Difference between revisions of "Media accounting/nb"

(Updating to match new version of source page) |

|||

| (32 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

<htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

<htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

||

| − | __FORCETOC__ |

||

| − | = Fakturering = |

||

| + | = Media Accounting = |

||

| − | All fakturering gjøres i Media: Fakturering; også akontofakturering og avregninger. |

||

| + | ==Invoicing== |

||

| − | {{ExpandImage|MED-EK-EN-Bild1.png}} |

||

| + | All invoicing is done in Media | Invoicing, including pre-invoicing, deductions and reversals of invoices. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild1.png}} |

||

| − | Utvalg kan gjøres på innrykksdato, budsjettnummer, kunder, kundekategorier, kampanje, osv. |

||

| + | |||

| + | Various selections can be made based on, for example, insertion date, plan number, client and client category. Invoicing per campaign can also be selected, if used. |

||

| + | If a specific media type or client is invoiced continuously, the selection can be saved so that a new selection does not have to be made each time. The options are located behind the blue arrow. |

||

| − | {{ExpandImage|MED-EK-EN-Bild2.png}} |

||

| + | ===Different selections and description=== |

||

| − | Dersom dere fakturerar en særskilt medietype eller kunder kontinuerlig, kan du lagra utvalget til neste gang. Du finner alternativen for lagring under den blå pilen. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild2.png}} |

| − | {| |

+ | {|class=mandeflist |

| + | !Current invoicing |

||

| − | !Løpende fakt |

||

| + | |Both = includes everything, regardless of whether the agreement has ‘Current invoicing’ or not. Yes = plans/orders that have ‘Current invoicing’ according to the agreement are invoiced. No = only includes agreements that do not have ‘Current invoicing’ checked. |

||

| − | |Hvis blank, vises alt uansett innstillinger i avtalen. Hvis du kun vil fakturere avtaler med løpende fakturering, velg Ja |

||

|- |

|- |

||

| + | !Also not checked |

||

| − | !Også ikke ktrl |

||

| + | |If ticked, insertions are included even if they haven’t been ad checked - if plan- or order number is entered. |

||

| − | |J= også ikke kontrollerte innrykk vises, forutsatt at budsjett- eller ordrenummer har angitts. |

||

|- |

|- |

||

| + | !No reference no. |

||

| − | !Ref nr savnes |

||

| + | |If Yes, all plans and orders without reference number but the client setting states that it is mandatory, will be invoiced. If Both is selected, everything is printed out but only in a test print. |

||

| − | |N= ordrer med referansenummer vil faktureres, forutsatt at parameteren Fakturer kun ordrer med referansenummer er aktivert. |

||

| − | | |

+ | |- |

| + | !Debit/credit |

||

| + | |Blank = everything is printed out. |

||

| + | Debit = Only debit invoices are printed out. |

||

| − | Ja = alle planer/budsjetter med blank referanse faktureres, forutsat at kunden angitt det som obligatorisk. |

||

| + | Credit = Only Credit invoices are printed out. |

||

| − | Blank= alt utskrives, men kun i prøveutskrift. |

||

| + | Separately = debit – and credit records are printed on separate invoices. |

||

| − | Hvis parameteren ”Fakturer kun ordrer med referansenummer” er aktivert i kunderegistret, må dette felt være satt til Ja. |

||

| − | Dersom du inntaster en feilaktig kombinasjon, viser systemet en feilmelding og du kan ikke fortsette å fakturere |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !Debet/Kredit |

||

| − | |Blank = alt faktureres. Debet = kun debetnotaer, Kredit = kun kreditnotaer. Separate = debet- og kreditnotaer på separate fakturaer. |

||

|- |

|- |

||

| + | !Corrections |

||

| − | !Korrigeringer |

||

| + | |Insertions that are marked with Correction (x) can be invoiced peparately or be excluded: |

||

| − | |Markerte fakturaer (x) kan faktureres separat. Ja = inkluder korrigeringer, Nei = ikke inkluder korrigeringer, Separate = fakturer ordinære og korrigerte i separate fakturaer |

||

| + | Not corrected + external corrections |

||

| − | |- |

||

| − | !Tvinge frem en faktura pr kunde |

||

| − | |Ja = styr over kunden sin minimumgrense for fakturering. |

||

| − | |} |

||

| + | External corrections |

||

| − | Hvis du vil skrive noe på fakturaen, bruk Generell fakturatekst. |

||

| + | Not corrected |

||

| − | == Krediter/vend en faktura == |

||

| + | Not corrected + external corrections separately |

||

| − | Dersom hele fakturaen er feil, kan den krediteres i fliken Kreditering |

||

| + | Internal corrections |

||

| − | {{ExpandImage|MED-EK-EN-Bild4.png}} |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !Ikke fakturer innrykk |

||

| − | |Alle innrykk blokkeres fra faktureringen da fakturaen krediteres. N= innrykkene blir definitive og kan korrigeres og faktureres på nyt. |

||

|- |

|- |

||

| + | !Force one invoice… |

||

| − | !Eposte kunder… |

||

| + | |If selected, the minimum amount for invoice in the client setting will be overruled and an invoice will be printed anyway |

||

| − | |Foraldret funksjon. Bruk Fakturadistribusjon i Økonomi: Fakturadistribusjon. |

||

| + | |- |

||

| + | !Invoice text |

||

| + | |Possibility to write an invoice text at every invoicing. |

||

|} |

|} |

||

| + | |||

| − | == Kreditere/vend innrykk== |

||

| + | == Credit an invoice == |

||

| + | If the entire invoice is incorrect, it can be credited under the Reversing tab. There, you can also reverse part of the invoice by entering the order number/entry. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild3.png}} |

||

| − | Åpn ordre og innrykk. Velg innrykket som må krediteres og tast {{btn|Krediter}}. |

||

| + | {|class=mandeflist |

||

| − | {{ExpandImage|MED-EK-EN-Bild5.png}} |

||

| + | !Inv.no.series |

||

| − | {{ExpandImage|MED-EK-EN-Bild6.png}} |

||

| + | |It is possible to set a deviating number series for credit invoices. |

||

| − | |||

| + | |- |

||

| − | |||

| + | !Block ins. after rev… |

||

| − | Innrykket blir vendt, dvs. vises som ett kreditinnrykk og markert som en korrigering. Det betyder at du kan fakturere den separat i den løpende faktureringen. |

||

| + | |Means that after reversal of the invoice, all its insertions are blocked for invoicing. |

