Difference between revisions of "Enter vouchers/sv"

(Updating to match new version of source page) |

|||

| Line 1: | Line 1: | ||

<htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

<htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

||

| + | A program for registration of supporting vouchers, either without integration to other subsystems och with assignations to other ledgers. |

||

| + | |||

| + | =Enter vouchers= |

||

| + | ==General== |

||

| + | Vouchers are registered in Accounting | Vouchers. The standard series has the prefix BO, but more voucher series can be registered in Accounting | Backoffice | Base registers, The General ledger tab. The series code must contain two characters and start with a B. |

||

| + | ==Enter voucher without assignment to another subsystem == |

||

| + | * Select series and press NEW |

||

| + | * Write heading |

||

| + | * Enter accounting date, the Today button gives today’s date. |

||

| + | * Enter thereafter account and debit/credit |

||

| + | {{ExpandImage|BOK-VER-EN-Bild1.png}} |

||

| − | Ett program för registrering av bokföringsordrar och andra verifikationer, med eller utan koppling till andra delsystem |

||

| − | |||

| − | |||

| − | |||

| − | == Registrering av verifikation utan integration till annat delsystem == |

||

| − | |||

| − | Verifikationer registreras i {{pth|Ekonomi|Verifikationer}}. Standardserien har prefixet BO, men fler verifikationsserier kan läggas upp i {{pth|System|Basregister/Bok/Verifikationsserier}}. Gemensamt för alla är att de ska bestå av två tecken, varav den första är B. |

||

| − | |||

| − | Välj serie och tryck på Ny. Registreringen börjas alltid med att ett bokföringsdatum anges. |

||

| − | |||

| − | {{ExpandImage|BOK-VER-SV-grafik1.png}} |

||

| − | |||

| − | |||

| − | En enkel verifikation registreras med två eller flera konton, samt belopp i debet och kredit. Andra funktioner är: |

||

| − | {| |

+ | {|class=mandeflist |

| + | !Fetch from |

||

| − | !Hämta från |

||

| + | |Function for copying previous voucher |

||

| − | |Funktion för att kopiera tidigare verifikation. Verifikationen väljs från en lista. |

||

|- |

|- |

||

| + | !Import template |

||

| − | !Hämta mall |

||

| + | |A voucher template can be registered in Accounting | Backoffice | Base register, under the General ledger tab. See the description under Create Voucher template. |

||

| − | |En verifikationsmall kan skapas i System/Basregister/Bok/Verifikationsmallar. Se beskrivning under Skapa verifikationsmall. |

||

|- |

|- |

||

| + | !Import (SIE 4) |

||

| − | !Importera |

||

| + | |Import of Sie 4- file to Swedish tax agency. |

||

| − | |Importerar sie-filer. |

||

|- |

|- |

||

| + | !Import |

||

| − | !Vändning i annan period |

||

| + | |Import from e.g. Excel |

||

| − | |Skapar en vänd verifikation med ett annat bokföringsdatum. |

||

|- |

|- |

||

| + | !Reversing in another period |

||

| − | !Bokföringsdatum + Idag |

||

| + | |Creates a reversed voucher with a different posting date |

||

| − | |Fältet Bokföringsdatum måste alltid fyllas i innan resterande uppgifter kan registreras. Klicka på Idag för att ange dagens datum, övriga datum fylls i manuellt. Det angivna datumet kommer som förslag i nästa verifikation. |

||

|- |

|- |

||

| + | !Accounting date + Today |

||

| − | !Rubrik |

||

| + | |The Accounting date field must be filled in before the remaining information can be registered. The specified date will be suggested in the next voucher. |

||

| − | |Denna rubrik syns på startsidan till verifikationsregistreringen och är sökbar. |

||

|- |

|- |

||

| + | !Heading |

||

| − | !Verifikationsnummer |

||

| + | |The heading is shown in the voucher list and is searchable |

||

| − | |Verifikationsnummer hämtas automatiskt från Basregister/BOK/Verifikationsserier. |

||

|- |

|- |

||

| + | !Voucher number |

||

| − | !Konto |

||

| + | |The voucher number is automatically fetched from Accounting | Backoffice | Base registers, General ledger tab |

||

| − | |Fyll i konto. |

||

|- |

|- |

||

| + | !Account |

||

| − | !Kostnadsställe/-bärare |

||

| + | |Enter account |

||

| − | |Fyll i kostnadsställe respektive kostnadsbärare om kontot kräver/tillåter detta. |

||

|- |

|- |

||

| + | !Cost centre/-object |

||

| − | !Debet/Kredit |

||

| + | |Enter cost centre and cost object if the account requires/allows that. |

||

| − | |Ange belopp. |

||

|- |

|- |

||

| + | !Debit/Credit |

||

| − | !Dimensioner |

||

| + | |Enter amount |

||

| − | |Om dimensioner används visas de som separata kolumner. Läggs upp i Basregister/Bok/Parametrar i fliken Dimensioner. Manuella dimensioner redigeras i Basregister/Bok/Dimensioner. |

