Difference between revisions of "Enter vouchers/fi"

(Created page with "{{ExpandImage|Registrering-verifikationer-fi-grafik9.png}}") |

(Updating to match new version of source page) |

||

| (51 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| + | <htmltag tagname="style">p a.image{border:1px rgb(0,0,0) solid;box-sizing:content-box;}</htmltag> |

||

| − | __FORCETOC__ |

||

| + | A program for registration of supporting vouchers, either without integration to other subsystems och with assignations to other ledgers. |

||

| + | |||

| + | =Enter vouchers= |

||

| + | ==General== |

||

| + | Vouchers are registered in Accounting | Vouchers. The standard series has the prefix BO, but more voucher series can be registered in Accounting | Backoffice | Base registers, The General ledger tab. The series code must contain two characters and start with a B. |

||

| + | ==Enter voucher without assignment to another subsystem == |

||

| + | * Select series and press NEW |

||

| + | * Write heading |

||

| + | * Enter accounting date, the Today button gives today’s date. |

||

| + | * Enter thereafter account and debit/credit |

||

| + | {{ExpandImage|BOK-VER-EN-Bild1.png}} |

||

| − | == Rekisteröi tositteita ilman integraatiota muihin osajärjestelmiin == |

||

| + | {|class=mandeflist |

||

| − | Tositteet rekisteröidään ohjelmassa Taloushallinto: Tositteet. Standarditositesarjalla on alkutunnus BO, mutta jos tarvitset useita tositesarjoja, niitä voi luoda ohjelmassa Järjestelmä: Perusrekisterit/KP/Tositesarjat. Yhteistä kaikille on, että ne koostuvat kahdesta merkistä, joista ensimmäinen on B. |

||

| + | !Fetch from |

||

| − | |||

| + | |Function for copying previous voucher |

||

| − | Valitse sarja ja valitse toiminta Uusi. Aloita aina rekisteröinti ilmoittamalla kirjauspäivämäärä. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-fi-grafik1.png}} |

||

| − | |||

| − | Yksinkertaisessa tositerekisteröinnissä on kaksi tai enemmän tiliä, sekä määrät debetissä ja kreditissä. |

||

| − | Muut valinnat ovat: |

||

| − | |||

| − | {| class=mandeflist |

||

| − | !Hae |

||

| − | |Voit hakea listan aikaisemmista tositteista ja kopioida siitä. |

||

|- |

|- |

||

| + | !Import template |

||

| − | !Hae malli |

||

| + | |A voucher template can be registered in Accounting | Backoffice | Base register, under the General ledger tab. See the description under Create Voucher template. |

||

| − | |Voit luoda tositemallin usein toistuville tositteille ohjelmassa Perusrekisterit/KP/Tositemallit. Lue lisää täältä: Luo tositemalli. |

||

|- |

|- |

||

| + | !Import (SIE 4) |

||

| − | !Tuo |

||

| + | |Import of Sie 4- file to Swedish tax agency. |

||

| − | |Hakee sie-tiedostoja (Ruotsissa käytettäviä veroviraston tietoja) |

||

|- |

|- |

||

| + | !Import |

||

| − | !Hyvitä toisessa kaudessa |

||

| + | |Import from e.g. Excel |

||

| − | |Hyvittää tositteen toisella kirjauspäivällä. |

||

|- |

|- |

||

| + | !Reversing in another period |

||

| − | !Kirjauspäivä + Tänään |

||

| + | |Creates a reversed voucher with a different posting date |

||

| − | |Kirjauspäiväkenttä on aina oltava täytettynä ennen kuin muita tietoja voi alkaa syöttää. Valitse Tänään, jos haluat käyttää päivän päiväystä. Ilmoittamaasi päivää ehdotetaan myös seuraavassa tositteessa. |

||

|- |

|- |

||

| + | !Accounting date + Today |

||

| − | !Otsikko |

||

| + | |The Accounting date field must be filled in before the remaining information can be registered. The specified date will be suggested in the next voucher. |

||

| − | |Otsikko näkyy tositerekisteröinnin alkusivulla. Voit hakea tositteita otsikon avulla hakuruudusta |

||

|- |

|- |

||

| + | !Heading |

||

| − | !Tositenumero |

||

| + | |The heading is shown in the voucher list and is searchable |

||

| − | |Tositenumero haetaan automaattisesti ohjelmasta Perusrekisterit/KP/Tositesarjat |

||

|- |

|- |

||

| + | !Voucher number |

||

| − | !Tili |

||

| + | |The voucher number is automatically fetched from Accounting | Backoffice | Base registers, General ledger tab |

||

| − | |Ilmoita tili. |

||

|- |

|- |

||

| + | !Account |

||

| − | !Kust.paikka/tulosyksikkö |

||

| + | |Enter account |

||

| − | |Ilmoitetaan, mikäli tili hyväksyy tai vaatii tiedot. |

||

|- |

|- |

||

| + | !Cost centre/-object |

||

| − | !Debet/Kredit |

||

| + | |Enter cost centre and cost object if the account requires/allows that. |

||

| − | |Ilmoita määrät |

||

|- |

|- |

||

| + | !Debit/Credit |

||

| − | !Dimensiot |

||

| + | |Enter amount |

||

| − | |Mikäli käytätte kirjanpidossa dimensioita, ne näkyvät erillisinä sarakkeina. Dimensiot määritellään Perusrekistereissä/KP/Parametri, välilehdellä Dimensiot. Manuaalisesti luotuja dimensioita voi muokata ohjelmassa Perusrekisterit/KP/Dimensiot. |

