Media accounting

Contents

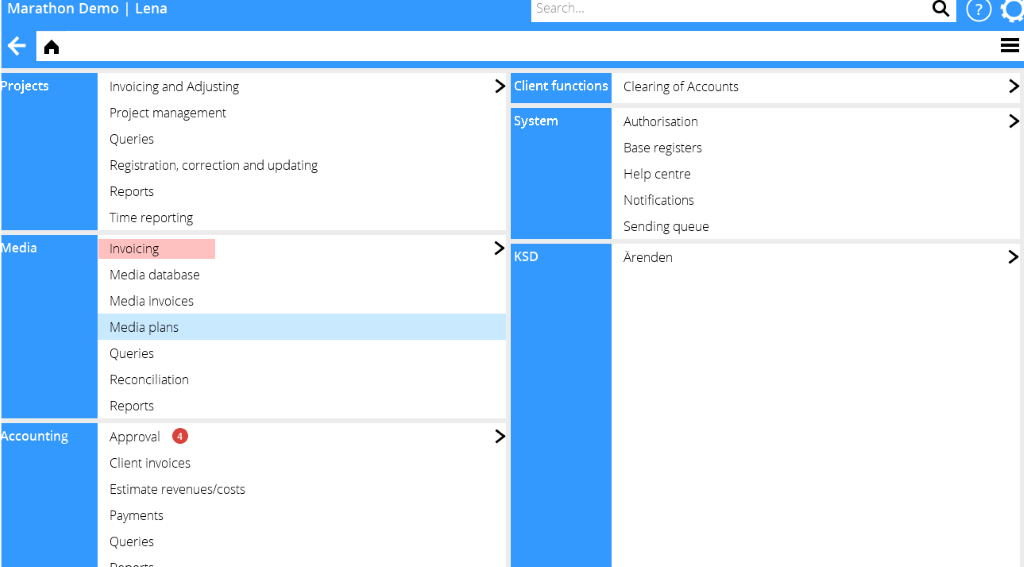

Invoicing

All invoicing is made in MEDIA/INVOICING, also pre-invoicing and deductions.

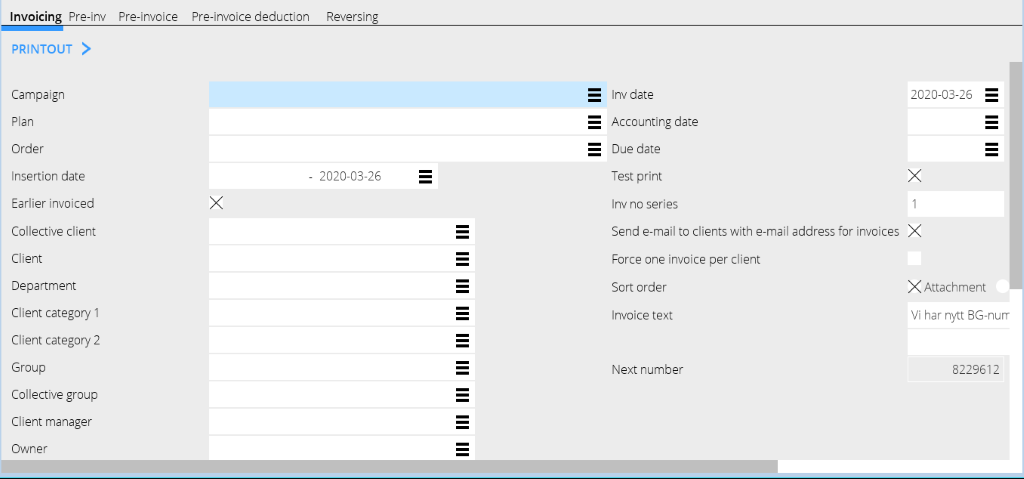

You can make different selections such as insertion date, plan number, client, client category etc. If you use invoicing per campaign, it is also possible to select.

If you invoice a certain media type or client continuously, you can save the selection for the next time. The options for saving are behind the blue arrow.