||

| − | |||

| − | {{ExpandImage|MED-EK-EN-Bild7.png}} |

||

| − | |||

| − | {| class=mandeflist |

||

| − | Denne kreditering innebær at hele innrykket, inklusive mulige gebyrer og kapitalkostnader, krediteres. |

||

| − | | |

||

|} |

|} |

||

| + | |||

| + | == Credit an insertion == |

||

| + | Orders and single insertions are credited in Media | Plans. Also, corrections are made here. |

||

| + | * Open order and insertion. |

||

| − | Dersom du vil kreditere innrykk uten at ta med gebyrer og kapitalkostnad, kan du velge å ekskludere dem |

||

| + | * Select one or several insertions that shall be credited and use the Credit button. |

||

| + | * Select type of crediting and press OK. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild4.png}} |

||

| + | |||

| + | The insertion will be reversed as a credit insertion and gets a correction mark. Now the credit can be separately invoiced in the current invoicing. |

||

| + | * Select if you want to use the previous invoice number as a comment on the credit invoice. |

||

| − | Det gjør du i innrykket, i fliken Annet |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild5.png}} |

| + | This credit means that the complete insertion including possible insertion fee and capital cost will be credited. To credit an insertion without including insertion fee and capital cost, they can be excluded. Exclude insertion fee in the Other tab on the insertion. |

||

| − | == Kreditere/vend del av fordeling == |

||

| + | {{ExpandImage|MED-ACC-EN-Bild6.png}} |

||

| − | Dersom du har en fordeling og du kun vil kreditere en av kundenen, "flytter" du i praktikken kostnaden til en annen kunde. |

||

| + | |||

| − | {| class=mandeflist |

||

| + | Exclude capital cost on the insertion. |

||

| − | !Eksempel: |

||

| − | | |

||

| − | |} |

||

| + | {{ExpandImage|MED-ACC-EN-Bild7.png}} |

||

| − | Kunden SAS Norway må krediteres, i stedet skal SAS Sweden debiteres, dvs. betale hele beløpet. |

||

| + | |||

| + | == Credit part of allocation == |

||

| + | If an allocation exists and only one of the clients shall be credited, the cost must be “moved” to another client. |

||

| + | '''Example''' The client Toyota Norway shall be credited, and Toyota Sweden shall be debited instead, meaning that Toyota Sweden shall pay the entire cost. |

||

| − | {{ExpandImage|MED-EK-EN-Bild9.png}} |

||

| + | {{ExpandImage|MED-ACC-EN-Bild8.png}} |

||

| − | Gjør såhär: |

||

| + | |||

| − | 1. Åpn ordren og velg innrykket, som må korrigeres. Tast {{btn|Krediter fordeling}}. |

||

| + | * Open the order and select the insertion that shall be corrected, press the Credit allocation button. |

||

| + | |||

| + | {{ExpandImage|MED-ACC-EN-Bild9.png}} |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild10.png}} |

| + | |||

| + | * Select the insertion to be credited, press OK. |

||

| + | * Open the credit row and write an invoice comment under the Correction tab. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild11.png}} |

||

| − | 2. Velg fakturaen som må debiteres. Tast {{btn|OK}}. |

||

| + | |||

| + | * Select the insertion to be debited (the original, not the credit). |

||

| + | * Use Debit allocation and select the client to be debited. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild12.png}} |

||

| + | |||

| + | * Select the new debit insertion and open. |

||

| + | * An invoice comment can be added in the correction tab. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild13.png}} |

| + | |||

| + | * Save. Two new invoices are printed at the next invoicing. A credit to Toyota Norway and a new debit to Toyota Sweden. |

||

| + | == Pre-invoicing == |

||

| − | {{ExpandImage|MED-EK-EN-Bild12.png}} |

||

| + | The list under the Pre-invoice tab shows pre-invoice status. Here you can see the invoice amount, how much has been deducted and from which amounts, and the remaining amount. |

||

| + | The Deduction from column shows definitive orders that can be deducted from. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild14.png}} |

||

| − | 3. Velg innrykket som må debiteres (det opprinnelige innrykket, ikke kreditinnrykket). |

||

| + | |||

| + | There are two ways to pre-invoice that are managed from the client agreement. |

||

| + | '''No current pre-invoice deduction''' The client is pre-invoiced, and a controlled deduction takes place. |

||

| + | '''Current pre-invoice deduction''' The client is pre-invoiced, and all definitive insertions are currently deducted. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild15.png}} |

||

| − | Tast {{btn|Debiter fordeling}} |

||

| + | |||

| + | The parameter setting ”Current pre-invoice deduction per row” should be set to make sure that what is in ”Deduction from” only shall be used. This parameter is in Media | Backoffice | Base registers | Parameters | Invoicing tab. |

||

| + | |||

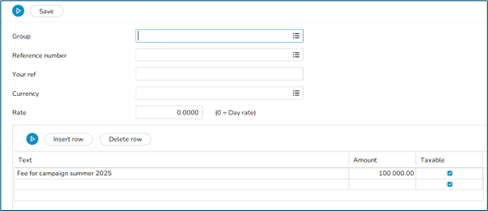

| + | ===New pre-invoice=== |

||

| + | * Go to the Pre invoice tab. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild16.png}} |

||

| − | 5. Velg posten, som skal debiteres på nyt(SAS Sverige) og tast {{btn|OK}}. |

||

| + | |||

| + | * Enter client and possible owner. Owner is only used for sorting and filtering in the pre-invoice list. |

||

| + | * Write a description. It will be shown in the pre-invoice list. |

||

| + | * Block current deduction means that the pre-invoice will not be deducted in the current pre-invoice deduction. |

||

| + | * It is possible to deduct from another client, if it belongs to the same collective client. |

||

| + | * Select NEW in the Pre-invoices tab. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild17.png}} |

||

| − | 6. Velg det nye debetinnrykket og åpn det. Under fliken Korrigering, bytt kunden til SAS Sweden og skriv en eventuell fakturakommentar. |

||

| + | |||

| + | * Fill in text and amount. Select if the pre-invoice shall be subject to VAT or not. The invoice cannot have mixed rows with VAT and VAT-free. |

||

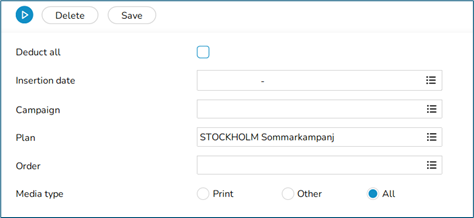

| + | * If you know from which plan/order the pre-invoice shall be deducted, you can fill in that in the Deduction from tab. |