||

|- |

|- |

||

| + | !Dimensions |

||

| − | !Text |

||

| + | |If dimensions are used, they are displayed as separate columns. Dimensions are set up in Accounting | Backoffice | Base registers, General ledger tab. Open the year and go to the Dimensions tab. Manual dimensions are edited in Accounting | Backoffice | Base registers, General ledger tab |

||

| − | |Ange eventuell text (25 tecken). Visas inne i huvudboken och kontospecifikationen. |

||

|- |

|- |

||

| + | !Text |

||

| − | !Summering |

||

| + | |Enter any text with a maximum of 25 characters. Displayed in the Nominal ledger and account specification. |

||

| − | |Längst ned summeras debet- respektive kreditkolumnerna. Det går inte att spara verifikationen om den inte balanserar. |

||

|- |

|- |

||

| + | !Subtotal |

||

| − | !Skapa momskontering |

||

| + | |The debit and credit columns are totalled at the bottom. The voucher cannot be saved if it does not balance. |

||

| − | |Om Marathons ingående momshantering används kan en automatisk kontering av moms skapas med hjälp av knappen Skapa momskontering. Avgörs av momsklasserna i Basregister/Bok/Momsklasser. Systemet beräknar den ingående momsen efter hur mycket som är uppmärkt med de olika momsklasserna och hämtar momskontot från momsklassen. |

||

|- |

|- |

||

| + | !Create VAT posting |

||

| − | !Fyll ut |

||

| + | |If Marathon's input VAT handling is used, automatic VAT posting can be created using the Input tax button, and the calculation of amounts is retrieved from the settings in the VAT classes. |

||

| − | |Fyller automatiskt i resterande belopp för att verifikationen ska balansera, förutsatt att ett konto har angivits. |

||

|- |

|- |

||

| + | !Fill |

||

| − | !Rest |

||

| + | |Automatically fills in the remaining amount to balance the voucher, provided that an account has been specified. |

||

| − | |Visar hur stort belopp som finns kvar att balansera. |

||

| + | |- |

||

| + | !Rem. |

||

| + | |Shows remaining amount to balance. |

||

|} |

|} |

||

| + | == Voucher template or automatic posting == |

||

| + | Voucher templates are created in Accounting | Backoffice | Base registers, General ledger tab. |

||

| + | * Press New and give the template a name. |

||

| + | * Enter account and possible cost centre and cost object if the account requires/allows that. |

||

| + | * Enter either a percentage of an amount or an amount. If a percentage is entered, the system will ask for the total amount when the template is used and calculate the share using the percentage. |

||

| + | * Press Import template button to import the template into a voucher. |

||

| + | * An automatic posting, without clicking the Import template button in a voucher, is performed when the Base account, Base cost centre and Base cost object fields in Automatic posting at the bottom of the voucher template are filled in. See image below. Automatic posting is triggered when the base account is specified in a voucher and is displayed in the registration screen. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild2.png}} |

||

| − | == Skapa verifikationsmall eller automatkontering == |

||

| + | |||

| + | == Enter voucher with assignment to another subsystem == |

||

| + | Accounts can be set up with assignment to a subsystem. When registering for an account that is integrated with another subsystem, a red tab with the name of the subsystem will appear. Information belonging to the subsystem is registered in this tab. The most common assignments are described below. |

||

| + | === Client payments === |

||

| + | The trade debtors’ account is assigned to the sales ledger. |

||

| + | * Fill in trade debtors’ account. A new tab opens, S/L. |

||

| + | * In the S/L tab, enter the invoice number that has been paid or search invoices with the Import invoices button. A payment file can be imported (requires settings). |

||

| + | * The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency). |

||

| + | {{ExpandImage|BOK-VER-EN-Bild3.png}} |

||

| − | Verifikationsmallar skapas i Basregister/Bok/Verifikationsmallar. Tryck på Ny, och namnge mallen. Fyll i konto och eventuellt kostnadsbärare och/eller kostnadsställe om kontot tillåter det. Ange antingen en procentuell del av ett belopp, eller ett belopp i SEK. Om en procentuell del anges frågar systemet efter totalbeloppet när mallen används, och räknar ut andelen med hjälp av procentsatsen. |

||

| + | |||

| + | ''Foreign currency'' |

||

| + | '''Automatic posting of spreads''' If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Sales ledger tab, exchange rate differences are posted automatically. |

||

| + | For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount paid into the bank must be entered. |

||

| − | Klicka på knappen Hämta mall för att hämta in mallen i en verifikation. |

||

| − | En automatkontering, utan att klicka på knappen Hämta mall i en verifikation, görs när Baskonto, Baskostnadsställe och Baskostnadsbärare vid Automatkontering nederst i verifikationsmallen är ifyllda. Automatkonteringen triggas när man anger baskontot i en verifikation och visas i registreringsbilden. |

||

| + | If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference. |

||

| − | {{ExpandImage|Registrering-verifikationer-sv-grafik14.png}} |

||

| + | '''Manual posting of spreads''' If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually. |

||

| − | == Registrering av verifikation med integration till annat delsystem == |

||

| + | Contrary posting is made in the G/L tab. Here you can use the Fill button, for posting the rest on the account. |

