Translations:Mva reports via Altinn/12/en

From Marathon Documentation

Revision as of 14:13, 26 April 2022 by FuzzyBot (talk | contribs) (Importing a new version from external source)

Closing balances on dedicated balance sheet accounts

The amounts for in- and output tax must stay on their defined balance sheet account in the end of each period (e.g., for period Jan-Feb on February 28th). This for the booked amount to be correctly fetched. The amounts can later be transferred to a vat deduction account in the beginning of the following period (in this case March 1st).

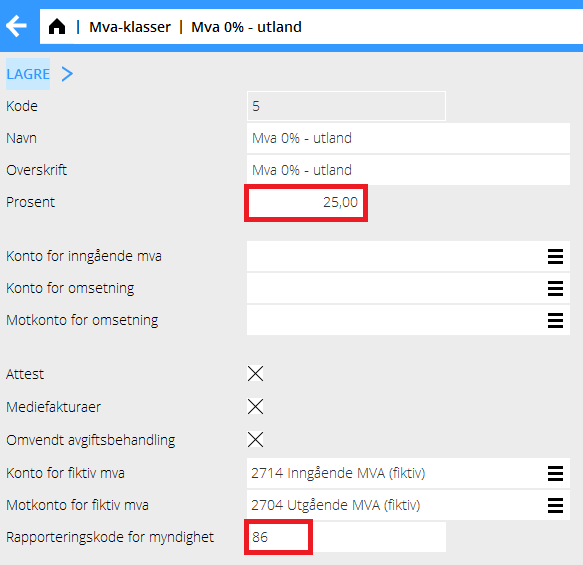

Fictive mva on import of services

As an alternative to adding booked mva with the NEW button in the new reporting, you can make a completion in the Marathon parameters as below, and thus fetch the booked mva on two defined 27XX accounts.