Difference between revisions of "Inventory ledger/sv"

(Created page with "'''Konto för anskaffning''' används vid bokföring av nya inventarier och vid avyttring. Vid anskaffning debiteras hela kostnaden för inventarien. Vid avyttring föreslås...") |

(Created page with "'''Konto för värdeminskning''' används vid avskrivning och avyttring. Vid avskrivning krediteras beloppet som skrivs av. Vid avyttring föreslås debitering av hela beloppe...") |

||

| Line 31: | Line 31: | ||

'''Konto för anskaffning''' används vid bokföring av nya inventarier och vid avyttring. Vid anskaffning debiteras hela kostnaden för inventarien. Vid avyttring föreslås kreditering av hela kostnaden för inventarien men kan ändras. |

'''Konto för anskaffning''' används vid bokföring av nya inventarier och vid avyttring. Vid anskaffning debiteras hela kostnaden för inventarien. Vid avyttring föreslås kreditering av hela kostnaden för inventarien men kan ändras. |

||

| + | '''Konto för värdeminskning''' används vid avskrivning och avyttring. Vid avskrivning krediteras beloppet som skrivs av. Vid avyttring föreslås debitering av hela beloppet som tidigare skrivits av. |

||

| − | The '''account for depreciations''' is used for depreciation and disposal. When depreciating, the amount being depreciated is credited. When disposing, the entire amount previously depreciated is debited. |

||

The '''account for depreciation costs''' is used for depreciation. When depreciating, the amount that is depreciated is debited. |

The '''account for depreciation costs''' is used for depreciation. When depreciating, the amount that is depreciated is debited. |

||

Revision as of 16:10, 28 January 2026

Contents

Inventariereskontran

Inventariereskontran är en separat modul i Marathon för att hantera företagets anläggningstillgångar. Inventariereskontran är integrerad med bokföringen – inventarierna registreras via leverantörsfakturor eller manuella verifikationer och avskrivningar och avyttringar konteras automatiskt på de konton som är inställda på inventarietyperna.

Inställningar och basregister

Det finns ett antal inställningar som rör funktionerna i inventariereskontran.

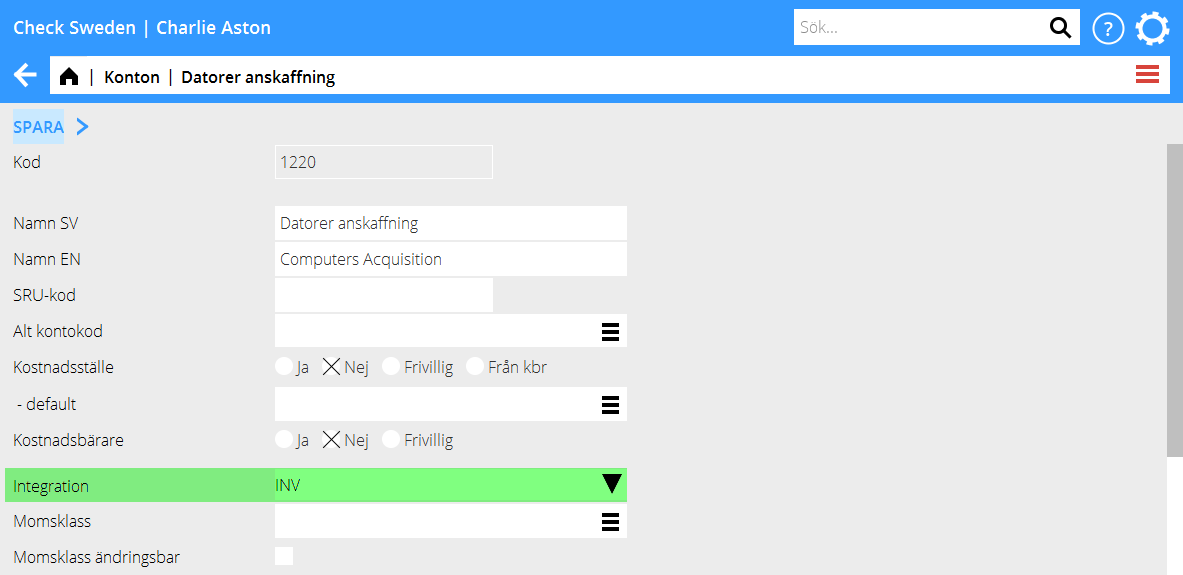

Integration på konton

För att kunna registrera inventarier från bokföringen och leverantörsfakturor behöver kontona för anskaffning ställas in med integration till Inventariereskontran. Inställningen ligger på kontot i Ekonomi | Backoffice | Basregister, fliken Bokföring. Öppna Kontot och välj INV i fältet Integrationstyp.

