Translations:SAF-T Finance in Marathon/8/en

From Marathon Documentation

Revision as of 13:40, 27 April 2021 by FuzzyBot (talk | contribs) (Importing a new version from external source)

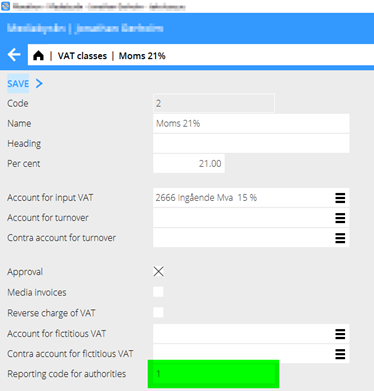

Information about how to map Your VAT classes is found on skatteetaten.

VAT number and post address on all clients and suppliers subject to VAT

All clients and suppliers which are subject to VAT must have VAT number in Marathon. This is registered on the client in MED or PRO (or S/L if you use DIN/DFA (Direct Invoicing). Only clients/Suppliers for which you have sent or received an invoice needs to be registered with VAT number. Recommendation: There is a parameter which makes VAT number mandatory on suppliers in Base register / P/L / Parameters, tab: General, field: VAT number mandatory. VAT no shall be registered in the following format: 999999999MVA or NO999999999MVA