Media ekonomi

Contents

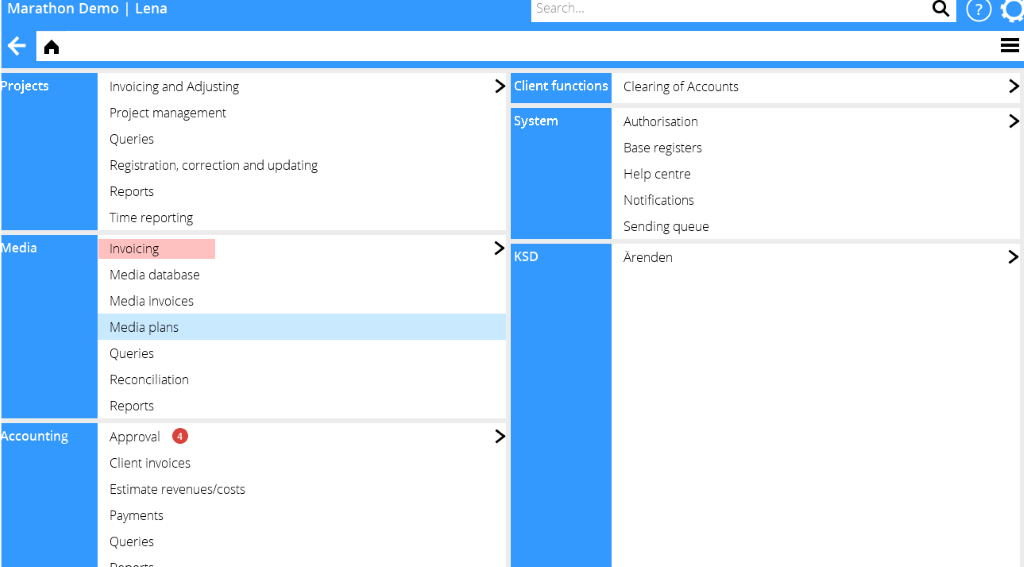

Fakturering

Faktureringen sker i Classic, 08-70-10.

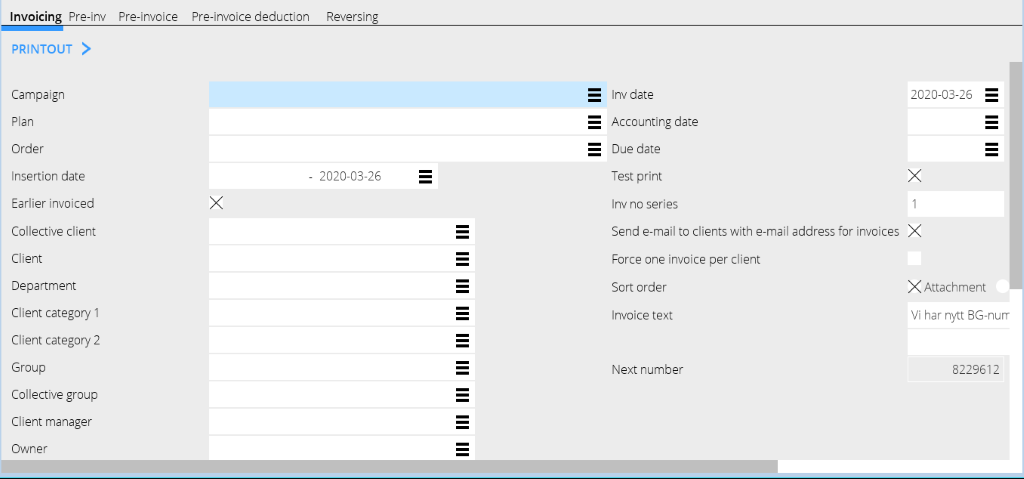

Olika selekteringar kan göras på införingsdatum, plannummer, kund, kundkategori osv.

