Translations:SAF-T Finance in Marathon/8/en

From Marathon Documentation

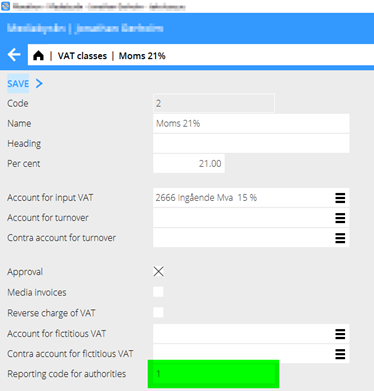

Information about how to map Your VAT classes is found on skatteetaten.

VAT number and post address on all clients and suppliers subject to VAT

All clients and suppliers , taxable or not must be registered with VAT number and postal address in Marathon. This is registered on the client in MED or PRO and S/L. Only clients/Suppliers for which you have sent or received an invoice needs to be registered with VAT number. Recommendation: There is a parameter which makes VAT number mandatory on suppliers in Base register / P/L / Parameters, tab: General, field: VAT number mandatory. VAT no shall be registered in the following format: 999999999MVA or NO999999999MVA