||

| − | Om kontot som anges är integrerat till ett annat delsystem, kommer en rödmarkerad flik med namnet på delsystemet att visa sig. I fliken registreras uppgifter som tillhör delsystemet. Nedan beskrivs de vanligaste integrationerna. |

||

| + | ===Suppliers’ payments=== |

||

| − | === Kundinbetalningar === |

||

| + | The trade creditors’ account is assigned to the Purchase ledger. |

||

| − | |||

| + | * Enter trade creditors’ account. A new tab appears, P/L. |

||

| − | Kontot för kundfordringar är integrerat till kundreskontran, vilket innebär att kontering på detta konto skapar en flik som heter Kun X, där X står för fliknumret. I fliken registreras kundinbetalningarna. Ange fakturanummer för den faktura som betalats, eller sök upp fakturor genom att klicka på Hämta fakturor. Här kan kund, datum, fakturanummer m.m. |

||

| + | * Write invoice number in the P/L tab or search invoice with the Import invoices function. A payment file can be imported (requires settings). |

||

| − | anges. |

||

| + | * The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency). |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-sv-grafik2.png}} |

||

| − | |||

| − | Systemet hämtar det totala fakturabeloppet. Vid delbetalning av faktura ska beloppet i fältet Erh. bel SEK skrivas över med det betalda beloppet. |

||

| − | |||

| − | === Utländsk valuta=== |

||

| − | '''Automatisk kontering av valutakursdifferens''' |

||

| − | Om Konto för valutakursvinst och Konto för valutakursförlust är ifyllt i Basregister/Kun/Parametrar fliken Betalningar så bokförs kursdifferensen automatiskt. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild4.png}} |

||

| + | ''Foreign currency'' |

||

| − | Vid utländsk valuta hämtas då inget belopp till fältet Erh. bel SEK, utan det ska alltid fyllas i med det belopp som betalats in på banken. |

||

| + | '''Automatic posting of spreads''' If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Purchase ledger tab, exchange rate differences are posted automatically. |

||

| + | For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount withdrawn from the bank must be entered. |

||

| − | Har en utländsk faktura delbetalats ska både fältet Erh. bel SEK och Erh. bel fakturavaluta fyllas i, och differensen blir då en restpost samt eventuellt en kursdifferens (om Erh. bel SEK delat med valutakursen inte är samma som beloppet i Erh. bel fakturavaluta blir mellanskillnaden en kursdifferens). |

||

| + | If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference. |

||

| − | '''Manuell kontering av valutakursdifferens''' |

||

| + | '''Manual posting of spreads''' If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually. |

||

| − | Om inget konto för valutakursvinst och Konto för valutakursförlust är ifyllt så hämtas belopp till fälten Erh. bel SEK och Erh. bel fakturavaluta. Beloppen kan ändras vid delbetalning och eventuell valutakursdifferens bokförs manuellt. |

||

| + | After registration, enter an account in the G/L tab. Here you can use the Fill button, for posting the rest on the account. |

||

| − | Efter att fakturorna registreras anges ett konto för betalningen i fliken Bok (exempelvis bankkontot). Här kan med fördel knappen Fyll ut användas, för att kontera resten på kontot. |

||

| + | ====Create excess invoice==== |

||

| − | === Leverantörsbetalningar === |

||

| + | By using the Create excess invoice function, an excess payment can be placed directly in the purchase ledger for a supplier whose invoice has not yet arrived. This payment is assigned an LA number. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild5.png}} |

||

| − | Kontot för leverantörsskulder är integrerat till leverantörsreskontran, vilket innebär att kontering på detta konto skapar en flik som heter Lev X, där X står för fliknumret. I fliken registreras leverantörsbetalningarna. Ange fakturanummer för den faktura som betalats, eller sök upp en skapad betalning med knappen Hämta betalningar. Här kan betalningsnummer, datum eller leverantör anges. Fakturor med ett restbelopp kan också hämtas. Med knappen Hämta betalningsfil kan en fil innehållande betalningar hämtas. |

||

| + | |||

| + | * Select supplier and enter amount when registering. |

||

| + | === Project purchases === |

||

| + | The account for project purchases is assigned to the project accounting. |

||

| + | * Fill in the project purchase account for purchases to be charged to the project, and a new tab called PRO will appear. |

||

| + | * Fill in project, purchase code and a purchase price. The sales price is automatically calculated according to the mark-up that has been registered on the purchase code. |

||

| + | * Write optional purchase text. |

||

| + | * If you use purchase orders, enter PO number when registering project purchases. All information will then be fetched from it. |

||

| − | {{ExpandImage| |

+ | {{ExpandImage|BOK-VER-EN-Bild6.png}} |

| + | |||

| + | ===Periodical allocations=== |

||

| + | The account for automatic accruals is assigned to Periodical allocations. |

||

| + | * Fill in account for periodical allocations for costs that shall be accrued over a period. A new tab appears, Allocation. |

