Media credit

Contents

Credit handling

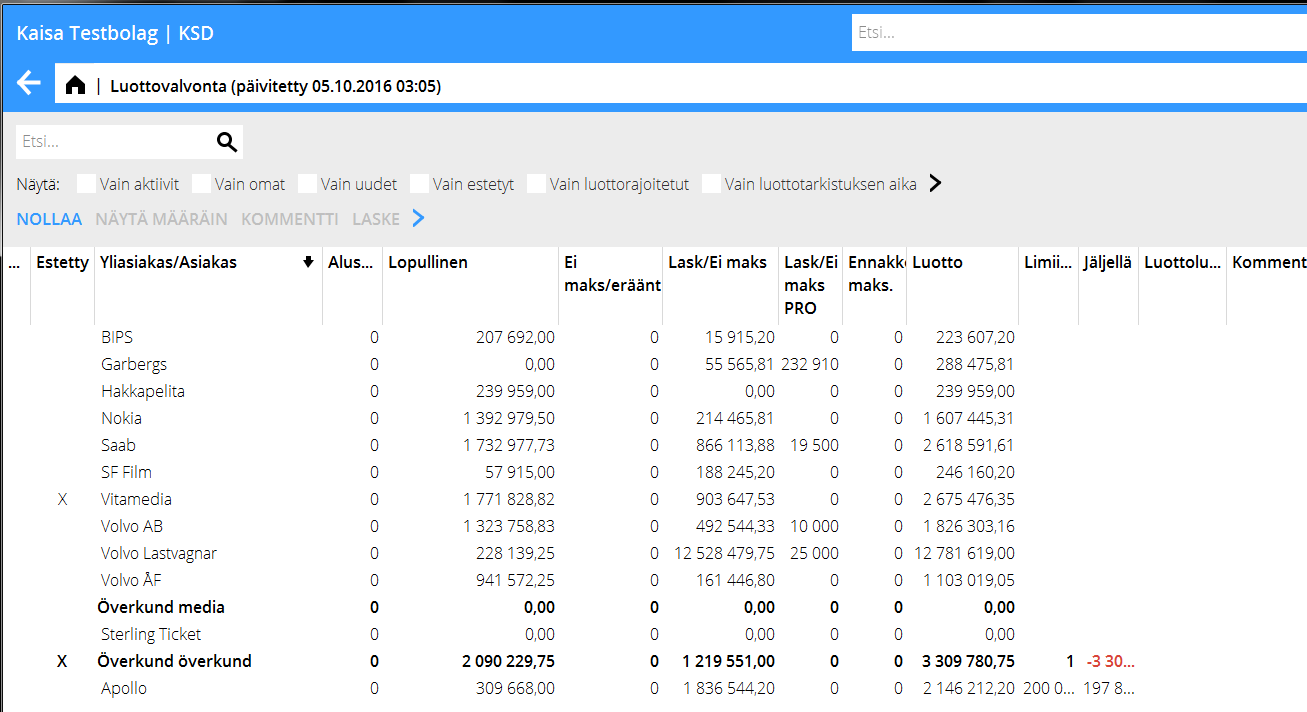

In Media: Credit monitoring you can see how much credit your client have been using and if they have been blocked.

| Reset to zero | Resetting means that the amount of new blocked clients is set to 0. Next night the program checks blocked clients and by checking the field "Only new" you can easily check if there are new blocked clients. |

|---|---|

| Show order | Click to open Media inquiries and thus the content of the order. The program is looking at allocations, only the main client's orders are shown. |

| Comment | Optional comment field. Shown only here. |

| Calculate | Checks current credit status at client/collective client immediately provided that the parameter "Continuous credit check – all functions"” has been checked. |

| Credit | Select a row and press Credit to see a sumamry of what the credit includes and a credit graph. |

| You can limit the list by selecting: | |

| Only active | Only active clients |

| Only own | Clients where you are client manager. |

| Only new | Blocked clients since last reset. |

| Only blocked | Only clients that have exceeded credit limit and thus have been blocked. |

| Only credit limited | Clients with credit limit. |

| Only those due for control | Only clients that are due for credit control, provided that a date has been set |

