Inventariereskontran

Inventariereskontran i Marathon

Inventariereskontran är en separat modul i Marathon för att hantera företagets anläggningstillgångar. Inventariereskontran är integrerad med bokföringen – inventarierna registreras via leverantörsfakturor eller manuella verifikationer och avskrivningar och avyttringar konteras automatiskt på de konton som är inställda på inventarietyperna. Inställningar och basregister Det finns ett antal inställningar som rör funktionerna i inventariereskontran.

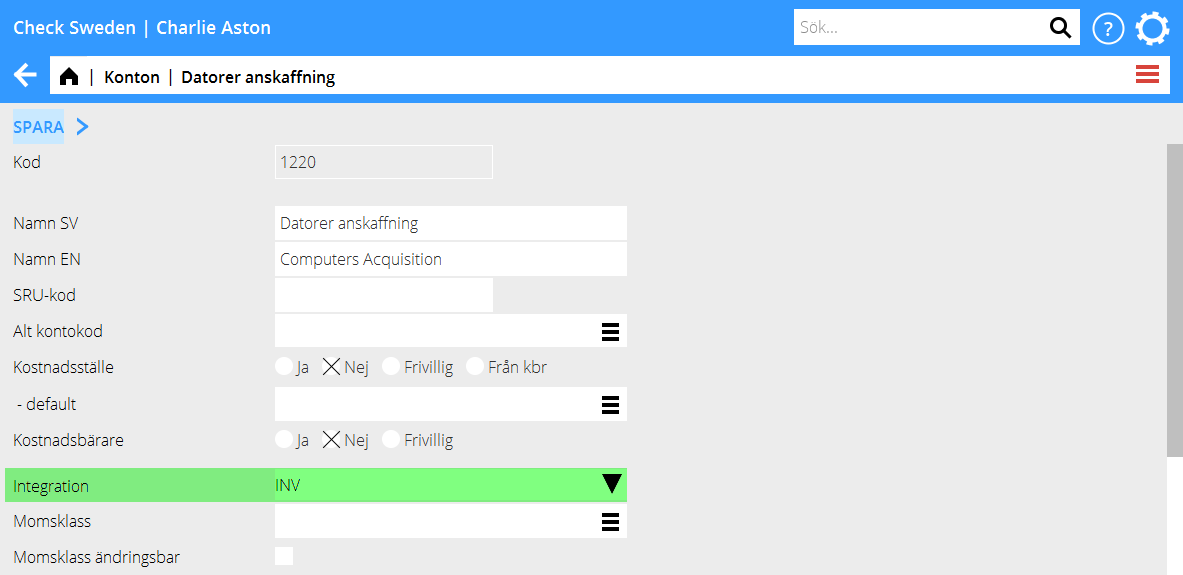

Integration på konton För att kunna registrera inventarier från bokföringen och leverantörsfakturor behöver kontona för anskaffning ställas in med integration till Inventariereskontran. Inställningen ligger på kontot i Basregister | BOK | Konton där du väljer INV i fältet Integrationstyp.

