Difference between revisions of "Expense reports startup/nb"

(Created page with "Kostnadsbærer opprettes i {{pth|System|Grunnregister/Bok/Kostnadsbærer}} med samme kode som bruker- og medarbeiderkode.") |

(Created page with "=== Utleggssorter ===") |

||

| Line 43: | Line 43: | ||

Kostnadsbærer opprettes i {{pth|System|Grunnregister/Bok/Kostnadsbærer}} med samme kode som bruker- og medarbeiderkode. |

Kostnadsbærer opprettes i {{pth|System|Grunnregister/Bok/Kostnadsbærer}} med samme kode som bruker- og medarbeiderkode. |

||

| − | === |

+ | === Utleggssorter === |

By using different expense types, entering expense reports as well as booking them will be easier. The different types can be selected from a drop-down menu. Yet we recommend not having too many expense types. Create new and administrate expense types in Base registers/GL/Expense types. |

By using different expense types, entering expense reports as well as booking them will be easier. The different types can be selected from a drop-down menu. Yet we recommend not having too many expense types. Create new and administrate expense types in Base registers/GL/Expense types. |

||

Revision as of 14:17, 1 February 2016

Contents

Innstillinger

Parametrer

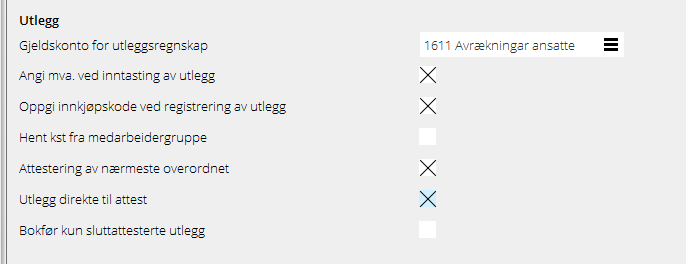

Parametrer innstilles i System: Grunnregister/Bok/Parametrer, flikenRegistrering.

| Parametrer innstilles i System: Grunnregister/Bok/Parametrer, fliken Registrering. | |

|---|---|

| Gjeldskonto for utleggsregnskap | Angi konto. Dersom betalingen skal sendes via Marathon må kontoen være integrert til Leverandørreskontroen.

Kontoen må ha kopling til Kostnadsbærer (System: Grunnregister/Bok/Konto). |

| Angi mva. for registrering av utlegg | Hvis den ansatte må angi momsbeløpet. |

| Angi innkjøpskode for reg av utlegg | Hvis den ansatte måtte angi innkjøpskode for prosjektinnkjøp. |

| Hent kst fra medarbeidergruppe | Hvis gjeldskontoen for utlegg krever kostnadssted skal det hentes fra den gruppe, som er angitt på medarbeideren. |

| Hvis nærmeste sjef skal attestere utleggen. | |

| Utlegg direkte til attest | Hvis utleggsregnskapet skal gå direkte til attest av nærmeste sjef eller hvis den først skal godkjennes av økonomiavdelingen i Bokføring/Utleggsovervåking.

Hvis parameteren er avkrysset og nærmeste sjef er angitt i Grunnregister/Generelt/Bruker, under fliken Øvrigt, vil utlegget bli synlig for attestering av nærmeste sjef i Prosjekt/Attest, eller må Ferdig for attest avkrysses på utlegget. |

| Bokfør kun sluttattesterte utlegg | Hvis kun sluttattesterte utlegg skal kunne bokføres eller ikke. |

Autorisasjon

Autorisasjon til utleggsmodulen innstilles i System: Autorisasjon under Bokføring og koples till brukeren i System: Grunnregister/Generelt/Brukere, under fliken Autorisasjon.

Kostnadsbærere

Kostnadsbærer opprettes i System: Grunnregister/Bok/Kostnadsbærer med samme kode som bruker- og medarbeiderkode.

