Registrering og godkendelse af leverandørfakturaer

Contents

Generelt

Da Marathons godkendelsesfunktion anvendes, skal leverandørfakturaer registreres i Økonomi: Leverandørfakturaer.

Blandt fanerne findes Ankomstregistrering, Godkendelse og Fakturaopfølgning.

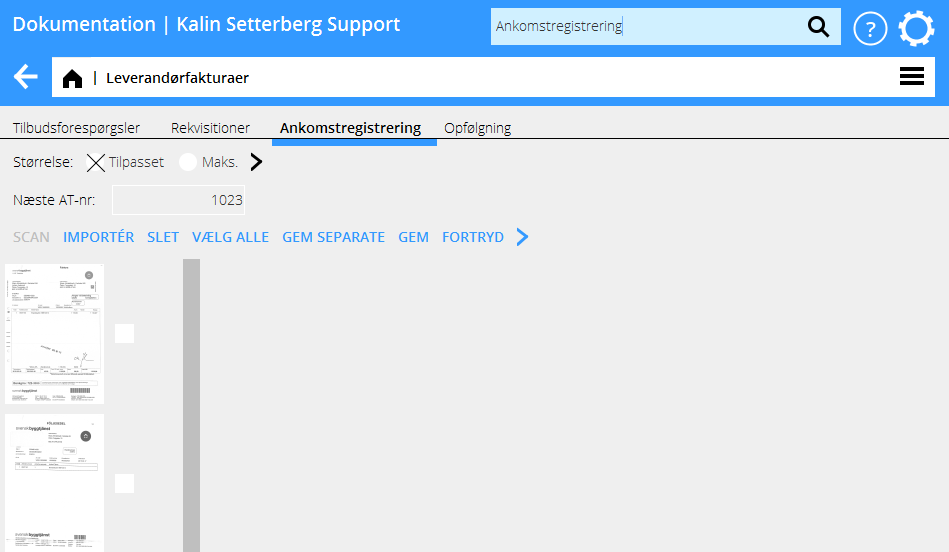

Ankomstregistrering – scanning

Registreringen af fakturaer begynder ved at fakturadokumenterne scannes ind i Økonomi: Leverandørfakturaer/Ankomstregistrering. Vælg Scanning. Læg et bundt fakturaer i scanneren og vælg Scan. Hvis scanneren ikke er koblet til Marathon kan en anden enhed bruges for indscanning for derefter at blive hentet til Marathon med funktionen Importér.

Kontrollér kvaliteten på den indscannede faktura ved at klikke på miniaturen til venstre i billedet. Markér fakturaen ved at afkrydse feltet ved siden af miniaturen og Gem. Hvis fakturaen indeholder flere sider, afkrydses siderne i tur og orden og gemmes sammen. Mærk originalfakturaen med det AT-nummer, der vises ved feltet Næste AT-nummer.

For at fjerne en indscanned faktura, klik på funktionen Slet. Med funktionen Vælg alle markeres alle indscannede dokument. Klik på Fortryd for at lægge igen indscannede og gemte, men ikke endnu registrerede fakturaer.