||

| + | * Deduct all is selected as default but you can remove it an enter plan, order or other to be deducted from. |

||

| − | {{ExpandImage|MED- |

+ | {{ExpandImage|MED-ACC-EN-Bild18.png}} |

| + | |||

| + | * Save and print the invoice in the Pre-invoice tab. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild19.png}} |

||

| − | 7. Lagre. Ved tidspunktet for neste fakturering skrivs to fakturaer ut. En kreditnota til SAS Norway og en ny debetnota til SAS Sweden. |

||

| + | |||

| + | === Pre-invoice deduction === |

||

| + | '''Current pre-invoicing''' is deducted in the Invoicing tab. |

||

| + | '''No current pre-invoicing''', i.e. a controlled deduction is done in the Pre-invoice deduction tab. Enter the pre-invoice number to be deducted here. Any surplus/deficit will be invoiced in the form of a debit or credit invoice, and the pre-invoiced will be cleared. |

||

| − | == Akontofakturering == |

||

| + | '''Keep in mind''' When invoicing clients with agreements that states ”Current pre-invoice deduction”, the system takes the oldest pre-invoice and begins with it. If nothing meets the condition set for the pre-invoice, deduction continues with the next pre-invoice and continues until as much as possible can be deducted. |

||

| + | You should therefore link a pre-invoice to a plan/order if you want to be sure that only that plan/those orders are included in the deduction. |

||

| − | Listen i fliken Akontofakturering viser status på akontoene; fakturabeløp, avregningsbeløp og avregnede fakturaer samt resterende beløp. Kolonnen Avregning fra viser planlagte ordrer som er tilgjengelige for avregning. |

||

| + | |||

| + | == Invoice project together with a media invoice == |

||

| − | {{ExpandImage|MED-EK-EN-Bild14.png}} |

||

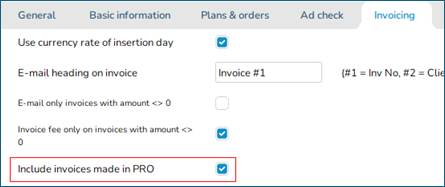

| + | To be able to print a project invoice together with a media invoice, parameter settings must be made in Media | Backoffice | Base registers | Parameters | Invoicing. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild20.png}} |

||

| − | Det finnes to måter for akontofakturering basert på kundeavtale |

||

| + | |||

| + | * Create an invoice in Project | Invoicing and connect the invoice to the media plan in the Parameters tab. |

||

| + | * The invoicing is done in media invoicing. |

||

| + | '''NB!''' The media invoice print template must be updated so that it fetches information from the project accounting. |

||

| + | |||

| − | 1. Kunden akontofaktures og en avregning gjøres etterpå.Ingen løpende akontoavregning. |

||

| + | == Reconcile media discrepancies/Discrepancy handling== |

||

| + | Reconciliation and booking away discrepancies are made in Media | Reconciliation. |

||

| + | You can select on reconciliation codes, owner, client, date among other things. Your choices can be saved as default or as a selection, so that you don’t need to change each time you want to print the list. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild21.png}} |

||

| − | Kunden akontofaktureres og alle planlagte innrykker avregnes løpende. Løpende akontoavregning. |

||

| + | |||

| + | '''Discr. net/Discr. Net-Net''' |

||

| + | This specifies how large the discrepancies should be to be displayed in the list. |

||

| − | {{ExpandImage|MED-EK-EN-Bild15.png}} |

||

| + | 1–999 999 999 in Discr.Net-Net is specified to avoid seeing all entries without a discrepancy or that are already booked away. |

||

| + | 0–999 999 999 in Diff Net-Net is specified to see all booked away discrepancies. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild22.png}} |

||

| − | Ny akontofaktura: |

||

| + | When reconciling with the media settlement account, only the accounting date is entered, nothing else. The Net-Net amount is reconciled with the media settlement account in, for example, Accounting | Queries, Accounts tab or the Account specification in Accounting | Reports, General Ledger tab. |

||

| − | Skap en ny akontofaktura i fliken Akonto. Husk, at det ikke er mulig å avregne akonto fra en annen kunde. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild23.png}} |

||

| − | Angi kunde og mulig eier (dersom du vil sortere og søke blant dine egne i listen) |

||

| − | Sperr løpende avregning = akontoen blir ikke avregnet ved løpende akontoavregning. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild24.png}} |

||

| − | |||

| + | |||

| − | I Akontofakturaer, klikk NY. |

||

| + | Set up the columns so that the relevant information is visible. The columns are selected using the list button on the far right of the header row. |

||

| − | {{ExpandImage|MED-EK-EN-Bild16.png}} |

||

| + | {|class=mandeflist |

||

| − | |||

| + | !Open |

||

| − | 3. Angi fakturadato, forfallsdato og tekst med beløp. Velg hvis akontoen har mva eller ikke. Lagre og utskriv i fliken Akontofaktura. |

||

| + | |Open the order for deepening. |

||

| − | Dersom du allerede vet hvilket budsjett/hvilken ordre akontoen skal avregnes fra, angi opplysningene i feltene før du skriver ut fakturaen. |

||

| − | |||

| − | {{ExpandImage|MED-EK-EN-Bild17.png}} |

||

| − | |||

| − | Avregning fra |

||

| − | {{ExpandImage|MED-EK-EN-Bild18.png}} |

||

| − | |||

| − | {{ExpandImage|MED-EK-EN-Bild19.png}} |

||

| − | |||

| − | Angi budsjett, ordre eller kampanje. Dersom du velger "Avregn alt" kan du ikke legge til noe i feltene, disse er defaultinnstillinger. |

||

| − | {{ExpandImage|MED-EK-EN-Bild20.png}} |

||

| − | |||

| − | Beskrivelsesfeltet kan være meget anvendbar. |

||

| − | |||

| − | Ved tidspunktet for avregningen, gjøres det enten i Fakturering (ved løpende acontoavregning) eller i fliken Acontoavregning (ved kontrollert avregning). Angi her akontofakturanummeret som skal avregnes. Mulige over- og underskudd fakturers som debit- eller kreditfakturaer og akontoen bliver utlignet. |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !To keep in mind: |