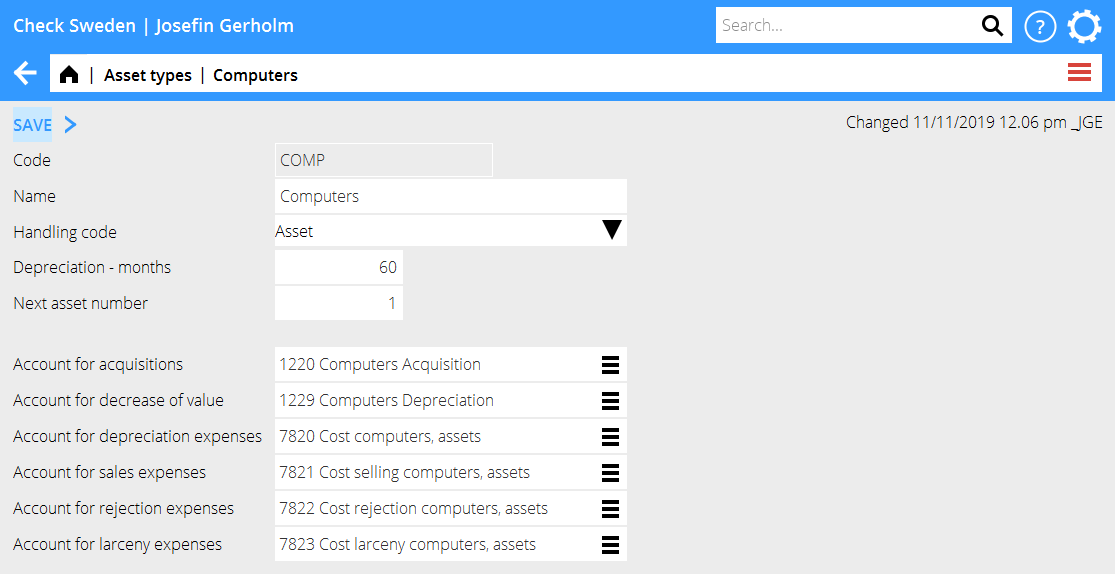

===Inventarietyper===

Alla inventarier i Marathon måste tillhöra en inventarietyp. Inventarietypen styr kontering vid avskrivningar och ger förslag på antal avskrivningsmånader. Det är också ett sätt att kategorisera inventarierna. Inventarietyper registreras i Ekonomi | Backoffice | Basregister, fliken Inventariereskontra

Kod får vara max fyra tecken och är vanligen ett kortnamn av typen, till exempel DAT för Datorer Hanteringskoden styr avskrivningsreglerna för inventarietypen: Inventarie är den vanliga hanteringskoden, inventarier med den här hanteringskoden kan skrivas av och avyttras med automatisk kontering. Leasing genererar inga avskrivningar och kostnadsför inte heller någon del av anskaffningen utan behandlar inventarien som leasing. Kostnadsfört kan användas för registrering av inventarier som kostnadsförs direkt vid anskaffning. Budget ger möjlighet att budgetera inventarier. I inventarierapporter går det att göra urval på hanteringskod.

Avskrives antal månader I fältet Avskrives antal månader registreras förslag på antal månader som inventarier för den här typen ska skrivas av. Antal månader kan ändras för en enskild inventarie i samband med registrering.

Nästa inventarienummer avgör nummer för kommande inventarier som registreras. Inventarienumret har formen XXXX-NNNNNN-NN där XXXX är koden för inventarietypen, NNNNNN ett löpnummer för huvudinventarien och NN i slutet är ett underlöpnummer till en huvudinventarie. Exempel på ett inventarienummer är DAT-000001-01.

Nästa inventarienummer. Det går att ha serierna separata per inventarietyp eller använda en central nummerserie för flera eller alla inventarietyper. Om serien ska vara central anges 0 som nästa inventarienummer.

Konto för anskaffning används vid bokföring av nya inventarier och vid avyttring. Vid anskaffning debiteras hela kostnaden för inventarien. Vid avyttring föreslås kreditering av hela kostnaden för inventarien men kan ändras.