||

| + | * Enter the cost account and amount, as well as the period over which the amount is to be distributed. There are two ways to enter the period: YYYYMM – YYYYMM or YYYYMMDD – YYYYMMDD. In the first case, the amount is distributed evenly over the months; in the second case, the amounts are distributed differently depending on how many days there are in the month. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild7.png}} |

||

| − | === Utländsk valuta=== |

||

| + | |||

| − | '''Automatisk kontering av valutakursdifferens''' |

||

| + | ===Assets/Inventory=== |

||

| − | Om Konto för valutakursvinst och Konto för valutakursförlust är ifyllt i Basregister/LEV/Parametrar fliken Bokföring så bokförs kursdifferensen automatiskt. |

||

| + | The account for the acquisition of assets is assigned to the Inventory ledger. |

||

| + | * Fill in acquisition account for the asset. A new tab appears, INV. |

||

| + | * If the acquisition account is only linked to one type of asset, the asset type will be filled in automatically. Otherwise, the asset type must be filled in. |

||

| + | * Enter amount and optional description. |

||

| − | Vid utländsk valuta hämtas då inget belopp till fältet Erh. bel SEK, utan det ska alltid fyllas i med det belopp som dragits från bankkontot. |

||

| + | == Correct a voucher== |

||

| − | Har en utländsk faktura delbetalats ska både fältet Bet. bel SEK och Bet. bel fakturavaluta fyllas i, och differensen blir då en restpost samt eventuellt en kursdifferens (om Bet. bel SEK delat med valutakursen inte är samma som beloppet i Bet. bel fakturavaluta blir mellanskillnaden en kursdifferens). |

||

| + | It is parameter-controlled to be able to click the Correct button on an AT, ER or LF voucher, as the original voucher and not the correction is reversed if the invoice is reversed after a manual correction has been made. |

||

| + | * Select the voucher you wish to correct, press Open. |

||

| + | * Press Correct. |

||

| + | * Answer the question about reversing the voucher. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild8.png}} |

||

| − | '''Manuell kontering av valutakursdifferens''' |

||

| + | |||

| + | * If the correction is to be saved with its own voucher number, tick the box ‘Save with new voucher number’ and enter the accounting date. The accounting date does not need to be in the same period as the original voucher. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild9.png}} |

||

| − | Om inget konto för valutakursvinst och Konto för valutakursförlust är ifyllt så hämtas belopp till fälten Bet. bel SEK och Bet. bel fakturavaluta. Beloppen kan ändras vid delbetalning och eventuell valutakursdifferens bokförs manuellt. |

||

| + | |||

| + | * If the correction is to be reversed in another period, select ‘Reverse correction in another period’ and an accounting date at the top. Both the correction and the reversal of the correction will be posted on this date and receive a number from the voucher series in this period. In total, two new vouchers are created – the correction and the reversal of the correction. |

||

| + | == Paste data into a voucher== |

||

| − | Efter att fakturorna registreras anges ett konto för betalningen i fliken Bok (exempelvis bankkontot). Här kan med fördel knappen Fyll ut användas, för att kontera resten på kontot. |

||

| + | * Start by right-clicking on the accounting table without selecting anything and choose Copy. Then paste into Excel. This is exactly how Excel should be structured in order to be copied into a voucher. |

||

| + | * To paste into the voucher, select the cells including headings and all columns. |

||

| + | * Right-click in the account table and select Paste. |

||

| + | |||

| − | |||

| + | [[Category:BOK-VER-EN]] [[Category:Manuals]] [[Category:Accounting]] |

||

| − | === Skapa förskottsfaktura === |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-sv-grafik10.png}} |

||

| − | |||

| − | |||

| − | Genom att använda funktionen Skapa förskottsfaktura kan ett förskottsbelopp placeras direkt i leverantörsreskontran på en leverantör vars faktura inte kommit än. Denna betalning får ett LA-nummer. |

||

| − | |||

| − | Ange leverantör och sedan ett belopp vid registreringen. |

||

| − | |||

| − | === Registrering av projektinköp === |

||

| − | |||

| − | Kontot för projektinköp är integrerat till projektredovisningen, vilket innebär att kontering på detta konto skapar en flik som heter Pro X, där X står för fliknumret. I fliken registreras inköp som ska belasta ett projekt. Fyll i projekt, inköpskod och ett inpris. Utpriset räknas ut automatiskt utefter det påslag som registrerats på inköpskoden. Detta är dock oftast ändringsbart (parameterstyrt) och kan skrivas över om så behövs. |

||

| − | Ange evetuellt en inköpstext. Om rekvisitioner används kan det anges vid registrering av projektinköp, och alla uppgifter hämtas då från rekvisitionen. Motkonteringen görs sedan i fliken Bok. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-sv-grafik4.png}} |

||

| − | |||

| − | === Registrering av periodiseringar === |

||

| − | |||

| − | Kontot för automatiska interimsfordringar är integrerat till periodiseringar, vilket innebär att kontering på detta konto skapar en flik som heter Periodisering X, där X står för fliknumret. I fliken registreras kostnader som ska periodiseras över en viss period. Ange kostnadsskonto och belopp, samt perioden som beloppet ska fördelas på. Det finns två sätt att ange perioden, ÅÅMM – ÅÅMM eller ÅÅMMDD – ÅÅMMDD. |