Utleggssorter

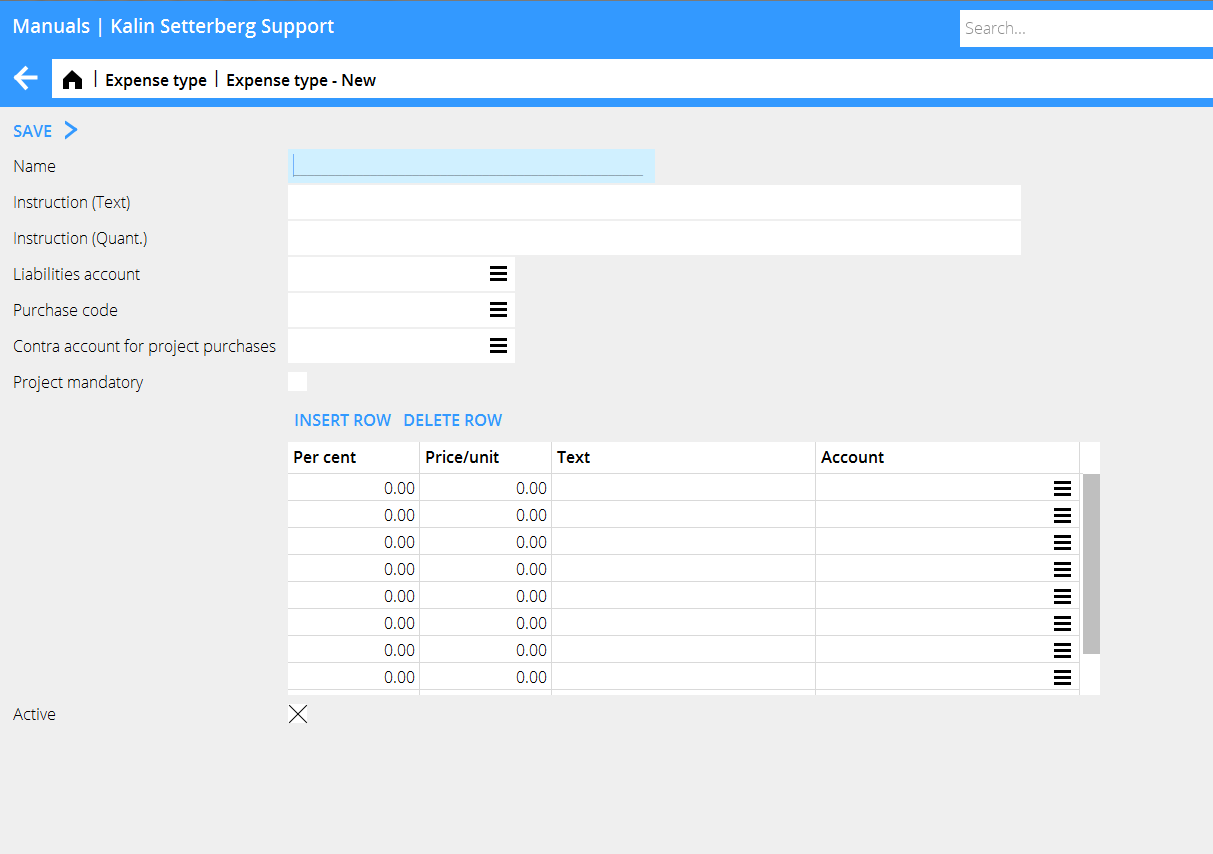

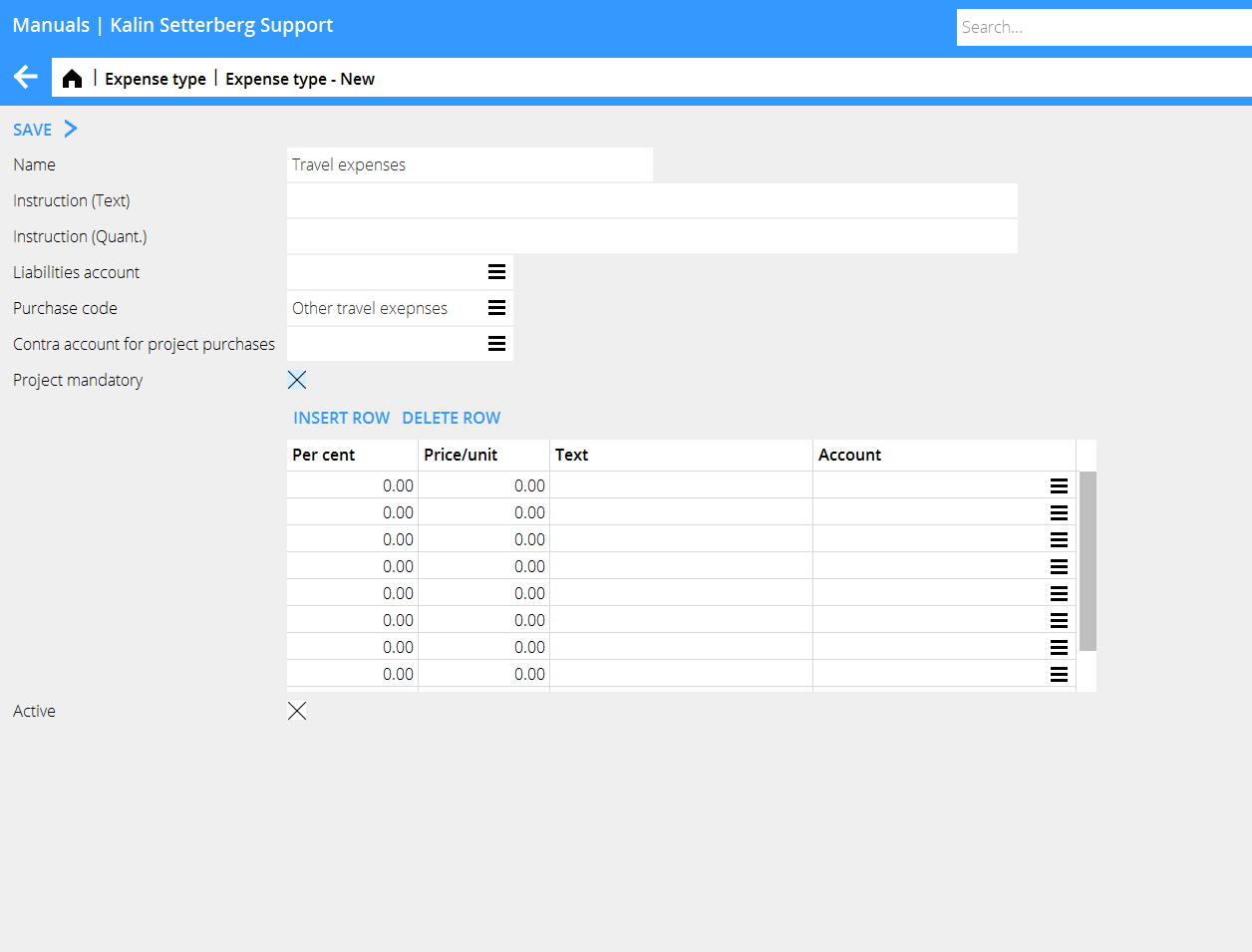

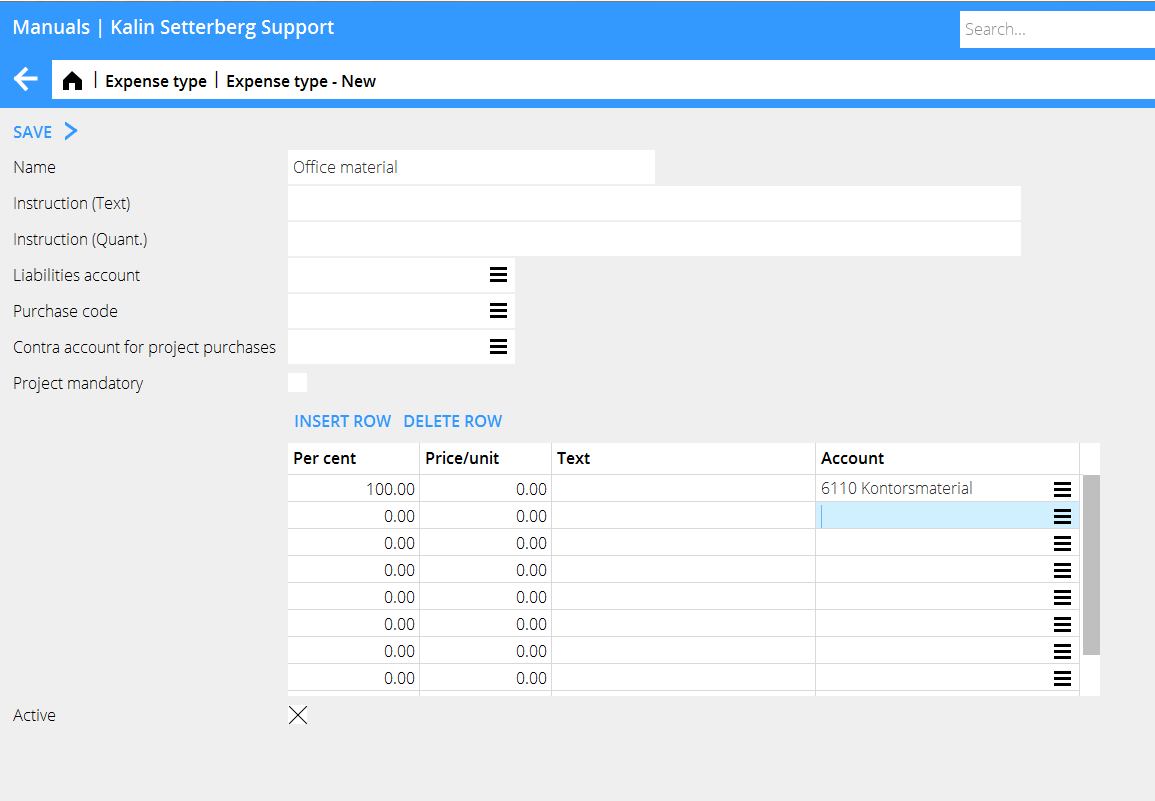