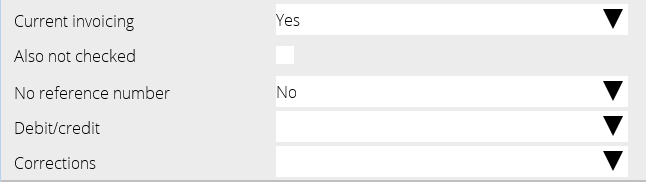

| Löpande fakturering | Om man sätter blankt kommer allt ut oavsett om avtalet har "Löpande fakturering"eller ej. Vill man bara fakturera ut de planer/ordrar som enligt avtal har "löpandefakturering skall valet vara J. |

|---|---|

| Även ej kontroll | Sätter man J kommer införande med även om de inte är annonskontrollerade under förutsättning att man anger plan eller ordernummer. |

| Ref-nr saknas | Om N så faktureras ordrar där ett referensnummer ligger inlagt - då parametern på kunden "Fakturera bara ordrar med ref. nr" är ikryssad. |

Ref-nr saknas = J så faktureras alla planer/ordrar där referensnummer är blankt och där man dessutom på kunden har sagt att det måste anges.

Om Ref. nr saknas = blankt kommer allt ut men endast vid provutskrift.

I Basregister på kunden finns en parameter "Fakturera bara ordrar med ref. nr". När denna är vald måste parametern vara J. Vid felaktig kombination av val kommer följande felmeddelande upp och fakturering tillåts inte.

| Debet/kredit | 0 = allt faktureras ut. 1 = bara debetfakturor skrivs ut. 2 = endast kreditfakturor skrivs ut.S = debet-och kreditposter faktureras ut på separata fakturor. | |

|---|---|---|

| Korrigeringar | Införanden som markerats med korrigering (x) kan faktureras ut separat. | J = tag med korrigeringar. N = tag inte med korrigeringar S = fakturera ordinarie fakturering och korrigeringar på separata fakturor. |

| Tvinga fram en faktura/kund | Genom att sätta J överstyr man kundens minibelopp för faktura. |

Allmän fakturatext kan man skriva in inför varje fakturering men om det är en text som skall vara en längre tid kan man lägga in den i 08-70-11.

Credit/Reverse an invoice

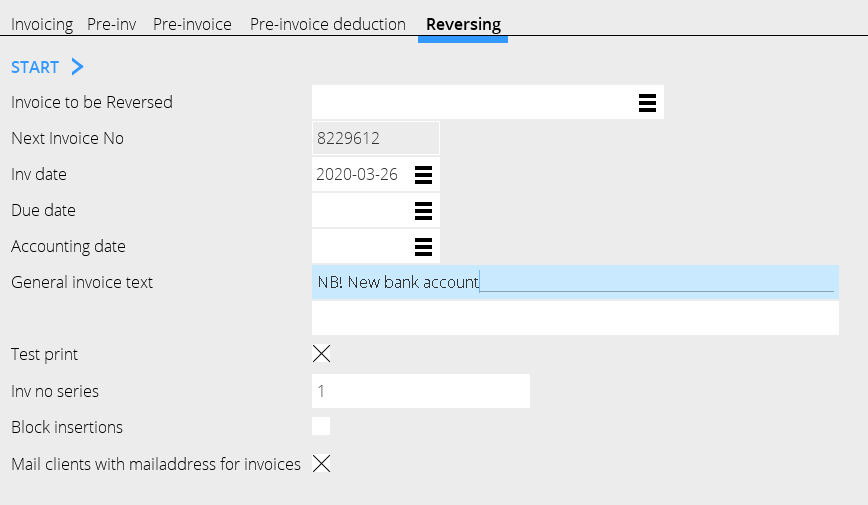

If a whole invoice is erroneous, you can credit it in Classic 08-70-12.

| Block insertions | All insertions will be blocked from invoicing when the invoice is credited. N= the insertions become definite and can be corrected and re-invoiced. |

|---|---|

| Mail clients with … | Obsolete function. Use Invoice distribution in Accounting: Invoice distribution. |