||

| − | | |

||

| − | |} |

||

| − | |||

| − | Ved fakturering av de kunder i 08-70-10, som har ”Løpende akontofakturering” i avtalene sine, begynner systemet alltid med den eldste akontoen. Hvis intet matcher med betingelsene i den, går den til neste akontofaktura. |

||

| − | |||

| − | |||

| − | = Differanser/Avstemming av differanser = |

||

| − | |||

| − | Overstyr (bok bort) differanser i {{pth|Media|Avstemming}}. |

||

| − | |||

| − | Lag et utvalg på skjermen med avstemmingskode, eier, kunde, dato, etc. |

||

| − | Du kan lagre utvalget ditt for fremtida. |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !Dff Net /Diff Net-net |

||

| − | |Angi størrelsen på de differanser som listen skal vise. Dersom du ikke ønsker å se alle innrykk, skriv minst 1-999 999 999 i Diff. Net-Net. Standardinnstillingen er at begge feltene har 0-999 999 999. |

||

| − | |} |

||

| − | |||

| − | Beløpet i listen som viser Diff Net-Net avstemmes mot medieavregningskontoen. |

||

| − | For avstemming mellan avregningskontoen og differanselistan, velg bare “til bookingsdato”, intet annet. |

||

| − | |||

| − | Juster kolonnene så at du kan se relevant informasjon. Bruk pilsymbolet lengst til høyre i overskriftsraden for å velge kolonner |

||

| − | |||

| − | |||

| − | {| class=mandeflist |

||

| − | ! Skap korrigering |

||

| − | |Skaper et nytt innrykk av det valgte innrykket sitt differanse, enten negativ eller positiv sådan. Det nye innrykket kan senere faktureres til kunden. |

||

|- |

|- |

||

| + | !Create correction |

||

| − | ! Overstyring |

||

| + | |Creates a new insertion of the selected insertion’s Net-Net discrepancy – negative or positive depending on the discrepancy. The new insertion can then be sent as an invoice to the client. |

||

| − | |Se neden |

||

|- |

|- |

||

| + | !Book away |

||

| − | !Avstemmingskode |

||

| + | |See chapter below |

||

| − | |Kan endres |

||

|- |

|- |

||

| + | !Reconciliation code/Comment |

||

| − | !Avstemmingskommentar |

||

| + | |Possibility to change reconciliation code or add a comment on the insertion. |

||

| − | |Mulighet for å skrive eller redigere kommentar. |

||

|- |

|- |

||

| + | !Change order no/insertion date |

||

| − | ! Bytt ordrenummer/innrykksdato |

||

| + | |A registered media invoice can be moved to a new insertion. Read more in the chapter below |

||

| − | |mulighet for å flytte mediefaktura fra ett innrykk til et annet. Les mer neden. |

||

|- |

|- |

||

| + | !Change owner/client |

||

| − | ! Bytt eier/kunde |

||

| + | |For changing plan owner or client. A parameter setting is required for change of client on an invoiced insertion. |

||

| − | |Mulighet for å bytte eier/kunder, forutsatt at parameteren er innstilt for det. |

||

| + | |- |

||

| + | !Show media invoices |

||

| + | |Shows invoice copy as PDF, if the invoice has been scanned. |

||

|- |

|- |

||

| + | !Claim |

||

| − | !Vis faktura |

||

| + | |If the invoice is erroneous, it can here be sent as a reclamation to the supplier. |

||

| − | |Viser kopi på fakturaen som en PDF. |

||

| − | |- |

||

| − | !Utskrift |

||

| − | |Skriver ut avstemmingslisten. For dette kreves en spesiell utskriftsmal. |

||

|} |

|} |

||

| + | |||

| − | == |

+ | == Book away discrepancies == |

| + | * Select one or several rows and press Book away. |

||

| + | * Enter accounting date. It is also possible to book away a part by changing the amount and also change to optional account. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild25.png}} |

||

| − | Velg en eller flere rader og klikk på {{btn|Overstyring}}. |

||

| + | == Move media invoice to another order or insertion date== |

||

| − | {{ExpandImage|MED-EK-EN-Bild26.png}} |

||

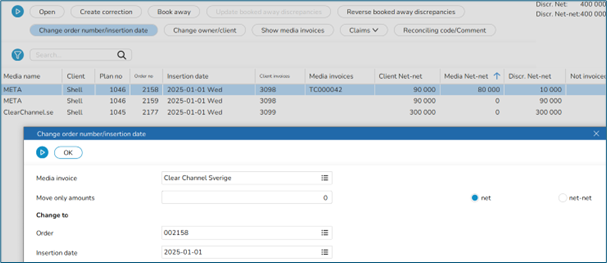

| + | * Use the function Change order number/insertion date for moving an erroneously registered media invoice. Select the order and press the button. |

||

| + | * Select the media invoice and enter order number the insertion date into which the invoice shall be moved. It is possible to move it to an existing order number/insertion date. |

||

| + | * If only a part of the invoice shall be moved, enter amount. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild26.png}} |

||

| − | {| class=mandeflist |

||

| − | !''Husk, at du ikke kan fortryde dette'' |

||

| − | |} |

||

| + | == Agency settlement== |

||

| − | = Flytt mediefaktura til annen ordre eller annen innrykksdato. = |

||

| + | For clients whose agreements stipulate that the advertising agency is to receive a share of commissions, fees and charges, Agency is added to the client in order to create an agency settlement. When the agency settlement is printed, a supplier invoice is created and added to the corresponding supplier in the Purchase ledger, which is then paid. |

||

| + | Set up agency in Media | Backoffice | Base registers | Agencies |

||

| − | Bruk funksjonen {{btn| Bytt ordrenummer/innrykksdato}} for å flytte en feilaktig innregistrert faktura. |

||

| + | Enter the agency on the client in Media | Backoffice | Base registers | Client, Parameters 1 tab. |

||

| + | On the client agreement in Media | Backoffice | Base registers | Agreements, you state how big part/percentage of insertion fee, agency commission and capital cost that shall be forwarded to the agency. |