Credit limit

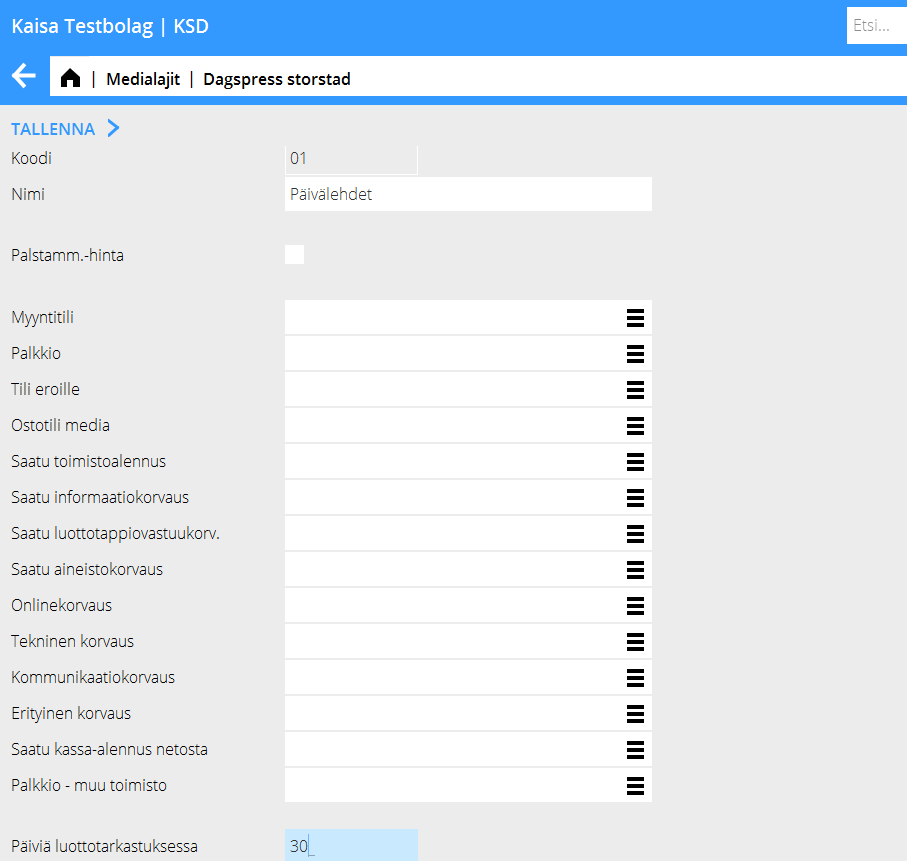

Credit limit can be set in two ways: On client and on Collective client (and collective client's collective client etc.) If a credit limit has been set on a client, Marathon primarily checks it. If it has been set on collective client, all clients connected to it without own credit limit are counted. The credit is counted from net and the net is compared with what has been booked on each media type during stated period. The period can be set in System: Base registers/MED/Media types.

In the below example we have stated that Marathon when it comes to Daily press counts 30 days ahead. This facilitates creation of long term media plans without interruption by the credit handling.