Konto för värdeminskning används vid avskrivning och avyttring. Vid avskrivning krediteras beloppet som skrivs av. Vid avyttring föreslås debitering av hela beloppet som tidigare skrivits av.

The account for depreciation costs is used for depreciation. When depreciating, the amount that is depreciated is debited.

The account for sales costs is used for disposals of the Sales type. When disposing, it is suggested that the amount remaining after the sale be debited.

The account for disposal costs is used for disposals of the disposal type.

The account for theft costs is used for disposals of the theft type.

Separate accounts should be used for each type of inventory and type of posting.

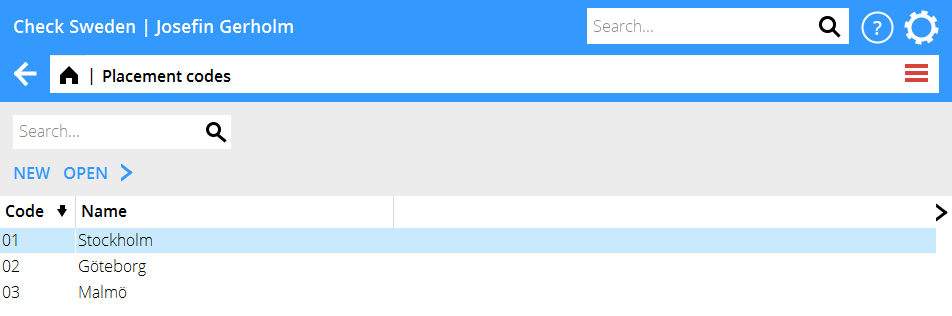

Placement codes

Placement codes can be used to link assets to different departments, such as different offices or floors. The codes are set up in Accounting | Backoffice | Base registers, on the Inventory Ledger tab, and require a Code and a Name.

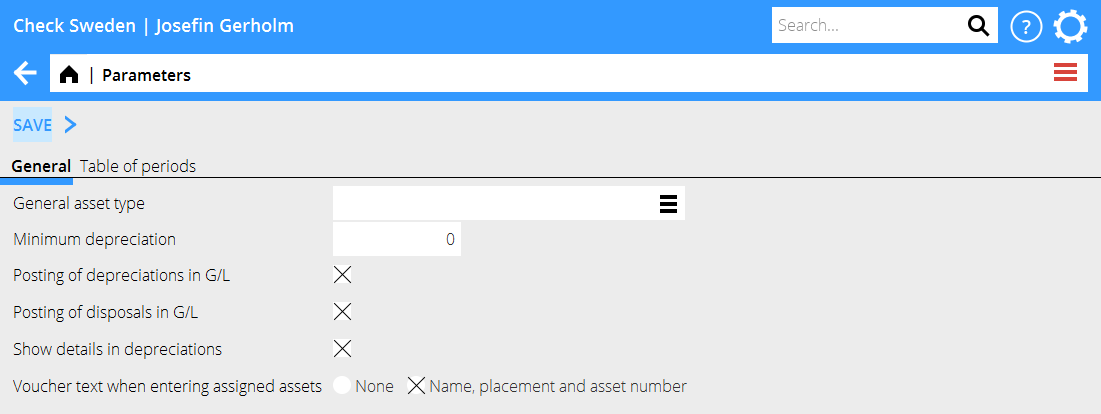

Parameters

The parameters for the inventory ledger are in Accounting | Backoffice | Base registers, Inventory ledger tab

General asset type Specifies whether one or more asset numbers should use the same number series. All asset types with 0 as the Next asset number use the central number series. In this case, the number series for the asset type registered here is used.

Posting of depreciations in G/L and Posting of disposals in G/L determine whether depreciation and disposals are to be posted automatically in the accounts. If this option is not selected, depreciation and disposals must be posted manually to ensure that the inventory ledger and the accounts match.

Register assets

You can register assets in three ways: in the purchase ledger, with a journal voucher or directly in the inventory ledger.

