News:Posting of fictitious VAT in the function for Reverse charge

| Published | 2018-06-05 |

|---|---|

| Module | Accounting |

| Version | 546 |

| Revision | 43187 |

| Case number | 1030918 |

Posting of fictitious VAT in the function for Reverse charge

There is a functionality in Marathon for booking of VAT base amounts on both media- and cost invoices. Now you can also post VAt amounts.

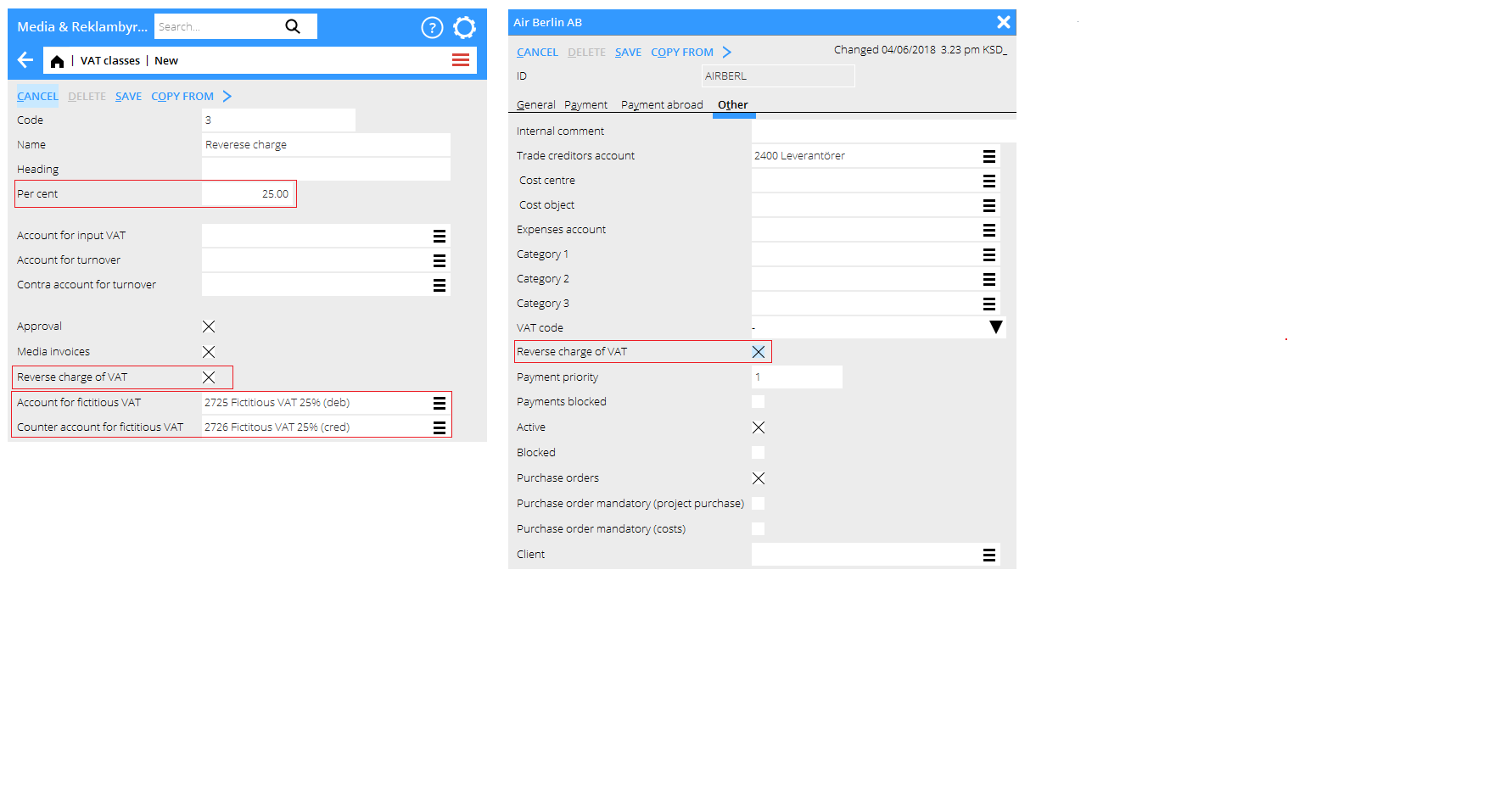

Preparations: Create a VAT class and set VAR percentage on the fictitious VAT. Check the box Reverse charge of VAT, and write account and contra account for fictitious VAt.

Mark the foreign suppliers theat fictitious VAT shall be calculated on by checking the box Reversed charge on VAT in the Other tab.