||

|- |

|- |

||

| + | !Dimensions |

||

| − | !Teksti |

||

| + | |If dimensions are used, they are displayed as separate columns. Dimensions are set up in Accounting | Backoffice | Base registers, General ledger tab. Open the year and go to the Dimensions tab. Manual dimensions are edited in Accounting | Backoffice | Base registers, General ledger tab |

||

| − | |Kenttä valinnaiselle tekstille (25 merkkiä). Teksti näkyy pääkirjassa ja tilin erittelyssä. |

||

|- |

|- |

||

| + | !Text |

||

| − | !Summa |

||

| + | |Enter any text with a maximum of 25 characters. Displayed in the Nominal ledger and account specification. |

||

| − | |Taulukon alaosassa debet- ja kreditsarakkeet summataan. Tositteen on täsmättävä, jotta sen voisi tallentaa. |

||

|- |

|- |

||

| + | !Subtotal |

||

| − | !Luo Alvin tiliöinti |

||

| + | |The debit and credit columns are totalled at the bottom. The voucher cannot be saved if it does not balance. |

||

| − | |Mikäli käytössänne on Marathon alv-velkakäsittely, voit tässä luoda alville automaattisen tiliöinnin. Marathon laskee tiliöinnin sen perusteella, mitä eri alv-luokille on ilmoitettu ja hakee myös alv-luokalle ilmoitetun alv-tilin. |

||

|- |

|- |

||

| + | !Create VAT posting |

||

| − | !Täytä |

||

| + | |If Marathon's input VAT handling is used, automatic VAT posting can be created using the Input tax button, and the calculation of amounts is retrieved from the settings in the VAT classes. |

||

| − | |Täyttää puuttuvan määrän tositteen täsmäämiseksi, edellyttäen että tili on ilmoitettu. |

||

|- |

|- |

||

| + | !Fill |

||

| − | !Jäännös |

||

| + | |Automatically fills in the remaining amount to balance the voucher, provided that an account has been specified. |

||

| − | |Näyttää määrän, joka on vielä jäljellä ennen kuin tositteen voi tallentaa. |

||

| + | |- |

||

| + | !Rem. |

||

| + | |Shows remaining amount to balance. |

||

|} |

|} |

||

| + | == Voucher template or automatic posting == |

||

| + | Voucher templates are created in Accounting | Backoffice | Base registers, General ledger tab. |

||

| + | * Press New and give the template a name. |

||

| + | * Enter account and possible cost centre and cost object if the account requires/allows that. |

||

| + | * Enter either a percentage of an amount or an amount. If a percentage is entered, the system will ask for the total amount when the template is used and calculate the share using the percentage. |

||

| + | * Press Import template button to import the template into a voucher. |

||

| + | * An automatic posting, without clicking the Import template button in a voucher, is performed when the Base account, Base cost centre and Base cost object fields in Automatic posting at the bottom of the voucher template are filled in. See image below. Automatic posting is triggered when the base account is specified in a voucher and is displayed in the registration screen. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild2.png}} |

||

| − | == Luo tositemalli == |

||

| + | |||

| − | |||

| + | == Enter voucher with assignment to another subsystem == |

||

| − | Tositemallit luodaan Perusrekistereissä/KP/Tositemallit. Valitse Uusi ja anna mallille nimi. Ilmoita tili ja mahdollinen kustannuspaikka/tulosyksikkö, mikäli tili sallii sen. |

||

| + | Accounts can be set up with assignment to a subsystem. When registering for an account that is integrated with another subsystem, a red tab with the name of the subsystem will appear. Information belonging to the subsystem is registered in this tab. The most common assignments are described below. |

||

| − | Ilmoita joko prosenttiosa määrästä tai määrä perusvaluutassa. Jos käytät prosenttiosaa, ohjelma kysyy mallia käyttäessä kokonaissummaa, jonka avulla se laskee prosenttiosan määrästä. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-fi-grafik14.png}} |

||

| − | |||

| − | == Rekisteröi tosite, joka on integroitu toiseen osajärjestelmään == |

||

| − | |||

| − | Jos ilmoittamasi tili on integroitu toiseen osajärjestelmään, kuvaan ilmestyy toinen välilehti, joka on keltainen ja jossa on ko. |

||

| − | osajärjestelmän nimi. |

||

| − | Siihen rekisteröidään ne tiedot, jotka liittyvät osajärjestelmään. |

||

| − | Tähän manualiin olemme |

||

| − | ottaneet mukaan tavallisimmat osajärjestelmäintegraatiot. |

||

| − | |||

| − | === Asiakasmaksut === |

||

| − | |||

| − | Myyntisaamistili on integroitu myyntireskontraan. Kun siis kirjaat tälle tilille, ohjelma luo uuden välilehden, jossa lukee MR X (X= välilehden numero). Asiakkaiden maksut rekisteröidään tälle välilehdelle. Ilmoita maksetun laskun laskunumero tai hae laskuja toiminnalla Hae laskuja. Voit käyttää asiakasta, päivämääriä, laskunumeroa, ym. |