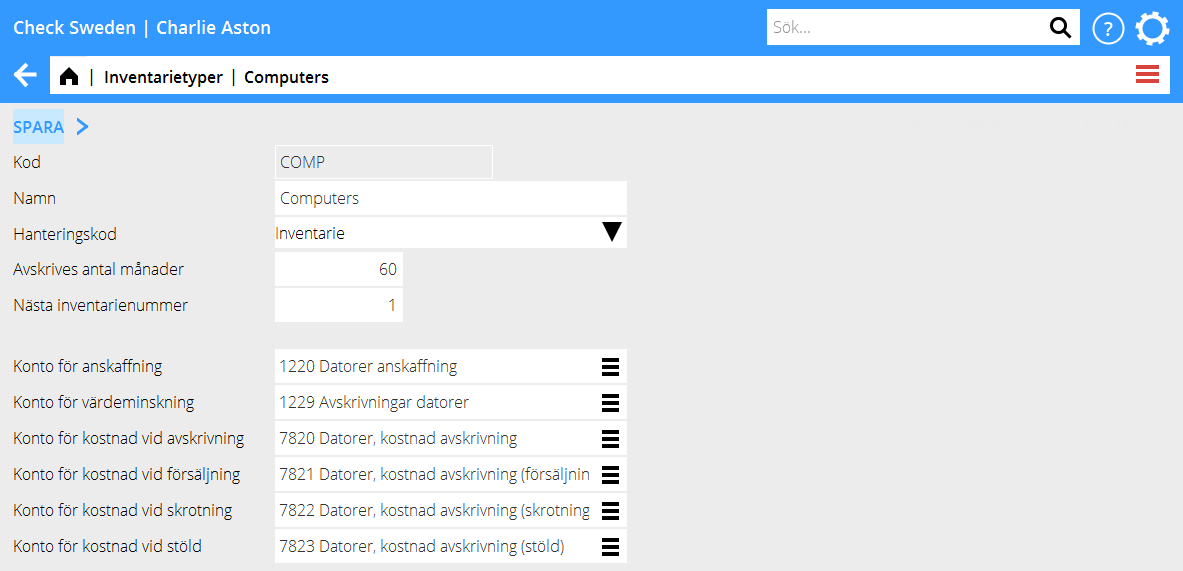

Inventarietyper Alla inventarier i Marathon måste tillhöra en inventarietyp. Inventarietypen styr kontering vid avskrivningar och ger förslag på antal avskrivningsmånader. Det är också ett sätt att kategorisera inventarierna. Inventarietyperna registreras i Basregister | INV | Inventarietyper

| The code | can be maximum four digits and is normally a short name of the type, e.g. COMP for Computers. |

|---|---|

| The Handling code | controls the depreciation rules for the asset type:

Asset is the most used handling code; assets with this type can be depreciated and sold with automatic posting. Leasing does not generate any depreciations and does not carry any part of the acquisition as expense but handles the asset as leasing. Carry as expensed can be used for registering assets that are carried as expenses directly at the time of acquisition. Estimate enables budgeting assets. In inventory related reports it is possible to make selections based on handling code. |

| The field Depreciation - months | shows a suggestion of number of depreciation months for this kind of asset. The number can be changed for single assets. |

| Next asset no | type code, NNNNNN a serial number for the main asset and the last NN a sub serial number to a main asset. An asset number can |look like this: COMP-000001-01 |

| The number ranges | can be kept separately per asset type. It is also possible to use one global number range number for several or all asset types. If you use a global numbering ranges, Next asset no must be 0. |

| Account for acquisitions | is used when booking new assets and disposals. By the time of acquisition, the total cost of the asset is charged. By time of selling an asset, a reversal of the total amount is suggested, but can be changed. |

| Account for decrease of value | is used in depreciations and disposals. When depreciating, the amount is credited. When selling, charging of the total previously depreciated amount is suggested. |

| Account for depreciation expenses | is used when depreciating. When depreciating the total amount to depreciate is charged. When selling, charging of the total previously depreciated amount is suggested |

| Account for sales expenses | is used in sales. When selling, the remaining amount is suggested to be charged. |

| Account for rejection expenses | Used when rejecting assets |

| Account for larceny expenses | Used when assets have been stolen |

We recommend you use separate accounts for each asset type and type of posting.

Contents

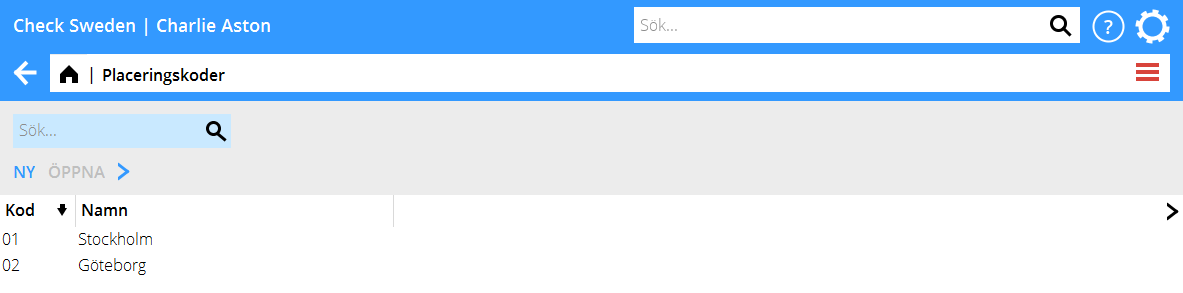

Placement codes

Placement codes can be used for connecting assets to different departments, e.g. offices or floor levels. Placement codes are registered in System: Base registers/INV/ Placement codes and requires only a code and a name.