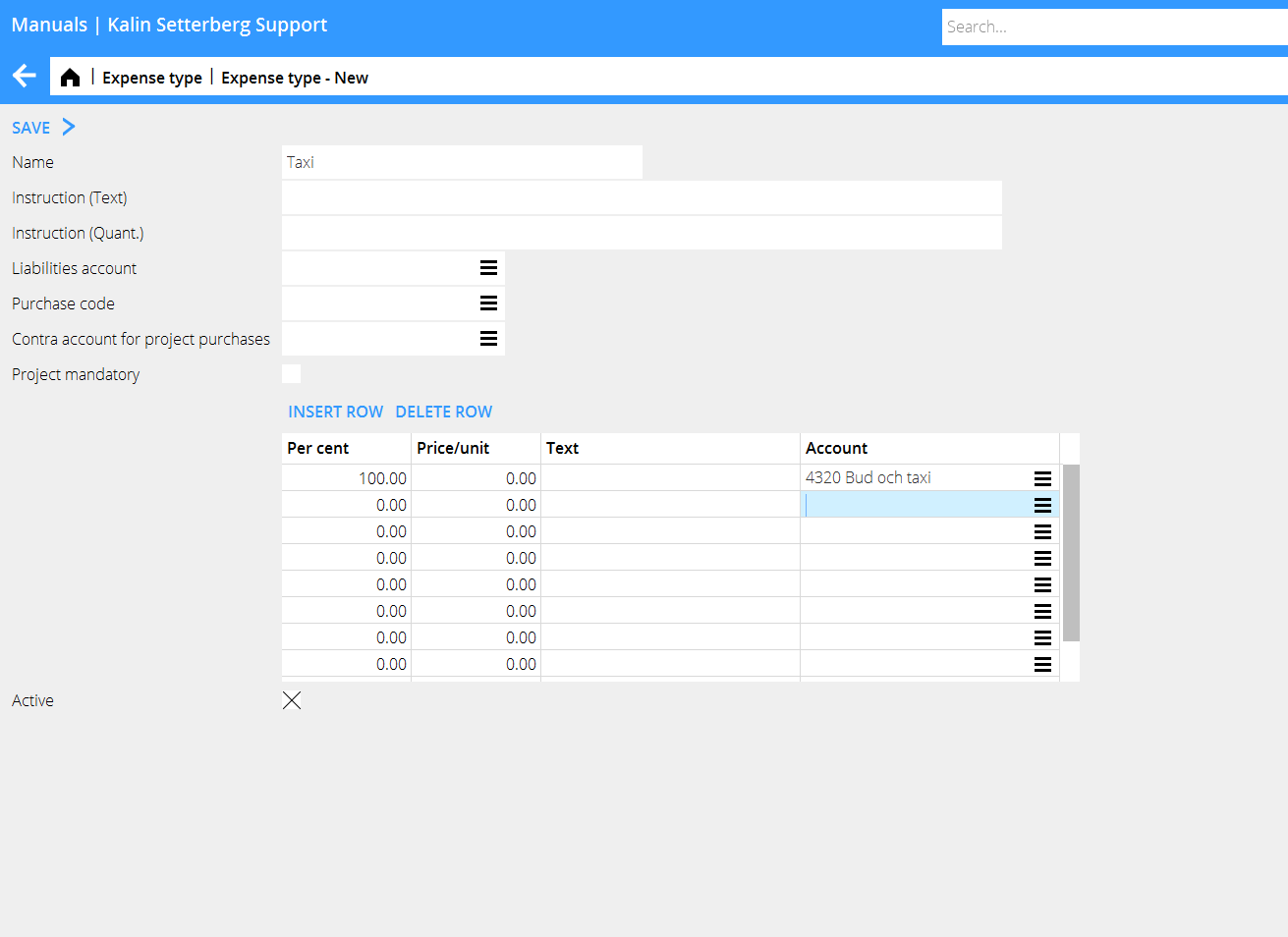

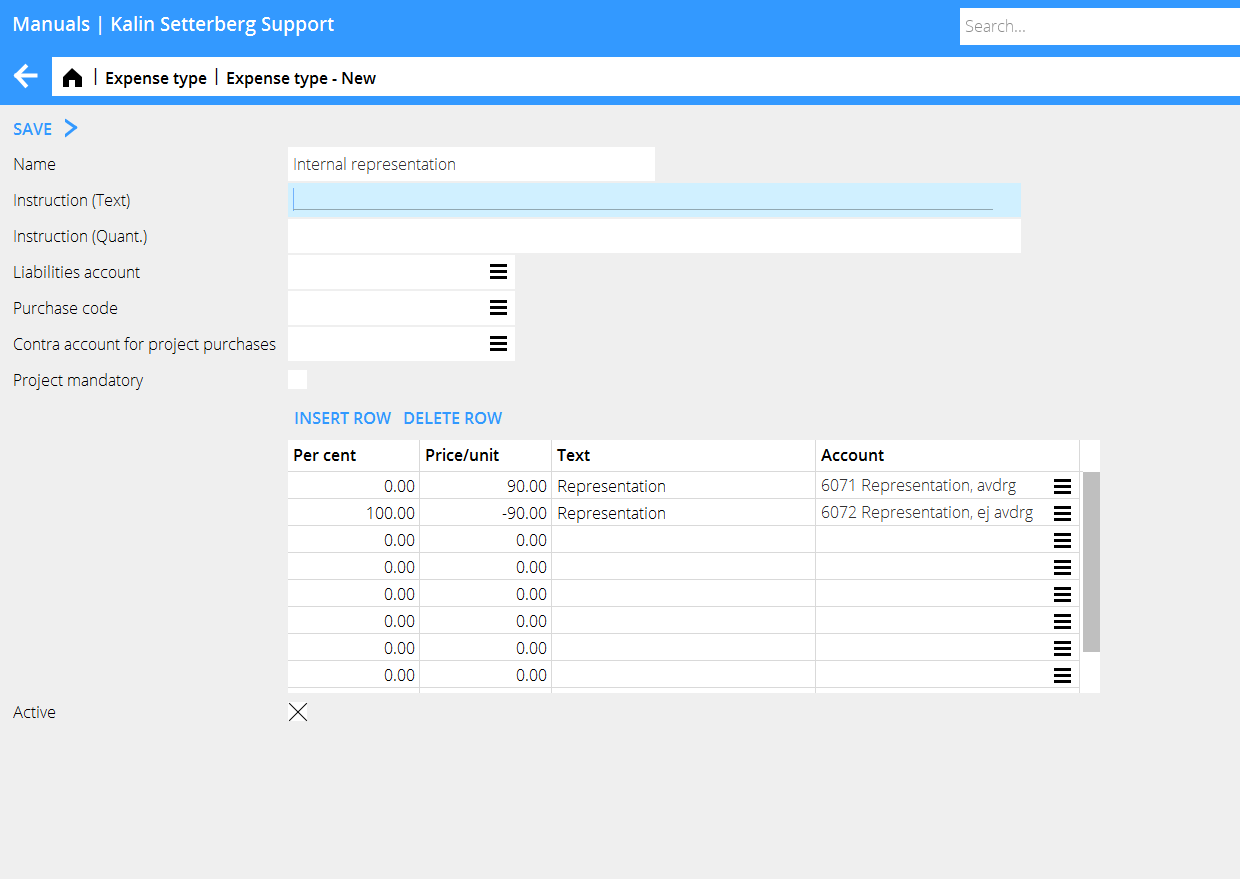

By using different expense types, entering expense reports as well as booking them will be easier. The different types can be selected from a drop-down menu. Yet we recommend not having too many expense types. Create new and administrate expense types in Base registers/GL/Expense types.