||

| − | hakukriteerinä. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-fi-grafik2.png}} |

||

| − | |||

| − | Marathon hakee laskun kokonaismäärän. Jos laskusta on maksettu vain osa, kirjoita saatu summa kenttään Vast ot. Mrä (oma valuutta) siinä olevan summan yli. Jos laskun määrä on ulkomaan valuutassa, tähän kenttään ei tule mitään automaattisesti, vaan siihen on aina ilmoitettava määrä, joka pankkitilille on tullut. Valuuttakurssin ero tiliöityy automaattisesti tilille, joka parametreissa on ilmoitettu (Perusrekisterit/MR/Parametrit, välilehti Maksut: Tili valuuttakurssitappioille ja Tili valuuttakurssivoitoille). |

||

| − | |||

| − | Jos ulkomainen lasku on osamaksettu, kirjoita vastaanotetut määrät molempiin kenttiin, sekä omassa valuutassa että laskun valuutassa. Erotuksesta tulee jäännösmäärä ja mahdollinen valuuttakurssiero (jos määrä omassa valuutassa jaettuna valuuttakurssiin ei täsmää laskuvaluutassa saatuun summaan, erotuksesta tulee kurssiero). |

||

| − | |||

| − | Kun olet rekisteröinyt laskut, ilmoita tili maksulle kirjanpito (KP)-välilehdelle, esimerkiksi pankkitili. |

||

| − | Jos haluat tiliöidä loput tälle tilille, voit käyttää toimintaa Täytä. |

||

| − | |||

| − | === Ostolaskut === |

||

| − | |||

| − | Ostovelkatili on integroitu ostoreskontraan. Kun kirjaat tälle tilille, ohjelma luo uuden välilehden, jossa lukee OR X (X= välilehden numero). Tälle välilehdelle rekisteröidään ostolaskujen maksut. Ilmoita maksettavan laskun numero, tai hae jo tehty lasku toiminnalla Hae laskut. Voit hakea maksun numerolla, päivämäärällä tai alihankkijalla. Voit myös hakea laskuja, joilla on jäännösmäärä. |

||

| − | Toiminta Hae maksutiedosto hakee tiedoston, joka sisältää maksuun meneviä laskuja. |

||

| − | |||

| − | {{ExpandImage|Registrering-verifikationer-fi-grafik8.png}} |

||

| − | |||

| − | Marathon hakee laskun kokonaismäärän. Jos laskusta maksetaan vain osa, kirjoita summa kenttään Vast ot. Mrä (oma valuutta) siinä olevan summan yli. Jos laskun määrä on ulkomaan valuutassa, tähän kenttään ei tule mitään automaattisesti, vaan siihen on aina ilmoitettava määrä, joka pankkitililtä on lähtenyt. |

||

| − | Valuuttakurssin ero tiliöityy automaattisesti tilille, joka parametreissa on ilmoitettu (Perusrekisterit/OR/Parametrit, välilehti Maksut: Tili valuuttakurssitappioille ja Tili valuuttakurssivoitoille) |

||

| − | |||

| − | Jos ulkomainen lasku on osamaksettu, kirjoita määrät molempiin kenttiin, sekä omassa valuutassa että laskun valuutassa. Erotuksesta tulee jäännösmäärä ja mahdollinen valuuttakurssiero (jos määrä omassa valuutassa jaettuna valuuttakurssiin ei täsmää laskuvaluutassa saatuun summaan, erotuksesta tulee kurssiero). |

||

| + | === Client payments === |

||

| − | Kun olet rekisteröinyt maksut, ilmoita tili maksulle kirjanpito (KP)-välilehdelle, esimerkiksi pankkitili. Jos haluat tiliöidä loput tälle tilille, voit käyttää toimintaa Täytä. |

||

| + | The trade debtors’ account is assigned to the sales ledger. |

||

| + | * Fill in trade debtors’ account. A new tab opens, S/L. |

||

| + | * In the S/L tab, enter the invoice number that has been paid or search invoices with the Import invoices button. A payment file can be imported (requires settings). |

||

| + | * The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency). |

||

| + | {{ExpandImage|BOK-VER-EN-Bild3.png}} |

||

| − | === Luo esilasku === |

||

| + | |||

| + | ''Foreign currency'' |

||

| + | '''Automatic posting of spreads''' If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Sales ledger tab, exchange rate differences are posted automatically. |

||

| − | {{ExpandImage|Registrering-verifikationer-fi-grafik10.png}} |

||

| + | For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount paid into the bank must be entered. |

||

| − | Toiminnalla Luo esilasku voit viedä ennakkomäärän suoraan ostoreskontraan alihankkijalle, jonka lasku ei vielä ole tullut. |

||

| − | Lasku saa LA-numeron. |

||

| + | If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference. |

||

| − | Ilmoita alihankkija ja rekisteröinnin yhteydessä määrä. |

||

| + | '''Manual posting of spreads''' If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually. |

||

| − | === Projektiostot === |

||

| + | Contrary posting is made in the G/L tab. Here you can use the Fill button, for posting the rest on the account. |

||

| − | Projektiostotili on integroitu projektihallintaan. Kun tiliöit sille, ohjelma luo uuden välilehden, jossa lukee PRO X (X= välilehden numero). |