||

| − | I det första fallet periodiseras beloppet jämnt över alla månader, i andra fallet periodiseras beloppen olika beroende på hur många dagar månaden har. |

||

| − | Motkonteringen görs sedan i fliken Bok. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-sv-grafik3.png}} |

||

| − | |||

| − | === Registrering av inventarier === |

||

| − | |||

| − | Kontot för anskaffning av inventarier är integrerat till inventariereskontran, vilket innebär att kontering på detta konto skapar en flik som heter Inv X, där X står för fliknumret. Om kontot för anskaffning endast är kopplat till en inventarietyp kommer inventarietypen att fyllas i automatiskt. I annat fall ska inventarietyp fyllas i. Ange sedan belopp, och eventuellt en beskrivning. Motkonteringen görs sedan i fliken Bok. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-sv-grafik5.png}} |

||

| − | |||

| − | == Korrigering av verifikation == |

||

| − | |||

| − | Markera den verifikation som ska korrigeras, och tryck på Öppna. |

||

| − | Tryck sedan på Korrigera. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-sv-grafik7.png}} |

||

| − | |||

| − | Systemet frågar om du vill vända verifikationen. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-sv-grafik9.png}} |

||

| − | |||

| − | Svara {{btn|Ja}} om verifikationen ska vändas helt, i annat fall svarar du {{btn|Nej}} och konterar själv upp korrigeringen i konteringstabellen längst ned i rutan. Vill du spara korrigeringen med ett eget verifikationsnummer kryssar du för rutan {{kryss|Spara med nytt verifikationsnummer}} och fyller i ett bokföringsdatum. Bokföringsdatumet behöver inte vara i samma period som ursprungsverifikationen. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-sv-grafik11.png}} |

||

| − | |||

| − | Vill du vända korrigeringen i en annan period kryssar du för {{kryss|Vänd korr i annan period}} och fyller i ett bokföringsdatum längst upp. |

||

| − | |||

| − | Både korrigeringen och vändningen av korrigeringen kommer att bokföras på detta datum och få ett nummer från verifikationsserien i denna period. Totalt skapas alltså två nya verifikationer – korrigeringen och vändningen av korrigeringen. |

||

| − | |||

| − | == Klistra in data i verifikation == |

||

| − | |||

| − | För att veta hur Excel ska se ut, börjar du med att klicka med höger musknapp över konteringstabellen (utan att markera något) och välja Kopiera. Klistra sedan in i Excel. |

||

| − | Exakt så ska din Excel vara uppbyggd för att kunna kopieras in i en verifikation. |

||

| − | För att klistra in i verifikationen markeras cellerna inklusive rubriker och med alla kolumner. Ställ dig sedan över konteringstabellen och högerklicka och välj Klistra in. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-sv-grafik12.png}} |

||

| − | |||

| − | [[Category:BOK-VER-SV]] [[Category:Manuals]] [[Category:Accounting]] |

||

Revision as of 09:47, 27 January 2026

A program for registration of supporting vouchers, either without integration to other subsystems och with assignations to other ledgers.