||

| − | = Byråavregning = |

||

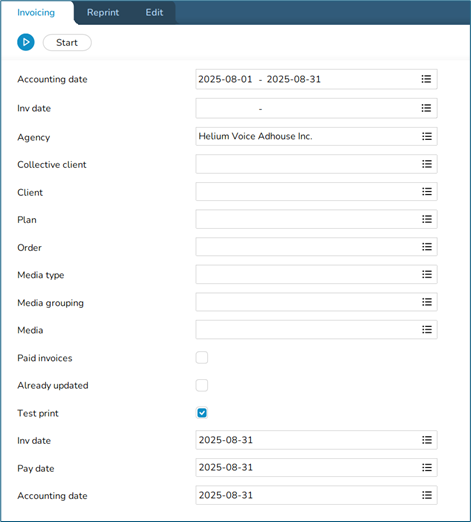

| + | * Media | Backoffice | Agency settlement for printing out invoice and agency settlement specification. |

||

| − | Visse kunder har avtale som sier at reklamebyrået må ha del av provisjoner og gebyrer. Dette gjøres ved at lage en byråavregning som sendes til reklamebyrået. |

||

| + | * Select agency and accounting date or another selection. You can have different selections for different purposes, e.g. if only a certain media shall be settled on a plan. |

||

| − | Da du skriver ut avregningen skapes en leverandørsfaktura i leverandørsreskontroen som blir betalt ut til byrået. |

||

| + | {{ExpandImage|MED-ACC-EN-Bild27.png}} |

||

| − | - Angi siden byrået i kunderegistret i {{pth|System|Grunnregister/MED/Kunder/Kunder}}, flik Parametrer 1. |

||

| + | {|class=mandeflist |

||

| − | - I avtalen, i {{pth|System|Grunnregister/MED/Kunder/Avtaler}}, angi prosentandeler av innrykksgebyrer, byråprovisjoner og kapitalkostnader som skal videre til byrået. |

||

| + | !Paid invoices |

||

| − | |||

| + | |Creates settlement only for paid client invoices. |

||

| − | {{ExpandImage|MED-EK-EN-Bild31.png}} |

||

| − | |||

| − | {{ExpandImage|MED-EK-EN-Bild32.png}} |

||

| − | |||

| − | |||

| − | Velg kunde og regnskapsdato, eller annen selektering, for eksempel om du bara vil avregne et spesifikt media på et budsjett. |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !Betalte fakturaer |

||

| − | |Y = Avregner kun betalte fakturaer. |

||

|- |

|- |

||

| + | !Already updated |

||

| − | !Allerede oppdatert |

||

| + | |Possibility to reprint the specification. |

||

| − | |Y= Mulighet for å skrive ut spesifikasjon på nytt. |

||

| + | |- |

||

| + | !Reprint |

||

| + | |All agency settlements can be reprinted. |

||

|} |

|} |

||

| + | [[Category:MED-ACC-EN]] |

||

| − | = Fakturer prosjekter sammen med mediefakturaer i 08-70-10. = |

||

| + | [[Category:Media]] |

||

| − | |||

| + | [[Category:Manuals]] |

||

| − | Kryss av parameteren Inkluder fakturaer opprettet i PRO i {{pth|System|Grunnregister/Parametrer}}, fliken Fakturering |

||

| − | |||

| − | Mediefakturamalen må oppdateres slik at den henter informasjon fra prosjektregnskapen. |

||

| − | |||

| − | [[Category:MED-EK-NO]] [[Category:Manuals]] [[Category:Media]] |

||

Latest revision as of 15:46, 26 January 2026

Contents

- 1 Media Accounting

- 1.1 Invoicing

- 1.2 Credit an invoice

- 1.3 Credit an insertion

- 1.4 Credit part of allocation

- 1.5 Pre-invoicing

- 1.6 Invoice project together with a media invoice

- 1.7 Reconcile media discrepancies/Discrepancy handling

- 1.8 Book away discrepancies

- 1.9 Move media invoice to another order or insertion date

- 1.10 Agency settlement

Media Accounting

Invoicing

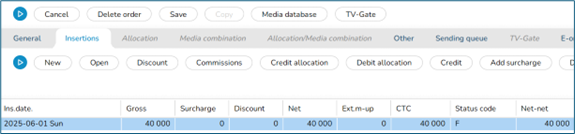

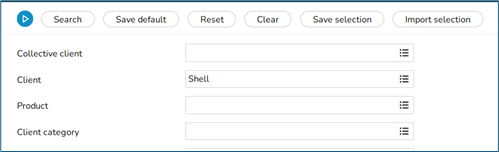

All invoicing is done in Media | Invoicing, including pre-invoicing, deductions and reversals of invoices.

Various selections can be made based on, for example, insertion date, plan number, client and client category. Invoicing per campaign can also be selected, if used.

If a specific media type or client is invoiced continuously, the selection can be saved so that a new selection does not have to be made each time. The options are located behind the blue arrow.

Different selections and description

| Current invoicing | Both = includes everything, regardless of whether the agreement has ‘Current invoicing’ or not. Yes = plans/orders that have ‘Current invoicing’ according to the agreement are invoiced. No = only includes agreements that do not have ‘Current invoicing’ checked. |

|---|---|

| Also not checked | If ticked, insertions are included even if they haven’t been ad checked - if plan- or order number is entered. |

| No reference no. | If Yes, all plans and orders without reference number but the client setting states that it is mandatory, will be invoiced. If Both is selected, everything is printed out but only in a test print. |

| Debit/credit | Blank = everything is printed out.

Debit = Only debit invoices are printed out. Credit = Only Credit invoices are printed out. Separately = debit – and credit records are printed on separate invoices. |

| Corrections | Insertions that are marked with Correction (x) can be invoiced peparately or be excluded:

Not corrected + external corrections External corrections Not corrected Not corrected + external corrections separately Internal corrections |

| Force one invoice… | If selected, the minimum amount for invoice in the client setting will be overruled and an invoice will be printed anyway |

| Invoice text | Possibility to write an invoice text at every invoicing. |

Credit an invoice

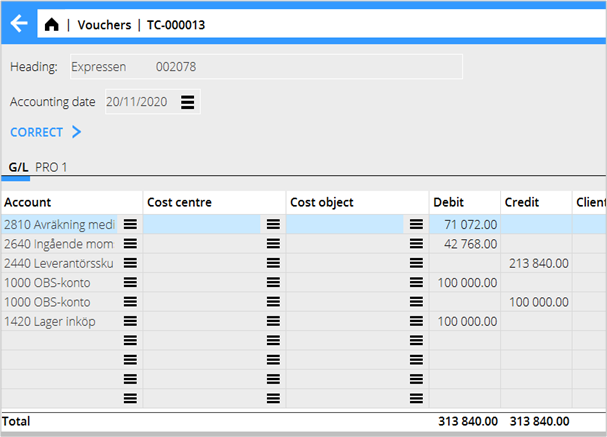

If the entire invoice is incorrect, it can be credited under the Reversing tab. There, you can also reverse part of the invoice by entering the order number/entry.

| Inv.no.series | It is possible to set a deviating number series for credit invoices. |

|---|---|

| Block ins. after rev… | Means that after reversal of the invoice, all its insertions are blocked for invoicing. |

Credit an insertion

Orders and single insertions are credited in Media | Plans. Also, corrections are made here.