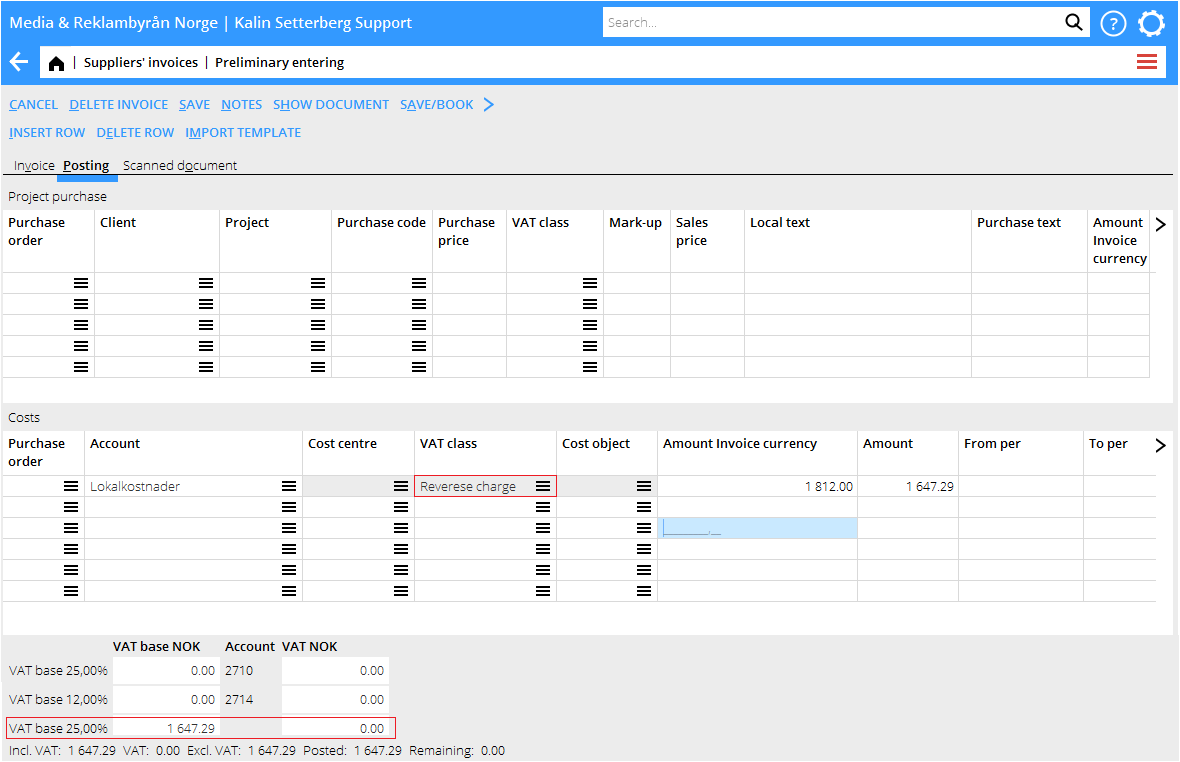

Posting: In this example we have a cost invoice but the functionality is also working on media invoices. VAT class is automatically selected from settings on the client. In the summary at the bottom you can see that the VAT base entitles to 25 % VAT but the VAT field is set to zero since the VAT is fictitious.

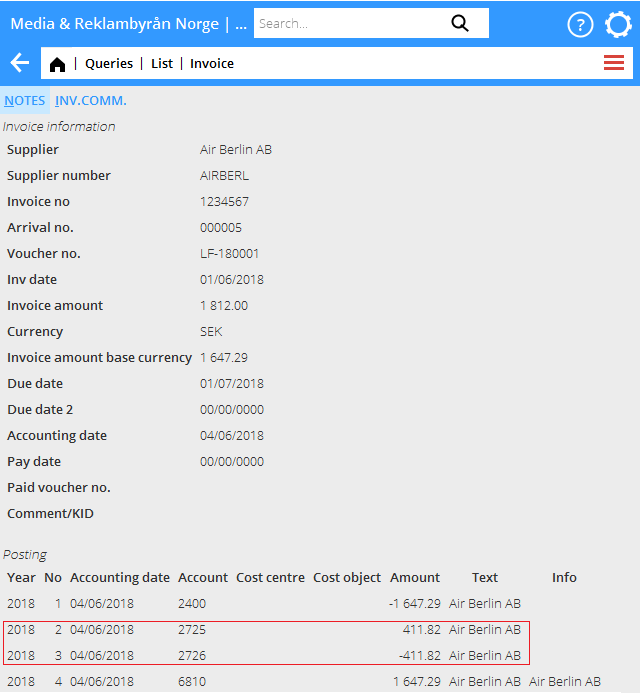

Bokförd kontering:

När fakturan bokförs så bokförs den fiktiva momsen i debet och kredit på de konton som angivits på momsklassen.