Contents

Enter vouchers

General

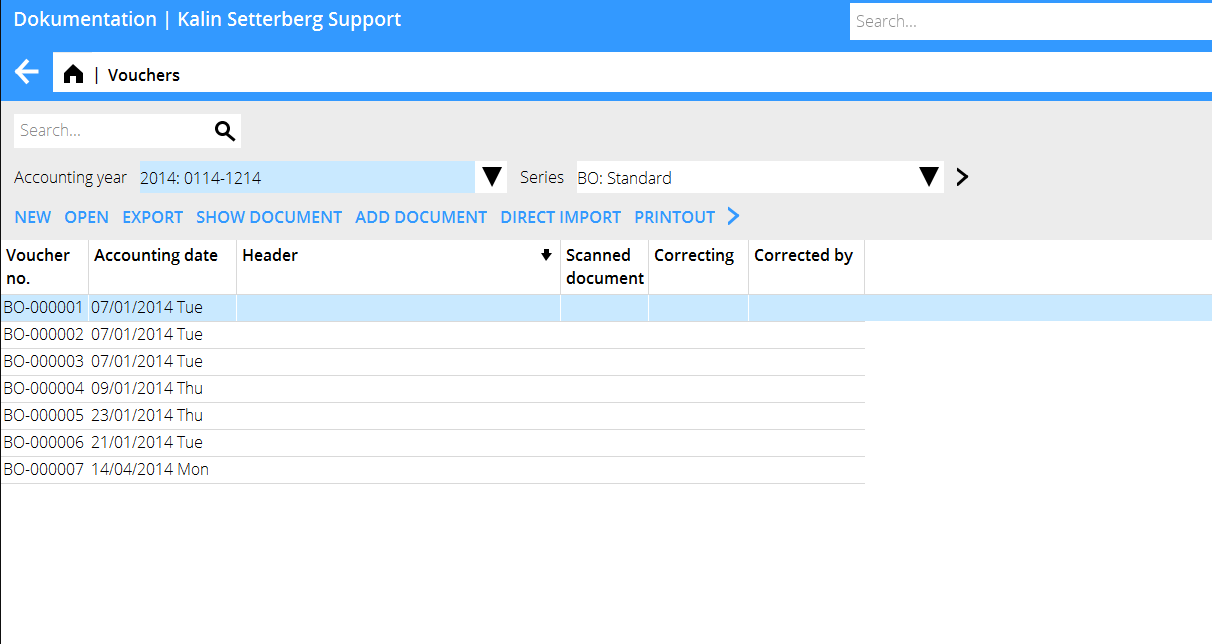

Vouchers are registered in Accounting | Vouchers. The standard series has the prefix BO, but more voucher series can be registered in Accounting | Backoffice | Base registers, The General ledger tab. The series code must contain two characters and start with a B.

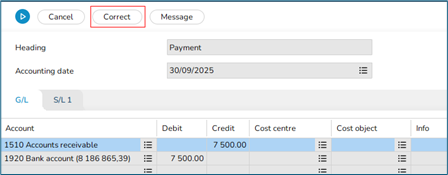

Enter voucher without assignment to another subsystem

- Select series and press NEW

- Write heading

- Enter accounting date, the Today button gives today’s date.

- Enter thereafter account and debit/credit

| Fetch from | Function for copying previous voucher |

|---|---|

| Import template | Backoffice | Base register, under the General ledger tab. See the description under Create Voucher template. |

| Import (SIE 4) | Import of Sie 4- file to Swedish tax agency. |

| Import | Import from e.g. Excel |

| Reversing in another period | Creates a reversed voucher with a different posting date |

| Accounting date + Today | The Accounting date field must be filled in before the remaining information can be registered. The specified date will be suggested in the next voucher. |

| Heading | The heading is shown in the voucher list and is searchable |

| Voucher number | Backoffice | Base registers, General ledger tab |

| Account | Enter account |

| Cost centre/-object | Enter cost centre and cost object if the account requires/allows that. |

| Debit/Credit | Enter amount |

| Dimensions | Backoffice | Base registers, General ledger tab. Open the year and go to the Dimensions tab. Manual dimensions are edited in Accounting | Backoffice | Base registers, General ledger tab |

| Text | Enter any text with a maximum of 25 characters. Displayed in the Nominal ledger and account specification. |

| Subtotal | The debit and credit columns are totalled at the bottom. The voucher cannot be saved if it does not balance. |

| Create VAT posting | If Marathon's input VAT handling is used, automatic VAT posting can be created using the Input tax button, and the calculation of amounts is retrieved from the settings in the VAT classes. |

| Fill | Automatically fills in the remaining amount to balance the voucher, provided that an account has been specified. |