- Open order and insertion.

- Select one or several insertions that shall be credited and use the Credit button.

- Select type of crediting and press OK.

The insertion will be reversed as a credit insertion and gets a correction mark. Now the credit can be separately invoiced in the current invoicing.

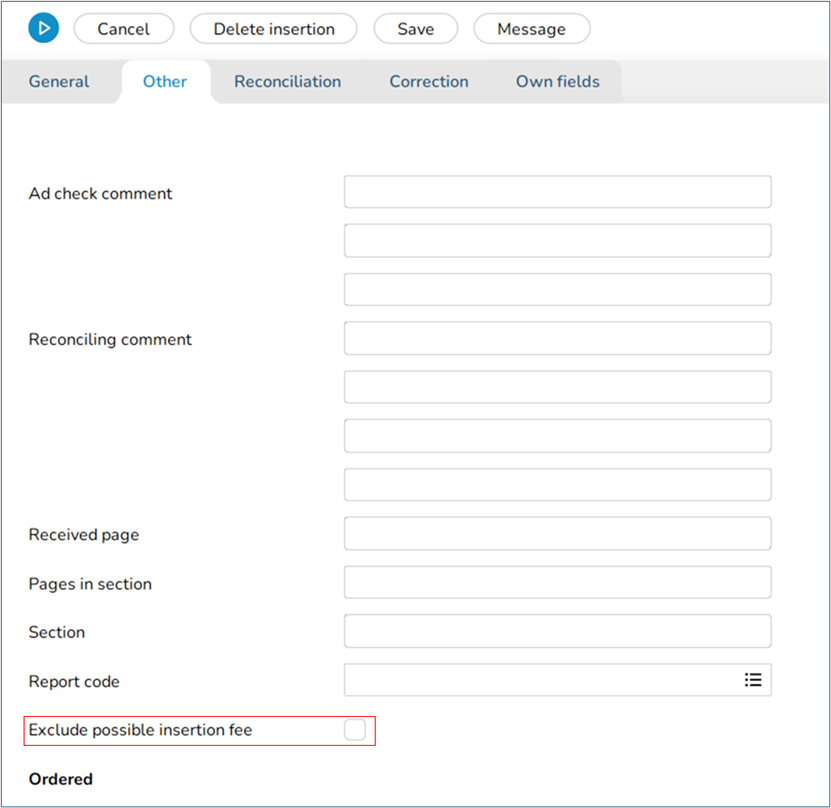

- Select if you want to use the previous invoice number as a comment on the credit invoice.

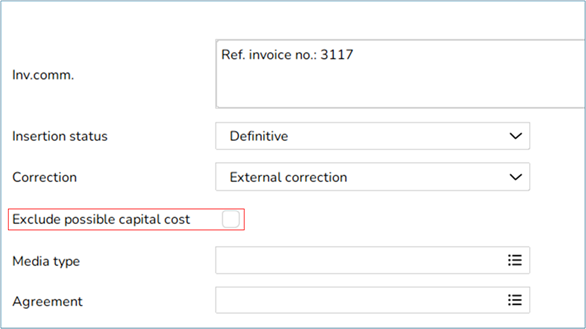

This credit means that the complete insertion including possible insertion fee and capital cost will be credited. To credit an insertion without including insertion fee and capital cost, they can be excluded. Exclude insertion fee in the Other tab on the insertion.

Exclude capital cost on the insertion.

Credit part of allocation

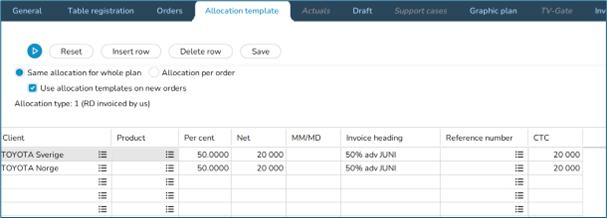

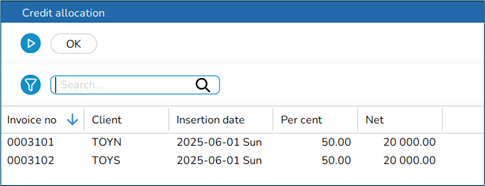

If an allocation exists and only one of the clients shall be credited, the cost must be “moved” to another client.

Example The client Toyota Norway shall be credited, and Toyota Sweden shall be debited instead, meaning that Toyota Sweden shall pay the entire cost.

- Open the order and select the insertion that shall be corrected, press the Credit allocation button.

- Select the insertion to be credited, press OK.

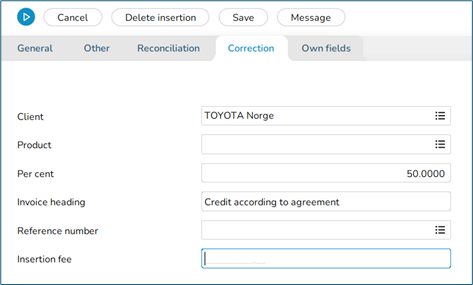

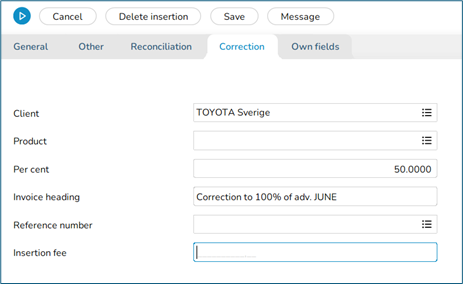

- Open the credit row and write an invoice comment under the Correction tab.

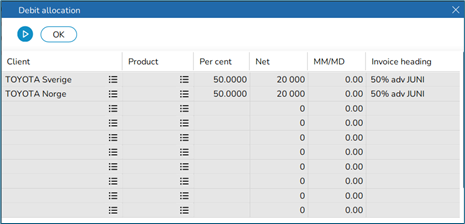

- Select the insertion to be debited (the original, not the credit).

- Use Debit allocation and select the client to be debited.

- Select the new debit insertion and open.