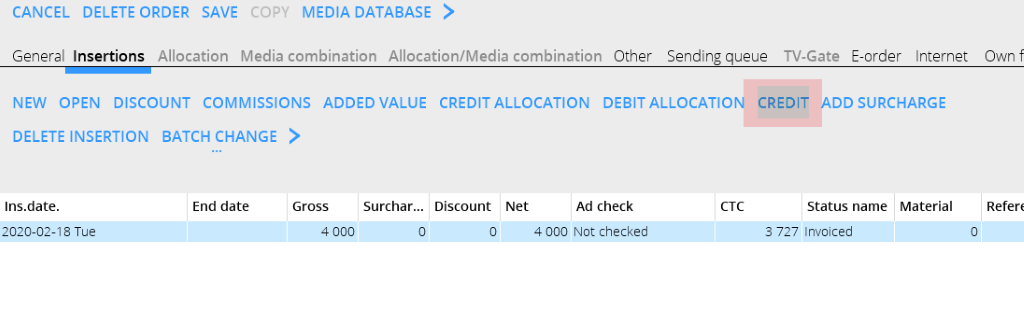

Credit/Reverse insertions

Open order and insertion. Select the insertion to be credited, use the function CREDIT.

The insertion is reversed, i.e. shown as a credit insertion and marked with a correction mark. This means that you can invoice this credit separately in the current invoicing.

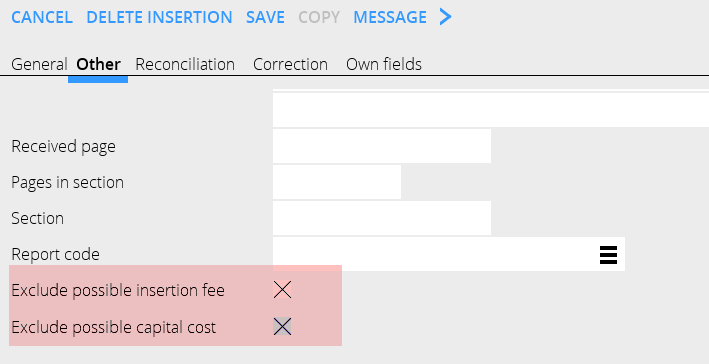

If you want to credit an insertion without including fees and capital costs, you can exclude them.

Exclude insertion fee and capital cost in the insertion, under the tab Other.