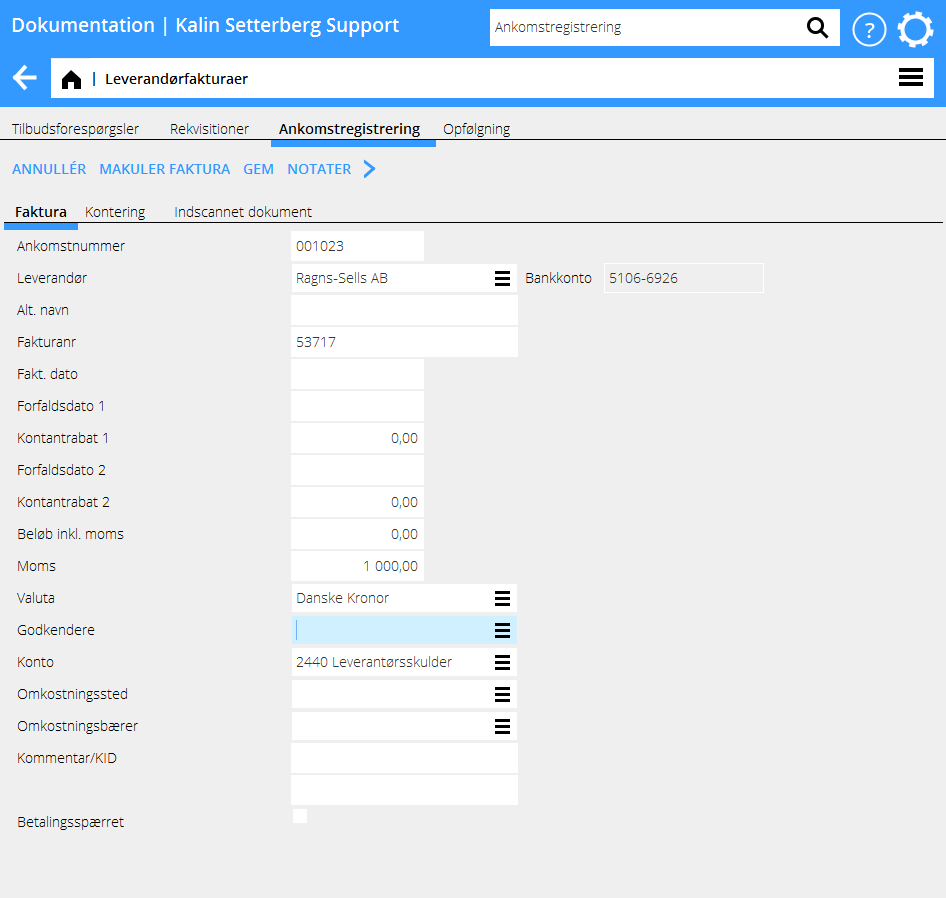

Ankomstregistrering

Vælg Ny i ankomstregistreringen. Systemet foreslår automatisk næste ankomstnummer, men du kan angive et andet nummer. Ankomstnummer er det nummer, fakturaen blev tildelt ved indscanningen. Sammenlign den indscannede faktura i fanen Indscannet dokument med den oprindelige faktura og kontrollér, at alt er i orden. Udfyld oplysninger om leverandør, fakturanummer, datum og fakturabeløb inklusive moms. (Momsbeløbet kan udregnes automatisk med elle ruden decimaler med en parameterindstilling i Basisregister/Kre/Parametre, fanen Fakturaer, feltet Beregning af momsbeløb.) Vælg én eller flere godkendere og gem, eller gå videre til Kontering.