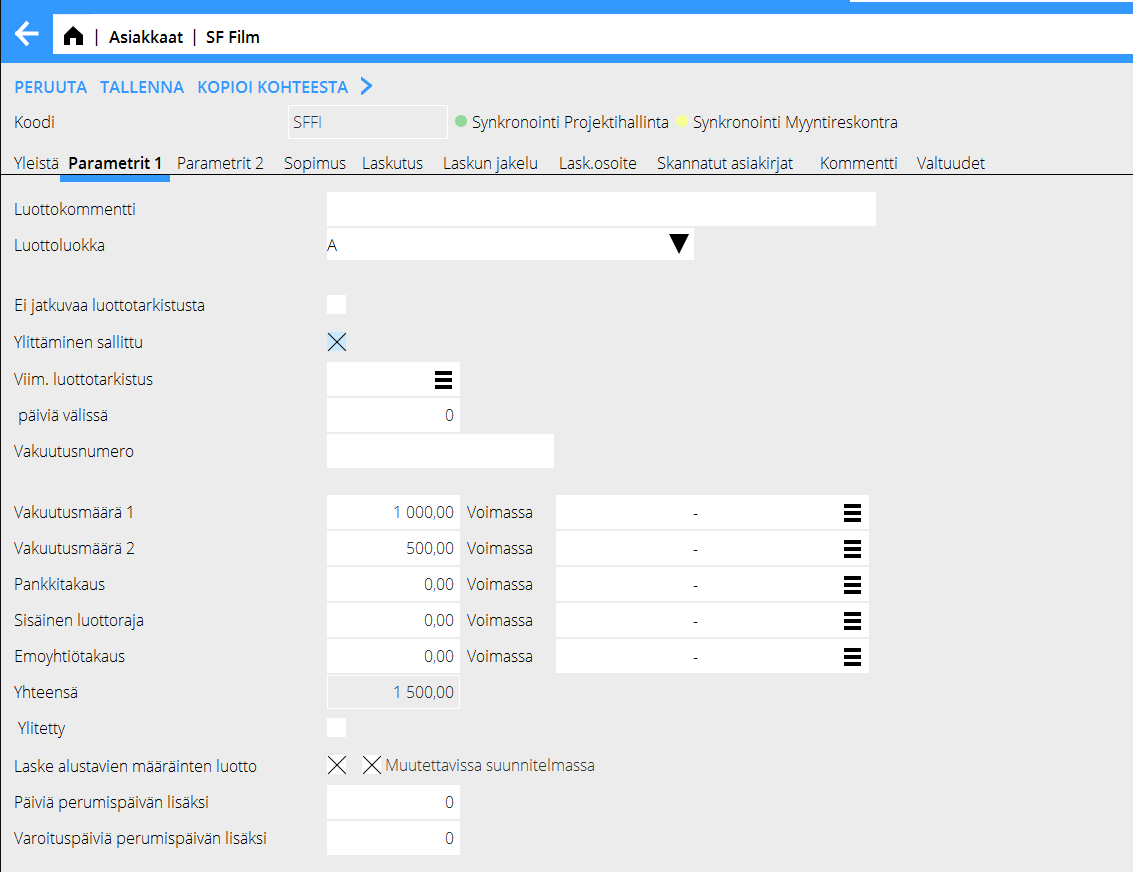

Settings on client and collective client

Settings are made in System: Base registers/MED/Clients ja System: Base registers/MED/Collective clients.

| Credit class | Shown in Media: Credit monitoring, where it is selecyable and sortable. |

|---|---|

| No continuous credit control | Uncheck if you want to make an exception from the standard setting (continuous credit control) |

| Exceeding allowed | Client/Collective client is included in control but will not be blocked if credit limit has been exceeded. |

| Insurance amount 1 | The insurance of the parent company. You can add up to five insurance amounts and enter validity periods on the m. |

| Exceeded | If continuous check not is in use the "exceeded-mark" has to be removed, otherwise you will have to wait until next control before you can make any bookings. |

| Calculate credit on preliminary orders | Choose if you want also preliminary orders to be included in the credit calculation. You can also select this to be stated on the media plan. |

| Days additional to cancellation date | You can add extra days to the cancellation period that is set on the media type. |

| Warning dates additional to cancellation date | The system gives a warning whilst making orders. If amount of days for a media group e.g. is set to 30, the control can start five days before insertion date and warnings will be ten days ahead. |