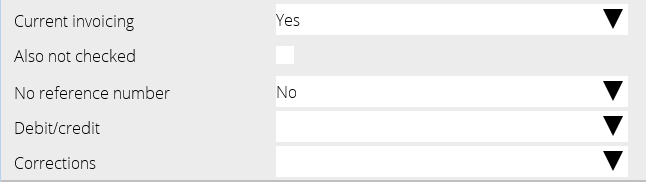

| Current invoicing | If this is left blank, everything is printed out regardless if the agreement has “current invoicing” or not. If you only want to invoice plans/orders with “current invoicing” in their agreements, select Yes. |

|---|---|

| Also not checked | If Yes, insertions will be printed out even if they haven’t been ad checked, provided that plan-/order number has been stated. |

| No reference number | If No here, all orders with reference number are invoiced, provided that the client has “invoice only orders with ref no” activated. |

If Yes, all plans/orders without reference number will be invoiced, provided that the client has stated that it is mandatory.

If left blank, everything will be printed out, but only in the test print.

In the base registers’ client record there is a parameter “Invoice only invoices with reference number". When selected, the parameter must be set on Yes. If you select an erroneous combination, you will receive an error message and invoicing will not be allowed.

| Debit/credit | Blank = everything is invoiced.

Debit = Only debit invoices are printed out. Credit = Only credit invoices are printed out. Separate = debit- and credit records are invoiced in separate invoices. |

|---|---|

| Corrections | Insertions marked with correction (x) can be invoiced separately.

Yes = include corrections No = don’t include corrections Separate = invoice ordinary invoicing and corrections on separate invoices Int = only internal corrections |

| Force one inv/client | If checked, the client’s minimum amount for invoicing is overruled. |

General invoice text can be written for each invoicing.

Credit/Reverse an invoice

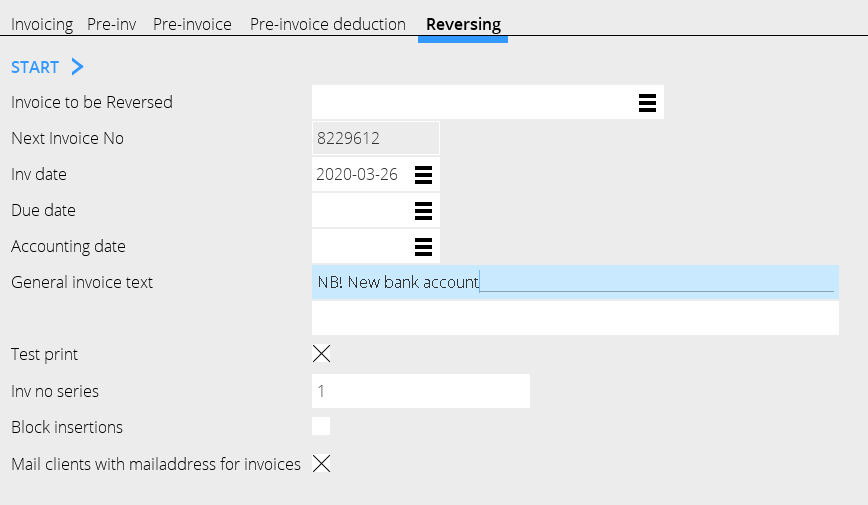

If the complete invoice is wrong, you can credit it in the tab Reversing.

| Block insertions | Means that when an invoice is reversed, all insertions will be blocked so that they cannot be invoiced. If unchecked, the insertions become definitive and open for corrections and can then be reinvoiced. |

|---|---|

| Mail clients with … | Obsolete function. Use Invoice distribution in Accounting: Invoice distribution. |

Credit/Reverse insertions

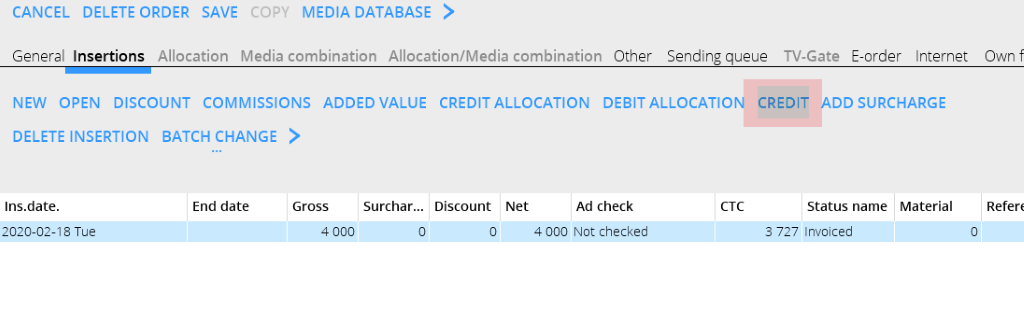

Open the order and the insertion. Select the insertion you wish to credit and press the option CREDIT.