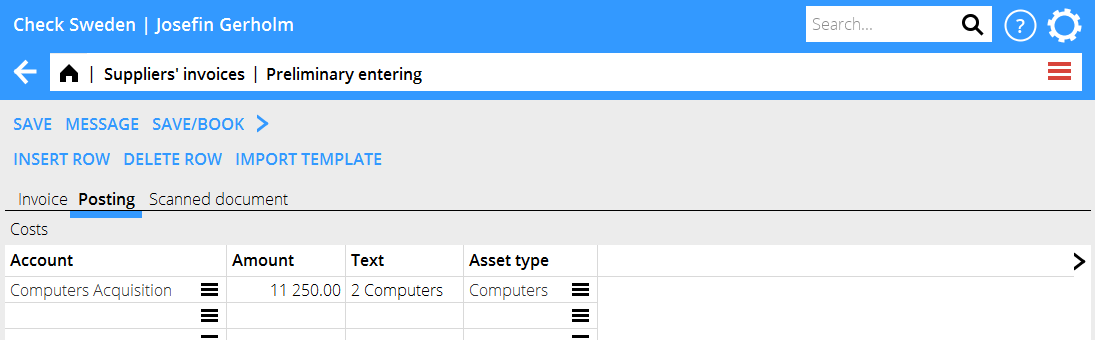

Via supplier’s invoice

If the asset comes from a supplier’s invoice, it can be registered when posting the invoice.

Enter the acquisition account for the asset. If only one asset type has this account set as the acquisition account, it is suggested for the Asset type field. If several asset types have this account set as the acquisition account, no asset type is suggested and must be selected manually.

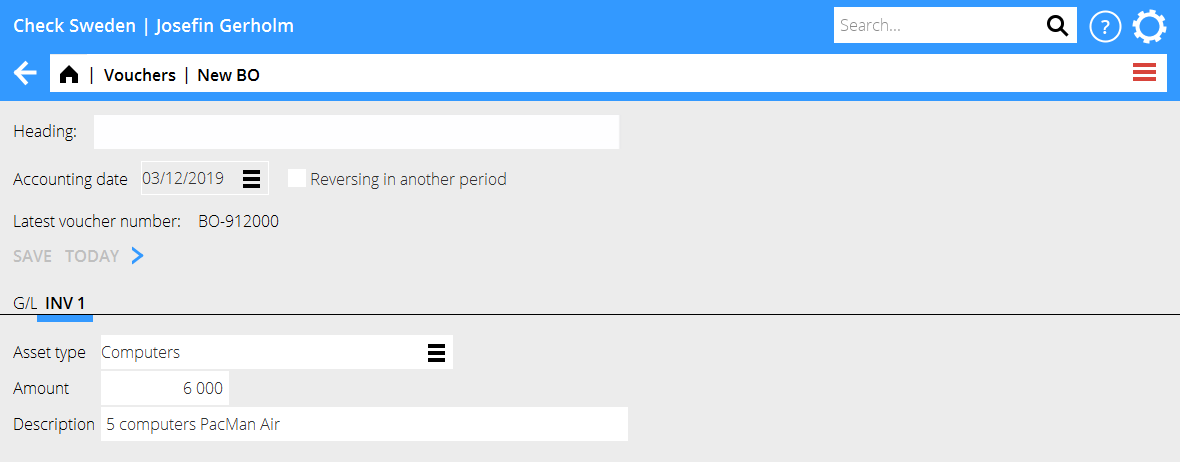

Via journal voucher

Enter the acquisition account for the asset. In the INV tab that has been created, enter the Asset type, Amount and Description. Return to the GL tab and complete the posting before saving the voucher.

Manual registration

It is possible to register assets directly in the inventory ledger. Manual registration must be booked manually for the subsystems to match. Manual assets are registered in Accounting | Backoffice | Base registers, Inventory Ledger tab using the New button.