- An invoice comment can be added in the correction tab.

- Save. Two new invoices are printed at the next invoicing. A credit to Toyota Norway and a new debit to Toyota Sweden.

Pre-invoicing

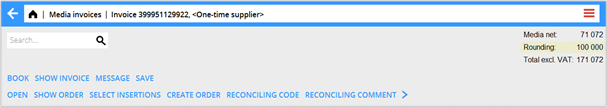

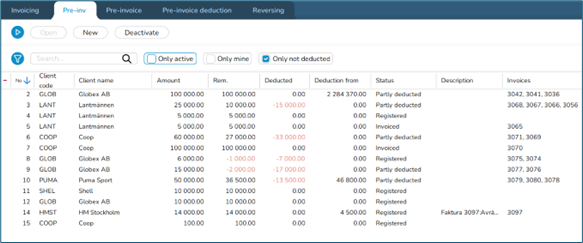

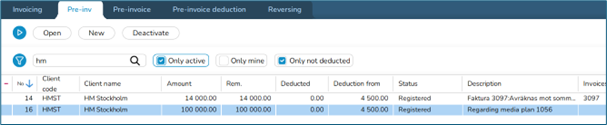

The list under the Pre-invoice tab shows pre-invoice status. Here you can see the invoice amount, how much has been deducted and from which amounts, and the remaining amount. The Deduction from column shows definitive orders that can be deducted from.

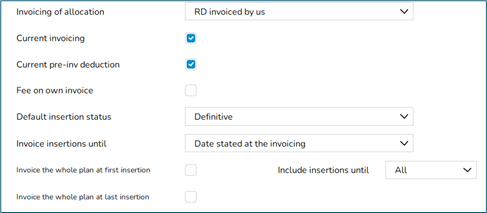

There are two ways to pre-invoice that are managed from the client agreement. No current pre-invoice deduction The client is pre-invoiced, and a controlled deduction takes place. Current pre-invoice deduction The client is pre-invoiced, and all definitive insertions are currently deducted.

The parameter setting ”Current pre-invoice deduction per row” should be set to make sure that what is in ”Deduction from” only shall be used. This parameter is in Media | Backoffice | Base registers | Parameters | Invoicing tab.

New pre-invoice

- Go to the Pre invoice tab.

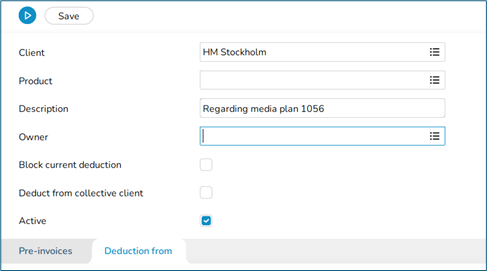

- Enter client and possible owner. Owner is only used for sorting and filtering in the pre-invoice list.

- Write a description. It will be shown in the pre-invoice list.

- Block current deduction means that the pre-invoice will not be deducted in the current pre-invoice deduction.

- It is possible to deduct from another client, if it belongs to the same collective client.

- Select NEW in the Pre-invoices tab.

- Fill in text and amount. Select if the pre-invoice shall be subject to VAT or not. The invoice cannot have mixed rows with VAT and VAT-free.

- If you know from which plan/order the pre-invoice shall be deducted, you can fill in that in the Deduction from tab.

- Deduct all is selected as default but you can remove it an enter plan, order or other to be deducted from.

- Save and print the invoice in the Pre-invoice tab.

Pre-invoice deduction

Current pre-invoicing is deducted in the Invoicing tab.

No current pre-invoicing, i.e. a controlled deduction is done in the Pre-invoice deduction tab. Enter the pre-invoice number to be deducted here. Any surplus/deficit will be invoiced in the form of a debit or credit invoice, and the pre-invoiced will be cleared.

Keep in mind When invoicing clients with agreements that states ”Current pre-invoice deduction”, the system takes the oldest pre-invoice and begins with it. If nothing meets the condition set for the pre-invoice, deduction continues with the next pre-invoice and continues until as much as possible can be deducted.

You should therefore link a pre-invoice to a plan/order if you want to be sure that only that plan/those orders are included in the deduction.

Invoice project together with a media invoice

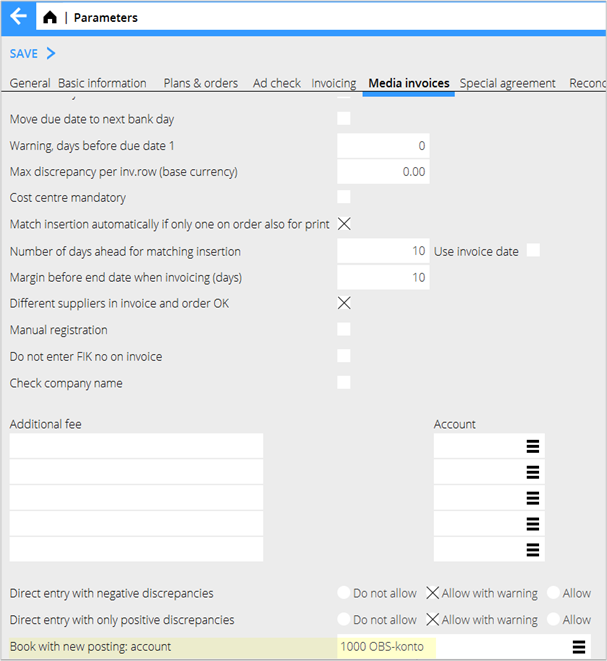

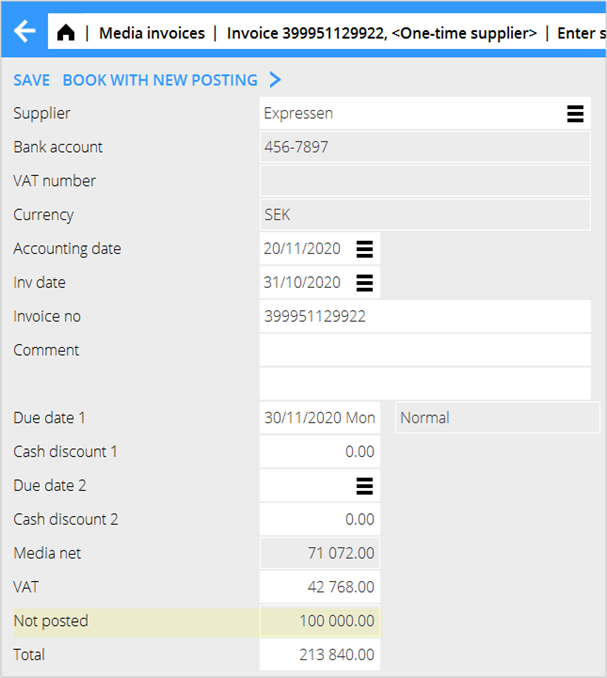

To be able to print a project invoice together with a media invoice, parameter settings must be made in Media | Backoffice | Base registers | Parameters | Invoicing.