The insertion is credited, meaning it is classified as a credit insertion and marked with a correction. That means that you can choose to invoice the credit separately in the current invoicing. Choose if the earlier invoice number should be added as a comment.

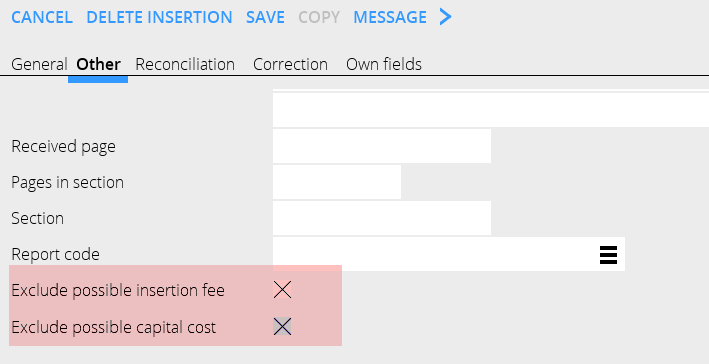

If you want to reverse an insertion without including insertion fee and capital cost, you can exclude these fees.

Exclude insertion fee and/or capital cost in the tab Other within the insertion.

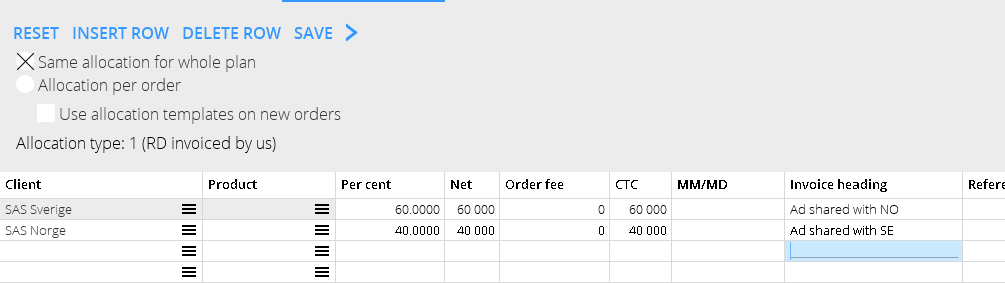

Credit/Reverse part of allocation

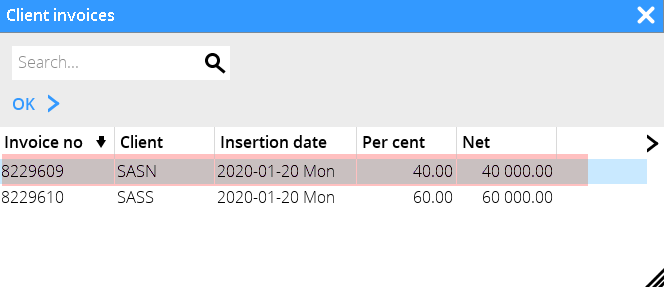

If you have an allocation and you only wish to credit one of the clients, you are practically “moving” the cost to another client.

| Example: |

|---|

The client SAS Norge shall be credited, and the client SAS Sverige shall be debited instead, meaning the latter shall pay the whole amount.

