A-contofakturering i Media

Contents

Fakturering med A-contohåndtering

- Løbende A-konto-afregning gøres i den generelle fakturering under fanen Fakturering.

- Ikke løbende a-conto-afregning gøres under fanen A-contoafregning

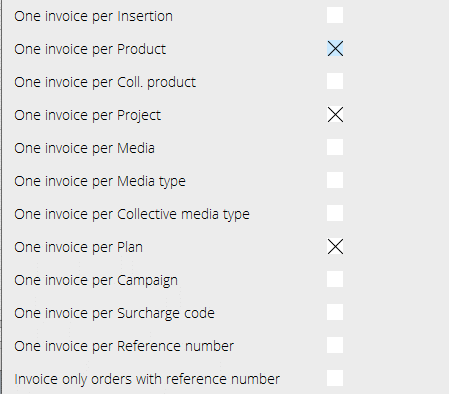

- Betingelserne for a-conto gælder kun pr. faktura, dvs. hvis en af fakturaens ordrer opfylder kriterierne afregnes hele fakturabeløbet og ikke ordrebeløbet. Hvis du vil undgå dette, skal fakturaen deles med fakturaindstillingerne for kunden i Basisregister/MED/Kunder/Fakturering, se billede.

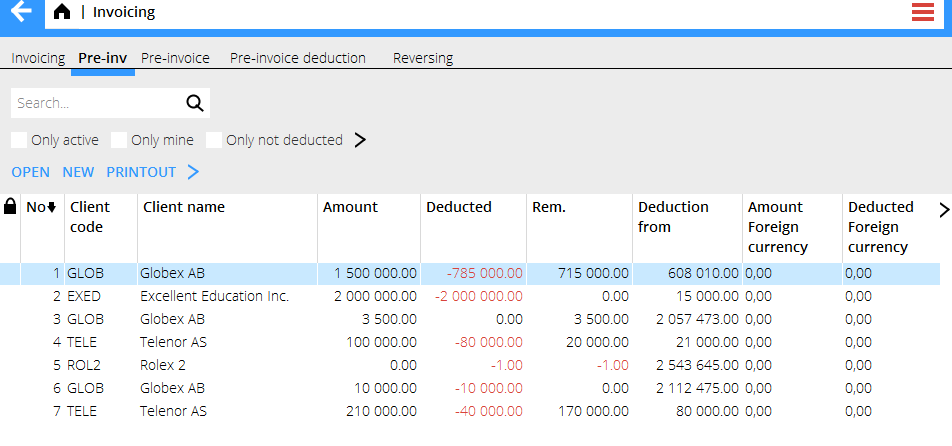

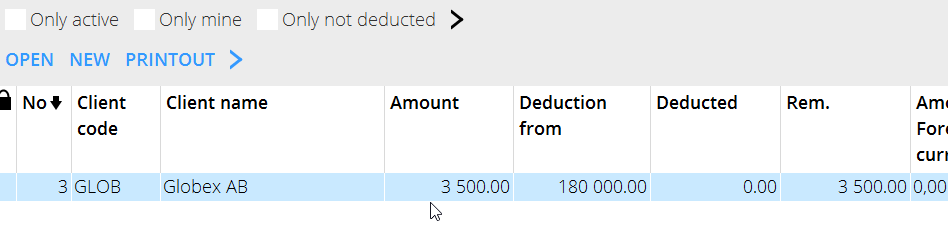

Kun aktive betyder, at a-contoen er synlig på listen. Når en a-conto er blevet afregnet og tømt/lukket, vil den kun have en status afregnet og kun vist, hvis krydset fjernes. Kolonnen "Afregnes mod" viser det beløb, der kan afregnes, og til den valutakurs, der er i basisregistret, eller hvis der er angivet en bestemt valutakurs i ordren. Beløb vises, hvis du:

- Har markeret for "Afregn alt"

- Har indsendt specifikke planer/ordrer/periode eller andet kriterium.

- Hvis du ikke angiver en bestemt plan/ordre eller markerer for " Afregning af alt", vises der ikke noget beløb på listen under Modkonto. Det betyder, at der kan afregning ske mod alle definitive indrykninger, der er på kunden og med løbende a-conto-afregning i aftalerne. Denne løbende a-conto-afregning sker i den generelle fakturering.