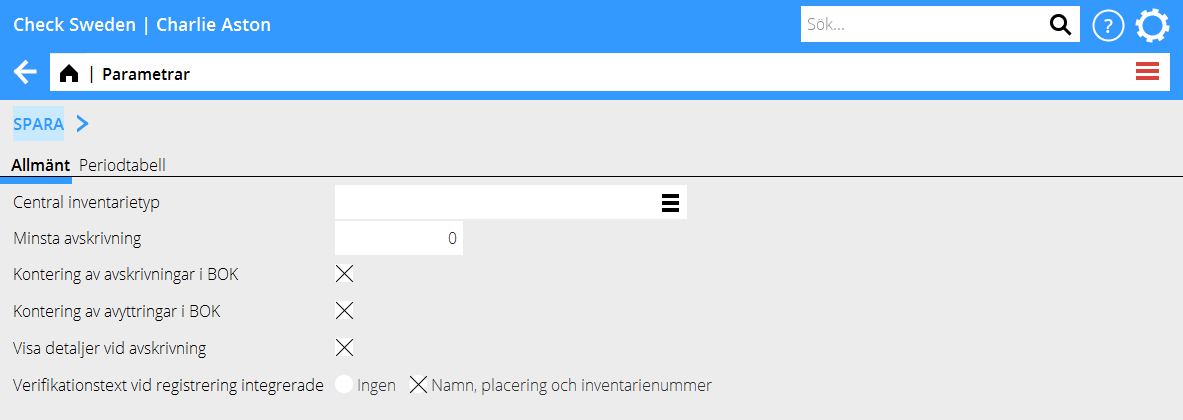

Parameters

The parameters concerning the inventory ledger are in System: Base registers/INV/ Parameters. General asset type shall be stated if one or several asset numbers shall use a global numbering range. All asset types with 0 as Next asset number use the global number range. It is the number range on asset type that is registered here that is used. The parameters Posting of depreciations in GL and Posting of disposals in GL control whether depreciation and disposals shall be posted automatically in the bookkeeping or not. If left unticked, they will have to be manually booked in order for the inventory ledger to agree with the bookkeeping.

Register assets

Assets can be registered through three different programs.

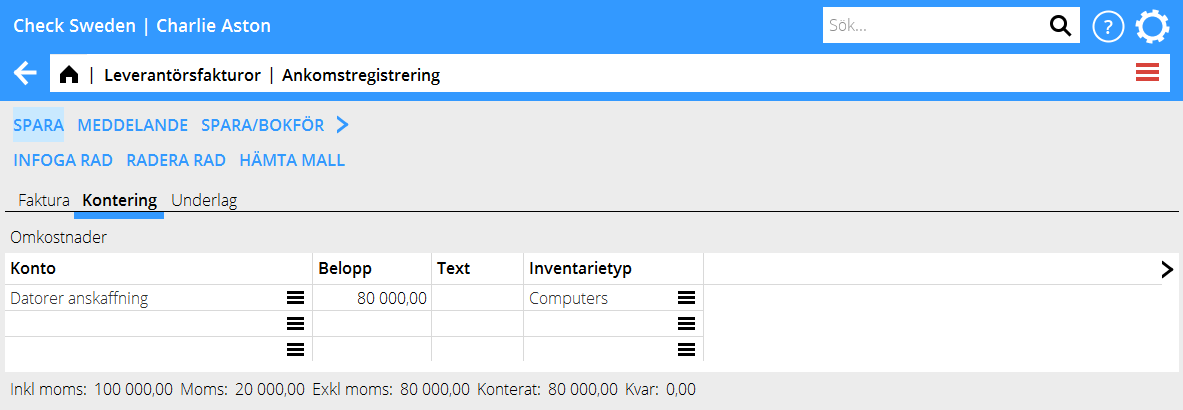

Through the purchase ledger

If the inventory comes from a suppliers’ invoice you can register it whilst posting the invoice. Enter acquisition account for the asset. Om only one asset type is assigned to this account, the asset type will be suggested in the field Asset type. If several asset types are assigned to the account, the field must be completed manually.

