Pre-invoicing in the Media system

Contents

Invoicing with Pre-invoice

- Current pre-invoicing is deducted in the general invoicing, tab Invoicing.

- Not current pre-invoicing is deducted in the tab Pre-invoice deduction.

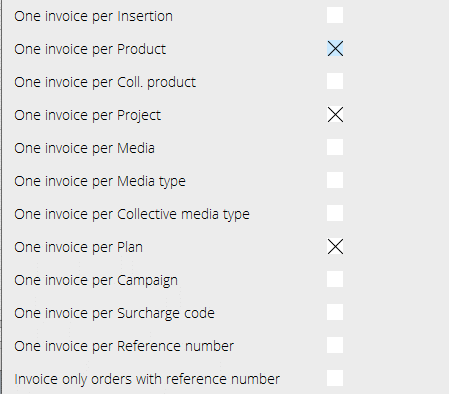

- The terms for pre-invoicing are only valid per invoice, i.e., if one of the orders in the invoice meets the conditions, then the whole invoice amount will be deducted, not the order amount. To avoid this the invoice can be split with the invoice settings op the client in Base register/MED/Clients/Invoicing.

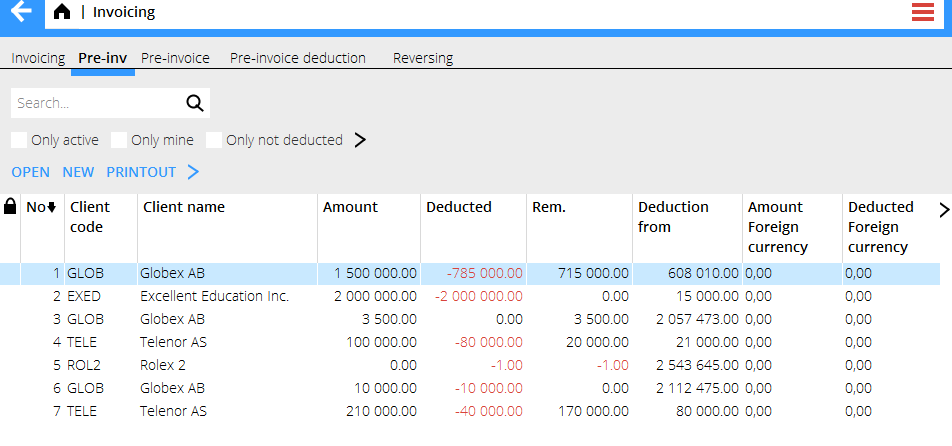

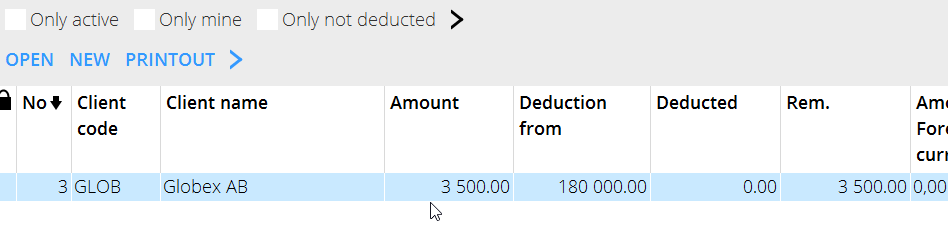

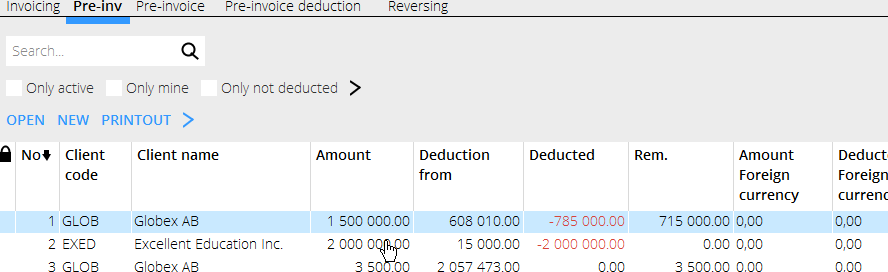

Only Active means that only pre-invoices are shown in the list. When a pre-invoice has been deducted and emptied/finished, its status will be Deducted, and it is only shown in the list if the box is unchecked. The column Deduction from shows the amount that is deductible in the currency set in Base registers (or if the order has a specific currency). Amount is shown if:

- “Deduct all” has been checked.