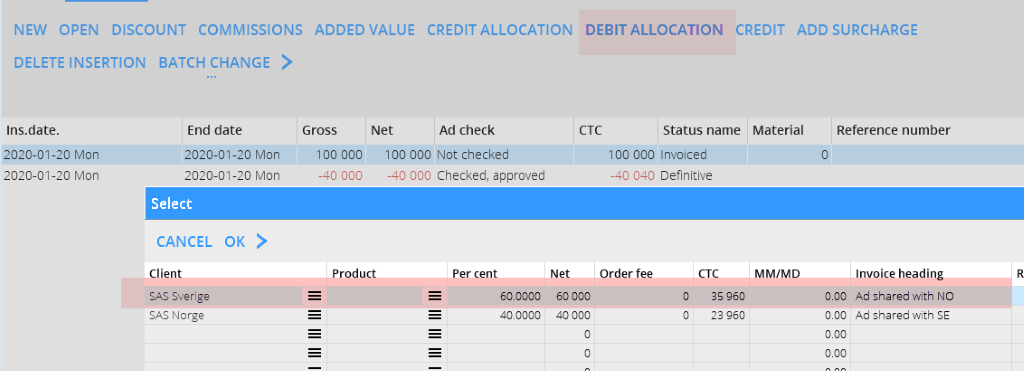

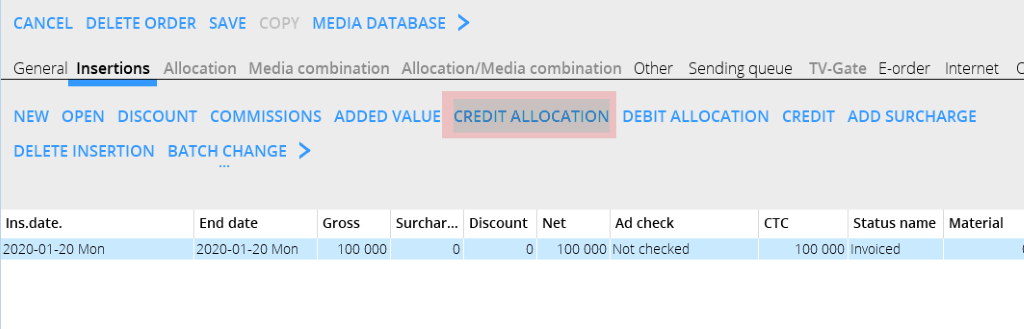

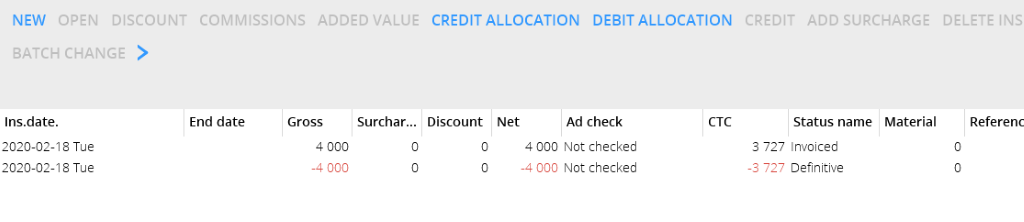

Proceed like this: 1. Open the order and select the insertion that shall be corrected. Use CREDIT ALLOCATION.

2. Select the invoice to be credited, press OK.

3. Select the insertion to be debited (the original insertion, not the credit).

4. Use DEBIT ALLOCATION.

5. Select the post that shall be debited again /SAS Sverige) and press OK.

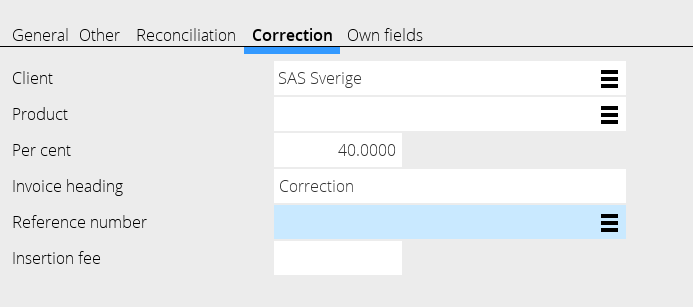

6. Select the new debit insertion and open it. Under the tab Correction, change the client to SAS Sweden and write a possible invoice comment.

7. Save. Two new invoices will be printed out at next invoicing. One credit invoice to SAS Norway and a new debit invoice to SAS Sweden.