| Rem. | Shows remaining amount to balance. |

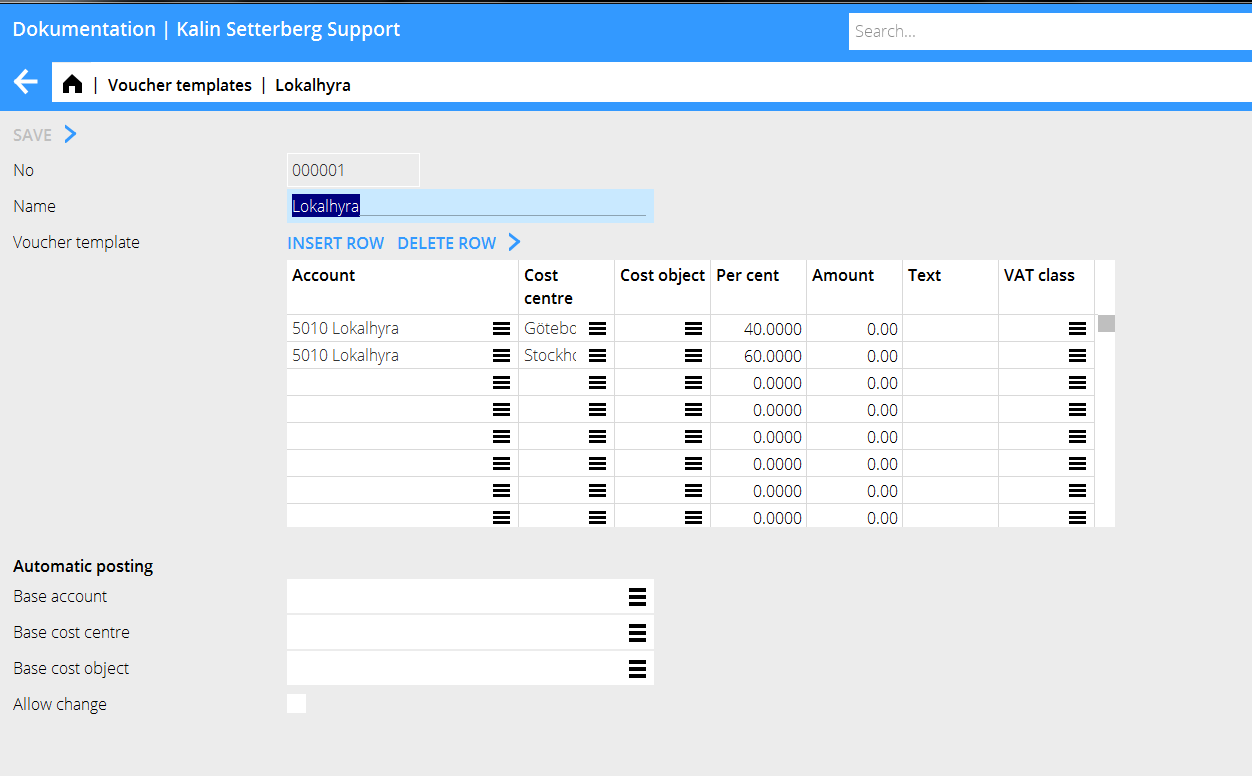

Voucher template or automatic posting

Voucher templates are created in Accounting | Backoffice | Base registers, General ledger tab.

- Press New and give the template a name.

- Enter account and possible cost centre and cost object if the account requires/allows that.

- Enter either a percentage of an amount or an amount. If a percentage is entered, the system will ask for the total amount when the template is used and calculate the share using the percentage.

- Press Import template button to import the template into a voucher.

- An automatic posting, without clicking the Import template button in a voucher, is performed when the Base account, Base cost centre and Base cost object fields in Automatic posting at the bottom of the voucher template are filled in. See image below. Automatic posting is triggered when the base account is specified in a voucher and is displayed in the registration screen.

Enter voucher with assignment to another subsystem

Accounts can be set up with assignment to a subsystem. When registering for an account that is integrated with another subsystem, a red tab with the name of the subsystem will appear. Information belonging to the subsystem is registered in this tab. The most common assignments are described below.

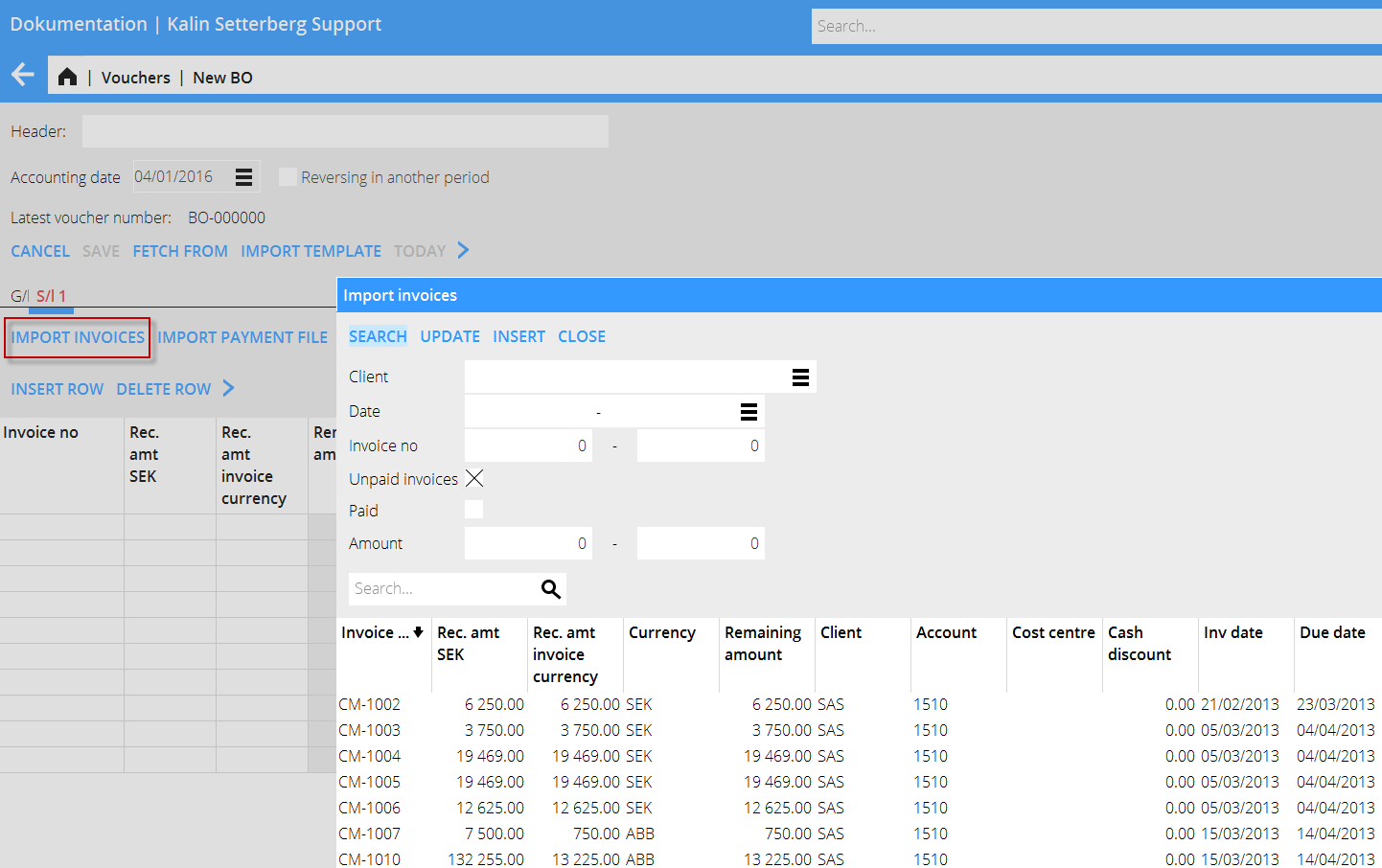

Client payments

The trade debtors’ account is assigned to the sales ledger.