- Specific plans/orders/periods or other criteria is entered.

- If no specific plan/order is entered or ”Deduct all” has been checked, no amount will be shown in the list under Deduction from. That means that all definitive insertions on the client with current pre-invoice deduction can be deducted. This current pre-invoice deduction is done in the general invoicing.

The deduction is made gradually on the pre-invoice numbers and continues as long there are amounts to deduct.

Agreements with current pre-invoice deduction:

When printing out under the tab Pre-invoice deduction, all the plans/orders listed under” Deduction from” - or all, if you have checked “Deduct all” - will be included. If there is nothing under ”Deduction from” the pre-invoice will be printed out without deduction.

When printing in the tab Invoicing all plans/orders that are definitive are included, regardless of what is listed (or if empty) under ”Deduction from”.

If you want to avoid deduction from a certain pre-invoice, you can Block current deduction. That is only possible if nothing is listed under ”Deduction from”.

If you want to remove “Deducted from”, open the row/rows and delete.

Agreement with No current pre-invoice deduction:

When printing out under the tab Pre-invoice deduction, all the plans/orders listed under” Deduction from” - or all, if you have checked “Deduct all” - will be included. If there is nothing under ”Deduction from” the pre-invoice will be printed out without deduction.

When printing out under the tab Invoicing, there will be no deduction. If plans/orders are listed under ”Deduction from”, they will be blocked from being invoiced in the usual manner.

Handling of pre-invoices in foreign currency

When setting up a pre-invoice in another currency, you must state the currency rate on the invoice. The deductions are not following the stated rate on the pre-invoice; they follow the client agreement with either day rate according to the base register or order rate stated on the order.

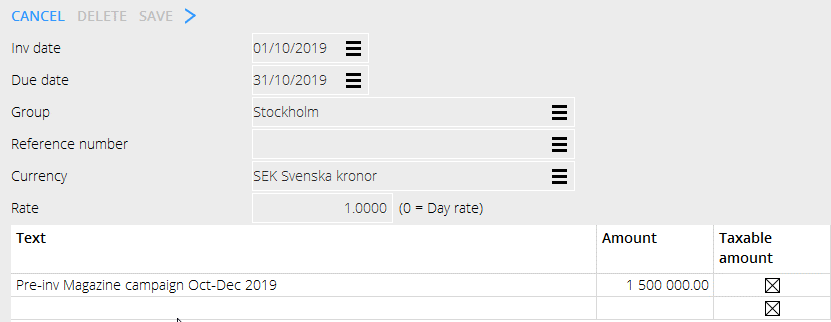

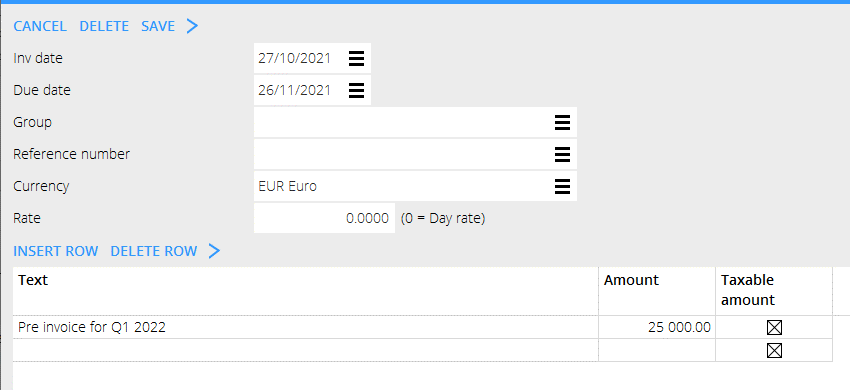

The pre-invoice:

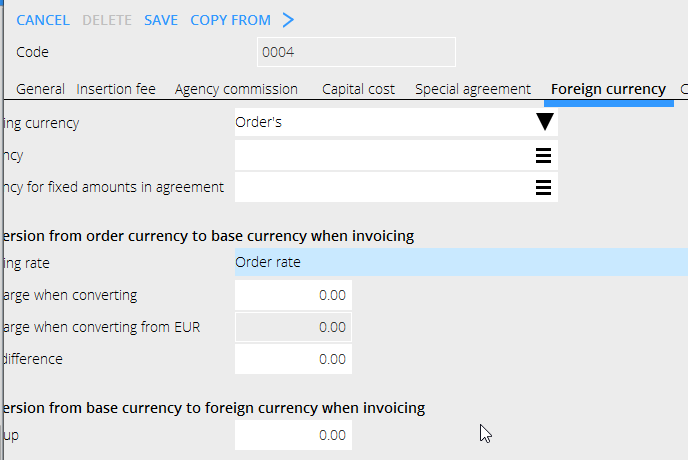

The client agreement where rate shall be stated on the order:

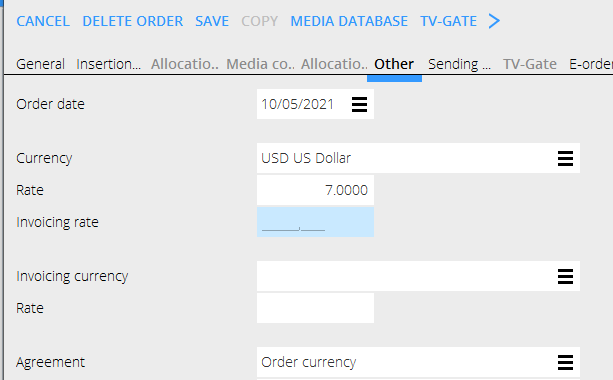

The order:

The order:

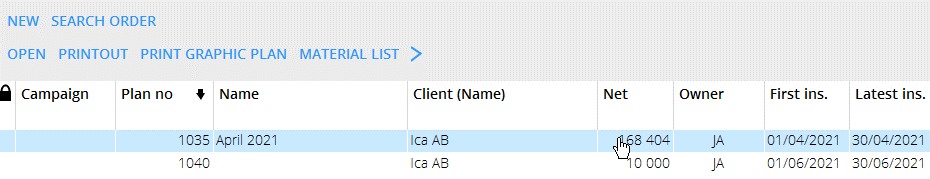

NB! In the list of plans, the order’s net is shown in the current day rate, regardless of what rate is set on the order.

NB! In the list of plans, the order’s net is shown in the current day rate, regardless of what rate is set on the order.

The list of pre-invoices shows according to the rate on the order in the column Deduction from.

The list of pre-invoices shows according to the rate on the order in the column Deduction from.

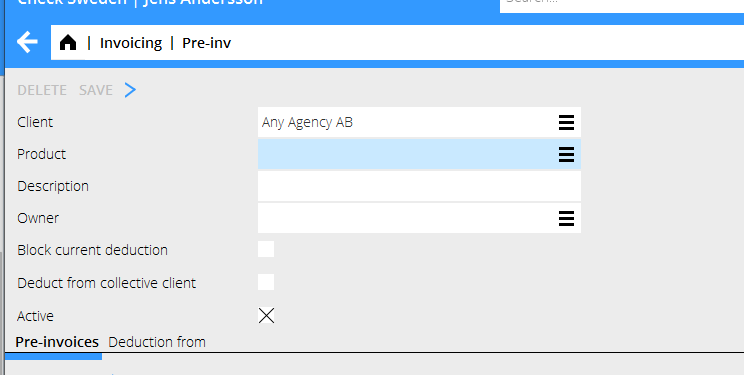

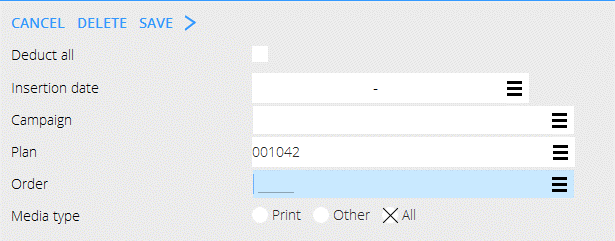

Create new pre-invoice with No current deduction according to the client agreement.

