News:Deduct from collective client for Pre-inv in MED

From Marathon Documentation

Deduct from collective client for Pre-inv in MED

| Published | 2020-06-17 |

|---|---|

| Module | Media |

| Version | 546W2022 |

| Revision | 0 |

| Case number | 1130081 |

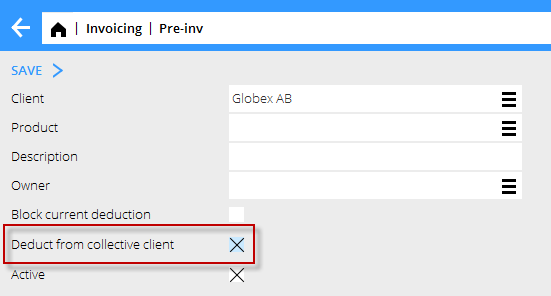

Deduct from collective client for Pre-inv in MED

If the checkbox is set - then the Pre-inv will deduct from all the clients that is connected to the same collective client as the client that the Pre-inv is registered on.

This applies to both current pre-inv deduction and total pre-inv deduction.