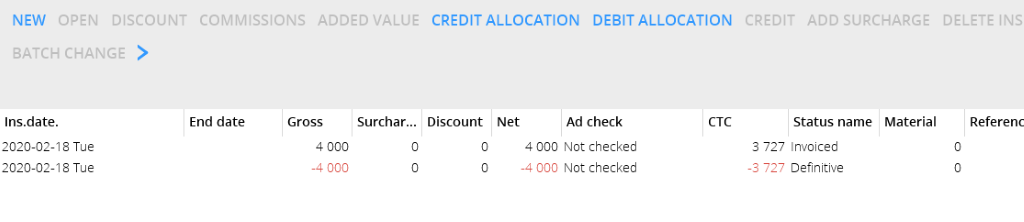

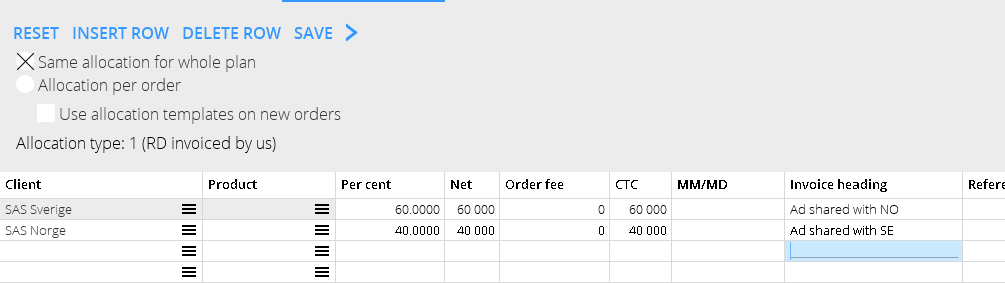

Credit/Reverse part of allocation

| Example: |

|---|

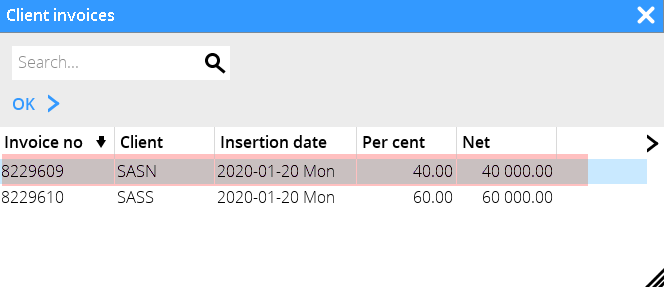

The client SAS Norway shall be credited and instead SAS Sweden shall be debited.

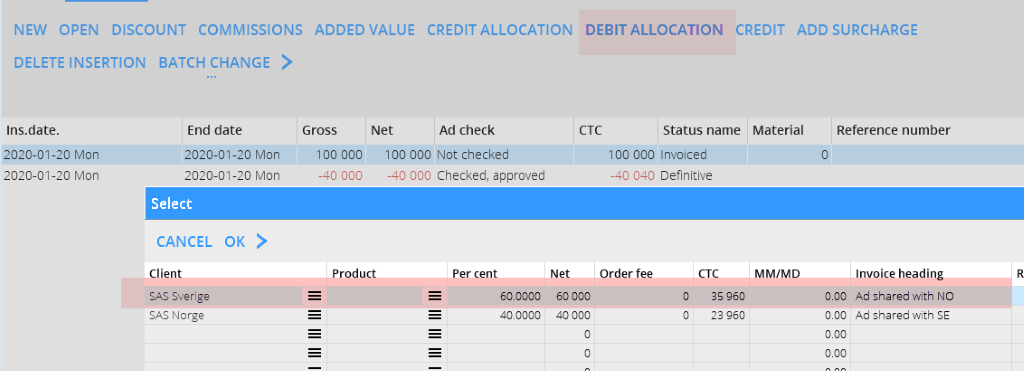

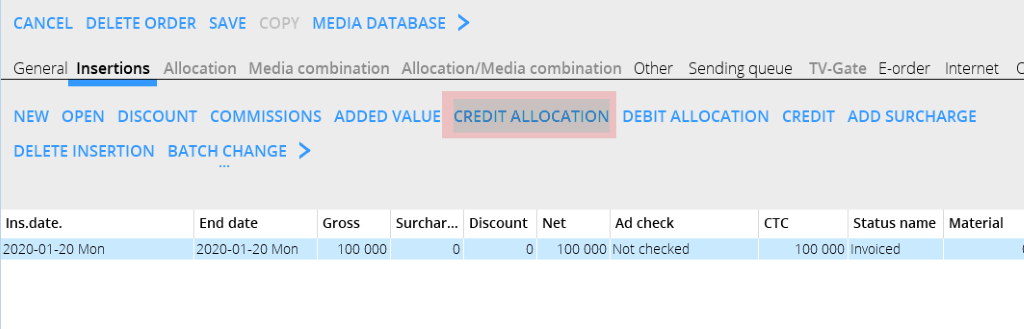

1. Open the order and select the insertion that shall be corrected. Use CREDIT ALLOCATION.

2. Select the invoice to be credited, press OK.

3. Select the insertion to be debited (the original insertion, not the credit).

4. Use DEBIT ALLOCATION.

5. Select the post that shall be debited again and press OK.

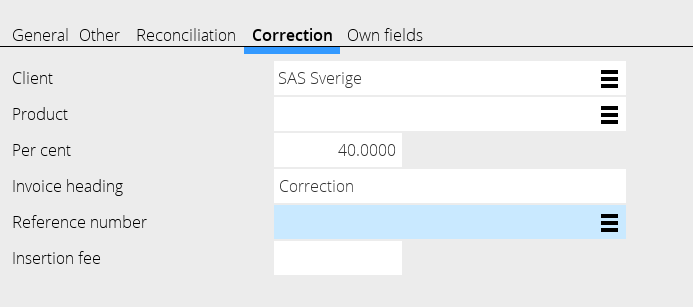

6. Select the new debit insertion and open it. Under the tab Correction, change the client to SAS Sweden and write a possible invoice comment.