||

| − | Rekisteröi siihen ne ostot, jotka liittyvät projektille. |

||

| − | Ilmoita projekti, ostokoodi ja omakustannushinta. Myyntihinta lasketaan automaattisesti ostokoodissa ilmoitetun lisän mukaan. Myyntihinnan voi useimmiten muuttaa (parametriasennus). |

||

| − | Ilmoita mahdollinen ostoteksti. Mikäli käytätte tilauksia, ilmoita tilausnumero; loput tiedot haetaan siitä. |

||

| − | Vastatiliöinti tehdään KP-välilehdellä. |

||

| + | ===Suppliers’ payments=== |

||

| − | {{ExpandImage|Registrering-verifikationer-fi-grafik4.png}} |

||

| + | The trade creditors’ account is assigned to the Purchase ledger. |

||

| + | * Enter trade creditors’ account. A new tab appears, P/L. |

||

| + | * Write invoice number in the P/L tab or search invoice with the Import invoices function. A payment file can be imported (requires settings). |

||

| + | * The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency). |

||

| + | {{ExpandImage|BOK-VER-EN-Bild4.png}} |

||

| − | === Jaksotukset === |

||

| + | |||

| + | ''Foreign currency'' |

||

| + | '''Automatic posting of spreads''' If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Purchase ledger tab, exchange rate differences are posted automatically. |

||

| − | Tili väliaikaissaamisille on integroitu jaksotuksiin, eli kun tiliöit tälle tilille, ohjelma luo välilehden, jonka nimi on Jaksotus X (X= välilehden numero). Rekisteröi sille kustannukset, joita jaksotetaan määrätyn jakson ajan. |

||

| − | Ilmoita kulutili ja määrä, sekä kausi, jolle määrä jaetaan. Kauden voi ilmoittaa kahdella tavalla, KK-VV tai PPKKVV-PPKKVV. Ensimmäisessä tapauksessa määrä jaksotetaan tasaisesti kaikkien kuukausien kesken, toisessa jaksotusmäärä vaihtelee sen mukaan, kuinka monta päivää kuukaudessa on. Tee vastatiliöinti välilehdellä KP. |

||

| + | For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount withdrawn from the bank must be entered. |

||

| − | {{ExpandImage|Registrering-verifikationer-fi-grafik3.png}} |

||

| + | If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference. |

||

| − | === Inventaarit === |

||

| + | '''Manual posting of spreads''' If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually. |

||

| − | Tili inventaarien hankinnoille on integroitu Inventaarireskontraan, eli kun tiliöit tälle tilille, ohjelma luo välilehden, jonka nimi on Jaksotus X (X= välilehden numero). Mikäli hankintatili on yhdistetty vain yhteen inventaarilajiin, se ilmestyy automaattisesti Inventaarilajikenttään. Muissa tapauksessa laji on valittava kenttään. Ilmoita määrä ja mahdollinen seloste. Vastatiliöinti tehdään KP-välilehdellä. |

||

| + | After registration, enter an account in the G/L tab. Here you can use the Fill button, for posting the rest on the account. |

||

| − | {{ExpandImage|Registrering-verifikationer-fi-grafik5.png}} |

||

| + | ====Create excess invoice==== |

||

| − | == Tositteen korjaus == |

||

| + | By using the Create excess invoice function, an excess payment can be placed directly in the purchase ledger for a supplier whose invoice has not yet arrived. This payment is assigned an LA number. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild5.png}} |

||

| − | Valitse korjattava tosite ja avaa se. Valitse toiminta Korjaa. |

||

| + | |||

| + | * Select supplier and enter amount when registering. |

||

| + | === Project purchases === |

||

| + | The account for project purchases is assigned to the project accounting. |

||

| + | * Fill in the project purchase account for purchases to be charged to the project, and a new tab called PRO will appear. |

||

| + | * Fill in project, purchase code and a purchase price. The sales price is automatically calculated according to the mark-up that has been registered on the purchase code. |

||

| + | * Write optional purchase text. |

||

| + | * If you use purchase orders, enter PO number when registering project purchases. All information will then be fetched from it. |

||

| − | {{ExpandImage| |

+ | {{ExpandImage|BOK-VER-EN-Bild6.png}} |

| + | |||

| + | ===Periodical allocations=== |

||

| + | The account for automatic accruals is assigned to Periodical allocations. |

||

| + | * Fill in account for periodical allocations for costs that shall be accrued over a period. A new tab appears, Allocation. |

||

| + | * Enter the cost account and amount, as well as the period over which the amount is to be distributed. There are two ways to enter the period: YYYYMM – YYYYMM or YYYYMMDD – YYYYMMDD. In the first case, the amount is distributed evenly over the months; in the second case, the amounts are distributed differently depending on how many days there are in the month. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild7.png}} |

||

| − | Saat kysymyksen tositteen hyvittämisestä. |

||

| + | |||

| + | ===Assets/Inventory=== |

||

| + | The account for the acquisition of assets is assigned to the Inventory ledger. |

||

| + | * Fill in acquisition account for the asset. A new tab appears, INV. |

||

| + | * If the acquisition account is only linked to one type of asset, the asset type will be filled in automatically. Otherwise, the asset type must be filled in. |