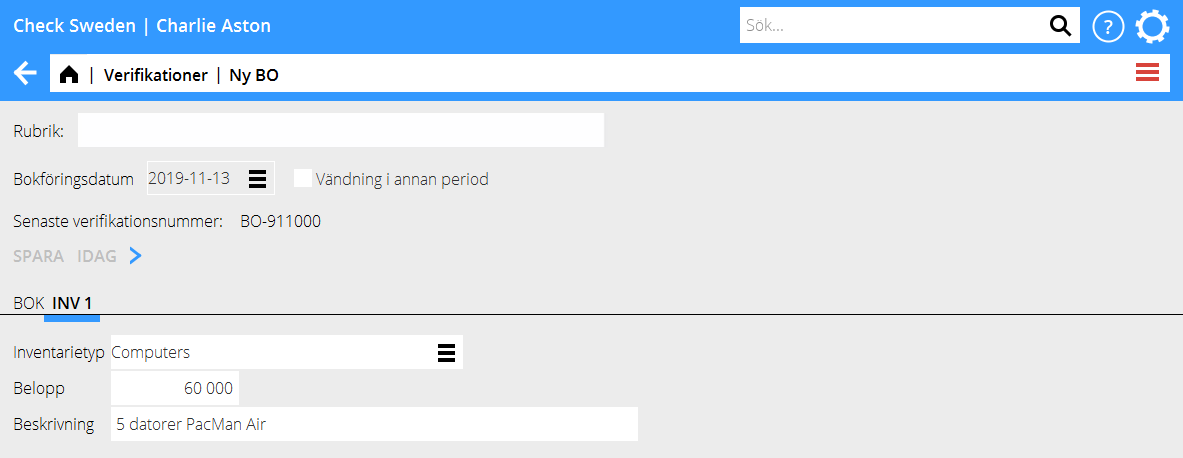

Through bookkeeping voucher

Enter acquisition account for the asset. The tab INV will be created. There, state Asset type, Amount and Name. Return to the tab GL and complete the posting before you save the voucher.

Through manual registration

It is possible to register assets directly in the inventory ledger. A manual registration has also to be manually booked so that the subsystems will agree. Manual asset registration is done in Accounting: Assets, by pressing New.

