Camt introduktionsguide

Denne guide håndterer rapportering af banktransaktioner i camt-format

camt – Introduction guide

camt053 and camt 054 are formats for bank statement reporting files that contain information on bank transactions carried out. These banking transactions include incoming and outgoing payments to and from your bank account. The daily camt053 file refers to the previous day's account events, i.e. the file received on 10 January refers to account events that took place on 9 January.camt054 occurs several times during a day and refers to the day's incoming and outgoing payments. Unlike camt053, camt054 contains only debit and credit transactions, when camt053 can contain other bank charges.

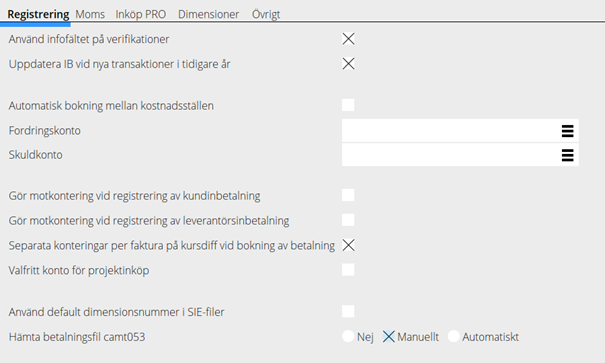

Setup:

GL/Parameters, Tab: Registration, Parameter: Import payment file Camt053. Choice between Manual and Automatic. Automatic requires setting up integration with the bank, contact Marathon for more information.

How to:

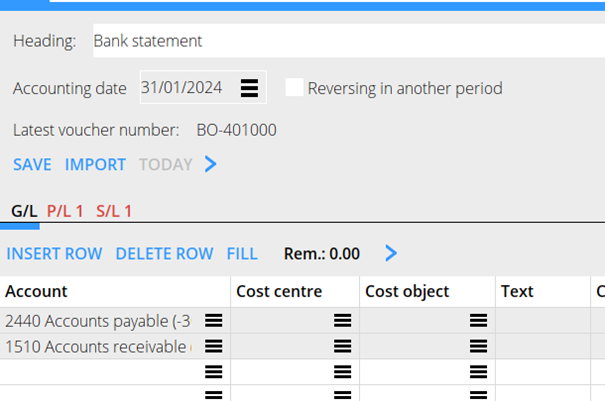

camtfiles are imported on a standard voucher in Accounting/Vouchers. Loading of camt files works analogue to other reporting files. First select the account with assignment K or L (SL and PL respectively).

Sales ledger:

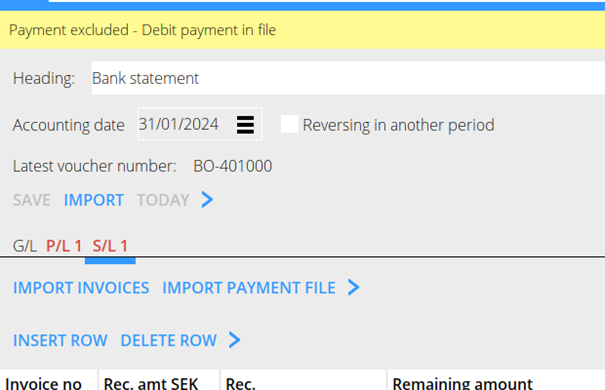

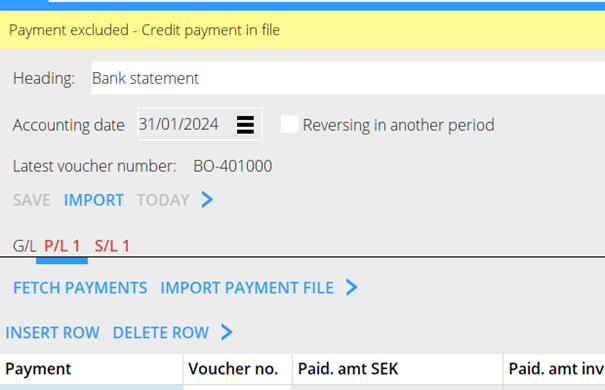

Tab SL, button: HBF(CAMT). Select the camt file to be imported from your file manager. Note that the camt file can contain both incoming and outgoing transactions, but only incoming ones are imported when importing in the SL tab (and only outgoing ones in the PL tab). If the file contains outgoing payments, the following message is displayed:

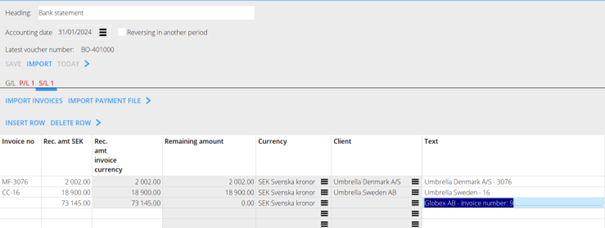

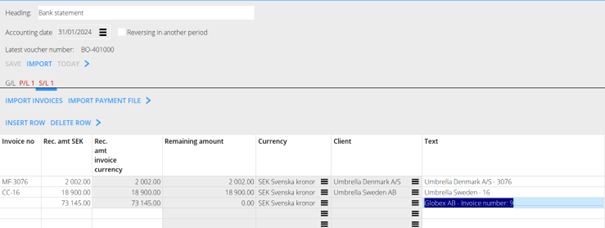

When importing, a match against unpaid invoices is made as good as possible, however, it is not guaranteed that the system will match all payments as the reference structure varies significantly per sender's bank, on the structure of the reference and possibly how the sender has registered the reference. For example, if the sender has entered the following payment reference: "Invoice number: 9", the system will not find the invoice number (9) as the reference contains introductory text:

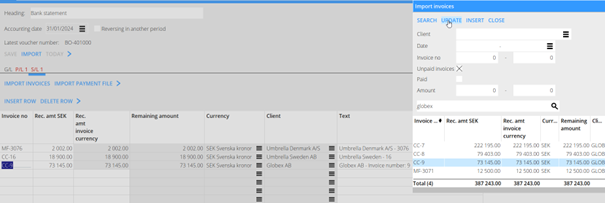

The Text field contains the reference number and the sender's name. In cases where the import has not been successful, the information in the field can be used to facilitate manual handling. To support the matching of payments where the import has not been successful, the function IMPORT INVOICES is available. In this pop-up you can search for invoices, e.g. you can search for all unpaid invoices from the sender specified in the Text field. The function UPDATE is available in IMPORT INVOICES. UPDATE updates the selected row with the selected invoice or invoices. It is therefore possible to match a row from the import with one or more invoices. If UPDATE is used on several invoices, the amount is distributed over the selected invoices.

Note that the window remains open even when you click outside, in order to be able to easily change the selected row. Note also that the button INSERT inserts a new row, i.e. the selected row in the verification is moved down one step. When importing a file, the INSERT button should not be used unless you want to actively add a row that was not in the file.

Purchase ledger:

Similar to the SL tab, the PL tab uses the HBF (CAMT) button. In the PL tab, outgoing payments should be imported. If the file you have imported also contains an incoming payment, the following message is displayed:

Import of outgoing transactions generally has a better match than incoming transactions as the reference structure is based on data in Marathon (in the outgoing payment file to the bank). However, you should be aware that when importing you get a hit against a "Payment in progress". That is, payments you have made, which are currently in the In progress tab in Accounting/Payments. This is indicated by the payment number being entered in the Payment column of the Voucher. If the import does not match a payment in progress, it says "Manual payment". This may be because the payment has already been booked. Alternatively, it is a payment that has not been made via Marathon and therefore has no data to match against. In these cases, you have to decide whether it should be booked together with other imported payments or whether it should be done manually in a separate voucher. Or in cases where you have made a payment of several invoices where credits have been utilised. Then the payments are sent in a lump to the bank in the payment file. In these cases, the invoice number is not always specified in the reporting file but only a text "DEBIT/CREDIT", these must be handled manually.

Please note that even if you have used the camt import, it is important to double-check the bank statement in the internet bank to make sure that no payments have been missed.