||

| + | * Enter amount and optional description. |

||

| − | {{ExpandImage| |

+ | {{ExpandImage|BOK-VER-EN-Bild8.png}} |

| − | Click on Yes if you want to reverse the whole voucher. If you want to reverse the correction in another period, check the box Reverse corr in another period and select Reversing date at the top of the screeen. |

||

| + | == Correct a voucher== |

||

| − | {{ExpandImage|Registrering-verifikationer-en-grafik11.png}} |

||

| + | It is parameter-controlled to be able to click the Correct button on an AT, ER or LF voucher, as the original voucher and not the correction is reversed if the invoice is reversed after a manual correction has been made. |

||

| + | * Select the voucher you wish to correct, press Open. |

||

| + | * Press Correct. |

||

| + | * Answer the question about reversing the voucher. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild9.png}} |

||

| − | The reversing can also be saved with the same date, but with a new voucher number. Use “Save withnew voucher number”. |

||

| + | |||

| + | * If the correction is to be saved with its own voucher number, tick the box ‘Save with new voucher number’ and enter the accounting date. The accounting date does not need to be in the same period as the original voucher. |

||

| + | {{ExpandImage|BOK-VER-EN-Bild10.png}} |

||

| − | Select No if the voucher shall be corrected and not reversed. Make the correction in the lower table. Also here you can reverse the correction in another period and/or save with the same date but a new voucher number. |

||

| + | |||

| + | * If the correction is to be reversed in another period, select ‘Reverse correction in another period’ and an accounting date at the top. Both the correction and the reversal of the correction will be posted on this date and receive a number from the voucher series in this period. In total, two new vouchers are created – the correction and the reversal of the correction. |

||

| + | == Paste data into a voucher== |

||

| − | {{ExpandImage|Registrering-verifikationer-en-grafik12.png}} |

||

| + | * Start by right-clicking on the accounting table without selecting anything and choose Copy. Then paste into Excel. This is exactly how Excel should be structured in order to be copied into a voucher. |

||

| + | * To paste into the voucher, select the cells including headings and all columns. |

||

| + | * Right-click in the account table and select Paste. |

||

| + | |||

| − | [[Category:BOK-VER-EN]] [[Category:Manuals]] [[Category:ACC]] |

||

| + | [[Category:BOK-VER-EN]] [[Category:Manuals]] [[Category:Accounting]] |

||

Latest revision as of 11:10, 27 January 2026

A program for registration of supporting vouchers, either without integration to other subsystems och with assignations to other ledgers.

Contents

Enter vouchers

General

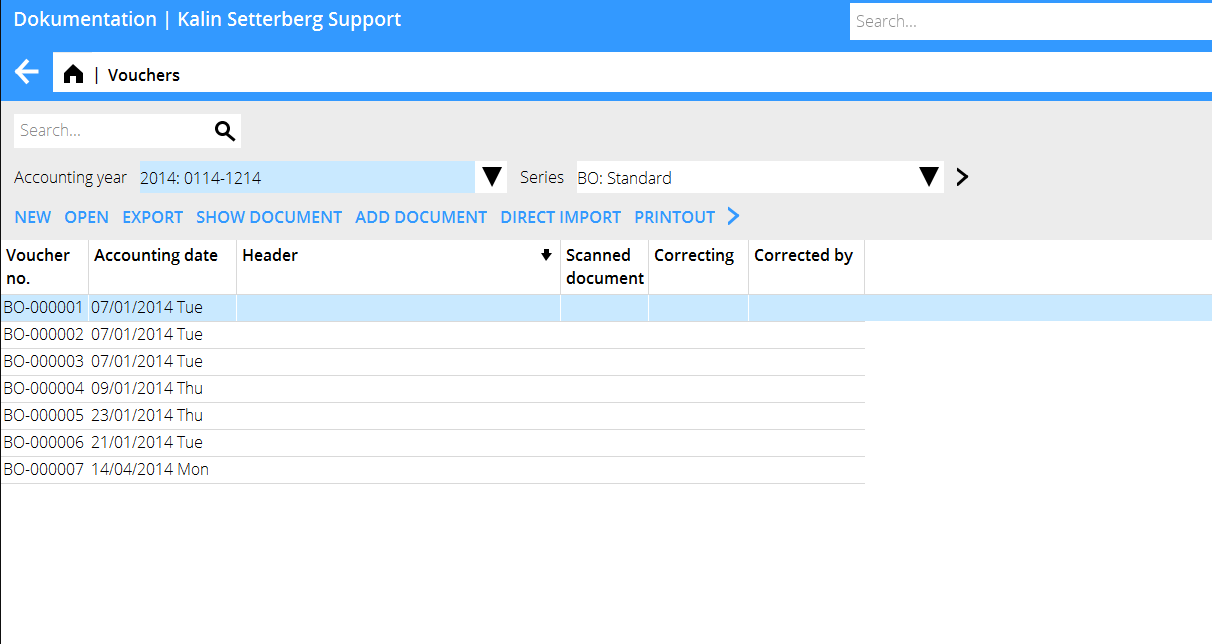

Vouchers are registered in Accounting | Vouchers. The standard series has the prefix BO, but more voucher series can be registered in Accounting | Backoffice | Base registers, The General ledger tab. The series code must contain two characters and start with a B.