Complete assets

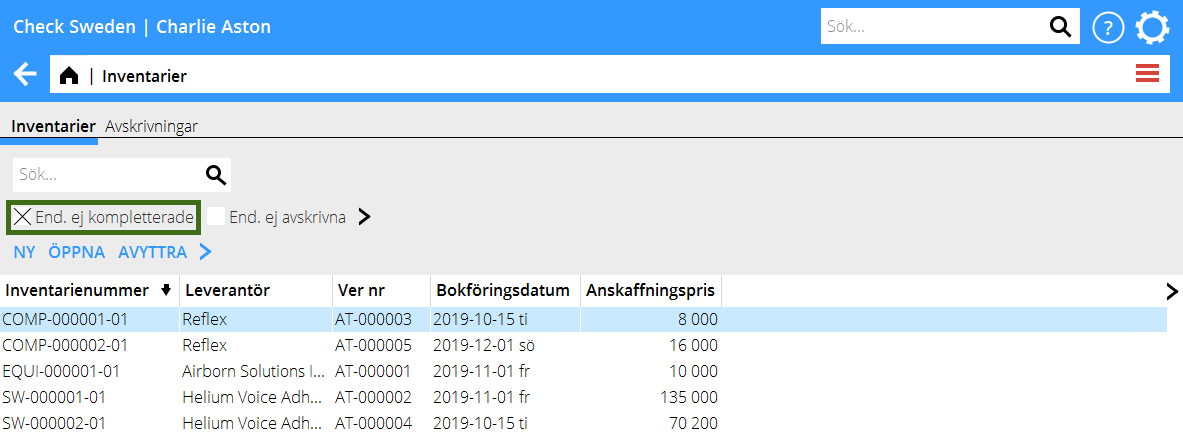

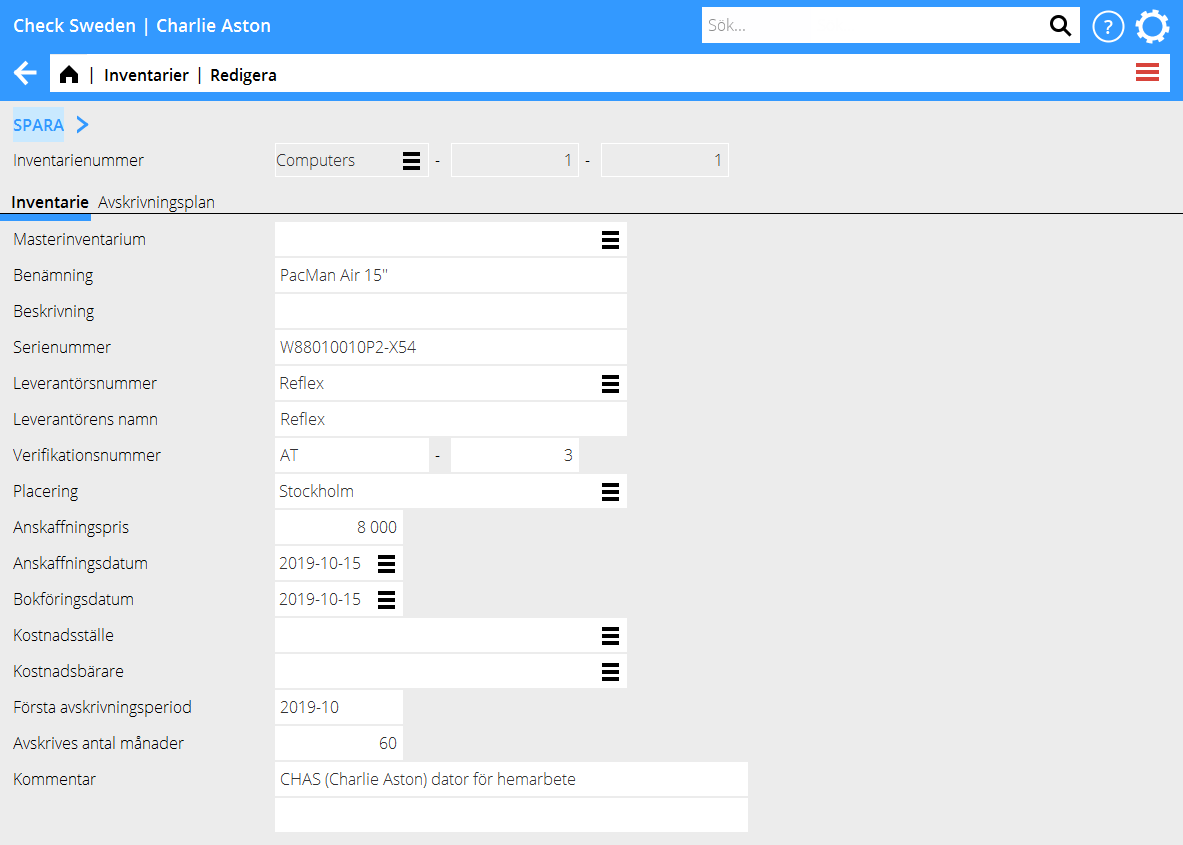

Assets that have been entered to the system with a supplier’s invoice or a voucher must be completed in Accounting: Assets, tab Depreciation Check the box Only not completed to see a list of assets not yet completed.

Open the asset and state at least First depreciation period. You can also write in other completing information such as Serial number, Placement and Comment.

Depreciation of assets

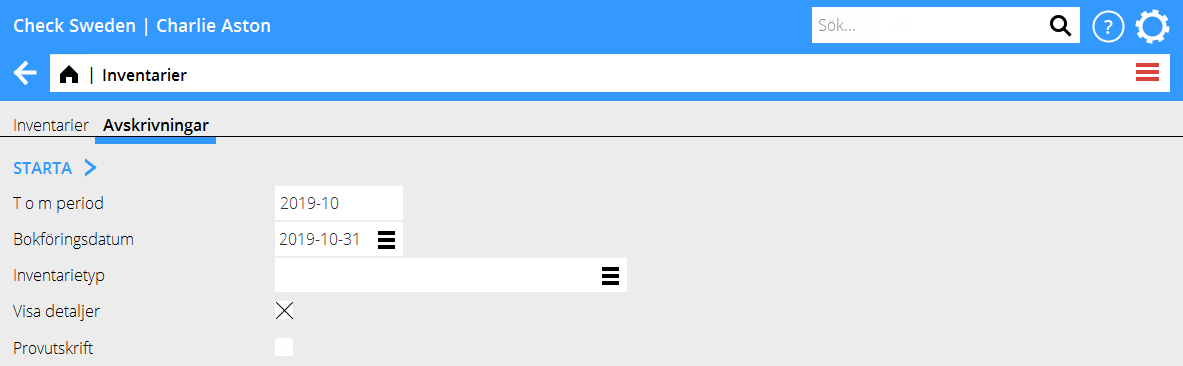

Depreciations are done in Accounting: Assets, tab Depreciation. Write To period for the depreciation and accounting date. You can choose to only depreciate a certain type of asset. If you leave the field empty, all asset types will be included. You can start with making a test print to get a list of what the depreciation includes and how the postings will be. When you have checked that it looks correct, remove the tick from Test print and then print.

