Interest invoicing

Contents

Interest invoicing

Interest invoicing is done in Accounting: Client invoices, tab Interest invoicing. Settings for interest invoices are in Base registers/Client/Parameters, tab Parameters Interest invoicing.

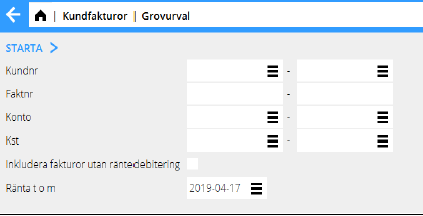

Start with making a preliminary selection. The criteria for your selection are: client number, invoice number, account and cost centre. If you don’t make any selection, all invoices that are ready for interest invoicing are included. You can also choose to include the invoices that have been set to “no interest charge” (interest=N.

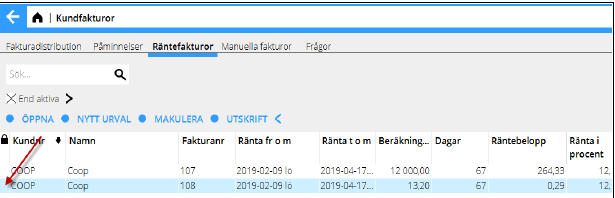

Edit selection

You can check and edit the selection in the list. If there is an invoice in the selection that not shall be sent, select the row and click in the column with a X. Click again to undo.

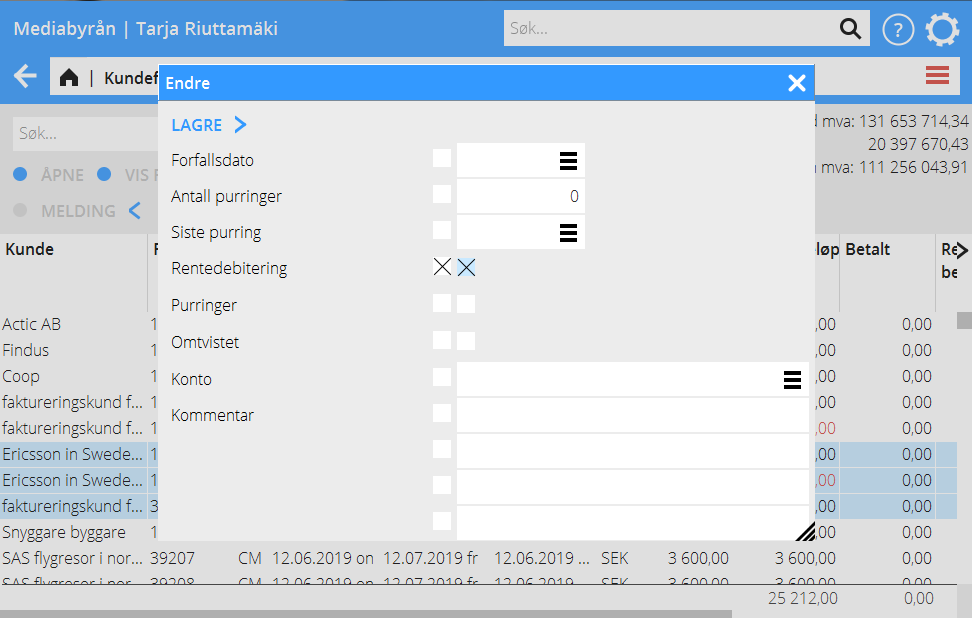

Change interest entries

Select an invoice and press OPEN if you want to change the interest entry.

Cancel selection

Click DELETE if you want to cancel the complete selection.

Print interest invoice

When you are sure that the selection is OK, you are ready to print out the invoices. All invoices in the selection will be printed. Remove the check from Test invoice to print a sharp one.

Reprint interest invoice

If you want to reprint an interest invoice, use the tab Queries in Accounting: Client invoices. Find the invoice and click SHOW INVOICE. If you use the invoice distribution for sending the invoice, you can search for it there.

Old interest amounts

In the list of invoices in Accounting: Client invoices you can open an invoice and remove the check from Interest charge. You can batch change that on several invoices. Select the invoices and press CHANGE