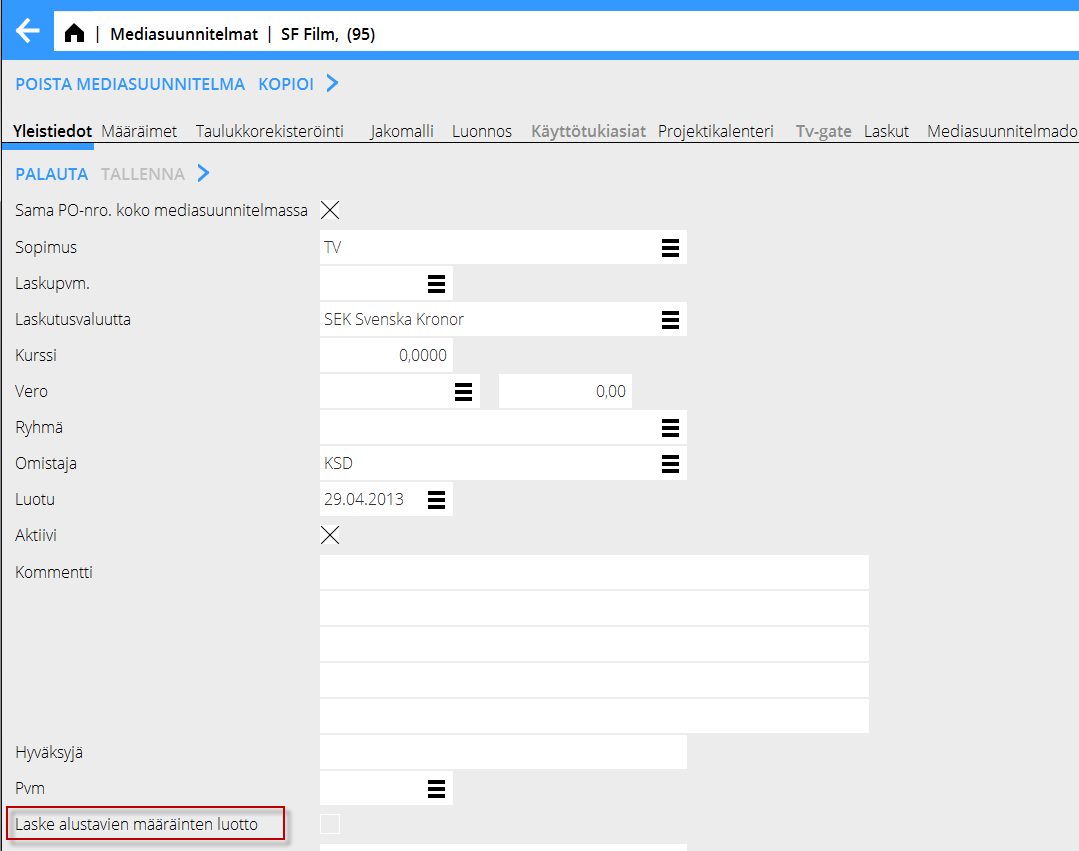

Settings on plan

| Calculate credit on preliminary orders | Posssibility to set separate parameter directly on plan that also preliminary orders will be included in the credit calculation, regardless of the settings on client/collective client. |