Afregningen gøres gradvist på a-conto numre og fortsætter, så længe der er beløb, der skal regnes af.

Aftale med nuværende a-contoafregning

Ved udskrivning under fanen A-contoafregning vises de planer/ordrer, der er angivet under "Forskydning i forhold til" eller alt, hvis de er markeret som "Forskydning af alt". Hvis intet er angivet under "modkonto", udskrives og afsluttes a-contoen uden udligning.

Når du udskriver under fanen Fakturering, medtages alle bookede budgetter/ordrer, uanset hvad der er angivet under "Afregnes mod" eller er tomt. Så det gør ingen forskel.

Hvis du vil undgå at gøre en afregning mod specifik a-conto, skal du spærre den aktuelle afregning. Dette kan kun gøres, når intet er angivet under "Afregnes mod".

Hvis du vil fjerne "Afregnes mod", åbn og slet linien eller linierne.

Agreement with No current pre-invoice deduction:

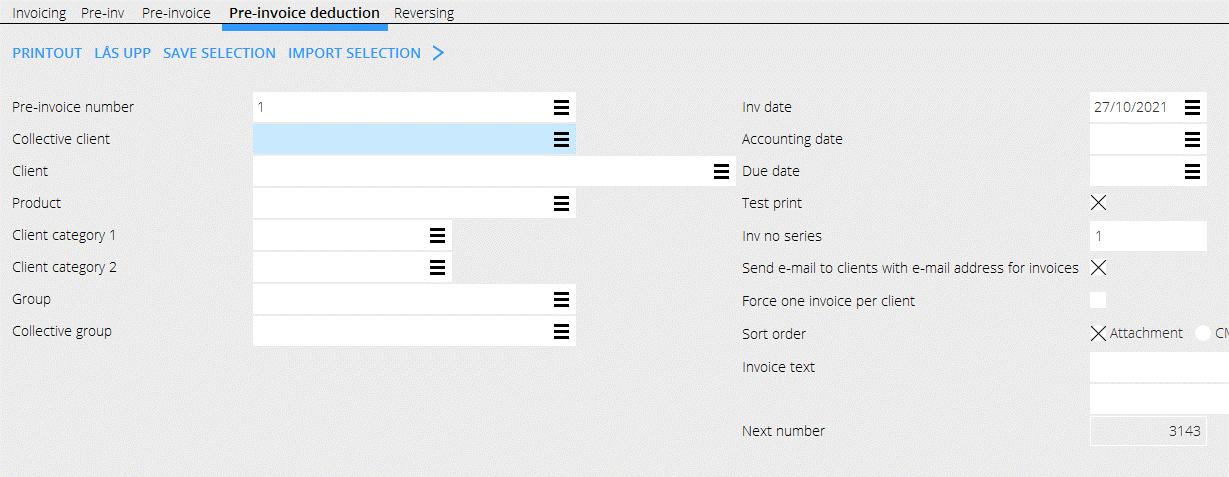

When printing out under the tab Pre-invoice deduction, all the plans/orders listed under” Deduction from” - or all, if you have checked “Deduct all” - will be included. If there is nothing under ”Deduction from” the pre-invoice will be printed out without deduction.

When printing out under the tab Invoicing, there will be no deduction. If plans/orders are listed under ”Deduction from”, they will be blocked from being invoiced in the usual manner.

Handling of pre-invoices in foreign currency

When setting up a pre-invoice in another currency, you must state the currency rate on the invoice. The deductions are not following the stated rate on the pre-invoice; they follow the client agreement with either day rate according to the base register or order rate stated on the order.

