Difference between revisions of "Pre-invoicing/fi"

(Created page with "== Tee uusi ennakkolasku == Ohjelmassa {{Pth|Media|Laskutus/Ennakkolasku}}, valitse {{btn|Uusi}}. Valitse asiakas, mahdollinen tuote ja kirjoita valinnainen seloste. Seloste...") |

(Created page with "== Laskun tekeminen == Laskussa, välilehdellä ennakkolasku, valitse {{btn|Uusi}} ja täytä kentät Laskupäivä ja Eräpäivä. Viitenumero tulostuu laskulle mutta ei muut...") |

||

| Line 6: | Line 6: | ||

Valitse asiakas, mahdollinen tuote ja kirjoita valinnainen seloste. Seloste on sisäinen ja näkyy vain tässä ennakkolaskulistassa. |

Valitse asiakas, mahdollinen tuote ja kirjoita valinnainen seloste. Seloste on sisäinen ja näkyy vain tässä ennakkolaskulistassa. |

||

| + | == Laskun tekeminen == |

||

| − | == Create the pre-invoice invoice == |

||

| − | + | Laskussa, välilehdellä ennakkolasku, valitse {{btn|Uusi}} ja täytä kentät Laskupäivä ja Eräpäivä. Viitenumero tulostuu laskulle mutta ei muutoin liity suunnitelman viitenumeron kanssa. Write text and amount and select possible VAT. Save. |

|

In ”Deduction from” you can connect the pre-invoice with insertion date, campaign, plan and order, from where the pre-invoice will be deducted. |

In ”Deduction from” you can connect the pre-invoice with insertion date, campaign, plan and order, from where the pre-invoice will be deducted. |

||

The field ”Deduct all” deducts the pre-invoice from all insertions belonging to the order. |

The field ”Deduct all” deducts the pre-invoice from all insertions belonging to the order. |

||

Revision as of 17:04, 24 January 2020

Contents

Ennakkolaskutus

Tee uusi ennakkolasku

Ohjelmassa Media: Laskutus/Ennakkolasku, valitse Uusi. Valitse asiakas, mahdollinen tuote ja kirjoita valinnainen seloste. Seloste on sisäinen ja näkyy vain tässä ennakkolaskulistassa.

Laskun tekeminen

Laskussa, välilehdellä ennakkolasku, valitse Uusi ja täytä kentät Laskupäivä ja Eräpäivä. Viitenumero tulostuu laskulle mutta ei muutoin liity suunnitelman viitenumeron kanssa. Write text and amount and select possible VAT. Save. In ”Deduction from” you can connect the pre-invoice with insertion date, campaign, plan and order, from where the pre-invoice will be deducted. The field ”Deduct all” deducts the pre-invoice from all insertions belonging to the order. Note, that it is not possible to deduct a pre-invoice from another client.

Print the invoice

Go to Media: Invoicing/Pre-invoice to print the invoice.

Deduct

In Media: Invoicing/Pre-invoice, you can see in the column ”Rem” the amount that remains to be deducted per pre-invoice. The column ”Deduction from” shows the amount for those insertions connected to the pre-invoice. It is alsp possible to see previously deducted, invoice number, description, currency, etc. There are two ways to deduct:

1

If the client agreement is set to ”Current pre-inv deduction”, the pre-invoice is deducted in Media: Invoicing/Invoicing. (Select ”Current invoicing by checking/unchecking the field). Current pre-invoice deduction is a complex function that requires attention. Otherwise the risk of unwanted pre-invoice deduction is high.

At the time of invoicing, an automatic deduction of the pre-invoiced is done. The remaining amount is saved to the next time that something connected to the pre-invoice shall be deducted. The system starts with the oldest pre-invoice. If there is nothing that corresponds with the terms for the pre-invoice, the system continues with the next one. A problem can occur if you have both general pre-invoices (not connected to certain plans/orders) and pre-invoices locked to specific plans. When deducting general pre-invoices, the system does not take the locked ones in account but deducts from everything that is possible.

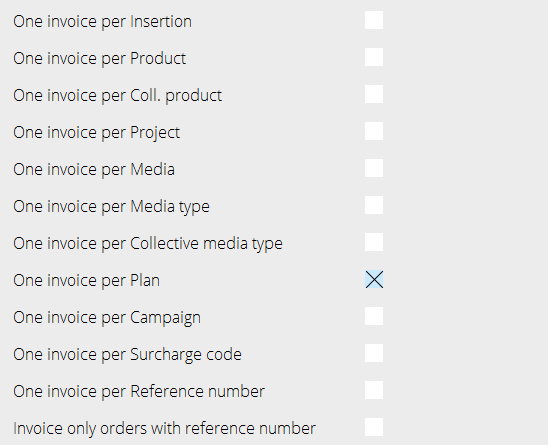

The terms for pre-invoices are set per invoice only. That means that if one of the orders in the invoice agrees with the terms, the whole invoice amount will be deducted, not the order’s amount. To avoid this, you can split the invoice with settings in System: Base registers/MED/Clients/Invoicing, see image.

2

If the client agreement is not set to Current deduction of pre-invoiced, the invoice and deduction is made in Media: Invoicing/Pre-invoice deduction. Select pre-invoice to deduct. The deduction is taken from what’s stated in “Deduction from” on the pre-invoice. Possible excesses and deficits are invoices as debit- or credit invoices and the pre-invoice is set off