|---|

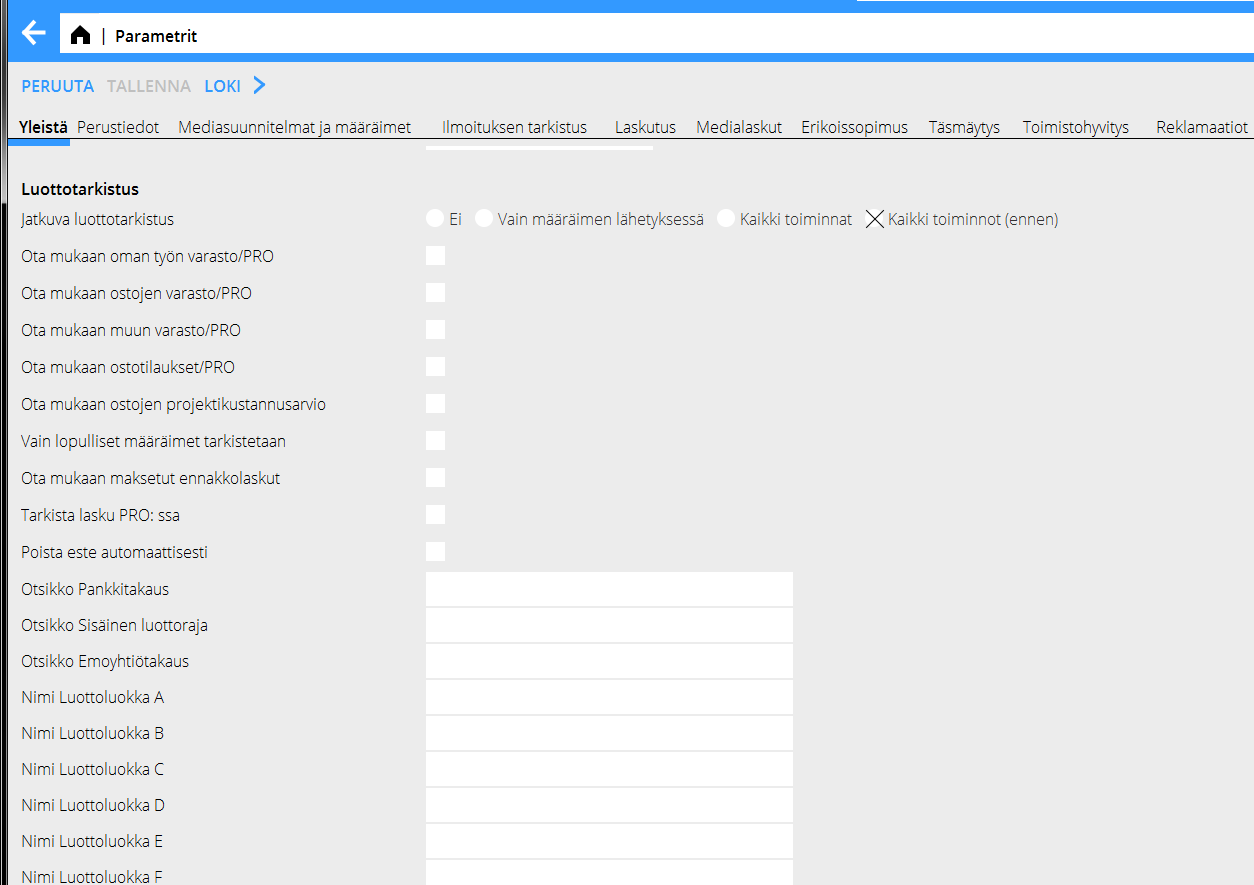

General parameter settings

| No | Normal credit check made at nighttime. Clients/Collective clients are checked and, if limit has been exceeded, blocked. |

|---|---|

| Only when sending orders | Credit control is made on booked orders at the time of sending (printing). |

| All functions | Full credit check directly when an order is created or booked. This can be overruled on some clients by e.g. including preliminary orders. |

| All functions (before) | Certain functions such as creating a new order or making an order definitive are checked immediately and leads to blocking if limits have been exceeded. Other functions such as allocation of media combinations and recalculations of yearly agreements are checked immediately as well but the client will not be blocked from these functions before the next day. |

Other parameters

(System: Base registers)

| Include fees' WIP in PRO | Fee on the client's project is counted in to the credit limit. |

|---|---|

| Include purchases' WIP in PRO | Purchases on the client's project are counted in to the credit limit. |

| Include others' WIP in PRO | Other/Materialon the client's project are counted in to the credit limit. |

| Include purchase orders in PRO | Purchase orders are counted in to the credit limit. |

| Include project estimate purchases | Estimated purchases on a project are counted in to the credit limit. |

| Only def. orders in credit check | This function can be overruled in the client/collective client register if you want to include also preliminary orders into the check. If this box is checked, it is no longer selectable in the client/coll client registers. |

| Include paid pre-invoices | Check if you want the pre-invoices to be counted into the credit limit control. |

| Remove blocking automatically | removes blocking from the client/collective client in the night check automatically when the exceedance has been handled (e.g client payment has been booked) |

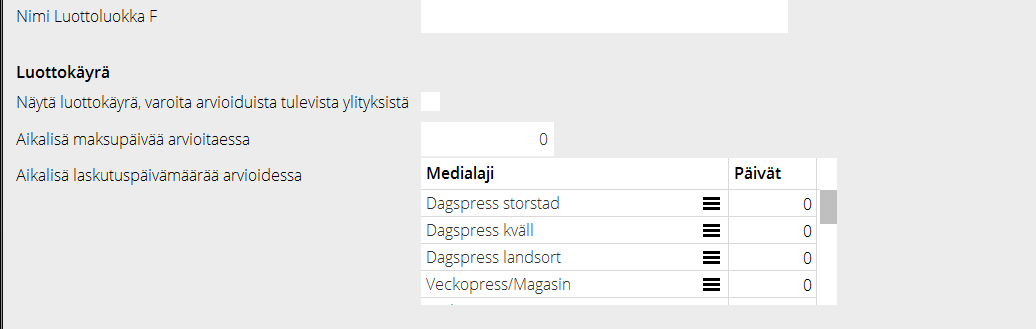

Credit graph

Credit graph requires additional days (at least one) for evaluation of payment- and invoicing dates. Additional days on invoicing date is set per media type