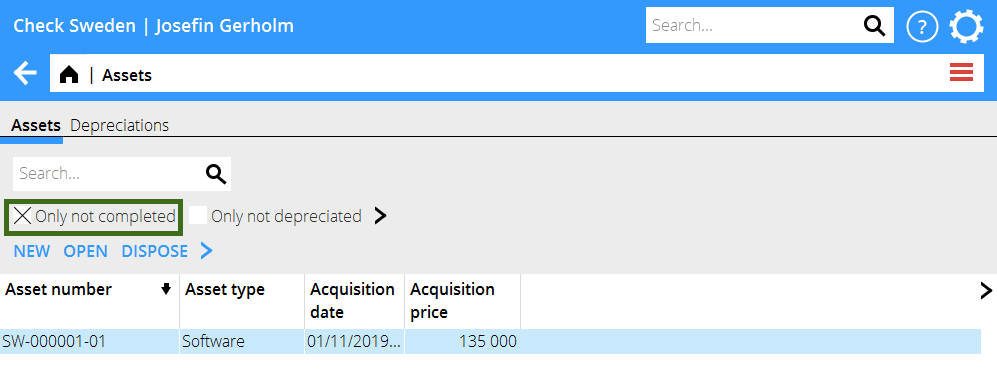

Complete assets

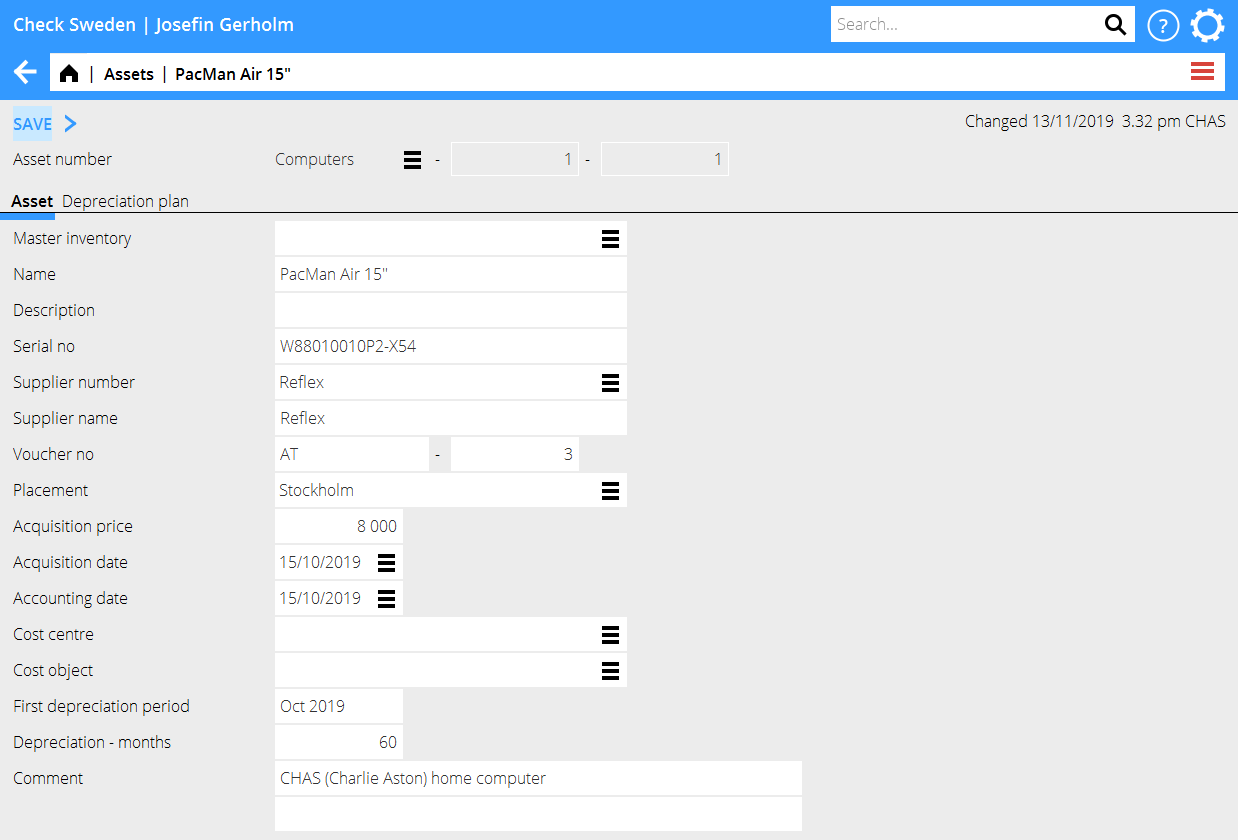

Asset registered via a supplier’s invoice, or a journal voucher needs to be completed in Accounting | Backoffice | Asset, the Asset tab.

Only not completed is ticked to see only assets that need to be completed.

Open the asset and enter at least the First depreciation period. Also enter other supplementary information such as Serial number, Placement and Comment.

