New year in Marathon

Contents

- 1 New year in Marathon

- 2 New accounting year in Marathon

- 3 Bank free days

- 4 Calendary

- 5 Frequent questions

- 5.1 » What does the alternative ”Update OB at new transactions in previous years” mean?

- 5.2 » I activated the parameter ""Update OB at new transactions in previous years”",but when I register accounts in the previous year I cannot see them in the new year?

- 5.3 » I didn't activate ""Update OB at transactions in previous year”" when I created new accounting year. Can I undo that?

- 5.4 » I receive a message ”Could not save: Open a new year first in the company with global chart of accounts”/"Open new year first in company for global report generator" when I try to save my new accounting year?

- 5.5 » I receive a message ”Could not save: Account for previous year's profit/loss missing in System: Base registers/GL/Parameters”?

- 5.6 » I receive a message ”Could not save: Account for previous year's profit/loss missing in the chart of accounts”?

- 5.7 » I created a new accounting year that I now want to delete. How do I do that?

New year in Marathon

There are three things you have to do at the time for a new year; Create new accounting year, create new table for bank free days and a new calendar for time reporting. This is a description of the different steps.

New accounting year in Marathon

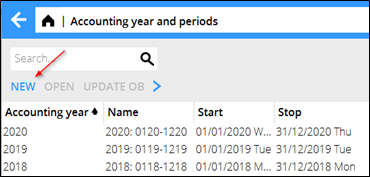

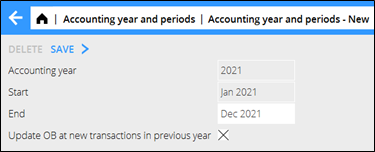

New accounting years are created in Accounting: Accounting year and periods. Click on New and ensure that the suggested start- and stop dates are correct. If the final period shall be another than the one stated, e.g due to prolonging, it can be overwritten. Select if the opening balances from previous year shall be updated automatically. Tick in or off the box "Update OB at new transactions in previous year". We recommend that you keep the box checked. Save.

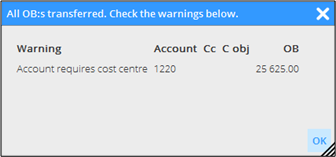

When the new accounting year is saved, the following records are transferred to it: OB, periodical allocations (accruals), chart of account, cost centres, cost objects, dimensions, automatic postings, cost estimate templates, voucher templates, automatic allocations, report templates, posting templates, VAT classes and voucher number series. Possible errors are shown on an error report, but only as warnings.

If an account has closing balances on cost centre or cost object in the previous year, and it is an account that not should have cc/obj, those will be removed from the account. If there is closing balance on accounts that require cc/obj and those are missing, the balances are transferred without them.

A warning in the list can look like this:

In the example above there is a balance on account 1220 without cost centre. The balance will be transferred without cost centre.

If you want, you can correct the reported error.The correction affects the OB automatically, if it is set in GL/Parameters. If the parameter not is set, a new transfer is necessaryin Accounting year and periods by selecting the year and klicking on Update OB.

Bank free days

Update bank holidays for the new year and the following year in System: Base registers/PL/Bank holidays so that payment dates will be correct in file payments.

Calendary

Create calendars for different working time measures in System: Base registers/PRO/Calendar. Click New and write in the year, same calendar number as before and name (if not, you have to do the change in the employees' records in System: Base registers/Pro/Employees. Write in amount of expected working hours per day in the field Time/day.

In the tab Working Days, you can click Import standard to import a standard calendar. Fill in which days that are working days and which are not. A working day is expressed as a digit with two decimals. A complete working day is 1,00, half day is 0,50 and a free day is 0,00. This enables different calendars for different working time measures.

You can copy working days from a calendar to another, as long as it is in the same year. Remember to change hours per day and the name after copying.

See more detailed descriptions in themanual for Calendar

Frequent questions

» What does the alternative ”Update OB at new transactions in previous years” mean?