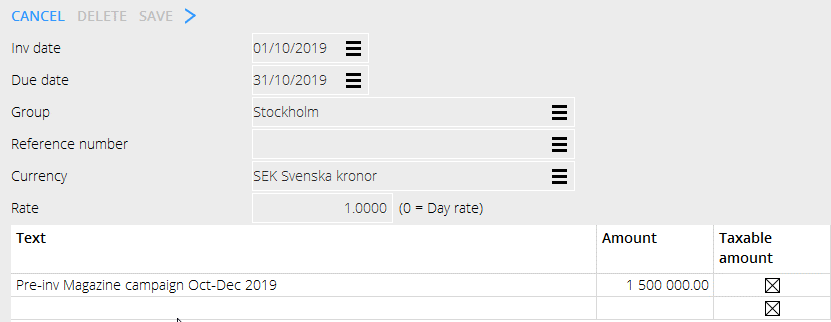

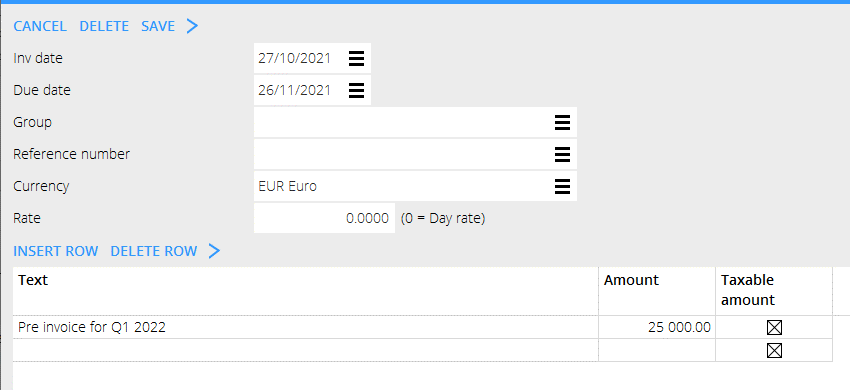

The pre-invoice:

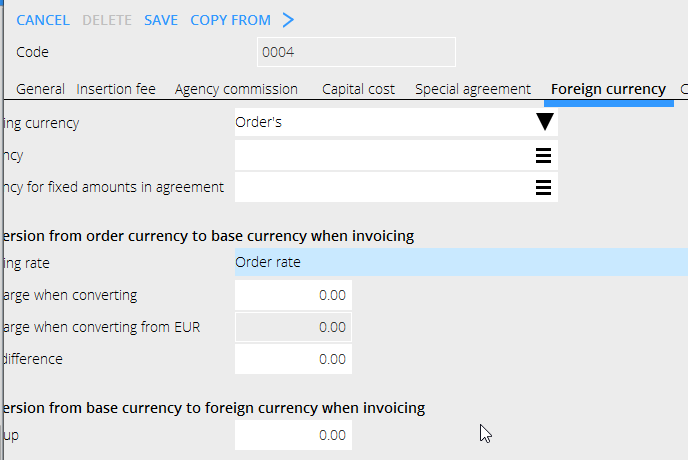

The client agreement where rate shall be stated on the order:

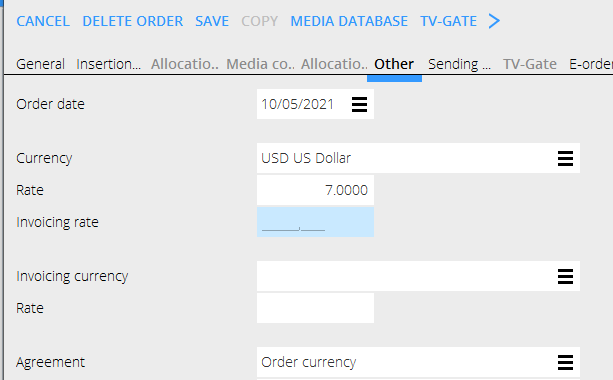

The order:

The order:

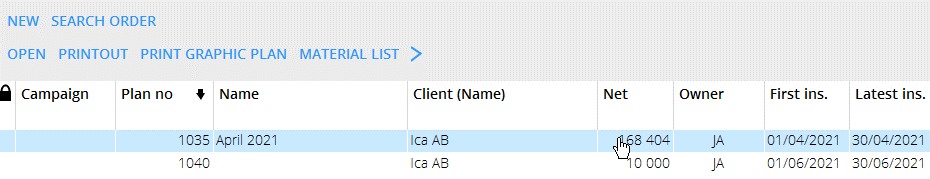

NB! In the list of plans, the order’s net is shown in the current day rate, regardless of what rate is set on the order.

NB! In the list of plans, the order’s net is shown in the current day rate, regardless of what rate is set on the order.