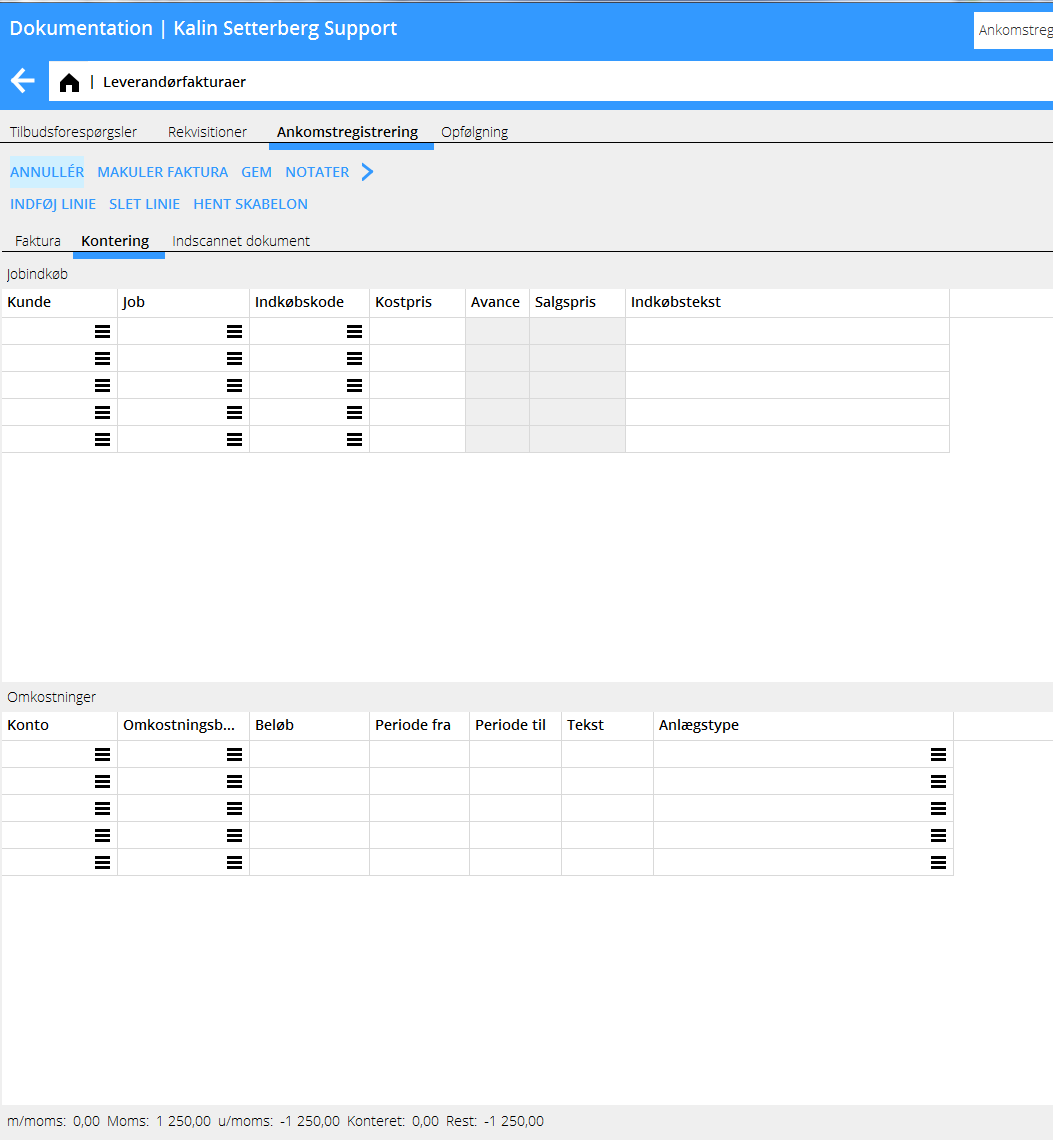

Kontering

Fakturaen kan allerede nu konteres i fanen Kontering.

Kontering af jobindkøb foretages i den øvre tabel. Ved kontering av jobindkøb angives ingen konto, fordi det allerede er forindstillet i parametrene. Hvis I har bruget rekvisition, angiv det i feltet Rekvisition; resterende oplysninger om kunde, job, indkøbskode og kostpris hentes da automatisk fra rekvisitionen. Hvis ikke, angiv disse oplysninger. Hent da kostprisen fra registreringen af fakturaen. Hent pålægget på kostprisen fra indkøbskoden i System: Basisregister/Job/Omkostningskoder (og i visse fald fra jobbet), og salgsprisen vil blive automatisk udregnet. Systemet kan indstilles sådan, et den foreslåede avance ikke er mulig at ændre. Gør indstillingen i System: Basisregister/Job/Parametre, fanebladet Indkøb og Øvrigt, feltet Ændr indkøbstillæg. Under fanebladet Justering findes yderligere en parameter, som påvirker håndteringen af forandringer i avance og salgspris. Den hedder "Afvigende indkøbsbrutto som justering". Hvis den er aktiveret, vil forskellen mellem den gamle og den nye salgspris blive en justering.

Ved kontering af omkostninger skal kontoen angives i den nedre tabel. Omkostningssted og omkostningsbærer kan angives, men kun hvis kontoen i kontoplanen tillader det. Hvis omkostningen skal periodiseres, angives kun omkostningskontoen og periode fra samt periode til. Balancekontoen for periodiseringer hentes fra parametrene.

Konteringen for jobindkøb eller omkostninger kan også foretages i fakturavalutaen i feltet Beløb fakturavaluta. Dette forenkler opdelingen af udenlandske fakturaer på flere forskellige jobs eller kontoer.