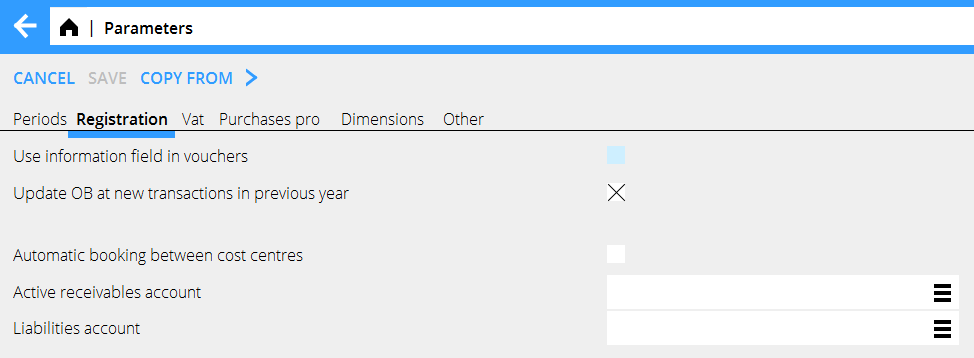

If the box is checked, the same parameter will be checked in System: Base registers/GL/Parameters, tab Registration.

Activating the parameter means that the OB will be updated automatically when a new transaction is registered in the previous year. Thus you don't need to update OB manually when working in two accounting years concurrently.

Please note that the automatic update only concerns OB and periodical allocations (accruals).

Other changes in the previous years such as accounts, cost centres and -objects, etc. shall be updated manually with the function Update OB, which is located in Accounting: Accounting year and periods.If you activate automatic update after you've already registered transaction in the previous year, these records must be updated manually with the Update OB -function.

If you choose not to check the box "Update OB at new transactions in previous year" and thus not the parameter either, you will have to update opening balances manually when working concurrently in two accounting years. The function is found in Accounting: Accounting year and period. Select year and click on Update OB. Check the records you wish to update and click on Start. If there is a global company, where these records exist, it is mentioned in parenthesis. Change company under the cog wheel and make the update there instead.

» I activated the parameter ""Update OB at new transactions in previous years”",but when I register accounts in the previous year I cannot see them in the new year?

The automatic update only concerns OB and periodical allocations (accruals). Other changes in the previous years such as accounts, cost centres and -objects, etc. shall be updated manually with the function Update OB, which is located in Accounting: Accounting year and periods.

» I didn't activate ""Update OB at transactions in previous year”" when I created new accounting year. Can I undo that?

Yes, you can check the parameter in System: Base registers/GL/Parameters, tab Registration. Note, that if you activate automatic update after you've already registered transaction in the previous year, these records must be updated manually with the Update OB-function.

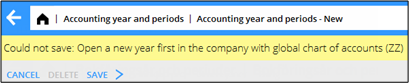

» I receive a message ”Could not save: Open a new year first in the company with global chart of accounts”/"Open new year first in company for global report generator" when I try to save my new accounting year?

A company can be connected with another company's chart of accounts and report generator. If that is the case, you will have to open the new accounting year in that company first, and Marathon will show a warning if you are trying to save other companies before it. Change company under the cog wheel and create a new year in the global company for chart of accounts and report generator (in this case company ZZ).

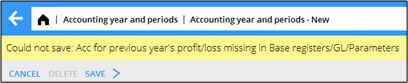

» I receive a message ”Could not save: Account for previous year's profit/loss missing in System: Base registers/GL/Parameters”?

Earlier the account for previous year's profit/loss was not mandatory in Marathon, it was shown on account 2999. Now the account has to be there. Register the account in System: Base registers/GL/Accounts and write it in the field for Account for previous year's profit/loss in System: Base registers/GL/Parameters, tab Other. The account does not have to have number 2999.

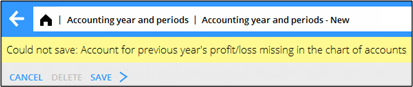

» I receive a message ”Could not save: Account for previous year's profit/loss missing in the chart of accounts”?

There is an account in the field “Account for previous year's profit/loss” in System: Base registers/GL/Parameters, tab Other, that is not in the chart of accounts. Register the account in System: Base registers/GL//Accounts or select another one from the chart of accounts.

» I created a new accounting year that I now want to delete. How do I do that?

Open the latest year and click on Delete.