Enter voucher without assignment to another subsystem

- Select series and press NEW

- Write heading

- Enter accounting date, the Today button gives today’s date.

- Enter thereafter account and debit/credit

| Fetch from | Function for copying previous voucher |

|---|---|

| Import template | Backoffice | Base register, under the General ledger tab. See the description under Create Voucher template. |

| Import (SIE 4) | Import of Sie 4- file to Swedish tax agency. |

| Import | Import from e.g. Excel |

| Reversing in another period | Creates a reversed voucher with a different posting date |

| Accounting date + Today | The Accounting date field must be filled in before the remaining information can be registered. The specified date will be suggested in the next voucher. |

| Heading | The heading is shown in the voucher list and is searchable |

| Voucher number | Backoffice | Base registers, General ledger tab |

| Account | Enter account |

| Cost centre/-object | Enter cost centre and cost object if the account requires/allows that. |

| Debit/Credit | Enter amount |

| Dimensions | Backoffice | Base registers, General ledger tab. Open the year and go to the Dimensions tab. Manual dimensions are edited in Accounting | Backoffice | Base registers, General ledger tab |

| Text | Enter any text with a maximum of 25 characters. Displayed in the Nominal ledger and account specification. |

| Subtotal | The debit and credit columns are totalled at the bottom. The voucher cannot be saved if it does not balance. |

| Create VAT posting | If Marathon's input VAT handling is used, automatic VAT posting can be created using the Input tax button, and the calculation of amounts is retrieved from the settings in the VAT classes. |

| Fill | Automatically fills in the remaining amount to balance the voucher, provided that an account has been specified. |

| Rem. | Shows remaining amount to balance. |

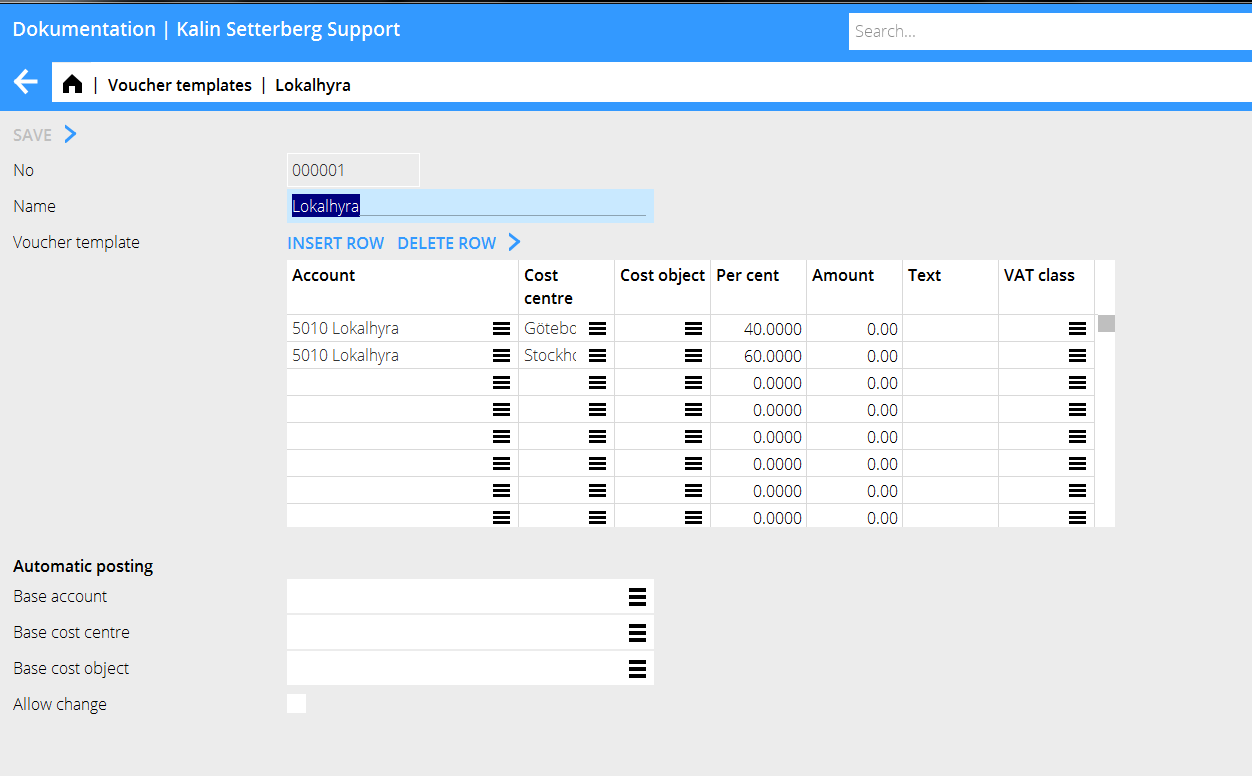

Voucher template or automatic posting

Voucher templates are created in Accounting | Backoffice | Base registers, General ledger tab.

- Press New and give the template a name.

- Enter account and possible cost centre and cost object if the account requires/allows that.

- Enter either a percentage of an amount or an amount. If a percentage is entered, the system will ask for the total amount when the template is used and calculate the share using the percentage.

- Press Import template button to import the template into a voucher.