Pre-invoicing

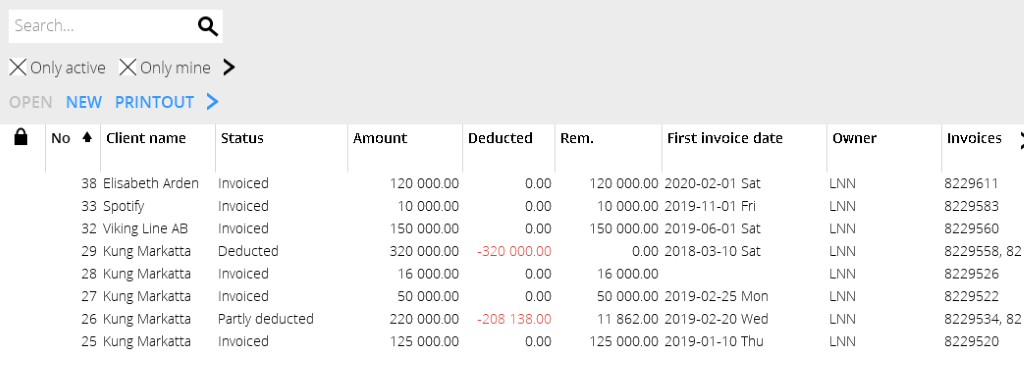

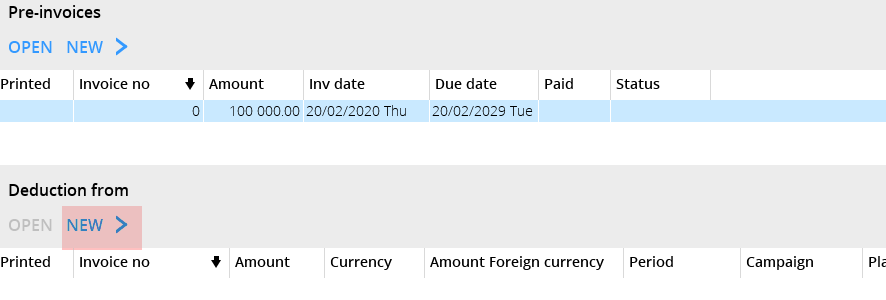

The list in the Pre-invoice tab shows the status of the pre-invoices; the invoice amount, deduction amount and deducted invoices, and remining amount. Deduction from shows definitive orders that are available for deduction

There are two ways to pre-invoice based on the client agreement:

• The client is pre-invoiced and a controlled deduction is made. Not current pre-invoicing.

The client is pre-invoiced, and all definitive insertions are deducted currently. Current pre-invoice deduction.

New pre-invoice:

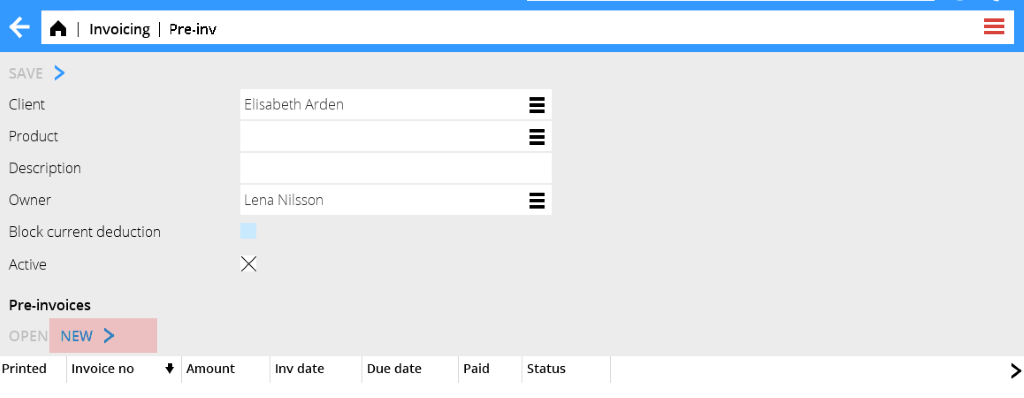

Make a new pre-invoice in the tab Pre-invoice Note, that it is not possible to deduct pre-invoiced from another client.

Enter client and possible owner (if you want to sort and search within your own in the list)

Block current deduction = the pre-invoiced is not deducted at the current pre-invoice deduction.

2. In pre-invoices, press NEW.

3. Enter invoice date, due date and text with amounts. Choose if the pre-invoice is taxable or not. Save and printout in the tab Pre-invoice. If you already know what plan/order the pre-invoice shall be deducted from, you can fill in that before printing out the invoice.

4.Deduction from

Enter plan, order or campaign. If you select “Deduct all”, you cannot enter anything in the fields, these are default settings.

