Translations:Pre-invoicing in the Media system/11/en

From Marathon Documentation

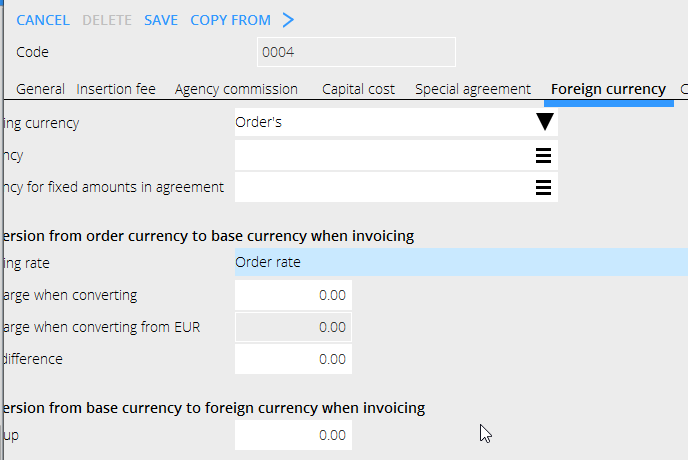

The client agreement where rate shall be stated on the order:

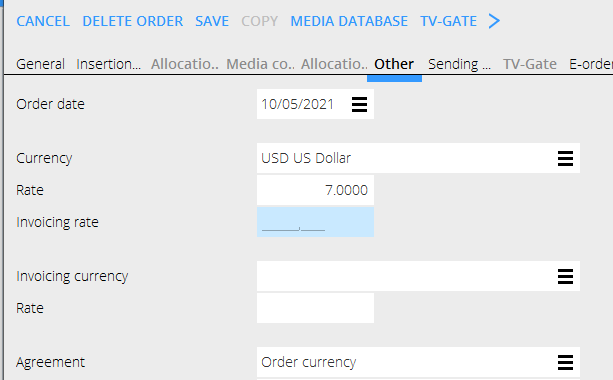

The order:

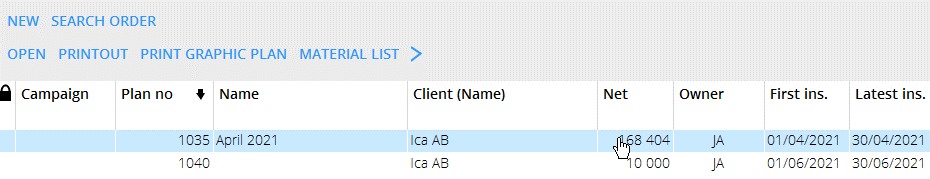

NB! In the list of plans, the order’s net is shown in the current day rate, regardless of what rate is set on the order.

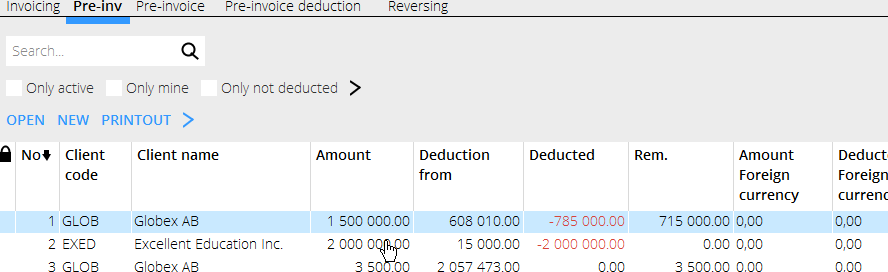

The list of pre-invoices shows according to the rate on the order in the column Deduction from.

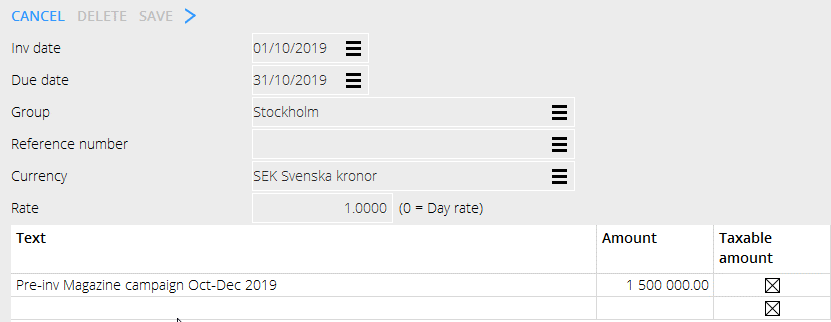

Create new pre-invoice with No current deduction according to the client agreement.

- Create new pre-invoice with NEW and print out. Check whether it is taxable or not. You should not mix VAT free pre-invoices with taxable ones.