| Instruction | Instructions written in the two fields (text and amount) makes the fields mandatory when entering an expense report. |

| Liabilities account | An alternative account to the one set in the parameter (optional). |

| Purchase code | If the expense is booked on an external project, enter purchase code. |

| Contra account for project purchases | A rarely used setting. An account in credit can be stated when an expense is entered on a project. (The account for project purchases set in the parameters in Base registers/PL/Parameters/Preliminary entering will be automatically debited). |

| Project mandatory | Check the box if project will be a mandatory field in the expense report. |

Use the table for determining how the posting of the expense shall be done. You can either make it simple and just enter an account that shall be suggested to the employee when entering expenses, or use a variety of combinations such as fixed prices, unit prices, percentages of the total sum to different accounts, etc. to facilitate the bookkeeping procedure.

If the employee is entering a project on an expense row, the expense will be considered and posted as a project regardless of expense type. The reason for this is to avoid missing a project purchase.

| Project purchases |

Project purchases are posted on the account for purchases stated in the parameters in Base registers/PL/Parameters/Preliminary entering

| Office material |

| Taxi |

| Internal representation |

When booking internal representation, the VAT posting has to be done manually.

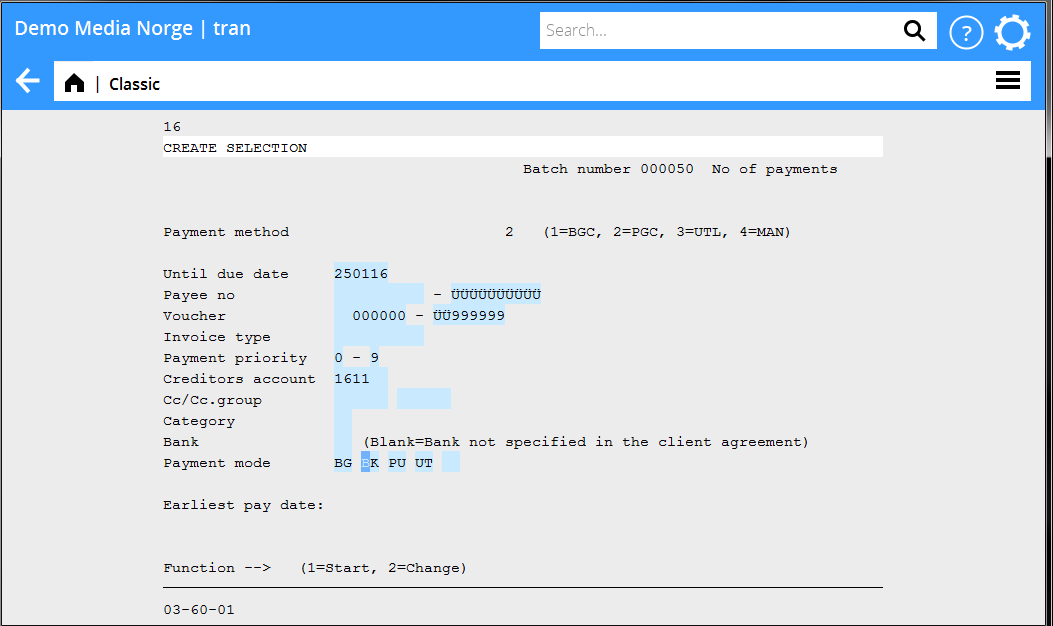

Disbursement of expenses

The disbursement to the employee is done the same way as payments to a supplier. The best payment method is Bank account without notification. The following settings are required before disbursement.

| Supplier | If the disbursement is executed via Marathon, the employee has to be filed as a supplier in Base registers/PL/Supplier with the same code as his/her employee- and user codes. |

Required fields:

| Name | (tab General) |

| Address | (tab General) |

| Payment method | Bank account without notification (tab Payment) |

| Rec account | The whole bank account number inclusive of clearing number (tab Foreign payments) |

| Trade creditors’ account | Liabilities account for the expense report (tab Other) |

| Cost object | (tab Other) |

| Payment selection | Print a payment selection in 03-60-01 and filter on the creditor’s account, which is stated on the expense type. Choose payment method BK.

The disbursement is made the same way as payment of suppliers’ invoices via the Payment program or file transfer to the bank. |