The description field can be very useful.

1. When the time for deduction comes, it is done either in Invoicing (if current deduction) or in the tab Pre-invoice deduction (if controlled deduction). Enter here the pre-invoice number that shall be deducted. Possible surpluses/deficits are invoiced as debit- or credit invoices and the pre-invoice is settled.

| To keep in mind: |

|---|

When invoicing clients with agreements based on Current pre-invoice deduction, the system starts with the oldest pre-invoice. If there is nothing that matches the conditions for the pre-invoice, it goes to the next one.

Reconciliation of media discrepancies/ Discrepancy handling

Book away discrepancies in Media: Reconciliation.

You can make a selection based on reconciliation codes, owner, client, date and many other fields. You can save your selection if you use it often.

| Discr Net /Discr Net-net | Describes how big discrepancies that shall be shown in the list.If you don’t want to see all the insertions, write 1-999 999 999 in Discr. Net-net. The setting to see booked away discrepancies is 0-999 999 999 in both fields. |

|---|

The amount in the list showing Discr Net-net is reconciled with the media deduction account. Select only “to accounting date” if you want to reconcile with the deduction account.

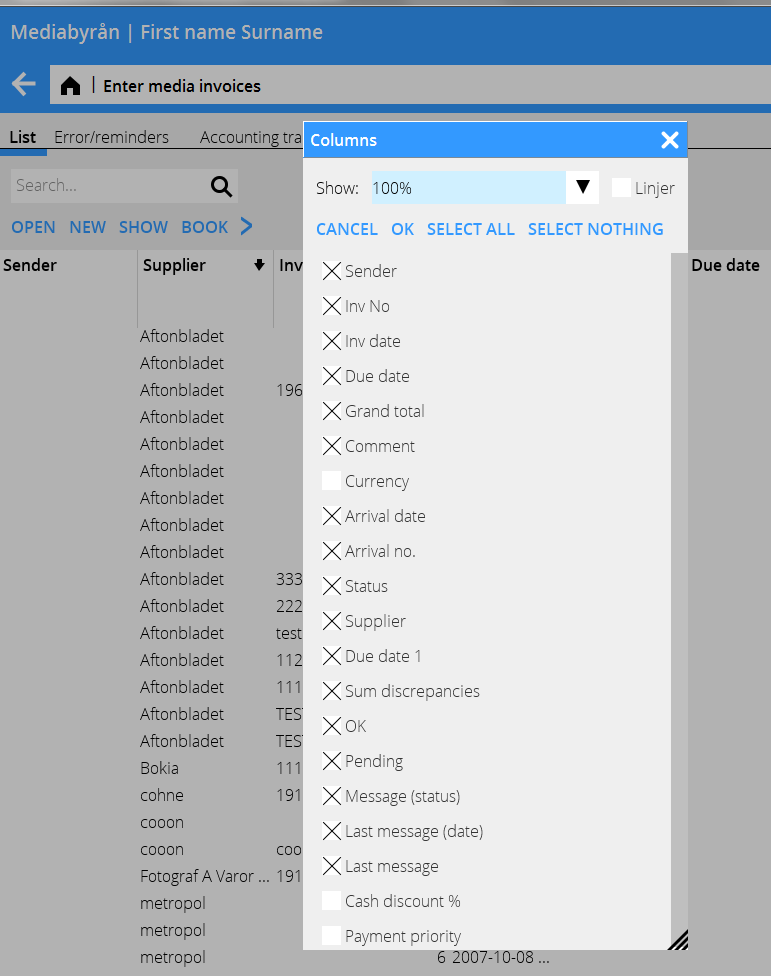

Order the column so that you can see all relevant information. Use the arrow on the right in heading row to see all column options.

| Open | Open the order to deepen into it |

|---|---|

| Create corrections | Creates a new insertion of the selected insertion's net-net discrepancy, depending on the discrepancy either a negative or a positive one. The new insertion can later be invoiced to client. |

| Book away | See below. |

| Reconciling code | Changeable. |

| Reconciling comment | Possibility to add or edit comments. |

| Change order number/ins. date | Here you can move the media invoice of the insertion to another insertion. See further description below. |

| Change owner/client | Change owner or client. This requires a parameter setting that allows change. |

| Show invoice | Shows an invoice copy in PDF format, if the invoice has been scanned. |

| Printout | Prints the reconciling list. Requires a special print template from Kalin Setterberg. |

Book away discrepancies

Select one or several rows and click on BOOK AWAY.