7. Save. Two new invoices will be printed out at next invoicing. One credit invoice to SAS Norway and a new debit invoice to SAS Sweden.

Reverse part of invoice

Use program 08-70-14 to reverse part of an invoice. Write invoice number and press Enter. All insertions are shown. Press the space key to select an insertion (marked with an asterisk*) that shall be credited.

NB! These credits are visible only in Classic.

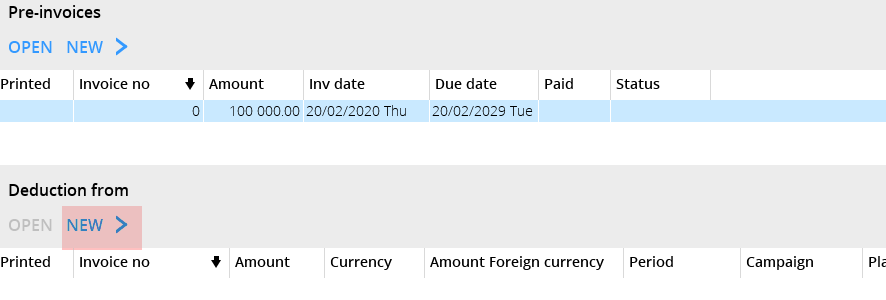

Pre-invoicing

There are two ways of pre-invoicing:

