Löpande acontoavräkning per rad

| Published | 2023-03-09 |

|---|---|

| Module | Media |

| Version | 546W2210 |

| Revision | 0 |

| Case number | CORE-3958 |

Löpande acontoavräkning per rad

Med Löpande acontoavräkning per rad aktiverat hanterar Marathon avräkningen av medieaconton så att endast den specifika planen, ordern eller perioden som skall avräknas blir det, oavsett om faktureringen innehåller mer än acontot.

The parameter applies to all deductions and it is not possible to mix Current pre-invoice deduction per row with Current pre-invoice deduction per pre-inv, which is the usual method.

The difference between the two methods is explained below.

Current pre-invoice deduction per pre-inv calculates the pre-inv deduction on the invoice total by, if possible, deduct enough to make it a 0-invoice. All pre-inv which are connected to any of the plans/orders in the invoice has been used in the effort to create a 0-invoice.

Current pre-invoice deduction per row makes it so that the pre-inv amount is retrieved per price row and only pre-invs that are connected to the respective price row. Because the calculation is made per row with calculated VAT, it is not certain that a 0-invoice is created even though there is enough pre-inv for every row. The reason for this is that the VAT is calculated on the total sum. Because of this, we recommend that you only use this parameter if you mix plans/order that are going to be deducted against pre-invs with those that are not going to be deducted.

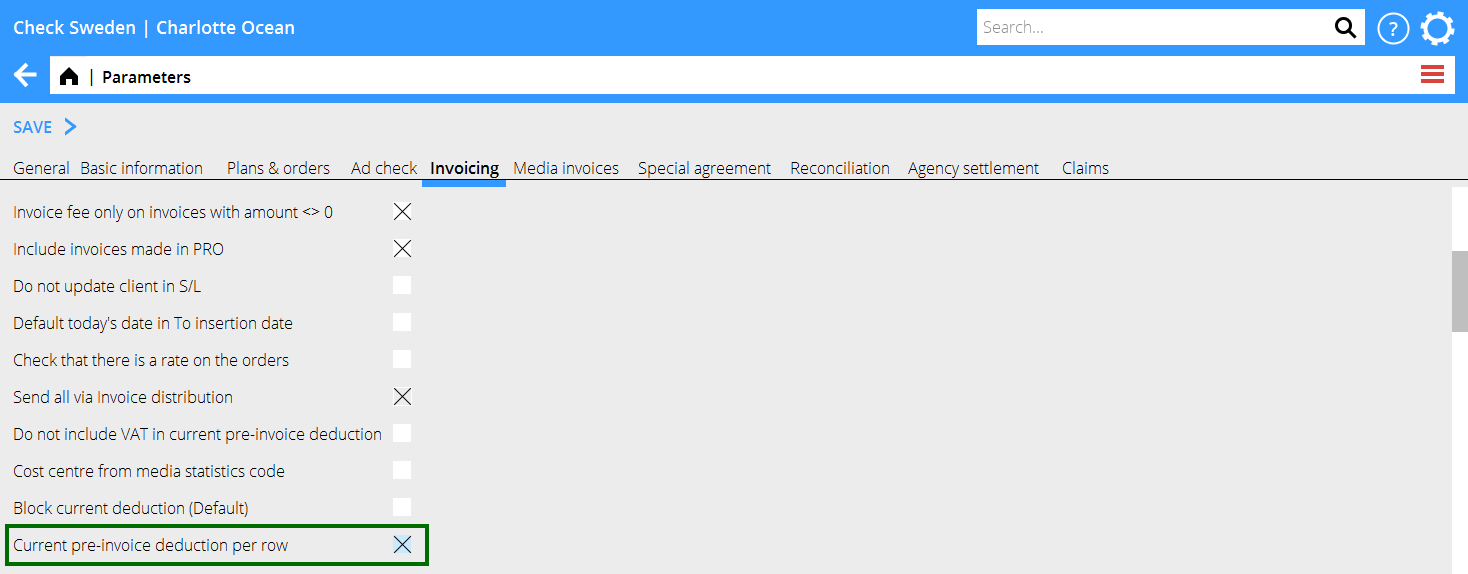

The parameter is located in Base registers | Media | Parameters, tab Invoicing.