Koncernkonsolidering

From Marathon Documentation

Revision as of 14:04, 22 October 2021 by TR (talk | contribs) (Created page with "=== Arbetsgång för konsolidering ===")

Group consolidation is used for linking togheter balances from different companies in the same installation.

Uppstart

Lägg upp ett företag som ska användas för konsolideringen iSystem: Basregister/Allmänt/Företag. Företaget ska ha delsystem BOK och Koncernsaldoföretag ikryssat under fliken BOK. I System: Basregister/BOK/Parametrar, i fliken Övrigt vid Företag för central rapportgenerator anges vilket bolags rapportgenerator koncernsaldoföretaget ska vara kopplat till.

Arbetsgång för konsolidering

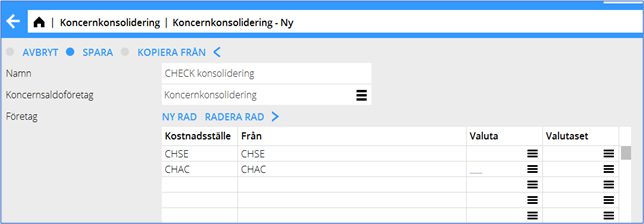

- Select New in Accounting/Group consolidation.

- Give the consolidation a name and select your company for consolidated balances in the designated field.

- Name the companies to be consolidated in the column Cost centre. The name here is the one that the balance will be marked with in reports after the consolidation.

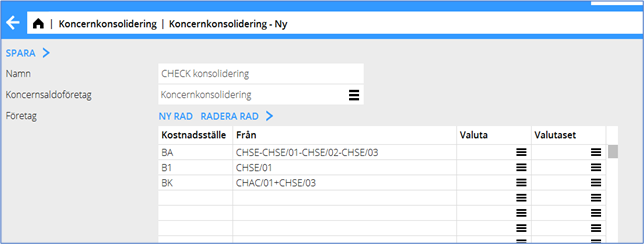

- Enter companies to be consolidated in the column From. You can enter one or several cost centres from a company and make calculations. See example 2 below.

- If the consolidation is in another currency, state it in the Currency column. Otherwise, the currency of the group consolidation company will be used. The currency is converted per each period, i.e., if the consolidation is made for period 0121 -1221, the months are calculated with the rate of the last date of each month.

- You can use Currency sets for a fixed rate throughout the year. Currency sets are created in System: Base registers/General/Currency sets. Contact Kalin Setterberg for more information about currency sets.

- Save and press the button Consolidate to start the consolidation.

- Print out reports in Accounting/Reports/Bookkeeping.

Examples

1. Example of a consolidation between companies CHSE and CHAC.

2. Example of consolidation with only certain cost centres per company included.

Explanation:

| Row1 | Here everything is fetched from company CHSE except cost centres KST 01, KST 02 and KST3 |

|---|---|

| Row | KST 01 in company CHSE |

| Row 3 | KST 01 in company CHAC plus KST 03 in company CHSE |