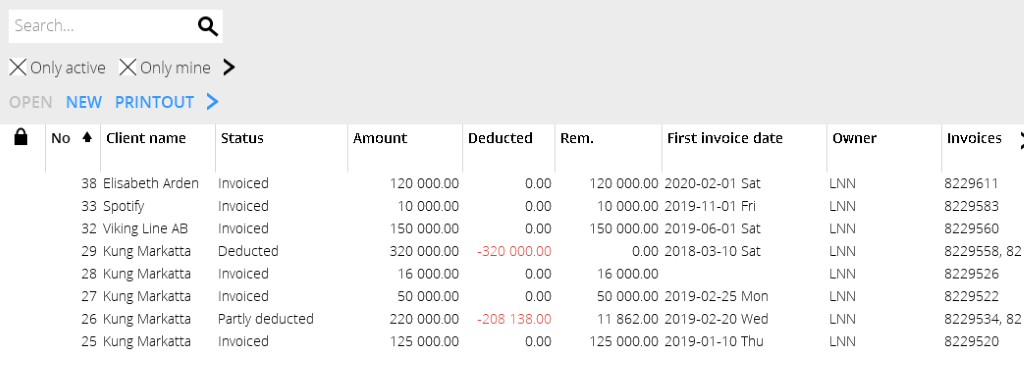

1. The client is pre-invoiced, later a deduction (settlement) is made.

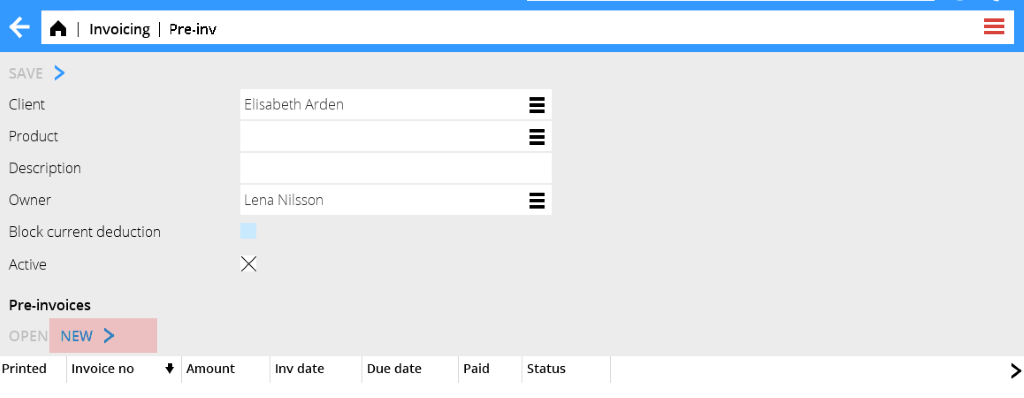

- Release a pre-invoice in Classic 08-70-20. State client, invoice date, due date and then select 3 3=Change settl agnst. State the same client code and make possible restrictions of records to settle with help of plan- and order numbers. Note, that you cannot make a settlement to another client.

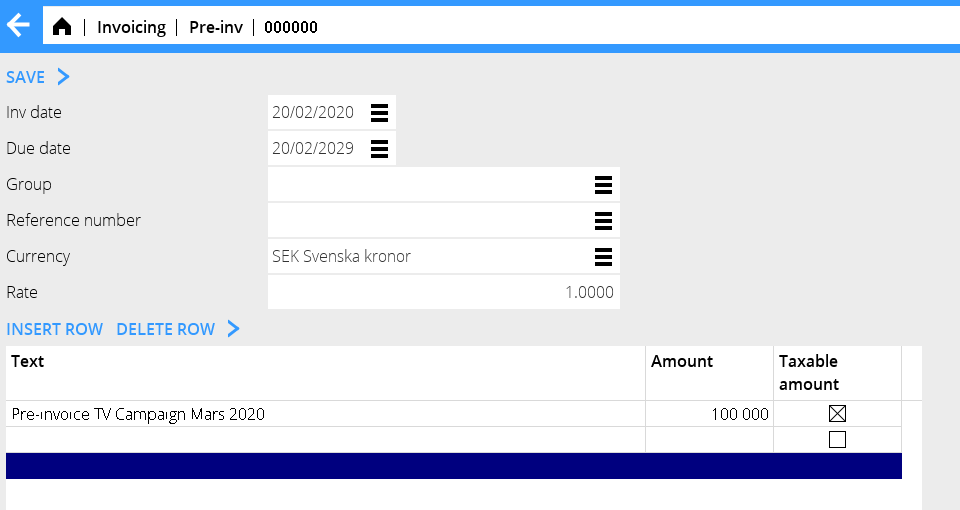

- Register pre-invoice text and amount in 08-70-21.

- Print out the pre-invoice in 08-70-23.

- The settlement is then made in 08-70-24. Write the pre-invoice number that shall be deducted. If there is discrepancies, those are invoiced as debit- or credit invoices and the pre-invoice wil be settled.

2. The client is pre-invoiced and the deduction is made currently as ads has been inserted and checked.

- Select Y on “Current pre-invoice deduction” on the agreement.

- Release a pre-invoice in 08-70-20. Select client, invoice date and due date.Select function 3= Change settle agnst. Write the same client code, make possible restrictions and enter period and/or plan- or order number. Note, that a pre-invoice cannot be deducted from another client.

- Write pre-invoice text and amount in 08-70-21.

- Print the pre-invoice in 08-70-23.

- When invoicing in 08-70-10, pre-invoiced will be automatically deducted. The part that possibly not is deducted will be saved for the next time that something concerning the pre-invoice shall be invoiced.

| Keep in mind: |

|---|

When invoicing clients in 08-70-10, who have “Current pre-invoicing” in their agreements, the system always starts with the oldest pre-invoice. If nothing matches the terms of it, it goes to the second pre-invoice.

A problem that can occur is if you have general pre-invoices (not pointing at any specific plan or order) and pre-invoices connected to certain plans. Regarding the general accounts, the system deducts from everything possible, regardless if the pre-invoice is connected to a plan or not.