Depreciation of assets

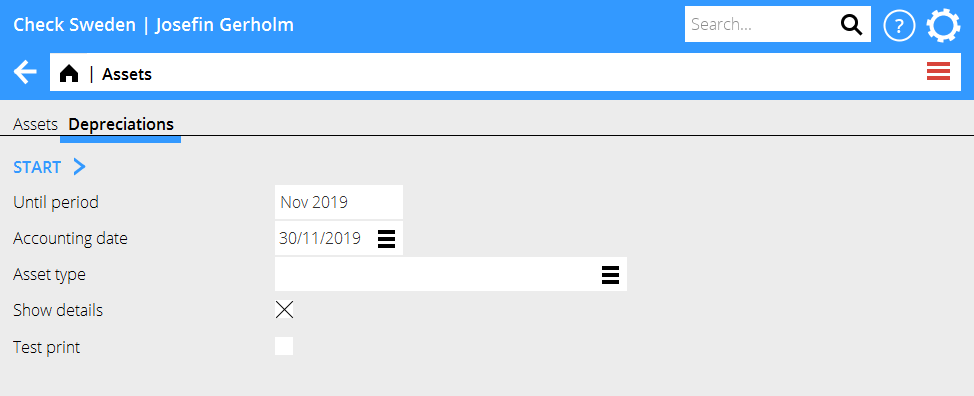

Depreciations are made in Accounting | Backoffice | Assets, Depreciation tab.

Enter the end period, Until period, for depreciation and the Accounting date for depreciation.

It is possible to depreciate only a specific type of asset. If the field is left blank, all types of assets will be included.

Start by making a test print to get a list showing what will be included in the depreciation and how the accounting will be done. If it looks correct, make a final printout by removing the check mark next to Test printout.

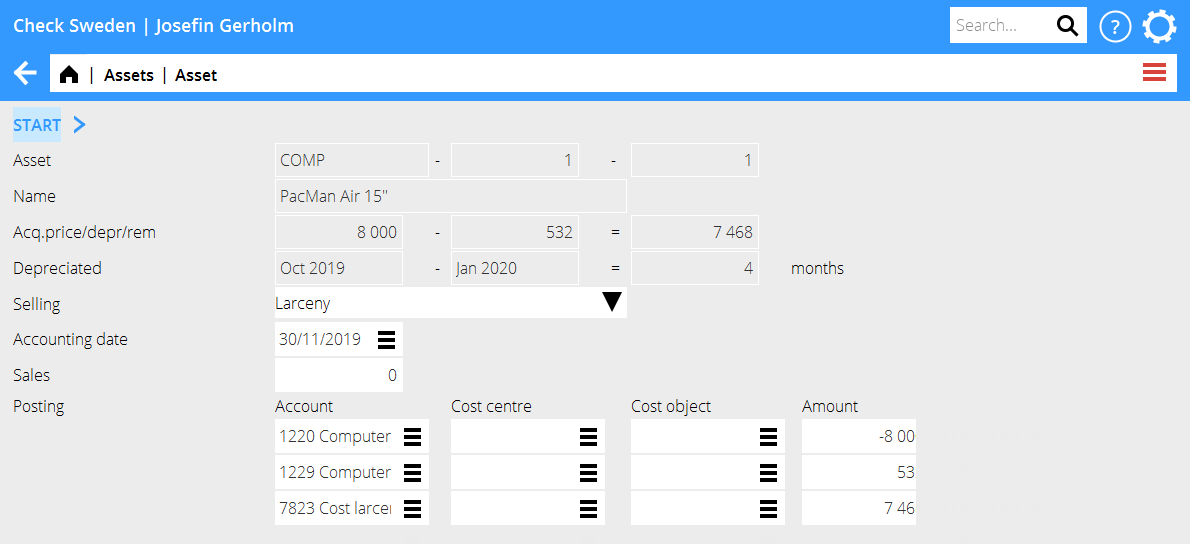

Disposal of assets

Disposal of assets is done in Accounting | Backoffice | Assets, under the Assets tab. Select the asset and click on the Dispose button.

Enter the Disposal code that corresponds to the reason for disposal and the Accounting date. If it is being disposed of due to a sale, the Sales price must be entered.

The posting for the disposal is suggested based on the remaining value of the asset, any sales price and the accounts you have set up for the asset type. The posting can be corrected manually. When the posting is complete, select Start.