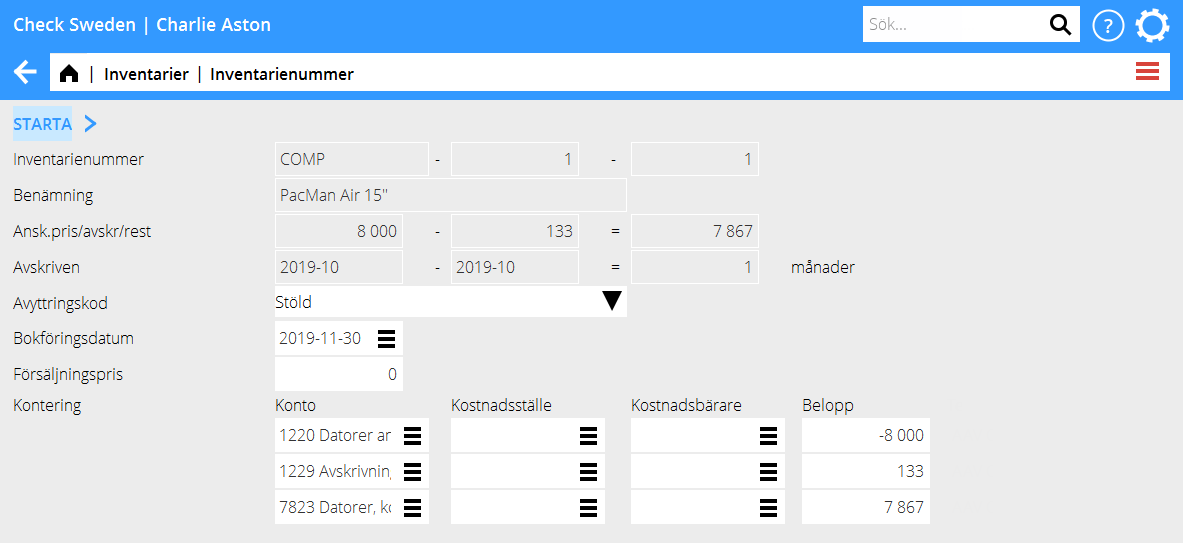

Disposal

To dispose an asset, go to Accounting: Assets, tab Assets. Select the asset and press Sell. Choose the code that correlates to type of disposal and accounting date. If the disposal is due to sales, enter also Sales price. The posting for the disposal is suggested based on the remaining amount on the asset, possible sales price and the accounts you have set on the asset type. The posting can be corrected manually. When the posting is ready, press Start.

