Difference between revisions of "Pre-invoicing/da"

(Created page with "== Udskriv faktura == Gå til {{Pth|Media|Fakturering/Acontofaktura}} for at skrive faktuaren ud.") |

(Created page with "== Afregning == I {{Pth|Media|Fakturering/Acontofaktura}}, vises i kolonnen ”Rest” hvilket beløb, der findes tilbage for afregning. Kolonnen "Afregnes fra" viser beløbe...") |

||

| Line 15: | Line 15: | ||

Gå til {{Pth|Media|Fakturering/Acontofaktura}} for at skrive faktuaren ud. |

Gå til {{Pth|Media|Fakturering/Acontofaktura}} for at skrive faktuaren ud. |

||

| − | == |

+ | == Afregning == |

| + | I {{Pth|Media|Fakturering/Acontofaktura}}, vises i kolonnen ”Rest” hvilket beløb, der findes tilbage for afregning. Kolonnen "Afregnes fra" viser beløben fra de indrykninger, acontoen er tilknyttet. Det er også mulig at se hvad der er blevet afregnet tidligere, fakturanummer, beskrivelse, valuta, mv. |

||

| − | In {{Pth|Media|Invoicing/Pre-invoice}}, you can see in the column ”Rem” the amount that remains to be deducted per pre-invoice. The column ”Deduction from” shows the amount for those insertions connected to the pre-invoice. It is alsp possible to see previously deducted, invoice number, description, currency, etc. |

||

| + | Afregning kan gøres på to forskellige måder: |

||

| − | There are two ways to deduct: |

||

===1=== |

===1=== |

||

| + | Hvis kundeaftalen er mærket "Løbende acontoafregning", afregnes acontoen i {{Pth|Media|Fakturering/Fakturering}}. (Vælg ”Løbende fakturering" ved at afkrydse feltet). |

||

| − | If the client agreement is set to ”Current pre-inv deduction”, the pre-invoice is deducted in {{Pth|Media|Invoicing/Invoicing}}. (Select ”Current invoicing by checking/unchecking the field). |

||

| + | Løbende acontoafregning er en kompleks funktion, der kræver opmerksomhed; ellers er risikoen for uønskede afregninger stor. |

||

| − | Current pre-invoice deduction is a complex function that requires attention. Otherwise the risk of unwanted pre-invoice deduction is high. |

||

At the time of invoicing, an automatic deduction of the pre-invoiced is done. The remaining amount is saved to the next time that something connected to the pre-invoice shall be deducted. |

At the time of invoicing, an automatic deduction of the pre-invoiced is done. The remaining amount is saved to the next time that something connected to the pre-invoice shall be deducted. |

||

Revision as of 09:17, 5 February 2020

Contents

Acontofakturering

Skab ny aconto

I Media: Fakturering/Aconto, vælg Ny. Vælg kunde, mulig produkt og valgfri instruktion. Instruktionen er intern og vises kun i acontolisten.

Skab acontofakturaen

In the pre-invoice, under the tab Pre-invoices, select New and complete the fields Invoice date and Du date. The reference number will be printed on the invoice but is otherwise not connected with the reference number of the plan. Write text and amount and select possible VAT. Save. In ”Deduction from” you can connect the pre-invoice with insertion date, campaign, plan and order, from where the pre-invoice will be deducted. The field ”Deduct all” deducts the pre-invoice from all insertions belonging to the order. Note, that it is not possible to deduct a pre-invoice from another client.

Udskriv faktura

Gå til Media: Fakturering/Acontofaktura for at skrive faktuaren ud.

Afregning

I Media: Fakturering/Acontofaktura, vises i kolonnen ”Rest” hvilket beløb, der findes tilbage for afregning. Kolonnen "Afregnes fra" viser beløben fra de indrykninger, acontoen er tilknyttet. Det er også mulig at se hvad der er blevet afregnet tidligere, fakturanummer, beskrivelse, valuta, mv. Afregning kan gøres på to forskellige måder:

1

Hvis kundeaftalen er mærket "Løbende acontoafregning", afregnes acontoen i Media: Fakturering/Fakturering. (Vælg ”Løbende fakturering" ved at afkrydse feltet). Løbende acontoafregning er en kompleks funktion, der kræver opmerksomhed; ellers er risikoen for uønskede afregninger stor.

At the time of invoicing, an automatic deduction of the pre-invoiced is done. The remaining amount is saved to the next time that something connected to the pre-invoice shall be deducted. The system starts with the oldest pre-invoice. If there is nothing that corresponds with the terms for the pre-invoice, the system continues with the next one. A problem can occur if you have both general pre-invoices (not connected to certain plans/orders) and pre-invoices locked to specific plans. When deducting general pre-invoices, the system does not take the locked ones in account but deducts from everything that is possible.

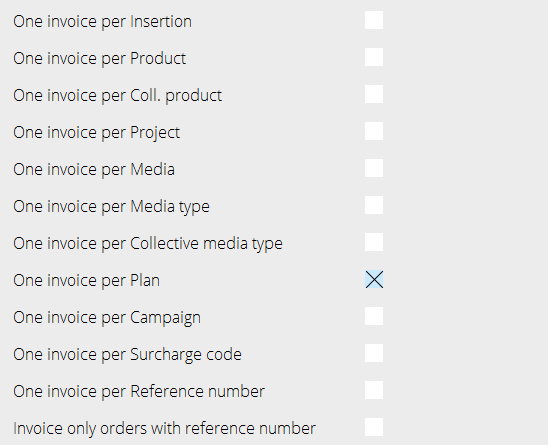

The terms for pre-invoices are set per invoice only. That means that if one of the orders in the invoice agrees with the terms, the whole invoice amount will be deducted, not the order’s amount. To avoid this, you can split the invoice with settings in System: Base registers/MED/Clients/Invoicing, see image.

2

If the client agreement is not set to Current deduction of pre-invoiced, the invoice and deduction is made in Media: Invoicing/Pre-invoice deduction. Select pre-invoice to deduct. The deduction is taken from what’s stated in “Deduction from” on the pre-invoice. Possible excesses and deficits are invoices as debit- or credit invoices and the pre-invoice is set off