Enter accounting date. You can also book away only a part of the amount by changing the amount, as well as the account.

Move media invoice to another order or insertion date.

The function Change order number/insertion date is used for moving an invoice that has been erroneously registered. Select the order and click on the function. Enter the media invoice (searchable in the list) and the order number and insertion date, where the invoice shall be moved. It is only possible to move to an existing order and insertion date. If only a part of the invoice shall be moved, enter amount.

Agency settlement

For clients, whose agreements allow a part of the commission, working fee and other fees to the advertising agency, the agency on the client is used for an agency settlement. When printing the settlement, a supplier invoice is created on the corresponding supplier in the purchase ledger. It will later be paid as a normal supplier’s invoice. Create agency in Base registers/MED/Agencies.

In the client record in Base registers/MED/Clients, enter the agency in the tab Parameters 1.

On the client agreement in Base registers/MED/Agreements, state how big part/how many percent units of insertion fee, agency commission and capital cost you want to pass on to the advertising agency. The invoice and the agency settlement document are printed out under Agency settlement

Select agency and accounting date or other selection. You can make different selections if for example a certain media only shall be settled against a certain plan.

| Paid invoices | If selected, only paid client invoices are taken into the settlement |

|---|---|

| Already updated | If selected, it is possible to reprint the specification |

| Reprint | All agency settlements can be reprinted. |

Invoice projects together with the media invoice

If you want to invoice project invoices together with media invoices, you have to activate a parameter in Media/Parameters/invoicing. The invoicing is made in the media invoicing part and in the project invoicing part you state on the invoice, which plan the invoice concerns. Create an invoice as normally in Adjusting/Invoicing and connect it to a plan in the tab Parameters.

The media invoice template must be updated such that it fetches information from the Project accounting.

The invoice is printed out in Classic 08-70-10. The bottom part of the invoice shows the project.

Enter media invoices

Register incoming media invoices in Media: Enter media invoices.

Search by order number and/or media, supplier, client or insertion date.

If the media is connected to a supplier in the base registers, it will be fetched from there. If not, fill in supplier info in the Registration part.

If the media has another currency, all amounts shall be entered in it.

You can write the invoice number here or when saving the invoice.

All matching insertions are shown. Select columns wih the > sign furthermost to the right in the heading bar.

If there is discrepancy between insertion and invoice, you can correct it directly on the insertion. Select insertion, open it and write invoice amount in the column This invoice.

In the fields to the left you can add a discount – or surcharge code. The fields will then be open for you to enter amounts.

If you want to send a reclamation (claim) of an erroneous invoice, use the function SAVE AND CLAIM.

The orders will be marked with an X when they are corrected and saved. You can mark an order as correct directly, if you can see that it is OK.

All marked orders will be included in the invoice. If the invoice is OK, save it.

| Cancel | Return to previous view |

|---|---|

| Save | Select invoice number and accounting date in order to save the invoice. The voucher number will be given after saving. |

| Create order | If an order not is entered but you still want to include it in the invoice, click on CREATE ORDER and select an insertion date. |

This order gets a temporary order number (900000-series) when the invoice is saved. It can thereafter be changed to a real order number in Reconciliation of media invoices with the function CHANGE ORDER NUMBER/INSERTION DATE.

| Insert order | If you cannot find an order or the order hasn't been included in the selection, you can insert it to the invoice. Click INSERT ORDER and write order number and insertion date, then click OK. |

|---|---|

| Find order | Search order with order number. |

| Save as pending | You can suspend the registration of an invoice that you have started with. |

When you want to continue, click Pending invoices instead of Search and select the invoice from the list shown.

| Claim | You can send a claim (reclamation) directly from the program after your correction. |

|---|

If you have a text that shall be shown automatically, you can write it (or several texts for different types of claims) in System: Base registers/Parameters, tab Claims. Use IMPORT TEXT and select from the list.

Before sending the claim you can check it with the function SHOW. Use SEND to email/fax the claim to the supplier.