- An automatic posting, without clicking the Import template button in a voucher, is performed when the Base account, Base cost centre and Base cost object fields in Automatic posting at the bottom of the voucher template are filled in. See image below. Automatic posting is triggered when the base account is specified in a voucher and is displayed in the registration screen.

Enter voucher with assignment to another subsystem

Accounts can be set up with assignment to a subsystem. When registering for an account that is integrated with another subsystem, a red tab with the name of the subsystem will appear. Information belonging to the subsystem is registered in this tab. The most common assignments are described below.

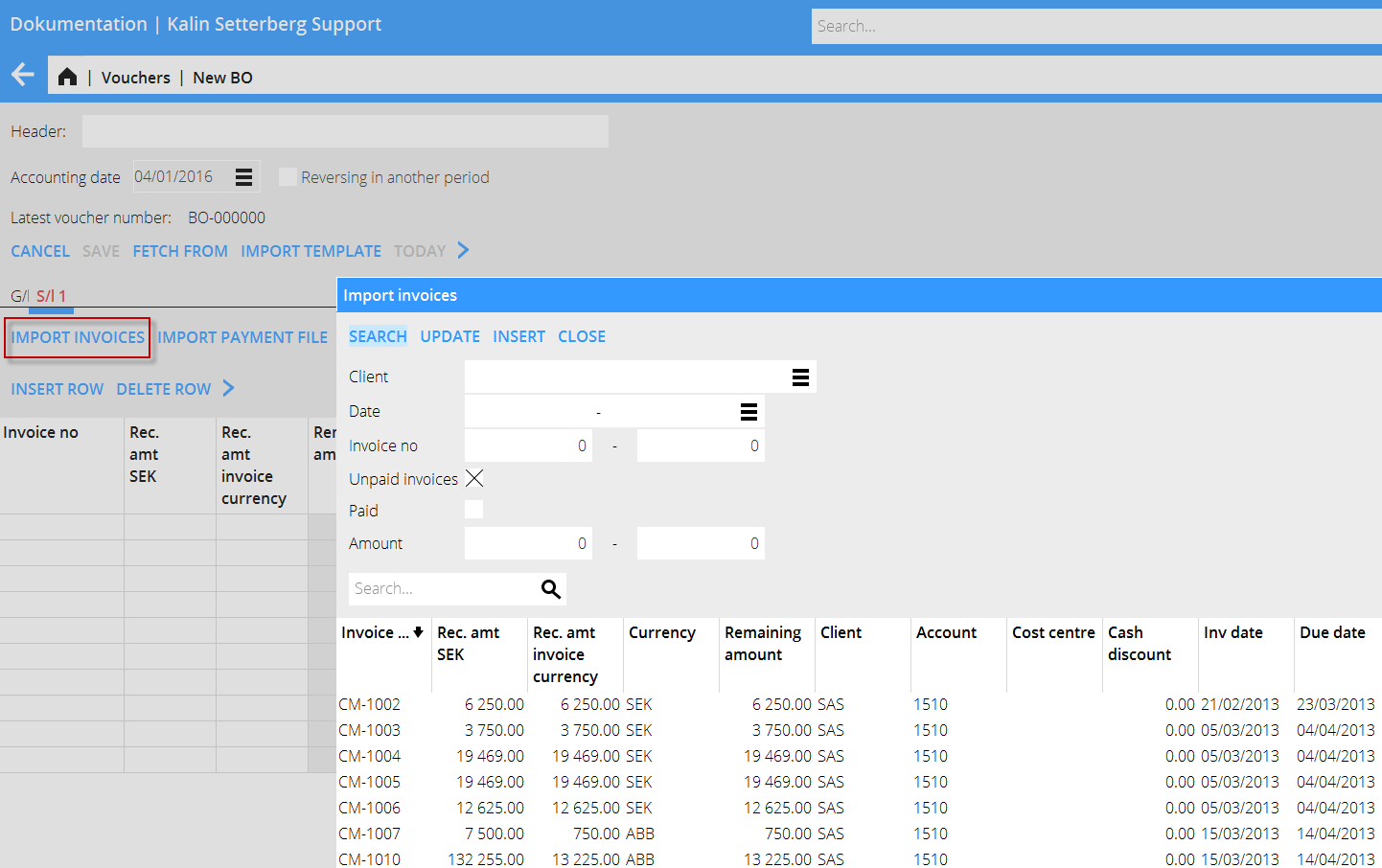

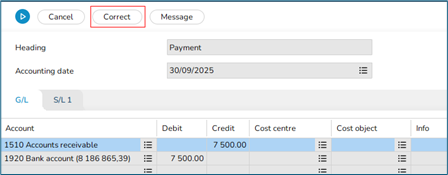

Client payments

The trade debtors’ account is assigned to the sales ledger.

- Fill in trade debtors’ account. A new tab opens, S/L.

- In the S/L tab, enter the invoice number that has been paid or search invoices with the Import invoices button. A payment file can be imported (requires settings).

- The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency).

Foreign currency

Automatic posting of spreads If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Sales ledger tab, exchange rate differences are posted automatically.

For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount paid into the bank must be entered.

If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference.

Manual posting of spreads If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually.

Contrary posting is made in the G/L tab. Here you can use the Fill button, for posting the rest on the account.

Suppliers’ payments

The trade creditors’ account is assigned to the Purchase ledger.

