Translations:SAF-T Finance in Marathon/7/en

From Marathon Documentation

Revision as of 15:56, 17 December 2020 by FuzzyBot (talk | contribs) (Importing a new version from external source)

Information about how to map Your VAT classes is found on skatteetaten.

Mapping of VAT-classes to the Norwegian SAF-T financial standard

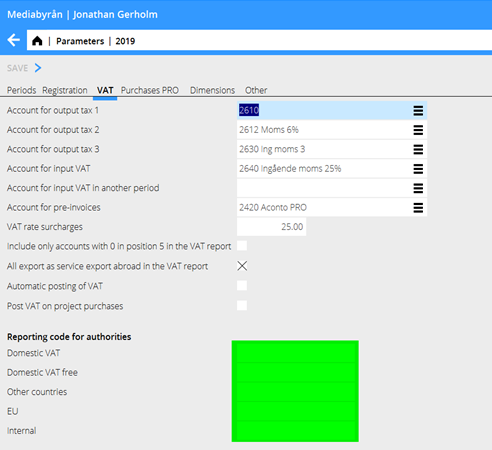

All VAT classes in the current bookkeeping year must be mapped according to the Norwegian SAF-T financial standard. This is done by filling the field Reporting code to authorities in Base registers / G/L, VAT classes.