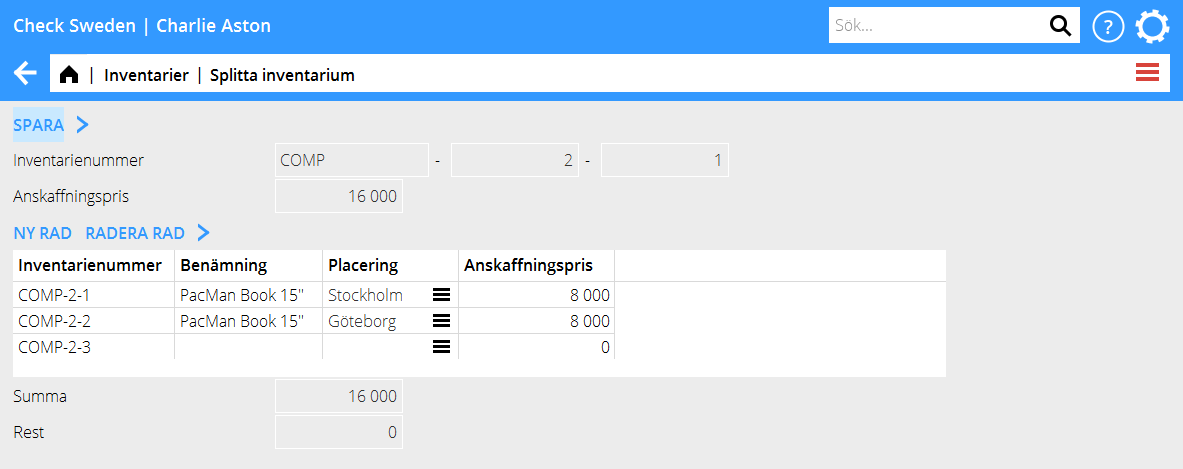

Split asset

If you want to split one asset into many assets; select it in Accounting: Assets, and press Split. In the table, register name, placement and acquisition price, one row per asset.

All assets that are created by a split get the same main number but separate subnumbers. For example, asset COMP-1-1 that gets split to two gets numbers COMP-1-1 and COMP-1-2.

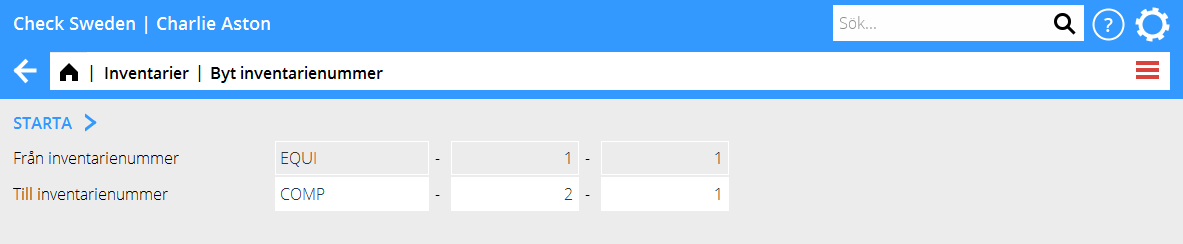

Change asset number

If you have an asset that for some reason has ended up in wrong asset type or gotten a wrong number, you can correct it in Accounting: Assets, tab Assets. Select the asset and press Change number and write the number the asset shall be moved to. Note that the bookkeeping must be manually corrected in order for the subsystems to agree.

Edit depreciation plan

The assets are depreciated with a flat depreciation plan, Acquisition price/Number of depreciation months. An asset for 60 000 SEK that shall be depreciated in 60 months is thus depreciated with 1000 SEK per month. There are two ways of changing the depreciation plan.

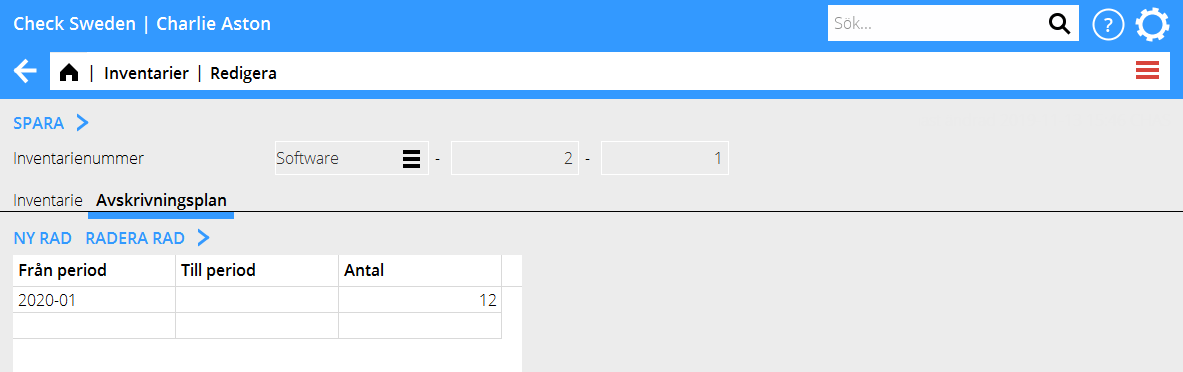

1.Edit depreciation plan (only correcting future depreciations)

If you want to change the depreciation pace of an asset’s remaining amount, open the asset in Accounting: Assets, tab Assets, tab Depreciation plan. State correction month in the field From period. The column To period is normally left blank; the new plan concerns hence all future depreciations. The new depreciation plan is valid from and including the month stated in the From period field. Already performed depreciations are not affected. Example: Acquisition price 60 000 SEK. First depreciation period 01-2019. Months to depreciate = 60. Performed depreciations as of 12-2019. New depreciation plan from period 01-2020 and forward with depreciation months = 12. During 2019 12 depreciations have been made with 1 000 SEK /month. Remaining amount after 2019 = 48 000 SEK. Depreciations 01-2020 and forward will be 5 000 SEK (60 000 SEK / 12).