- Enter trade creditors’ account. A new tab appears, P/L.

- Write invoice number in the P/L tab or search invoice with the Import invoices function. A payment file can be imported (requires settings).

- The total invoice amount is fetched. If the invoice is partially paid, write the received amount over the amount in the field Rec. amt (your currency).

Foreign currency

Automatic posting of spreads If the accounts for currency rate losses and profits are filled in the payment parameters in Accounting | Backoffice | Base registers, Purchase ledger tab, exchange rate differences are posted automatically.

For foreign currencies, no amount is retrieved for the Received (your currency) field; instead, the amount withdrawn from the bank must be entered.

If a foreign invoice has been partially paid, both the Received amount in (your currency) and Received amount in invoice currency fields must be filled in, and the difference will then become a residual item and possibly an exchange rate difference. If the Received amount in (your currency) divided by the exchange rate is not the same as the amount in Received amount in invoice currency, the difference is posted as an exchange rate difference.

Manual posting of spreads If no accounts for currency rate losses and profits are filled in the payment parameters, the amounts will be fetched to the fields for amounts received in your currency and invoice currency respectively. The amounts can be changed if there has been a partial payment and a possible spread must be booked manually.

After registration, enter an account in the G/L tab. Here you can use the Fill button, for posting the rest on the account.

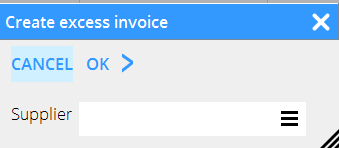

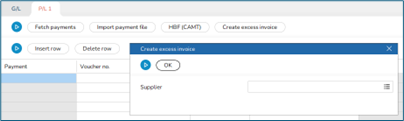

Create excess invoice

By using the Create excess invoice function, an excess payment can be placed directly in the purchase ledger for a supplier whose invoice has not yet arrived. This payment is assigned an LA number.

- Select supplier and enter amount when registering.

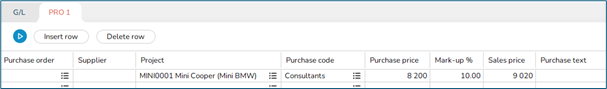

Project purchases

The account for project purchases is assigned to the project accounting.

- Fill in the project purchase account for purchases to be charged to the project, and a new tab called PRO will appear.

- Fill in project, purchase code and a purchase price. The sales price is automatically calculated according to the mark-up that has been registered on the purchase code.

- Write optional purchase text.

- If you use purchase orders, enter PO number when registering project purchases. All information will then be fetched from it.

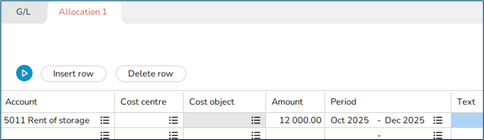

Periodical allocations

The account for automatic accruals is assigned to Periodical allocations.

- Fill in account for periodical allocations for costs that shall be accrued over a period. A new tab appears, Allocation.

- Enter the cost account and amount, as well as the period over which the amount is to be distributed. There are two ways to enter the period: YYYYMM – YYYYMM or YYYYMMDD – YYYYMMDD. In the first case, the amount is distributed evenly over the months; in the second case, the amounts are distributed differently depending on how many days there are in the month.

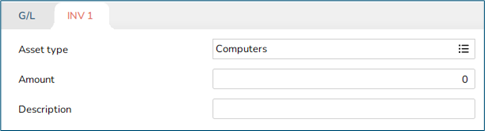

Assets/Inventory

The account for the acquisition of assets is assigned to the Inventory ledger.

- Fill in acquisition account for the asset. A new tab appears, INV.

- If the acquisition account is only linked to one type of asset, the asset type will be filled in automatically. Otherwise, the asset type must be filled in.

- Enter amount and optional description.

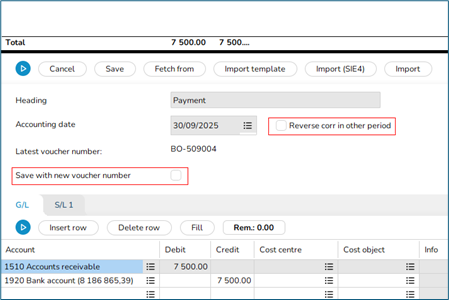

Correct a voucher

It is parameter-controlled to be able to click the Correct button on an AT, ER or LF voucher, as the original voucher and not the correction is reversed if the invoice is reversed after a manual correction has been made.

- Select the voucher you wish to correct, press Open.

- Press Correct.

- Answer the question about reversing the voucher.

- If the correction is to be saved with its own voucher number, tick the box ‘Save with new voucher number’ and enter the accounting date. The accounting date does not need to be in the same period as the original voucher.

- If the correction is to be reversed in another period, select ‘Reverse correction in another period’ and an accounting date at the top. Both the correction and the reversal of the correction will be posted on this date and receive a number from the voucher series in this period. In total, two new vouchers are created – the correction and the reversal of the correction.

Paste data into a voucher

- Start by right-clicking on the accounting table without selecting anything and choose Copy. Then paste into Excel. This is exactly how Excel should be structured in order to be copied into a voucher.

- To paste into the voucher, select the cells including headings and all columns.

- Right-click in the account table and select Paste.