Med Hent skabelon kan Konteringsskabeloner, der er skabte i System: Basisregister/Kre/Konteringsskabeloner bruges, se beskrivelse under Skab konteringsskabelon.

Da alle indscannede fakturaer er blevet ankomstregistrerede, sendes de til dem, der skal godkende fakturaerne. Anvend funktionen Send e-mail i Økonomi: Leverandørfakturaer/Fakturaopfølgning. Mailet sendes til alle godkendere på endnu ikke godkendte fakturaer.

The email will be sent to all approvers on unapproved invoices. The invoice is marked with the approver in Frontoffice: Project/Approval.

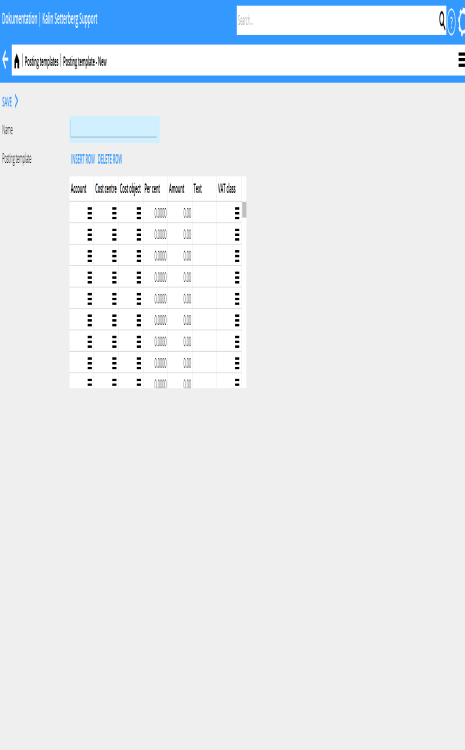

Create posting template

You can create Posting templates in Base registers/PL/Posting templates. Click on New and write a name for the template. Enter account and possible cost centre/cost objects if the account allows it. The amount can be stated either as percentage or as a monetary amount in your currency. If you choose percentage, you will get a question about the total amount at the time you use the template and calculates the share with help of the percentage.

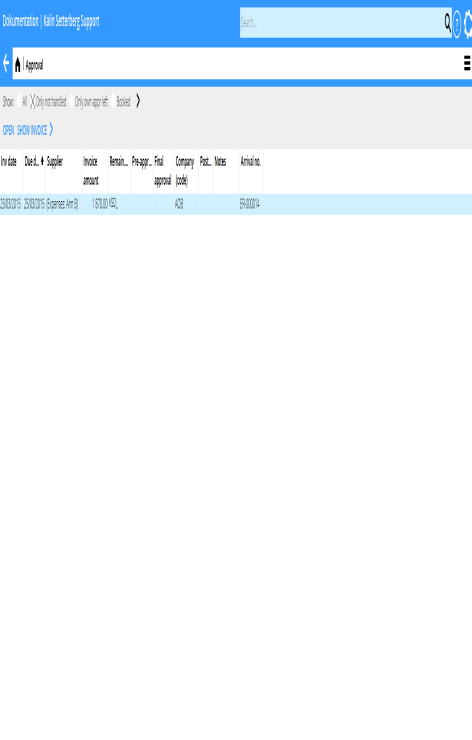

Approval

The approver can open the invoices in Frontoffice: Project/Approval for approving and posting. The approval function can also be reached with the link to Approval at the page bottom.

You can see the invoice document with the function Show invoice. If you are authorised you can also approve an invoice without opening it with Direct approval. Select:

| All | Shows all invoices, also those without approvers |

| Only not handled | Shows all unapproved invoices |

| Only own app. left | Shows only the invoices whrer you are the only remaining approver |

| Booked | Shows all booked invoices |

Select an invoice and click Open.

