Translations:Pre-invoicing in the Media system/11/en

From Marathon Documentation

Revision as of 13:16, 25 May 2021 by FuzzyBot (talk | contribs) (Importing a new version from external source)

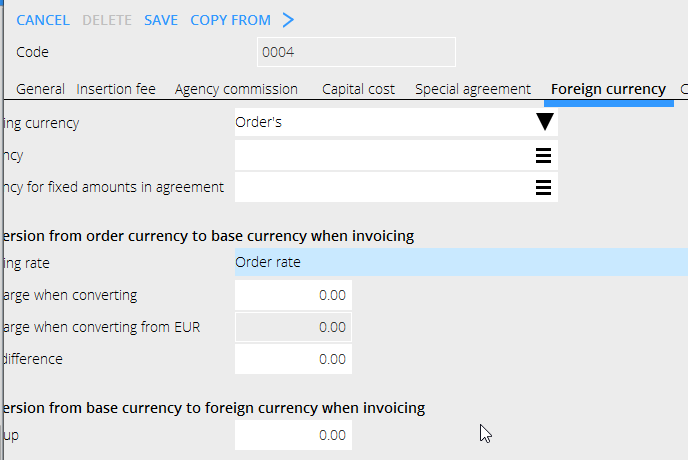

The client agreement where rate shall be stated on the order:

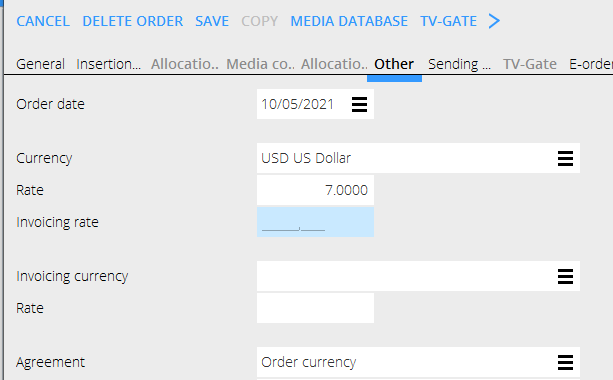

The order:

The order:

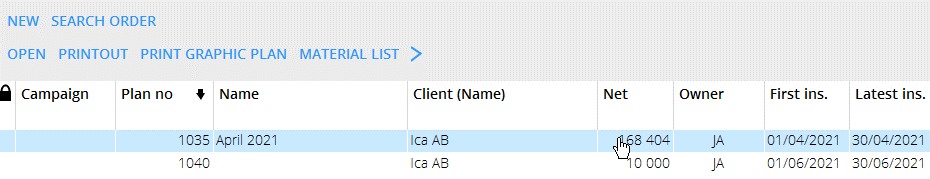

NB! In the list of plans, the order’s net is shown in the current day rate, regardless of what rate is set on the order.

NB! In the list of plans, the order’s net is shown in the current day rate, regardless of what rate is set on the order.

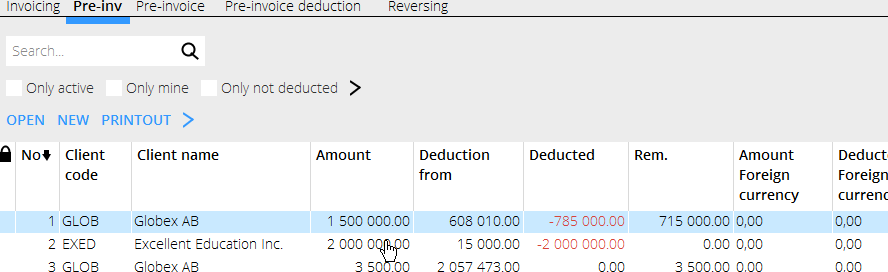

The list of pre-invoices shows according to the rate on the order in the column Deduction from.

The list of pre-invoices shows according to the rate on the order in the column Deduction from.

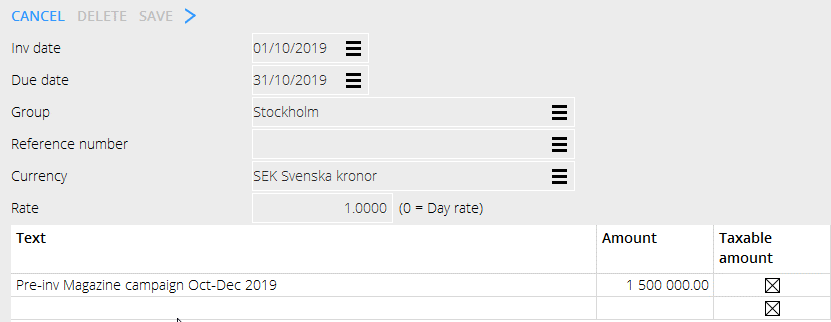

Create new pre-invoice with No current deduction according to the client agreement.

- Create new pre-invoice with NEW and print out. Check whether it is taxable or not. You should not mix VAT free pre-invoices with taxable ones.