2.Edit months (correction retrospectively)

If the asset’s depreciation plan is erroneous and you want to correct also already performed depreciations, you can change months directly on the asset Accounting: Assetst, tab Assets, tab Asset. The next depreciation will correct previous depreciations based on the new number of months. Example: Acquisition price 60 000 SEK. First depreciation period 01-2019. Months to depreciate = 60. Performed depreciations to 12–2019. Change in field Months to depreciate on the asset = 24, which means monthly depreciation of 2 500 SEK. During 2019 there has been 12 depreciations of 1 000 SEK/month = 12 000 SEK. In 01–2020, 20 500 SEK is depreciated. 2 500 SEK for 01-2020 and 18 000 SEK that corrects the previous depreciations for 2019 (60 000 / 24 * 12 - 12 000).

Reports

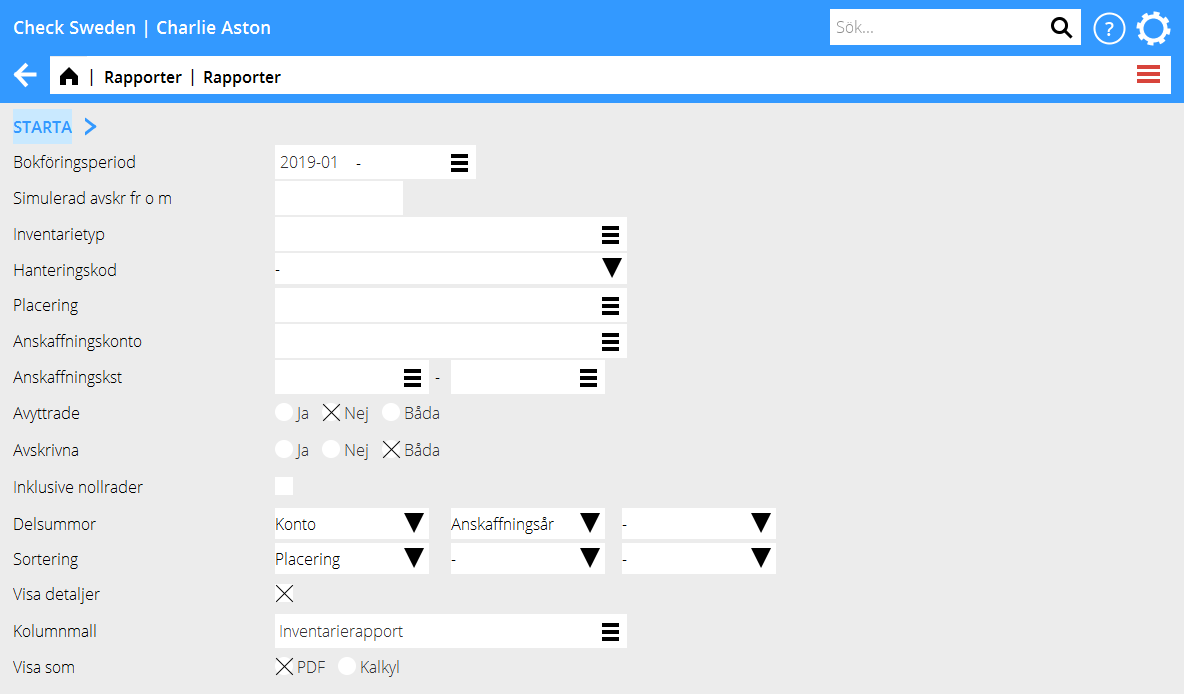

Inventory ledger reports is found in Accounting: Reports, tab Inventory ledger.

The report List depreciations is a standard report that lists assets selected on depreciation period, accounting date and asset type.

The report Reports is used for printing reports with tailor-made column templates.

[Category: Accounting] [Category: ACC-INV-EN] [Category: Manuals]