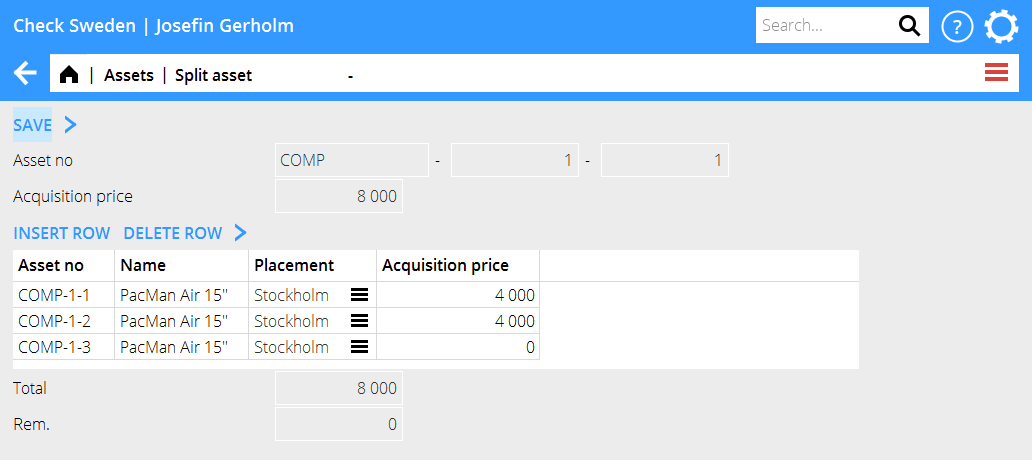

Split asset

An asset can be split into several in Accounting | Backoffice | Assets, tab Assets. Press the Split button. Then enter the name, placement, and acquisition price for each asset per row in the table.

All assets created because of splitting are given the same main number but separate sub-numbers. An asset COMP-1-1 that is split into two is therefore given the numbers COMP-1-1 and COMP-1-2 respectively.

Change asset number

If an asset has been assigned to the wrong asset type or given the wrong number, this can be corrected in Accounting | Backoffice | Assets, under the Assets tab. Select the asset and press Change Number, then enter the number to which the asset should be moved. Please note that the accounting needs to be corrected manually when changing the asset type for the subsystem to be correct.

Edit depreciation plan

Assets are depreciated using a straight-line depreciation plan, Acquisition price / Number of months to depreciate. An asset of SEK 60,000 to be depreciated over 60 months is therefore depreciated at SEK 1,000 per month.

If the depreciation plan needs to be changed, there are two different options.

1. Edit depreciation plan (only correction of future depreciation)

To correct the depreciation rate on the remaining amount of the asset, the depreciation plan can be changed under Accounting | Backoffice | Asset, the Asset tab. Open the asset, the Depreciation Plan tab. Enter the month from which the number of depreciation months is to be changed in the From Period column. The To period column is usually left blank, in which case the new plan applies to all future depreciation. The Quantity column specifies the number of months for which the asset is to be depreciated.

The From period is filled in where the new depreciation plan is to apply. Depreciation already made is not affected.

Example: Acquisition price SEK 60,000. First depreciation period 2024–01. Number of months to depreciate = 60. Depreciation made up to and including 2024–12. New depreciation plan from period 2025–01 onwards with number of months to depreciate = 12.

In 2024, there are 12 depreciation amounts of SEK 1,000 per month. The remaining amount after 2024 = SEK 48,000.

For depreciation in 2025–01 and onwards, SEK 5,000 is depreciated (SEK 60,000 / 12).

2. Edit number of months (retroactive correction)

If the depreciation plan for the asset is incorrect and depreciation already made needs to be corrected, this is done directly on the asset in Accounting| Backoffice | Assets, under the Assets tab.

The next depreciation will correct previous depreciation according to the new number of months.

Example: Acquisition price SEK 60,000. First depreciation period 2024–01. Number of months to depreciate = 60. Depreciation made up to and including 2024–12.

Change to the asset to Number of months to depreciate = 24, which means that SEK 2,500 per month should be depreciated.

In 2024, there are 12 depreciations of SEK 1,000 per month = SEK 12,000.

In 2025–01, SEK 20,500 is depreciated. SEK 2,500 for 2025–01 and SEK 18,000 to correct the previous depreciation for 2024 (60,000 / 24 * 12 - 12,000).

Reports

Reports for the fixed asset ledger are located under Accounting | Reports, the Inventory Ledger tab.

The Depreciation List report is a standard report that lists assets according to selection by depreciation period, accounting date and asset type. The Reports report is used to print reports with custom column templates.