- Fill in trade debtors’ account. A new tab opens, S/L.

- In the S/L tab, enter the invoice number that has been paid or search invoices with the Import invoices button. A payment file can be imported (requires settings).

- The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency).

Foreign currency Automatic posting of spreads If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Sales ledger tab, exchange rate differences are posted automatically.

For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount paid into the bank must be entered.

If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference.

Manual posting of spreads If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually.

Contrary posting is made in the G/L tab. Here you can use the Fill button, for posting the rest on the account.

Suppliers’ payments

The trade creditors’ account is assigned to the Purchase ledger.

- Enter trade creditors’ account. A new tab appears, P/L.

- Write invoice number in the P/L tab or search invoice with the Import invoices function. A payment file can be imported (requires settings).

- The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency).

Foreign currency Automatic posting of spreads If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Purchase ledger tab, exchange rate differences are posted automatically.

For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount withdrawn from the bank must be entered.

If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference.

Manual posting of spreads If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually.

After registration, enter an account in the G/L tab. Here you can use the Fill button, for posting the rest on the account.

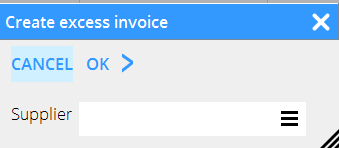

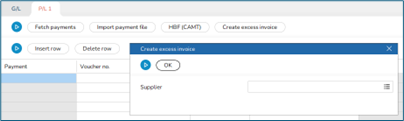

Create excess invoice

By using the Create excess invoice function, an excess payment can be placed directly in the purchase ledger for a supplier whose invoice has not yet arrived. This payment is assigned an LA number.

- Select supplier and enter amount when registering.

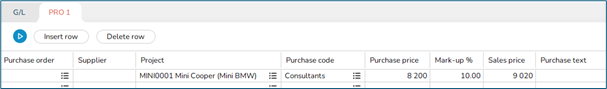

Project purchases

The account for project purchases is assigned to the project accounting.

- Fill in the project purchase account for purchases to be charged to the project, and a new tab called PRO will appear.

- Fill in project, purchase code and a purchase price. The sales price is automatically calculated according to the mark-up that has been registered on the purchase code.

- Write optional purchase text.

- If you use purchase orders, enter PO number when registering project purchases. All information will then be fetched from it.

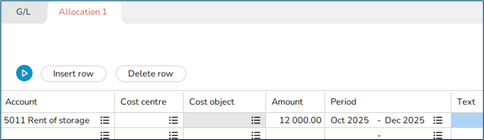

Periodical allocations

The account for automatic accruals is assigned to Periodical allocations.

- Fill in account for periodical allocations for costs that shall be accrued over a period. A new tab appears, Allocation.

- Enter the cost account and amount, as well as the period over which the amount is to be distributed. There are two ways to enter the period: YYYYMM – YYYYMM or YYYYMMDD – YYYYMMDD. In the first case, the amount is distributed evenly over the months; in the second case, the amounts are distributed differently depending on how many days there are in the month.

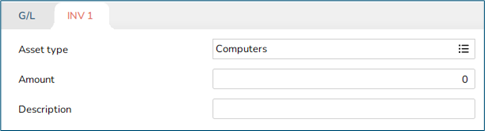

Assets/Inventory

The account for the acquisition of assets is assigned to the Inventory ledger.

- Fill in acquisition account for the asset. A new tab appears, INV.

- If the acquisition account is only linked to one type of asset, the asset type will be filled in automatically. Otherwise, the asset type must be filled in.

- Enter amount and optional description.

Correct a voucher

It is parameter-controlled to be able to click the Correct button on an AT, ER or LF voucher, as the original voucher and not the correction is reversed if the invoice is reversed after a manual correction has been made.

- Select the voucher you wish to correct, press Open.

- Press Correct.

- Answer the question about reversing the voucher.

- If the correction is to be saved with its own voucher number, tick the box ‘Save with new voucher number’ and enter the accounting date. The accounting date does not need to be in the same period as the original voucher.

- If the correction is to be reversed in another period, select ‘Reverse correction in another period’ and an accounting date at the top. Both the correction and the reversal of the correction will be posted on this date and receive a number from the voucher series in this period. In total, two new vouchers are created – the correction and the reversal of the correction.

Paste data into a voucher

- Start by right-clicking on the accounting table without selecting anything and choose Copy. Then paste into Excel. This is exactly how Excel should be structured in order to be copied into a voucher.

- To paste into the voucher, select the cells including headings and all columns.

- Right-click in the account table and select Paste.