Translations:Inventory ledger/20/en

2.Edit months (correction retrospectively)

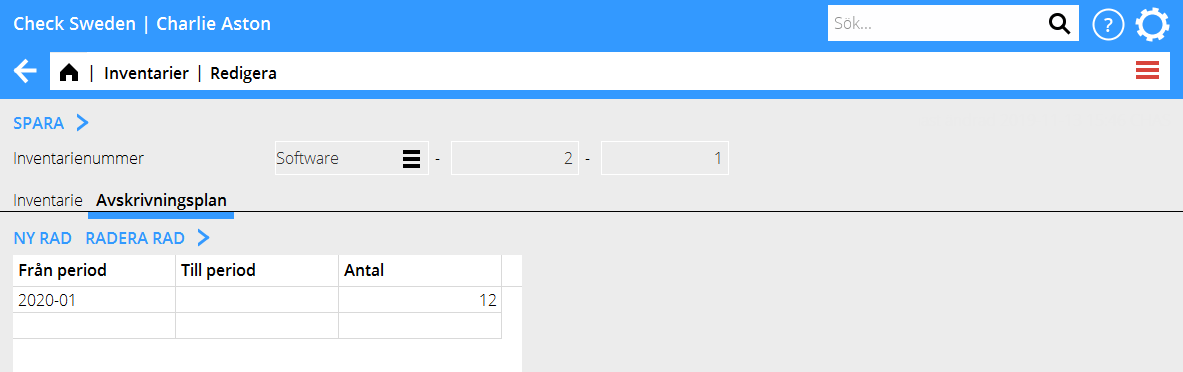

If the asset’s depreciation plan is erroneous and you want to correct also already performed depreciations, you can change months directly on the asset Accounting: Assetst, tab Assets, tab Asset. The next depreciation will correct previous depreciations based on the new number of months. Example: Acquisition price 60 000 SEK. First depreciation period 01-2019. Months to depreciate = 60. Performed depreciations to 12–2019. Change in field Months to depreciate on the asset = 24, which means monthly depreciation of 2 500 SEK. During 2019 there has been 12 depreciations of 1 000 SEK/month = 12 000 SEK. In 01–2020, 20 500 SEK is depreciated. 2 500 SEK for 01-2020 and 18 000 SEK that corrects the previous depreciations for 2019 (60 000 / 24 * 12 - 12 000).