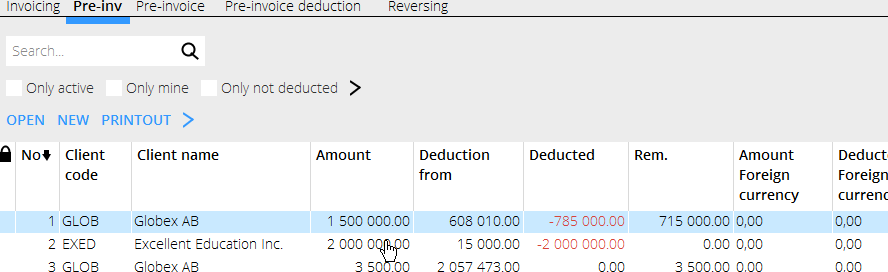

The list of pre-invoices shows according to the rate on the order in the column Deduction from.

The list of pre-invoices shows according to the rate on the order in the column Deduction from.

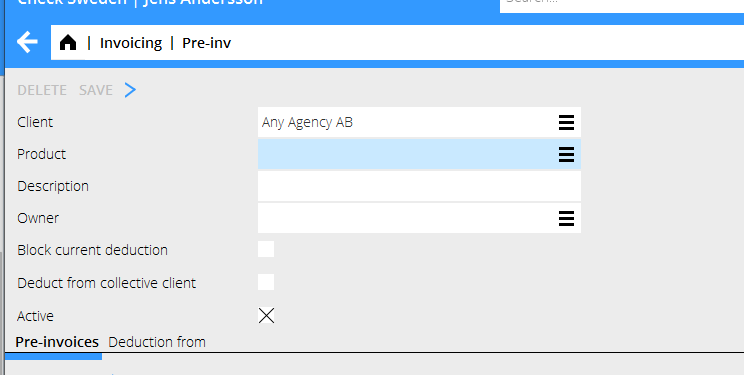

Create new pre-invoice with No current deduction according to the client agreement.

- Create new pre-invoice with NEW and print out. Check whether it is taxable or not. You should not mix VAT free pre-invoices with taxable ones.

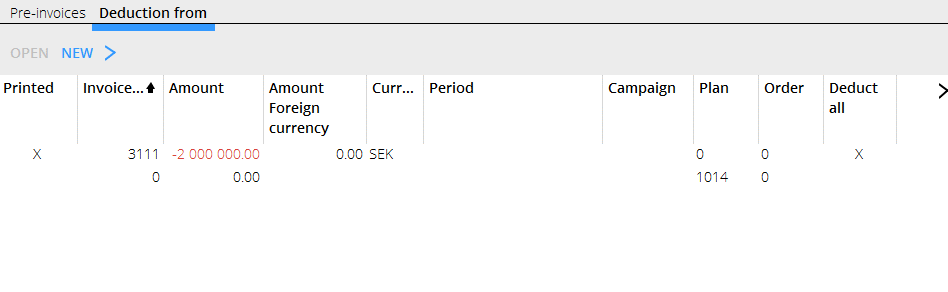

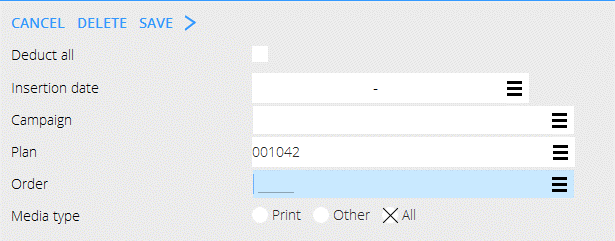

- State where the pre-invoice shall be deducted from. You can add more rows under “Deducted from”.

- Plan 1092 ”Februari kampanj” is on 700 000 which you can see in the list under Deducted from.

- The deduction is done in Pre-invoice deduction

Here we are certain that this pre-invoice will be settled to zero and deducted from the stated plan. If the plan only has a smaller amount, the deduction takes what it can, and the remaining pre-invoice generates a credit invoice. Or vice versa if the plan has a bigger amount. The pre-invoice is settled.

Create new pre-invoice for current pre-invoice deduction according to the client agreement.

- Create new pre-invoice with NEW and print out. Check whether it is taxable or not. You should not mix VAT free pre-invoices with taxable ones.

- Current pre-invoice deduction means that it can be deducted from all definitive insertions on the client. This current deduction is done in the general Invoicing.

Deduction is done continuously on all pre-invoice numbers on the same client code and continues as long as there are amounts from which to deduct. When the pre-invoice/-s have been used to the end, the remaining amount is generated to the invoice.