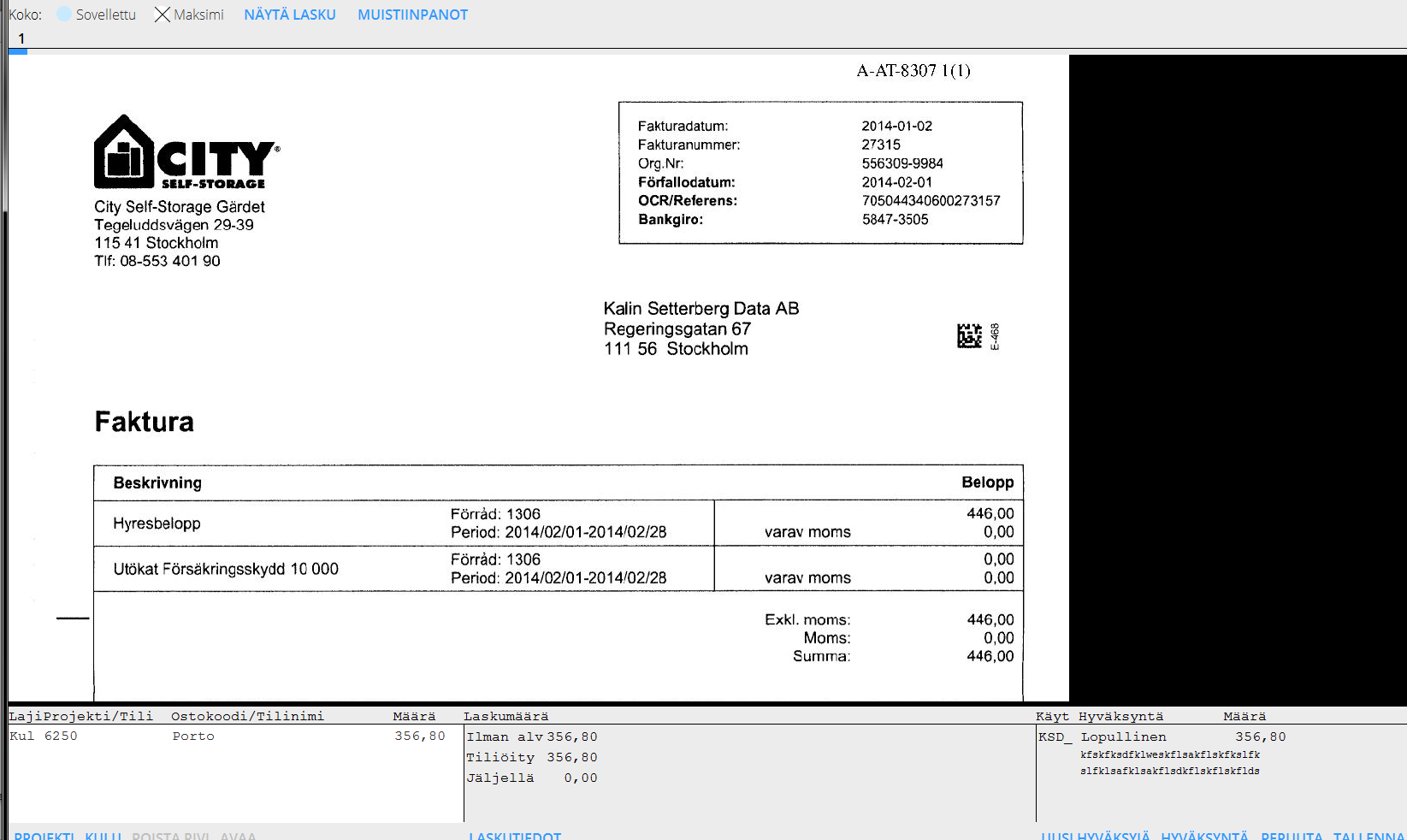

If the invoice already is posted it is shown as one or several posting rows in the field at the bottom left side of the page. Type Pro means project purchase and Type Cost a cost invoice. The field in the middle shows a summary of the invoice with invoice amount, how much that has been posted and how much posting remains. Click on Invoice information to see other invoice details. You can also scroll in the scanned invoice in the upper part of the screen. Click on Show invoice. The function Notes shows all notes that has been made concerning the invoice. You can also make new notes there.