Use the list in 08-70-26 to see the actual deductions/settlements status. Select Y on Details.

Reconciliation of discrepancies/ Discrepancies

Book away discrepancies in Media: Reconciliation.

Make a selection in the screen with reconciliation code, owner, client, date, etc. You can save your selection for coming uses.

| Discr Net /Discr Net-net | State how big discrepancies you wish to see in the list. If you don't want to see all insertions, write at least 1-999 999 999 in Discr. Net- net. The setting is that both fields should have 0-999 999 999. |

|---|

The amount in the list showing Discr Net-net is reconciled with the media deduction account. Select only “to booking date” if you want to reconcile with the deduction account.

Adjust the columns such that you see the information that is relevant for you. Select columns with the > symbol furthest to the right in the heading row.

Open

| Create corrections | Creates a new insertion of the selectedinsertion's net-net discrepancy, depending on the discrepancy either a negative or a positive one. The new insertion can later be invoiced to client. |

|---|---|

| Book away | See below. |

| Reconciling code | Changeable. |

| Reconciling comment | Possibility to add or edit comments. |

| Change order number/ins. date | Possibility to move the media invoice of the insertion to another insertion. See further description below. |

| Change owner/client | Change owner or client, if the parameter has been set to allow it. |

| Show invoice | Shows an invoice copy as PDF. |

| Printout | Prints the reconciling list. Requires a special print template. |

Book away discrepancies

Select one or several rows and click on BOOK AWAY.

| Note, that you cannot undo this action! |

|---|

Update the book-away to G/L in Classic 08-80-22.

The voucher is booked directly on the accounts stated in the media parameters under the Reconciliation tab.

Move media invoice to another order or insertion date.

Use the function CHANGE ORDER NUMBER/INSERTION DATE to move an invoice that was incorrectly registered.

Select order and click on the function.

Fetch the media invoice (from the search box) and enter order number + insertion date of the media invoice's destination.

If only a part of the invoice shall be moved, write amount.

Agency settlement

Some clients have an agreement that the advertising agency shall have part of commissions and fees. This is done by making an agency settlement and send it to the advertising agency. When you print out the settlement, a supplier's invoice is created in the purchase ledger and will be paid out to the agency.

- Enter the agency in System: Base registers/MED/Clients/Agencies.

- Then state the agency in the client record in System: Base registers/MED/Clients/Clients, tab Parameters 1.

- In the agreement in System: Base registers/MED/Clients/Agreements, set percentages of insertion fees, agency commissions and capital costs to be forwarded to the agency.

- Print the invoice and the agency settlement in 08-71-10.

Select client and accounting date, or another selection if you for example want to deduct only one certain media on a plan.

| Paid invoices | Y = Settles only paid client invoices. |

|---|---|

| Already updated | Y= Possibility to reprint specification. |

You can edit amounts that has yet not been settled in 08-71-20.Select agency and press Enter. Press the F1 -key to edit. This corrects the booking of the client invoice.

Invoice projects together with the media invoice in 08-70-10.

Check the parameter Include invoices made in PRO in System: Base registers/Parameters, tab Invoicing

The media invoice template must be updated such that it fetches information from the Project accounting.

Create an invoice as normally in Project: Adjusting/invoicing and connect it to the media plan in the tab Parameters.

The invoice is printed out in Classic 08-70-10. The bottom part of the invoice shows the project.