- Create an invoice in Project | Invoicing and connect the invoice to the media plan in the Parameters tab.

- The invoicing is done in media invoicing.

NB! The media invoice print template must be updated so that it fetches information from the project accounting.

Reconcile media discrepancies/Discrepancy handling

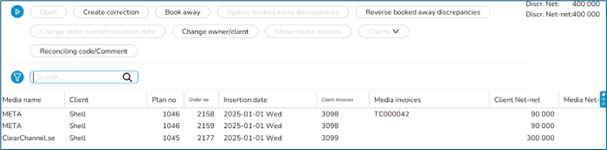

Reconciliation and booking away discrepancies are made in Media | Reconciliation. You can select on reconciliation codes, owner, client, date among other things. Your choices can be saved as default or as a selection, so that you don’t need to change each time you want to print the list.

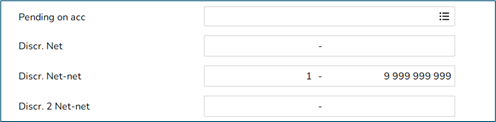

Discr. net/Discr. Net-Net

This specifies how large the discrepancies should be to be displayed in the list. 1–999 999 999 in Discr.Net-Net is specified to avoid seeing all entries without a discrepancy or that are already booked away. 0–999 999 999 in Diff Net-Net is specified to see all booked away discrepancies.

When reconciling with the media settlement account, only the accounting date is entered, nothing else. The Net-Net amount is reconciled with the media settlement account in, for example, Accounting | Queries, Accounts tab or the Account specification in Accounting | Reports, General Ledger tab.

Set up the columns so that the relevant information is visible. The columns are selected using the list button on the far right of the header row.

| Open | Open the order for deepening. |

|---|---|

| Create correction | Creates a new insertion of the selected insertion’s Net-Net discrepancy – negative or positive depending on the discrepancy. The new insertion can then be sent as an invoice to the client. |

| Book away | See chapter below |

| Reconciliation code/Comment | Possibility to change reconciliation code or add a comment on the insertion. |

| Change order no/insertion date | A registered media invoice can be moved to a new insertion. Read more in the chapter below |

| Change owner/client | For changing plan owner or client. A parameter setting is required for change of client on an invoiced insertion. |

| Show media invoices | Shows invoice copy as PDF, if the invoice has been scanned. |

| Claim | If the invoice is erroneous, it can here be sent as a reclamation to the supplier. |

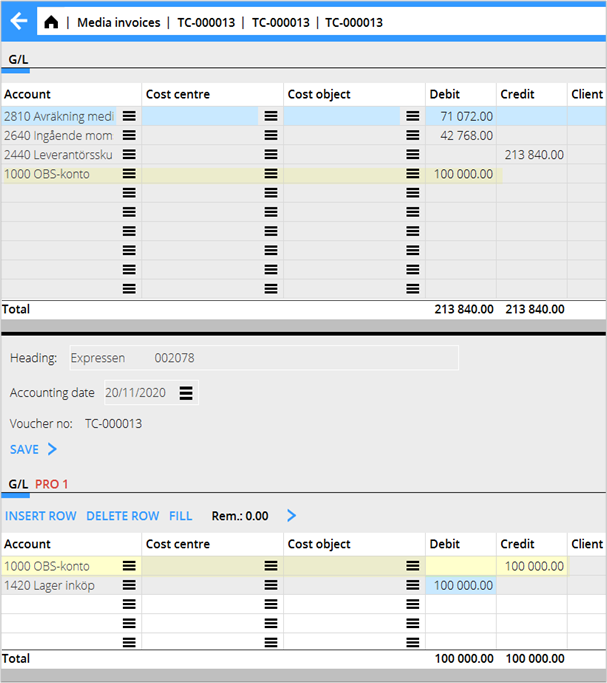

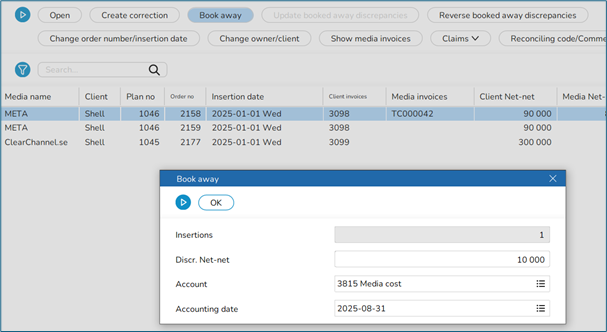

Book away discrepancies

- Select one or several rows and press Book away.

- Enter accounting date. It is also possible to book away a part by changing the amount and also change to optional account.

Move media invoice to another order or insertion date

- Use the function Change order number/insertion date for moving an erroneously registered media invoice. Select the order and press the button.

- Select the media invoice and enter order number the insertion date into which the invoice shall be moved. It is possible to move it to an existing order number/insertion date.

- If only a part of the invoice shall be moved, enter amount.

Agency settlement

For clients whose agreements stipulate that the advertising agency is to receive a share of commissions, fees and charges, Agency is added to the client in order to create an agency settlement. When the agency settlement is printed, a supplier invoice is created and added to the corresponding supplier in the Purchase ledger, which is then paid.

Set up agency in Media | Backoffice | Base registers | Agencies

Enter the agency on the client in Media | Backoffice | Base registers | Client, Parameters 1 tab.

On the client agreement in Media | Backoffice | Base registers | Agreements, you state how big part/percentage of insertion fee, agency commission and capital cost that shall be forwarded to the agency.

- Media | Backoffice | Agency settlement for printing out invoice and agency settlement specification.

- Select agency and accounting date or another selection. You can have different selections for different purposes, e.g. if only a certain media shall be settled on a plan.

| Paid invoices | Creates settlement only for paid client invoices. |

|---|---|

| Already updated | Possibility to reprint the specification. |

| Reprint | All agency settlements can be reprinted. |