- Create new pre-invoice with NEW and print out. Check whether it is taxable or not. You should not mix VAT free pre-invoices with taxable ones.

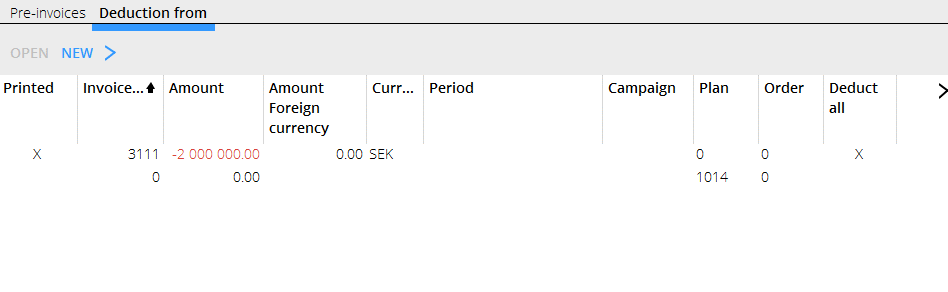

- State where the pre-invoice shall be deducted from. You can add more rows under “Deducted from”.

- Plan 1092 ”Februari kampanj” is on 700 000 which you can see in the list under Deducted from.

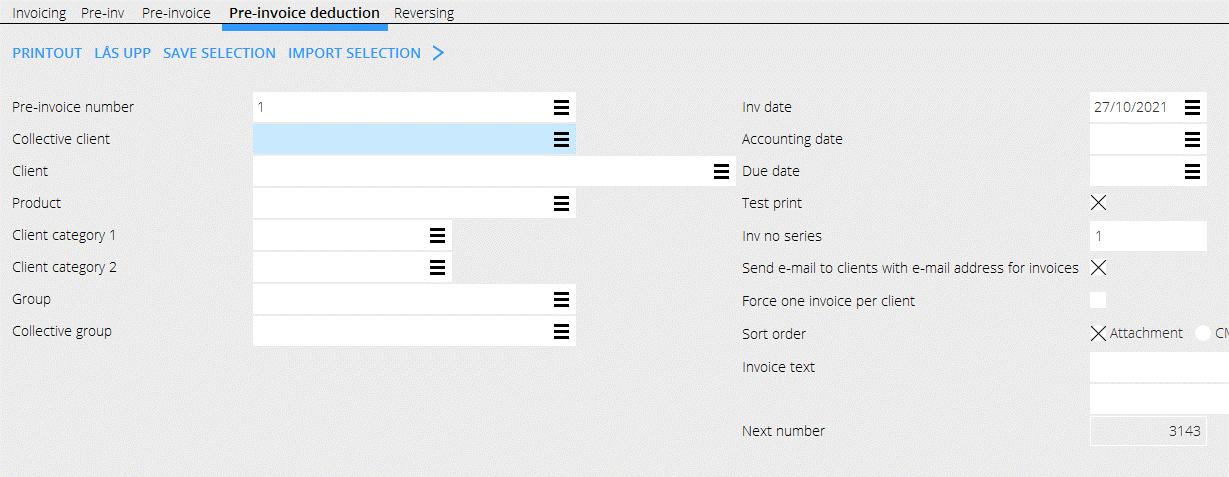

- The deduction is done in Pre-invoice deduction

Here we are certain that this pre-invoice will be settled to zero and deducted from the stated plan. If the plan only has a smaller amount, the deduction takes what it can, and the remaining pre-invoice generates a credit invoice. Or vice versa if the plan has a bigger amount. The pre-invoice is settled.

Create new pre-invoice for current pre-invoice deduction according to the client agreement.

- Create new pre-invoice with NEW and print out. Check whether it is taxable or not. You should not mix VAT free pre-invoices with taxable ones.

- Current pre-invoice deduction means that it can be deducted from all definitive insertions on the client. This current deduction is done in the general Invoicing.

Deduction is done continuously on all pre-invoice numbers on the same client code and continues as long as there are amounts from which to deduct. When the pre-invoice/-s have been used to the end, the remaining amount is generated to the invoice.