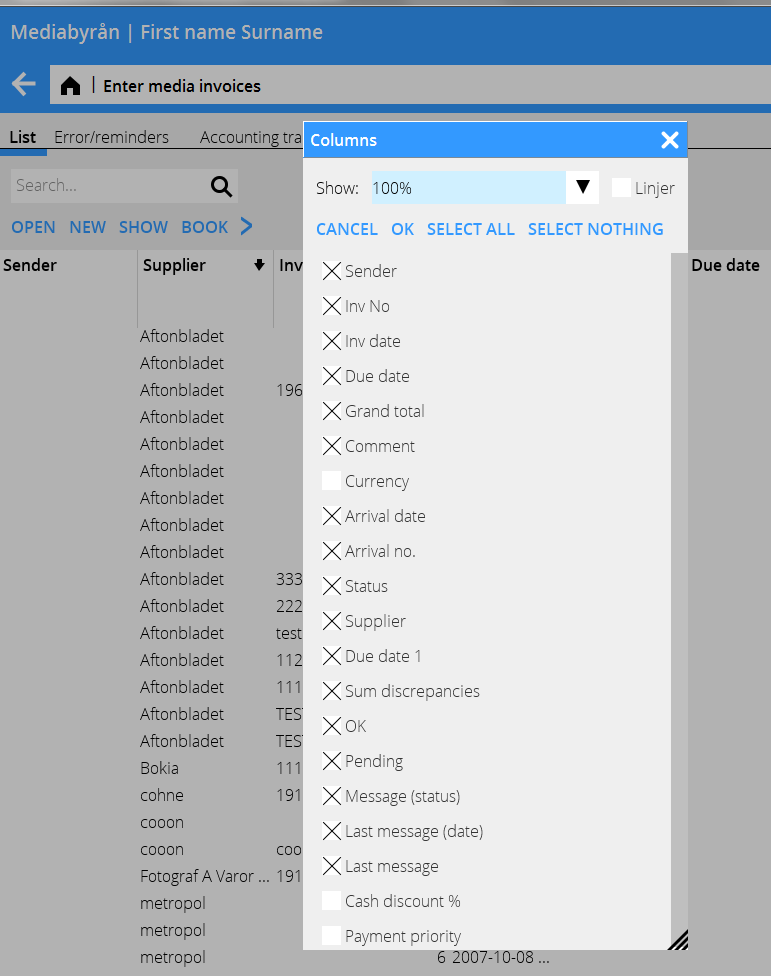

Enter media invoices

Register incoming media invoices in Media: Enter media invoices.

Search by order number and/or media, supplier, client or insertion date.

If the media is connected to a supplier in the base registers, it will be fetched from there. If not, fill in supplier info in the Registration part.

If the media has another currency, all amounts shall be entered in it.

You can write the invoice number here or when saving the invoice.

All matching insertions are shown. Select columns wih the > sign furthermost to the right in the heading bar.

If there is discrepancy between insertion and invoice, you can correct it directly on the insertion. Select insertion, open it and write invoice amount in the column This invoice.

In the fields to the left you can add a discount – or surcharge code. The fields will then be open for you to enter amounts.

If you want to send a reclamation (claim) of an erroneous invoice, use the function SAVE AND CLAIM.

The orders will be marked with an X when they are corrected and saved. You can mark an order as correct directly, if you can see that it is OK.

All marked orders will be included in the invoice. If the invoice is OK, save it.

| Cancel | Return to previous view |

|---|---|

| Save | Select invoice number and accounting date in order to save the invoice. The voucher number will be given after saving. |

| Create order | If an order not is entered but you still want to include it in the invoice, click on CREATE ORDER and select an insertion date. |

This order gets a temporary order number (900000-series) when the invoice is saved. It can thereafter be changed to a real order number in Reconciliation of media invoices with the function CHANGE ORDER NUMBER/INSERTION DATE.

| Insert order | If you cannot find an order or the order hasn't been included in the selection, you can insert it to the invoice. Click INSERT ORDER and write order number and insertion date, then click OK. |

|---|---|

| Find order | Search order with order number. |

| Save as pending | You can suspend the registration of an invoice that you have started with. |

When you want to continue, click Pending invoices instead of Search and select the invoice from the list shown.

| Claim | You can send a claim (reclamation) directly from the program after your correction. |

|---|

If you have a text that shall be shown automatically, you can write it (or several texts for different types of claims) in System: Base registers/Parameters, tab Claims. Use IMPORT TEXT and select from the list.

Before sending the claim you can check it with the function SHOW. Use SEND to email/fax the claim to the supplier.