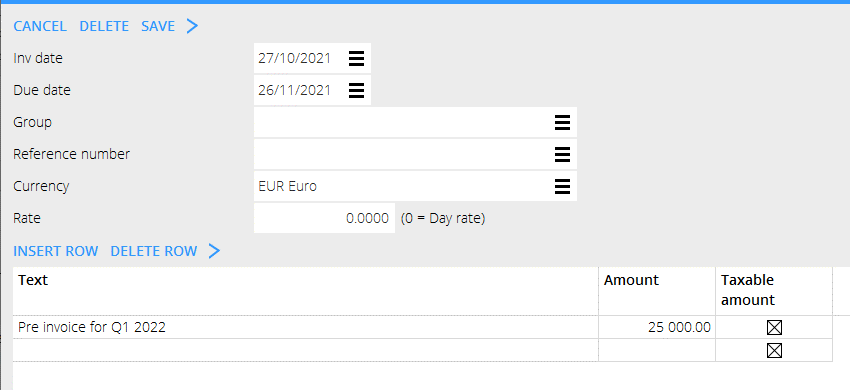

The pre-invoice:

The client agreement where rate shall be stated on the order:

The order:

The order:

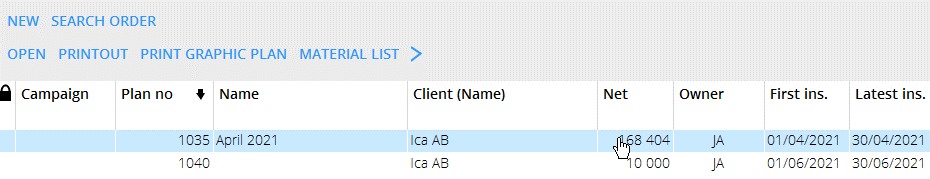

NB! In the list of plans, the order’s net is shown in the current day rate, regardless of what rate is set on the order.

NB! In the list of plans, the order’s net is shown in the current day rate, regardless of what rate is set on the order.

The list of pre-invoices shows according to the rate on the order in the column Deduction from.

The list of pre-invoices shows according to the rate on the order in the column Deduction from.

Create new pre-invoice with No current deduction according to the client agreement.

- Create new pre-invoice with NEW and print out. Check whether it is taxable or not. You should not mix VAT free pre-invoices with taxable ones.

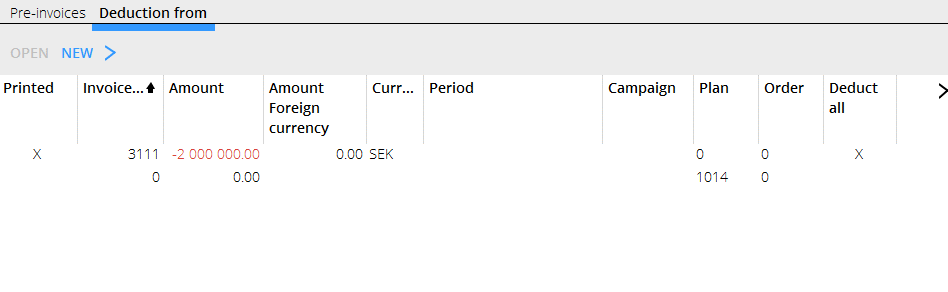

- State where the pre-invoice shall be deducted from. You can add more rows under “Deducted from”.

- Plan 1092 ”Februari kampanj” is on 700 000 which you can see in the list under Deducted from.

- The deduction is done in Pre-invoice deduction

Here we are certain that this pre-invoice will be settled to zero and deducted from the stated plan. If the plan only has a smaller amount, the deduction takes what it can, and the remaining pre-invoice generates a credit invoice. Or vice versa if the plan has a bigger amount. The pre-invoice is settled.

Create new pre-invoice for current pre-invoice deduction according to the client agreement.

- Create new pre-invoice with NEW and print out. Check whether it is taxable or not. You should not mix VAT free pre-invoices with taxable ones.

- Current pre-invoice deduction means that it can be deducted from all definitive insertions on the client. This current deduction is done in the general Invoicing.

Deduction is done continuously on all pre-invoice numbers on the same client code and continues as long as there are amounts from which to deduct. When the pre-invoice/-s have been used to the end, the remaining amount is generated to the invoice.