To post a project purchase, select Insert row Project. If you have been using purchase orders and state the PO-number, the remaining contents will be filled in automatically (client, project, purchase code and purchase price). Otherwise, fill in these fields, the purchase price will be fetched from the invoice registration. The mark-up for the purchase price comes from the purchase code in Base registers/Pro/Cost codes Purchases (and in some cases from the project). The sales price is automatically calculated. You can also use the invoice currency, which makes dividing a foreign invoice in several projects easier. The system can be set such that the suggested mark-up not can be changed. The setting is in the Base registers/PA/parameters; tab Purchases and Other, field Change purchase mark-up. In the Adjustments tab there is more alternative in handling mark-ups and sales prices. It is called Special gross purchase as adjustment. When activated, it turns the difference between the suggested and the new sales price into an adjustment.

Use the lower table for posting costs. Write the account number and possible cost centre and -object if the account allows/requires it in the chart of accounts. If the cost shall be allocated over a period (accrued), state cost account only and fill in the fields for periods. The balance sheet account for periodical allocations is fetched from the parameters.

For pre-approval, final approval, partial approval or to state that the invoice not shall be paid, press Approval and select type of approval. You can also write comments regarding the approval. Click on Save approval. You can add approvers to the invoice with the function New approver. Save the whole invoice with Save.

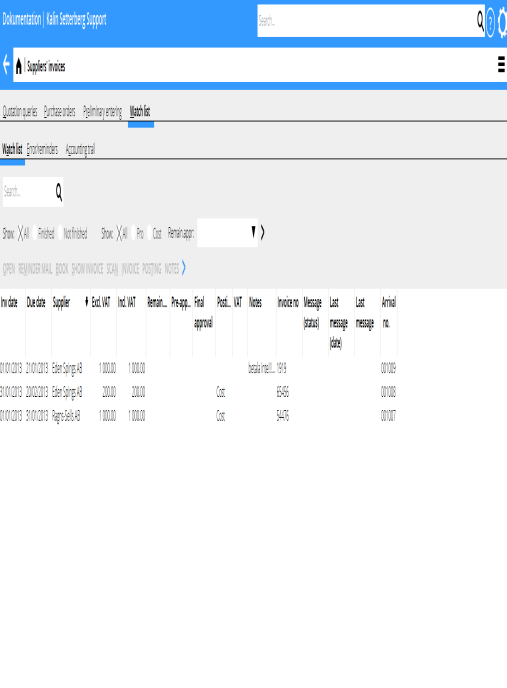

Watch list

The watch list module is only used by the accounting department. The list shows all preliminary entered, but not booked invoices. List selections:

| All (1) | Shows all invoices regardless of approval status |

| Finished | Shows fully approved invoices |

| Not finished | Shows invoices with at least one remaining approver |

| All (2) | Shows all project- and cost invoices |

| Pro | Shows all project invoices |

| Cost | Shows all cost invoices |

| Rem. appr | You can select a specific approver's unapproved invoices |

| Reminder mail | Selected invoices will be sent as reminders to the approver |

| Book | Book one or several selected invoices that are fully posted and approved. Today's date is suggested as accounting date. |

| Show invoice | Shows the scanned invoice document |

| Scan | Possibility to add documents to the invoice |

| Invoice | Shows invoice information. You can also edit the information here |

| Posting | Shows posting. You can change posting here |

| Notes | Shows notes, possibility to add notes |

Move the mouse pointer over the Posting pro/cost field to see more detailed information. Move the pointer over the employee code to see how much that has been approved and possible comments. If a final approval or a posting is red and in parenthesis it indicates that the whole amount not is approved or that the approver has written a comment.

After booking project related purchases they need to be updates ti the project accounting in Backoffice: Project accounting /Update, tab Purchases. That can also be done automatically; the parameter is in Backoffice: Base registers/Pro/Parameters, tab Purchase and Other. Note that possible existing purchases must be updated manually at the time you check the parameter box.

Bookkeping trail

The trail shows the booked invoices. It shows also time and approver and what type of approval it was in the columns Final approval and Pre-approval. Select an invoice and click Open. The same invoice picture and invoice information as in the approval will be shown. It is also possible to read notes here.